Faster drug discovery, clinical-trial optimization, and clinical-decision support.

This is an excerpt of the publication “The next frontier for AI in China could add $600 billion to its economy”, with the title above, focusing on the topic in question.

June 7, 2022 | Report

By Kai Shen, Xiaoxiao Tong, Ting Wu, and Fangning Zhang

In the past decade, China has built a solid foundation to support its AI economy and made significant contributions to AI globally.

Stanford University’s AI Index, which assesses AI advancements worldwide across various metrics in research, development, and economy, ranks China among the top three countries for global AI vibrancy.

On research, for example, China produced about one-third of both AI journal papers and AI citations worldwide in 2021.

In economic investment, China accounted for nearly one-fifth of global private investment funding in 2021, attracting $17 billion for AI start-ups.

Today, AI adoption is high in China in finance, retail, and high tech, which together account for more than one-third of the country’s AI market (see sidebar “Five types of AI companies in China”).

In tech, for example, leaders Alibaba and ByteDance, both household names in China, have become known for their highly personalized AI-driven consumer apps.

In fact, most of the AI applications that have been widely adopted in China to date have been in consumer-facing industries, propelled by the world’s largest internet consumer base and the ability to engage with consumers in new ways to increase customer loyalty, revenue, and market valuations.

So what’s next for AI in China?

In the coming decade, our research indicates that there is tremendous opportunity for AI growth in new sectors in China, including some where innovation and R&D spending have traditionally lagged global counterparts: automotive, transportation, and logistics; manufacturing; enterprise software; and healthcare and life sciences. (See sidebar “About the research.”)

In these sectors, we see clusters of use cases where AI can create upwards of $600 billion in economic value annually. (To provide a sense of scale, the 2021 gross domestic product in Shanghai, China’s most populous city of nearly 28 million, was roughly $680 billion.)

In some cases, this value will come from revenue generated by AI-enabled offerings, while in other cases, it will be generated by cost savings through greater efficiency and productivity.

These clusters are likely to become battlegrounds for companies in each sector that will help define the market leaders.

Unlocking the full potential of these AI opportunities typically requires significant investments-in some cases, much more than leaders might expect-on multiple fronts, including the data and technologies that will underpin AI systems, the right talent and organizational mindsets to build these systems, and new business models and partnerships to create data ecosystems, industry standards, and regulations.

In our work and global research, we find many of these enablers are becoming standard practice among companies getting the most value from AI.

To help leaders and investors marshal their resources to accelerate, disrupt, and lead in AI, we dive into the research, first sharing where the biggest opportunities lie in each sector and then outlining the core enablers to be tackled first.

Following the money to the most promising sectors

We looked at the AI market in China to determine where AI could deliver the most value in the future.

We studied market projections at length and dug deep into country and segment-level reports worldwide to see where AI was delivering the greatest value across the global landscape.

We then spoke in depth with experts across sectors in China to understand where the greatest opportunities could emerge next.

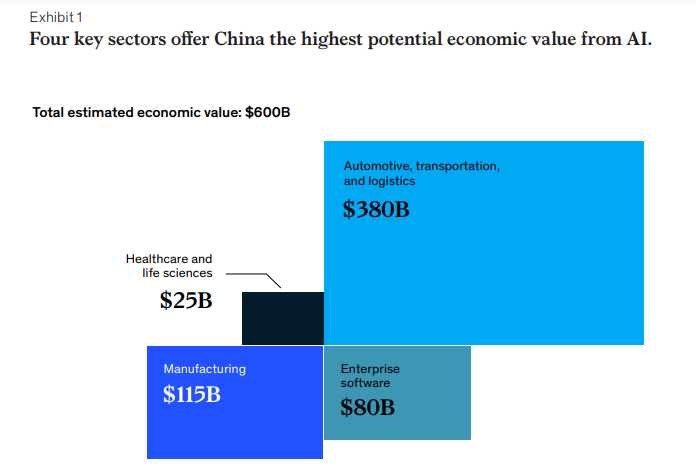

Our research led us to several sectors: automotive, transportation, and logistics, which are collectively expected to contribute the majority-around 64 percent-of the $600 billion opportunity; manufacturing, which will drive another 19 percent; enterprise software, contributing 13 percent; and healthcare and life sciences, at 4 percent of the opportunity.

Within each sector, our analysis shows the value-creation opportunity concentrated within only two to three domains.

These are typically in areas where private-equity and venture-capital-firm investments have been high in the past five years and successful proof of concepts have been delivered.

Automotive, transportation, and logistics

See the original publication.

Manufacturing

See the original publication.

Enterprise software

See the original publication.

Healthcare and life sciences

In recent years, China has stepped up its investment in innovation in healthcare and life sciences with AI. China’s “14th Five-Year Plan” targets 7 percent annual growth by 2025 for R&D expenditure, of which at least 8 percent is devoted to basic research.

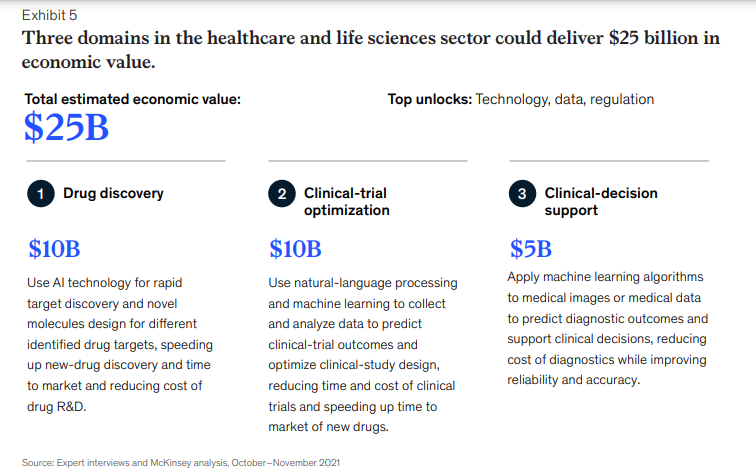

One area of focus is accelerating drug discovery and increasing the odds of success, which is a significant global issue.

In 2021, global pharma R&D spend reached $212 billion, compared with $137 billion in 2012, with an approximately 5 percent compound annual growth rate (CAGR).

Drug discovery takes 5.5 years on average, which not only delays patients’ access to innovative therapeutics but also shortens the patent protection period that rewards innovation.

Despite improved success rates for new-drug development, only the top 20 percent of pharmaceutical companies worldwide realized a breakeven on their R&D investments after seven years.

Another top priority is improving patient care, and Chinese AI start-ups today are working to build the country’s reputation for providing more accurate and reliable healthcare in terms of diagnostic outcomes and clinical decisions.

Our research suggests that AI in R&D could add more than $25 billion in economic value in three specific areas: faster drug discovery, clinical-trial optimization, and clinical-decision support.

How to unlock these opportunities

During our research, we found that realizing the value from AI would require every sector to drive significant investment and innovation across six key enabling areas (exhibit).

The first four areas are data, talent, technology, and significant work to shift mindsets as part of adoption and scaling efforts.

The remaining two, ecosystem orchestration and navigating regulations, can be considered collectively as market collaboration and should be addressed as part of strategy efforts.

Some specific challenges in these areas are unique to each sector.

For example, in automotive, transportation, and logistics, keeping pace with the latest advances in 5G and connected-vehicle technologies (commonly referred to as V2X) is crucial to unlocking the value in that sector.

Those in healthcare will want to stay current on advances in AI explainability; for providers and patients to trust the AI, they must be able to understand why an algorithm made the decision or recommendation it did.

Broadly speaking, four of these areas-data, talent, technology, and market collaboration-stood out as common challenges that we believe will have an outsized impact on the economic value achieved.

Without them, tackling the others will be much harder.

1.Data

For AI systems to work properly, they need access to high-quality data, meaning the data must be available, usable, reliable, relevant, and secure.

This can be challenging without the right foundations for storing, processing, and managing the vast volumes of data being generated today.

In the automotive sector, for instance, the ability to process and support up to two terabytes of data per car and road data daily is necessary for enabling autonomous vehicles to understand what’s ahead and delivering personalized experiences to human drivers.

In healthcare, AI models need to take in vast amounts of omics data to understand diseases, identify new targets, and design new molecules.

Companies seeing the highest returns from AI-more than 20 percent of earnings before interest and taxes (EBIT) contributed by AI-offer some insights into what it takes to achieve this. McKinsey´s 2021 Global AI Survey shows that these …

… high performers are much more likely to invest in core data practices, such as

- rapidly integrating internal structured data for use in AI systems (51 percent of high performers versus 32 percent of other companies),

- establishing a data dictionary that is accessible across their enterprise (53 percent versus 29 percent), and

- developing well-defined processes for data governance (45 percent versus 37 percent).

Participation in data sharing and data ecosystems is also crucial, as these partnerships can lead to insights that would not be possible otherwise.

For instance, medical big data and AI companies are now partnering with a wide range of hospitals and research institutes, integrating their electronic medical records (EMR) with publicly available medical-research data and clinical-trial data from pharmaceutical companies or contract research organizations.

The goal is to facilitate drug discovery, clinical trials, and decision making at the point of care so providers can better identify the right treatment procedures and plan for each patient, thus increasing treatment effectiveness and reducing chances of adverse side effects.

For instance, medical big data and AI companies are now partnering with a wide range of hospitals and research institutes, integrating their electronic medical records (EMR) with publicly available medical-research data and clinical-trial data from pharmaceutical companies or contract research organizations.

One such company, Yidu Cloud, has provided big data platforms and solutions to more than 500 hospitals in China and has, upon authorization, analyzed more than 1.3 billion healthcare records since 2017 for use in real-world disease models to support a variety of use cases including clinical research, hospital management, and policy making.

2.Talent

In our experience, we find it nearly impossible for businesses to deliver impact with AI without business domain knowledge.

Knowing what questions to ask in each domain can determine the success or failure of a given AI effort.

As a result, organizations in all four sectors (automotive, transportation, and logistics; manufacturing; enterprise software; and healthcare and life sciences) can benefit from systematically upskilling existing AI experts and knowledge workers to become AI translators-individuals who know what business questions to ask and can translate business problems into AI solutions.

We like to think of their skills as resembling the Greek letter pi ( π). This group has not only a broad mastery of general management skills (the horizontal bar) but also spikes of deep functional knowledge in AI and domain expertise (the vertical bars).

To build this talent profile, some companies upskill technical talent with the requisite skills.

One AI start-up in drug discovery, for instance, has created a program to train newly hired data scientists and AI engineers in pharmaceutical domain knowledge such as molecule structure and characteristics.

Company executives credit this deep domain knowledge among its AI experts with enabling the discovery of nearly 30 molecules for clinical trials.

Other companies seek to arm existing domain talent with the AI skills they need. An electronics manufacturer has built a digital and AI academy to provide on-the-job training to more than 400 employees across different functional areas so that they can lead various digital and AI projects across the enterprise.

3.Technology maturity

We have found through past research that having the right technology foundation is a critical driver for AI success.

For business leaders in China, our findings highlight four priorities in this area:

1.Increasing digital adoption.

There is room across industries to increase digital adoption.

In hospitals and other care providers, many workflows related to patients, personnel, and equipment have yet to be digitized.

Further digital adoption is required to provide healthcare organizations with the necessary data for predicting a patient’s eligibility for a clinical trial or providing a physician with intelligent clinical-decision-support tools.

The same holds true in manufacturing, where digitization of factories is low. Implementing IoT sensors across manufacturing equipment and production lines can enable companies to accumulate the data necessary for powering digital twins.

2.Implementing data science tooling and platforms.

The cost of algorithmic development can be high, and companies can benefit greatly from using technology platforms and tooling that streamline model deployment and maintenance, just as they benefit from investments in technologies to improve the efficiency of a factory production line.

Some essential capabilities we recommend companies consider include reusable data structures, scalable computation power, and automated MLOps capabilities. All of these contribute to ensuring AI teams can work efficiently and productively.

3.Advancing cloud infrastructures.

Our research finds that while the percent of IT workloads on cloud in China is almost on par with global survey numbers, the share on private cloud is much bigger due to security and data compliance concerns.

As SaaS vendors and other enterprise-software providers enter this market, we advise that they continue to advance their infrastructures to address these concerns and provide enterprises with a clear value proposition.

This will require further advances in virtualization, data-storage capacity, performance, elasticity and resilience, and technological agility to customize business capabilities, which enterprises have come to expect from their vendors.

4.Investments in AI research and advanced AI techniques.

Many of the use cases described here will require fundamental advances in the underlying technologies and techniques.

For instance, in manufacturing, additional research is needed to improve the performance of camera sensors and computer vision algorithms to detect and recognize objects in dimly lit environments, which can be common on factory floors.

In life sciences, further innovation in wearable devices and AI algorithms is necessary to enable the collection, processing, and integration of real-world data in drug discovery, clinical trials, and clinical-decision-support processes.

In automotive, advances for improving self-driving model accuracy and reducing modeling complexity are required to enhance how autonomous vehicles perceive objects and perform in complex scenarios.

For conducting such research, academic collaborations between enterprises and universities can advance what’s possible.

Market collaboration

AI can present challenges that transcend the capabilities of any one company, which often gives rise to regulations and partnerships that can further AI innovation.

In many markets globally, we’ve seen new regulations, such as Global Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act in the United States, begin to address emerging issues such as data privacy, which is considered a top AI relevant risk in our 2021 Global AI Survey.

And proposed European Union regulations designed to address the development and use of AI more broadly will have implications globally.

Our research points to three areas where additional efforts could help China unlock the full economic value of AI:

1.Data privacy and sharing.

For individuals to share their data, whether it’s healthcare or driving data, they need to have an easy way to give permission to use their data and have trust that it will be used appropriately by authorized entities and safely shared and stored.

Guidelines related to privacy and sharing can create more confidence and thus enable greater AI adoption. A 2019 law enacted in China to improve citizen health, for instance, promotes the use of big data and AI by developing technical standards on the collection, storage, analysis, and application of medical and health data.18

Meanwhile, there has been significant momentum in industry and academia to build methods and frameworks to help mitigate privacy concerns.

For example, the number of papers mentioning “privacy” accepted by the Neural Information Processing Systems, a leading machine learning conference, has increased sixfold in the past five years.

2.Market alignment.

In some cases, new business models enabled by AI will raise fundamental questions around the use and delivery of AI among the various stakeholders.

In healthcare, for instance, as companies develop new AI systems for clinical-decision support, debate will likely emerge among government and healthcare providers and payers as to when AI is effective in improving diagnosis and treatment recommendations and how providers will be reimbursed when using such systems.

In transportation and logistics, issues around how government and insurers determine culpability have already arisen in China following accidents involving both autonomous vehicles and vehicles operated by humans. Settlements in these accidents have created precedents to guide future decisions, but further codification can help ensure consistency and clarity.

3.Standard processes and protocols.

Standards enable the sharing of data within and across ecosystems.

In the healthcare and life sciences sectors, academic medical research, clinical-trial data, and patient medical data need to be well structured and documented in a uniform manner to accelerate drug discovery and clinical trials.

A push by the National Health Commission in China to build a data foundation for EMRs and disease databases in 2018 has led to some movement here with the creation of a standardized disease database and EMRs for use in AI.

However, standards and protocols around how the data are structured, processed, and connected can be beneficial for further use of the raw-data records.

Likewise, standards can also eliminate process delays that can derail innovation and scare off investors and talent.

An example involves the acceleration of drug discovery using real-world evidence in Hainan’s medical tourism zone; translating that success into transparent approval protocols can help ensure consistent licensing across the country and ultimately would build trust in new discoveries.

On the manufacturing side, standards for how organizations label the various features of an object (such as the size and shape of a part or the end product) on the production line can make it easier for companies to leverage algorithms from one factory to another, without having to undergo costly retraining efforts.

4.Patent protections.

Traditionally, in China, new innovations are rapidly folded into the public domain, making it difficult for enterprise-software and AI players to realize a return on their sizable investment.

In our experience, patent laws that protect intellectual property can increase investors’ confidence and attract more investment in this area.

AI has the potential to reshape key sectors in China.

However, among business domains in these sectors with the most valuable use cases, there is no low-hanging fruit where AI can be implemented with little additional investment.

Rather, our research finds that unlocking maximum potential of this opportunity will be possible only with strategic investments and innovations across several dimensions-with data, talent, technology, and market collaboration being foremost.

Working together, enterprises, AI players, and government can address these conditions and enable China to capture the full value at stake.

June 7, 2022 | Report

Originally published at mckinsey.com

By Kai Shen, Xiaoxiao Tong, Ting Wu, and Fangning Zhang