health transformation institute

healthcare platform unit (& marketplaces)

Joaquim Cardoso MSc

Founder and Senior Advisor

January 17, 2023

EXECUTIVE SUMMARY

Recent data shows a 47% drop in investment in digital health in 2022 and the investment community is currently focused on profitability rather than growth.

However, this perspective may be misguided for startups that are pursuing network effects-driven business models, which underlie four of the five most highly valued companies in the world.

- Network effects occur when the value of a product increases with the adoption and use of the product by others, and can lead to significant revenue growth and profitability.

- 2023 may be a good time for founders and investors to pursue building marketplaces and platforms in digital health, despite the current economic climate.

What are the Six Steps For Founders and Investors To Take Now?

- 1.Focus on inefficient interactions that are massive problems

- 2.Develop a thesis about how the world should work

- 3.First things first — build an atomic network

- 4.Invest in understanding platform strategy

- 5.Align on expectations

- 6.Right metrics

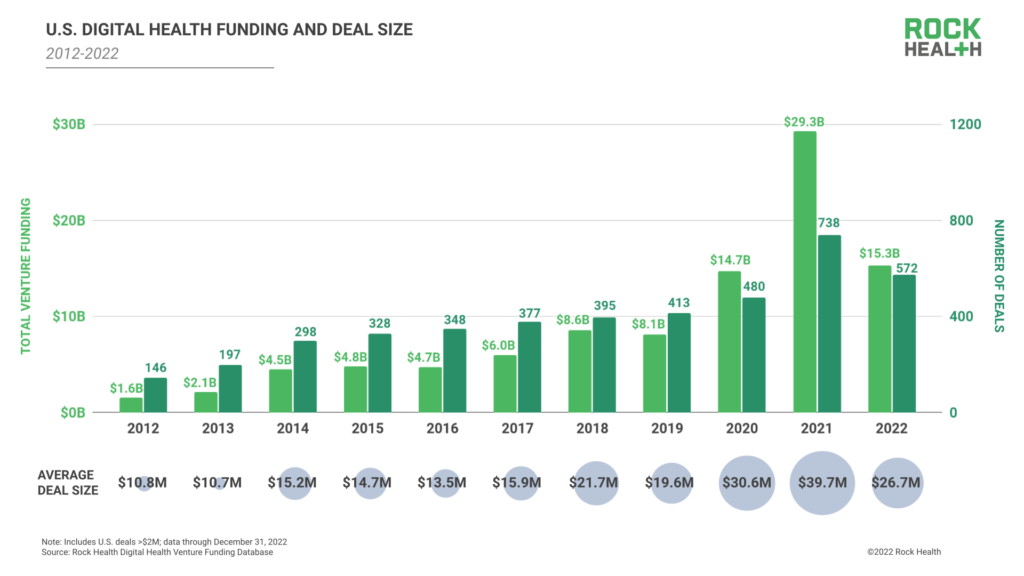

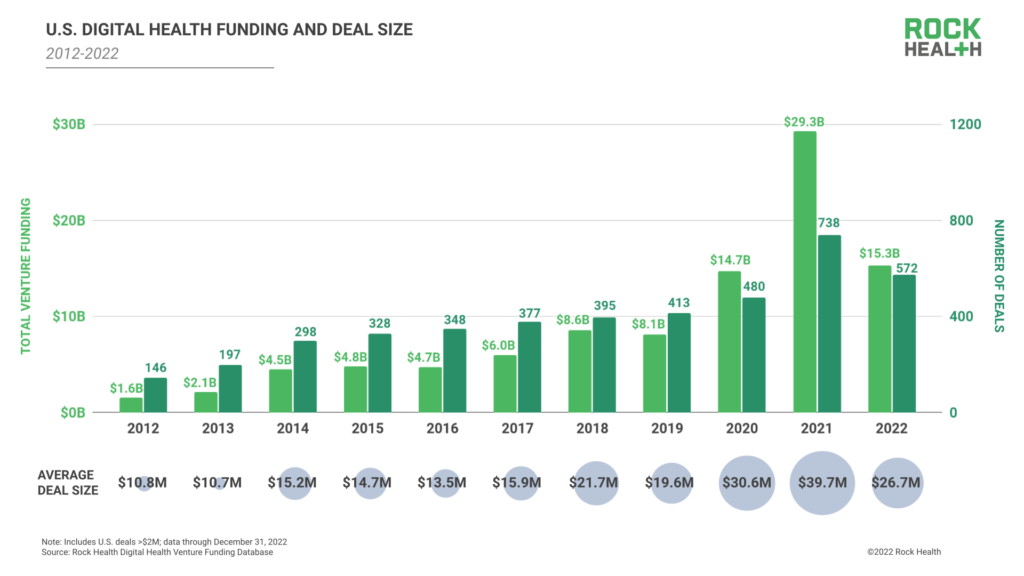

INFOGRAPHIC

- 2022’s total funding among US-based digital health startups amounted to $15.3B across 572 deals, with an average deal size of $27M.

- Not only did 2022’s annual funding total come in at just over half of 2021’s $29.3B2, but it also just squeaked past 2020’s $14.7B sum.

- Notably, 2022’s year’s Q4 $2.7B total was less than half of last year’s Q4 raise ($7.4B).

- Overall, U.S. digital health funding scraped by with $15.3B, underperforming 2021’s pot and just beating out 2020’s total.

DEEP DIVE

Is A Downturn The Best Time To Invest In Marketplaces And Platforms In Healthcare?

Forbes

Set Joseph

January 17, 2023

“Our goal is… modest: we simply attempt to be fearful when others are greedy and to be greedy only when others are fearful,” wrote Warren Buffett in a 1986 letter to shareholders about the twin contagions of fear and greed in the investment community.

“Our goal is… modest: we simply attempt to be fearful when others are greedy and to be greedy only when others are fearful — Warren Buffet –

More recently, the real-world Covid-19 contagion drove investment in digital health to record-breaking levels in 2021, roughly double the previous record.

Experts gushed (in large part, correctly) about how a silver lining of the contagion was that it had done more to advance telehealth, virtual care and digital health writ large in 10 months than the previous 10 years.

Gravity is a powerful force, however, especially when combined with rising interest rates, continued war and threat of escalation in Ukraine, and fears of a recession.

Accordingly, Rock Health recently reported that investment in digital health dropped a whopping 47% in 2022.

A quickly emerging consensus has arrived among the early stage investment community, summed up well by the recent JP Morgan healthcare conference: focus on profitability, not growth.

The only problem with this perspective? It may well be the dead wrong advice for startups pursuing network effects-driven business models, which underpin four of the five most highly valued companies in the world.

For founders and investors focused on building marketplaces and platforms in digital health, 2023 may be the time to heed Buffett’s counsel:

when everybody around seems fearful and focused on playing it safe, it just may be the right time to be audacious (or even a little greedy, using Buffett’s parlance).

Why Platforms and Marketplaces Are Different From (And Outperform) Most Technology Companies

Network effects are often misunderstood, but also fairly easily explained:

they occur when the value of a product (or service) increases with the adoption and use of the product by others.

There can be “same side” network effects (as in the case of Facebook), or “cross side” network effects (e.g., Uber) in which the presence of one side of users (riders) creates value for the other (drivers) and vice versa.

Both online marketplaces (e.g., Amazon) and multi-sided platforms (e.g., Plaid) take advantage of network effects.

Network effects are a simple enough concept, but consider the implications: as more people use the product, more value is created for all, which can in turn attract new users and makes the product itself ‘stickier’ for existing users.

As the user footprint itself grows, there are increasing opportunities for monetization.

Just one example: from 2007 to 2021 while Facebook grew its user footprint an astonishing 50X (from 58M to 2.9B users), its revenue grew at an even more astonishing 732X (from $153M to $112B).

Consider research comparing some of the largest technology companies embracing network effects (marketplaces and platforms) with their equally large pure play technology peers.

The data shows that platforms and marketplaces significantly outperform their peers

- Grow revenue faster than their pure tech peers (25% vs 10%)

- Are more scalable, generating substantially higher revenue per employee than their pure tech peers ($891K vs $409K)

- Achieve higher levels of profitability than their pure tech peers (22% vs 16%)

- Are accordingly valued more highly their pure tech peers (4.5X to 3.3X EV/Revenue)

… platforms and marketplaces significantly outperform their peers

If platforms and marketplaces are so powerful and so clearly outperform their ‘pure technology’ peers, why don’t all companies embrace network effects?

There are of course many contributing reasons (including that platforms tend to fail at higher rates), but perhaps chief among them:

platform thinking requires a different management paradigm and approach to value creation than traditional ‘ pipeline ‘ business models.

… platforms tend to fail at higher rates), but perhaps chief among them, is that, platform thinking requires a different management paradigm and approach to value creation than traditional ‘ pipeline ‘ business models.

The emerging wisdom for digital health — to focus on profitability — applies to one, less so to the other.

Why Is Now The Time To Invest In Platforms And Marketplaces?

Virtually every startup in healthcare winds up offering some type of discount, free offer, or other form of subsidy early on in their lifecycle.

Long and painful sales cycles or the lack of proven outcomes are just two reasons why a startup may trade revenue for something in return: a referral customer, a testimonial, partnership to validate the ROI, etc.

The challenge for any early stage investor is to weigh the economic promise of a company against the massive weight of uncertainty and market inertia; demonstration of revenue and attractive unit economics is one way to do so.

For pipeline businesses, especially those in healthcare, this approach makes sense.

Achieving product-market fit in any industry is hard work (and most venture backed companies will fail), and healthcare’s regulatory environment, complex financing and payment system increase the risks.

Just above we called attention to how mature marketplace and platform businesses outperform and are more capital efficient than their pure tech counterparts, it’s important to note that the inverse is also true:

in the early stages, it takes substantially more effort and capital to start the ‘flywheel’ process, and both revenue and unit economics are a lagging indicator of business prospects.

in the early stages, it takes substantially more effort and capital to start the ‘flywheel’ process, and both revenue and unit economics are a lagging indicator of business prospects.

This makes sense if one considers the nature of network effects: if the platform gains value with more adoption, then early on there is little value to early adopters and little incentive for prospects to adopt.

And even less incentive to pay for the product if the intrinsic value is heavily driven by the presence of others.

This is what constitutes the ‘ Cold Start ‘ problem.

But less recognized that the ‘Cold Start’ problem, which focuses on adoption and value, is how founders and investors should think about the Cold Start from a capital and burn rate perspective.

Investors in particular tend to invest in and may actively manage a portfolio of companies; they look for patterns both prior to and following investment, and most of these patterns are driven by pipeline thinking, which constitute the majority of dollars and deals in healthcare.

Investors in particular tend to invest in and may actively manage a portfolio of companies; they look for patterns both prior to and following investment, and most of these patterns are driven by pipeline thinking, which constitute the majority of dollars and deals in healthcare.

Hence the tension that early stage platform and marketplace founders may face: most investors will have an eye toward short term macro conditions and toward profitability, while founders may understand theirs is a longer term play and a seemingly high rate of cash burn may be entirely appropriate.

For those contrarian founders and investors who can align on vision, strategy and execution plan, however, now may be precisely the right time to invest in platforms and marketplaces in healthcare.

For those contrarian founders and investors who can align on vision, strategy and execution plan, however, now may be precisely the right time to invest in platforms and marketplaces in healthcare.

Now may be precisely the right time to invest in platforms and marketplaces in healthcare. Why? For many reasons.

First, where competition exists, it is likely facing significant challenges.

Belts are tightening, and capital is drying up. And, as described above, there is likely significant tension between management and investors around use of resources. The more conservative the approach, the less likely the long term strategy. Further, the current drop in funding means there is likely to be less competition for a period of time. Forward-thinking teams and investors will take advantage.

Second, forward-thinking investors will recognize that, while first mover advantage can frequently be overstated in importance, they can matter a great deal in winner-take-all (or winner-take-most markets).

There is perhaps no greater contributing factor to creating ‘winner-take-all’ dynamics than network effects. Timing matters of course. If a platform can begin generating momentum to get the proverbial ‘flywheel’ turning before competitors, it has more than a substantial (and perhaps insurmountable) head start.

Third, aligned understanding of platform strategy between founders and investors can lead to deep structural advantages.

Customers whose belts have tightened are likely to be very receptive to adopting technology that yields an immediate return with no upfront or costs in the near term.

Fourth, the longer growth cycles for marketplaces and platform businesses means that exits are likely to occur in a materially different macroeconomic environment.

We can also look to the past for examples.

Uber was founded in March 2009, during the Great Recession.

Likewise, Airbnb was founded in 2008.

Amazon now is one of the biggest companies in the world, but survived in 2000 in large part because it raised significant capital just before the market crashed.

For forward-thinking investors, now may indeed be the right time to invest in marketplaces and platforms. Is there a reason to think about doing so in healthcare?

Why Marketplaces and Platforms in Healthcare?

Three macro trends suggest we’re at a unique period in time for investors in healthcare.

- First, it’s hard to overstate the sea change that has occurred — and also the one that has not yet — as a result of 2009’s stimulus bill.

- Second, it’s not news to suggest that healthcare is recession-proof.

- Third, many of the biggest challenges in healthcare are those best addressed by marketplaces and platforms.

- Finally, while it’s important to note that healthcare is indeed different, that difference can be rewarding for founders and investors.

1.First, it’s hard to overstate the sea change that has occurred — and also the one that has not yet — as a result of 2009’s stimulus bill.

Known as the American Recovery and Reinvestment Act, the bill contained massive subsidies to drive physician and hospital adoption and “meaningful use” of electronic health records.

The sea change that happened: EHR adoption shot up to >90%, from under 10% adoption.

The sea change that didn’t happen (yet): meaningful use and interoperability in a manner that would enable improved care coordination, population health management, and researcher accessibility to vast swaths of real world data.

The sea change that didn’t happen (yet): meaningful use and interoperability in a manner that would enable improved care coordination, population health management, and researcher accessibility to vast swaths of real world data.

Today, virtually every doctor in the U.S. now practices medicine and interacts with patients while working in an application on a laptop.

It is no coincidence that levels of digital health have risen dramatically — and will likely do so again — over the past decade, as investors and entrepreneurs see the opportunity to leverage digitized processes and data, and to deliver on the sea change that hasn’t happened yet.

2.Second, it’s not news to suggest that healthcare is recession-proof.

In fact, recent data suggests that demand for healthcare services actually increases during recessions.

In addition, the record $29 billion invested in digital health in 2021 is still tiny compared with the $4T in healthcare spend (of which perhaps 25% is wasteful), suggesting there remains enormous opportunity to improve healthcare quality and access while reducing costs.

In addition, the record $29 billion invested in digital health in 2021 is still tiny compared with the $4T in healthcare spend (of which perhaps 25% is wasteful), suggesting there remains enormous opportunity to improve healthcare quality and access while reducing costs.

3.Third, many of the biggest challenges in healthcare are those best addressed by marketplaces and platforms.

Care coordination, provider-payer relationships, care navigation, information asymmetry, and price transparency are all examples of the types of challenges created by a complex, highly regulated and fragmented industry where quality is highly variable and trust between constituents is low.

Platforms and marketplaces create economic value by bringing different constituents / sides of users together and enabling exchange.

To do so, they must identify where incentives do or can align, bring uniformity and standardization to transactions, and introduce or increase transparency in order to build trust.

Doing so is a business imperative, and one that aligns the platforms’ interest with the broader societal interest in making healthcare more efficient, accessible, and higher quality for all.

To do so, they must identify where incentives do or can align, bring uniformity and standardization to transactions, and introduce or increase transparency in order to build trust.

4.Finally, while it’s important to note that healthcare is indeed different, that difference can be rewarding for founders and investors.

The highly regulated nature of healthcare, fragmentation, highly educated and trained workforce, and importance of clinical workflow can all lead to greater barriers to entry and higher switching costs for customers. In other words, defensibility for companies and investors.

What are the Six Steps For Founders and Investors To Take Now?

- 1.Focus on inefficient interactions that are massive problems

- 2.Develop a thesis about how the world should work

- 3.First things first — build an atomic network

- 4.Invest in understanding platform strategy

- 5.Align on expectations

- 6.Right metrics

What are some insights from the article?

Some potential steps that founders and investors may want to consider include:

- Researching companies that are pursuing network effects-driven business models in the healthcare industry.

- Identifying companies that are leveraging technology to improve healthcare delivery and have a clear path to monetization.

- Conducting due diligence to evaluate the potential growth and profitability of these companies.

- Considering the scalability of the business model, as well as the potential for future revenue growth.

- Looking for opportunities to invest in companies that are well-positioned to benefit from the growing trend towards digital health.

- Being open to taking calculated risks and embracing an audacious mindset, as the author suggests that this may be the right time to invest in such companies.

INFOGRAPHIC

- 2022’s total funding among US-based digital health startups amounted to $15.3B across 572 deals, with an average deal size of $27M.

- Not only did 2022’s annual funding total come in at just over half of 2021’s $29.3B2, but it also just squeaked past 2020’s $14.7B sum.

- Notably, 2022’s year’s Q4 $2.7B total was less than half of last year’s Q4 raise ($7.4B).

- Overall, U.S. digital health funding scraped by with $15.3B, underperforming 2021’s pot and just beating out 2020’s total.

DEEP DIVE

Is A Downturn The Best Time To Invest In Marketplaces And Platforms In Healthcare?

Forbes

Set Joseph

January 17, 2023

“Our goal is… modest: we simply attempt to be fearful when others are greedy and to be greedy only when others are fearful,” wrote Warren Buffett in a 1986 letter to shareholders about the twin contagions of fear and greed in the investment community.

“Our goal is… modest: we simply attempt to be fearful when others are greedy and to be greedy only when others are fearful — Warren Buffet –

More recently, the real-world Covid-19 contagion drove investment in digital health to record-breaking levels in 2021, roughly double the previous record.

Experts gushed (in large part, correctly) about how a silver lining of the contagion was that it had done more to advance telehealth, virtual care and digital health writ large in 10 months than the previous 10 years.

Gravity is a powerful force, however, especially when combined with rising interest rates, continued war and threat of escalation in Ukraine, and fears of a recession.

Accordingly, Rock Health recently reported that investment in digital health dropped a whopping 47% in 2022.

A quickly emerging consensus has arrived among the early stage investment community, summed up well by the recent JP Morgan healthcare conference: focus on profitability, not growth.

The only problem with this perspective? It may well be the dead wrong advice for startups pursuing network effects-driven business models, which underpin four of the five most highly valued companies in the world.

For founders and investors focused on building marketplaces and platforms in digital health, 2023 may be the time to heed Buffett’s counsel:

when everybody around seems fearful and focused on playing it safe, it just may be the right time to be audacious (or even a little greedy, using Buffett’s parlance).

Why Platforms and Marketplaces Are Different From (And Outperform) Most Technology Companies

Network effects are often misunderstood, but also fairly easily explained:

they occur when the value of a product (or service) increases with the adoption and use of the product by others.

There can be “same side” network effects (as in the case of Facebook), or “cross side” network effects (e.g., Uber) in which the presence of one side of users (riders) creates value for the other (drivers) and vice versa.

Both online marketplaces (e.g., Amazon) and multi-sided platforms (e.g., Plaid) take advantage of network effects.

Network effects are a simple enough concept, but consider the implications: as more people use the product, more value is created for all, which can in turn attract new users and makes the product itself ‘stickier’ for existing users.

As the user footprint itself grows, there are increasing opportunities for monetization.

Just one example: from 2007 to 2021 while Facebook grew its user footprint an astonishing 50X (from 58M to 2.9B users), its revenue grew at an even more astonishing 732X (from $153M to $112B).

Consider research comparing some of the largest technology companies embracing network effects (marketplaces and platforms) with their equally large pure play technology peers.

The data shows that platforms and marketplaces significantly outperform their peers

- Grow revenue faster than their pure tech peers (25% vs 10%)

- Are more scalable, generating substantially higher revenue per employee than their pure tech peers ($891K vs $409K)

- Achieve higher levels of profitability than their pure tech peers (22% vs 16%)

- Are accordingly valued more highly their pure tech peers (4.5X to 3.3X EV/Revenue)

… platforms and marketplaces significantly outperform their peers

If platforms and marketplaces are so powerful and so clearly outperform their ‘pure technology’ peers, why don’t all companies embrace network effects?

There are of course many contributing reasons (including that platforms tend to fail at higher rates), but perhaps chief among them:

platform thinking requires a different management paradigm and approach to value creation than traditional ‘ pipeline ‘ business models.

… platforms tend to fail at higher rates), but perhaps chief among them, is that, platform thinking requires a different management paradigm and approach to value creation than traditional ‘ pipeline ‘ business models.

The emerging wisdom for digital health — to focus on profitability — applies to one, less so to the other.

Why Is Now The Time To Invest In Platforms And Marketplaces?

Virtually every startup in healthcare winds up offering some type of discount, free offer, or other form of subsidy early on in their lifecycle.

Long and painful sales cycles or the lack of proven outcomes are just two reasons why a startup may trade revenue for something in return: a referral customer, a testimonial, partnership to validate the ROI, etc.

The challenge for any early stage investor is to weigh the economic promise of a company against the massive weight of uncertainty and market inertia; demonstration of revenue and attractive unit economics is one way to do so.

For pipeline businesses, especially those in healthcare, this approach makes sense.

Achieving product-market fit in any industry is hard work (and most venture backed companies will fail), and healthcare’s regulatory environment, complex financing and payment system increase the risks.

Just above we called attention to how mature marketplace and platform businesses outperform and are more capital efficient than their pure tech counterparts, it’s important to note that the inverse is also true:

in the early stages, it takes substantially more effort and capital to start the ‘flywheel’ process, and both revenue and unit economics are a lagging indicator of business prospects.

in the early stages, it takes substantially more effort and capital to start the ‘flywheel’ process, and both revenue and unit economics are a lagging indicator of business prospects.

This makes sense if one considers the nature of network effects: if the platform gains value with more adoption, then early on there is little value to early adopters and little incentive for prospects to adopt.

And even less incentive to pay for the product if the intrinsic value is heavily driven by the presence of others.

This is what constitutes the ‘ Cold Start ‘ problem.

But less recognized that the ‘Cold Start’ problem, which focuses on adoption and value, is how founders and investors should think about the Cold Start from a capital and burn rate perspective.

Investors in particular tend to invest in and may actively manage a portfolio of companies; they look for patterns both prior to and following investment, and most of these patterns are driven by pipeline thinking, which constitute the majority of dollars and deals in healthcare.

Investors in particular tend to invest in and may actively manage a portfolio of companies; they look for patterns both prior to and following investment, and most of these patterns are driven by pipeline thinking, which constitute the majority of dollars and deals in healthcare.

Hence the tension that early stage platform and marketplace founders may face: most investors will have an eye toward short term macro conditions and toward profitability, while founders may understand theirs is a longer term play and a seemingly high rate of cash burn may be entirely appropriate.

For those contrarian founders and investors who can align on vision, strategy and execution plan, however, now may be precisely the right time to invest in platforms and marketplaces in healthcare.

For those contrarian founders and investors who can align on vision, strategy and execution plan, however, now may be precisely the right time to invest in platforms and marketplaces in healthcare.

Now may be precisely the right time to invest in platforms and marketplaces in healthcare. Why? For many reasons.

First, where competition exists, it is likely facing significant challenges.

Belts are tightening, and capital is drying up. And, as described above, there is likely significant tension between management and investors around use of resources. The more conservative the approach, the less likely the long term strategy. Further, the current drop in funding means there is likely to be less competition for a period of time. Forward-thinking teams and investors will take advantage.

Second, forward-thinking investors will recognize that, while first mover advantage can frequently be overstated in importance, they can matter a great deal in winner-take-all (or winner-take-most markets).

There is perhaps no greater contributing factor to creating ‘winner-take-all’ dynamics than network effects. Timing matters of course. If a platform can begin generating momentum to get the proverbial ‘flywheel’ turning before competitors, it has more than a substantial (and perhaps insurmountable) head start.

Third, aligned understanding of platform strategy between founders and investors can lead to deep structural advantages.

Customers whose belts have tightened are likely to be very receptive to adopting technology that yields an immediate return with no upfront or costs in the near term.

Fourth, the longer growth cycles for marketplaces and platform businesses means that exits are likely to occur in a materially different macroeconomic environment.

We can also look to the past for examples.

Uber was founded in March 2009, during the Great Recession.

Likewise, Airbnb was founded in 2008.

Amazon now is one of the biggest companies in the world, but survived in 2000 in large part because it raised significant capital just before the market crashed.

For forward-thinking investors, now may indeed be the right time to invest in marketplaces and platforms. Is there a reason to think about doing so in healthcare?

Why Marketplaces and Platforms in Healthcare?

Three macro trends suggest we’re at a unique period in time for investors in healthcare.

- First, it’s hard to overstate the sea change that has occurred — and also the one that has not yet — as a result of 2009’s stimulus bill.

- Second, it’s not news to suggest that healthcare is recession-proof.

- Third, many of the biggest challenges in healthcare are those best addressed by marketplaces and platforms.

- Finally, while it’s important to note that healthcare is indeed different, that difference can be rewarding for founders and investors.

1.First, it’s hard to overstate the sea change that has occurred — and also the one that has not yet — as a result of 2009’s stimulus bill.

Known as the American Recovery and Reinvestment Act, the bill contained massive subsidies to drive physician and hospital adoption and “meaningful use” of electronic health records.

The sea change that happened: EHR adoption shot up to >90%, from under 10% adoption.

The sea change that didn’t happen (yet): meaningful use and interoperability in a manner that would enable improved care coordination, population health management, and researcher accessibility to vast swaths of real world data.

The sea change that didn’t happen (yet): meaningful use and interoperability in a manner that would enable improved care coordination, population health management, and researcher accessibility to vast swaths of real world data.

Today, virtually every doctor in the U.S. now practices medicine and interacts with patients while working in an application on a laptop.

It is no coincidence that levels of digital health have risen dramatically — and will likely do so again — over the past decade, as investors and entrepreneurs see the opportunity to leverage digitized processes and data, and to deliver on the sea change that hasn’t happened yet.

2.Second, it’s not news to suggest that healthcare is recession-proof.

In fact, recent data suggests that demand for healthcare services actually increases during recessions.

In addition, the record $29 billion invested in digital health in 2021 is still tiny compared with the $4T in healthcare spend (of which perhaps 25% is wasteful), suggesting there remains enormous opportunity to improve healthcare quality and access while reducing costs.

In addition, the record $29 billion invested in digital health in 2021 is still tiny compared with the $4T in healthcare spend (of which perhaps 25% is wasteful), suggesting there remains enormous opportunity to improve healthcare quality and access while reducing costs.

3.Third, many of the biggest challenges in healthcare are those best addressed by marketplaces and platforms.

Care coordination, provider-payer relationships, care navigation, information asymmetry, and price transparency are all examples of the types of challenges created by a complex, highly regulated and fragmented industry where quality is highly variable and trust between constituents is low.

Platforms and marketplaces create economic value by bringing different constituents / sides of users together and enabling exchange.

To do so, they must identify where incentives do or can align, bring uniformity and standardization to transactions, and introduce or increase transparency in order to build trust.

Doing so is a business imperative, and one that aligns the platforms’ interest with the broader societal interest in making healthcare more efficient, accessible, and higher quality for all.

To do so, they must identify where incentives do or can align, bring uniformity and standardization to transactions, and introduce or increase transparency in order to build trust.

4.Finally, while it’s important to note that healthcare is indeed different, that difference can be rewarding for founders and investors.

The highly regulated nature of healthcare, fragmentation, highly educated and trained workforce, and importance of clinical workflow can all lead to greater barriers to entry and higher switching costs for customers. In other words, defensibility for companies and investors.

Six Steps For Founders and Investors To Take Now

What to do with all this information? Get started.

Although there is no step-by-step guide for founders or investors interested in building or investing in marketplaces and platforms in healthcare, here are six steps that each can take:

- 1.Focus on inefficient interactions that are massive problems

- 2.Develop a thesis about how the world should work

- 3.First things first — build an atomic network

- 4.Invest in understanding platform strategy

- 5.Align on expectations

- 6.Right metrics

1.Focus on inefficient interactions that are massive problems:

Jonathan Bush has said that healthcare is not a $4T market, but rather thousands of billion dollar markets.

But it’s also true that many of the biggest problems involve interactions that involve two or more constituents.

One easy place to look, for instance: provider-to-payer interactions.

Whether it’s reimbursement, network contracting, utilization management, directory management, or hundreds of other transactions, today’s ‘system’ is rife with inefficiencies and lack of trust in terms of how providers and payers interact.

Whether it’s reimbursement, network contracting, utilization management, directory management, or hundreds of other transactions, today’s ‘system’ is rife with inefficiencies and lack of trust in terms of how providers and payers interact.

2.Develop a thesis about how the world should work

Today’s system is still largely paper- or fax-based. And that’s when it’s not being handled over the phone.

If there were a common, trusted platform to facilitate interactions, how would it work? Who would benefit? Why would different constituents use it? Who would pay for it?

Today’s system is still largely paper- or fax-based. And that’s when it’s not being handled over the phone.

If there were a common, trusted platform to facilitate interactions, how would it work? Who would benefit? Why would different constituents use it? Who would pay for it?

3.First things first — build an atomic network

One of the most important things to remember is that reality will differ from your vision in profound ways.

Better to figure those things out, and the difference between what works and what doesn’t, early on when the network is smaller, mistakes are less costly.

Andrew Chen recommends building an ‘atomic network’, which is the minimum size for a network to survive on its own (See Musk, Elon, re importance of this lesson).

4.Invest in understanding platform strategy

As described above, building a platform or marketplace requires a different mindset from building a pipeline business.

There’s too little platform strategy expertise and experience in healthcare, but there are resources and good books out there to get started. It’s worthwhile to understand the nuances, since not all network effects are equal.

5.Align on expectations

Among the most important lessons for both founders and investors is for them both to understand what they’re getting into, what it’s going to take to get there, why it’s worth the effort, and what the process is likely going to look like.

6.Right metrics:

The recognition that platforms build value in a different trajectory and have a different revenue profile than ‘pure technology’ pipeline companies should not be taken to mean that money should be invested willy-nilly.

If the payout is larger but longer, it’s even more critical for both sides (management and investor) to hold each other accountable for progress.

Developing the right metrics to track, and understanding which ones are most important during which stage of growth, is critical.

Be Mindful of Buffett When Others Are Fearful

Warren Buffett has had a decent streak of success since his 1986 letter to shareholders. This, of course, is putting it mildly.

This author doesn’t believe in advocating for greed (and certainly not greed alone), but in recognizing the attractive and long term investment opportunities that remain right in front of us while most are taking the seemingly safer and certainly more well-traveled path.

This author doesn’t believe in advocating for greed (and certainly not greed alone), …

… but in recognizing the attractive and long term investment opportunities that remain right in front of us …

… while most are taking the seemingly safer and certainly more well-traveled path.

Originally published at https://www.forbes.com.