BCG — Boston Consulting Group

Camille Brege

June 15, 2021

Key Messages

- Among the potential responses that managers might think of when facing a business turnaround, the pricing lever is usually at the bottom of their list, if not immediately ruled out.

- And yet, if the right approach is followed, a review of pricing policies can prove highly effective (typically 3–5% margin increase) in securing short-term liquidity and providing early support to fund a more comprehensive turnaround strategy.

- Our experience has taught us that a successful approach revolves around 3 key points, enabling to guarantee quick and tangible margin impact, while ensuring the core business is preserved.

– Identifying and taking advantage of existing leeway

– Following a logic of targeted price increases

– Tailoring the increase trajectory to customer sensitivity

- A successful pricing strategy cannot be decoupled from a fact-based and iterative design methodology.

– Start with data

– Trust your sales force

– Adopt a test & learn approach

Full Article

Corporate turnarounds and restructurings are now more than ever at the core of CEO concerns.

In a context of uncertainty and repetitive lock downs caused by Covid-19 crisis, supply chains are being disturbed, and companies must cope with increasing raw material and transportation costs.

At the same time, sales volumes are dropping due to increasingly cautious consumer behavior, further eroding companies’ margins.

Among the potential responses that managers might think of when facing a business turnaround, the pricing lever is usually at the bottom of their list, if not immediately ruled out.

There are two reasons for this.

- First, the general belief is that only structural changes could help address the extent of the difficulties.

- Second, managers show reluctance towards affecting prices as they fear a negative impact on already declining volumes.

And yet, if the right approach is followed, a review of pricing policies can prove highly effective (typically 3–5% margin increase) in securing short-term liquidity and providing early support to fund a more comprehensive turnaround strategy.

This is especially true for B2B businesses characterized by high number of clients and SKUs, which are the focus of this article — though proposed approach could easily be applied across all industries.

Lessons from experience

Over the last few months, we have helped several B2B companies under restructuring to rethink their pricing strategy. We have secured +1% revenue increase and +4% margin increase in a few months.

Our experience has taught us that a successful approach revolves around 3 key points, enabling to guarantee quick and tangible margin impact, while ensuring the core business is preserved.

- Identifying and taking advantage of existing leeway.

- Following a logic of targeted price increases

- Tailoring the increase trajectory to customer sensitivity

Identifying and taking advantage of existing leeway. To be effective and quickly implemented, chosen approach should be built around existing mechanisms and processes, and focus on “variable” element of the pricing waterfall. In B2B companies for example, focusing on discount excellence is easier and more effective than to modify catalogue prices.

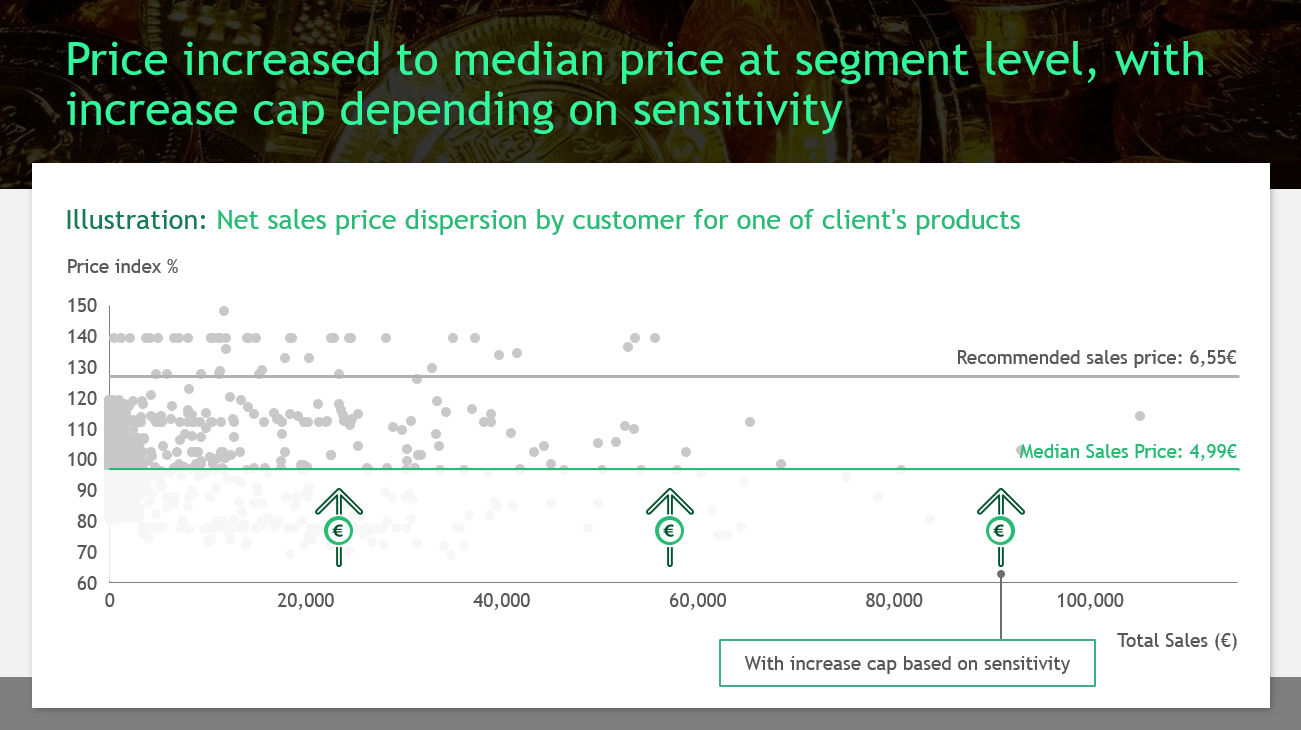

Following a logic of targeted price increases. Undifferentiated price increases, even minor, are much less effective and put companies at risk of losing market share to competitors. An effective approach consists in focusing on off-market or below-market prices within a specific customer segment. In case of limited information on competition prices, focusing on own salesforce price dispersion (compared to median price for instance) in each segment is already an opportunity to target price increase on relevant transactions.

Tailoring the increase trajectory to customer sensitivity. Any price increase policy, especially at a time of challenging economic environment, must be applied very cautiously. This implies implementing gradual rather than one-off price rises, spread out over time, with increase caps in line with the sensitivity of a customer for a given product. Special attention should be paid to core products, whose prices are likely to be well-known by customers.

In practice, when a company counts thousands of customers, to whom a portfolio of hundreds of products may be sold, it is far from obvious to identify the optimal increase scenario for each possible combination.

For this reason, a successful pricing strategy cannot be decoupled from a fact-based and iterative design methodology.

- Start with data

- Trust your sales force

- Adopt a test & learn approach

1. Start with data. In-depth analysis of transactions and customers data is key to build an accurate view of customer segmentation and pricing dynamics. It will allow to target the right products and customer segments, and to calibrate adequate pricing trajectory according to customers sensitivities.

2. Trust your sales force. As the modeling of any potential situation or client specificity is not realistic, capitalizing on sales reps field knowledge and expertise to challenge data-driven recommendations is essential. Moreover, the human dimension needs to be kept at the heart of the negotiation process, and recommendation tools should only be an aid provided to sales reps in their decision making, not a substitute.

3. Adopt a test & learn approach. Following an iterative process through the conduct of an early pilot on a reduced perimeter is the best way to ensure that the model perfectly reflects the reality of the field. Collected feedbacks should then be used to refine the model logic or to integrate more specific scenarios. It is also an opportunity to allow commercial teams to take full ownership of the new policy, and to generate buy-in across the organization.

What makes the above approach particularly interesting in a turnaround context is its ability to provide quickly and safely part of the capital required to fund the longer-term investments of the upcoming turnaround journey.

During pilot, cash inflows are tangible from the very first months, and a reliable estimate of upcoming gains can be provided.

At the same time, risk taken is low, given the restricted perimeter and the ability to initiate corrective actions almost immediately.

Further gains are then generated at the time of scale-up, which can take place relatively quickly provided scaling strategy has been prepared from the start.

Pilot phase can indeed be leveraged to identify teams needs in terms of tools adjustments to ensure long-term adoption, and to prepare the communication and change management plans, both internally and externally.

It is worth noting that generated earnings are recurring gains, and can be increased over time if the new pricing policy is embedded in a continuous improvement logic, with periodic updates of price recommendations — test & learn mindset should not remained limited to the design phase.

Conclusion

In short, companies undergoing difficulties should start considering pricing as an integral part of their response strategy.

When properly applied, it is an efficient way to quickly restore margins and ensure short-term liquidity.

This requires a targeted and precautionary pricing policy review supported by an agile methodology making the most of human expertise and data & technology use cases.

Going beyond, it may be worthwhile to reposition this pricing lever within an overall logic, by complementing it with additional short-term levers — such as inventory reduction or promotion optimization, contributing to a shared goal of funding a longer-term turnaround plan.

About the authors

Camille Brégé, Managing Director & Partner at BCG,

Renaud Montupet, Managing Director & Partner at BCG,

Nicolas Manuelli, Principal at BCG,

Hélène Scheer, Associate at BCG.

Originally published at https://www.linkedin.com.