the health strategist

institute for strategic health transformation

& digital technology

Joaquim Cardoso MSc.

Chief Research and Strategy Officer (CRSO),

Chief Editor and Senior Advisor

September 27, 2023

One page summary

What is the message?

IT leaders face a dual challenge in 2023 – driving digital transformation while maintaining cost control.

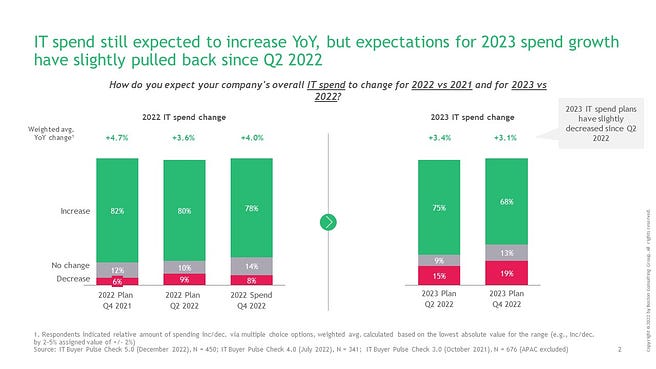

Despite an overall planned increase in IT spend by 3.1%, a growing number of respondents (19% vs. 15% in July 2022) intend to decrease IT spending.

The majority still prioritize digital transformation, particularly in cloud services, security, and analytics.

The shift towards cost control is a notable trend, reflecting the need for leaner growth strategies.

Key Takeaways:

Digital Transformation Remains a Top Priority:

- The top three priorities for IT buyers, including digital transformation, security enhancement, and enabling company growth, have remained consistent over the past surveys.

- Cost control has risen as a priority, closely following the top three.

Leaner Digital Transformation Strategies:

- While digital transformation remains a key focus, IT leaders are looking to pursue it in a more cost-efficient manner.

- Cloud migration continues to gain importance for IT leaders, along with initiatives to enhance sales efficiency.

Shift in Priorities and Spending Trends:

- Priorities around internal HR support are declining in importance, as are certain customer experience activities.

- A growing minority of IT buyers (19%) plan to decrease IT spending, while 13% do not intend to change budgets, signaling a shift in spending trends.

Supplier Consolidation in IT Stack:

- Most areas of the IT stack are experiencing supplier consolidations, with server infrastructure, devices, ITOM, and communication & collaboration showing significant consolidation trends.

- IT buyers are favoring a smaller vendor base to reduce overall costs.

Expectations of Price Increases:

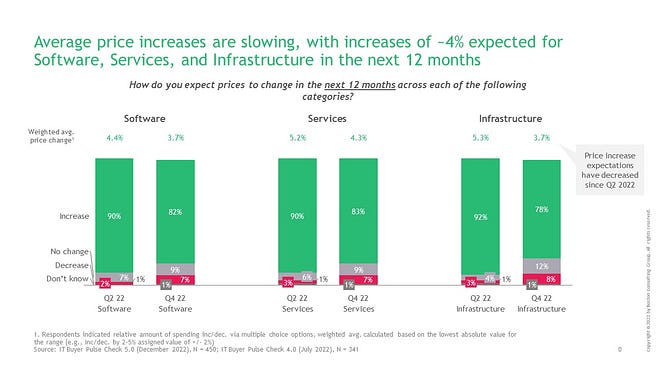

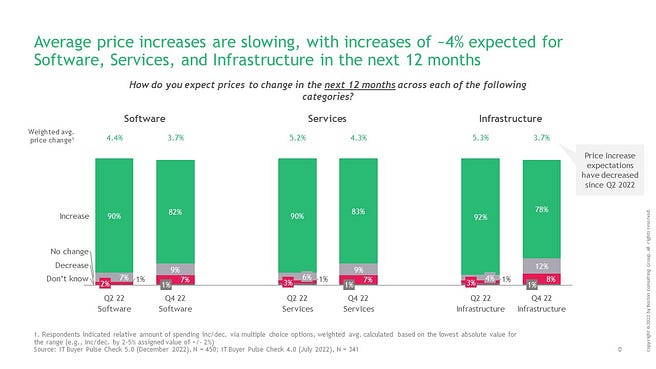

- IT buyers still anticipate price increases from suppliers, but these expectations have slightly decreased since Q2 2022.

- The focus is on cost-effective operations, leading to reduced budget allocations for hardware and server infrastructure.

Statistics and Examples:

- IT spend is expected to increase by 3.1% in 2023.

- 19% of IT buyers plan to decrease IT spending, up from 15% in July 2022.

- The majority of IT buyers prioritize digital transformation, particularly in cloud services, security, and analytics.

- Cloud migration remains a top priority for IT leaders.

- Initiatives to boost sales efficiency are gaining importance.

- Expectations of price increases have slightly decreased since Q2 2022.

In conclusion:

IT leaders in 2023 face the challenge of balancing digital transformation with cost control. While digital initiatives remain a top priority, there is a growing emphasis on leaner approaches and a shift in spending trends.

Supplier consolidation and cost-effective operations are central to IT strategies in the coming year.

Vendors and investors should be prepared to navigate these dynamics while capitalizing on resilient demand in key areas like digital transformation, security, and company growth.

Infographics

DEEP DIVE

IT Spending Pulse #5: Slowing spending, leaner growth

Federico Fabbri, Clark O’Niell, and Ryan Barbaccia

IT leaders are facing a double-headed challenge for 2023: Transforming their organizations digitally while controlling costs. While IT spend is still planned to increase by 3.1% in 2023, there is an increase in the number of respondents who plan to decrease IT spend (19% vs 15%) compared to respondents surveyed six months ago in July 2022. Moreover, almost all of the IT stack is experiencing supplier consolidations, as IT buyers are moving towards a smaller vendor-base. Expectations of price increases from suppliers have lowered slightly as well since July 2022. Amidst this slowdown, digital transformations remain atop the priority list for 60% of IT buyers, who remain committed to increasing spending in cloud services, security, and analytics. The need to evolve these digital capabilities is, however, coupled with an increasing focus on controlling IT costs to drive efficiencies.

This survey was conducted during December 2022 with ~450 IT buyers. 55% respondents were from North America and 45% respondents were from Europe, all across diverse verticals. Respondents are at Director / Senior Director level and above; they all possess a clear view of company IT priorities & budgets. Roughly 67% of them work in large (>$1B) size companies and 33% in mid-sized companies.

Lean growth and transformation

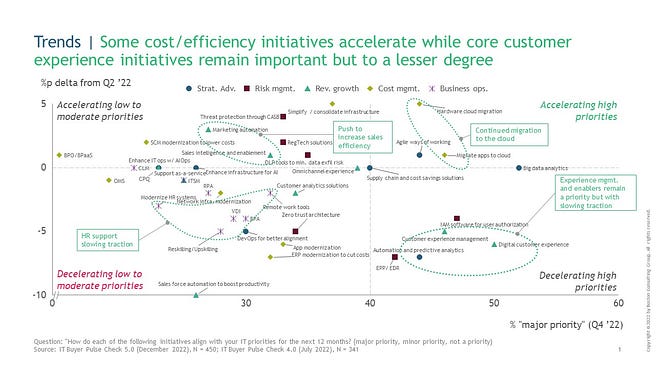

In our four previous surveys, conducted in April-May 2020, October-November 2020, and October-November 2021 and July 2022, the top three priorities — driving digital transformation, increasing security and mitigating risks, as well as enabling company growth — of IT buyers have remained largely consistent. Those priorities haven’t changed in our latest and fifth survey. The main difference now, as shown in exhibit 1, is that cost-control has shot up as a priority, now trailing closely behind in fourth place.

Buyers are still bent on continuing their digital transformation projects, but they now want to do so in a leaner way.

Cloud migration and efficiency initiatives increasing in priority

We broke down IT leaders’ priorities on a more granular level and compared them to their priorities six months ago. In exhibit 2 below, we plotted this comparative data along two axes: How high a priority is currently (x-axis) and the change in importance of that priority, if any, since Q2 (y-axis).

From this exhibit we see that cloud migration has not only remained a major priority, but it has continued to accelerate in importance for IT leaders. Additionally, initiatives to boost sales efficiency, such as marketing automation and sales intelligence, are also increasing in importance relative to six months ago, even though they are still low to moderate in importance.

In contrast, internal HR support represents a cluster of lowly-ranked priorities that are declining further in importance. IT leaders are also taking the foot off the pedal when it comes to priorities around customer experience; while this cluster is still a high priority for many leaders, it’s declining in urgency for them. In short, IT leaders are increasingly prioritizing digital transformations and activities that are core to the business, such as sales, and decreasing activities, such as HR systems, that are more peripheral.

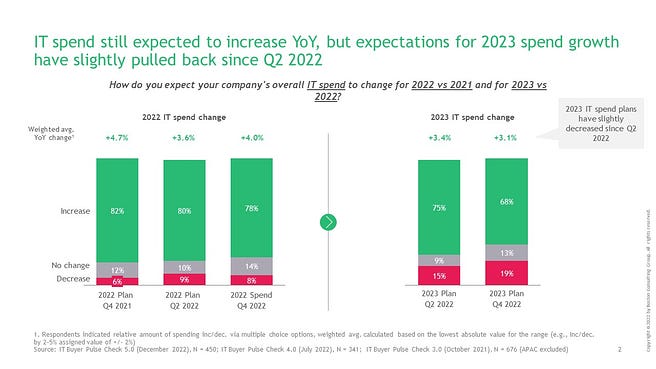

Growing minority of IT buyers plan to decrease or not change spend

IT spend is on track to increase year-over-year, with a predicted 3.1% increase this year, as shown below in exhibit 3. But when we compare results from this Q4 survey to our Q2 survey in the same year, there is an increase in the number of respondents who plan to decrease IT spend (19% vs 15%). Moreover, 13% of IT buyers do not plan to change their budgets, a jump from 9%. Since IT spending trends have consistently increased as companies and markets become more digitally-oriented, a decision not to increase budget — and, even more, decrease budget — is a significant choice. Overall, 2023 IT spend plans are still on track to grow, even if they have decreased slightly since Q2 2022.

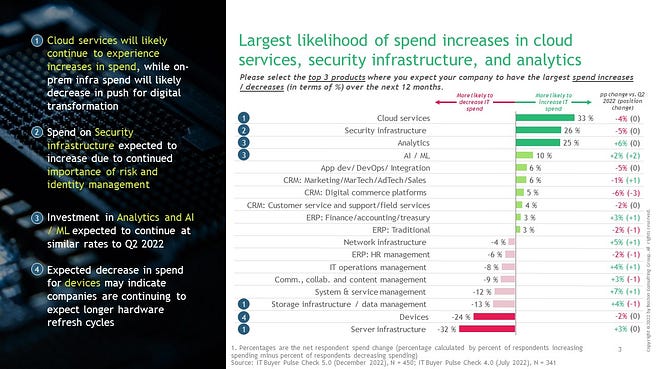

Nevertheless, buyers who plan to decrease spend are still in the minority. The majority of buyers still plan on increasing spend, particularly on cloud services, security infrastructure and analytics, as we see below in exhibit 4. In contrast, buyers are seeking to decrease spend on hardware (devices and server infrastructure, etc.), a move which is driven by digital transformation as buyers continue to move off-prem.

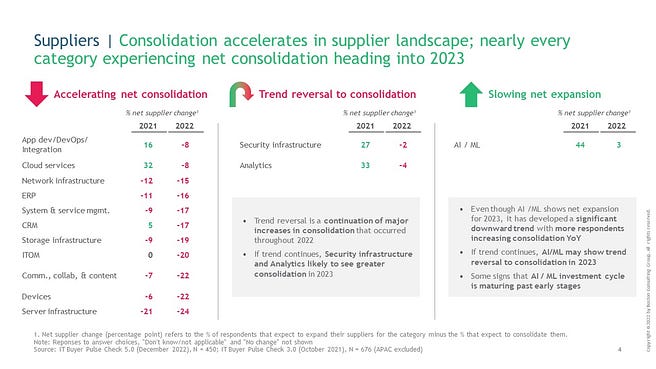

Buyers are moving towards supplier consolidation

Almost all of the IT stack are experiencing net consolidation as we head into 2023. In particular, server infrastructure, devices, ITOM and communication & collaboration suppliers underwent significant net supplier consolidations last year, as shown in exhibit 45 below. While security infrastructure and analytics in 2021 had an increase in suppliers, last year marked a trend-reversal in that there was a net decrease in suppliers utilized. AL/ML is the only category with an increase in net suppliers, but that expansion has slowed down considerably compared to 2021. Buyers are seeking to bring down overall costs by supplying their needs through a smaller vendor-base. IT vendors could strategically respond to this trend by focusing on increasing sales within their existing customer base, instead of trying to win new logos.

Price increases still expected, but slowly

While IT buyers still expect price increases from suppliers, those expectations have slightly decreased since Q2 2022, dropping an average of one percentage point across software, services, and infrastructure. For instance, as we see in exhibit 6 below, infrastructure was expected to increase by 5.3% six months ago, but now it’s expected to by 3.7%.

Overall, IT buyers are striving to operate in a leaner and more cost-effective manner. IT leaders are consolidating suppliers, downgrading in priority activities that are not core to the business, and cutting spending in hardware and server infrastructure. While vendors and investors need to be ready to navigate these potentially challenging dynamics, they can count on pockets of resilient demand among IT buyers in digital transformation, security concerns, and company growth.

Originally published at https://medium.com/bcgontech/it-buyer-pulse-check-5-slowing-spending-leaner-growth-d2f40c0aa395