Front Office Sports

April, 22

DESIGN: ALEX BROOKS

Executive Summary

Wearable technology isn’t new — particularly when it comes to biometric wearables.

Medical patients, the elderly, and other compromised populations have utilized bio wearables for decades to monitor their health.

Telehealth and remote patient monitoring became the norm during the pandemic, increasing the importance and prevalence of biometric wearables for patients being treated at home.

From a consumer standpoint, wearables have enjoyed positive tailwinds.

Increased interest in health tracking, along with a rise in human performance and connected fitness (anything from Peloton bikes to commercial continuous glucose monitors), has spurred funding for various new entrants into the market.

Any way you look at it, wearables are coming into the consumer spotlight.

In this report, we’ll provide context on the market, break down the difference between patient monitoring and consumer use, and look into data monetization.

Patient Behaviors

It’s important to first contextualize the role wearables play in a healthcare and patient context.

One of the initial use cases for wearables — and one that continues to drive innovation and new use cases in the space — is remote patient monitoring (“RPM”).

One of the initial use cases for wearables — and one that continues to drive innovation and new use cases in the space — is remote patient monitoring (“RPM”).

By definition, remote patient monitoring refers to the use of technology to monitor patients outside of clinical settings.

These online devices transmit data directly to healthcare providers and are integrated into workflows that allow doctors and other care providers to work efficiently.

Additionally, the U.S. Government Accountability Office defined remote patient monitoring as “a coordinated system that uses one or more home-based or mobile monitoring devices that transmit vital sign data or information on activities of daily living that are subsequently reviewed by a healthcare professional.”

From diabetes to cancer to congestive heart failure, remote patient monitoring and bio wearables have helped transform the cost structure of the healthcare system for the better.

According to a survey by Software Advice, most patients (86%) using prescribed wearables experience improved health outcomes, quality of life, and quality of care.

While the survey indicated that medical-caliber wearables improved outcomes, there were certain indications that products would require improved functionality from a user experience and accuracy standpoint.

While the survey indicated that medical-caliber wearables improved outcomes, there were certain indications that products would require improved functionality from a user experience and accuracy standpoint.

Some interesting takeaways from the survey:

- 1 in 5 patients think their wearable device is too hard to use.

- Most (43%) think consumer wearables such as Apple Watch, Oura, and Whoop are easier to use than medically prescribed devices (9%).

- A majority of patients (87%) have reported inaccurate biometric data with their wearable devices at some point.

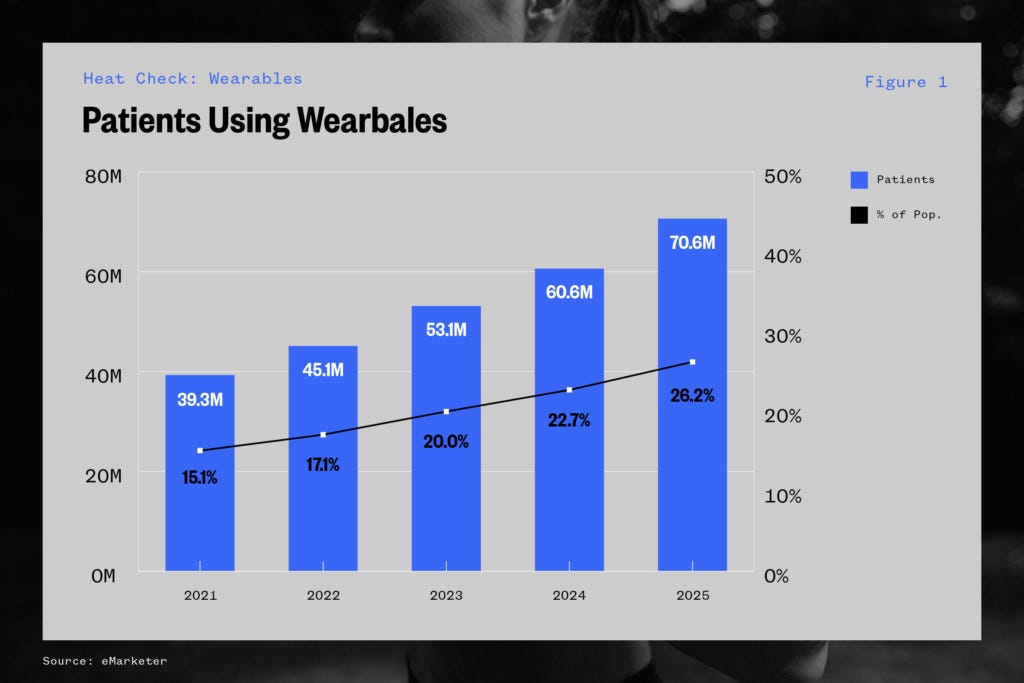

The anticipated market for remote patient monitoring is expected to grow to 70.6 million users in 2025, up from 39.3 in 2021.

The efficacy and increased utilization of telehealth and remote patient monitoring (there’s been a 38-fold increase in Telehealth since the onset of Covid-19, per McKinsey) has also led to an increase in the adoption of wearables — including bio wearables — as consumers without preexisting health conditions become more interested in tracking their health metrics.

The anticipated market for remote patient monitoring is expected to grow to 70.6 million users in 2025, up from 39.3 in 2021.

Consumer Behavior

Consumers love displaying their wrist-based wearables.

Over the past decade, many consumers have taken to utilizing wearables, from smartwatches to wireless headphones to continuous glucose monitors.

The shift, precipitated by lower costs and more devices to choose from, has been impacted by the recent telehealth boom, but also by a general desire to decrease reliance on smartphones.

The shift, precipitated by lower costs and more devices to choose from, has been impacted by the recent telehealth boom, but also by a general desire to decrease reliance on smartphones.

The consumer wearable market is currently dominated by the wrist.

If an individual is strapping on a wearable device, more than half the time it will be placed squarely on their wrist.

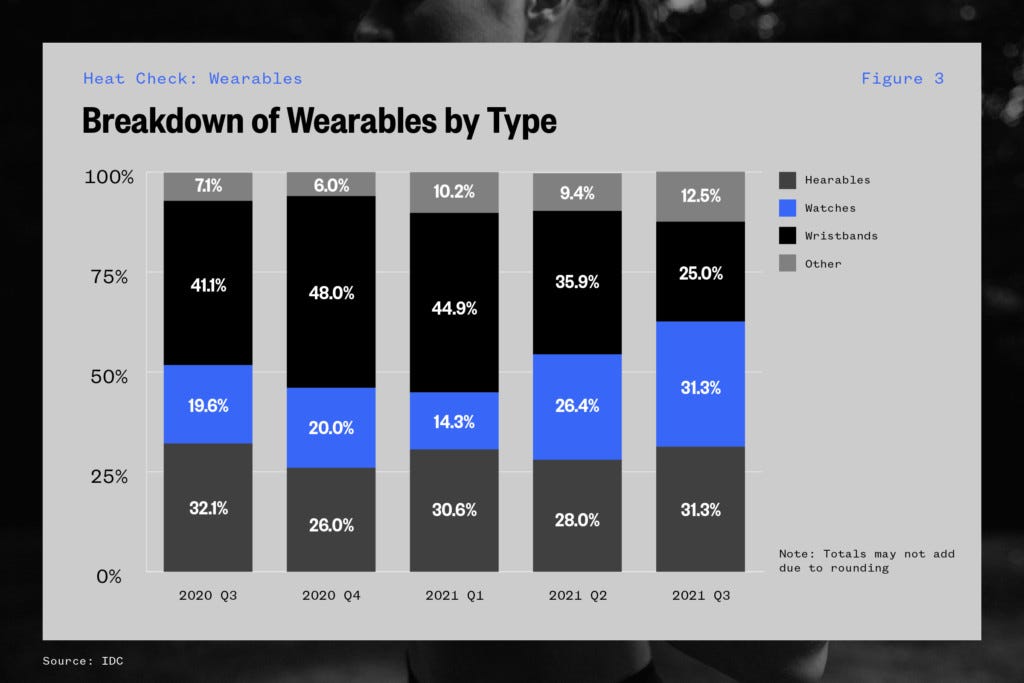

According to data from IDC, ~56% of the wearables market consists of “wrist worn” wearables.

Furthermore, Apple currently dominates that segment of the market. The IDC stated that Apple claims 53% of the wrist-worn market in terms of revenue.

The consumer wearable market is currently dominated by the wrist.

Moving Away from the Wrist

The trend of wrist-worn consumer wearables — though currently prevalent — is slowly shifting.

The share of wearable devices that aren’t wrist- or ear-based increased from 7% in late 2020 to 12% roughly 12 months later, indicating a greater appetite for different form factors.

Whoop, the wearable technology company with a focus on performance and fitness, recently launched new variations of its Whoop band (originally intended to be worn on the wrist).

The company announced the “Whoop Body,” a new apparel line that allows customers to place the sensor-based wearable on different parts of the body.

Many of the same metrics tracked by wrist-based wearables are collected, even though the sensors are on different parts of the body.

In an interview conducted with Emerging Tech Brew, Whoop co-founder John Capodilupo noted that some of the best places to get an accurate measurement of heart rate may not be the wrist, bicep, or torso, but instead the forehead, ear lobes, and lips.

…some of the best places to get an accurate measurement of heart rate may not be the wrist, bicep, or torso, but instead the forehead, ear lobes, and lips.

Although there seem to be equivalent (and sometimes better) alternatives to wrist-worn wearables, the ability to create products around biometric earrings or headbands is limited.

Consumers are currently unwilling to pay the requisite premium for non-wrist-worn or hearing-based wearables.

Oura Ring, the manufacturer of a finger-based wearable, has further broken the wrist-worn mold.

Oura Ring’s intent is to be the most accurate consumer sleep tracker on the market while maintaining an elegant and non-intrusive feel.

Battery and semiconductor sizes have come down as the technology to produce them has improved and become more efficient.

With that change, Oura and other companies are taking advantage of the ability to test more form factors.

It is fair to assume that as sensors continue to improve, they will be able to extrapolate exponentially more insights from a single reading while simultaneously being small enough to include in any form-factor wearable.

The issue, however, remains consumer behavior and a lack of scientific study. Experts in the space note that most of the existing scientific literature deals with the efficacy of wrist-worn wearables.

For many new products (think biometric-sensing lip rings), the clinical validation might have to come from the products themselves.

There is no reason to even assume that all wearables will require continuous monitoring.

There will still be instances where wearables are not required to reach the designation of “medical grade.”

Examples include swimsuits that track UV exposure, hydration monitoring, or even carpets that can create 3D virtual renderings in real time.

The possibilities stretch across existing and new consumer products.

Telehealth, remote patient monitoring, and the miniaturization of semiconductors and batteries all present strong tailwinds for continued growth in the wearables market.

Market Size and Expansion

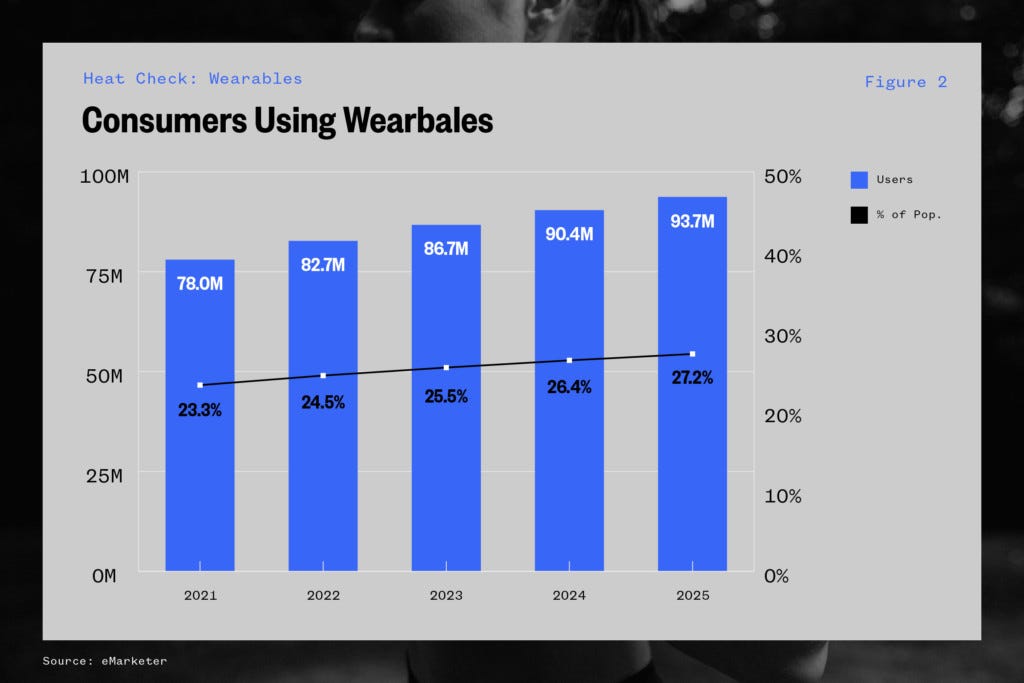

While the existing market is large — estimated at around 78 million users — it is expected to grow substantially to 94 million and 27% of the population by 2025.

These figures are potentially conservative due to some of the headwinds consumer wearables companies face.

Larger tech companies such as Apple and Amazon do not currently operate under the guise of their devices being classified as medical grade.

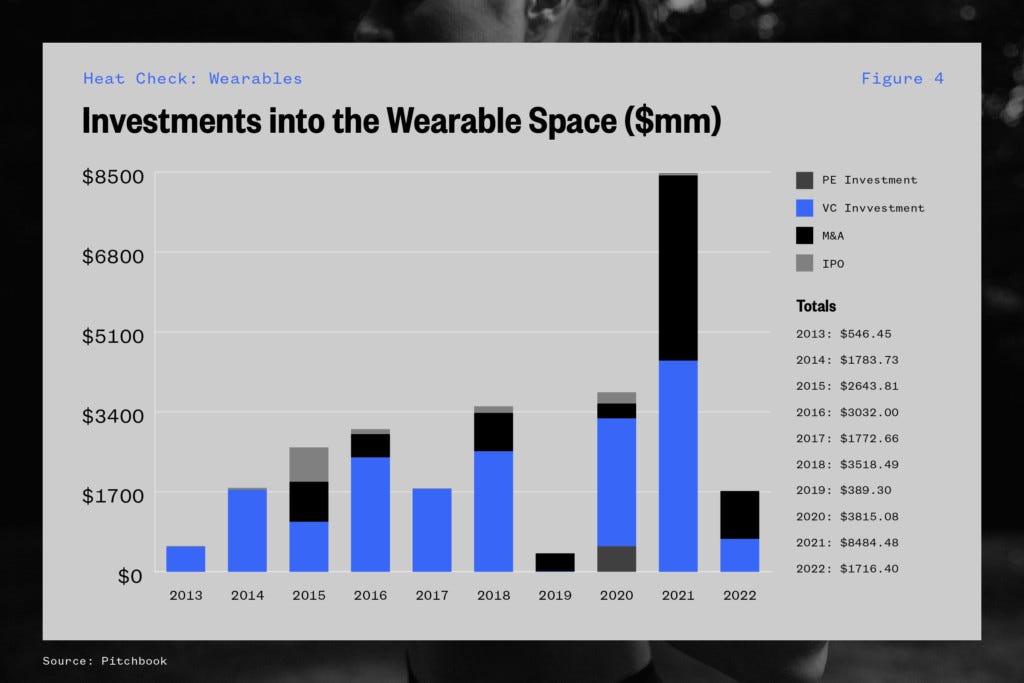

There has also been substantial investment in the space.

According to data from Pitchbook, funding for wearables and the quantified self reached an all time high in 2021 with over $8 billion in total investments.

Unlike most medically prescribed wearables, the larger tech companies depend on the consumer market to sell their wearables as “nice to have” rather than necessities.

With the continued surge in telehealth adoption, however, clinical viability became a priority.

Consumer wearables, once considered merely a substitute for smartphones, are now considered viable options for healthcare-compatible devices.

Consumer wearables, once considered merely a substitute for smartphones, are now considered viable options for healthcare-compatible devices.

Privacy and the Healthcare Market

While a foray into the approximately $11.9 trillion healthcare industry will expand the total addressable market (“TAM”) for these wearables, there are serious repercussions to entering this new market.

Getting more directly involved in the healthcare industry is a stated goal for many of these companies.

Claiming medical-grade status of wearables, however, puts greater liability risks on big tech companies such as Apple and Amazon.

Claiming medical-grade status of wearables, however, puts greater liability risks on big tech companies such as Apple and Amazon.

Inaccurate readings turn from product bugs to potential lawsuits. Inaccurate data could cause patients to experience adverse health effects.

In those cases, tech companies would be subject to taking full accountability for their devices’ mishaps — including any legal action that would result.

Then there’s data privacy. Current consumers aren’t too hot on big tech companies.

According to a study done by the Public Affairs Council and Morning Consult, the tech industry ranks as one of the least trusted in the survey.

It was once the most trusted industry in the survey, but 32% of 2021 respondents consider the industry less trustworthy than others.

Furthermore, the survey also found that the percentage of Americans who believe the technology industry is under-regulated has more than tripled in the last eight years to 36%.

Unfortunately, manufacturers of some of the most popular consumer wearables (Apple, Fitbit, Amazon Halo, Facebook) fall squarely within the consumer skepticism about data.

Sensitive health data sounds the alarm for consumers when it comes to big tech.

According to Fitt Insider, Amazon’s Halo has raised eyebrows for monitoring users’ tone of voice, raising red flags on intrusion of privacy.

Additionally, Google faced several probes from regulators relating to consumer data usage for advertisements following its acquisition of Fitbit.

Lastly, Facebook has had its own difficulty battling their public perception as data miners.

In order to reach medical-grade device status, these tech companies will need to alter their public images when it comes to data and privacy.

In order to reach medical-grade device status, these tech companies will need to alter their public images when it comes to data and privacy.

Further Applications

The market for wearables writ large is expected to be massive. The market is currently expected to grow to $265 billion by 2025, up from just $116 billion in 2021 — a roughly 18% compound annual growth rate.

In order to reach this level of scale, it’s likely that we will be moving beyond the wrist.

Rings

As previously discussed, Oura has been a leader in the ring-based wearable space — but other companies are vying for market share in the space as well.

- Motiv is another ring-based wearable intended to strengthen the motivation for healthy living. The company is focused on B2C and doesn’t currently intend to get into the medical device space.

- Movano ring is designed specifically for chronic disease monitoring while also providing consumers with an elegant product they can use in their everyday lives.

- French fitness tech company Circular provides users with biometric data and is capable of tracking heart rate, sleep, and energy levels.

Head Gear

Of course, there is also the presence of headgear. Sleep and meditation require the monitoring of specific types of state changes in brain waves. And what better way to monitor those than a headband that can track your biometric data? Also, the rise of VR, AR, and XR headsets could ultimately equip more of these devices with the ability to track biometric data from the forehead and even the eyes.

- Muse — a brain-sensing headband -uses real-time biofeedback to let consumers “refocus” during the day and recover overnight. The headband is intended to make the “intangible tangible” with live insights on how brain waves are working.

- Mojo Vision, the developer of a smart contact lens, recently raised $45 million in capital from the Amazon Alexa Fund. The company’s product was initially intended for the visually impaired but has since evolved to include high-performance athletes looking to see performance data overlaid on their vision.

- Cove is a head-based wearable used to improve sleep, reduce stress, and sharpen focus. The technology has been validated by rigorous research at Brown University and a leading researcher at Harvard Medical School. In clinical trials with a total of 3500+ participants reported 50% better sleep and 41% less stress.

- Omegawave, the neuro-based wearable company became famous when the Golden State Warriors adopted its technology in 2016. Different from other wearables, the Omegawave device measures and assesses the functional readiness of athletes with the aim of identifying the optimal methods of training and recovery, improving performance and helping avoid injury.

Sweat

There will also likely be a higher frequency of companies focusing on tracking biomarkers through blood, sweat, and tears. Wearables that generate insights based on sweat can range from hydration to stress tracking. These particular sensors have recently become more popular for real-time monitoring.

- Nix Biosensors, the developer of a wearable biosensor designed to detect hydration levels in athletes, soldiers, and laborers, brings a TAM-expanding use case to wearables. Like many of the aforementioned wrist-worn examples, wearables can be utilized by day laborers, military, and the elderly population, possibly representing a more commercialized approach to large-scale distribution.

- Xsensio’s wearable skin patch can help detect levels of cortisol — the hormone that indicates levels of stress. The Switzerland-based company is looking to build a full-scale clinical laboratory that lives on your skin.

- In March 2021, Gatorade launched a Gx Sweat Patch that tracks hydration levels in athletes. The patch is intended to provide athletes with real-time insights into their performance.

This subset of potential wearable categories only scratches the surface. Wrist-worn wearables will continue to grow in market share and improve in efficacy and portability, but it seems clear that bio wearables could benefit from moving away from the wrist — and many companies are working on cracking the code to get consumers to buy in. The future will include wearables, but not just ones found on the wrist.

The Importance of Real World Data

Many overlook the importance of wearables and their ability to track and store data.

While fitness technology companies such as Peloton, Tonal, Mirror, and Zwift have received much of the attention in the capital markets, there is a growing number of companies that collect biometric data known as real-world evidence (RWE), health or biometric data that can be used across the entire healthcare ecosystem.

The ultimate product comes in the form of a structured dataset that can be used to make individualized care and treatment decisions.

According to the FDA, RWE, and real-world data (RWD) are increasingly relying on data collected outside a clinical setting:

- FDA uses RWD and RWE to monitor postmarket safety and adverse events, and make regulatory decisions.

- The healthcare community is using this data to support coverage decisions and develop guidelines and decision support tools for use in practice.

- Medical product developers are using RWD and RWE to support clinical trial designs and observational studies to generate innovative, new treatment approaches.

Providers can use RWE to not only compare different treatment methods but determine optimum drug dosages and refine treatment guidelines for individual patients.

While historically, RWD and subsequent RWE have come from electronic health records (EHRs) and claims and billing activities, the recent explosion of consumer wearables has accelerated clinicians’ abilities to gather this contextualized data.

While historically, RWD and subsequent RWE have come from electronic health records (EHRs) and claims and billing activities, the recent explosion of consumer wearables has accelerated clinicians’ abilities to gather this contextualized data.

According to Kaiser Associates and Intel, 70% of clinical trials will incorporate some type of wearable sensor by 2025.

With the advancement of consumer wearables, academic researchers, and medical societies can use RWE to advance understanding of current treatments and diseases by conducting observational, retrospective, and prospective studies.

Why it matters

First, the market size and opportunity is substantial. According to Pitchbook, companies within the RWE space have raised $1.8 billion since 2019, with the industry expected to grow at a compound annual growth rate of 15% through 2027 to a total market size of $2.9 billion.

At the same time, the wearable device and medical device markets were estimated at a respective $27.91 billion and $10.28 billion in 2020.

Assuming that consumer bio-wearable technology takes up a fraction of those respective market shares and the data layers they provide can and will be utilized by RWE companies, the TAM for these companies has a growth vector higher than most anticipate.

Additionally, many of the bio-wearables we see in the market were originally designed for “elite athletes” and high-level performers.

The ways in which teams and coaches measure the performance of their athletes can often be a leading indicator of potential downstream consumer products in the future.

For example, Michael Phelps and Lebron James were two of the first 100 adopters of the Whoop band.

Opportunities

Some startups have and are developing remote patient monitoring devices and biometric tracking wearables.

As the invasiveness of products decreases and consumers become more educated on the biomarkers that provide high health returns, we’re poised to see an explosion in the space. Companies no longer need to rely on the SaaS revenue from the data collection or the price of their hardware, but have a real (and legal) path toward utilizing the real-world data collected and monetized through valuable databases.

Web3.0 Integration

That’s right — web3.0 is an option.

In a blog post, Next Ventures Investor Jordan Pascasio cited some potential applications for web3.0 integrations with fitness wearables.

One company that was mentioned, Genopets, provides an interesting use case at the nexus of web3.0 and fitness tracking.

A trend in the crypto space since late 2019 has been play-to-earn gaming. While the ability to earn native currencies within a blockchain gaming framework has been popular (learn more here) we have yet to see the same earning potential when it comes to fitness. NFTs present an interesting use case for a concept known as “move-to-earn.” In his piece, Pascasio describes it through the lens of NFT project Genopets.

“Taking it one step further, Move-to-Earn NFT game Genopets is unique in that the project not only uses immersive gaming as a lever to achieve an active lifestyle, but it also is entirely predicated on a crypto-economic network (Solana) that enables the incorporation of NFTs, adding the concepts of ownership, proven scarcity and self-expression via a user’s ‘Genopet’ to the overall player experience. For the Millenials out there, I think Neopets meets the training and battling of Pokémon (Blue version, of course) meets the parallel worlds of Pokémon Go.”

Competition and rewarding active lifestyles could become a new way to utilize data generated by wearable technology. If consumers could use their data to earn benefits or actual currency, the potential value of wearables will increase exponentially.

Originally published at https://frontofficesports.com.

TAGS: Wearables; Remote Patient Monitoring; Telehealth; Virtual Care; Home Based Clinical Trials; Digital Health; Data Driven Health Care; AI Augmented Health Care