the health strategist

knowledge platform

Joaquim Cardoso MSc.

Chief Research Officer (CSO), Chief Editor

Chief Strategy Officer (CSO) and Senior Advisor

August 9, 2023

What is the message?

Artificial Intelligence (AI) has a crucial role as a catalyst for change in the insurance industry. The potential of AI to rapidly process vast amounts of data and inform decision-making is undeniable, offering a pathway to enhanced efficiency and innovative solutions.

However, the responsible integration of AI demands more than just technical prowess. It requires adherence to a set of guiding principles that prioritize human rights, fairness, transparency, and ethical considerations.

By aligning with laws, embracing accountability, safeguarding data, and fostering a harmonious collaboration between AI and human expertise, the insurance sector can harness the full benefits of AI while upholding its societal and ethical responsibilities.

Key takeaways:

- In today’s rapidly evolving insurance landscape, Artificial Intelligence (AI) emerges as a critical driver of business efficiency and innovation.

- This white paper, published by SwissRe, addresses the transformative potential of AI in the insurance industry and outlines a set of ten guiding principles for its responsible and effective deployment.

- AI’s remarkable ability to analyze massive volumes of data within moments positions it as an invaluable tool for generating insights and informed decision-making in insurance operations. However, alongside its capabilities, AI also introduces complexities related to ethics, compliance, transparency, and fairness.

- This paper underscores the importance of aligning AI applications with applicable laws, regulations, and ethical considerations while maintaining a focus on societal well-being.

- The ten guiding principles outlined in this white paper are designed to cultivate a responsible and sustainable AI environment within the insurance sector:

- Human Dignity and Rights: AI applications should uphold human dignity, rights, and fundamental freedoms. Fairness and transparency must be at the forefront of AI policies to ensure compliance and safeguard ethical considerations.

- Governance and Compliance: Adequate AI governance consistent with laws and regulations is paramount. Clear responsibilities and frameworks, including ongoing assessment and review throughout the AI lifecycle, must be established.

- Risk Mitigation: Effective risk management for AI applications is essential. Developing robust analytics and AI risk management frameworks and processes helps mitigate potential risks.

- Transparency and Accountability: Transparency, within the boundaries of legal constraints, is critical. Explainability and accessible recourse options aid stakeholders in making informed decisions while maintaining privacy and security.

- Data Protection and Security: Maintaining stringent data protection standards, cybersecurity measures, and standardized systems is fundamental. Obtaining consent, ensuring data quality and quantity, are pivotal for AI success.

- Value Chain Impact: The positive impact of AI within the value chain, either through efficiency improvements or innovative solutions, should be clearly defined and communicated.

- Human-AI Collaboration: Recognizing the limitations of AI in the customer journey is vital. Human input remains indispensable in critical decisions to establish digital trust.

- Workforce Upskilling: Commitment to upskilling the existing workforce in new analytics and AI technologies is crucial for successful integration and adoption.

- Independent Validation: Ensuring independent validation and adjustments of algorithms is recommended for unbiased and reliable AI performance.

- Stakeholder Engagement: Given the transformative potential of AI, fostering continuous dialogue with all stakeholders is imperative. This ongoing engagement enables the insurance industry to adapt to changing needs and perspectives.

- The authors emphasize that while AI holds significant promise for the insurance industry and broader society, its implementation requires thoughtful consideration of the outlined principles.

- Responsible AI adoption not only strengthens business efficiency but also maintains ethical standards and societal well-being.

- As the insurance landscape continues to evolve, these principles serve as a foundational framework for ensuring AI’s positive impact while addressing challenges and complexities.

DEEP DIVE

How is AI used in business? Part 1: Decrypting AI for insurance

Swiss Re

Pravina Ladva & Antonio Grasso

March 14, 2023

With its capability to analyse vast amounts of data in a short time for the insurance industry, Artificial Intelligence (AI) is an increasingly important backbone for insights. In addition, it’s decision-making capabilities can be a giant step for business efficiency and new solutions. However, the decisions AI takes must be compliant with applicable laws and regulations, and must also be ethical, unbiased and sustainable. And here lies the crux: to be beneficial to the insurance industry and society at large there are many governance, organisational and cultural conditions that applications of AI need to fulfil. Antonio Grasso and Pravina Ladva have put together ten recommended guiding principles they consider to be important for a responsible AI fit for business success.

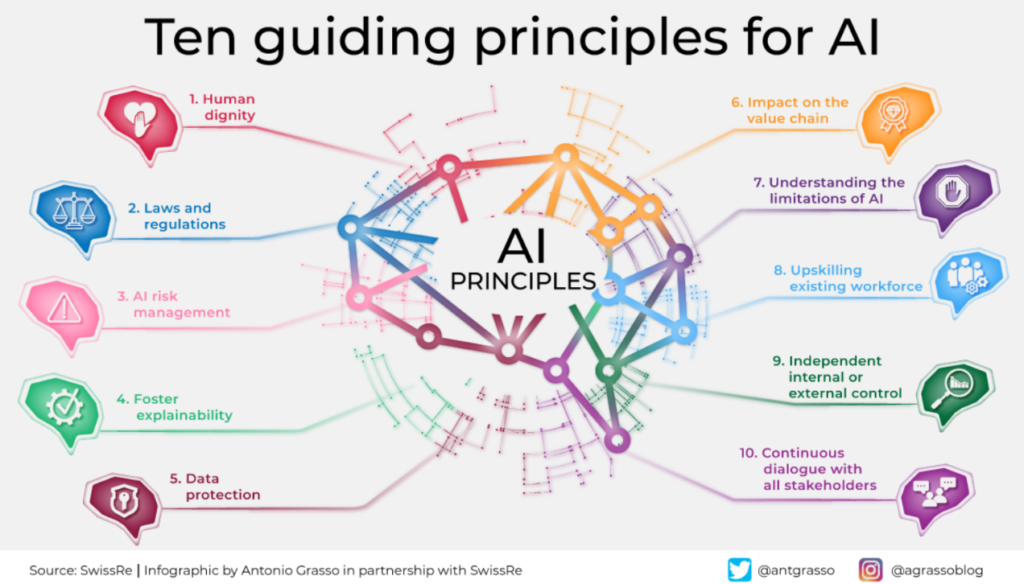

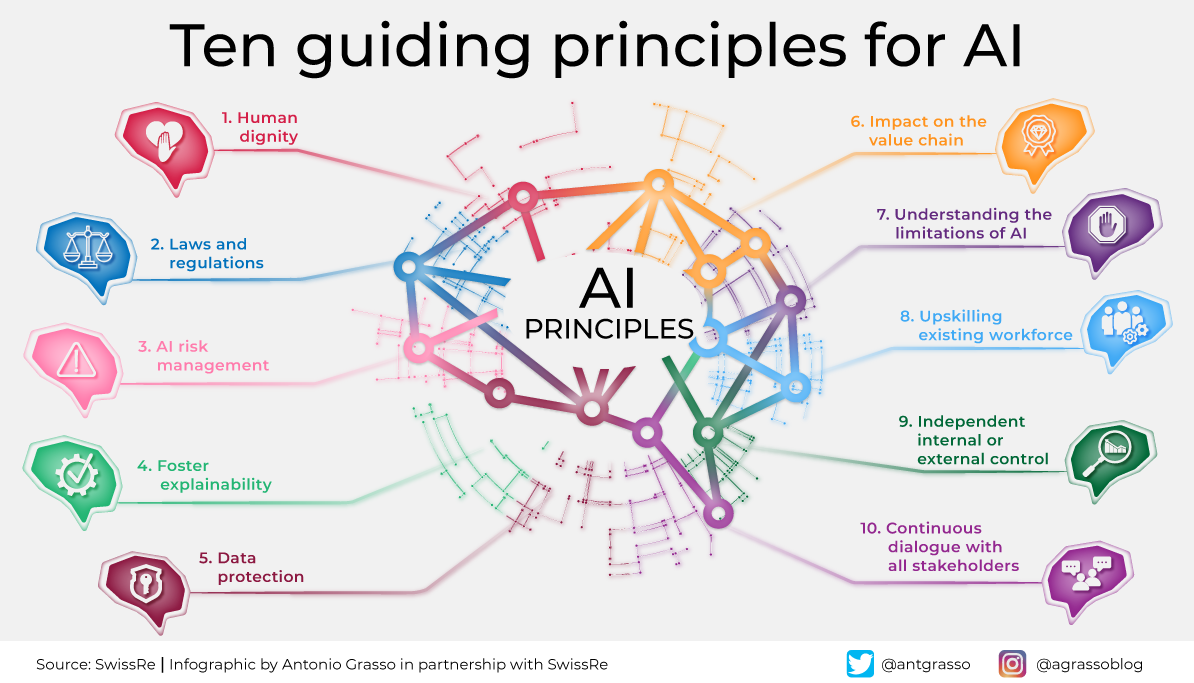

Ten guiding principles for AI

Ten AI principles

1. AI applications should protect human dignity, rights and fundamental freedoms. Create an AI policy that ensures compliance with requirements including driving fairness and transparency.

2. Ensure AI governance that is consistent with laws and regulations. Including responsibilities and frameworks to assess and review them throughout the entire life cycle of AI, e.g.with model monitoring.

3. Mitigate the risks of AI applications– by setting up an adequate analytics and AI risk management framework and related processes.

4. Internal and external transparency to the extent permissible under applicable laws and regulations. Foster explainability, where applicable to help stakeholders make informed decisions while protecting privacy, confidentiality and security. Provide options for recourse.

5. Solid data protection standards, cyber security, data foundations and standardised systems are paramount. Consent to use the data, data quality and quantity are among the key factors to succeed with AI.

6. Clarity on where and how AI in combination with human processes has a positive impact on the value chain – be it to increase efficiency or enable new solutions and on its costs.

7. Understanding the limitations of AI in the customer journey. Human input might remain invaluable in some critical decisions to ensure digital trust.

8. Foster and commit to upskilling existing workforce on the use of new analytics and AI technologies

9. To ensure that the ongoing validation of the algorithms and adjustments is performed independently, an additional independent internal or external control function is recommended.

10. The use of AI will likely have profound effects on the insurance industry and society. Therefore, it is necessary to ensure a continuous dialogue with all stakeholders to be able to respond to changing needs and views.

The Authors

Pravina Ladva – Chief Digital & Technology Officer

Antonio Grasso – Entrepreneur, Technologist, Founder & CEO @dbi.srl, and author

Originally published at https://www.swissre.com