institute for health transformation (InHealth)

Joaquim Cardoso MSc — Founder and CSO

January 20, 2023

EXECUTIVE SUMMARY

Healthcare merger and acquisition (M&A) activity ended 2022 with 53 announced transactions and more than $45 billion in total transacted revenue

- There was a rebound in M&A activity after COVID-19 dampened enthusiasm over the last couple of years.

- The total number of healthcare transactions remains below pre-pandemic levels, but there are clear signs that the momentum will continue into 2023.

- The mega merger trend continued through 2022, with more than 15% of smaller parties having annual revenues over $1 billion and a credit rating of A- or higher.

- The high percentage of mega mergers led to a historically high average smaller party size by annual revenue of $852 million, more than $200 million greater than last year’s historic high.

- Financial pressures are expected to continue in 2023, but higher interest rates, rising costs of capital, and heightened regulatory scrutiny of M&A activity across industries could present some headwinds.

Among the largest and most transformative transactions announced in 2022, are the deals between

- Advocate Health and Atrium Health,

- Essentia Health and Marshfield Clinic Health Systems, and

- Sanford Health and Fairview Health, as well as

- the University of Michigan Health’s $800 million commitment to expand services as part of its merger with Sparrow Health.

There are 3 main trends in 2022 transactions:

- 1.Transformative Mergers

- 2.Cross-Market Transactions

- 3.An Academic Focus on Community Hospital Networks

The mega merger trend continued through 2022, with more than 15% of smaller parties having annual revenues over $1 billion and a credit rating of A- or higher.

INFOGRAPHIC

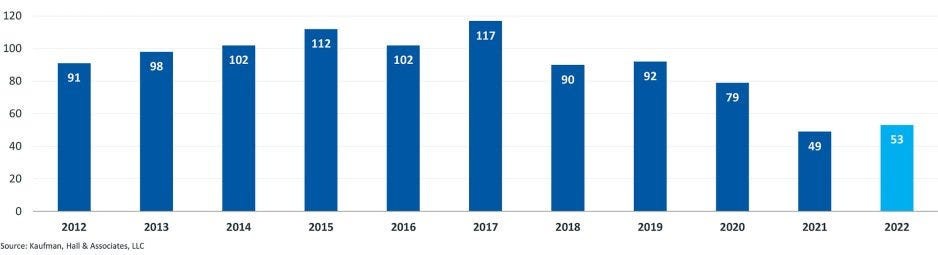

Figure 3: Number of Announced Transactions, 2012–2022

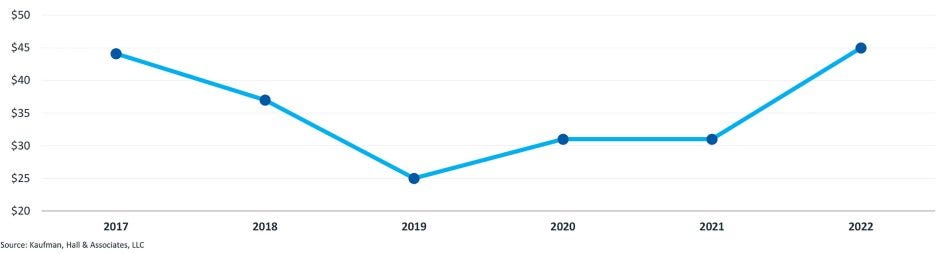

Figure 7: Total Transacted Revenue, 2017–2022 ($s in Billions)

DEEP DIVE

Healthcare Mergers and Acquisitions Regain Momentum

A new analysis records 53 announced healthcare mergers and acquisitions in 2022 and historically high transaction revenues.

RevCycleIntelligence

By Jacqueline LaPointe

January 16, 2023

Healthcare merger and acquisition (M&A) activity has regained momentum, ending 2022 with 53 announced transactions and more than $45 billion in total transacted revenue, reports Kaufman Hall.

The healthcare consulting firm’s latest analysis of healthcare transactions shows a rebound in M&A activity after COVID-19 dampened enthusiasm over the last couple of years.

The total number of healthcare transactions remains below pre-pandemic levels, but there are clear signs that the momentum will continue into 2023, the firm says.

Firm chair Ken Kaufman noted in a recent blog post, “this is a transformative period in American healthcare, when hospital organizations are faced with the need to fundamentally reinvent themselves both financially and clinically.”

Severe financial pressures and the “unpausing” of initiatives put off during the height of the pandemic will prompt more transactions this year, analysis authors write.

“this is a transformative period in American healthcare, when hospital organizations are faced with the need to fundamentally reinvent themselves both financially and clinically.”

The “mega merger” trend continued through 2022, the analysis shows. Mega mergers are transactions in which the smaller party has annual revenues of over $1 billion.

Smaller party annual revenues exceeded $1 billion in more than 15 percent of last year’s transactions, coming in just below the previous year’s historic high of 16.3 percent.

More than 15 percent of smaller parties also had a credit rating of A- or higher, representing a recent trend toward stronger credit ratings.

The high percentage of mega mergers, along with other significant transactions announced in 2022, led to a historically high average smaller party size by annual revenue of $852 million, more than $200 million greater than last year’s historic high of $619 million.

The analysis shows that the compound annual growth rate (CAGR) of the average smaller party size over the past decade nears 12 percent, up from 8 percent in 2021.

Among the largest and most transformative transactions announced in 2022, according to Kaufman Hall, are the deals between Advocate Health and Atrium Health, Essentia Health and Marshfield Clinic Health Systems, and Sanford Health and Fairview Health, as well as the University of Michigan Health’s $800 million commitment to expand services as part of its merger with Sparrow Health.

The analysis notes that these four transactions are also representative of cross-market deals, marking another significant trend in 2022. These organizations have little or no overlap between markets, indicating “capability-based scale is much more prominent than adjacent market-based scale.”

… hese four transactions are also representative of cross-market deals, marking another significant trend in 2022.

These organizations have little or no overlap between markets, indicating “capability-based scale is much more prominent than adjacent market-based scale.”

“A benefit of cross-market mergers is that they do not actually change the competitive structure of the markets involved in the merger — there is no increase in the concentration of local hospitals or health systems, an increasingly important feature considering the current regulatory landscape,” the analysis states.

“A benefit of cross-market mergers is that they do not actually change the competitive structure of the markets involved in the merger — there is no increase in the concentration of local hospitals or health systems, an increasingly important feature considering the current regulatory landscape,”

“A noteworthy element of many of this year’s cross-market mergers is that the systems have a common focus (e.g., rural health), complementary skillsets (academic medicine and community health), or a shared desire to improve health outcomes.”

Additionally, Kaufman Hall highlights that the percentage of financially distressed sellers remained steady at 15 percent last year versus 16 percent in 2020 and 2021. This is in the face of the financial difficulties hospitals and health systems faced in 2022.

…the percentage of financially distressed sellers remained steady at 15 percent last year versus 16 percent in 2020 and 2021.

This is in the face of the financial difficulties hospitals and health systems faced in 2022.

Financial pressures are sure to continue in 2023. However, higher interest rates, rising costs of capital, and heightened regulatory scrutiny of M&A activity across industries could present some headwinds this year, the analysis says.

Financial pressures are sure to continue in 2023. However, higher interest rates, rising costs of capital, and heightened regulatory scrutiny of M&A activity across industries could present some headwinds this year, the analysis says.

Highlights of announced transactions in 2022 include the following: [1]

- The 53 total announced transactions for 2022 moved up from 2021’s recent historic low of 49 announced transactions (Figure 3).

- The average profile of the smaller party in announced transactions remained strong. Smaller party annual revenues exceeded $1 billion in more than 15% of the transactions (Figure 4), just below last year’s historic high of 16.3%. More than 15% of smaller parties had a credit rating of A- or higher, consistent with a trend toward stronger credit ratings noted in 2020 and 2021 and significantly surpassing those historically high watermarks (Figure 5).

- The high percentage of mega mergers and other significant transactions over the course of 2022 resulted in an historically high average smaller party size by annual revenue of $852 million (Figure 6), more than $200 million higher than last year’s historic high of $619 million. The compound annual growth rate (CAGR) of the average smaller party size over the past 10 years approached 12%, up from 8% in 2021.

- While the number of announced transactions increased year over year, it remained below pre-pandemic activity levels. Nonetheless, the combined revenues of the parties in this year’s announced transactions resulted in more than $45 billion in total transacted revenue for the year, surpassing 2017’s recent historic high of $44 billion (Figure 7) despite recording less than half of the total transaction volume.

- Despite the financial difficulties that many hospitals and health systems encountered in 2022, the percentage of financially distressed sellers, at 15%, was slightly below the 16% level observed in 2020 and 2021.

- Activity by not-for-profit hospitals and health systems as both acquirers and sellers continued to increase, growing from 81% of total transactions in 2020 to 87% in 2021 to 91% in 2022.

Trends in 2022 Transactions

- 1.Transformative Mergers

- 2.Cross-Market Transactions

- 3.An Academic Focus on Community Hospital Networks

1.Transformative Mergers

With the exception of Q1 2022, mega mergers had a significant impact on the metrics reported in our quarterly reports, with average size of the smaller party reaching historic highs in Q2 ($1.5 billion), Q3 ($834 million), and Q4 ($855 million).

In addition, there were a significant number of transactions in which the smaller party had annual revenues between $500 million and $1 billion.

Kaufman Hall has long observed an increased emphasis from leading industry participants on the importance of expanding operations, markets, and expertise to complete the transformation of healthcare services.

Mounting new pressures on legacy hospitals and health systems during and after the pandemic have highlighted the importance of investing in new capabilities, supporting resources, and business intelligence models.

Hospitals and health systems are facing competition from highly capitalized (albeit specialized) tech companies, national health plans, and retail giants.

A clear and present challenge to all in the industry is the scarcity (and resulting supply/demand realities) of human resources.

Operational and financial challenges have kept operating margins depressed throughout 2022, making the search for economies of scale even more critical to organizations’ long-term sustainability.

there is an increased emphasis from leading industry participants on the importance of expanding operations, markets, and expertise to complete the transformation of healthcare services.

Hospitals and health systems are facing competition from highly capitalized (albeit specialized) tech companies, national health plans, and retail giants.

And as we have noted before, the pandemic demonstrated the resiliency of certain large systems, in which operational risk was distributed across multiple markets and resources could be moved to where they were needed most.

… the pandemic demonstrated the resiliency of certain large systems, in which operational risk was distributed across multiple markets and resources could be moved to where they were needed most.

These transactions transcend the simplicity of raw scale, and instead more often exhibit a desire to transform healthcare for the communities that will be served by the combined system is an explicit goal of the transaction:

- Advocate Health — the organization formed in 2022 through the merger of Advocate Aurora Health and Atrium Health — cites among its goals an intent to address root causes of health inequities and increase the speed with which medical innovations reach patients.

- University of Michigan Health has committed $800 million to accelerate expansion of services and integrate leading edge technology as part of its planned combination with Sparrow Health.

- Essentia Health and Marshfield Clinic Health Systems — based in northern Minnesota and central Wisconsin — will use their combined resources “to ensure sustainable and thriving rural health care.”

- Sanford Health and Fairview Health — based in the Dakotas and Minnesota — plan to deploy their complementary experiences in serving rural and urban populations to drive innovations that “benefit rural, urban and indigenous communities across the Midwest.”

2.Cross-Market Transactions

All four of the announced transactions featured above — Advocate-Aurora Health/Atrium Health, University of Michigan Health/Sparrow Health, Essentia Health/Marshfield Clinic Health Systems, and Sanford Health/Fairview Health — are representative of cross-market transactions, another significant trend in 2022.

These transactions connect health systems located in different geographies, with little or no overlap between their markets.

As we have continued to report, the movement to capability-based scale is much more prominent than adjacent market-based scale.

These transactions connect health systems located in different geographies, with little or no overlap between their markets.

As we have continued to report, the movement to capability-based scale is much more prominent than adjacent market-based scale.

A key element of these mergers is geographic diversity, spreading the combined organization’s operating risks across multiple markets and different market types (e.g., urban vs. rural).

But other strategies can come into play: expanding access to an academic medical center’s specialty services to new markets, for example, or creating a mixture of diverse market “laboratories” in which new innovations can be tested against different demographics.

A key element of these mergers is geographic diversity, spreading the combined organization’s operating risks across multiple markets and different market types (e.g., urban vs. rural).

A benefit of cross-market mergers is that they do not actually change the competitive structure of the markets involved in the merger — there is no increase in the concentration of local hospitals or health systems, an increasingly important feature considering the current regulatory landscape.

A noteworthy element of many of this year’s cross-market mergers is that the systems have a common focus (e.g., rural health), complementary skillsets (academic medicine and community health), or a shared desire to improve health outcomes.

3.An Academic Focus on Community Hospital Networks

Academic medical centers (AMCs) demonstrated a renewed focus on extending their community hospital networks in announced transactions that included:

- Thomas Health’s integration into the WVU Health System in West Virginia

- UChicago Medicine’s acquisition of a controlling interest in AdventHealth’s Great Lakes Region, which includes four suburban Chicago hospitals

- Olathe Health’s partnership with the University of Kansas Health System

- Sparrow Health’s combination with University of Michigan Health

Community hospital networks can support multiple strategic goals for both the AMC and its community hospitals partners.[1] They can:

- Improve access to the AMC’s services, extending the AMC’s clinicians and brand into expanded markets and, to the extent lower-acuity cases can be treated by community hospital partners, improving capacity at the AMC’s main campus for the higher-acuity care

- Enhance quality and breadth of care at community hospital partner locations by providing care design protocols and other clinical best practices to its community hospital partners

- Reduce the AMC’s total cost of care by treating lower-acuity patients in a lower-cost community hospital setting

- Enhance the AMC’s research and academic stature by providing access to a broader patient population for clinical trials

- Provide a natural talent pipeline for residency programs and physician recruitment in community hospital settings

- Expand access to capital and credit markets for community hospital partners

These partnerships will also align with an AMC’s growth strategy, creating an expanded population basis able to support the growth or addition of specialty service lines.

Looking Forward: Regaining Momentum

While the total number of transactions remained below pre-pandemic levels in 2022, there were clear signs that M&A activity was beginning to regain momentum, and we expect that momentum to continue into 2023.

This expectation is informed by several factors.

- The need to transform healthcare

- Severe financial pressures

- Moving past the pandemic.

The need to transform healthcare. As our colleague and firm chair Ken Kaufman noted in a recent blog, “this is a transformative period in American healthcare, when hospital organizations are faced with the need to fundamentally reinvent themselves both financially and clinically.”

The high level of transformative transactions that we witnessed in 2022, culminating in Q4, is evidence that health systems are recognizing and responding to this need.

Severe financial pressures. As detailed throughout 2022 in our National Hospital Flash Reports, the past year was extremely challenging for many hospitals and health systems across the U.S. Organizations that were able to amass strong balance sheets have had some cushion against these financial pressures, although that cushion is getting thinner as resources are used to offset operating losses and financial markets exhibit continued challenges. Smaller organizations and organizations that did not have balance sheet strength may soon have to look for alternatives, including stronger partners that can help them stabilize financially.

Moving past the pandemic. COVID-19 is still with us, but the worst strains of the pandemic seem to be moving behind us. Strategic discussions that were put on “pause” during the height of the pandemic are occurring, including conversations on how to find the next level of intellectual and capital capabilities required to remain competitive in a rapidly evolving healthcare marketplace.

Some market forces present challenging headwinds to transaction activity, including a higher interest rate environment that is raising the cost of capital as well as heightened regulatory scrutiny of M&A activity across multiple industries, including healthcare.

We believe, however, that these tactical factors are overshadowed by an increasingly important strategic rationale for providers to form partnerships.

In our conversations with clients, one of the questions we hear most frequently is “What are our strategic options going forward?”

For many organizations, the answer to at least part of that question will be a partnership or transaction that provides the resources needed to pursue their post-pandemic strategies.

What are our strategic options going forward?”

For many organizations, the answer to at least part of that question will be a partnership or transaction that provides the resources needed to pursue their post-pandemic strategies.

References:

[1] “2022 M&A in Review: Regaining Momentum”, by KH

Co-contributors:

Anu Singh,

David Cyganowski,

Kris Blohm,

Nora Kelly,

Courtney Midanek,

Chris Peltola,

Blake Dorris,

Matthew Santulli,