Consumer Healthcare Survey 2021

By David Fries, Phil Furrer, Charlie Hoban, and Sarah Snider

cedar

The COVID-19 pandemic has reshaped how consumers access healthcare services. Our latest Consumer Healthcare Survey suggests that healthcare companies will need to realign their strategies to meet evolving consumer expectations.

Gains in Virtual Care

Hospitals and health systems reportedly saw telehealth utilization surge to nearly 90% for non-COVID-19 related visits during the pandemic.

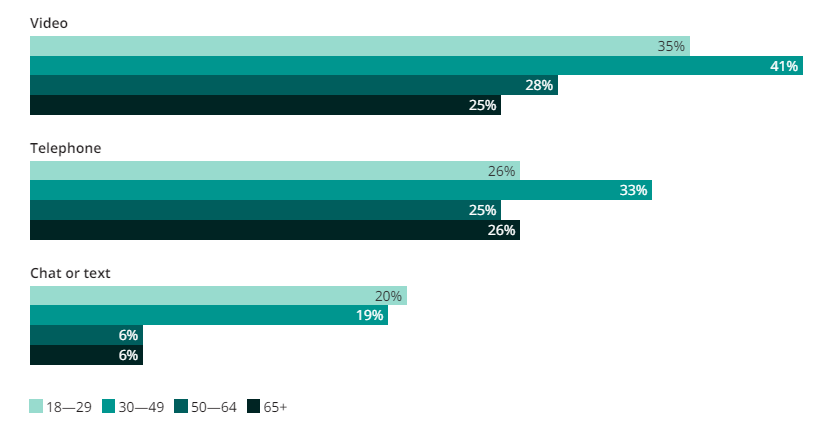

For 85% of patients, the pandemic was the first time they used any kind of virtual care — video, telephone, chat or text, according to 2021 Consumer Healthcare Survey. Usage climbed across all age demographics.

Received virtual care in the last two years, by age

Accessing Mental Healthcare

Throughout the COVID-19 pandemic, the number of Americans suffering from mental illness and substance abuse rose steadily — 4 in 10 adults reported symptoms of anxiety and/or depression in early 2021, compared to 1 in 10 in 2019, according to the Centers for Disease Control and Prevention.

Additionally, 20% of adults said they had taken a prescription medication for mental health, received therapy or counseling, or done both over the past 12 months. But experience in accessing mental health services varied greatly, according to Oliver Wyman’s consumer survey.

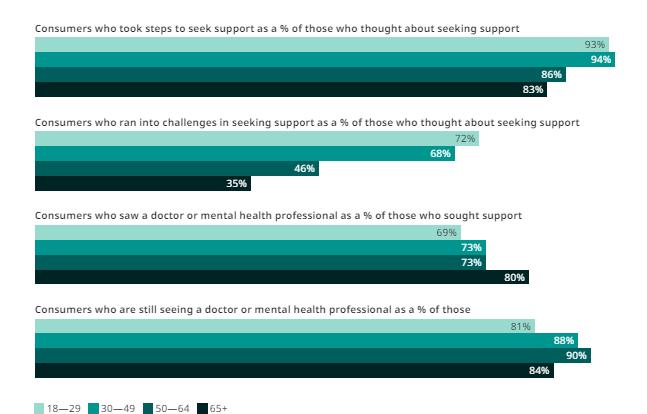

Young adults, ages 18–29, were most likely over the past two years to think about seeking support for mental healthcare services. Seniors were the least likely age cohort.

Mental Health Access Funnel (% of total consumers surveyed)

While the percentage of those patients seeking and getting care was high across all ages, younger patients were more likely to report barriers to care, suggesting they have a different set of expectations.

While the percentage of those patients seeking and getting care was high across all ages, younger patients were more likely to report barriers to care, suggesting they have a different set of expectations.

Mental Health Access Funnel (% of previous step)

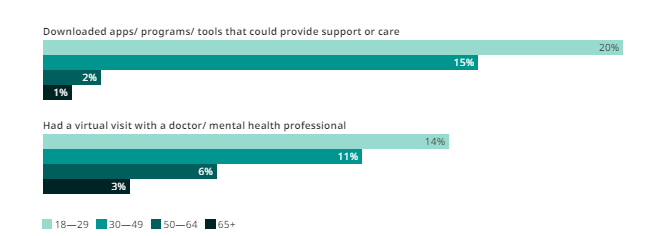

Perhaps not surprisingly, younger adults were more likely to either download an app or program, or conduct a virtual visit compared to older cohorts.

Virtual Mental Health (of all consumers)

The most common hurdles sited for accessing care were availability of appointments (41% of all consumers) and couldn’t find someone who was in-network (39%).

The increased need for mental health services will not dissipate anytime soon.

As the consumer survey suggests, healthcare providers will need segmented approaches for getting services to different age demographics.

As the consumer survey suggests, healthcare providers will need segmented approaches for getting services to different age demographics.

Five Behaviors that May Predict Consumer Engagement

Understanding how consumers interact with the healthcare system is complicated. There are a lot of variables at play — age, income, insurance coverage, location, previous healthcare experiences, and more.

With so many attributes to consider, true consumer segmentation is often entirely overlooked by healthcare incumbents, and even new entrants.

It can be daunting to get stuck in a confusing, complex analysis without any outcomes.

With consumers having more choices than ever before to interact with the healthcare system, we wanted to test how useful a few simple questions about everyday behaviors could be in predicting engagement.

Our findings in the survey have some interesting implications for healthcare organizations and may pave the way for creating new market share.

Understanding how consumers interact with the healthcare system is complicated. There are a lot of variables at play — age, income, insurance coverage, location, previous healthcare experiences, and more.

With so many attributes to consider, true consumer segmentation is often entirely overlooked by healthcare incumbents, and even new entrants.

A simple consumer engagement index can be highly predictive.

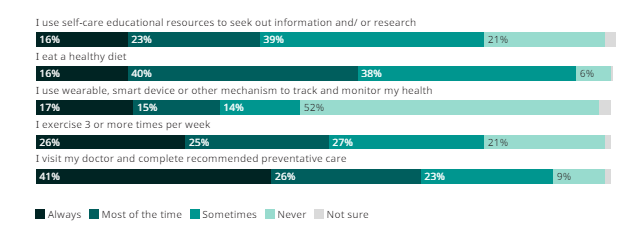

Our analysis is based on five everyday behaviors (see chart).

Understanding where consumers fall on the index can help organizations develop outreach strategies.

For instance, those scoring on the high end — between 80–100% — are most likely to be active participants in their care journey, while those who score low may need more interventions.

Creating a Healthy Living Behaviors Index

In the last two years, how often was the following statement true about surveyed consumer

Understanding where consumers fall on the index can help organizations develop outreach strategies.

As the figures below indicate, consumers with high engagement scores are more active at almost every level of their engagement with the healthcare system.

They seek out information about their health and are more active in accessing care. They rely heavily on their doctor and are significantly more inclined to rely on additional sources for information — pharmacists, support groups, social media, and medical journals.

Where consumers go for health information and research

Similarly, they are more likely to shop for insurance coverage than their less engaged counterparts.

The index also correlates to how consumers think about their health coverage.

Among those who ranked as highly engaged, 73% said they investigated new coverage options and either switched or stayed with their existing plan, compared to 27% who let their coverage automatically renew without considering other options.

By contrast, auto renewal is nearly twice as common among unengaged consumers, with 51% at the low end of the index choosing to roll over coverage from year-to-year.

How consumers renew their health coverage

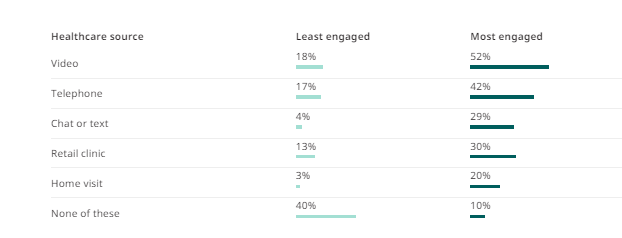

Importantly, more engaged consumers seem to be the first to line up to test industry innovations and are willing to try different front doors to the delivery system, whether it was virtual care or home visits.

Importantly, more engaged consumers seem to be the first to line up to test industry innovations and are willing to try different front doors to the delivery system, whether it was virtual care or home visits.

Use of New Access Points

The data also suggests that stakeholders need to be mindful how they roll out or expand an offering.

Looking at the example of mental health services in the chart below, engaged consumers were more likely than their counterparts to report challenges in accessing care, suggesting they not only have different expectations when it comes to convenience, but might also be more critical of how solutions like virtual care are being deployed.

Varying Expectations

All of this leads to some interesting questions about which consumers organizations should target, design for, and plan around.

Activating unengaged consumers will require a more intensive set of outreach strategies, and perhaps a different set of solutions.

If the goal is to increase market share or member stickiness, organizations need to be ready to meet the expectations of their most discerning customers.

Regardless of the organizational goal, healthcare organizations — whether incumbents or new entrants — need to look beyond mere demographics or clinical segmentation and start to examine consumer engagement behaviors to ensure success of their strategies.

Regardless of the organizational goal, healthcare organizations — whether incumbents or new entrants — need to look beyond mere demographics or clinical segmentation and start to examine consumer engagement behaviors to ensure success of their strategies.

Consumer Healthcare Survey 2021, oliverwyman.com

By David Fries, Phil Furrer, Charlie Hoban, and Sarah Snider

cedar