This represents a staggering 73% decline from the over quarter-trillion dollar market cap these businesses had at their peaks

Ari Gottlieb @ Linkedin

A2StrategyGroup

January 26, 2022

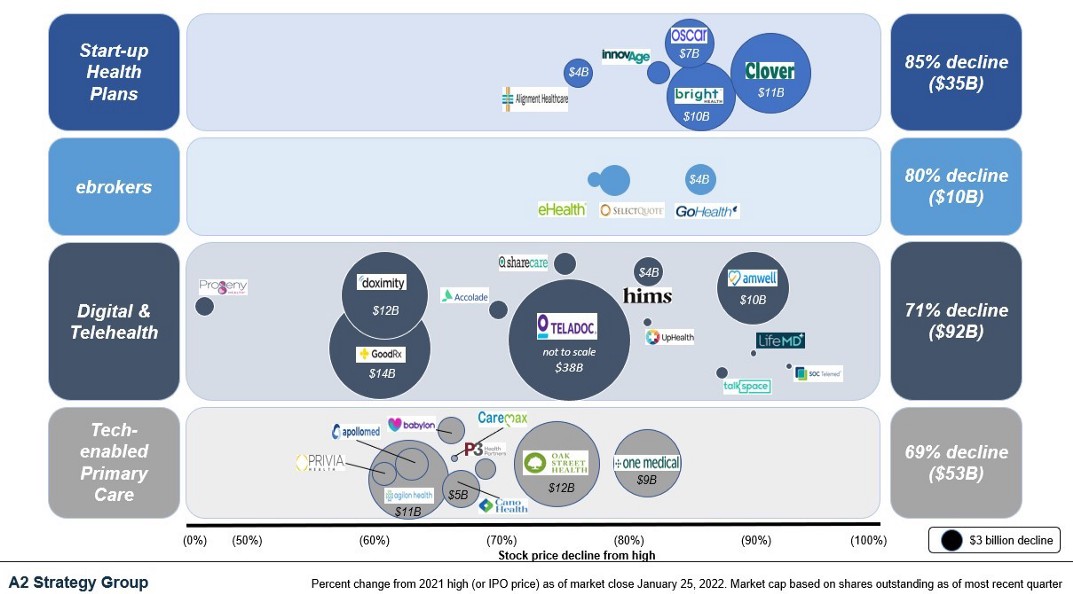

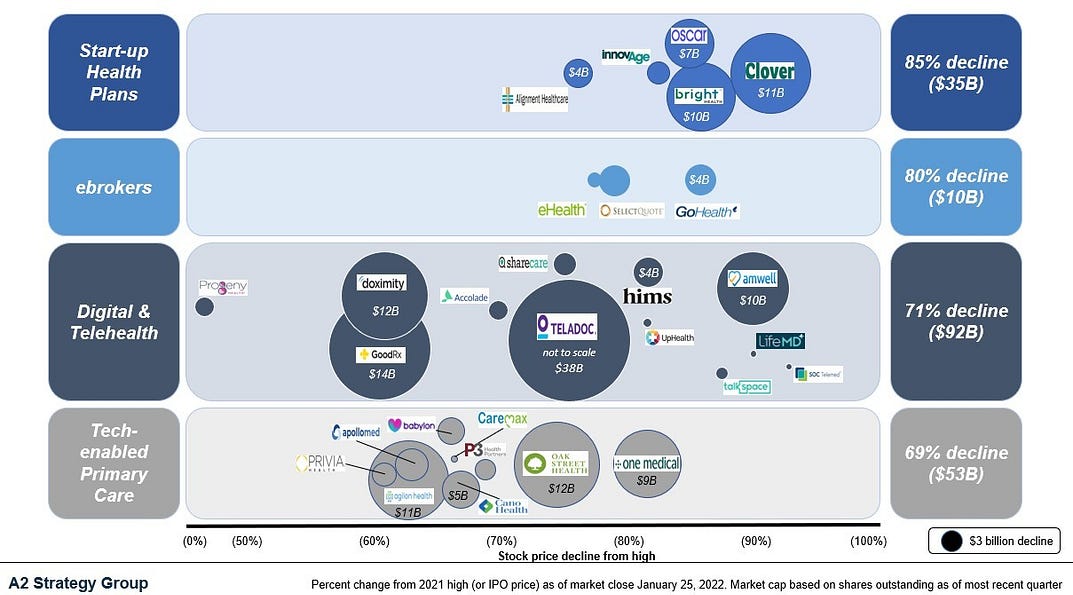

Collectively, public start-up health insurers, ebrokers, tech-enabled primary care businesses, and digital/telehealth companies have lost $190 billion in market cap from their 2021 highs through January 25, 2022.

This represents a staggering 73% decline from the over quarter-trillion dollar market cap these businesses had at their peaks

The significant declines have been broad and impacted every public company.

- Start-up insurers have performed worst, declining 85% from their highs (or IPO price for Oscar and Bright, which never traded above it) on a market cap-weighted basis.

- Ebrokers are down 80%,

- digital and telehealth companies 71% — representing a $92 billion market cap reduction, and

- tech-enabled primary care 69%.

In fact, aside from Progeny, the infertility-focused digital health player (down 45%), every company is trading at least 50% below its high.

In many ways, the decline in valuations for health tech businesses appears to be somewhat rational.

For example, nearly all of the public start-up health plans have struggled with execution and meeting financial guidance, with public markets responding accordingly.

The exception is Alignment, which continues to deliver solid membership growth and financial performance, but is still down 76% from its high.

Yet even today Alignment is valued at $14,000 per member, still rich compared to Medicare Advantage acquisition multiples closer to $10,000 (and even more so being so California-focused with limited capital requirements; Bright purchased Brand New Day for under $7,000 per member).

A similar story in tech-enabled primary care:

- Oak Street has lost $12 billion in market cap, or 74%, with a $4.2 billion market cap today, serving 112,000 patients,

- while in 2019 UnitedHealth/Optum acquired DaVita Medical Group (including HealthCare Partners) with 1.7 million patients for $4.9 billion.

Looking forward what are the implications?

Foremost, the ability for health tech companies to access funding for seemingly unlimited amounts of start-up losses is likely over.

Businesses with fundamentally flawed models without any real hope of profitability and significant capital needs (hi Oscar) particularly in the start-up health insurance space will be forced into highly dilutive situations that will further diminish any hope of recovery for existing shareholders and need to begin to price more rationally, and a result see significant slowing of growth.

Their longer-term prospects are uncertain, particularly those companies without any real assets of note.

Businesses in spaces with real secular support such as the growth in Medicare Advantage and shifting of risk to providers of care will see continued growth opportunities aided by continued market tailwinds.

More limited access to capital and historically reasonable valuations will force companies to continue to innovate, particularly around developing long-term economically sustainable models as well as improving operational performance and execution.

Particularly for the risk-bearing providers well established paths exist to success; one only has to look at Apollomed or Cano for examples of profitable, scaled providers, which may benefit further from reduced valuations as they continue to roll-up physician practices.

Undoubtedly telehealth and digital health will have a significant future role in American healthcare.

But it is important not to overstate the current utilization or scope: Teladoc, with over 80 million health plan members, only expected 4 million visits in Q4 2021 — or 5% utilization (ignoring users that have ongoing appointments).

Consolidation will likely pick up as capital runs low and companies look for ways to accelerate revenue growth and presence to obtain further capital infusions.

At reduced valuations, it is likely that larger traditional healthcare businesses will look to acquire and integrate digital and telehealth assets, backed by substantially larger balance sheets and large existing customer bases.

Businesses that create real and deliver differentiated value will be successful as execution becomes increasingly important and just proffering giant addressable market figures without a clear path to scale or achieve profitability will no longer suffice.

And one piece of good news:

despite almost $200 billion of value disappearing at least we all can feel better that America is not going bankrupt from healthcare spend, which was nearly implied given the future profitability required to support such valuations.

Originally published at https://www.linkedin.com.