institute for

health transformation

Joaquim Cardoso MSc

Senior Advisor for Continous Health Transformation

and Digital Health

January 9, 2023

This is an excerpt of the publication “Smart Insurers Are Using AI to Power Distribution. Are You?”, with the title above, focusing on the topic in question.

JANUARY 04, 2023

By Laurent Richaud, Matt Sweeny, Daniel van Wassem, Sara Codella, and Angelo Candreia

Executive Summary

Overview

- The paper “Smart Insurers Are Using AI to Power Distribution. Are You?” makes the following points:

- Insurers that utilize artificial intelligence (AI) in their distribution processes can drive growth, increase revenue and market share, and reduce distribution expenses.

- Personalization using AI can also improve stagnant agent productivity, as demonstrated by an insurer in Singapore whose productivity increased by 25% and business growth increased by 5–6 percentage points.

- Despite common misconceptions, such as the belief that traditional data analytics can achieve the same results as AI at a lower cost, or that AI is too costly and complex to be worthwhile, insurers can begin with small, high-impact projects to demonstrate proof of value and build strong business cases for increasingly ambitious projects.

Principles applied to AI Health Care

- Below we present an excerpt of the paper, containing two points that are applicable to AI Health Care projects as well

Data is the foundation

- For most organizations, the data in their core legacy systems is not ready to be used for AI use cases.

- It’s stored in siloed systems that may have highly inconsistent definitions of data types. And data quality may vary substantially.

- The solution is a layer that decouples front and back systems, liberating data from the core transactional systems.

- These new digital foundations should be built using a modular, cloud-based architecture.

Change Management: The Real Challenge

- Change management is essential in any AI project

- Any new system must get buy-in from this highly heterogeneous, semiautonomous group, and some of them may be very skeptical about change.

- From the start of the project, it’s key to demonstrate that agents will be empowered-not replaced-by AI. The best strategy is an end-to-end approach that considers change management even at the first stage, when insurers are identifying and selecting their AI solutions.

- Change management must remain an integral part of the project as it continues through development and scale-up.

- Here are five levers for generating the essential buy-in: (1) Cocreate from the start, (2) Encourage data sharing, (3) Explain why, (4) Make it easy, (5) Be flexible

Infographic

DEEP DIVE

Data Is the Foundation

Insurers have centuries of experience leveraging data in underwriting, claims, and pricing.

But for most insurers, the data in their core legacy systems is not ready to be used for AI use cases.

It’s stored in siloed systems that may have highly inconsistent definitions of data types. And data quality may vary substantially.

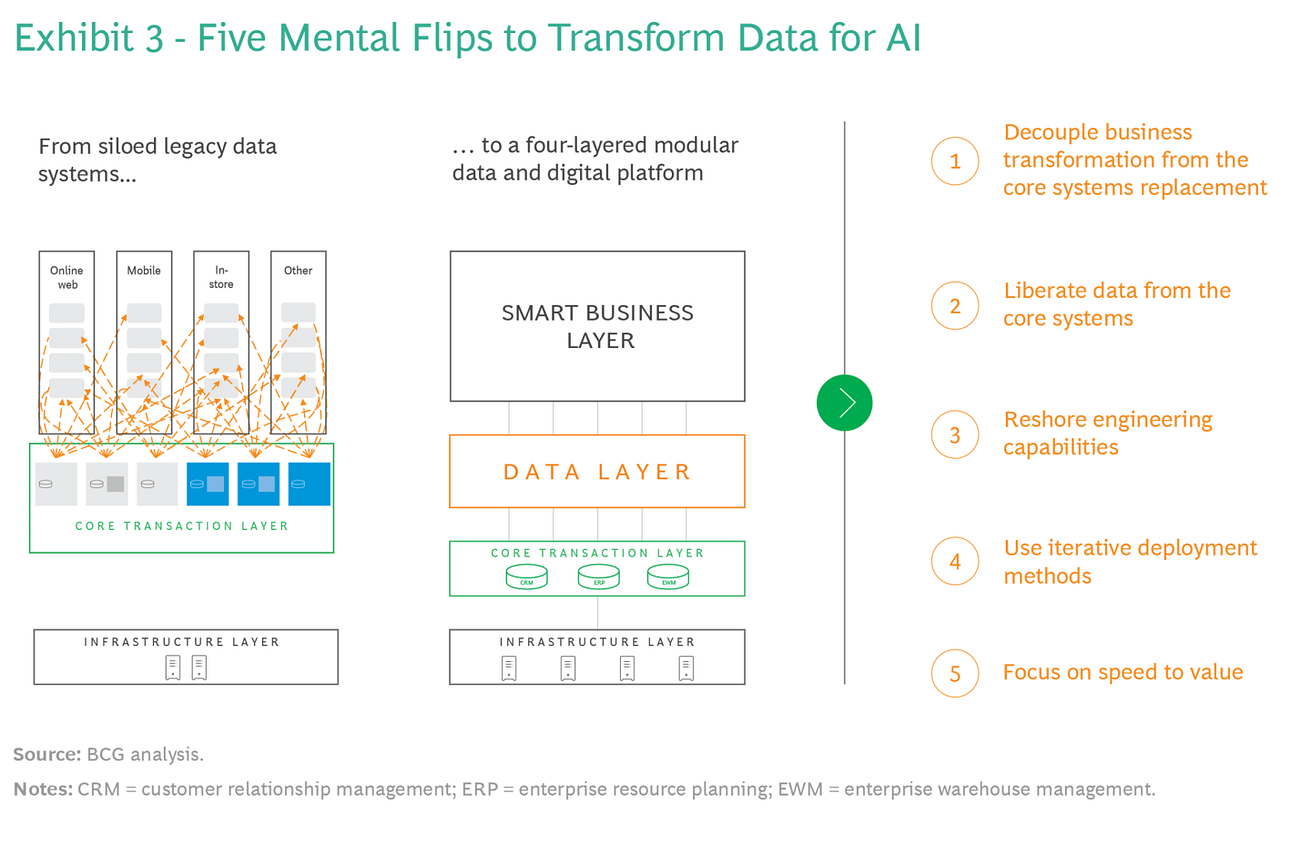

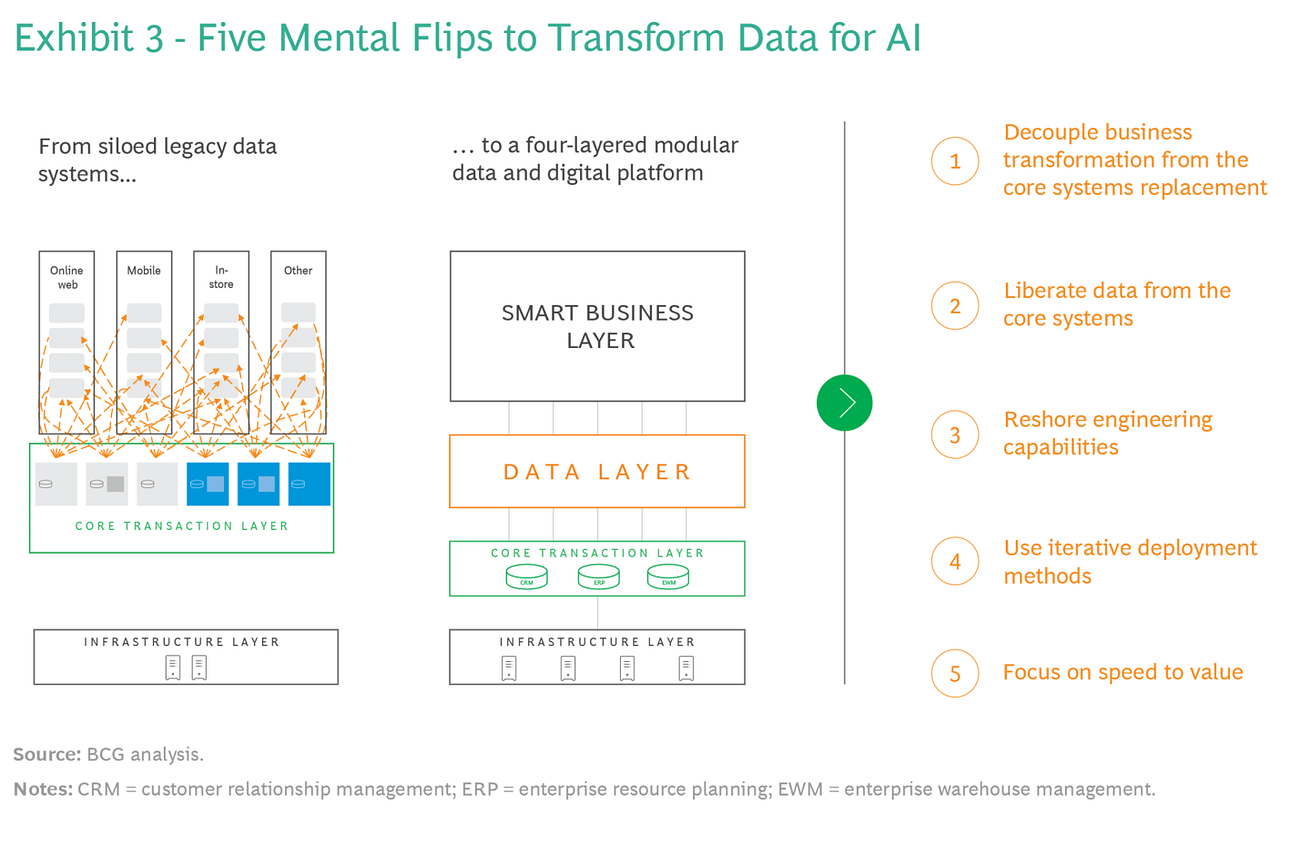

The solution is a layer that decouples front and back systems, liberating data from the core transactional systems. (See Exhibit 3.)

These new digital foundations should be built using a modular, cloud-based architecture.

The solution is a layer that decouples front and back systems, liberating data from the core transactional systems.

These new digital foundations should be built using a modular, cloud-based architecture.

But you don’t need to wait to have all these new foundations in place to develop AI products.

They can be built in parallel with the delivery of key AI initiatives.

It’s important to underline that insurers’ internal technical skills, such as data science and engineering, will need to be strongly reinforced. Staff will need to be upskilled. And new capabilities will need to be imported.

This requires much more than just placing an ad on a recruiting website.

Insurers that want to attract data scientists must develop a value proposition that is appealing to top talent, offering flexibility and highlighting the interesting problems they will tackle.

Insurers also need to use the appropriate recruiting channels and engage with the data science community via hackathons or platforms such as Kaggle (a data science site where firms can post real-world challenges for the community to solve).

In addition, insurers must create a speedy recruiting process that identifies their best candidates, supplementing interviews with coding and analytics tests.

We worked with a European insurer that took four months to recruit data scientists, creating a constant risk of losing much-needed talent to rival insurers. An overhaul of the company’s recruiting processes reduced this time to just one month.

Change Management: The Real Challenge

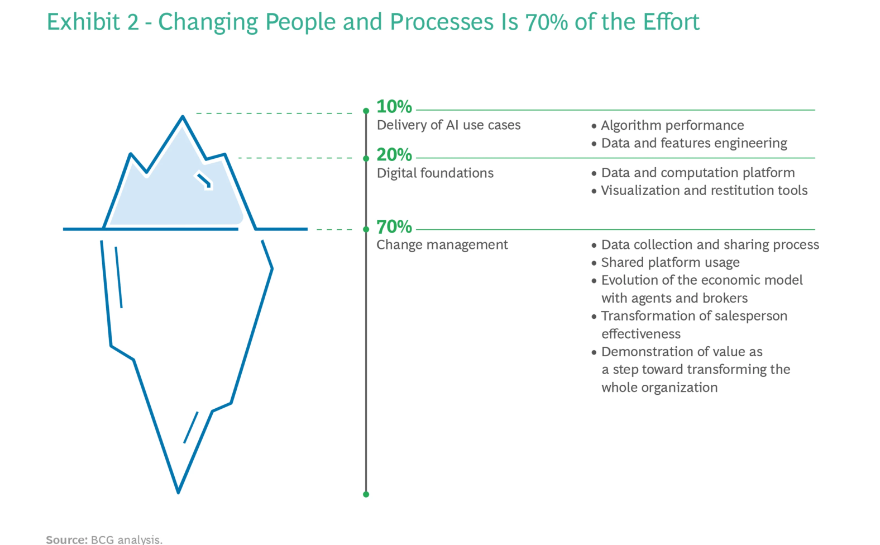

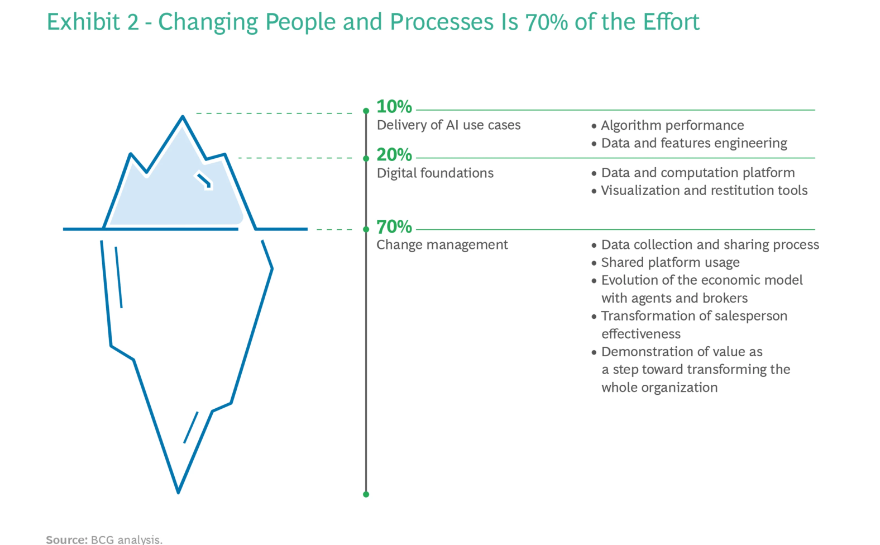

Change management is essential in any AI project, but the stakes are particularly high when it is deployed in insurance distribution.

The challenge is that this function-so critical to an insurer’s business- is typically done by outside advisors, agents, or brokers.

Any new system must get buy-in from this highly heterogeneous, semiautonomous group, and some of them may be very skeptical about change.

They may have many ways of working and varied attitudes toward technology. They may perceive some changes as not being beneficial to them.

There is also an essential connection with the data challenges mentioned earlier.

Agents may be reluctant to share the data necessary to the success of AI projects for a number of reasons, one of which is a fear of disintermediation.

More broadly, they may worry about a change in the value split between themselves and the insurer-to their detriment.

The agent mindset, however, can be turned into an advantage if the new AI-driven processes are implemented with care.

Agents have an entrepreneurial mentality with strong financial incentives; they will overwhelmingly adopt new ways of working and tools if these deliver additional sales or productivity.

From the start of the project, it’s key to demonstrate that agents will be empowered-not replaced-by AI.

The best strategy is an end-to-end approach that considers change management even at the first stage, when insurers are identifying and selecting their AI solutions.

Strong product managers are needed who link technical and business teams.

Change management must remain an integral part of the project as it continues through development and scale-up.

Here are five levers for generating the essential buy-in:

- Cocreate from the start. At the proof-of-concept stage, cocreation is essential. A dedicated team embedding agents and technical contributors will secure early agent participation and ensure that the tool fits their needs. As deployment progresses, the team will kickstart a feedback loop that will iteratively improve AI effectiveness.

- Encourage data sharing. It’s vital to incentivize agents’ data sharing by leveraging data from other sources, such as digital channels or claims management centers. Hopefully, when agents see how this data adds value, they will be more willing to share data into the pool.

- Explain why. The AI should provide agents with some rationale when it recommends actions. Without this, the agent may not take the suggested step.

- Make it easy. Everything must integrate with agents’ workflow and tools such as click-to-call or email automation. The new system must reduce, not increase, pain points.

- Be flexible. The insurer’s change management support must adapt to each agent, reflecting that agents vary significantly in their tech maturity and ability to absorb new systems. The tool should recommend only those actions that the agent can perform.