This is an excerpted and adapted version of the article “The next frontier of care delivery in healthcare” by Shubham Singhal, Mathangi Radha, and Nithya Vinjamoori, March 24, 2022. The Editor of the blog has grouped the 10 itens in topic areas, and reordered the initial list.

Introduction

Even when COVID-19 becomes endemic, as is likely to be the case, healthcare delivery in the United States will continue to transform rapidly.

Stakeholders must prepare as policy direction, reimbursement, and investor appetite move care delivery in distinct directions. McKinsey’s 14th annual healthcare conference, held in July 2021 in Chicago, explored the next wave of industry evolution and how healthcare organizations must innovate to thrive. To help healthcare leaders as they work to spur innovation, we have collected insights and highlights from featured conference speakers, as well as our own research and experience.

The results show that the future of care delivery is fundamentally evolving to become patient-centric, virtual, ambulatory, in the home, value based and risk bearing, driven by data and analytics, transparent and interoperable, enabled by new medical technologies, funded by private investors, and integrated yet fragmented.

The results show that the future of care delivery is fundamentally evolving

The future of Care Delivery is fundamentally evolving to become:

PAYMENT MODEL AND FUNDING

1.Value-based and risk bearing

2.Funded by private investors

PATIENT ORIENTATION

3.Patient-centric

CARE CHANNEL AND INTEGRATION

4.Virtual

5.Ambulatory

6.In the home

7.Integrated yet fragmented

NEW TECHNOLOGIES

8.Driven by data & technology

9.Transparent and interoperable

10.Enabled by new medical technologies

PAYMENT MODEL AND FUNDING

1.Value-based and risk bearing

2.Funded by private investors

1.Value-based and risk bearing

Value-based models are continuing to grow, and we expect the proportion of the insured population in “at risk” contracts to continue to rise significantly:

10 percent annually from 2021 to 2025 as compared with the 1 percent growth of the overall insured population over the same period.

The shift to value-based care can be seen across various care model segments and payer types.

Management services organizations, which can support the shift to risk-bearing models by providing tech and administrative services for providers seeking to take on risk, are projected to grow rapidly over the next few years to comprise 9 percent of total insured lives by 2025, up from 5 percent today.

The situation is similar for capitated risk staff/employed risk models, though these comprise the smallest segment of at-risk models.

Accountable care organizations are also expected to grow at a steady pace through 2025.

Overall, between 2021 and 2025, value-based contracts are projected to grow to 22 percent of insured lives, from around 15 percent, covering nearly 65 million people in the United States.

2.Funded by private investors

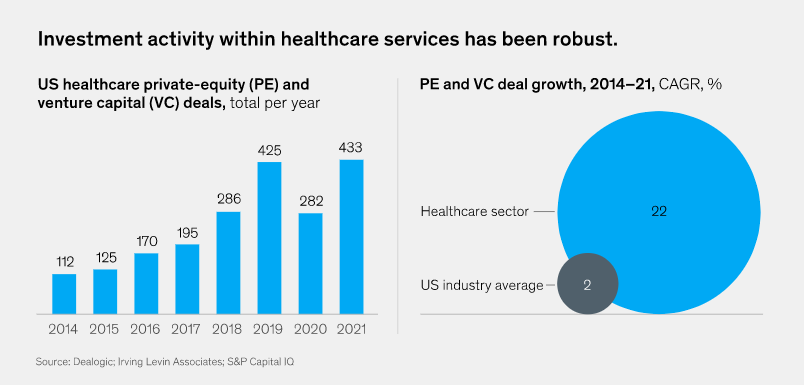

Private investment in healthcare has evolved thematically over the past decade.

For much of the 2010s, investments were focused on consolidation of fragmented assets and optimization of back-end functions.

Beginning around 2018, investments in business model expansion became more popular, as seen in bets on platform models or the integration of ancillary offerings.

Looking forward from today, we see significant investment going into care delivery innovations, including

- redesigning the patient journey through digital enablement,

- shifting care delivery into ambulatory and home settings, and

- value-based care models.

Private-equity deal volume in healthcare is also growing much faster than the US industry average.

In the healthcare sector, private-equity and venture capital deal growth grew at a 29 percent annualized rate from 2014 to 2021, compared with only about 2 percent for all private-equity and venture capital deals (Exhibit 5).

Exhibit 5

PATIENT ORIENTATION

3.Patient-centric

3.Patient-centric

As a healthcare experience, patient centricity is meant to be convenient, transparent, and personalized, where consumers expect to be treated as whole people with individualized needs, not as problems to be solved.

Indeed, US consumers already take proactive steps to manage their own health and well-being, spending between $300 billion and $400 billion out of pocket on health expenses every year.

US consumer spending on wellness categories, including fitness, nutrition, appearance, sleep, and mindfulness, is increasing, as about 40 percent of US consumers consider these categories to be a high priority.

Consumers are also demanding greater access to healthcare and a more seamless experience.

For example, more than 60 percent of consumers expect to be able to change or schedule a healthcare appointment, check medical records and test results, and renew a medication online.

The expectation that healthcare information should be available at one’s fingertips has been growing with the ubiquity of mobile phones and has compounded during the pandemic with the increase of telehealth and virtual care.

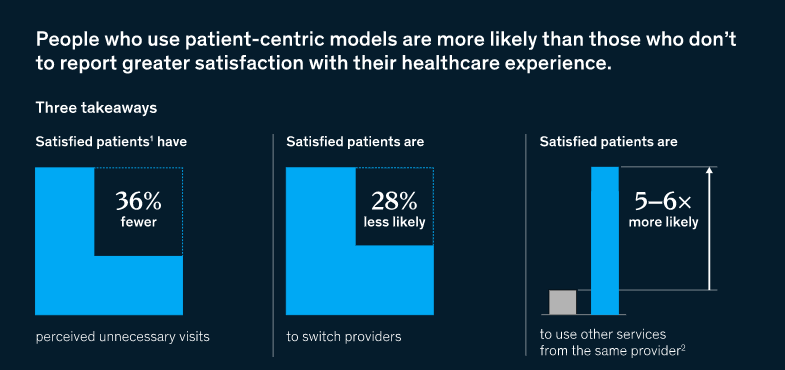

The economic case for patient-centric models is overwhelming.

Our recent surveys show that satisfied patients who use patient-centric models are

- 28 percent less likely than those who don’t to switch providers and are

- five to six times more likely to use other services from that provider.

More than a third of patients also noted that they perceived having fewer visits with physicians (Exhibit 1).

Satisfied patients feel more empowered to engage in their own health and feel like they are receiving better care, which helps lead to better health outcomes overall.

Exhibit 1

CARE CHANNEL AND INTEGRATION

4.Virtual

5.Ambulatory

6.In the home

7.Integrated yet fragmented

4.Virtual

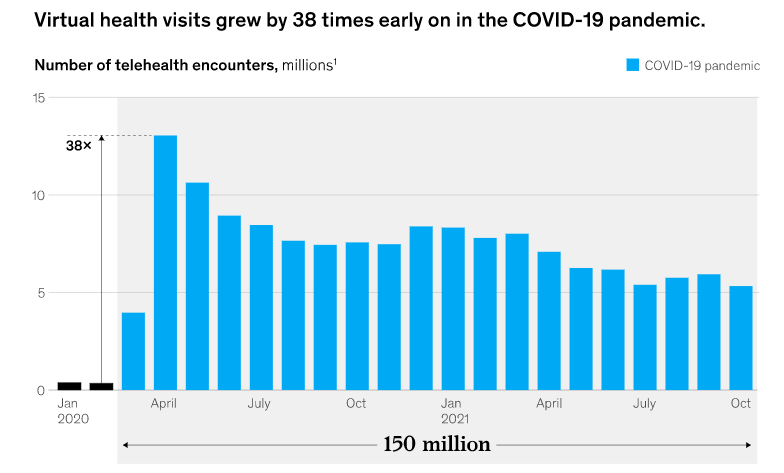

The adoption of virtual health has increased dramatically since March 2020.

Virtual health visits grew by more than 3,000 percent early on in the COVID-19 pandemic, with 150 million telehealth claims in less than two years (Exhibit 2).

Exhibit 2

These numbers signal the potential of virtual care to spur great innovation in care delivery more broadly, with favorable consumer perception and ongoing investment contributing to continued growth of virtual health.

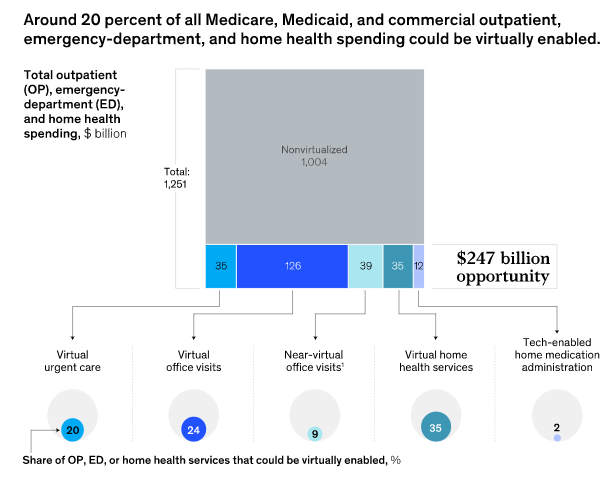

We estimate that around $250 billion in outpatient spend could potentially be shifted to virtual settings through advancements in more complex care models, including

- virtual specialty care,

- longitudinal virtual care, and

- virtual diagnostics (Exhibit 3).

Exhibit 3

The potential for savings is significantly higher for virtual care models in acute care, including

- tele-ICU (intensive care unit), and

- when combined with innovative care models in the home, such as remote patient monitoring and hospital-at-home models.

Many virtual health solutions have focused on increasing convenience and access for patients, but we also see the potential of virtual care to improve cost and outcomes.

5.Ambulatory

The growing segment of ambulatory care comprises one-third of provider revenues in the United States, representing about $750 billion dollars.

A number of different services are embedded within ambulatory care, including

- physician practices,

- outpatient behavioral-health centers,

- ambulatory-surgery centers, and

- urgent-care centers, among many others.

Studies have shown that ambulatory-care settings can provide advantages for patients, such as

- shorter average visit length — 25 percent shorter for ambulatory-care services than comparable hospital outpatient visits — and

- lower complication rates, such as 1.1 percent total hip arthroplasty complication rates in ambulatory-care services versus 5.2 percent in hospital outpatient departments.

While inpatient hospital stays will still be necessary for more complex situations, patients and physicians are finding that many types of care can be delivered safely in ambulatory settings.

In a recent rule, the US Centers for Medicare & Medicaid Services (CMS) removed 255 of the 267 codes that were added to its Ambulatory Surgical Center Covered Procedure List (ASC CPL) in 2021.

This was because of concerns that the codes were added prematurely, as the corresponding procedures still typically involve stays or active medical monitoring that span overnight.

However, in the same rule, CMS indicated that it expected that it “would continue to expand the ASC CPL in future years,” which would further accelerate these shifts.

We see these shifts reflected in the overall provider profit pools, as the general acute-care setting faces continued margin pressures, while outpatient and ambulatory settings are estimated to grow more than 5 percent a year from 2021 to 2025.

6.In the home

Opportunities for in-home care are expanding to additional patient profiles and types of care.

More commoditized services, such as traditional post-acute home health and personal-care services, still make up about two-thirds of market revenues ($75 billion to $85 billion in 2019).

However, emerging home care segments — such as home infusions, home-based dialysis, primary home care, and hospital-at-home models — are growing rapidly.

These quickly expanding segments of the home care market are more complex and technology enabled, and, in many cases, the capabilities to scale them are still being developed.

Care-at-home capabilities today vary in sophistication but are expected to grow significantly.

We estimate that over the next three years,Medicare beneficiaries could see three to four times more care in their homes, if home care capabilities continue to develop into viable and at-scale offerings, representing up to $265 billion dollars or more of Medicare spend on care delivered in the home in 2025.

The expansion of in-home care capabilities can appeal to non-Medicare patient populations as well, and many of these technology-enabled services may be first adopted by tech-forward patients.

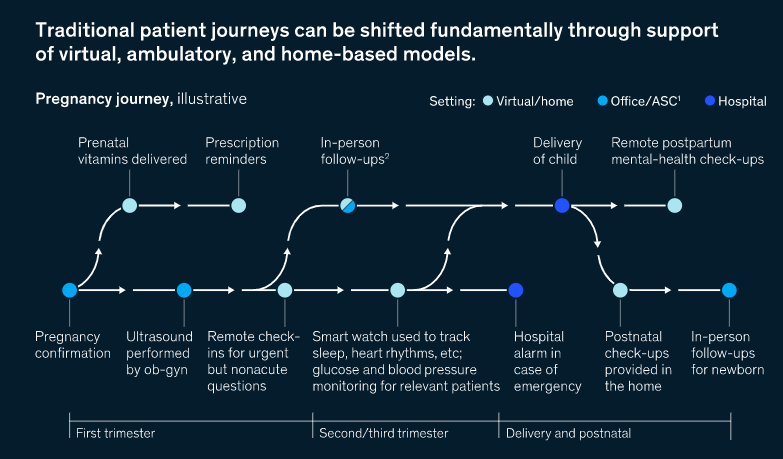

To illustrate how a traditional patient journey could be fundamentally shifted through the support of virtual, ambulatory, and home-based models, consider a pregnancy care journey (Exhibit 4).

Exhibit 4

Prenatal vitamin prescriptions could be filled online and mailed directly to the home, and virtual visits could replace in-office visits for more urgent but nonacute questions.

In-person check-ups (one per trimester at minimum) to check for fetal growth could be conducted in the home using portable ultrasounds.

Data from wearables and home monitoring devices (for example, continuous glucose monitors for patients with gestational diabetes, or blood pressure checks at home for those at risk for gestational hypertension) could be transmitted to providers for more proactive monitoring, especially for higher-risk patients.

Options for the delivery of the child can be expanded to include home delivery for low-risk patients who seek it, but only after careful selection (through clinical and data-driven assessment) has occurred and robust contingencies are in place.

More frequent postnatal check-ups could be conducted in the home by the physician or other practitioners (such as a lactation specialist, doula, or behavioral-health specialist).

The option of in-home check-ins can ease the transition for patients who have given birth and are balancing the care of a newborn while managing their own health.

This patient-friendly platform, managed by a central provider, could increase a patient and her baby’s access to care and support and help enable the patient to manage her and her baby’s health more actively.

7.Integrated yet fragmented

To support greater patient centricity and on-demand accessibility, care delivery in the United States is evolving from its highly fragmented state.

We can see this already in the emergence of “one-stop shop” innovators in care management and care coordination.

These players partner with payers, providers, and, in some cases, employers to ease consumers’ navigation of complex care journeys, such as prenatal care or kidney disease management.

Although care delivery may become less fragmented for some patient journeys, the shift toward more integrated models will take time.

Consolidation is occurring. For example,

- payer incumbents are investing in data-driven care delivery start-ups, and

- hospital systems are continuing to acquire provider groups and pursue partnerships or joint ventures with post-acute and ambulatory-care providers to support value-based care strategies.

But fragmentation is likely to persist in the near term as the US healthcare system shifts its focus from specialization to more value-based and consumer-centric models.

In time, however, we may see a new type of integrated yet fragmented ecosystem,

- one in which atomized sites of care work in concert with one another,

- where tech-enabled platforms allow data to be transferred and shared more easily,

where clinical care is harmonized,

and where patients can seamlessly transition from one part of their care journey to the next to improve their health and well-being.

NEW TECHNOLOGIES

8.Driven by data & technology

9.Transparent and interoperable

10.Enabled by new medical technologies

8.Driven by data & technology

Generally, new technologies in healthcare have added costs, not removed them.

But as technologies improve and become more useful for helping healthcare innovations to scale, that trend may change.

If the healthcare delivery industry could rely more heavily on labor productivity gains rather than workforce expansion to meet demand growth, by 2028 healthcare spending could potentially be about $280 billion to $550 billion less than current national health expenditure (NHE) projections suggest.

Continued improvements to care delivery technologies will no doubt play a significant role in capturing these productivity gains.

- Technology is enabling care to be more virtualized, through advancements in areas such as remote patient monitoring;

- closer linked to value, by making data more available in the workflow at the time of the physician encounter;

- more personalized, with analytics and insights to deliver the right messages to the right patients at the right time; and

- delivered more seamlessly, by integrating capabilities and experiences across the patient journey.

9.Transparent and interoperable

As recent regulatory changes take effect, we are beginning to see the first wave of data and industry responses.

Three primary themes are emerging: price transparency, data interoperability, and data access.

Price transparency improvements have been on the regulatory agenda for years, but today, negotiated-rate information is finally becoming available.

Starting in January 2020, hospitals have begun publishing rate information — about 70 percent of hospitals (based on a McKinsey review of about 320 providers) have published some form of negotiated rate by payer. In 2022, another wave of negotiated-rate information will become available, this time from payers.

Interoperability rules went into effect in 2021.

There are prohibitions on data blocking between providers; CMS-regulated payers have to make encounter and claims data available to members through publicly accessible APIs.

Additionally, new requirements for vendors of electronic health records will go into effect at the end of 2022, making structured data, including clinical components, available to consumers.

Third parties (including payers, providers, and technology companies) will also be able to access these data sets, providing these groups with additional insights to help drive decision making.

10.Enabled by new medical technologies

Medical technologies are enabling innovations in patient care in three primary ways.

New products and services are creating self-service opportunities.

Products such as wearables that can track blood sugar (for patients who don’t have diabetes) are still not prevalent but could soon facilitate a number of opportunities for self-service, such as continuous care for management of chronic conditions.

Advances in automation are reducing the number of patient touchpoints needed to deliver care.

Technologies such as remote patient monitoring, home telemetry, and robotic technologies are supporting the blending of virtual and home-based care delivery.

Technology is also supporting the shift to lower-acuity sites of care — for example, joint-replacement-surgery robots can help make procedures more predictable and therefore possible to perform in ambulatory-surgery settings, and medical wearables that are able detect certain health issues earlier can help prevent the need for inpatient care.

New medical technologies are also helping to reduce care delivery costs. For example, cardiac monitoring patches can be used to identify arrhythmias for about 90 percent less cost than an implantable loop recorder.

Cologard, a self-service technology, has likewise greatly reduced the cost of colon cancer screenings compared with a traditional colonoscopy, according to our interviews with experts.