This is an excerpt of the report below, focusing on the topic above.

IQVIA

Global Oncology Trends 2022–26

Murray Aitken, Executive Director

IQVIA Institute for Human Data Science

May 2022

EXCERPT BY

Joaquim Cardoso MSc

Cancer Platform Institute

May 2022

NOVEL ACTIVE SUBSTANCES IN ONCOLOGY

A record 30 oncology novel active substances (NASs) were initially launched globally in 2021, 104 in the past five years and a total of 159 since 2012.

While not all of these drugs have become available in every country, most have access to some key breakthroughs in immuno-oncology and the use of precision biomarkers have become the standard of care in dozens of tumors.

In the U.S. there were 83 unique new cancer medicines launched in the past five years, with many approved for more than one indication.

There have been important concentrations of new therapies in solid tumors of the lung, breast, prostate, and skin, as well as hematological malignancies such as non-Hodgkin’s lymphoma and multiple myeloma.

Many of these drugs are receiving accelerated approvals, orphan or breakthrough designations, and a small but increasing number are proceeding from patent filing to product launch in less than five years.

As with most years in the past decade, new medicines launched in 2021 included significant clinical advances across a range of tumors and mechanisms.

The global oncology community and patients continue to struggle with the impact from delays in screenings, diagnoses and cancer care from COVID-19, as well as gaps in access and care which predated the pandemic.

- A number of significant events have occurred in oncology since January 2021, with important implications for drug development.

- A record 30 oncology novel active substances (NASs) were initially launched globally in 2021, and a total of 159 have been launched since 2012.

- A total of 104 oncology NASs have launched globally in the past five years, bringing the 20-year total to 215.

- In the U.S. there were 83 unique new cancer medicines launched in the past five years, with many approved for more than one indication.

- The median time from patent filing to product launch for the 2020 NAS cohort for oncology products fell to 8.5 years in 2021.

- Oncology drugs increasingly receiving accelerated approvals, orphan or breakthrough designations.

- The EMA approved six small molecule and four biologic NASs for oncology in 2021, fewer than the 14 total approved in 2020.

- Since 2011, 96 NASs were launched in the U.S. to treat solid tumors, with some approved for multiple indications.

- In the U.S., there were 55 unique new hematological cancer medicines launched since 2011.

- New medicines launched in 2021 included significant clinical advances across a range of tumors and mechanisms.

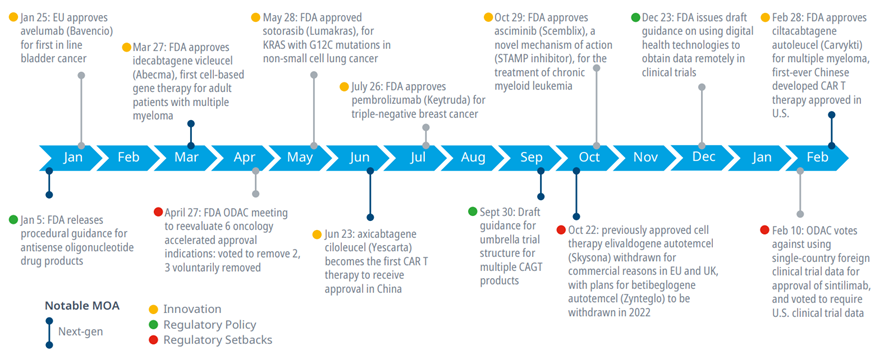

A number of significant events occurred in oncology since January 2021 with important implications for drug development

Exhibit 1: Notable events in drug approvals and regulatory action

Source: IQVIA Institute, Apr 2022.

· 2021 and the beginning of 2022 saw significant events in oncology innovation, regulatory decisions and guidance from the FDA.

· Next-generation biotherapeutics continue to be important in oncology with an increasing focus on chimeric antigen receptor (CAR) T-cell therapies. FDA approved idecabtagene vicleucel (Abecma) and ciltacabtagene autoleucel (Carvykti) for multiple myeloma. Carvykti became the first Chinese developed CAR T therapy to be approved in the U.S. Additionally, axicabtagene ciloleucel (Yescarta) became the first CAR T therapy approved in China, highlighting the increasing role of China in research and development.

· In April last year, FDA requested the Oncologic Drugs Advisory Committee (ODAC) re-evaluate accelerated approval indications for PD-1/L1 checkpoint inhibitors. In total, nine accelerated approval indications were withdrawn or revoked for PD-1/L1 checkpoint inhibitors in 2021, with most of these voluntarily withdrawn by companies prior to or following the ODAC meeting. By contrast, checkpoint inhibitors are still approved for dozens of other indications that have not been withdrawn or revoked.

· ODAC also highlighted the importance of U.S. clinical trial data in the review of sintilimab, a Chinese developed checkpoint inhibitor, which it rejected for several reasons, including having China-only clinical trial data and being unrepresentative of the U.S. population as well as the trial lacking FDA site inspections.

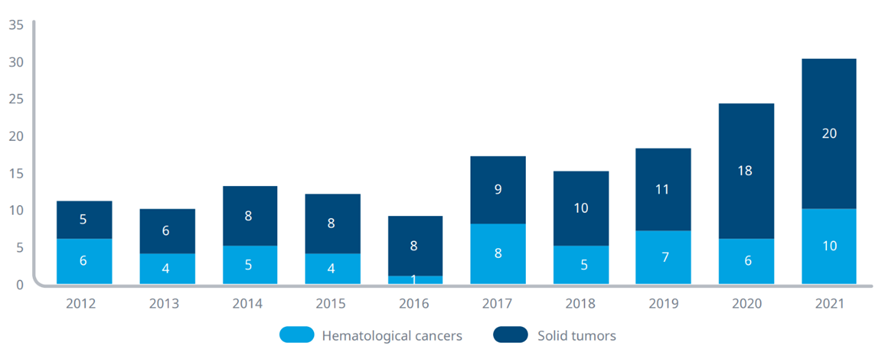

A record 30 oncology novel active substances (NASs) were initially launched globally in 2021, with 159 total since 2012

Exhibit 2: Global oncology launches of novel active substances (NAS), 2012–2021

Source: IQVIA Institute, Apr 2022

Notes: A novel active substance (NAS) is a new molecular or biologic entity or combination where at least one element is new; includes NASs launched anywhere in the world by year of first global launch. Oncology includes diagnostics.

· A record 30 novel active substances (NASs) for oncology were launched globally in 2021.

· While the number of NASs launched for oncology globally averaged 11 each year from 2012–2016 — and averaged just 5 the five years prior — this has grown to an average of 21 new oncology launches each year from 2017–2021 and is steadily trending upward.

· Two-thirds of oncology NAS launches have been for solid tumors in recent years, with 68 launches for solid tumors in the last five years, up from 35 in the five years prior.

· While a majority of the innovation has been in solid tumors, hematological cancers continue to see increased innovation, with 36 NASs launched for hematological cancers in the last five years, up from 20 in the five years prior.

· Many of the NAS launched have multiple indications, further increasing the number of patients who may benefit from these novel compounds.

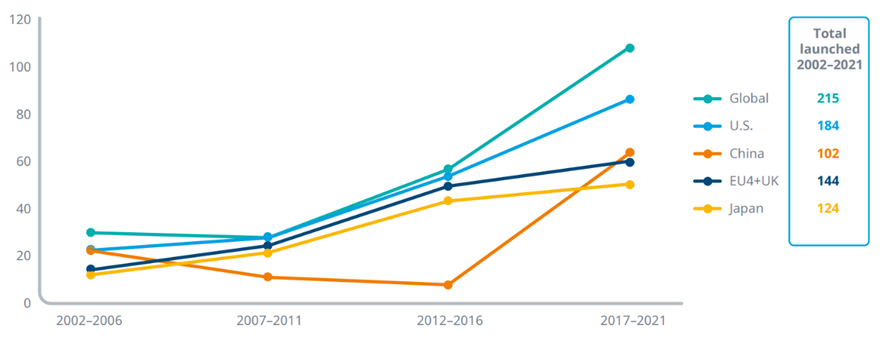

A total of 104 oncology NASs have launched globally in the past 5 years and 215 over 20 years, with large geographic variations

Exhibit 3: Number of oncology novel active substances launched globally and in selected countries

Source: IQVIA Institute, Apr 2022

Notes: A novel active substance (NAS) is a new molecular or biologic entity or combination where at least one element is new and is noted in the year it launches for the first time in the relevant geography. Oncology includes diagnostics.

· Globally, 215 NASs have launched to treat cancers in the last 20 years, with nearly half of these (104) in the last five years.

· The U.S. has seen 83 NAS launches for oncology in the last five years, with 184 over the last 20 years, and has consistently been first to launch the majority of cancer medicines worldwide.

· Notably, 21 global NASs launched in the last five years have not launched in the U.S., and all but two were first launched in China or Japan, suggesting the emergence of divergent sources and destinations of innovation.

· EU4+UK has had 58 oncology NASs launched in the last five years and 144 over the 20-year period, with 31 of those launched in the U.S. during 2017–2021 not yet approved in Europe.

· China had 61 oncology NASs launched in the most recent five-year period compared to 41 from 2002–2016. This is likely driven by regulatory acceleration mechanisms from the National Medical Products Administration (NMPA) to bring both domestic and foreign developed drugs to Chinese citizens faster.

· Of the 61 NASs launched in China during 2017–2021, 14 have only been launched in China and only three of these have no development activity outside of China.

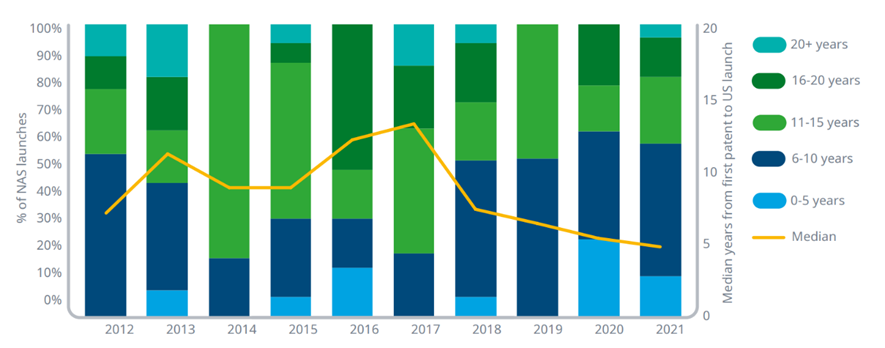

8 oncology drugs were launched less than 5 years into their patent terms in the past 2 years, up from 4 in total from 2012–2019

Exhibit 4: Time from first patent filing and U.S. launch for novel active substances (NASs), 2012–2021

Source: IQVIA ARK Patent Intelligence, IQVIA Institute, Apr 2022.

Notes: For each novel active substance (NAS) launched, the first patent filing was researched to determine the time difference. The patent is not necessarily the binding patent that determines loss of exclusivity but represents the first time the sponsor deemed the innovation worthy of filing. Oncology includes diagnostics. Time from first patent filing to launch relates to the first indication(s) regardless of the future withdrawal or revocation of those indications. None of the withdrawn indications (see exhibit 1) were first indications for the relevant products.

· The time between the first patent filing for a drug and the launch into the market represents an important assessment of the amount of protected life remaining when a product launches.

· As some accelerated approval pathways shorten approval times, this measurement of elapsed time provides insight into whether the acceleration changes these other dynamics of a product’s lifecycle.

· The median patent to launch for the 2021 oncology NAS cohort was 8.5 years and is the shortest since 2007.

· The median patent to launch has declined significantly for oncology products launched in recent years, from a peak median patent to launch time of nearly 15 years in 2017.

· Sixty-one percent of oncology NASs launched in 2020 and 2021 had patent to launch times less than 10 years, with 20% less than five years.

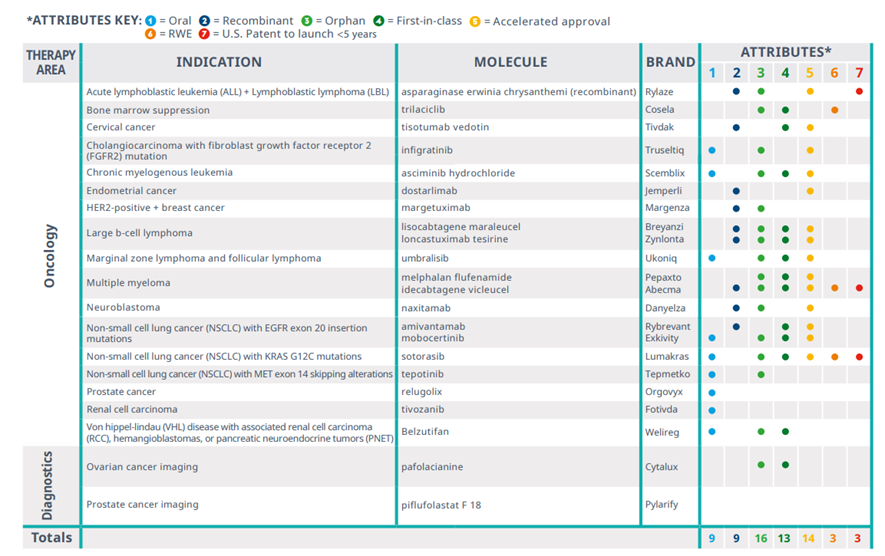

There were 20 new cancer medicines and 2 cancer diagnostic agents, with 16 that were orphan designate

Exhibit 5: Oncologic novel active substances launched in the U.S. in 2021

Source: IQVIA Institute, Apr 2022.

· Twenty-two oncology novel active substances were launched in the U.S. in 2021 across a variety of solid tumors and hematological cancers, including two diagnostic agents.

· Sixteen of these NASs launched with orphan drug designations and 13 were first-in-class, indicating a focus on new mechanisms of action to treat rare cancers.

· Nearly half were oral medications that may be easier to administer outside of a hospital or clinic, a benefit for cancer patients but involving different patient cost-sharing models, depending on the patient’s insurance.

· Sixty-four percent were approved through accelerated approval and will require further confirmatory clinical trials before conversion to standard approval.

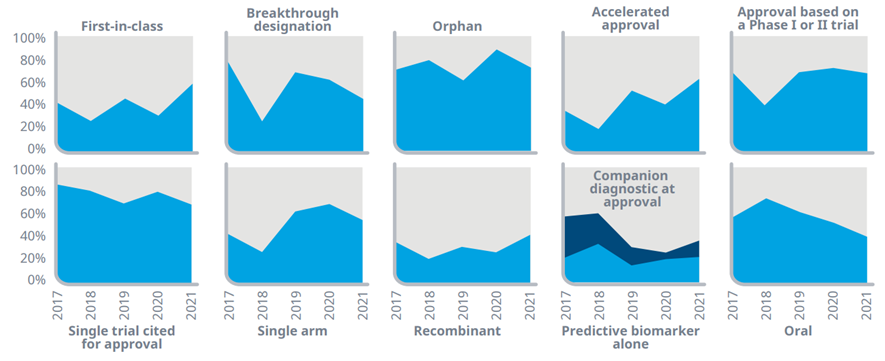

Oncology drugs increasingly receiving accelerated approvals, orphan designations and are approved based on early trials

Exhibit 6: U.S. oncology NAS launches by characteristics of approval, 2017–2021

Source: IQVIA Institute, Apr 2022

Notes: A novel active substance (NAS) is a new molecular or biologic entity or combination where at least one element is new; includes NASs launched in the U.S. 2017–2021 regardless of the timing of FDA approval. Oncology includes diagnostics. Orphans include drugs with one or more orphan indications approved by the FDA at product launch. Products are not reclassified in this analysis as orphan if they subsequently receive an approval for an orphan designated indication after the launch year.

· New launches in the past six years have demonstrated diverse trends across specialized attributes relating to their novelty, form, approval pathway, and nature of evidence.

· Most of the discovery and development of new oncology medicines in recent years has focused on patients with rare cancers where few, if any, treatments may already exist, and 76% of NAS launches in the last five years received one or more orphan designations.

· Drugs which were the first-in-class using a novel mechanism represent an increasing share of NAS launches in oncology, with 59% in 2021 and 42% in the last five years.

· Increasingly, oncologics are approved through accelerated approval, with 64% of 2021 NAS launches approved this way, up from 36% in 2017.

· Many of the medicines over the past five years have been approved based on relatively limited trial evidence, in single trials with a single study arm, and based on their demonstrated evidence in earlier phase trials.

· The number of new oncologics administered orally has been declining, with 41% of the launches in 2021 and 55% in the last five years, an aspect that influences the setting in which they can be administered and the type of insurance benefit that covers them.

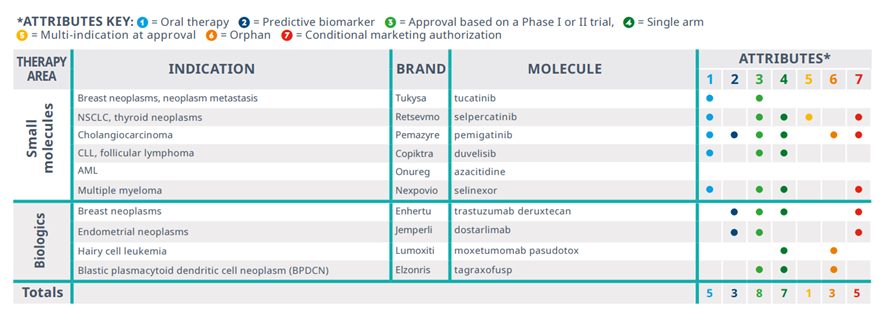

The EMA approved 6 small molecule and 4 biologic NASs for oncology in 2021, fewer than the 14 total approved in 2020

Exhibit 7: EMA approval trends for oncologic NASs approved for the first time in 2021

Source: IQVIA Institute, Apr 2022.

Notes: AML=acute myeloid leukemia; NSCLC=non-small cell lung cancer; CLL=chronic lymphocytic leukemia.

· There were 10 new oncology drugs approved by the EMA in 2021, fewer than the 14 approved in 2020.

· Only three were associated with predictive biomarkers, including dostarlimab (Jemperli) a PD-1 checkpoint inhibitor, and trastuzumab deruxtecan (Enhertu), an antibody-drug conjugate targeting HER2-positive breast cancer.

· Five out of ten approvals are small molecules administered orally, reducing the need for specialty visits for IV infusions.

· Only three were developed to address rare cancers, notably different from the U.S. launches where nearly all received orphan designation.

· Nearly all (8 of 10) were approved based on earlier phase trials, and half are conditional marketing authorizations. EMA has noted that these authorizations require further data post-approval to convert to full approvals and have balanced the unmet need of patients with the benefit to patients of the immediate availability of the new treatments.

· With the robust numbers of ongoing clinical trials, along with rising numbers of approved treatments essentially competing for patients, the scarcity of eligible patients is becoming a factor for sponsors and regulators to balance in determining the risks and benefits of novel drugs.

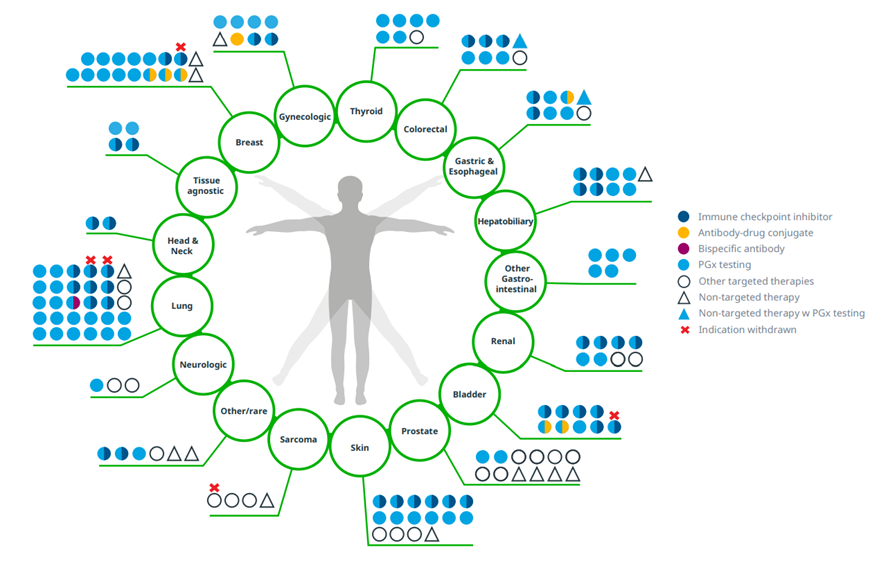

Since 2011, 96 NASs were launched in the U.S. to treat solid tumors, with some approved for multiple indications

Exhibit 8: U.S. NASs in solid tumors launched 2011–2021 with indications including those granted after initial launch

Source: IQVIA Institute, May 2022.

Notes: Oncology excludes supportive care. Targeted therapies are cancer treatments that target specific genes and proteins that are involved in the growth and survival of cancer cells. PGx testing is a type of genetic test that assesses a patient’s risk of an adverse response or likelihood to respond to a given drug, informing drug selection and dosing. Gynecologic cancers include cervical cancer, endometrial cancer, and ovarian cancer. Neurologic cancers include neuroblastoma and neurofibromatosis. Other gastrointestinal includes cholangiocarcinoma, gastroenteropancreatic neuroendocrine tumors, and pancreatic cancer. Other/rare includes cancers associated with von Hippel-Lindau disease, pleural mesothelioma, tenosynovial giant cell tumor, and neuroendocrine tumors. Skin includes basal cell carcinoma, melanoma, merkel cell carcinoma, and squamous cell carcinoma. Products with multiple attributes are represented with more than one color. Products may be approved for more than one indication within each type of cancer (e.g., small cell lung cancer and non-small cell lung cancer) but are only represented once; withdrawals are only indicated if the product had all approvals within that group of cancers withdrawn or revoked.

· Ninety-six novel cancer drugs have launched in the U.S. since 2011 to treat solid tumors, with 25 approved for multiple indications since launch.

· Significant innovation has occurred in lung cancer, with 30 products launched and predominantly targeted therapies for a variety of biomarker subtypes, including eight checkpoint inhibitors and one bispecific antibody.

· Breast cancer has had 17 new medicines launched for treatment since 2011, including three antibody-drug conjugates targeting HER2-positive and triple-negative breast cancer.

· Most novel cancer treatments utilize pharmacogenetic testing (PGx) providing personalized care to ensure the appropriate dose and drug are selected for each individual patient.

· Checkpoint inhibitors have provided significant therapeutic improvements across a range of solid tumors; however, nine indications have been withdrawn or revoked for these drugs following accelerated approval.[1]

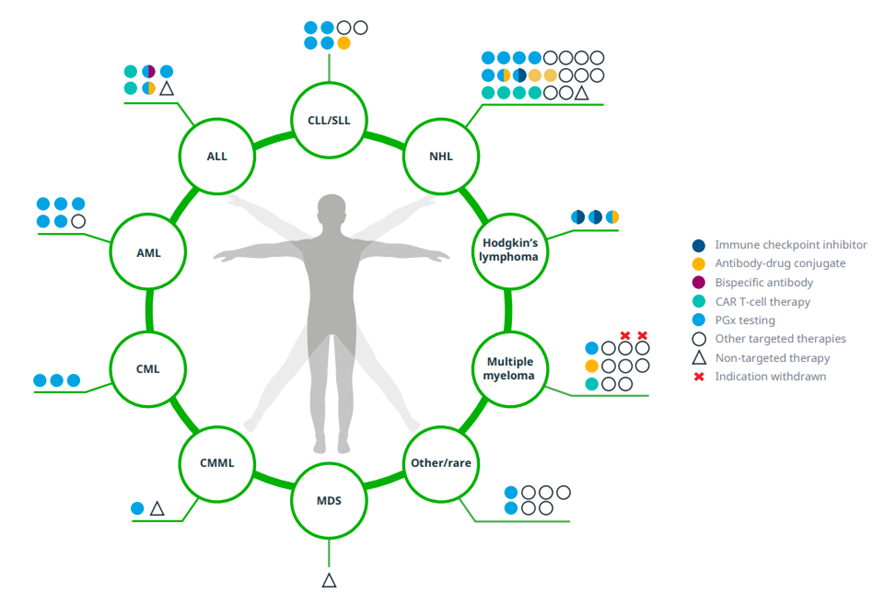

In the U.S., 55 unique new hematological cancer medicines have been launched since 2011

Exhibit 9: U.S. NASs in hematology-oncology launched 2011–2021 with indications including those granted after initial launch

Source: IQVIA Institute, May 2022.

Notes: Oncology excludes supportive care. ALL=acute lymphoblastic leukemia; AML=acute myeloid leukemia; CLL=chronic lymphocytic leukemia; CML=chronic myeloid leukemia; CMML=chronic myelomonocytic leukemia; MDS=myelodysplastic syndrome; SLL=small lymphocytic lymphoma. Targeted therapies is a cancer treatment that uses drugs to target specific genes and proteins that are involved in the growth and survival of cancer cells. PGx testing is a type of genetic test that assesses a patient’s risk of an adverse response or likelihood to respond to a given drug, informing drug selection and dosing. Other/rare includes advanced systemic mastocytosis, blastic plasmacytoid dendritic cell neoplasms, Castleman disease, Erdheim-Chester disease, myelofibrosis, and polycythemia vera. Products may be approved for more than one indication within each type of cancer (e.g., small cell lung cancer and non-small cell lung cancer) but are only represented once; withdrawals are only indicated if the product had all approvals within that group of cancers withdrawn or revoked.

· Fifty-five novel hematological cancer drugs have launched in the U.S. since 2011, with 17 approved for multiple indications since launch.

· Non-Hodgkin’s lymphoma has seen the most innovation in hematological cancers, with 23 new drugs launched since 2011. This includes four CAR T cell therapies and three antibody-drug conjugates predominantly for the treatment of relapsed or refractory large B-cell lymphoma.

· Twelve new drugs have been launched since 2011 to treat multiple myeloma, including a CAR T cell therapy and antibody-drug conjugate. Another CAR T cell therapy was launched for multiple myeloma in early 2022 (not shown). Notably two products for the treatment of multiple myeloma have been withdrawn, with one of them just having launched in 2021.

· Although fewer novel drugs have been launched for leukemias, there have been important steps in innovation particularly for acute lymphoblastic leukemia, which has had two CAR T cell therapies, a bispecific antibody and an antibody-drug conjugate introduced for treatment in the last decade.

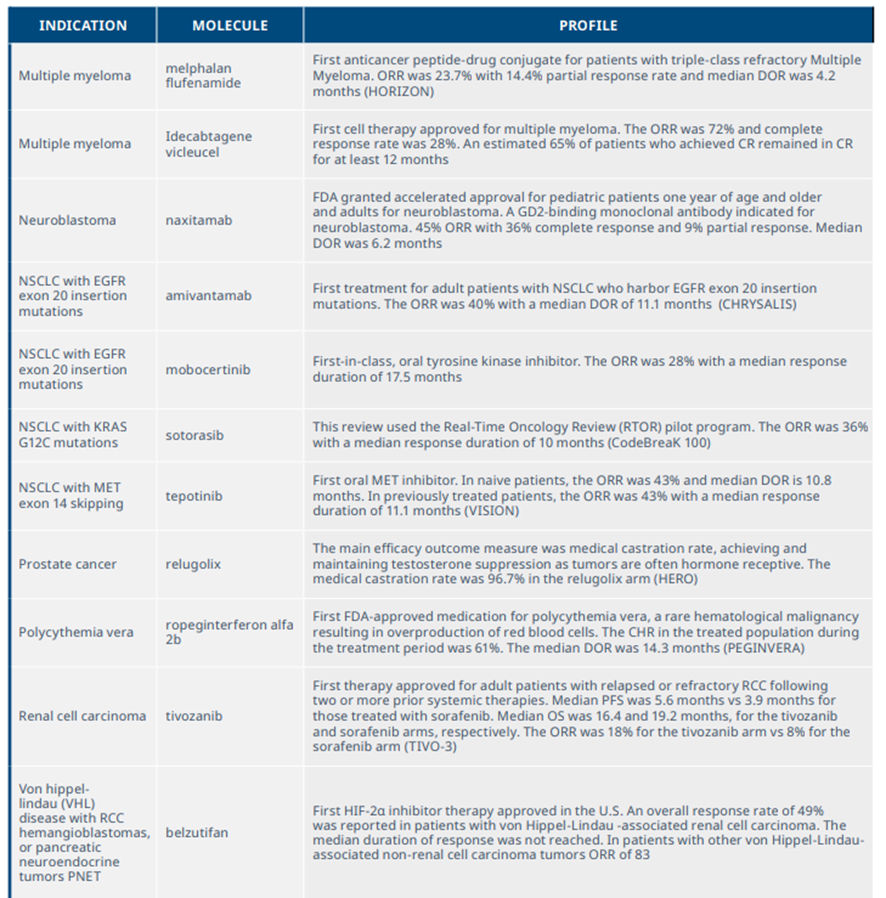

New medicines launched in 2021 included significant clinical advances across a range of tumors and mechanisms

Exhibit 10: NASs launched in 2021 and summary of clinical benefits

Source: IQVIA Institute, Apr 2022.

Notes: Summary of trials used as the basis for FDA approval of relevant drugs. ORR=overall response rate, CR=complete response, DOR=duration of response, PFS= progression-free survival, RMAT=Regenerative medicine advanced therapy designation.

[1] Friends of Cancer Research. Targeted Oncology — FDA Cracks Down on Dangling Accelerated Approvals in 2021, Pathway Is Scrutinized. 2021 Dec 20. Available from: https://friendsofcancerresearch.org/news/ targeted-oncology-fda-cracks-down-on-dangling-accelerated-approvals-in-2021-pathway-is-scrutinized/. Accessed May 16, 2022.

WEB SUMMARY (of the full version)

IQVIA

Global Oncology Trends 2022–26

Murray Aitken, Executive Director

IQVIA Institute for Human Data Science

May 2022

Oncology is the leading therapy area for innovation — in terms of the level of clinical trial activity, number of companies investing in therapeutics, size of the pipeline of therapies in clinical development, novel active substances being launched, and the level of expenditure on these drugs.

In 2021, during a global pandemic, cancer care continued to be delivered although a backlog in treatment and screenings raised worrying questions.

In a record-setting year, more novel cancer medicines became available for the first time than in any year in history, and many of them employ immunology or precision biomarkers to transform the way patients are treated.

Adoption of breakthrough medicines and diagnostics is improving outcomes for millions around the world, though broad and equitable access remains a significant challenge to healthcare stakeholders — including patients.

This year’s annual report on Global Oncology Trends examines those novel medicines and the clusters of research, which promise a continuing sequence of breakthroughs in the decade to come.

The report explores the impact of COVID-19 disruptions and the longer-term trends in the use of cancer medicines as well as the drivers of spending globally, in key geographies, by tumor type, and for specific types of oncology drugs.

Key Findings

- Oncology trial starts reached historically high levels in 2021, up 56% from 2016 and mostly focused on rare cancer indications

- A record 30 oncology novel active substances (NASs) were initially launched globally in 2021, and a total of 159 have been launched since 2012

- Oncologists report caseloads are 20–29% below pre-COVID-19 levels, and while cancer screenings in the U.S. have returned to pre-pandemic levels, more than 30 million screenings in four common tumors were disrupted since the start of the pandemic, risking delayed or missed diagnoses for more than 58,000 patients

- Global numbers of treated patients have increased at an average of 4% over the past five years

- Global oncology spending is expected to exceed $300 billion by 2026

Oncologists report caseloads are 20–29% below pre-COVID-19 levels, and while cancer screenings in the U.S. have returned to pre-pandemic levels, …

… more than 30 million screenings in four common tumors were disrupted since the start of the pandemic, risking delayed or missed diagnoses for more than 58,000 patients

Originally published at https://www.iqvia.com