Health and Tech Institute

strategy for continuous transformation

Joaquim Cardoso MSc

Senior Advisor for Continuous Health Transformation

and Digital Health

January 10, 2023

This is an excerpt of the publication “2022 year-end digital health funding: Lessons at the end of a funding cycle”, published by Rock Health. The title above was given by the editor of this site.

Executive Summary

What is the context?

- In 2022, health systems were faced with a number of challenges such as staffing crises, wage inflation, and burnout among clinicians, which led to significant financial losses for several hospitals across the US.

- In a year of roadblocks, big health players were pushed to implement near-term solutions while still stretching to keep eyes on the innovation horizon.

- Particularly for health systems, 2022 may be remembered as the year things went upside down.

- Excluding COVID-19 and behavioral care visits, patient encounters were 6.2% lower compared to early 2019, suggesting that some patients permanently forwent pandemic-delayed care.

- Staffing crises and wage inflation hiked up operating costs faster than CMS-influenced rate adjustments, squeezing health system margins rather than allowing hospitals to pass costs through to payers.

- As a cherry on top, burnout pushed record numbers of clinicians to retire or work fewer hours, which kept health systems in crisis mode…and paying crisis wages.

- With all these forces compounded, several hospitals across the U.S. recorded losses of over one billion dollars in 2022.

Brief Summary:

- In order to address these issues, health systems prioritized identifying immediate steps to reduce costs and improve efficiency.

- This included traditional expense reduction efforts, charging new fees, and implementing nonclinical and clinical workflow improvements.

- 45% of provider organizations reported accelerating their software investments in 2022 to streamline operations, particularly in nonclinical workflow solutions.

- Health systems also pursued long-term partnerships with software providers, such as Cleveland Clinic’s 10-year deal with Palantir, to better forecast and manage patient flows using AI solutions.

- Additionally, health systems shifted towards care models such as hospital-at-home initiatives, which aimed to free up hospital beds and allow top-of-license practice while reimagining care pathways.

Infographic

DEEP DIVE

Balancing frontline and frontier innovation

Rock Health

Kyle Bryant, Madelyn Knowles, Adriana Krasniansky,

With help from: Sean Day, Bill Evans, Mihir Somaiya, Uday Suresh

January 9, 2023

For health systems, a top 2022 priority was identifying immediate steps to stop the bleeding (healthcare pun intended).

In addition to taking traditional expense reduction efforts and charging new fees, hospital systems evaluated nonclinical and clinical workflow improvements to unlock efficiency gains and reduce provider pain points at work.

Forty-five percent of provider organizations reported accelerating their software investments in 2022 to streamline operations.

In addition to taking traditional expensereductionefforts and charging new fees, hospital systems evaluated nonclinical and clinical workflow improvements to unlock efficiency gains and reduce provider pain points at work.

Forty-five percent of provider organizations reported accelerating their software investments in 2022 to streamline operations.

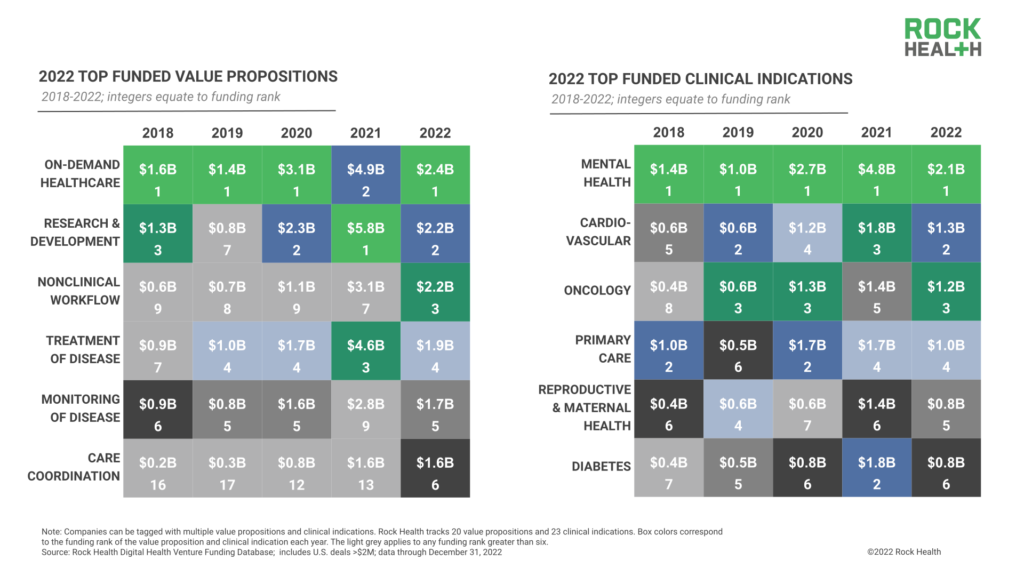

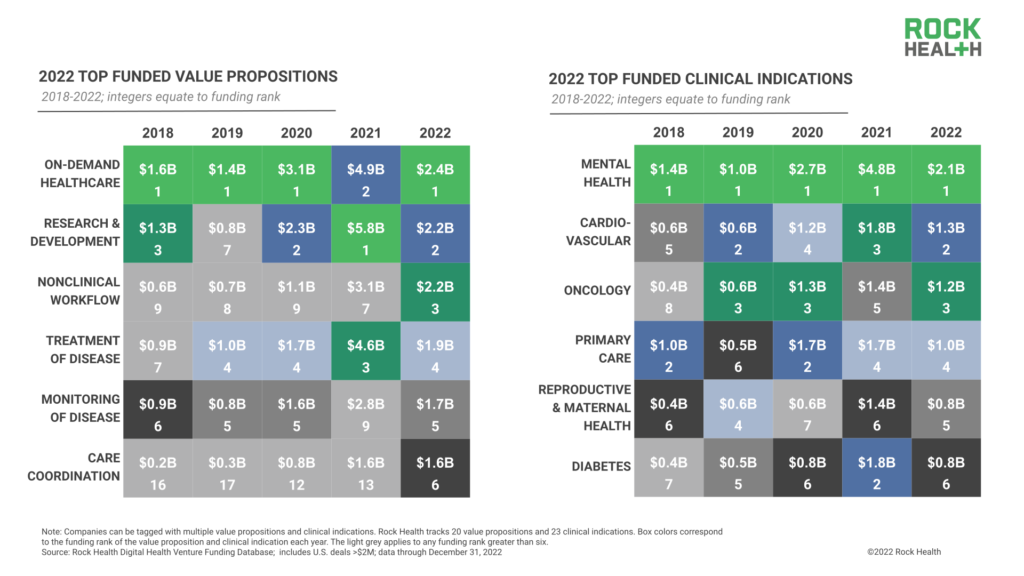

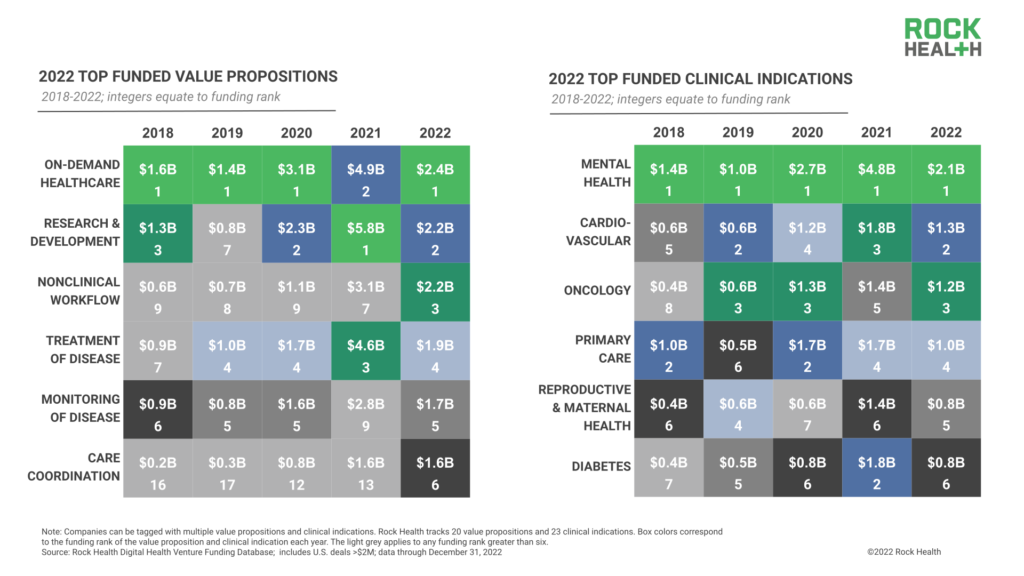

The front-and-center focus on efficiency gains boosted investment for nonclinical workflow solutions.

Funding for this value proposition earned third place in 2022 ($2.2B), jumping from seventh place in 2021.

And clinical workflow software, which earned eighth place in 2022 ($1.5B), moved up from eleventh in 2021.

Besides investments, health systems pursued long-term partnerships with software providers to make efficiency inroads, such as Cleveland Clinic’s 10-year deal with Palantir to roll out AI solutions that better forecast and manage patient flows.

Besides investments, health systems pursued long-term partnerships with software providers to make efficiency inroads, such as Cleveland Clinic’s 10-year deal with Palantir to roll out AI solutions that better forecast and manage patient flows.

“Health systems are looking for digital solutions that are easy to understand, can be deployed relatively quickly, and deliver tangible cost savings and efficiencies. We need to find ways to help health systems reduce admin burden and free up clinician time.”

– Navid Farzad, Partner, Frist Cressey Ventures

Health systems also took steps to shift toward care models that decrease operational burden.

Ambitious hospital– at– home initiatives were launched to free up hospital beds, allow top of license practice, and reimagine care pathways.

- Mass General Brigham announced plans to grow its hospital-at-home programs from 25 patients to 200 over the next two years,

- while 12-hospital health system Allina Health partnered with Flare Capital Partners to spin out hospital-at-home company Inbound Health ($20M), delivering extra-clinical care across 185 different diagnoses.

Seizing the opportunity, startups in the on-demand care space like TytoCare emphasized their role to play in hospital-at-home programs.

In part because of hospital-at-home excitement, on-demand healthcare landed the top-funded digital health value proposition spot of 2022 ($2.4B), led by urgent-care-at-home service DispatchHealth ($330M) and startups like Homeward Health, which raised twice in 2022.

Mass General Brigham announced plans to grow its hospital-at-home programs from 25 patients to 200 over the next two years …

In addition to dealing with frontline priorities, 2022 saw key health systems continue to carve out brainspace …

… to expand and explore new businesses that would diversify revenue streams in years to come-an important balance even as tough times bias toward short-term solutions.

Provider venture capital funds remained the top corporate investors by deal volume, and provider organizations increased their acquisitions by 5x, from three deals in 2021 to 15 in 2022 (acquisition targets included specialty care coordinators and telemedicine startups).

Health systems also established partnerships as first steps into new revenue or equity pathways, shaking hands with venture capital teams like General Catalyst and a16z to establish digital health startup pilot sites on hospital campuses.

It’s worth calling out that competition is a powerful motivator for health system innovation, especially as retail giants battle their way into care delivery.

In the early innings of retail care, questions were raised about the quality of care being delivered; however, access-related benefits for patients and heavy internal and external investment activity suggest that care delivered in the retail setting is here to stay.

Big H2 2022 splashes from retail giants Walmart and Walgreens have raised the stakes for primary care, at-home, and omnichannel care delivery expansion.

Health systems strategizing for the years ahead are coming to realize that their beyond-the-hospital care offerings must stand up to a growing pool of competitors.

Health systems strategizing for the years ahead are coming to realize that their beyond-the-hospital care offerings must stand up to a growing pool of competitors.

Health systems’ 2022 innovation “grace under pressure” is noteworthy and sets a precedent for other major healthcare companies facing less difficult, but nonetheless challenging situations.

For employers, health plans, and life science firms bracing for cost challenges or new mandates in 2023-not to mention the impending end of the COVID-19 public health emergency-we hope health systems’ 2022 moves set the tone for all enterprises balancing the immediate with long-term innovation decisions.

RELATED ARTICLES