HBR

by Scott D. Anthony, Alasdair Trotter, Evan I. Schwartz

September 24, 2019

In 2012, Denmark’s biggest energy company, Danish Oil and Natural Gas, slid into financial crisis as the price of natural gas was plunging by 90% and S&P downgraded its credit rating to negative.

The board hired a former executive at LEGO, Henrik Poulsen, as the new CEO.

Whereas some leaders might have gone into crisis-management mode, laying off workers until prices recovered, Poulsen recognized the moment as an opportunity for fundamental change.

“We saw the need to build an entirely new company,” says Poulsen.

He renamed the firm Ørsted after the legendary Danish scientist Hans Christian Ørsted, who discovered the principles of electromagnetism.

“It had to be a radical transformation;

we needed to build a new core business

and find new areas of sustainable growth.

We looked at the shift to combat climate change,

and we became one of the few companies to wholeheartedly make this profound decision, to be one of the first to go from black to green energy.”

That strategic impulse-to identify a higher-purpose mission that galvanizes the organization-is a common thread among the Transformation 20, a new study by Innosight of the world’s most transformative companies.

Fortifying this new view, the Business Roundtable last month released a statement signed by 181 CEOs stating that serving shareholders can no longer be the main purpose of a corporation; rather, it needs to be about serving society, through innovation, commitment to a healthy environment and economic opportunity for all.

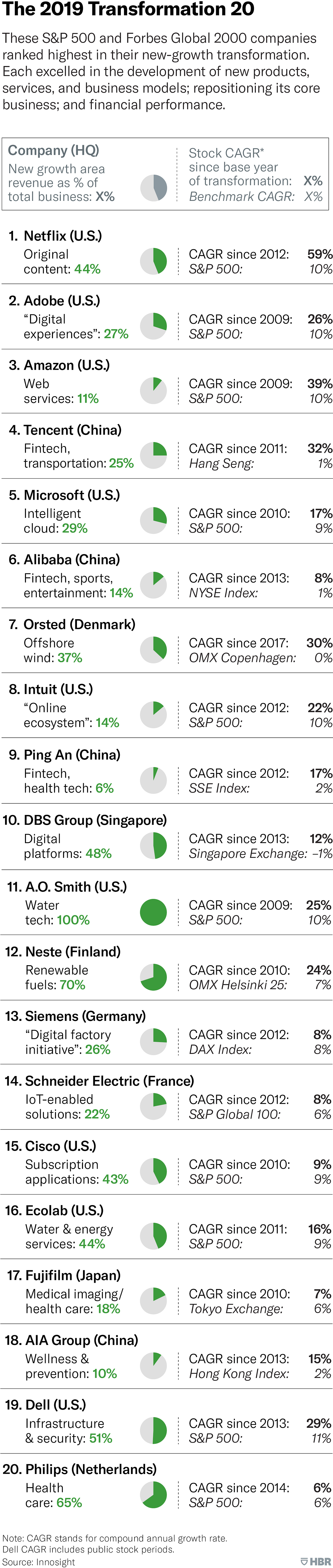

Our aim was to identify the global companies that have achieved the highest-impact business transformations over the past decade, using the same methodology as our 2017 study.

Our research team screened all the firms in the S&P 500 and Global 2000 using three lenses:

- New growth: How successful has the company been at creating new products, services, new markets, and new business models? This includes our primary metric: the percentage of revenue outside the core that can be attributed to new growth areas.

- Repositioning the core: How effectively has the company adapted its traditional core business to changes or disruptions in its markets, giving its legacy business new life?

- Financials: Has the company posted strong financial and stock market performance, or has it turned around its business from losses or slow growth to get back on track? We looked at revenue CAGR (compound annual growth rate), profitability, and stock price CAGR during the transformation period, which was different for each firm.

Our initial phase of research identified 52 companies making substantial progress towards strategic transformation-merely 3% of the public companies in our data set.

From this second-round list, an Innosight partner panel voted to narrow it down to 27 finalists.

For the third round, the following companies were selected as the Transformation 20 and ranked by a panel of management experts (see judges).

Each of these companies developed new-growth businesses outside its traditional core which have become a significant share of the overall business.

However, we believe it’s the decision to infuse a higher purpose into the culture, one that guides strategic decisions and gives clarity to everyday tasks, that has propelled these companies to success.

1.Netflix

The #1 company, Netflix, is a case in point.

In 2013, CEO Reed Hastings released an 11-page memo to employees and investors detailing a commitment to move from just distributing content digitally to become a leading producer of original content that could win Emmys and Oscars.

As the memo said, “We don’t and can’t compete on breadth with Comcast, Sky, Amazon, Apple, Microsoft, Sony, or Google.

For us to be hugely successful we have to be a focused passion brand.

Starbucks, not 7-Eleven. Southwest, not United. HBO, not Dish.”

Since unveiling that new purpose, Netflix revenue has roughly tripled, its profits have multiplied 32-fold, and its stock CAGR has increased 57% annually, versus 11% for the S&P 500.

Finding new purpose

In a comparable way, the purpose-driven mission of preventative healthcare has spurred major change at other large organizations that made the list.

- China’s AIA Group has moved beyond insurance to become a wellness company, whereas

- Dutch electronics giant Philips has largely divested its legacy lighting business to focus on healthcare technology.

The technology companies on our list also discovered ways to infuse purpose into their organizations as part of their fundamental change.

- Siemens moved beyond a purpose of maximizing shareholder value to a mission of “serving society.”

This transformation began in 2014 with a plan called Vision 2020 that called for harnessing technologies such as AI and the Internet of Things.

However, changing the mission also called for changing the culture. “The biggest obstacle to any transformation is literally just the way we’ve always done things,” says Siemens USA CEO Barbara Humpton.

Infusing a higher purpose into the company called for pushing decision making out from the center to every business unit, so that managers and rank-and-file employees feel they have a stake in future success.

“Ownership culture is central to everything,” Humpton says. This shift in the culture at Siemens has propelled plans to divest its core oil and gas business and redeploy the capital to its Digital Industries unit and Smart Infrastructure business focused on energy efficiency, renewable power storage, distributed power, and electric vehicle mobility.

The case of Tencent Holdings

In the case of Tencent Holdings, the company was founded in 1998 to harness the Internet opportunity, launching online chat forums and video games for China’s new generation of digital natives.

As of 2005, shortly after its IPO, Tencent defined its purpose in terms of “implementing our Online Lifestyle strategy, which strives to cater to the basic needs of our users.”

Only in subsequent years did founder and CEO Pony Ma Huateng broaden the firm’s outlook by embracing a mission of “improving the quality of human life through digital innovation.”

Since 2011, Tencent has invested heavily in new growth ranging from education and entertainment to autonomous vehicles and ride sharing to fintech and the industrial internet-areas that together now represent 25% of its $46 revenue.

Through its Tencent Education business unit, the firm is now developing educational content and services for individuals, schools, and education management.

All of this growth helped Tencent become the first Asian company to surpass $500 billion in market valuation.

In 2019, Tencent refined its mission once again, in response to the growing global backlash against technology’s dominance in our lives, boiling it down to: tech for social good.

Several companies found that refocusing the organization to help save the planet can be especially powerful.

Ecolab, #16 on our list, is a prime example.

In the early 2000s, when Douglas Baker Jr. became its CEO, Ecolab was an 80-year-old firm growing 10% annually by selling industrial cleansers and food safety services. “Our strategic plan was to sell more of what we had,” Baker says.

To grow much beyond its $3.8 billion in revenue, the company could have kept moving into adjacent markets or new geographies, but Baker felt that wasn’t bold enough.

The transformation began by talking to customers, Baker says. The same customers who were buying its core products were also voicing concerns about access to clean water. And they weren’t alone. Projections for the year 2030 showed that 70% of the world’s GDP would be based in water-stressed regions, California and Southern India being prime examples.

In 2011, Ecolab had a $12 billion market cap when it acquired water technology company Nalco in an $8 billion deal.

The combined company is now one of the world’s leading suppliers of hardware, software, and chemistry that helps manufacturers and service firms become more efficient users of water. A primary metric driving the organization is how much water is saved by its clients annually, which now stands at 188 billion gallons, against a 2030 target of 300 billion gallons.

“We broadened our vision and our purpose changed,” Baker says.

“As our teams widened their awareness of global issues, our pride has been enhanced.” So has Ecolab’s market value, which has surpassed $55 billion, placing it among America’s top 100 most valuable firms.

Performing mission impossible

Such transformations are never easy.

When the firm now known as Ørsted divested its oil and natural gas businesses and began phasing out coal, that created a giant earnings gap that urgently needed to be filled. The company had invested in offshore wind power, but the technology was too expensive, producing energy that was more than double the price of onshore wind.

Under Poulsen, Ørsted embarked on what critics called an impossible mission: a systematic “cost-out” program to reduce the price of offshore wind while achieving scale. The company managed to cut the cost by more than 60% while building three major new ocean-based wind farms in the U.K. and acquiring a leading company in the U.S.

The result: Previously about 80% owned by the Danish government, Ørsted’s IPO in 2016 was one the year’s largest. Net profits have increased by $3 billion since it began the transformation, and Ørsted is now the world’s largest offshore wind company, with about a third share of booming global growth market.

Takeaways

The takeaway lesson from these mission-changers is clear: In an era of relentless change, a company survives and thrives based not on its size or performance at any given time but on its ability to reposition itself to create a new future, and to leverage a purpose-driven mission to that end.

That’s why strategic transformation may be the business leadership imperative of the 21st century

Click here to see the full T20 study results and methodology.

T20 Panel of Judges

- Rita McGrath, management professor at Columbia Business School

- BEH Swan Gin, Chair of the Singapore Economic Development Board

- Phil Coughlin, Chief Strategy Officer at Expeditors (Seattle)

- Amantha Imber, CEO of Inventium (Sydney, Australia)

- Nathan Furr, Professor of Strategy, INSEAD

Editor’s note: Every ranking or index is just one way to analyze and compare companies or places, based on a specific methodology and data set. At HBR, we believe that a well-designed index can provide useful insights, even though by definition it is a snapshot of a bigger picture. We always urge you to read the methodology carefully.

Originally published at https://hbr.org on September 24, 2019.