the health strategist

institute for

strategic health transformation

& digital technology

Joaquim Cardoso MSc.

Chief Research and Strategy Officer (CRSO),

Chief Editor and Senior Advisor

August 25, 2023

What is the message?

The article underscores the vital significance of digital trust in the insurance sector’s adoption of AI and data-driven technologies.

It emphasizes the disparity between advanced digital infrastructure regions and emerging growth markets in terms of consumer trust in AI.

While technological advancements are pivotal, the article advocates for a multifaceted approach that considers cultural factors, transparency, and a balanced integration of AI models and human interaction to foster true digital trust.

Key takeaways:

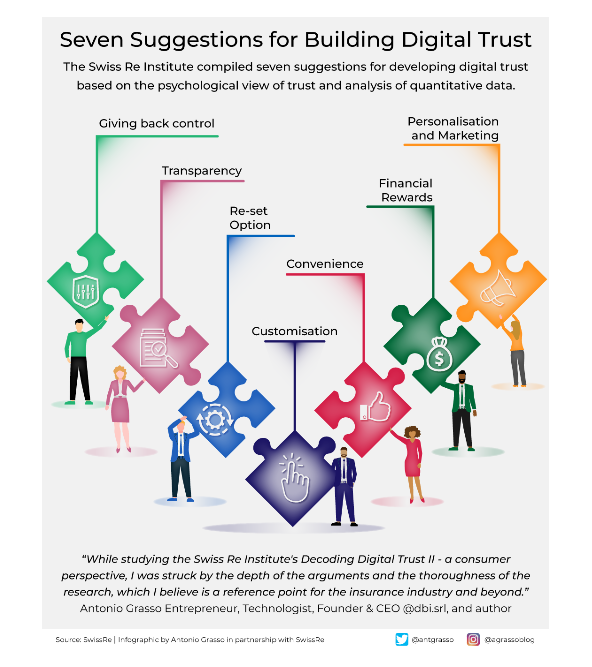

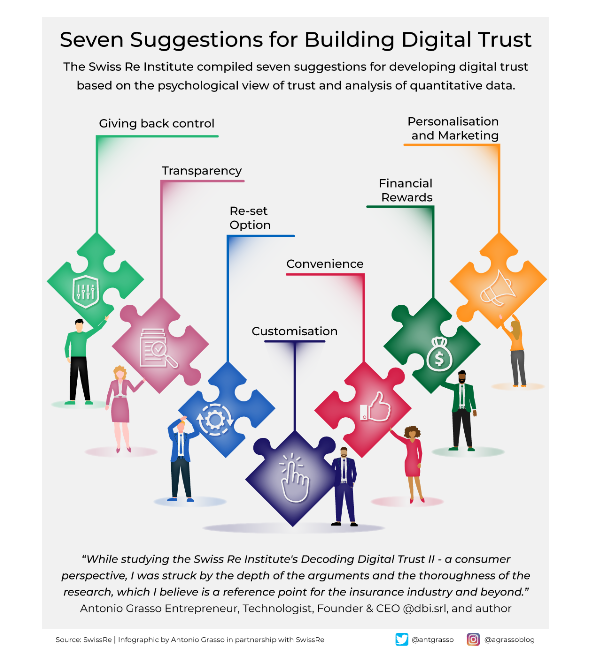

- The article “Trustworthy AI – the way forward for insurance”, published by SwissRe, focuses on the importance of building digital trust in the insurance industry, particularly in the context of AI and data-driven technologies.

- Digital Trust and Its Importance: The article emphasizes that digital trust is crucial for insurers and reinsurers. As the industry incorporates advanced analytics and AI into its operations, building and maintaining trust among customers is vital. Digital trust is seen as essential for accessing valuable consumer data, which aids in understanding and pricing risk effectively.

- AI and Consumer Perception: The article highlights a finding from the Swiss Re Institute’s analysis that trust in AI is lower in countries with advanced digital infrastructure (like North America, Germany, France, and the UK). In contrast, trust in companies using AI is higher in emerging digital growth markets such as India, Mexico, and Nigeria. This suggests that factors beyond infrastructure influence consumer trust in AI.

- Misalignment between Trust Factors: The article points out a potential gap between what institutions consider important for building digital trust (such as digital infrastructure or AI capabilities) and what matters to consumers (sense of purpose, incentives, ease of use, and transparency of AI models). This indicates that focusing solely on technological advancements might not be sufficient to establish trust.

- Tailored Approaches to Building Trust: The article suggests that there’s no one-size-fits-all approach to building digital trust. Re/insurers should adopt various strategies to explain the benefits of data sharing to consumers. This includes structuring functionality, navigation, and search functions to ensure ease of use and understanding. However, the article acknowledges that psychological and cultural factors also play a role in shaping trust and should be considered.

- Human-Centered AI and Transparency: The article highlights the importance of transparency in AI solutions. To build trust, stakeholders need to understand how AI uses data to make fair and ethical decisions. The article emphasizes that effective AI use requires a combination of AI models and human processes, rather than relying solely on AI.

- The Role of Human Interaction: The article underscores the value of human interaction within AI-driven processes. It suggests that the true potential of AI can be harnessed through a smart combination of AI models and human intervention, rather than depending solely on automated AI systems.

- Authorship and Authenticity: The article concludes by confirming that the text has been generated by a human. This touches on the increasing challenge of distinguishing between content created by AI and content created by humans, further emphasizing the need for digital trust.

- Overall, the article highlights the complex interplay between technological advancements, consumer perceptions, cultural factors, and transparency in building digital trust within the insurance industry’s AI-driven landscape.

Infográfico

DEEP DIVE

Trustworthy AI – the way forward for insurance – Part 3: Decrypting AI for insurance

SwissRe

Pravina Ladva and Antonio Grasso

June 5, 2023

Pravina Ladva´s view

Can you guess whether this content was created by AI or by a human? Most of us have likely come across fake images, generated by AI, at some point – and they can look incredibly real. As a result, I’ve found myself more often questioning the authenticity of photos and content online.

Having second thoughts, a sense of distrust and particularly a reluctance to share data are not new in the digital realm. But with the rise of AI generated images and AI chatbots, consumer digital trust has become critically important.

For re/insurers, digital trust is essential to business. With ever improving risk analytics and automation capabilities, digital trust allows the industry to tap into a highly valuable resource: data. It’s access to consumer data that allows us to better understand and price risk – and ultimately fulfil our purpose of working to make the world more resilient.

So as re/insurers increasingly improve the re/insurance value chain with advanced analytics and some forms of AI, we need to bring our customers along for the ride. But – at a time where it can be difficult to distinguish the real from the fake – how can trust be won? Swiss Re Institute’s (SRI) expertise paper Decoding Digital Trust 2 explores how psychological, regional and cultural factors influence consumers’ perceptions of risk and their willingness to share data. It builds on last year’s report, Decoding Digital trust 1 – an insurance perspective, which outlined the building blocks of digital trust in the re/insurance value chain.

Strong AI infrastructure does not correlate with digital trust

What stands out for me is the finding that trust in AI is relatively low in countries with advanced levels of digital infrastructure, such as North America, Germany, France and the UK. By contrast, trust in companies using AI and positive perceptions of AI were highest in emerging digital growth markets such as India, Mexico and Nigeria.

The SRI analysis suggests a possible gap between what institutions think is important to build digital trust (such as digital infrastructure or AI capabilities) and what really matters to consumers (a sense of purpose, incentives, ease of use, and transparency of AI models).

Re/insurers can build digital trust – but there’s ‘no one size fits all’

The report outlines many ways in which re/insurers can explain the benefits of data sharing with consumers, as well as structuring functionality, navigation and search functions to facilitate ease of use and understanding.

But this will not be sufficient for all customers. Trust is also shaped by psychological and cultural factors that may not always appear easily explicable or even rational – and these concerns are no less valid. Understanding and acknowledging some of these barriers to trust can help re/insurers overcome them. To enrich insurance products and processes with an understanding of human nature, Swiss Re’s B2B2C digital insurer iptiQ has a dedicated customer insights team. It uses customer insights to help meet their expectations of a seamless digital experience and ensure their trust.

Informed decisions are based on transparency

Trust in AI solutions requires transparency with consumers. Fostering explainability helps stakeholders make informed decisions while protecting privacy, confidentiality and security. “Trust in an AI system lies in understanding how it uses the data to reach fair and ethical decision making, without compromising on human dignity,” SRI experts write.

AI will require entire value chains for its effective use, including human interaction. The added value of AI will only come from a smart combination of AI models and human processes, not just a standalone AI model.

Finally, in case of doubt, I can confirm this text has been generated by a human.

Antonio Grasso’s view

While diving into the fascinating study “Decoding Digital Trust II – A consumer perspective” by the Swiss Re Institute, it struck me that certain concepts will shape our society as we transition to the post-digital era. One such concept is digital trust, which extends beyond technological prowess and must acknowledge the fundamental needs of individuals as sentient and social beings.

As our civilisations have progressed, our needs have evolved from mere survival to encompass a profound desire for belonging, autonomy, and a sense of agency over our lives. We no longer wish to be passive observers or subject to the whims of fate. Instead, we aspire to shape our lives, make choices, and exert influence over the outcomes we desire. This quest for agency is driven by a fundamental human need to steer our own paths and determine our future course.

As our awareness and understanding of the world has expanded, we have strived for knowledge of what lies ahead, be it in the realm of personal relationships, career paths, or societal developments. This curiosity arises from a deep-seated urge to anticipate and prepare for potential challenges and opportunities. By gaining foresight, we can make informed decisions, mitigate risks, and proactively navigate the complexities of our evolving world.

Human Yearnings in the Digital Age

Reflecting on Dante Alighieri’s words, “Consider your origins: you were not made to live as brutes, but to follow virtue and knowledge” (The Divine Comedy Inferno, Canto 26), it becomes clear that, as complex and conscious human beings, ignorance is not our destiny. We yearn to express ourselves and to be acknowledged as vital components of the social and economic fabric we are a part of.

Far from diminishing these needs, the digital age has amplified them, given the rapidity of phenomena in our increasingly virtual and transient world. We have become even more demanding in our role as protagonists, realising that we are the driving force behind an economy that is reliant on people consuming goods and services. This realisation has ignited a desire to share our thoughts and creations, fueling our longing for recognition.

René Descartes’ philosophical principle “Cogito, ergo sum” or “I think, therefore I am” elucidates our yearning for protagonism, which we currently express through social media, blogging, videos, and the array of digital tools that enable us to showcase our unrivaled creativity. However, we also encounter events that erode our trust in the digital realm, particularly concerning the sharing and handling of our data by entities that – whether through ignorance or ill intent – violate our privacy. Often, it is not merely a feeling but a tangible concern.

Still, we persist in using digital tools that foster a sense of belonging to a larger community, empowering us to manifest our inner impulses. This clash between digital trust and our mindset generates apprehension, but it fails to impede the progress of our digital civilisation. When we weigh the scales, consciously or not, we consistently opt for what connects us as human beings—the choice that unveils the marvels of our biological machinery and allows us to exhibit it to others.

Navigating Privacy and Creative Empowerment

Innovation has granted us the means to express our creativity through social media, blogs, and videos, and we have enthusiastically embraced these opportunities. However, this pursuit of creative expression in the digital realm is not without its challenges and trade-offs. The very act of sharing one’s creativity often entails relinquishing a certain degree of privacy. In the quest for visibility and recognition, individuals may willingly expose aspects of their lives, thoughts, and personal information. They navigate a delicate balance between revealing themselves authentically and preserving their privacy in an increasingly interconnected world.

Even if it entails occasional sacrifices in terms of privacy, we persist in our battle, refusing to surrender.

About the Authors

Pravina Ladva, Chief Digital & Technology Officer

Antonio Grasso, Entrepreneur, Technologist, Founder & CEO

Originally published at https://www.swissre.com