This is a republication of the paper “Biopharma Is Betting Big on Digital and Data. Are Companies Organized for Success?”, with the title above.

Site editor:

Joaquim Cardoso MSc

The Health Strategist — Journal

September 29, 2022

29 SEPTEMBER 2022

By Margaret Ayers, Nadia Shamsad, Valtteri Tulkki, Chris Meier, and Ben Shuttleworth

Biopharma has undergone a digital and data revolution over the last decade, reshaping the entire value chain from drug discovery to clinical trials, from manufacturing to sales and marketing.

The pandemic accelerated the adoption of digital, data, and analytics (DD&A) and put these tools to use in new ways, virtualizing and decentralizing clinical trials, for example, and enabling remote engagement with physicians and patients.

In pushing this transformation forward, biopharma companies have invested heavily in technology and talent.

Today, most large organizations employ hundreds, and in some cases thousands, of DD&A experts.

But many of them are wrestling to integrate this talent into their medical, scientific, and commercial organizations and operations. So far, many have not seen the expected return on their digital investment.

We have worked with many biopharma companies as they try to establish their DD&A capabilities, including supporting their digital transformations.

We also have conducted an outside-in benchmarking exercise of major biopharma companies’ DD&A teams and how they are organized and integrated with existing teams and functions.

Here are some key findings and lessons learned so far.

Setting Up DD&A Teams for Success

DD&A hiring by large biopharma companies has skyrocketed in the last decade:

US job postings rose by an average of almost 30% a year from 2011 through 2021, despite a slowdown during the early years of the COVID pandemic. (See Exhibit 1.)

In recent years, hiring of advanced-analytics talent, specifically artificial intelligence and machine learning skills, has soared even faster.

Job postings jumped almost 70% a year between 2019 and 2021.

DD&A hiring by large biopharma companies has skyrocketed in the last decade:

The rapid increase in demand has led to new strategic challenges for companies in several areas, …

…including attracting and retaining DD&A talent (especially senior leaders and experts in advanced skills, such as AI and machine learning), organizing new roles, and achieving the desired impact and ROI from their investment.

The rapid increase in demand has led to new strategic challenges for companies in several areas, …including: (1) attracting and retaining DD&A talent , (2) organizing new roles, and (3) achieving the desired impact and ROI from their investment.

Several companies have built up DD&A groups that are organizationally isolated from the business.

Others have focused heavily on technology, investing tens or hundreds of millions in IT platforms, without paying sufficient attention to the human skills needed to make the technology work.

Several companies have built up DD&A groups that are organizationally isolated from the business.

Others have focused heavily on technology, investing tens or hundreds of millions in IT platforms, without paying sufficient attention to the human skills needed to make the technology work.

There’s no single “right” answer to all the challenges companies encounter, of course.

But tested solutions to the most common issues are beginning to take shape:

- LESSON 1: START WITH A STRATEGY AND ROADMAP

- LESSON 2: WINNING THE TALENT WAR REQUIRES NEW SKILL PROFILES AND PRACTICES

- LESSON 3: A HYBRID ORGANIZATIONAL MODEL IS EMERGING AS THE MOST EFFECTIVE SETUP

- LESSON 4: DD&A NEEDS A SEAT AT THE TOP TABLE

- LESSON 5: BUILD CAPABILITIES INTERNALLY AND THROUGH EXTERNAL PARTNERSHIPS

Lesson 1: Start With a Strategy and Roadmap

While most biopharma companies have strong ambitions for DD&A, they have often failed to link it directly to the business strategy, lay out a prioritized roadmap, or establish KPIs.

At the same time, disconnected DD&A initiatives mushroom throughout the organization from the bottom up, fragmenting resources and frustrating teams that cannot deliver.

Both factors contribute to DD&A teams struggling to add value in scalable ways.

Successful companies directly link their DD&A efforts to existing business priorities and KPIs.

They typically focus on no more than five to seven major areas or initiatives where DD&A will be applied.

They articulate exactly what will be done and the business outcomes that DD&A will enable, such as using it to optimize specific steps in clinical trials; refining certain chemistry, manufacturing, and controls processes; and accelerating specific sales and marketing efforts.

They focus DD&A talent on these tasks and incentivize business teams to collaborate on the development and scaling up of workable solutions.

Lesson 2: Winning the Talent War Requires New Skill Profiles and Practices

Competition for DD&A skills is an issue in every industry. Because this talent is often scarce and difficult to recruit, employees can be demanding.

Biopharma has had a hard time competing with tech companies on compensation and perks, but it can level the playing field in areas such as purpose and career paths.

A well-thought-out digital strategy and plan, a clear mandate for the roles being filled, inspiring senior leadership, and a vibrant and dynamic culture take on added importance in a recruiting context.

For DD&A to have an impact, biopharma companies need to bring together multiple distinct, and often new, capabilities with existing scientific, medical, and commercial expertise in cross-functional teams. This is no simple task.

Among the newer roles to be filled are data scientists, engineers, and digital experts, as well as DD&A-experienced managers who can speak the language of both the biopharma business and the digital and analytics teams. (See Exhibit 2.)

Depending on the specific remit of the DD&A group, technology and IT roles-such as systems engineers and managers-may also be required.

Many of these skills are not found in the usual industry recruiting channels, and many biopharma companies struggle to attract them.

Exploring alternative channels, such as universities, tech companies, and tech conferences and events (hackathons, for example) can be helpful.

But to be successful, companies must figure out the best way to present themselves and the opportunities they offer in these nonindustry contexts.

For example, they might emphasize that biopharma improves lives by finding disease cures, which is a potentially attractive employee value proposition.

Companies need to show recruits how DD&A helps achieve this mission and the roles they will play.

Internal processes may need revisiting.

Biopharma companies’ recruitment procedures can seem slow and cumbersome to digitally native talent.

We have seen companies lose prospective hires because they did not move quickly enough in the recruiting process.

Some have used letters of intent, DD&A-specific compensation structures, and dedicated DD&A recruiters to speed things up.

Others have adapted their training and development opportunities, putting in place upskilling programs for all staff.

Moderna, for example, has launched an AI academy to train employees on the use of AI and machine learning solutions.

Moderna, for example, has launched an AI academy to train employees on the use of AI and machine learning solutions.

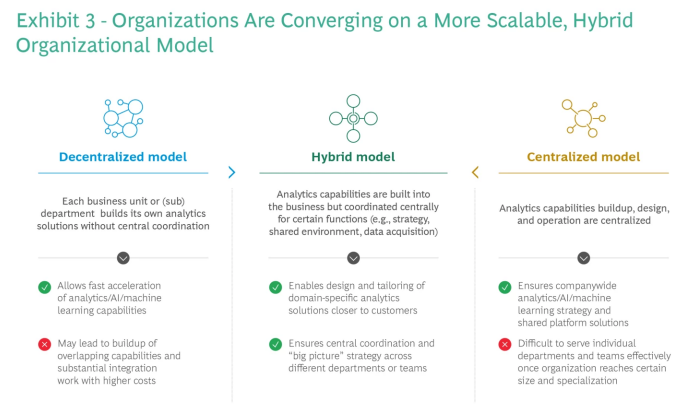

Lesson 3: A Hybrid Organizational Model Is Emerging As the Most Effective Setup

Five or more years ago, when many biopharma companies started building DD&A capabilities, most companies housed them in different places throughout the organization, which was often the result of individual departments hiring for specific needs.

This decentralized, and sometimes fragmented, approach advanced business-unit-specific capabilities and furthered strong alignment with business needs.

But it also led to duplicative roles and siloed teams.

A few biopharma and some larger biotech companies took the opposite approach, building highly centralized DD&A units, sometimes as part of the IT or technology organization.

This allowed for strong coordination and faster capability building, but teams often operated too far from the business to deliver real impact.

While both of these models are natural ways to get started, over time neither one achieves the three-way goal of establishing the necessary capabilities, scaling activities, and achieving impact.

As a result, successful companies are now converging on a hybrid model. (See Exhibit 3.)

… successful companies are now converging on a hybrid model [for DD&A]

This allows capabilities to sit close to the business but also facilitates the coordination needed to drive consistency and scale.

Eventually, as DD&A capabilities scale up and become integral to daily business operations, we expect them to decentralize into the business units.

This will take time, though, and the hybrid model seems to be the best way to meet immediate needs and effect the transition.

Lesson 4: DD&A Needs a Seat at the Top Table

When biopharma companies try setting up DD&A organizations deep down in the business-within a business unit, region, or subfunction, …

… for example-teams often have a tough time achieving input, buy-in, and visible sponsorship from senior leadership.

This reduces impact and leads to difficulties in hiring and talent retention.

The DD&A teams often run of out of steam.

Accelerating and scaling the DD&A agenda requires dedicated leadership with the oversight responsibility needed to integrate DD&A into the business strategy.

It also requires consensus in the C-suite about the role (or roles) that DD&A will play.

Some companies have established the role of chief digital officer to set the overall strategic direction and ambition and to coordinate efforts across the enterprise.

In some cases, individual departments, such as R&D, chemistry, manufacturing and controls, and commercial have established heads of DD&A.

These leaders identify, shape, and drive the execution of concrete initiatives and programs, from inception to scaling.

Whether companies decide on a single enterprise leader or a different oversight leader for each function, it’s important that these individuals have a seat at the top table, as part of the R&D, manufacturing, or commercial leadership team, for example.

They need to be part of the strategy-setting process that shapes how DD&A contributes.

They also need sufficient influence over DD&A resources to channel capacity to the top priorities.

A good test for the effectiveness of your setup is whether business leaders are visibly supporting and communicating a consistent message about DD&A in connection with the business strategy.

Lesson 5: Build Capabilities Internally and Through External Partnerships

Building in-house capability, whether through hiring or upskilling, can be take time.

Successful companies pursue a dual strategy, leveraging partnerships with academic organizations, startups, and tech companies to accelerate acquisition of needed capabilities while also ramping up recruiting and training.

The dual approach does require determining which capabilities to develop in-house (usually those deemed strategic for the longer term) and which to access through partnerships or outsourcing. Decisions need to be aligned with long-term ambition.

For example, AstraZeneca initially partnered with Huma, a digital-native health care company, to improve clinical outcomes using digital health solutions in select use cases.

When the collaboration proved successful, Huma acquired AstraZeneca’s digital health platform and AstraZeneca became a Huma shareholder.

Huma is now helping AstraZeneca scale up its digital health innovations. This arrangement allows AstraZeneca to access external capabilities and talent.

Some companies have accelerated building their DD&A capabilities by “acquihiring,” that is, buying a company primarily to gain access to its staff and their expertise.

This approach can work, but it requires careful planning and execution, especially with respect to talent retention.

Some companies have accelerated building their DD&A capabilities by “acquihiring,” that is, buying a company primarily to gain access to its staff and their expertise.

Most companies-especially those starting from scratch-will need to rely on a mix of these channels.

Companies that have already made good progress should continue to experiment as recruiting accelerates and competition for talent intensifies.

Four Steps to Take Now

Here are some steps biopharma companies can take to further develop and organize their DD&A capabilities, as well as achieve value and impact from capabilities they have already built:

- Define, or update, your DD&A strategy and roadmap, establishing clear KPIs and links with business objectives.

Pick five to seven priority use cases that can be clearly defined, articulated, and funded.

- Evaluate the workforce gap between your strategy and roadmap and your current teams.

Decide which strategic capabilities should be built in-house and prioritize recruiting and (re)training accordingly.

- Assess and enhance your digital employee value proposition.

Assemble a team, including HR, individuals familiar with the current DD&A recruiting market (such as newly recruited talent), and DD&A-supportive culture carriers, to determine how best to create an attractive environment.

- (Re)examine how to organize DD&A teams, especially if you have foundational capabilities embedded in the business or IT.

Explore a hybrid structure in which DD&A capabilities are built into the business but coordinated centrally in order to scale IT investments and establish consistent approaches.

As the biopharma industry becomes more DD&A-savvy and competitive for talent, smart organizational design and setup will go a long way towards maximizing the impact of companies’ investments and achieving transformative, sustainable value.

As the biopharma industry becomes more DD&A-savvy and competitive for talent, smart organizational design and setup will go a long way towards maximizing the impact of companies’ investments and achieving transformative, sustainable value.