Forbes

May, 2022

getty

The healthcare technology industry is no stranger to consolidation, as organizations vie for scale, stability, access to capital, and growth in an ever-changing market.

And there have certainly been calls for digital health solution consolidation across stakeholder groups, despite the record funding and new market entrants still pouring into the sector.

An article in the Wall Street Journal from last year makes the case for consolidation among employer-focused digital health solutions, for example, citing the “enough already” attitude from buyers when it comes to the seemingly never-ending parade of redundant, overpriced options in the marketplace.

Similar points can be made for hospitals, health systems and other care delivery organizations, and likewise for payers, who face a time- and capital-intensive procurement and contracting process for each technology implementation.

With this thinking in mind, the emerging conventional wisdom seems to be: for healthcare technology purchasers, when it comes to evaluating, selecting and meaningfully implementing new technologies, there are too many choices, too many options.

Per 1990s vintage Phil Collins, it’s a land of confusion.

Consolidation can reduce market confusion, bring operational efficiency to companies, and offer returns to investors who capital into innovative but risky areas.

Consolidation can reduce market confusion, bring operational efficiency to companies, and offer returns to investors who capital into innovative but risky areas.

It’s also fair to say that, after a run of several years of explosive investment in digital health that has resulted in even more explosive startup valuations, it’s possible a market correction is now starting, which will see a winnowing of the digital health field.

We’re also seeing global and macroeconomic conditions wreaking havoc on capital markets, which may result in founders and investors are rapidly adopting a more conservative financial approach and openness to selling earlier.

“Large companies will continue to want to scale, and smaller, newer players can find the offer of an acquisition by a larger player a relief from fighting for visibility or sales cycles.

Consolidation isn’t necessarily the best for patient choice, but it can look good for the bottom line,” says Dr. Andrew Le, CEO of Buoy Health.

It’s also fair to say that, after a run of several years of explosive investment in digital health that has resulted in even more explosive startup valuations, it’s possible a market correction is now starting, which will see a winnowing of the digital health field.

Consolidation isn’t necessarily the best for patient choice, but it can look good for the bottom line,”

Healthcare has seen an uptick in large-scale M&A with bigger deal sizes than ever before, especially in digital health.

Big tech is buying and investing in valuable healthcare assets (Amazon/Pillpack, Verily/Google, Microsoft/Nuance, Salesforce, Oracle/Cerner) — though the true value to consumers from these deals is still very much unknown.

And digital health behemoths continue to join forces (Teledoc/Livongo, Grand Rounds/Doctor On Demand), to achieve scale, broaden service offerings, leverage efficient distribution channels, and reach new markets/customer segments.

Big tech is buying and investing in valuable healthcare assets (Amazon/Pillpack, Verily/Google, Microsoft/Nuance, Salesforce, Oracle/Cerner) — though the true value to consumers from these deals is still very much unknown.

And digital health behemoths continue to join forces (Teledoc/Livongo, Grand Rounds/Doctor On Demand), to achieve scale, broaden service offerings, leverage efficient distribution channels, and reach new markets/customer segments.

Digital health consolidation is clearly an answer, for technology developers, buyers and consumers alike (as well as investors).

But when it comes to helping solve healthcare’s biggest problems, it may not be the right answer.

As Le of Buoy Health explains it, “Digital health consolidation is not the answer to patient choice — in fact, it moves us backwards in terms of siloed information and constrained care.”

Digital health consolidation is clearly an answer, for technology developers, buyers and consumers alike (as well as investors).

But when it comes to helping solve healthcare’s biggest problems, it may not be the right answer.

Lessons Learned From Consolidation At The Industry Level

We’ve seen what consolidation can bring to healthcare: federal scrutiny, for one, and destroyed company value, for another.

Among local health systems, for example, consolidation can lead to monopolistic tendencies and overall bad behavior.

We’ve seen what consolidation can bring to healthcare: federal scrutiny, for one, and destroyed company value, for another.

Among local health systems, for example, consolidation can lead to monopolistic tendencies and overall bad behavior.

Because of these negative consequences, the Federal Trade Commission and the Department of Justice are working to overhaul M&A enforcement in the industry, referencing the “ongoing merger surge” with filings more than doubling from 2020 to 2021.”

At the same time, the American Hospital Association’s “pro-merger” stance is that the federal enforcement guidelines do not need any major revisions, citing benefits of M&A for health systems, including better cost and quality control, as well as organizational stability.

Because of these negative consequences, the Federal Trade Commission and the Department of Justice are working to overhaul M&A enforcement in the industry…

At the same time, the American Hospital Association’s “pro-merger” stance is that the federal enforcement guidelines do not need any major revisions …

Payer consolidation and collaboration is also prevalent in the industry, though not without hesitation and new vehicles for oversight.

The recently passed Competitive Health Insurance Reform Act (CHIRA), for example, was designed to “investigate and challenge anticompetitive mergers and deceptive conduct by insurance companies.”

Most recently, the DOJ has challenged UnitedHealth Group’s $8 billion acquisition of Change Healthcare, citing data access that stands to increase costs for consumers.

This is all to say, while M&A is an answer for some healthcare companies, it’s often one that provides a short term benefit to the companies themselves (in the form of a share price bump), not their constituents.

Consolidation in digital health may be an answer, but it’s perhaps a lazy answer; it eliminates choice, and replaces that plethora of choice for buyers and consumers with superficial comfort and trust in the form of brand names making big moves that often do little for those they serve.

Consolidation in digital health may be an answer, but it’s perhaps a lazy answer …

As Jonathan Bush, CEO of Zus Health notes, “In the realm of digital health, I think that if we play our cards right, we will have a decent run before any consolidation kicks in.

There are SO MANY areas of care that will fare better as digital first, digital rich ventures than they ever fared as sub-specialization within medical centers, that are currently devoid of the resources — product design, funding, dedicated tech, leadership — they need to truly prosper.”

There are SO MANY areas of care that will fare better as digital first, digital rich ventures than they ever fared as sub-specialization within medical centers …

Consolidation Won’t Address The Underlying Costs Of Fragmentation: Search And Transaction Costs

Perhaps the market doesn’t need fewer digital health companies and solutions.

After all, digital health fragmentation is an issue for buyers (and consumers) primarily because “point solutions” don’t fluidly work with each other the way most consumer technology does, and deciding on a solution is one of the most onerous processes that tech purchasers go through.

What the industry actually needs is a way to solve for the two biggest challenges that all stakeholders face when assessing digital health solutions: search costs and transaction costs.

What the industry actually needs is a way to solve for the two biggest challenges that all stakeholders face when assessing digital health solutions: search costs and transaction costs.

Search costs: “ Do I know what I’m looking for? Can I describe it, and is it available? How many options are there, how do they differ, and which is best for my needs?”

These are all search-related questions, which in today’s world of healthcare can feel impossible for buyers to answer. Why? Several reasons.

First, most buyers of digital health solutions are employers, health systems, and payers, for whom evaluation of digital health solutions is not an area of expertise.

Second, there are few well known sources of information about what digital health solutions exist, and the problems they address.

Finally, because these buyers make decisions individually and often for competitive advantage, there is little information sharing or user reviews to inform buying decisions.

Transaction costs: Once a decision has been made, there are the costs of the commercial relationship itself: privacy and security reviews, legal involvement and contracting, implementation and contract enforcement.

Every organization — whether the employer or digital health company — employs people and invests in resources to manage these costs; high levels of fragmentation on both sides means that, at a macro level, these costs are duplicative and therefore economically inefficient.

One need only to look at levels of current fraud, waste and abuse in the system (estimated at $935 billion) generated by providers and payers to understand the degree to which transaction costs contribute to spiraling healthcare spend.

One need only to look at levels of current fraud, waste and abuse in the system (estimated at $935 billion) generated by providers and payers to understand the degree to which transaction costs contribute to spiraling healthcare spend.

Digital health platforms and marketplaces can play a critical role for tech purchasers (and consumers) in reducing search and transaction related costs, including:

- Solving for trust issues by generating user review feedback loops.

- Ensuring the integrity of a commercial transaction, including assurance that a vendor will get paid and the customer will get what they were promised.

- Improve information flow and generate feedback loops on the quality of information on certain demographics or certain member populations.

- Solving for information asymmetry.

- Solving the many-to-many problem, which is endemic to our highly-fragmented healthcare system, across the hundreds of different transaction types that exist

- Smooth out the friction associated with search costs, transaction costs and technology integration.

The sheer number of digital health companies that exist makes it incredibly challenging for buyers to identify the right vendors, sort through and find the right one for their organization.

The right marketplaces, however, could help curate those options, and perhaps use AI to match the organization with the best service/options for their unique needs, while providing procurement and implementation support.

Buoy Health is building one such marketplace, utilizing its symptom checker as an entry point to help people understand their symptoms and guide them to care resources as appropriate.

CEO Le makes the case that the benefits for employers and patients are clear.

“For employers there’s no negotiating with dozens of vendors in an attempt to find the right mix of options and pricing, and no wishful thinking for employees that they stumble upon a digital health provider that understands their condition or personal needs based on their background.”

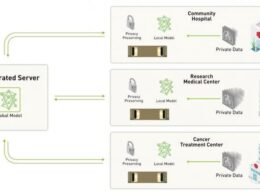

To lower transaction costs, infrastructure platforms like Zus Health are building the “plumbing” that can become common low cost and interoperable components for every digital health company.

“Zus is attempting to be the extra wind beneath these digital health company’s wings…in hopes that they in fact reach this fuller expression …they would all benefit from common tech tools for encounter management, for connectivity, for patient identity and permission management,” says CEO Bush.

To solve healthcare’s biggest challenges, we need more disruption, not less.

For digital health innovation to flourish and deliver on its promise to buyers, consolidation is a poor choice and a superficial answer.

It replaces true competition and market forces with the presumption that the biggest providers are the best, and that they can tackle issues like smaller, newer innovators can’t.

But company size is not indicative of power, and funding raised is not a real measuring stick for success.

In healthcare technology, the answer isn’t a consolidated market, but a more efficient, more informed, better facilitated search and transaction process. And platforms can be part of the answer.

In healthcare technology, the answer isn’t a consolidated market, but a more efficient, more informed, better facilitated search and transaction process. And platforms can be part of the answer.

Originally published at https://www.forbes.com.

Names mentioned

Jonathan Bush, CEO of Zus Health

Dr. Andrew Le, CEO of Buoy Health.