This is an excerpt of the article “How Chinese Grocers Can Leapfrog the Competition” authored by “By Rune Jacobsen, Yossi Arouch, Josh Ding, Allen Zhang, Linda Zou, and Ann Yeoh”, published on MAY 12, 2022.

For the full version of the publication, please, refer to the second part of this article.

EXCERPT

Introduction

By digitizing their value chains from end to end, Chinese grocers can increase efficiency, boost margins, please customers — and make gains against the competition.

Digitization has long been a strong suit for online and offline grocers in China.

Many have boosted their top line through higher online sales and successful cross-selling programs.

During the COVID-19 pandemic, online grocery sales in China reached double-digit shares of total sales for most retailers, while for some, including Wumart, Hema, and Sam’s Club, a third of their sales were online.

In short, Chinese grocers have been able to continue pushing the frontier of digital offerings and digitized customer engagement.

Yet the Chinese grocery market remains highly fragmented, and grocers are struggling to sustain margins and boost the bottom line.

There is an opportunity for retailers to extend their digital prowess into the end-to-end value chain, thanks to a variety of new tools based on analytics and artificial intelligence (AI).

By seizing it, they can significantly increase efficiency throughout their operations, increase profitability, and ultimately better serve their customers.

The benefits include stronger and tighter relations with suppliers, more efficient inventory, transportation and logistics, optimized store location, layout and pricing, and happier, more loyal customers.

There is an opportunity for retailers to extend their digital prowess into the end-to-end value chain, thanks to a variety of new tools based on analytics and artificial intelligence (AI).

The benefits include stronger and tighter relations with suppliers, more efficient inventory, transportation and logistics, optimized store location, layout and pricing, and happier, more loyal customers.

The goal: to digitize the entire retail value chain, creating a complete end-to-end ecosystem dedicated to serving customers as effectively as possible.

Grocers who successfully digitize first will be in a position to leapfrog the competition with more efficient, more agile operations. Here’s how to get there.

The goal: to digitize the entire retail value chain, creating a complete end-to-end ecosystem dedicated to serving customers as effectively as possible.

The Status Quo

See the original publication (for the complete version)

Many Chinese retailers have made considerable strides in digitizing both their brick-and-mortar and online operations to promote growth.

These companies have been customer-focused, offering digital platforms and experiences that address shoppers’ daily needs, capture considerable screen time and enable the cross-selling of a wide range of products.

Grocery retailers are also actively developing wider e-commerce marketplaces, offering a huge range of products beyond groceries across different channels, and delivering goods and services with considerable efficiency.

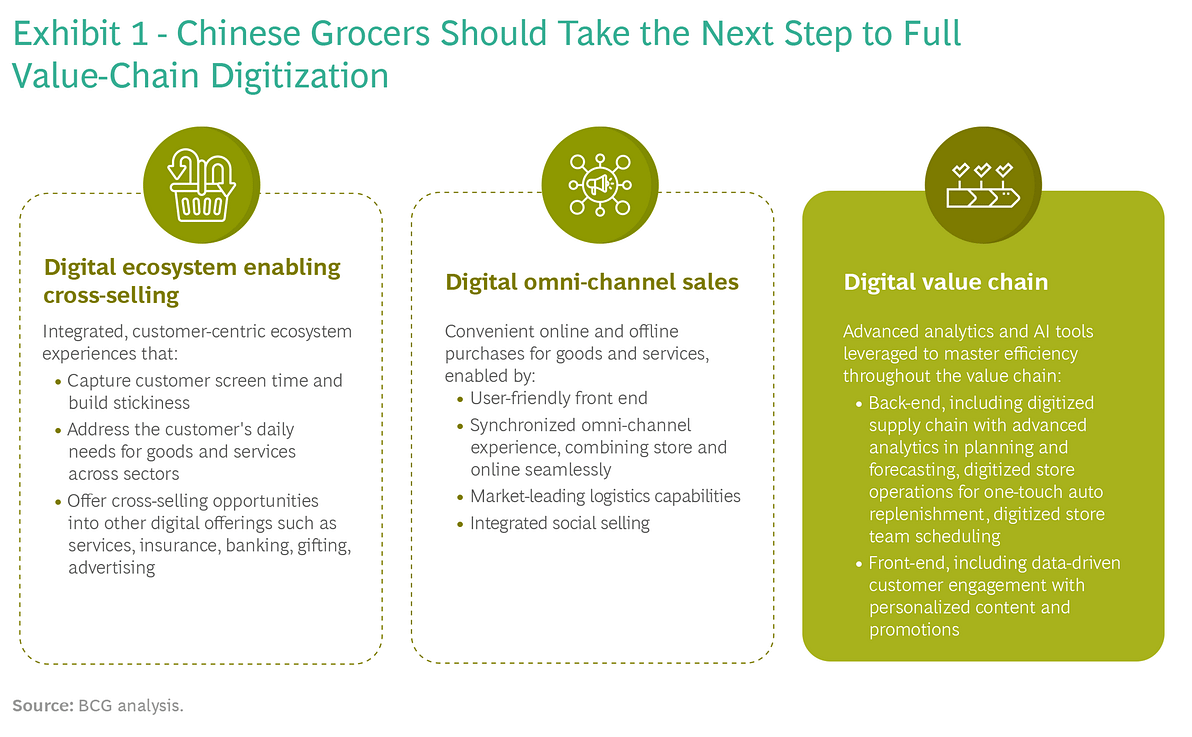

Despite the focus on their online sales channels, however, most grocers have not succeeded in building a completely digitized end-to-end value chain using the full range of digital technologies, including AI, to maximize efficiency and ensure even greater customer service and loyalty. (See Exhibit 1.)

As a result, grocers in China are not achieving their fullest profitability potential.

For example, logistics makes up as much as 5% of sales in China, compared to 2.5% at grocers in other major markets. Losses of fresh goods from shrinkage, markdowns, and other factors at grocers in China are between 7% and 15%, compared to about 5% elsewhere, resulting in fewer fresh products on offer for Chinese customers. The average availability of fresh goods in China ranges between 82% and 90%, compared with 95% to 98% in other markets, leading to hundreds of millions in potential lost revenue for large grocers.

Moreover, if the costly promotions that grocers often use to attract customers don’t substantially increase sales, they dilute margins further while raising labor costs. And labor costs are accelerating in China, more than doubling in the past ten years due to increased hours and rising wages.

Digitizing the Retail Value Chain

As proficient as Chinese grocers are in digitized customer engagement and online/O2O sales, they still can build a truly sustainable end-to-end platform that maximizes the value of AI and digitization across the retail value chain.

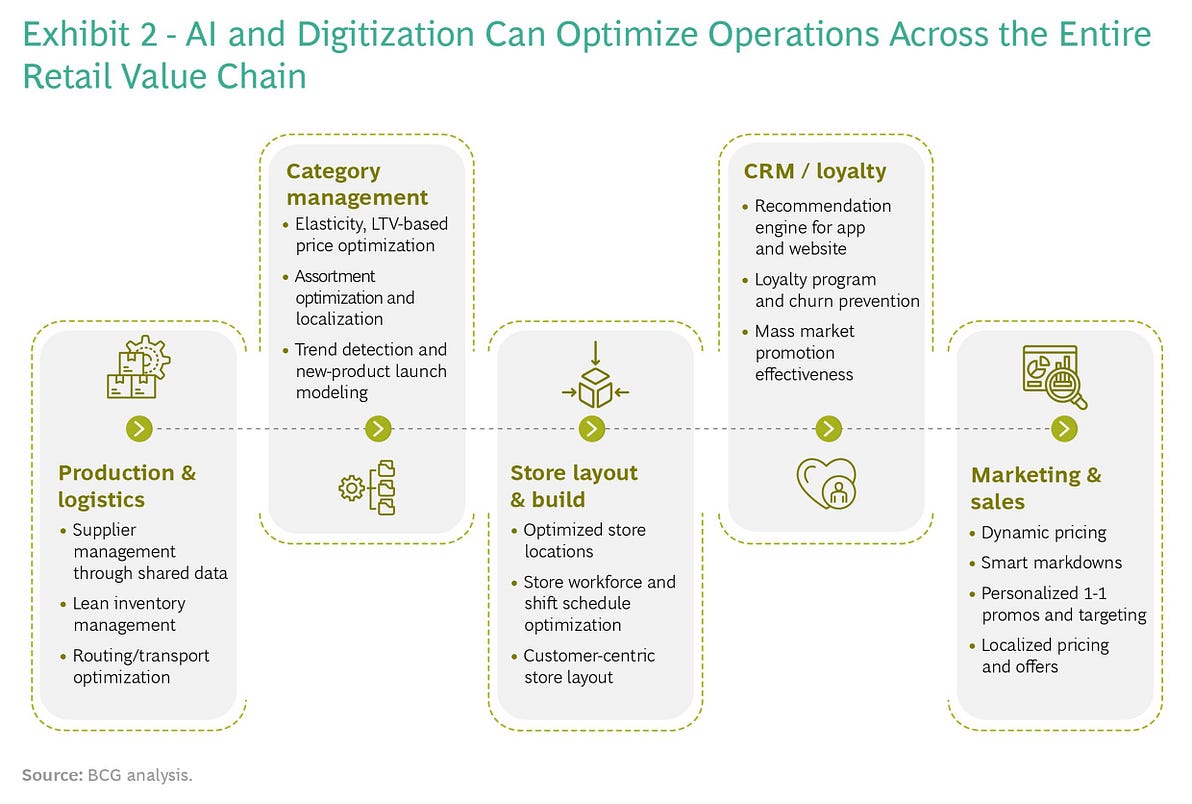

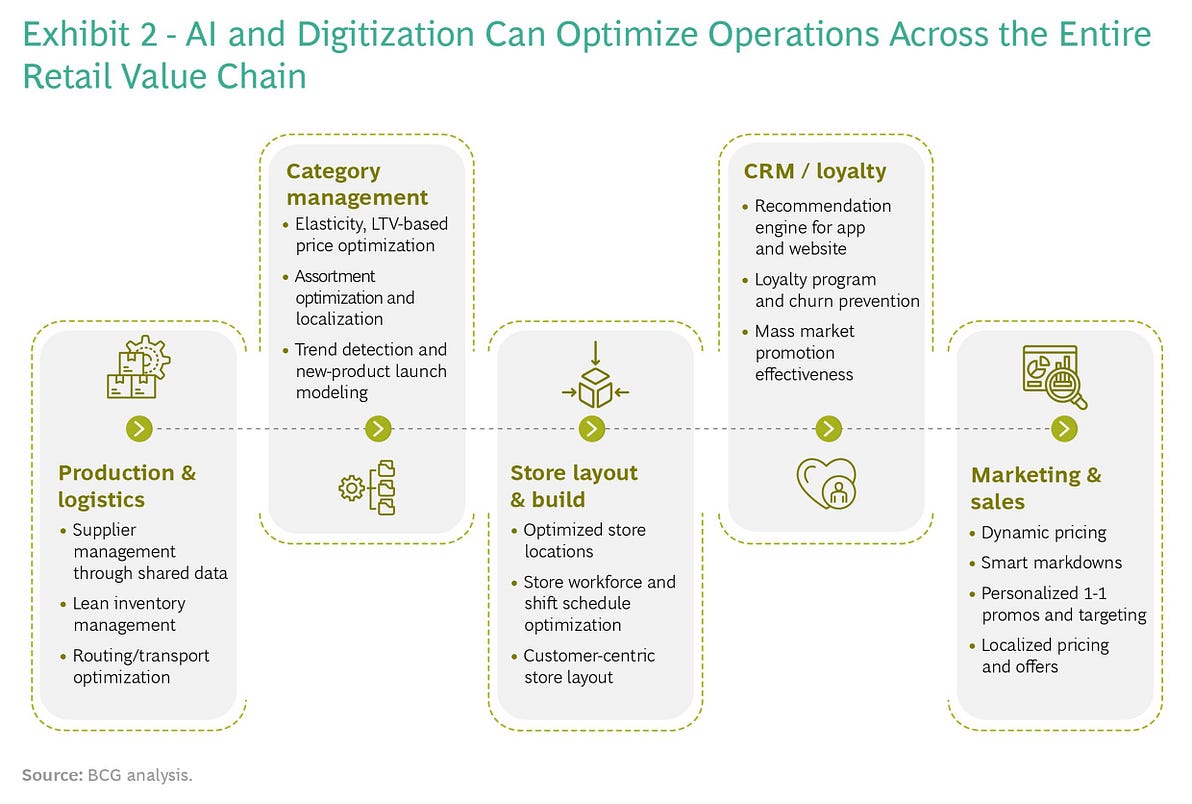

Exhibit 2 lays out the key elements needed to ensure maximum efficiency, from production and logistics to marketing and sales.

Production and logistics. Supply chains in China are growing increasingly complicated, given the proliferation of online and offline sales channels and the increasing demand for innovative products. As a result, different types of products require their own optimized flows, depending on seasonality, frequency of turn, and stability of supply. But Chinese retailers continue to rely on pre-digital processes to manage their suppliers and match inventory with customer demand.

The digital transformation of production and logistics through AI and other tools would allow retailers to plan, buy and allocate better by improving demand forecasting and defining store-level optimal orders in line with predicted demand, available inventory, and product substitution effects. Having a smart brain to help in forecasting and planning is particularly important in a market where the intensity of promotions is so high, making demand variable.

These tools can help retailers optimize how stock is allocated within and between warehouses and how it is delivered to stores and customers. Digitally sharing data with suppliers can provide them with transparency into demand and the supply chain, ensuring timely replenishment of high-demand categories and minimizing the risk of supply bottlenecks.

Our experience shows that companies that leverage AI and big data to optimize their supply chains can boost the amount of demand they can meet by up to 6%, even as they reduce warehousing and distribution costs by as much as 20%. And smarter inventory management can free up 15% to 30% of working capital.

… companies that leverage AI and big data to optimize their supply chains can boost the amount of demand they can meet by up to 6%, even as they reduce warehousing and distribution costs by as much as 20%.

And smarter inventory management can free up 15% to 30% of working capital.

Category management. Precision and flexibility in product assortment and placement in stores are crucial for both operational efficiency and customer appeal. Yet few retailers are fully leveraging customer data on buying habits to make assortment optimization decisions, instead carrying out these critical activities manually, using experience alone.

Assortment decisions can be augmented if retailers use AI and other tools to capture data from multiple online and offline customer touch points-including purchasing history, customer profiles, and local demographics-and connecting this data with information about product margins. Retailers not only can fine-tune product assortment, but also customize assortment at the level of the individual store. Furthermore, AI offers the potential to mine structured and unstructured data to detect emerging customer trends, further informing product assortment decisions and helping grocers develop their own store brands.

By working with suppliers to optimize margins and develop even more attractive product ranges, retailers can be more experimental with their product assortment, with less risk.

In our experience, better product assortment and economics, based on profitability and demand analysis, can improve grocers’ cost of goods sold by 1.5% or more, savings that grocers can pass on to customers as price reductions and other perks.

…better product assortment and economics, based on profitability and demand analysis, can improve grocers’ cost of goods sold by 1.5% or more, savings that grocers can pass on to customers as price reductions and other perks.

Store location, layout and staffing. Chinese retailers have the opportunity to leverage data to enhance their store networks and design their stores with optimal layouts that maximize in-store revenue and profitability. Store networks can be optimized by using AI to determine predicted consumer demand by store location, store presence in key areas, optimal number of stores, and demographics. Within a store, retailers can optimize in-store merchandise displays based on store layout, predicted demand, sales and profitability goals, and inventory availability.

Chinese companies tend to staff their brick-and-mortar outlets with more employees than retailers in other markets, in part because labor costs in China are lower. But having the right team in the right place at the right time is key. Using AI algorithms to link scheduling to forecasted customer traffic and expected timing of labor-intensive activities (such as pallet receipt and replenishment), grocers can staff stores more efficiently, therefore better serving customers.

We have seen grocers save as much as 10% of workforce hours in non-customer facing activities, which can then be reinvested in customer-facing activities.

grocers can save as much as 10% of workforce hours in non-customer facing activities, which can then be reinvested in customer-facing activities.

Loyalty and customer relationship management (CRM). Chinese retailers, especially online platforms operated by large technology companies, are adept at digitizing the customer-facing retail experience. Brick-and-mortar grocery retailers, too, can seize the opportunity to capture a greater amount of online-to-offline traffic by using AI and other tools to target prospective customers and by personalizing products, promotions, and rewards that accurately reflect customer profiles.

At Hema, a grocery retailer operated by Alibaba, customers can shop and dine in physical stores, then purchase or repurchase products online, delivered within 30 minutes. Coupled with its leading customer data analytics capabilities, the integration of the online and offline customer experience enables Hema to tailor product recommendations to fit customer habits and preferences.

Marketing and sales. Even as their online customer-facing activities improve, many Chinese retailers have much to gain by integrating their pricing and marketing strategies into their end-to-end value chain. Rather than determining prices with gut instinct, for example, Chinese retailers can boost profitability and offer customers better value through next-generation category pricing. Digital platforms combined with AI tools allow retailers to optimize pricing based on category strategy, customer response, supplier economics, and even competitor reaction.

Promotions that combine robust pricing strategies with accurate customer data can become a net incremental revenue generator. And by linking inventory data and sales goals with predicted customer response, retailers can dynamically adjust pricing and offer “smart markdowns” to avoid over-discounting.

We have seen grocers improve margins by up to 2 percentage points by employing historical analysis and analytics-driven optimization to improve the effectiveness of their promotions.

We have seen grocers improve margins by up to 2 percentage points by employing historical analysis and analytics-driven optimization to improve the effectiveness of their promotions.

Retailers that invest in building these capabilities can gain a differentiated competitive advantage and potentially commercialize these digital products and tools, monetizing them into new revenue streams. (See “The Digital Advantage.”)

BOX: The Digital Advantage

Consider the case of Wumart, a major Chinese online and offline grocer that has been actively digitizing its end-to-end value chain.

In selected Wumart stores, customers can shop using “smart carts” that automatically register items and pay at self-checkout counters, significantly lowering labor costs.

And its app allows customers to seamlessly transfer their online activities offline via data links between their membership ID, reward points, coupons, and payments.

On the back end, Wumart has implemented digitized inventory management solutions (with hourly out-of-stock calculation and root cause analytics), reducing out-of-stocks by 5% to 10%.

Its use of smarter demand forecasting and a real-time view of inventory has helped cut inventory days to about 20, therefore improving cash flow.

The company also optimizes its product assortment using analytics on transaction numbers, daily sales, and profitability figures, offering customers a more carefully curated range of products that meet their shopping needs.

For support digitizing the value chain, Wumart has been partnering closely with Dmall for its integrated retail value chain solution (especially middle ware), customer app ecosystem for e-commerce, and tech implementation capabilities.

How to Get There

See the original publication

Chinese retailers have much to gain in digitizing their end-to-end value chain. As important as new technologies such as big data and analytics, AI, and the Internet of Things are in enabling the digital transformation, the journey calls for the right leadership mindset and culture, and no such major effort can succeed without them.

Every digital transformation requires new ways of working that support cross-functional collaboration and faster decision making.

To successfully implement digital and new ways of working, it’s important to craft a coherent digital transformation strategy and roadmap.

- A clear vision.

- A phased approach

- AI and digital levers

- Change management

ORIGINAL PUBLICATION (full version)

How Chinese Grocers Can Leapfrog the Competition

By Rune Jacobsen, Yossi Arouch, Josh Ding, Allen Zhang, Linda Zou, and Ann Yeoh

MAY 12, 2022

By digitizing their value chains from end to end, Chinese grocers can increase efficiency, boost margins, please customers — and make gains against the competition.

Digitization has long been a strong suit for online and offline grocers in China.

Many have boosted their top line through higher online sales and successful cross-selling programs.

During the COVID-19 pandemic, online grocery sales in China reached double-digit shares of total sales for most retailers, while for some, including Wumart, Hema, and Sam’s Club, a third of their sales were online.

In short, Chinese grocers have been able to continue pushing the frontier of digital offerings and digitized customer engagement.

Yet the Chinese grocery market remains highly fragmented, and grocers are struggling to sustain margins and boost the bottom line.

There is an opportunity for retailers to extend their digital prowess into the end-to-end value chain, thanks to a variety of new tools based on analytics and artificial intelligence (AI).

By seizing it, they can significantly increase efficiency throughout their operations, increase profitability, and ultimately better serve their customers.

The benefits include stronger and tighter relations with suppliers, more efficient inventory, transportation and logistics, optimized store location, layout and pricing, and happier, more loyal customers.

There is an opportunity for retailers to extend their digital prowess into the end-to-end value chain, thanks to a variety of new tools based on analytics and artificial intelligence (AI).

The benefits include stronger and tighter relations with suppliers, more efficient inventory, transportation and logistics, optimized store location, layout and pricing, and happier, more loyal customers.

The goal: to digitize the entire retail value chain, creating a complete end-to-end ecosystem dedicated to serving customers as effectively as possible.

Grocers who successfully digitize first will be in a position to leapfrog the competition with more efficient, more agile operations. Here’s how to get there.

The goal: to digitize the entire retail value chain, creating a complete end-to-end ecosystem dedicated to serving customers as effectively as possible.

The Status Quo

Between 2015 and 2020, the Chinese retail grocery market enjoyed sustained growth of close to 3% a year. But the top 20 grocery operators in China account for just 15% of the market, in contrast to Western economies, where the top five represent between 40% and 60%. Fragmentation means lower efficiency and the inability to move quickly when consumer tastes change, which eats into earnings. And with smaller mom-and-pop stores banding together to digitize their own operations and boost their competitive positions, greater efficiency is more important now than ever.

Many Chinese retailers have made considerable strides in digitizing both their brick-and-mortar and online operations to promote growth. These companies have been customer-focused, offering digital platforms and experiences that address shoppers’ daily needs, capture considerable screen time and enable the cross-selling of a wide range of products. Grocery retailers are also actively developing wider e-commerce marketplaces, offering a huge range of products beyond groceries across different channels, and delivering goods and services with considerable efficiency.

China’s top 20 grocery operators account for just 15% of the market, in contrast to Western economies, where the top five represent 40% to 60%. Fragmentation means lower efficiency and the inability to move quickly when consumer tastes change.

Despite the focus on their online sales channels, however, most grocers have not succeeded in building a completely digitized end-to-end value chain using the full range of digital technologies, including AI, to maximize efficiency and ensure even greater customer service and loyalty. (See Exhibit 1.)

As a result, grocers in China are not achieving their fullest profitability potential. For example, logistics makes up as much as 5% of sales in China, compared to 2.5% at grocers in other major markets. Losses of fresh goods from shrinkage, markdowns, and other factors at grocers in China are between 7% and 15%, compared to about 5% elsewhere, resulting in fewer fresh products on offer for Chinese customers. The average availability of fresh goods in China ranges between 82% and 90%, compared with 95% to 98% in other markets, leading to hundreds of millions in potential lost revenue for large grocers.

Moreover, if the costly promotions that grocers often use to attract customers don’t substantially increase sales, they dilute margins further while raising labor costs. And labor costs are accelerating in China, more than doubling in the past ten years due to increased hours and rising wages.

Digitizing the Retail Value Chain

As proficient as Chinese grocers are in digitized customer engagement and online/O2O sales, they still can build a truly sustainable end-to-end platform that maximizes the value of AI and digitization across the retail value chain. Exhibit 2 lays out the key elements needed to ensure maximum efficiency, from production and logistics to marketing and sales.

Production and logistics. Supply chains in China are growing increasingly complicated, given the proliferation of online and offline sales channels and the increasing demand for innovative products. As a result, different types of products require their own optimized flows, depending on seasonality, frequency of turn, and stability of supply. But Chinese retailers continue to rely on pre-digital processes to manage their suppliers and match inventory with customer demand.

The digital transformation of production and logistics through AI and other tools would allow retailers to plan, buy and allocate better by improving demand forecasting and defining store-level optimal orders in line with predicted demand, available inventory, and product substitution effects. Having a smart brain to help in forecasting and planning is particularly important in a market where the intensity of promotions is so high, making demand variable.

These tools can help retailers optimize how stock is allocated within and between warehouses and how it is delivered to stores and customers. Digitally sharing data with suppliers can provide them with transparency into demand and the supply chain, ensuring timely replenishment of high-demand categories and minimizing the risk of supply bottlenecks.

Our experience shows that companies that leverage AI and big data to optimize their supply chains can boost the amount of demand they can meet by up to 6%, even as they reduce warehousing and distribution costs by as much as 20%. And smarter inventory management can free up 15% to 30% of working capital.

… companies that leverage AI and big data to optimize their supply chains can boost the amount of demand they can meet by up to 6%, even as they reduce warehousing and distribution costs by as much as 20%.

And smarter inventory management can free up 15% to 30% of working capital.

Category management. Precision and flexibility in product assortment and placement in stores are crucial for both operational efficiency and customer appeal. Yet few retailers are fully leveraging customer data on buying habits to make assortment optimization decisions, instead carrying out these critical activities manually, using experience alone.

Assortment decisions can be augmented if retailers use AI and other tools to capture data from multiple online and offline customer touch points-including purchasing history, customer profiles, and local demographics-and connecting this data with information about product margins. Retailers not only can fine-tune product assortment, but also customize assortment at the level of the individual store. Furthermore, AI offers the potential to mine structured and unstructured data to detect emerging customer trends, further informing product assortment decisions and helping grocers develop their own store brands.

By working with suppliers to optimize margins and develop even more attractive product ranges, retailers can be more experimental with their product assortment, with less risk.

In our experience, better product assortment and economics, based on profitability and demand analysis, can improve grocers’ cost of goods sold by 1.5% or more, savings that grocers can pass on to customers as price reductions and other perks.

…better product assortment and economics, based on profitability and demand analysis, can improve grocers’ cost of goods sold by 1.5% or more, savings that grocers can pass on to customers as price reductions and other perks.

Store location, layout and staffing. Chinese retailers have the opportunity to leverage data to enhance their store networks and design their stores with optimal layouts that maximize in-store revenue and profitability. Store networks can be optimized by using AI to determine predicted consumer demand by store location, store presence in key areas, optimal number of stores, and demographics. Within a store, retailers can optimize in-store merchandise displays based on store layout, predicted demand, sales and profitability goals, and inventory availability.

Chinese companies tend to staff their brick-and-mortar outlets with more employees than retailers in other markets, in part because labor costs in China are lower. But having the right team in the right place at the right time is key. Using AI algorithms to link scheduling to forecasted customer traffic and expected timing of labor-intensive activities (such as pallet receipt and replenishment), grocers can staff stores more efficiently, therefore better serving customers.

We have seen grocers save as much as 10% of workforce hours in non-customer facing activities, which can then be reinvested in customer-facing activities.

grocers can save as much as 10% of workforce hours in non-customer facing activities, which can then be reinvested in customer-facing activities.

Loyalty and customer relationship management (CRM). Chinese retailers, especially online platforms operated by large technology companies, are adept at digitizing the customer-facing retail experience. Brick-and-mortar grocery retailers, too, can seize the opportunity to capture a greater amount of online-to-offline traffic by using AI and other tools to target prospective customers and by personalizing products, promotions, and rewards that accurately reflect customer profiles.

At Hema, a grocery retailer operated by Alibaba, customers can shop and dine in physical stores, then purchase or repurchase products online, delivered within 30 minutes. Coupled with its leading customer data analytics capabilities, the integration of the online and offline customer experience enables Hema to tailor product recommendations to fit customer habits and preferences.

Marketing and sales. Even as their online customer-facing activities improve, many Chinese retailers have much to gain by integrating their pricing and marketing strategies into their end-to-end value chain. Rather than determining prices with gut instinct, for example, Chinese retailers can boost profitability and offer customers better value through next-generation category pricing. Digital platforms combined with AI tools allow retailers to optimize pricing based on category strategy, customer response, supplier economics, and even competitor reaction.

Promotions that combine robust pricing strategies with accurate customer data can become a net incremental revenue generator. And by linking inventory data and sales goals with predicted customer response, retailers can dynamically adjust pricing and offer “smart markdowns” to avoid over-discounting.

We have seen grocers improve margins by up to 2 percentage points by employing historical analysis and analytics-driven optimization to improve the effectiveness of their promotions.

We have seen grocers improve margins by up to 2 percentage points by employing historical analysis and analytics-driven optimization to improve the effectiveness of their promotions.

Retailers that invest in building these capabilities can gain a differentiated competitive advantage and potentially commercialize these digital products and tools, monetizing them into new revenue streams. (See “The Digital Advantage.”)

BOX: The Digital Advantage

Consider the case of Wumart, a major Chinese online and offline grocer that has been actively digitizing its end-to-end value chain.

In selected Wumart stores, customers can shop using “smart carts” that automatically register items and pay at self-checkout counters, significantly lowering labor costs.

And its app allows customers to seamlessly transfer their online activities offline via data links between their membership ID, reward points, coupons, and payments.

On the back end, Wumart has implemented digitized inventory management solutions (with hourly out-of-stock calculation and root cause analytics), reducing out-of-stocks by 5% to 10%.

Its use of smarter demand forecasting and a real-time view of inventory has helped cut inventory days to about 20, therefore improving cash flow.

The company also optimizes its product assortment using analytics on transaction numbers, daily sales, and profitability figures, offering customers a more carefully curated range of products that meet their shopping needs.

For support digitizing the value chain, Wumart has been partnering closely with Dmall for its integrated retail value chain solution (especially middle ware), customer app ecosystem for e-commerce, and tech implementation capabilities.

How to Get There

Chinese retailers have much to gain in digitizing their end-to-end value chain. As important as new technologies such as big data and analytics, AI, and the Internet of Things are in enabling the digital transformation, the journey calls for the right leadership mindset and culture, and no such major effort can succeed without them.

Every digital transformation requires new ways of working that support cross-functional collaboration and faster decision making.

To successfully implement digital and new ways of working, it’s important to craft a coherent digital transformation strategy and roadmap.

A clear vision.

Many retailers who embark on digital transformation journeys often start with the technology or tool rather than trying to solve a particular pain point or achieving a specific business objective. Before beginning experiments in digitization or signing off on projects, it is important to align the organization around a vision for the transformation, such as personalization for Starbucks or supply chain optimization for H&M. This allows the organization to stay focused on where to put capital rather than diluting it through investments in unproven technology.

A phased approach

Grocers serious about digitizing their end-to-end value chain should immediately begin to develop a data platform consolidating all available data on the cloud, if they don’t already have one. After meeting this requirement, grocers should apply a three-step approach for this large-scale complex transformation program. First, engage in a “Rapid Assessment” phase to evaluate digitization’s full potential, set specific targets and KPIs, and put in place a governance mechanism for the transformation program. Second, carry out the “100-Day Impact” phase, where the focus is on capturing immediate value, while activating governance activities and engaging employees. Finally, begin the “Full Value Realization” stage, a journey of 12 to 24 months during which the full range of digital initiatives are fully implemented and the necessary capabilities are built throughout the organization.

AI and digital levers

Chinese grocers have a variety of levers they can pull to complete the digitization of their operations across the value chain. While grocers already have considerable experience in digitizing their marketing efforts, for example, new AI-based tools offer increased precision and improved results. Pricing, too, can benefit from these new tools, which enable companies to connect specific offers to specific customers.

Operational levers include AI and analytical tools that allow grocers to better understand their suppliers, gaining clarity into spending and pricing, and giving them an edge in negotiating more effectively. And there are a variety of tools designed to improve transparency into supply chains, enabling companies to predict with greater accuracy the availability of products amid changes in demand, better manage inventory, and optimize multichannel product selection.

When used carelessly, however, AI can lead to inaccurate outputs and unfair outcomes. So it is critical that companies use it responsibly, ensuring that its algorithms are checked for fairness and an understanding of the human element involved. But companies do not need to choose between protecting customers with responsible AI and boosting the bottom line. Developing AI in a responsible manner can both allow companies to realize its transformative power and amplify its benefits. Incorporating an organization’s authentic human purpose and AI ethics into the core of AI can boost the bottom line, differentiate the brand, and improve recruiting and retention.

Change management

Perhaps the biggest challenge is the change management effort needed. Too often, companies fail to achieve the full benefits of digital planning because employees remain entrenched in old ways of working. In our experience, getting the technology and analytics right is less than half the effort involved in major digital transformations. Getting your people to understand, trust, work with, and benefit from the technology is far more difficult.

Therefore, companies should prepare the organization for the upcoming changes before beginning the implementation phase. Creating a pilot-refine-repeat approach to change will generate a good sense of how well each solution is going to work and allow companies to get a rapid understanding of where the digital payoffs lie. In addition, successful pilots will be hugely helpful in gaining traction and buy-in for the new ways of working across the rest of the company, breaking ingrained habits and reinforcing new behaviors.

Chinese grocers seeking improved profitability and sales and greater market share have much to gain by digitizing their end-to-end value chain. Production and logistics, category management, store layout and staffing, customer relationship management and pricing and promotions all play a role in providing a seamless on- and offline customer experience.

The effort will not be easy, and no company can go it alone. The tools required, including AI and advanced analytics, can be complex, and the process requires careful management and execution. But the results are well worth the effort: Greater efficiency, lower labor costs, full channel integration and happier customers mean growth on both the top and bottom lines.

Originally published at https://www.bcg.com on March 23, 2022.