health transformation . institute

for better prevention, better wellness,

better health and better care, at an affordable cost,

for all !

Joaquim Cardoso MSc.

Chief Research & Strategy Officer (CRSO),

Chief Editor and Senior Advisor

August 25, 2023

What is the message?

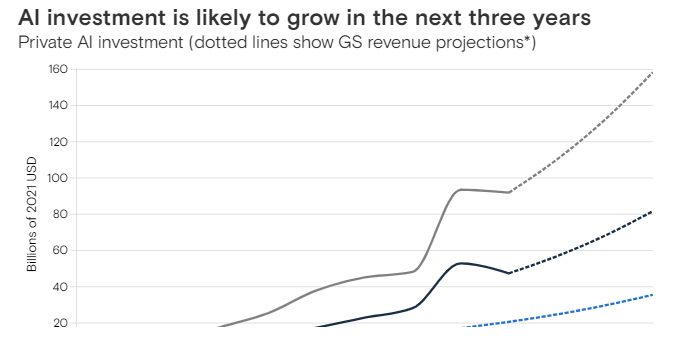

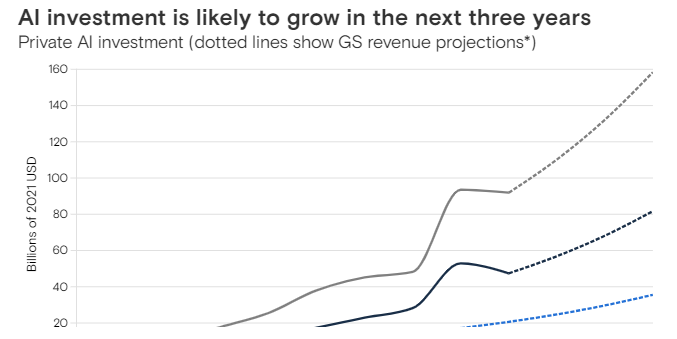

Global investment in artificial intelligence (AI) is on a rapid rise and could approach $200 billion by 2025.

- The potential of AI to have a profound impact on global GDP.

- Generative AI, in particular, is identified as a major driver of economic growth, with the potential to significantly boost global labor productivity over a decade following widespread adoption.

However, this transformation necessitates substantial upfront investments from businesses in various areas, including physical, digital, and human capital.

- Despite the potential for substantial gains in productivity, the impact on GDP in the near term might be relatively modest due to AI investment’s current low share of global and U.S. GDP.

The U.S. is a leader in AI technology, positioning American companies as early adopters, while also acknowledging potential similar trends in other AI-leading nations.

The timing of the AI investment cycle is challenging to predict precisely, but meaningful impacts could start to emerge in the latter half of the current decade.

Infographic

DEEP DIVE

AI investment forecast to approach $200 billion globally by 2025

Goldman Sachs

Published on01 AUG 2023

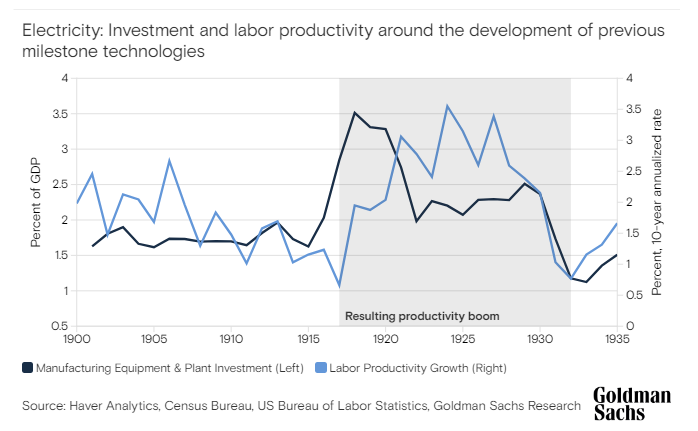

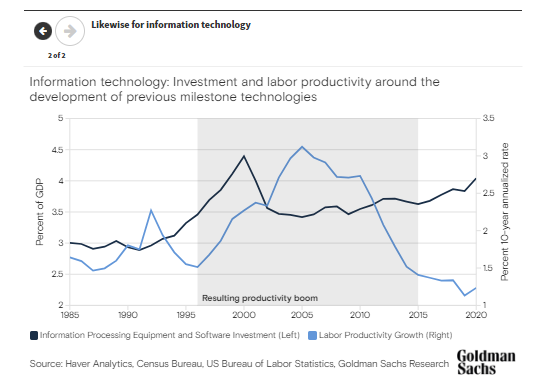

Innovations in electricity and personal computers unleashed investment booms of as much as 2% of U.S. GDP as the technologies were adopted into the broader economy. Now, investment in artificial intelligence is ramping up quickly and could eventually have an even bigger impact on GDP, according to Goldman Sachs Economics Research.

Generative AI has enormous economic potential and could boost global labor productivity by more than 1 percentage point a year in the decade following widespread usage, Goldman Sachs economists Joseph Briggs and Devesh Kodnani write in the team’s report. But for large-scale transformation to happen, businesses will need to make significant upfront investment in physical, digital, and human capital to acquire and implement new technologies and reshape business processes. Those investments, which could amount to around $200 billion globally by 2025, will probably happen before adoption and efficiency gains start driving major gains in productivity.

AI-related investment is climbing from a relatively low starting point and will likely take a few years to have a major impact on the economy, Briggs and Kodnani write. The U.S., meanwhile, is positioned as the market leader in AI technology, and American companies will likely be relatively early adopters, according to Goldman Sachs Research. While a similar effect could also play out in other AI leaders (such as China), the investment impact will likely be smaller and more delayed.

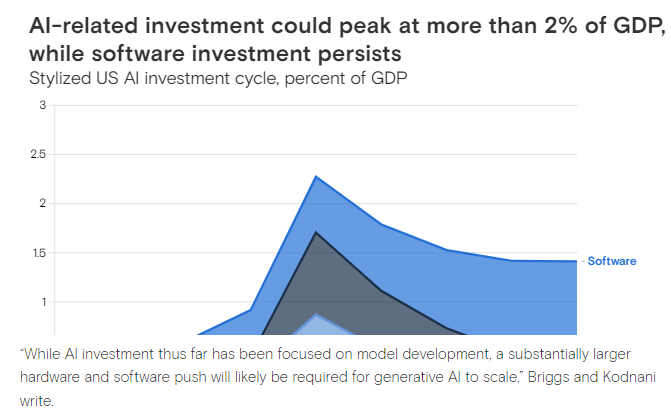

Over the longer-term, AI-related investment could peak as high as 2.5 to 4% of GDP in the U.S. and 1.5 to 2.5% of GDP in other major AI leaders, if Goldman Sachs Research’s AI growth projections are fully realized.

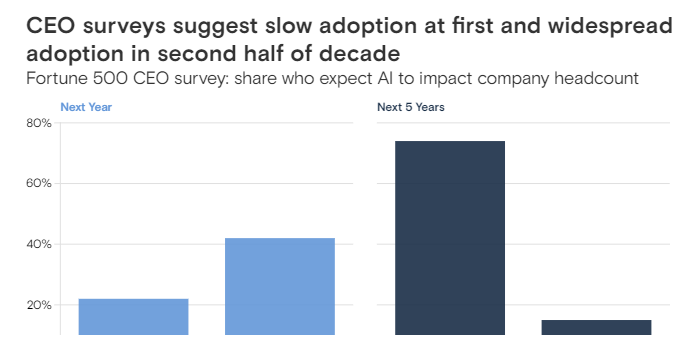

While the timing of the AI investment cycle is hard to predict, business surveys suggest that it’s likely to start having an investment impact in the second half of this decade, with earlier adoption by larger firms in information and professional, scientific, and technical services.

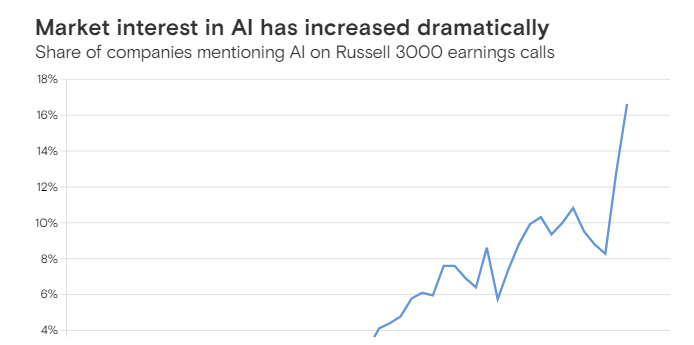

And even though it will take time for AI to boost productivity, market interest in AI has already increased rapidly, with more than 16% of companies in the Russell 3000 mentioning the technology on earnings calls, up from less than just 1% of those firms in 2016. Roughly half of that spike came after the release of ChatGPT in the fourth quarter of 2022. Our economists’ previous research has shown that such mentions tend to predict increases in company-level capital spending.

Incorporating that information, along with our equity analysts’ revenue growth projections for key AI-exposed businesses, Goldman Sachs Research estimates AI investment could approach $100 billion in the U.S. and $200 billion globally by 2025. “Despite this extremely fast growth, the near-term GDP impact is likely to be fairly modest given that AI-related investment currently accounts for a very low share of U.S. and global GDP,” Briggs and Kodnani write.

AI investment is expected to be concentrated in four key business segments:

- companies that train and develop AI models,

- those that supply the infrastructure (for example, data centers) to run AI applications,

- companies that develop software to run AI-enabled applications, and

- enterprise end-users that pay for those software and cloud infrastructure services.

Our economists expect AI investment to largely come from hardware investment to train AI models and run AI queries, as well as increased spending on AI-enabled software.

“

While AI investment thus far has been focused on model development, a substantially larger hardware and software push will likely be required for generative AI to scale,” Briggs and Kodnani write.

In the meantime, there are signs of early AI adoption in a few industries, even as Goldman Sachs Research expects the broader macro effects are still a few years off. Previous breakthroughs in technology show it’s hard to predict when adoption will increase enough to meaningfully nudge the economy. The productivity effects of the electric motor and personal computer only showed up in the macro data once about half of U.S. businesses had adopted the technology.

In the 2021 American Business survey, only 4% of US firms reported using AI in their business processes. Likewise, CEO surveys show less than a quarter expect generative AI will impact their company or lower their labor needs over the next one to three years. That said, a significant majority expect to have adopted AI over a three- to 10-year horizon. If those timelines are correct, then AI adoption would likely start having a meaningful impact on the U.S. economy sometime between 2025 and 2030.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Originally published at https://www.goldmansachs.com.

Names mentioned

Joseph Briggs and Devesh Kodnani write in the team’s report.