Health & Care Transformation (HCT)

research institute, knowledge portal and

advisory consulting

Joaquim Cardoso MSc*

Founder, Chief Researcher & Editor

December 4, 2022

MSc* from London Business School

MIT Sloan Masters Program

Senior Advisor for Health & Care Transformation ,

and Digital Health

Executive Summary

For cloud incumbents, healthcare is an appealing target

- Amazon Web Services is a leader in the cloud healthcare market, refining and deploying a range of AI/machine learning (ML) and life sciences tools.

- Microsoft is developing and promoting Microsoft Cloud for Healthcare, combining new tools and integrations for enterprise healthcare.

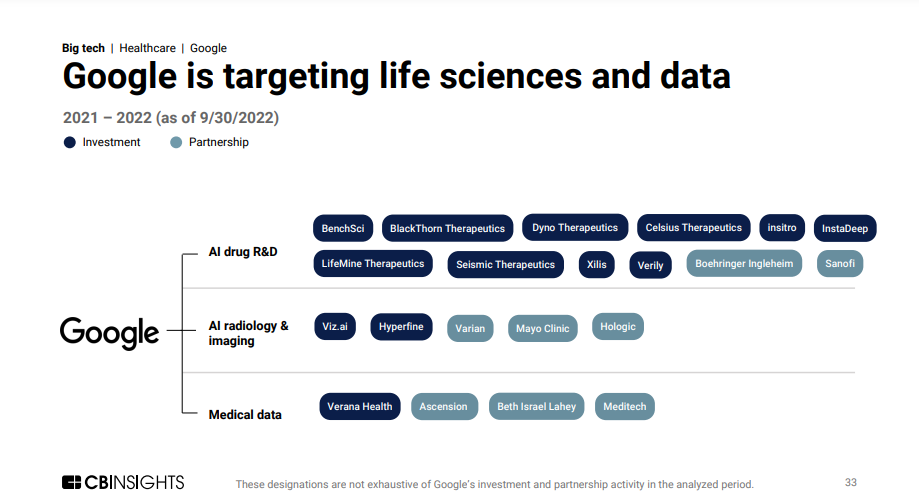

- Google is prioritizing life sciences, with a focus on developing search technologies for clinicians like Care Studio.

- Subsidiary Verily raised $1B in September 2022 to double down on precision medicine.

- Oracle recently acquired EHR vendor Cerner, marking its first major foray into health tech.

- Integrating Cerner with its other products will help Oracle expand its service lines while gaining valuable data customers.

The home monitoring & wearables market is growing

- Apple is focused on bringing its device ecosystem — including the Apple Watch and iPad — into healthcare settings, including care at home.

- Google is making bets in wearables. It’s opting for a diversified approach, having recently dissolved its Google Health division and reallocating personnel to verticals like Fitbit.

- It released its first Google Pixel Watch in October 2022.

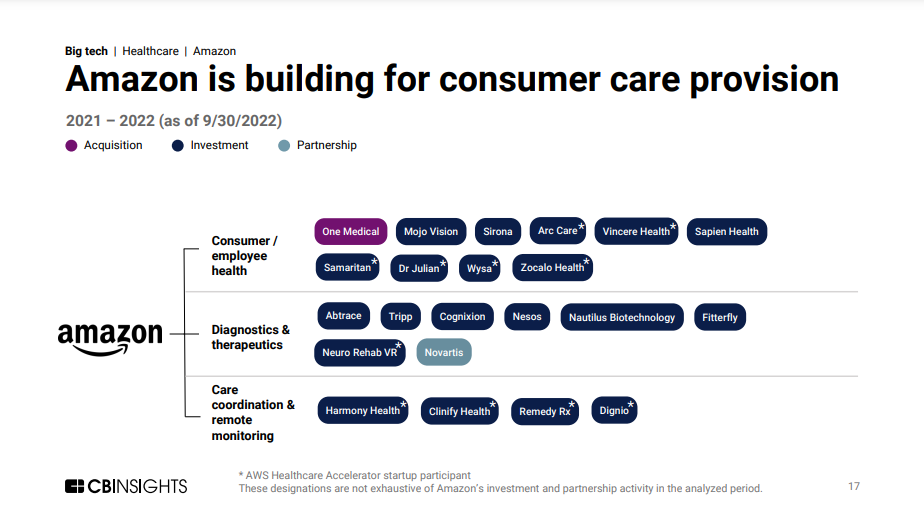

For Amazon, providing direct care is the next frontier

- Amazon is focusing on direct care offerings for employers and consumers, primarily through One Medical and its newest service, Amazon Clinic.

What’s next?

7 Big tech players’ presence in healthcare will grow.

- As they become more familiar with the idiosyncrasies of healthcare, big tech players will continue to improve their potentially disruptive technologies.

- In the near term, they are focusing on growing market share and building tools for a space that’s notoriously slow to adapt.

Consolidation will continue, with acquisitions most likely in the remote monitoring and home clinical spaces.

- Ambient monitoring technologies are growing in sophistication and represent a significant improvement in user experience and long-term adoption potential over wearables.

- Amazon, Apple, and Google are the most likely to pursue acquisitions in this space.

Access to data is a major driver for every player.

- Algorithms and products increasingly depend on access to patient and user data.

- Gathering, leveraging, and monetizing data is a guiding force in big tech activity.

Home health for seniors is the next industry boom.

- As global populations age and seniors increasingly accept and use technology, look for big tech to begin acquiring, designing, and marketing with the senior health and Medicare Advantage markets in mind.

Black box algorithms won’t go away, but transparency will become a selling point.

- With AI and ML becoming more involved in care distribution and delivery, concerns about how algorithms make decisions will drive more demand for transparency and explainability.

- Google and Microsoft are far ahead of the pack in responding to this demand

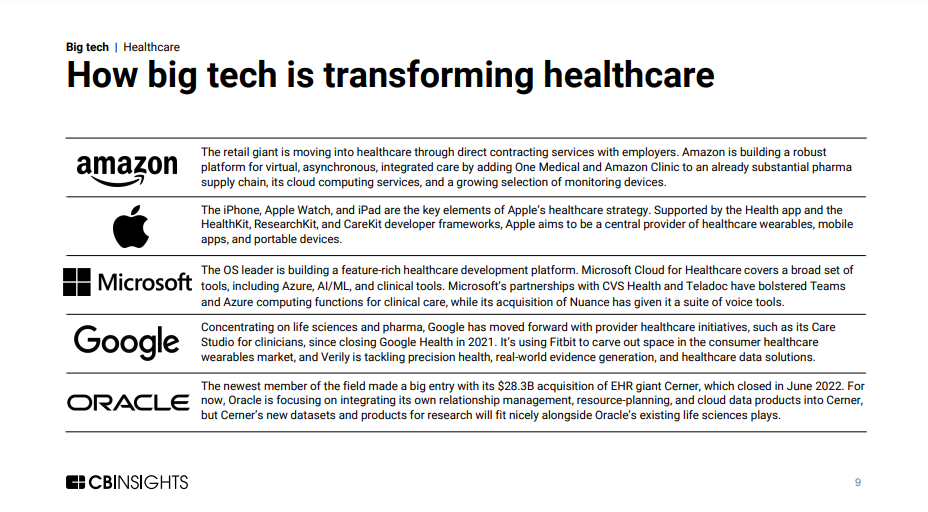

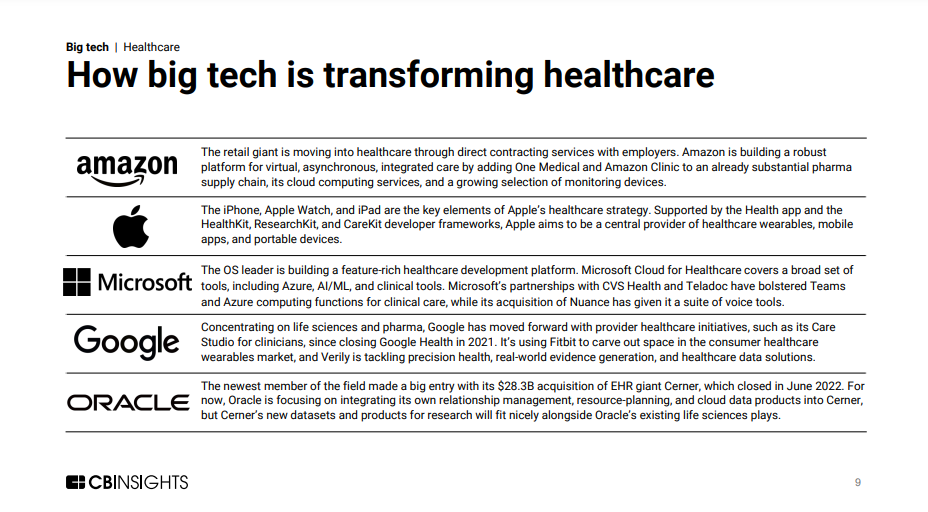

How big tech is transforming healthcare

Amazon

- The retail giant is moving into healthcare through direct contracting services with employers.

- Amazon is building a robust platform for virtual, asynchronous, integrated care by adding One Medical and Amazon Clinic to an already substantial pharma supply chain, its cloud computing services, and a growing selection of monitoring devices.

Apple

- The iPhone, Apple Watch, and iPad are the key elements of Apple’s healthcare strategy.

- Supported by the Health app and the HealthKit, ResearchKit, and CareKit developer frameworks, Apple aims to be a central provider of healthcare wearables, mobile apps, and portable devices

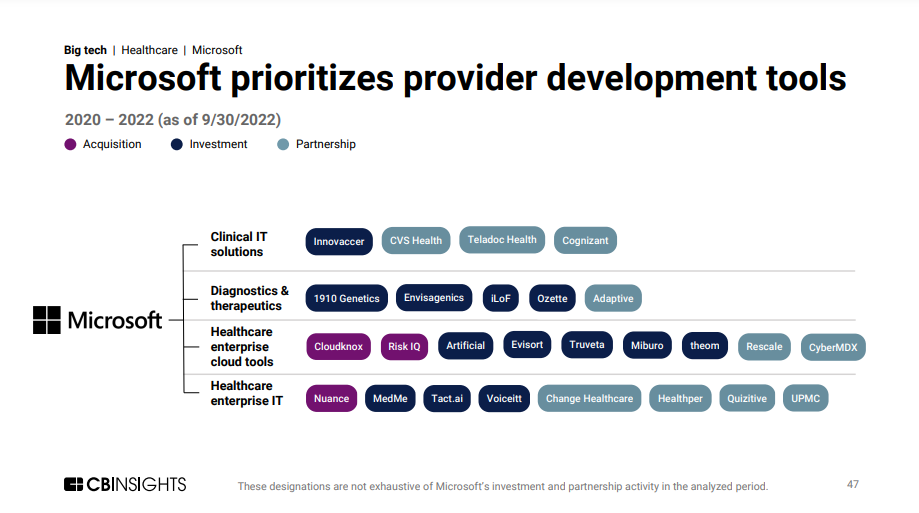

Microsoft

- The OS leader is building a feature-rich healthcare development platform.

- Microsoft Cloud for Healthcare covers a broad set of tools, including Azure, AI/ML, and clinical tools.

- Microsoft’s partnerships with CVS Health and Teladoc have bolster

- Concentrating on life sciences and pharma, Google has moved forward with provider healthcare initiatives, such as its Care Studio for clinicians, since closing Google Health in 2021.

- It’s using Fitbit to carve out space in the consumer healthcare wearables market, and Verily is tackling precision health, real-world evidence generation, and healthcare data solutions.

Oracle

- The newest member of the field made a big entry with its $28.3B acquisition of EHR giant Cerner, which closed in June 2022.

- For now, Oracle is focusing on integrating its own relationship management, resource-planning, and cloud data products into Cerner, …

- … but Cerner’s new datasets and products for research will fit nicely alongside Oracle’s existing life sciences plays.

Consumer demand

- The pandemic has driven patients to demand more unified, easy-to-access services and technologies.

- With extensive experience in building consumer-driven user interfaces and experiences, tech companies can quickly set themselves apart.

Fragmented systems

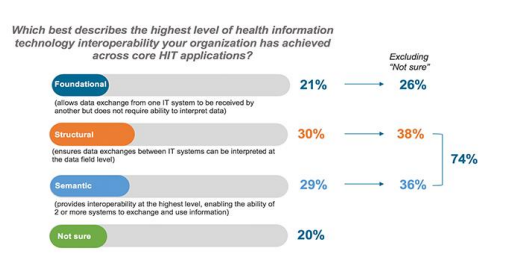

- The explosion of virtual care, analytics, and monitoring solutions has emphasized the importance of data interoperability and transparency.

- Big tech is wellpositioned to offer end-to-end platforms that simplify data management

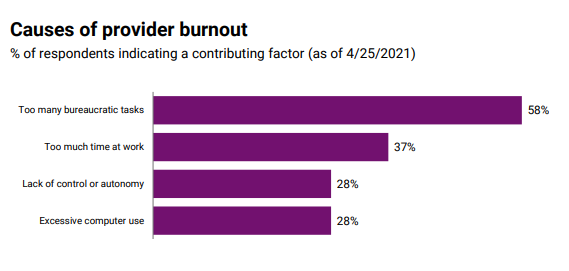

High administrative burden

- Providers and payers are inundated with manual, repetitive, and time consuming admin tasks.

- Tech companies are solving for this through improved workflows and automation.

Demographic pressure

- As populations age, tech companies are investing in home health and other technologies to support seniors in the long term.

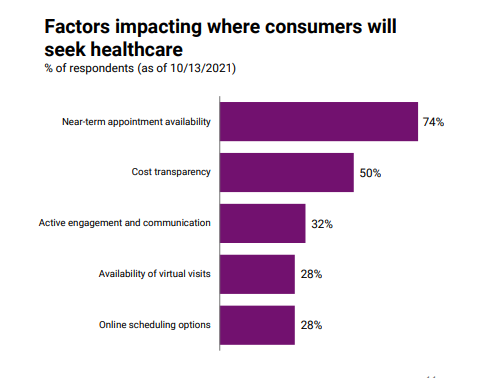

Consumers want a range of care options

- Consumers aren’t willing to give up the convenient and accessible care options that arose during Covid-19. In fact, most of them want more.

- Bringing in new patients and retaining existing ones requires not just offering basic telehealth services, but also continuing to expand the options available to patients over time.

- Hybrid care, for instance, integrates remote encounters, in-person care, and virtual care so providers can be continuously informed and involved in decision-making.

- Big tech vendors looking to get involved in healthcare are targeting these sophisticated opportunities.

Interoperable data could connect fragmented systems

- It’s becoming easier to use, transform, and monetize healthcare data as stakeholders adopt healthcare APIs and data interoperability standards, such as Fast Healthcare Interoperability Resources (FHIR).

- Cloud services like AWS and Microsoft Azure built their revenue models in other industries on the ability to create network effects with the data they house and transact.

- As more third-party and independent vendors store and access interoperable healthcare data, big tech could take advantage of these growing network effects.

The admin burden needs automation

- Healthcare providers are feeling more pressure and burden from repetitive tasks and non-clinical work, …

- … while organizations are faced with an overworked, unhappy workforce.

- Big tech has extensive experience in leveraging AI/ML and process automation to build efficiencies in other industries.

- Healthcare is more than ready for this disruption.

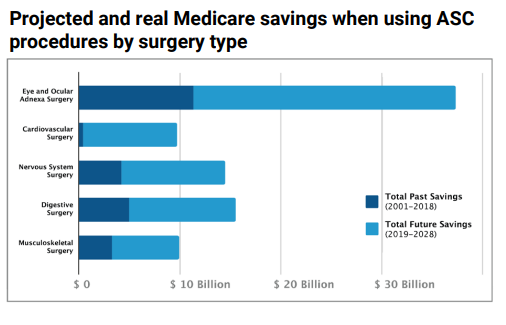

Demographic and spending shifts are driving home healthcare investment

- Shifting from in-patient (IP) to outpatient care at a home, clinic, or ambulatory surgical center (ASC) can realize significant cost savings for payers, providers, and patients.

- This is especially important as populations age and as age-specific payer programs like Medicare become more cost conscious.

- With consumers increasingly willing to receive care from a variety of sources, big tech companies are positioning themselves to be integral to digitally enabled home care.

Shifting from in-patient (IP) to outpatient care at a home, clinic, or ambulatory surgical center (ASC) can realize significant cost savings for payers, providers, and patients.