What is the Message?

China’s emergence of ‘AI-in-a-box’ products presents a significant threat to Big Tech’s cloud growth strategies by enabling companies to deploy AI capabilities on-premise rather than through public cloud services.

Key Points

- Huawei’s Leadership: Huawei is at the forefront of this trend, partnering with over a dozen AI start-ups to offer comprehensive AI solutions combining hardware and large language models.

- Market Potential: The Chinese market for AI-in-a-box solutions is projected to reach Rmb16.8bn ($2.3bn) in 2024, with the government market potentially hitting Rmb450bn by 2027.

- Data Security Concerns: Chinese companies are increasingly favoring on-premise AI solutions due to concerns over data protection, diverging from Western commercialization strategies.

- Impact on Big Tech: The rise of AI-in-a-box could disrupt the business models of major cloud providers like Alibaba, Baidu, and Tencent, which have traditionally relied on public cloud offerings.

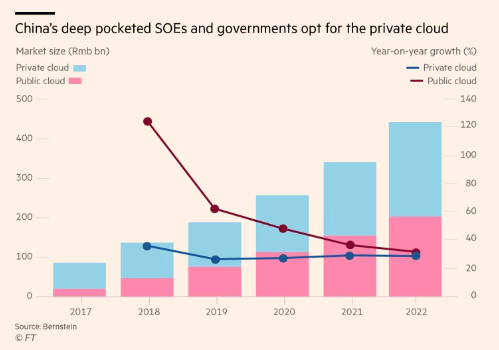

- Government and State-Owned Enterprises: There is a strong preference for private cloud solutions among large state-owned groups, influenced by national security and data sovereignty considerations.

- Technology and Efficiency Issues: While on-premise AI solutions address security concerns, they may lead to inefficiencies due to sporadic usage of expensive AI hardware.

Key Statistics

- Market Size: The Chinese market for AI-in-a-box products is estimated to reach Rmb16.8bn ($2.3bn) in 2024.

- Government Market Forecast: The government sector for AI boxes could grow to Rmb450bn by 2027.

- Baidu’s AI Revenue: Baidu reported sales of Rmb324mn from generative AI and foundational models in the first quarter.

- Zhipu AI’s Pricing: Zhipu AI charges Rmb1.8mn annually for a 12bn-parameter model packaged with eight Huawei Ascend 910 chips.

Executive Summary

China’s ‘AI-in-a-box’ products are reshaping the landscape of AI deployment, posing a significant challenge to the growth strategies of major cloud providers like Alibaba, Baidu, and Tencent.

Led by Huawei, which has partnered with numerous AI start-ups, these products enable businesses to operate advanced AI applications on-premise.

This shift is driven by concerns over data security and sovereignty, particularly among Chinese companies and government entities.

The market for these all-in-one AI solutions is rapidly expanding, with Huawei projecting a market size of Rmb16.8bn ($2.3bn) in 2024 and analysts forecasting the government sector alone could reach Rmb450bn by 2027.

This trend capitalizes on local data protection concerns and the desire for greater control over AI infrastructure, diverging from Western models that favor cloud-based AI services.

These companies, particularly Alibaba and Tencent, have seen their growth stunted by regulatory crackdowns and now face additional competition from on-premise solutions.

While Baidu and other tech giants have started offering their versions of all-in-one machines, they struggle to compete with the localized, secure solutions provided by Huawei and its partners.

Despite the appeal of on-premise AI for security and control, there are concerns about the efficiency of these setups.

High costs and potential underutilization of AI hardware could pose challenges.

However, the need for data protection and compliance with national policies appears to outweigh these drawbacks for many Chinese organizations.

Overall, China’s move towards AI-in-a-box solutions highlights a broader shift in how AI technology is adopted and commercialized, reflecting unique market dynamics and regulatory environments.

This trend not only impacts domestic cloud strategies but also signals a potential realignment in the global AI and cloud services market.

Adapted from:

China’s ‘AI-in-a-box’ products threaten Big Tech’s cloud growth strategies (ft.com)