By Oleg Bestsennyy, Greg Gilbert, Alex Harris, and Jennifer Rost

July 9, 2021

Update: July 9, 2021

EXECUTIVE SUMMARY 2 (2021)

Telehealth usage has surged during the COVID-19 pandemic as consumers and providers sought ways to safely access and deliver healthcare.

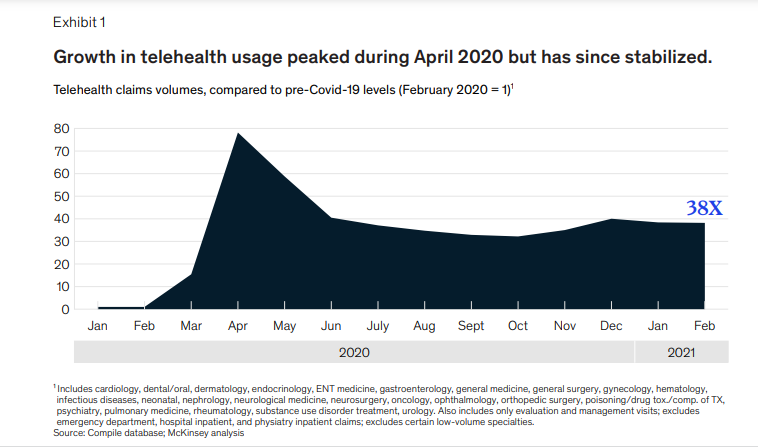

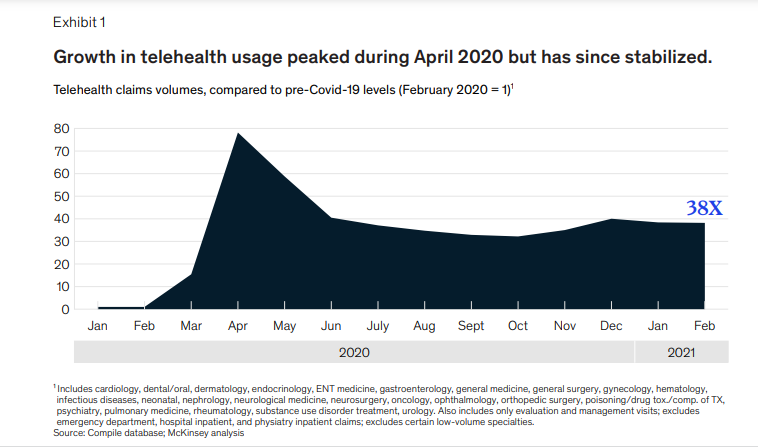

- In April 2020, overall telehealth utilization for office visits and outpatient care was 78 times higher than in February 2020.

- This step-change was enabled by increased consumer and provider willingness to use telehealth and regulatory changes enabling greater access and reimbursement.

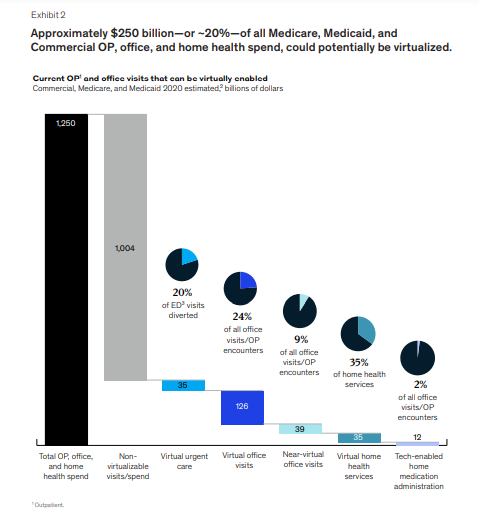

- A year ago, it was estimated that up to $250 billion of US healthcare spend could potentially be shifted to virtual or virtually enabled care.

As of July 2021, telehealth utilization has stabilized at levels 38 times higher than before the pandemic.

- Consumer and provider attitudes towards telehealth have improved since the pre-COVID-19 era, but barriers such as perceptions of technology security still need to be addressed to sustain consumer and provider virtual health adoption.

- After an initial spike to more than 32 percent of office and outpatient visits occurring via telehealth in April 2020, utilization levels have largely stabilized, ranging from 13 to 17 percent across all specialties.

- This utilization reflects more than two-thirds of what we anticipated as visits that could be virtualized.

Investment in virtual care and digital health has skyrocketed, …

- … fueling further innovation and virtual healthcare models and business models are evolving and proliferating,

- with the potential to improve consumer experience/convenience, access, outcomes, and affordability.

INFOGRAPHIC 2 (2021)

DEEP DIVE 2 (2021)

Telehealth: A quarter-trillion-dollar post-COVID-19 reality?

By Oleg Bestsennyy, Greg Gilbert, Alex Harris, and Jennifer Rost

July 9, 2021

Update: July 9, 2021

Early in the COVID-19 pandemic, telehealth usage surged as consumers and providers sought ways to safely access and deliver healthcare.

In April 2020, overall telehealth utilization for office visits and outpatient care was 78 times higher than in February 2020 (Exhibit 1).

This step-change, borne out of necessity, was enabled by these factors:

- increased consumer willingness — to use telehealth,

- increased provider willingness — to use telehealth,

- regulatory changes — enabling greater access and reimbursement.

During the tragedy of the pandemic, telehealth offered a bridge to care, and now offers a chance to reinvent virtual and hybrid virtual/in-person care models, with a goal of improved healthcare access, outcomes, and affordability.

During the tragedy of the pandemic, telehealth offered a bridge to care, and now offers a chance to reinvent virtual and hybrid virtual/in-person care models, with a goal of improved healthcare access, outcomes, and affordability.

A year ago, we estimated that up to $250 billion of US healthcare spend could potentially be shifted to virtual or virtually enabled care.

Approaching this potential level of virtual health is not a foregone conclusion.

It would likely require sustained consumer and clinician adoption and accelerated redesign of care pathways to incorporate virtual modalities.

Approaching this potential level [ $ 250 billion] of virtual health is not a foregone conclusion. It would likely require sustained consumer and clinician adoption and accelerated redesign of care pathways to incorporate virtual modalities.

As of July 2021, we step back to review the progress of telehealth since the initial COVID-19 spike …

… and to assess implications for telehealth and virtual health more broadly going forward.

Our findings include the following insights:

- 1.Telehealth utilization has stabilized at levels 38X higher than before the pandemic.

- 2.Similarly, consumer and provider attitudes toward telehealth have improved since the pre-COVID-19 era.

- 3.Some regulatory changes that facilitated expanded use of telehealth have been made permanent

- 4.Investment in virtual care and digital health more broadly has skyrocketed

- 5.Virtual healthcare models and business models are evolving and proliferating

1.Telehealth utilization has stabilized at levels 38X higher than before the pandemic.

After an initial spike to more than 32 percent of office and outpatient visits occurring via telehealth in April 2020, utilization levels have largely stabilized, ranging from 13 to 17 percent across all specialties.

This utilization reflects more than two-thirds of what we anticipated as visits that could be virtualized.

After an initial spike to more than 32 percent of office and outpatient visits occurring via telehealth in April 2020, utilization levels have largely stabilized, ranging from 13 to 17 percent across all specialties.

This utilization reflects more than two-thirds of what we anticipated as visits that could be virtualized.

2.Similarly, consumer and provider attitudes toward telehealth have improved since the pre-COVID-19 era.

Perceptions and usage have dropped slightly since the peak in spring 2020.

Some barriers-such as perceptions of technology security-remain to be addressed to sustain consumer and provider virtual health adoption, and models are likely to evolve to optimize hybrid virtual and in-person care delivery.

Some barriers-such as perceptions of technology security-remain to be addressed to sustain consumer and provider virtual health adoption, and models are likely to evolve to optimize hybrid virtual and in-person care delivery.

3.Some regulatory changes that facilitated expanded use of telehealth have been made permanent

For example, the Centers for Medicare & Medicaid Services’ expansion of reimbursable telehealth codes for the 2021 physician fee schedule.

But uncertainty still exists as to the fate of other services that may lose their waiver status when the public health emergency ends.

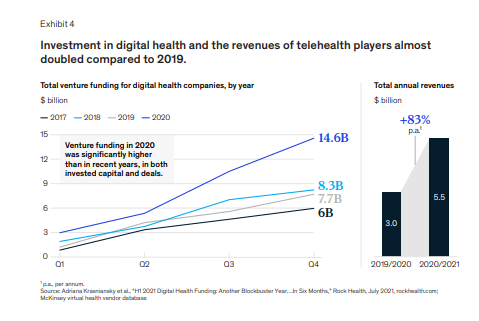

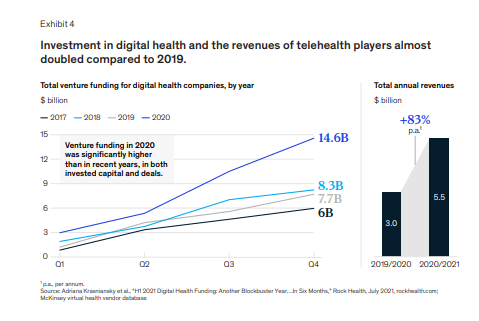

4.Investment in virtual care and digital health more broadly has skyrocketed

Fueling further innovation, with 3X the level of venture capitalist digital health investment in 2020 than it had in 2017.

5.Virtual healthcare models and business models are evolving and proliferating

Moving from purely “virtual urgent care” to a range of services enabling longitudinal virtual care, integration of telehealth with other virtual health solutions, and hybrid virtual/in-person care models, with the potential to improve consumer experience/convenience, access, outcomes, and affordability.

Virtual healthcare models and business models are evolving and proliferating

Moving from purely “virtual urgent care” to a range of services enabling longitudinal virtual care, …

integration of telehealth with other virtual health solutions, and ..

.. hybrid virtual/in-person care models,

with the potential to improve consumer experience/convenience, access, outcomes, and affordability.

Telehealth uptake

Since the initial spike in April 2020, telehealth adoption overall has approached up to 17 percent of all outpatient/office visit claims with evaluation and management (E&M) services.

This utilization has been relatively stable since June 2020.

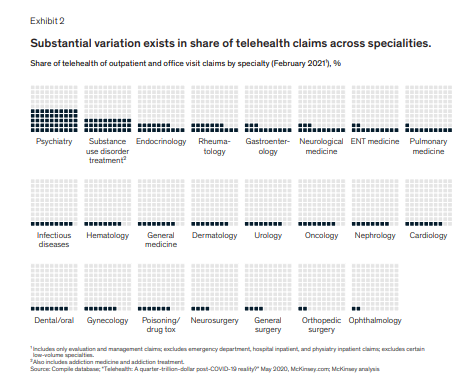

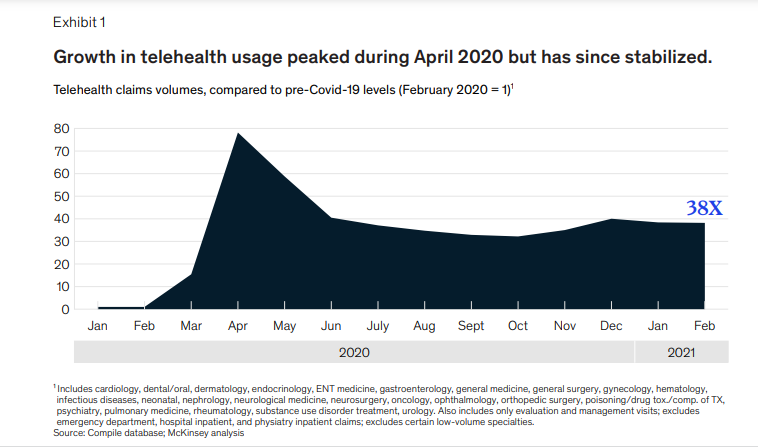

We are also seeing a differential uptake of telehealth depending on specialty, with the highest penetration in psychiatry (50 percent) and substance use treatment (30 percent) (Exhibit 2).

We are also seeing a differential uptake of telehealth depending on specialty, with the highest penetration in psychiatry (50 percent) and substance use treatment (30 percent)

Consumer and provider perceptions of telehealth

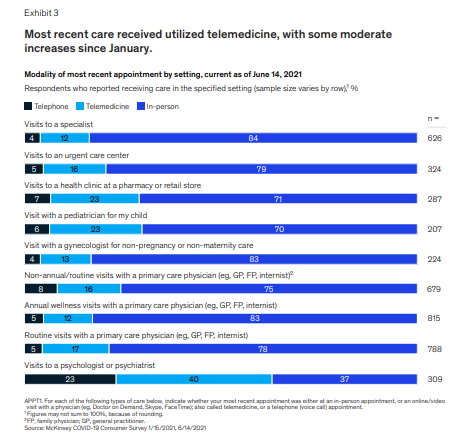

Our consumer research shows that consumers continue to view telehealth as an important modality for their future care needs, but-as expected-this view varies widely depending on the type of care.

Overall, consumer perception tracks closely to what we believe is possible telehealth uptake by various specialties (Exhibit 3).

Around 40 percent of surveyed consumers stated that they believe they will continue to use telehealth going forward-up from 11 percent of consumers using telehealth prior to COVID-19.

Moreover, our research shows between 40 and 60 percent of consumers express interest in a set of broader virtual health solutions, such as a “digital front door” or lower-cost virtual-first health plan.

However, a gap has historically existed between consumers’ expressed interest in digital health solutions and actual usage.

Continuing to focus on creating a seamless consumer interface, breaking down silos in care provision (across virtual and in-person) with improved data integration and insights, and proactive consumer engagement will all be important to sustaining and growing consumer use of virtual health as the pandemic wanes.

Moreover, our research shows between 40 and 60 percent of consumers express interest in a set of broader virtual health solutions, such as a “digital front door” or lower-cost virtual-first health plan.

On the provider side, 58 percent of physicians continue to view telehealth more favorably now than they did before COVID-19, though perceptions have come down slightly since September 2020 (64 percent of physicians).

As of April 2021, 84 percent of physicians were offering virtual visits and 57 percent would prefer to continue offering virtual care.

However, 54 percent would not offer virtual care at a 15 percent discount to in-person care.

Most health systems are closely monitoring reimbursement.

Those in bed capacity-constrained environments and value-based care arrangements are looking to understand whether there is scalable volume decanting or cost savings potential at equivalent quality.

Those in bed capacity-constrained environments and value-based care arrangements are looking to understand whether there is scalable volume decanting or cost savings potential at equivalent quality.

Regulatory changes

Some regulatory changes that enabled greater telehealth access during COVID-19 have been made permanent.

For example, CMS allowed telehealth coverage for a number of current procedural terminology (CPT) codes permanent in the 2021 physician fee schedule final rule.

However, other restrictions on telehealth may return to pre-COVID-19 normal when the public health emergency expires.

For example, there were several dozen additional CPT codes that CMS allowed telehealth coverage for on a temporary basis in the 2021 physician fee schedule.

In addition, a waiver for public health emergency allowed telehealth to be provided for Medicare beneficiaries outside of rural areas and from home rather than from a provider’s office.

The future of these provisions once the public health emergency ends is not yet clear.

Investor activity

Investment in virtual health continues to accelerate.

- Per Rock Health’s H1 2021 digital health funding report the total venture capital investment into the digital health space in the first half of 2021 totaled $14.7 billion,

- … which is more than all of the investment in 2020 ($14.6 billion) and nearly twice the investment in 2019 ($7.7 billion) (Exhibit 4).

- This increase would reflect an annualized investment of $25 billion to $30 billion in 2021, if this rate continues.

- In addition, total revenue of the top 60 virtual health players increased in 2020 to $5.5 billion, from around $3 billion the year before.

- As the investment into virtual health companies continues to grow at record levels, so does the pressure on the companies within the ecosystem to innovate and find winning models that will provide sustainable competitive advantage in this quickly evolving space.

This is good news for consumers and patients, as we are likely to continue seeing increased innovation in the virtual care delivery models.

The next chapter of telehealth

Telehealth appears poised to stay a robust option for care.

Strong continued uptake, favorable consumer perception, the regulatory environment, and strong investment into this space are all contributing to this rate of adoption.

We are observing a quick evolution of the space and innovation beyond the “virtual urgent care” convenience.

Innovations around virtual longitudinal care (both primary and specialty), enablement of care at home through remote patient monitoring and self-diagnostics, investment in “digital front doors,” and experimentation with hybrid “online/offline” models will bring new care models for consumers that help achieve healthcare’s “triple aim.”

In order to fully realize the potential of virtually enabled care models, both payers and providers should consider these new delivery models part of the core day-to-day value proposition to consumers across three areas:

- 1. Increasing convenience to receive routine care

- 2. Improving access, especially for behavioral health and specialty care

- 3. Improving care models and health outcomes, particularly for those with chronic conditions or in need of post-acute care support

1. Increasing convenience to receive routine care

- Integrating e-triage solutions with virtual visits to create a broader “digital front door” for healthcare that enables consumers to easily get care when they need it, through the most convenient channels, and lowers the cost of care by avoiding unnecessary ED visits

- Integrating care advocacy and telehealth solutions, as evidenced by recent M&A activity with the value proposition to make it easy for consumers to access care and find the best provider for their individual needs

- Experimenting with virtual-first health plans. The number of virtual-first health plans grew from one in 2019 to at least eight in 2020. While these products are still nascent, they offer the potential of lower premiums and greater convenience, in return for seeing a virtual primary care provider as the first point of care. These advantages are attracting increasing attention from employers, brokers, and payers

- Expanding the types of care that can be delivered virtually or near-virtually with innovations in at-home diagnostics/equipment or combining virtual care with at-home nurse visits

2. Improving access, especially for behavioral health and specialty care

- Continuing to expand the range of behavioral health offerings with potential to address provider shortages in many parts of the country. For example, 56 percent of counties in the United States are without a psychiatrist, 64 percent of counties have a shortage of mental health providers, and 70 percent of counties lack a child psychiatrist.

This kind of access may also be an opportunity to expand community, payer, and provider partnerships

- Expanding access to specialty care capacity, such as in rural areas where many specialties may not be available.

Even outside of rural areas, provider-to-provider virtual health can improve experience and quality of care by rapidly getting specialist input

3. Improving care models and health outcomes, particularly for those with chronic conditions or in need of post-acute care support

- Integrating remote monitoring and digital therapeutics with virtual visits, especially in value-based provider arrangements, where incorporating virtual health into their care models could improve patient outcomes and overall performance

- Growing hospital-at-home and post-acute care-at-home models

Remaining challenges to scale

Even with these innovations, challenges remain to be worked through to realize the full potential of virtual care.

These challenges include the following items:

- The need for better data integration and improved data flows across the various players in the ecosystem, in light of the fast proliferation of point solutions, which are overwhelming consumers, payers, and providers alike

- The need for better integration of the virtual health-related activities into day-to-day workflows of clinicians, particularly to enable hybrid care models that combine online and in-person care delivery

- Alignment of incentives for virtual health activities with the broader movement toward value-based care, to break out of the fee-for-service mentality and the worry about reimbursement parity, especially for the virtual health models that aim to reduce total cost of care

Potential exists to improve access, quality, and affordability of healthcare, plus embrace the quarter-trillion dollar economic opportunity represented by telehealth.

Collectively, industry leaders have a chance to help consumers and providers improve access and quality through the power of telehealth.

Potential exists to improve access, quality, and affordability of healthcare, plus embrace the quarter-trillion dollar economic opportunity represented by telehealth.

Update: May 29, 2020

EXECUTIVE SUMMARY 1 (2020)

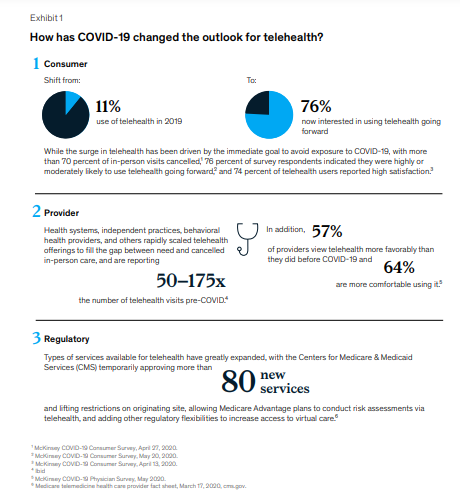

The COVID-19 pandemic has led to a rapid increase in the use of telehealth, with consumer adoption rising from 11% in 2019 to 46% currently.

- Providers are seeing 50–175 times more patients via telehealth than before the pandemic.

- Pre-COVID, the total annual revenue of US telehealth players was estimated at $3 billion, with the largest vendors in the “virtual urgent care” segment.

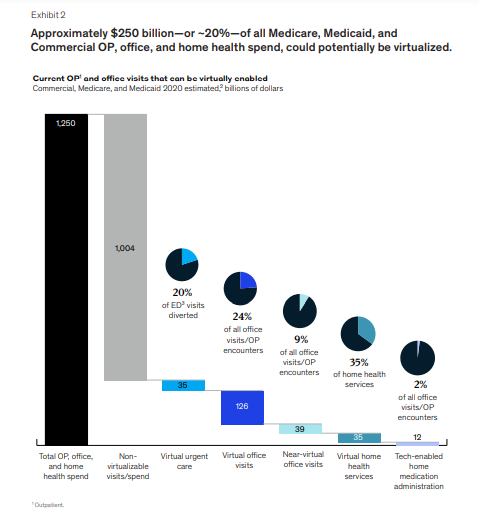

- However, with the acceleration of consumer and provider adoption of telehealth, up to $250 billion of current US healthcare spend could potentially be virtualized.

- The shift towards telehealth has the potential to improve convenience and access to care, better patient outcomes, and a more efficient healthcare system.

- However, challenges remain, such as security, workflow integration, effectiveness compared to in-person visits, and reimbursement.

The estimates are that

- 20% of emergency room visits,

- 24% of healthcare office visits and outpatient volume, and

- 35% of regular home health attendant services could potentially be virtualized,

resulting in a potential shift of $250 billion in healthcare spend in 2020 to virtual or near-virtual care.

The estimates are that : (1) 20% of emergency room visits, (2) 24% of healthcare office visits and outpatient volume, and (3) 35% of regular home health attendant services could potentially be virtualized,

resulting in a potential shift of $250 billion in healthcare spend in 2020 to virtual or near-virtual care.

INFOGRAPHIC 1 (2020)

DEEP DIVE 1(2020)

Telehealth: A quarter-trillion-dollar post-COVID-19 reality?

By Oleg Bestsennyy, Greg Gilbert, Alex Harris, and Jennifer Rost

July 9, 2021

COVID-19 has caused a massive acceleration in the use of telehealth.

Consumer adoption has skyrocketed, from 11 percent of US consumers using telehealth in 2019 to 46 percent of consumers now using telehealth to replace cancelled healthcare visits.

Providers have rapidly scaled offerings and are seeing 50 to 175 times the number of patients via telehealth than they did before.

Pre-COVID-19, the total annual revenues of US telehealth players were an estimated $3 billion, with the largest vendors focused in the “virtual urgent care” segment: helping consumers get on-demand instant telehealth visits with physicians (most likely, with a physician they have no relationship with).

With the acceleration of consumer and provider adoption of telehealth and extension of telehealth beyond virtual urgent care, up to $250 billion of current US healthcare spend could potentially be virtualized.

Pre-COVID-19, the total annual revenues of US telehealth players were an estimated $3 billion, with the largest vendors focused in the “virtual urgent care” segment …

With the acceleration of consumer and provider adoption of telehealth and extension of telehealth beyond virtual urgent care, up to $250 billion of current US healthcare spend could potentially be virtualized.

Pre-COVID-19, the total annual revenues of US telehealth players were an estimated $3 billion, with the largest vendors focused in the “virtual urgent care” segment …

With the acceleration of consumer and provider adoption of telehealth and extension of telehealth beyond virtual urgent care, up to $250 billion of current US healthcare spend could potentially be virtualized.

This shift is not inevitable.

It will require new ways of working for a broad set of providers, step-change improvements in information exchange, and broadening access and integration of technology.

The potential impact is improved convenience and access to care, better patient outcomes, and a more efficient healthcare system.

Healthcare players may consider moves now that support such a shift and improve their future position.

Telehealth has surged under COVID-19

Many of these dynamics are likely to be in place for at least the next 12 to 18 months, as concerns about COVID-19 remain until a vaccine is widely available.

During this period, consumers’ preferences for care access will continue to evolve, and virtual health could become more deeply embedded into the care delivery system.

However, challenges remain.

Our research indicates providers’ concerns about telehealth include security, workflow integration, effectiveness compared with in-person visits, and the future for reimbursement.

Similarly, there is a gap between consumers’ interest in telehealth (76 percent) and actual usage (46 percent).

Factors such as lack of awareness of telehealth offerings, education on types of care needs that could be met virtually, and understanding of insurance coverage are some of the drivers of this gap.

What is the full potential for telehealth and virtual care?

We identified five models for virtual or virtually enabled non-acute care and analyzed the full potential of healthcare volume and spend that could be delivered this way.

These models of virtual care have increasing requirements to engage broader and broader portions of the healthcare delivery system, going from offering one-off urgent visits, to building omnichannel care models that deliver a large portion of office visits virtually or near virtually, to embedding virtual services in home care models.

They include:

- 1.On-demand virtual urgent care — as an alternative to lower acuity emergency department (ED) visits, urgent care visits, and after-hours consultations.

- 2. Virtual office visits — with an established provider for consults that do not require physical exams or concurrent procedures.

- 3.Near-virtual office visits- extend the opportunity for patients to conveniently access care outside a provider’s office, by combining virtual access to physician consults with “near home” sites for testing and immunizations, such as worksite clinics or retail clinics.

- 4.Virtual home health services — leverage virtual visits, remote monitoring, and digital patient engagement tools to enable some of these services to be delivered remotely, such as a portion of an evaluation, patient and care giver education, physical therapy, occupational therapy, and speech therapy.

- 5.Tech-enabled home medication administration — allows patients to shift receiving some infusible and injectable drugs from the clinic to the home.

1.On-demand virtual urgent care — as an alternative to lower acuity emergency department (ED) visits, urgent care visits, and after-hours consultations.

These care needs are the most common telehealth use cases today among payers.

This allows a consumer to remotely consult on demand with an unknown provider to address immediate concerns (such as an acute sinusitis) and avoid a trip to the ED or an urgent care center.

Such usage could be further scaled to address a larger portion of low acuity visits previously seen in EDs.

2. Virtual office visits — with an established provider for consults that do not require physical exams or concurrent procedures.

Such visits can be primary care (such as chronic condition checks, colds, minor skin conditions), behavioral health (such as virtual psychotherapy sessions), and some specialty care (select follow-up visits such as virtual cardiac rehabilitation).

An omnichannel care model that fully leverages virtual visits includes a mix of telehealth and in-person care with a consistent set of providers, improving patient convenience, access, and continuity of care.

This model also enables clinicians to better manage patients with chronic conditions, with the support of remote patient monitoring, digital therapeutics, and digital coaching, in addition to virtual visits.

3.Near-virtual office visits- extend the opportunity for patients to conveniently access care outside a provider’s office, by combining virtual access to physician consults with “near home” sites for testing and immunizations, such as worksite clinics or retail clinics.

For example, a virtual visit of a patient with flu or COVID-like symptoms could be followed up by a trip to a nearby retail clinic for a flu or COVID-19 test, with a subsequent follow-up virtual check-in with the primary care physician to consult on follow-on care

4.Virtual home health services — leverage virtual visits, remote monitoring, and digital patient engagement tools to enable some of these services to be delivered remotely, such as a portion of an evaluation, patient and care giver education, physical therapy, occupational therapy, and speech therapy.

Direct services, such as wound care and assistance with daily living routines, would still occur in person, but virtual home health services could enhance the patient’s and caregiver’s experience, extend the reach of home health providers, and improve connectivity with the broader care team.

For example, a physical therapist could conduct virtual sessions with elderly patients at their home to improve their strength, balance, and endurance, and to advise them how to avoid physical hazards to reduce risk of falls.

5..Tech-enabled home medication administration allows patients to shift receiving some infusible and injectable drugs from the clinic to the home.

This shift can happen by leveraging remote monitoring to help manage patients and monitor symptoms, providing self-service tools for patient education (for example, training for selfadministration), and providing telehealth oversight of staff (for example, an oncologist overseeing a nurse delivering chemotherapy to a patient at home and monitoring for side effects).

This would be coupled with home delivery of the therapeutics.

Our claims-based analysis suggests that approximately 20 percent of all emergency room visits could potentially be avoided via virtual urgent care offerings, …

- … 24 percent of healthcare office visits and outpatient volume could be delivered virtually, and an additional 9 percent “near-virtually.”

- Furthermore, up to 35 percent of regular home health attendant services could be virtualized, and 2 percent of all outpatient volume could be shifted to the home setting, with tech-enabled medication administration.

- Overall, these changes add up to $250 billion in healthcare spend in 2020 that could be shifted to virtual or near-virtual care, or 20 percent of all office, outpatient, and home health spend across Medicare, Medicaid, and commercially insured populations.

Scaling telehealth does more than alleviate patient and provider concerns over the next 12 to 18 months until a COVID-19 vaccine is available.

Telehealth can increase access to necessary care in areas with shortages, such as behavioral health, improve the patient experience, and improve health outcomes.

Fundamentally, the integration of fully virtual and near-virtual health solutions brings care closer to home, increasing the convenience for patients to access care when they need it and the likelihood that they will take the right steps to manage their care.

These solutions can also make healthcare more efficient; evidence prior to COVID-19 shows that telehealth solutions deployed for chronic populations can improve total cost of care by 2 to 3 percent.

The actual opportunity is likely greater once stakeholders embed telehealth as the new normal (for example, driven by improved abilities to manage chronic patients, potential increases in provider productivity).

What actions should healthcare stakeholders take in the near term to shape this opportunity?

Actions payers could consider:

- 1.Define a value-backed virtual health roadmap, taking a data-driven view to prioritize interventions that will improve outcomes for priority populations, and develop strategies to digitally enable end-to-care care journeys.

- 2.Optimize provider networks and accelerate value-based contracting to incentivize telehealth. Define approaches (beyond the immediate COVID-19 response measures) to reimbursement and covered services, embed in contracting, and optimize networks and value-based models to include virtual health. Align incentives for using telehealth, particularly for chronic patients, with the shift to risk-based payment models.

- 3.Build virtual health into new product designs to meet changing consumer preferences and demand for lower-cost plans. This new design may include virtual-first networks, digital front-door features (for example, e-triage), seamless “plug and play” capabilities to offer innovative digital solutions, and benefit coverage for at-home diagnostic kits.

- 4.Integrate virtual health into the care delivery approach. Given the significant disruptions to providers, payers are reassessing their role in care delivery — from ownership of care delivery assets, value-based contracting, or anything in between. Consider options in virtual health (for example, platforms, digital-first providers) as a critical element of this approach.

- 5.Reinforce the technology and analytics foundation that will be required to achieve the full potential of virtual health.

Actions health systems could consider:

- 1.Accelerate development of an overall consumer-integrated “front door.” Consider what the integrated product will initially cover beyond what currently exists and integrate with what may have been put in place in response to COVID-19 (for example, e-triage, scheduling, clinic visits, record access).

- 2.Segment the patient populations (for example, with specific chronic disease) and specialties whose remote interactions could be scaled with home-based diagnostics and equipment.

- 3.Build the capabilities and incentives of the provider workforce to support virtual care (for example, workflow design, centralized scheduling, and continuing education); align benefit structure to drive adoption in line with health system and/or physician practice economics.

- 4.Measure the value of virtual care by quantifying clinical outcomes, access improvement, and patient/provider satisfaction to drive advocacy and contracting for continued expanded coverage. Include the potential value from telehealth when contracting with payers for risk models to manage chronic patients.

- 5.Consider strategies and rationale to go beyond “telehealth”/clinic visit replacement to drive growth in new markets and populations and scale other applications (for example, teleICU, post-acute care integration).

Actions investors and health services and technology firms could consider:

1.Develop scenarios on how virtual health will evolve and when, including how usage evolved post-COVID-19, based on expected consumer preferences, reimbursement, CMS, and other regulations.

2.Assess impact across virtual health solution/service types, developing a view of the opportunity for each solution/service type, including expected consumer/provider adoption, impact (for example, to outcomes, experience, affordability), and reimbursement.

3.Develop potential options and define investment strategies based on the expected virtual health future (for example, combinations of existing players/platforms, linkages between in-person and virtual care offerings) and create sustainable value.

4.Identify the assets and capabilities to implement these options, including specific assets or capabilities to best enable the play, and business models that will deliver attractive returns.

5.Execute, execute, execute. The next normal will rapidly take hold, and those that can best anticipate its impact will create disproportionate value. Don’t underestimate the potential of network effect.

The window to act is now.

The current crisis has demonstrated the relevance of telehealth and created an opening to modernize the care delivery system.

This modernization will be achieved by embedding telehealth in the care continuum at scale.

A $3 billion revenue market has the potential to grow to $250 billion.

The seeds for success will be sown in the next few months during the COVID-19 crisis.

Healthcare systems that come out ahead will be those who act decisively, invest to build capabilities at scale, work hard to rewire the care delivery model, and deliver distinctive high-quality care to consumers.

Originally published at https://www.mckinsey.com.

BOX: SIDEBAR 1

What changes need to happen to realize the full potential of telehealth?

This value will not happen without concerted efforts by healthcare stakeholders, innovations in care models, adoption of new technologies, and supporting infrastructure.

1.Scale the use of virtual urgent care.

This change will require building out flexible provider networks to address the shortages and long wait times that consumers experienced during the initial escalation of telehealth demand.

Sustaining and growing patient use also will likely require active, personalized patient engagement, by both providers and payers, to ensure a positive experience with telehealth.

Integration with e-triage/symptom solutions (by either provider or payer) can make the patient experience even more seamless and can leverage artificial intelligence (AI) to guide patients to the most appropriate care. Finally, the ability to access patients’ medical records and make post-encounter additions may be needed to enable care integration.

2. Scale the use of fully virtual office visits.

This change would require going beyond on-demand visits with an unknown provider and embedding virtual health in the “brick and mortar” healthcare system.

Telehealth solutions will likely need to be easier to embed in provider workflows and address security concerns, both of which have been raised by providers as limiting factors to telehealth adoption.¹

Capabilities are needed to allow for more seamless information exchange and sufficiently rich clinical data to be transferred among providers and between providers and patients (for example, ensuring all providers caring for a complex patient have access to the clinical record and can update it based on virtual visits, plus leveraging AI and natural language processes to capture notes in easily sharable forms).

In addition, retail diagnostic kits (for example, home pulse oximeters, blood pressure machines) must be widely available, so patients can take basic measurements at home and enable a broader set of care to be delivered virtually.

Providers should have a clear end-to-end value proposition for integrating telehealth into their service delivery model (for example, incorporating the value from patient attraction and retention and operating model efficiency, in addition to reimbursement for visits).

Payers should also have a clear view of potential outcomes and total cost of care impact (for example, by population and care journey) to inform decisions on provider engagement strategies and reimbursement.

3. Integrate “near virtual” office visits into the care continuum.

These near-virtual visits will have requirements similar to fully virtual office visits, and scale up the availability of “nearhome” sites of care (for example, workplace and retail clinics).

They would be integrated into provider networks and delivery system footprints, and optimize care protocols to guide patients to these sites.

Even further data integration will likely be needed.

This may include patient data shared across platforms outside of a single health system and patient tools (for example, comprehensive personal health records applications, care navigation tools) that allow patients to manage their care across providers.

4. Virtualize home care services.

This change would likely require increased access to and use of remote monitoring devices, tailored to specific clinical conditions (such as remote continuous glucose monitoring sensors for people with diabetes or remote heartbeat monitors and blood pressure monitors for people with cardiovascular conditions).

Providers may be required to integrate use of such devices into care plans. Payers may need to offer reimbursement, and solutions may need to enable integrated access between, for example, primary care physicians, care managers, and at-home caregivers.

These services could also require the deployment of supportive patient engagement tools (for example, digital coaching, care plan navigation tools), tailored to patients’ needs and integrated with communication channels to providers, care managers, and others involved in their care.

5. Tech-enabled home medication administration.

This change will have requirements similar to virtualized home care services, as well as tailored digital tools to support monitoring and care delivery (for example, medication adherence tools), and virtual access to pharmacist consults.