Series: “The rise of healthcare platforms”

This is an excerpt of the publication “The rise of healthcare platforms”, focusing with the title above, focusing on the topic in question.

Peter Choueiri, Morris Hosseini , Thilo Kaltenbach, Ulrich Kleipass, Karsten Neumann and Oliver Rong

September, 2020

INDUSTRY EXPERTS GIVE THEIR PREDICTIONS FOR THE NEXT FIVE YEARS

How does the healthcare industry see platforms developing in the period to 2025?

To find out what industry insiders think, we carried out a survey of more than 500 experts from around the globe.[1]

This was the second in our series of major industry surveys on the future of health, following on from our 2019 study.

We also carried out qualitative research into the top 100 healthcare platforms worldwide.[2]

The results of our research were in many cases surprising.

In particular, the survey reveals how actors right across the healthcare industry have changed their minds about the future of the market since last year. We look at six of our key findings below.

KEY FINDINGS OF THE 2020 FUTURE OF HEALTH SURVEY

1. Growth expectations for digital health have risen strongly

2. Platforms build on customer proximity and relationships

3. Ownership of platforms is key

4. Different types of platforms will emerge

5. Outpatient care will see the most disruption

6. Everything is still to play for

Customer experience is the key success factor for platforms; trust and health benefit come next.

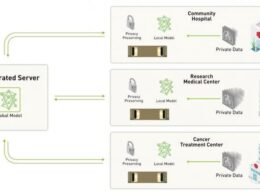

1.GROWTH EXPECTATIONS FOR DIGITAL HEALTH HAVE RISEN STRONGLY

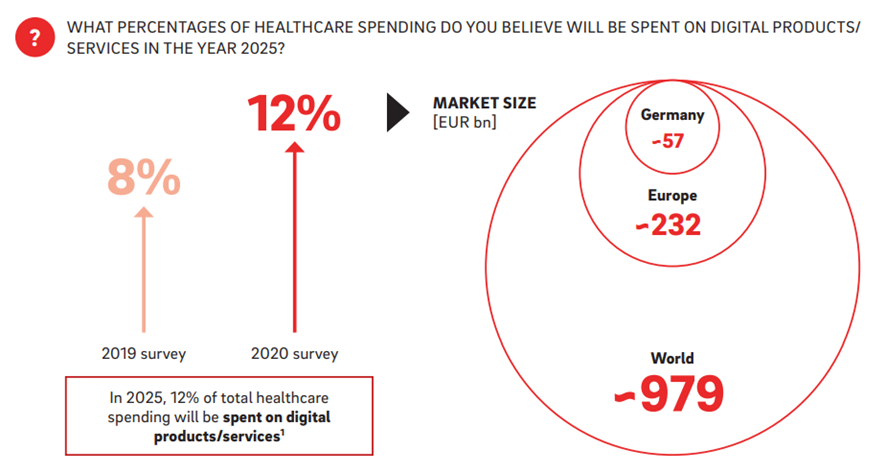

Respondents in this year’s Future of Health survey anticipate that digital products and services will make up as much as 12 percent of healthcare spending by 2025.

This is up four percentage points from last year’s survey. Industry experts have thus increased their expectations of growth.

If they are right, we calculate that spending on digital health in 2025 will be EUR 57 billion in Germany (up EUR 19 billion on expectations from last year’s survey), EUR 232 billion in the European Union as a whole (up EUR 77 billion) and EUR 979 billion around the globe (up EUR 326 billion).[3] (B)

B: Digital products and services will grow to a market share of 12% within the healthcare sector by 2025

Expected share of digital products/services in healthcare

1 Result calculated as weighted average of medians. Estimated to be higher than 2019 survey, Source: RB

Covid-19 is one of the many factors accelerating the development and acceptance of digital healthcare.

The pandemic has created new demand from health consumers, particularly for remote services, and greater acceptance of such services in general.

Digital infrastructure has developed accordingly, with regulations such as the Digital Healthcare Act (DVG) in Germany and similar legislation in other countries facilitating reimbursement of digital medical solutions by payors.

Mergers and acquisitions have expanded, both across borders and across the value chain, and many companies have launched new platform services.

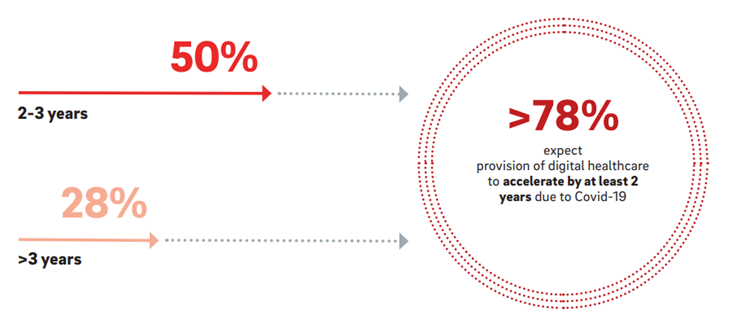

More than three-quarters of respondents in the survey believe that the pandemic will speed up the provision of digital healthcare by at least two years as the public adapts to contactless mechanisms for medical treatment.

Digital diagnostics and treatments will become increasingly normal, with people only visiting their physician if it is unavoidable. ©

C: Covid-19 is speeding up the development of digital healthcare

Impact of the pandemic on online health services, Source: RB

2. PLATFORMS BUILD ON CUSTOMER PROXIMITY AND RELATIONSHIPS

Three-quarters of respondents believe that patients will increasingly be the owners of their health data and will decide who to grant access to, up 16 percent on last year’s survey.

For the industry this means that the entry point to platform systems is critical.

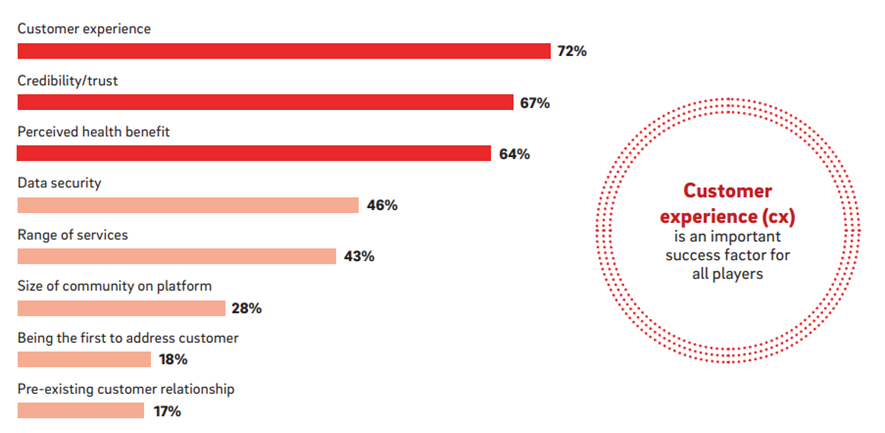

Surprisingly, customer experience is considered the number-one success factor, not perceived health benefits.

Usability, it seems, is the key criterion when it comes to health apps — something that players should keep in mind when developing platforms. Trust in the platform is the number-two factor, and only then come health benefits in number-three position. (D)

3. OWNERSHIP OF PLATFORMS IS KEY

One of the key questions that everyone in the industry is asking is who will win the platform game?

The survey results offer some important insights into current thinking in the industry.

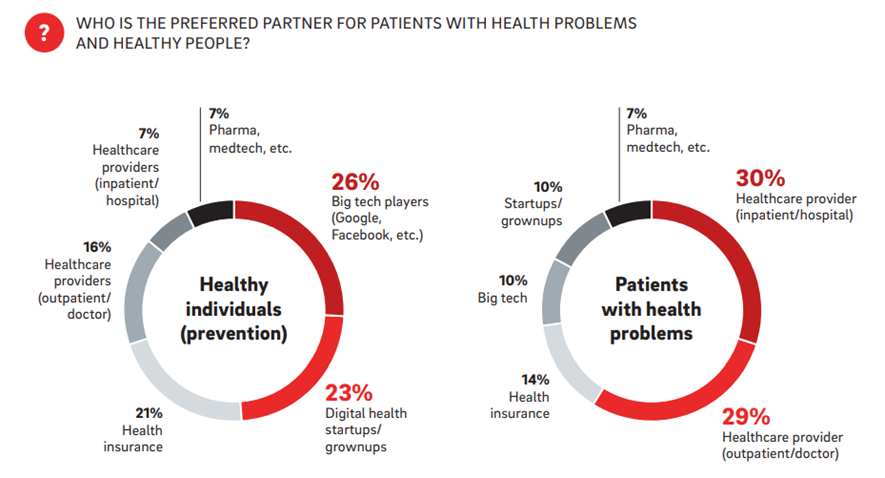

Respondents appear to believe that different types of players will “own” different types of customers: Healthcare providers are best positioned to access patients — individuals who already have health problems — while tech companies are better positioned when it comes to prevention, due to the enormous amount of behavioral data on users that they possess.

Healthcare providers and tech players, including startups, are expected to occupy different spaces in the market. (E)

D: Customer experience is the number-one success factor

Perceived success factors for healthcare platforms, Source: RB

This leads to some important questions.

For example:

- How do tech companies pass customers on to providers when they fall ill?

- Why is the industry not expected to play a key role in the prevention segment?

- And how can the fragmented provider sector manage the question of ownership?

Here, the survey reveals a certain disconnect between how players see themselves and how others view them.

Around half of the health insurers in the survey see themselves as being in the best position to own patients, that is, as the preferred provider for patients with actual health problems.

But that view of insurers’ importance is not shared by the rest of the expert group.

E: Providers in best position to “own” patients Preferred points of access for healthy individuals and patients

Source: RB

Health insurers must decide on what their best approach will be.

- Should they build their own platforms?

- Or should they partner with tech companies for prevention-focused platforms and providers for acute-care platforms, fusing them to create a value-adding meta-platform?

What is clear is that whoever controls the customer interface will be able to steer patients towards particular providers, and will therefore enjoy a significant competitive advantage.

4. DIFFERENT TYPES OF PLATFORMS WILL EMERGE

Today’s healthcare platform landscape is highly fragmented.

It would be logical to expect a certain amount of consolidation to take place over the coming years.

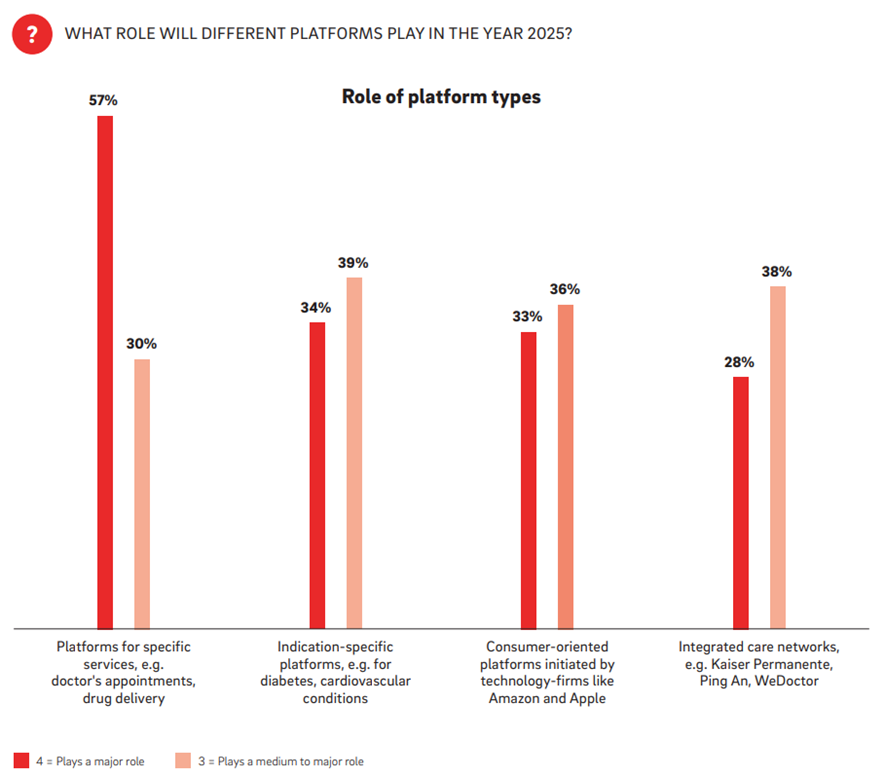

Yet, contrary to expectations, respondents believe that platforms offering specific services are likely to continue to play a major role in 2025.

It may also be that Europeans prefer highly specialized, personalized services and would not accept the dominance of a single, government-monitored meta-platform, such as Tencent or WeChat. (F)

F: Platforms specializing in specific services are expected to grow

Expected relevance of platforms, Source: RB

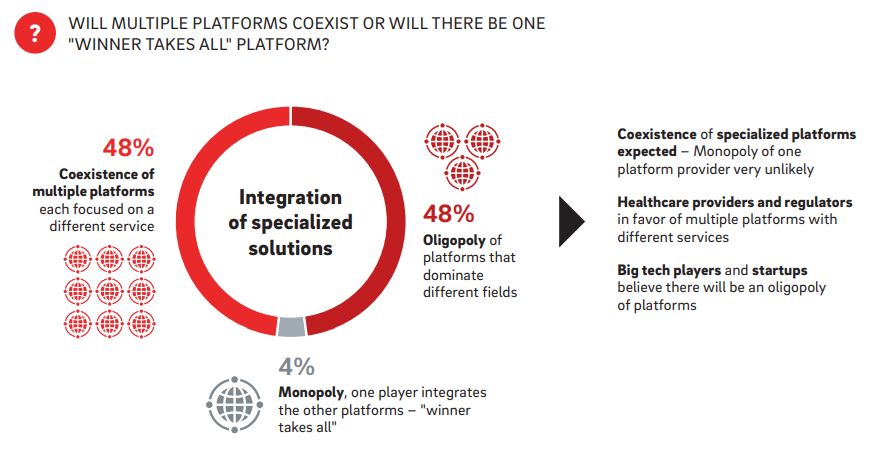

G: Coexistence of multiple platforms or oligopoly of platforms with individual focus on services expected

Coexistence of platform models, Source: RB

The survey shows, for example, that platforms offering appointments with physicians or drug delivery will gain in importance, as will platforms specializing in specific indications (mainly horizontally integrated platforms).

At the same time, this year’s survey shows less of an expectation that Big Tech players such as Google or Amazon will be part of the healthcare system in the same way that insurance companies and hospitals are today.

Even specialized platforms can expand and/or collaborate, e.g. by combining telemedicine and drug delivery. But experts foresee different extents of integration. They are, however, in agreement that it will not lead to a monopoly. (G)

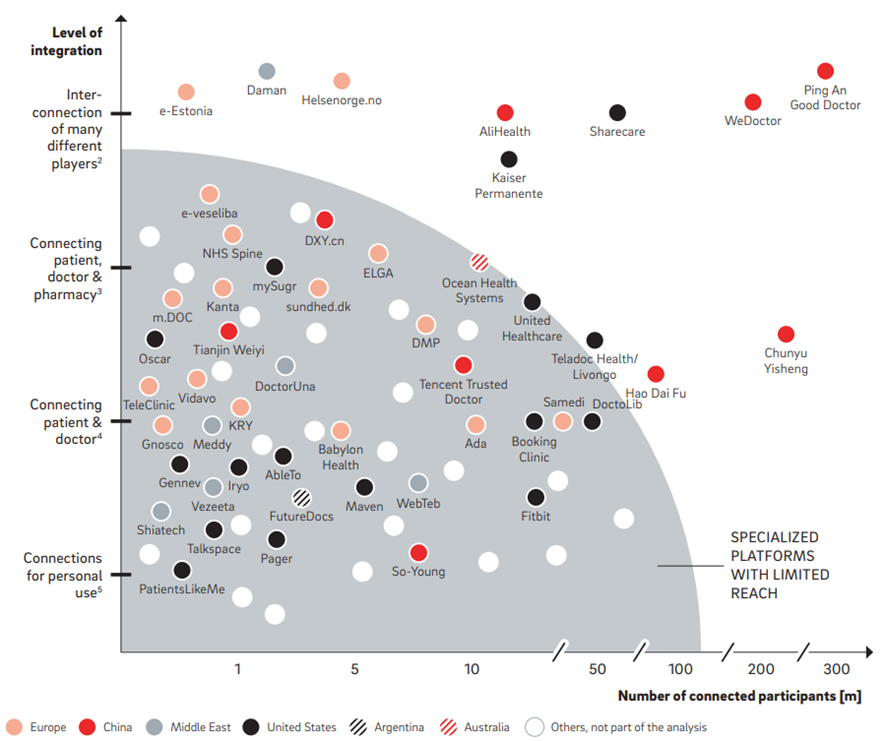

H: The healthcare platform landscape is highly fragmented

Level of integration and number of stakeholders in selected platforms worldwide1, 1 Disclaimer: Figures are indicative and a snapshot of August 2020, estimations are based on accessible online resources, but deviations are possible 2 Health institutions, dentists, psychologists, etc. 3 Telemedicine, patient record, e-prescription 4 Telemedicine, patient record, engagement tool, booking 5 For private use of patients; Source: RB

In our analysis of the top 100 platforms, we grouped companies by their number of stakeholders and level of integration.

The results were in line with the findings of the survey.

Over three-quarters either operate as single-solution providers or connect fewer stakeholders than meta-platforms; often, they are both horizontally and vertically integrated in order to create increased customer value and reach. (H)

Another finding of the survey, and one that is of the utmost importance for healthcare players’ strategy, is that it will be essential to integrate the online and offline worlds.

The idea here is to ensure a seamless journey for patients and other healthcare consumers.

As many as 84 percent of respondents expect to see growth of platforms that combine virtual and real-world services.

For example, patients may choose to access a video consultation via a diagnostic platform, but if this is insufficient for a valid diagnosis they will need to be transferred to a specialist for a physical examination. Ensuring that this transition is smooth will be critical.

This integration of online and offline realms is not widespread as yet, but we see signs of it emerging.

Where it does occur, it often originates in the online world. For example, Tencent initially operated online, and only later started connecting real physicians to the network.

Sweden-based provider of digital doctor appointments KRY’s merger with Helsa, which runs physical health centers, is another example; the merger of the two companies makes it possible to offer patients a combination of online and offline treatments.

One possible future scenario is the development of patient-centered healthcare built around collaborative ecosystems with different entry points, depending upon the individual’s needs (prevention, diagnosis, treatment).

Users — both healthy individuals and those requiring treatment — will be able to access a combination of analog and digital services, from consultations and fitness programs to physiotherapy sessions.

It will be essential to integrate the online and the offline world, say 84% of respondents.

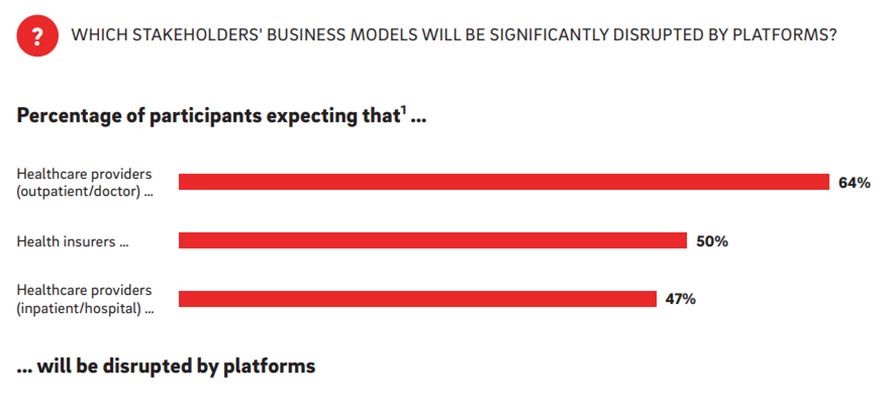

I: Providers of outpatient services and physicians face the greatest disruption

Threat to business models of various stakeholders. 1 Disruption potential of other players: startups: 32%, pharma 29%, medtech: 24%, others: 4%; Source: RB

5. OUTPATIENT CARE WILL SEE THE MOST DISRUPTION

Healthcare providers today enjoy the best access to patients and are therefore in a strong position to succeed with a platform play.

However, providers of outpatient services and physicians face the greatest risk of disruption in terms of their business model (64 percent of responses in the survey).

Other players at risk of disruption are insurance companies (50 percent of responses) and providers of inpatient or hospital care (47 percent).

Less at risk are startups (32 percent), pharmaceutical companies (29 percent) and medtech companies (24 percent). (I)

Thus, the same category of players have both the biggest chance of “owning” patients and the biggest chance of being disrupted.

A contradiction? Not necessarily. Both statements are true for the category as a whole, but some providers will succeed, while others will be swallowed up or displaced by bigger platforms or structures.

The outpatient sector will form a particular battle arena as it represents the normal entry point for patients into the healthcare system.

Our qualitative research on the top 100 healthcare platforms worldwide backs this up.

Currently, more than 60 percent of the top healthcare platforms connect patients and physicians, including areas such as patient records, data transfer, online booking systems and telemedicine.

By contrast, larger networks that include hospitals, pharmacies, insurance companies and other health institutions are often government supported

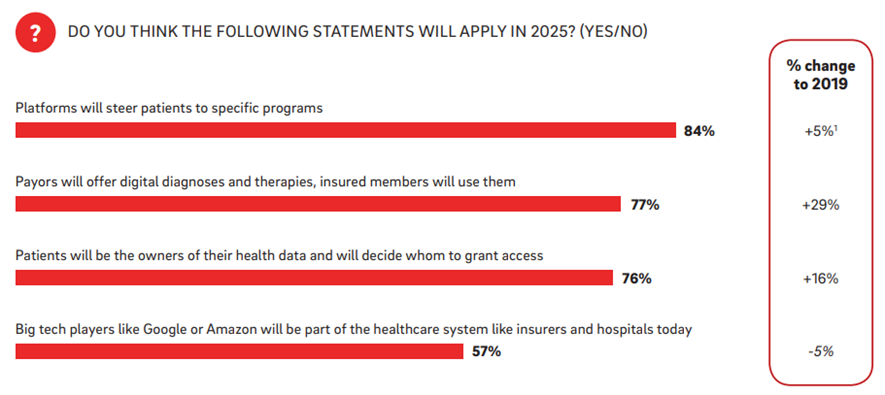

J: Platforms will play an important role in providing and organizing healthcare

Will the following statements hold true for 2025? 1 Question in 2019 survey focused on patient steering by health insurances; Source: RB

Who will pay for the services offered by platform solutions?

More than 80 percent of respondents believe that health insurance companies are most likely to continue acting as payors, as is traditionally the case.

However, legislation such as Germany’s Digital Healthcare Act (DVG) means that digital health solutions will become an established part of the public health insurance system.

At the same time, it is likely that consumers will partly pay for digital health solutions; more than 60 percent of respondents think that private customers will make out-of-pocket payments for additional services.

One possible scenario is that health insurers will pay for most digital solutions but, due to the sheer amount of innovation, a larger portion of healthcare services than today will be paid for by patients out of pocket. (J)

6. EVERYTHING IS STILL TO PLAY FOR

Our final key finding should give industry players food for thought.

Compared to last year’s survey, our respondents this year are even more certain that platforms will be highly relevant in the future.

Some 84 percent believe that platforms will steer patients towards specific treatments, therapies or disease management programs.

All types of platforms are expected to grow in importance through 2025, in a landscape characterized by a variety of digital platforms and both analog and digital services.

Respondents are not expecting a “winner takes all” market. Everything is still to play for.

Notably, respondents are not expecting to see a “winner takes all” market. Everything is still to play for.

What is as yet unclear is whether we will see multiple healthcare platforms coexisting, each focused on specific services, or an oligopoly of platforms, in which a small number of players offer services that cut across different medical conditions or fields.

Fewer people than last year expect the large consumer tech companies to dominate the market.

Rather, the consolidation might be driven from within the healthcare space.

In any case, we will likely see further consolidation in the period to 2025, with some players disappearing altogether.

References

[1] Survey respondents came from Germany, Austria and Switzerland (44%), the rest of Europe (25%), Asia-Pacific (14%), Middle East (8%) and the rest of the world (9%). They included industrial players (23%), healthcare providers (21%), startups and tech companies (19%), health insurers (9%), political bodies (2%) and other stakeholders (26%).

[2] We selected the 100 platforms with the highest number of associated stakeholders. The market leaders together count more than 300 million users.

[3] This figure represents the mean of the experts’ estimates.