Series: “The rise of healthcare platforms”

This is an excerpt of the publication “The rise of healthcare platforms”, focusing with the title above, focusing on the topic in question.

Peter Choueiri, Morris Hosseini , Thilo Kaltenbach, Ulrich Kleipass, Karsten Neumann and Oliver Rong

September, 2020

Introduction

Global spending on digital health is expected to reach almost EUR 1 trillion by 2025.

With a wide variety of digital platforms reshaping the market, from pure data platforms to integrated meta-platforms, the industry is grappling with a number of questions of existential importance.

- What type of platforms will dominate the market in the future?

- What makes some platforms more successful than others?

- Who will be best positioned to own the patient interface?

- And which players face the greatest disruption to their business model?

Our second Future of Health survey, building on our 2019 investigation, provides some answers to these questions.

Industry insiders are expecting even stronger growth of digital health than a year ago, partly driven by the Covid-19 pandemic.

They see customer experience as the number-one success factor of platforms, more important even than perceived health benefits.

Healthcare providers are best positioned to “own” patients, while tech companies have a stronger starting point when it comes to preventive care.

Rather than consolidation, the industry is expecting platforms offering specific services to retain their important role in the period until 2025 — particularly in Europe.

Ultimately, it appears that everything is still to play for.

Healthcare players must fine-tune their radars and identify upcoming trends in the market.

Only then can they define an appropriate strategy for their business, be that building their own platform or entering into partnerships with other players.

Access to a strong network of platforms will be a key success factor for all types of players, and this may require boosting the company’s “collaborative IQ”.

For all types of healthcare players, the key message is clear. It is time to define a platform strategy — and with no clear winner in sight, there is no time like the present to make your platform play.

For all types of healthcare players, the key message is clear. It is time to define a platform strategy — and with no clear winner in sight, there is no time like the present to make your platform play.

Platforms are transforming healthcare (A Sector in Transition)

There is no doubt about it: Digitalization has transformed our day-to-day lives.

Hardly an hour goes by when we do not go online to book a ride with Uber, arrange a vacation with booking.com or order some new product from Amazon.

Our regular, everyday activities have to a large extent shifted onto digital platforms.

We all know what “digital platforms” are in practice, but how can we best define their role and function?

Broadly speaking, digital platforms bring together customer groups with similar interests, using network technologies and often data pools to provide superior services to customers, such as a wider choice of service providers.

They strive to achieve critical mass and eventually dominate their markets. Already, they encompass practically all areas of the economy.

The healthcare market is no exception.

There is little doubt among experts that platforms will also transform the healthcare sector in the coming years.

Industry platforms already integrate healthcare services and different technologies to provide a customized, end-to-end solution for users and patients.

Applying new business models, they enable an improved customer experience with easy access to different services and treatments, greater efficiency and — in theory, at least — improved outcomes.

Compared to platforms in other industries, healthcare platforms are both more complex and more fragmented.

Want to order lunch? Simply visit your favorite platform and choose between the offers from different restaurants, listed side by side on the website.

Want an online medical consultation? That is not quite so straightforward. Type “online doctor” into Google and you get more than four million hits in less than a second.

Healthcare consumers are currently faced with a large number of single-solution providers offering different services with various pricing models.

More often than not, they are left feeling confused — and not a little exasperated.

Types of healthcare platforms

A wide range of platforms currently occupy the healthcare space, ranging from “pure data platforms” to “integrated meta-platforms”.

The field is highly fragmented: In our survey, the results of which we present below, no one platform was mentioned more than three times by respondents as an example of best practice.

Yes, platforms are critically important.

But right now it is impossible to say which particular platforms will dominate in the future — or whether, indeed, this is how the landscape will develop.

We can classify the different platforms found in healthcare by the following categories:

- pure data platforms,

- platforms with horizontal integration,

- platforms with vertical integration, and

- integrated meta-platforms.

1.Pure data platform.

These platforms create value out of collecting and analyzing large amounts of data, which is then used to improve diagnoses and generate personalized treatment plans, as well as better and more tailored products and services, ultimately leading to better outcomes.

Pure data platforms also enhance patient engagement.

For example, 23andMe, which provides a direct-to-consumer genetic testing service, has access to data from more than 9 million patients.[1]

IQVIA, a global provider of advanced analytics, technology solutions and clinical contract research valued at around EUR 9 billion, has access to millions of items of data from patients, providers and payors.

Amazon, thanks to its cooperation with Cerner, now has access to around 200 million pieces of patient data.[2]

2.Platforms with horizontal integration …

… generally focus either on a specific indication, such as cancer or diabetes, or on a specific treatment setting, such as health management within companies.

They support users along the entire patient journey.

For example, health and wellness engagement platform Sharecare, provides consumers with personalized information, programs and resources for improving their health.

Another platform, Deep Lens, matches cancer patients with clinical trials and treatments.

One Drop, a diabetes management platform, offers solutions for glucose monitoring via an app and personal health coaching.

Siemens recently acquired Varian and has created an integrated platform to address the entire cancer care path, from screening and diagnosis to care delivery and post-treatment.

3.Platforms with vertical integration …

… do not focus on specific indications but integrate different steps along the value chain or patient journey.

Quite often, they connect players from different parts of the healthcare value chain, such as pharmaceutical companies with pharmacies, or telemedicine providers with hospitals.

In this way they support collaboration across disciplines and specialties. Some also operate across international borders.

The insurance company AXA in Mexico connects insurance services with treatments via its technological platform SaludOnNet, which brings together more than 22,000 clinics and hospitals including many outpatient medical care centers and more than 250,000 patients.[3]

In Switzerland, Zur Rose Versandapotheke cooperates with the supermarket chain Migros and has recently acquired TeleClinic, a provider of medical video consulting.

Hospital chain Asklepios cooperates with startup Samedi for digital appointment booking.

And global tele-health leader Teladoc has recently announced an EUR 18 billion merger with chronic disease platform Livongo with the aim of offering technology-enabled longitudinal care — the largest digital health deal seen to date.

4.Integrated meta-platforms …

… operate on an even larger scale.

They interlink most of the players in a specific healthcare system and are both vertically and horizontally integrated.

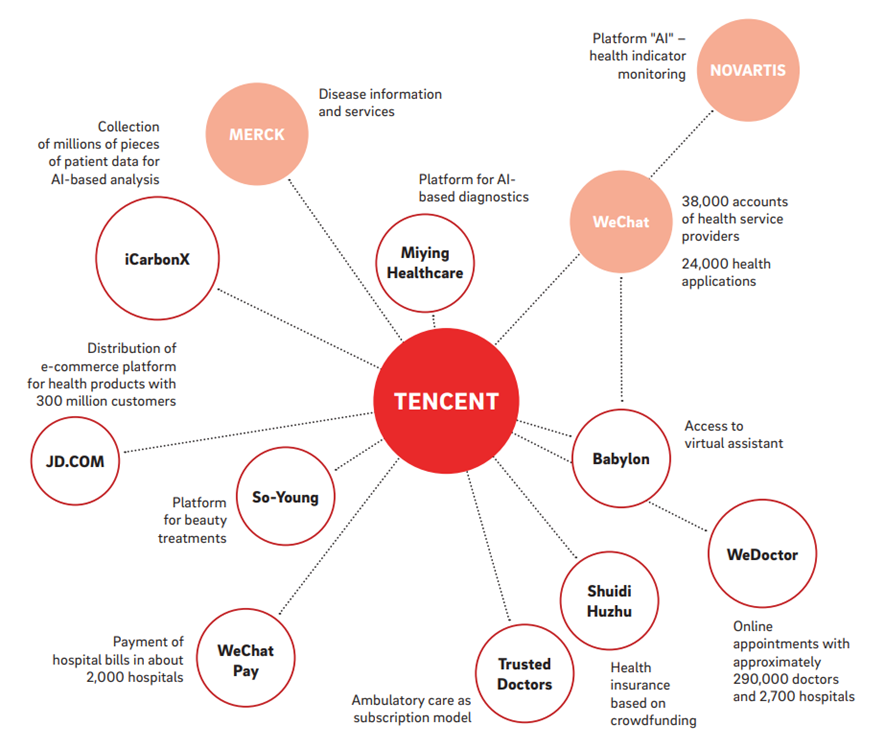

The Chinese group Tencent is a good example.

It brings together different categories of players:

- iCarbonX collects millions of pieces of patient data for evaluation using artificial intelligence (AI);

- WeDoctor enables online appointment scheduling with around 290,000 doctors and 2,700 hospitals; and

- WeChat integrates 38,000 accounts belonging to health service providers and offers 24,000 health and wellness-related “Mini Programs”.[4]

Tencent integrates digital and analog care processes, at the same time collecting large amounts of data.

The company also cooperates with startups and pharmaceutical companies from Europe. (A)

A: Meta-platforms interlink players across the healthcare system

Tencent’s network of healthcare players in China

Source: Tencent, RB

Some integrated meta-platforms go even further, encompassing a country’s entire public health system.

Saudi Arabia, for example, has launched two healthcare initiatives — the Saudi Health Insurance Bus (SHIB) Project and the Saudi e-Health Record (SeHE) Platform — which will together create an integrated platform called UniPlat, a national e-health program for the digital transformation of all healthcare-related services in the country.

The aim of the platform will be to increase efficiency for payors and providers and deliver an enhanced healthcare experience to the country’s citizens.

Given the current diversity of platforms and fragmentation of the healthcare landscape, a number of questions present themselves.

- What type of platform is likely to dominate in the future?

- Will we see a multiplicity of platforms with no one particular type dominating?

- What makes certain platforms successful and others less so?

- Who will own the patient interface in the coming years?

- And which areas of healthcare will see the greatest disruption?

We turn to these questions in the following chapter.

References

See the original publication

Healthcare Platforms; Digital Health Systems; National EHR