health transformation institute (HTI)

the most comprehensive knowledge portal, for health transformation

Joaquim Cardoso MSc*

Founder, Chief Researcher and Editor

November 28, 2022

MSc* from London Business School — MIT Sloan Masters Program

This is a republication of the white paper “If Disruption Is the New Normal, Operational Resilience Is the New Necessity”, with the title above.

- A lot has happened since COVID-19 first disrupted the world order nearly three years ago.

The war in Ukraine, rising inflation, and severe weather events — all happening on top of the ongoing pandemic and associated challenges, such as the semiconductor shortage — have made it plain that disruption is no longer a one-off event.

Extreme volatility is the new reality worldwide.

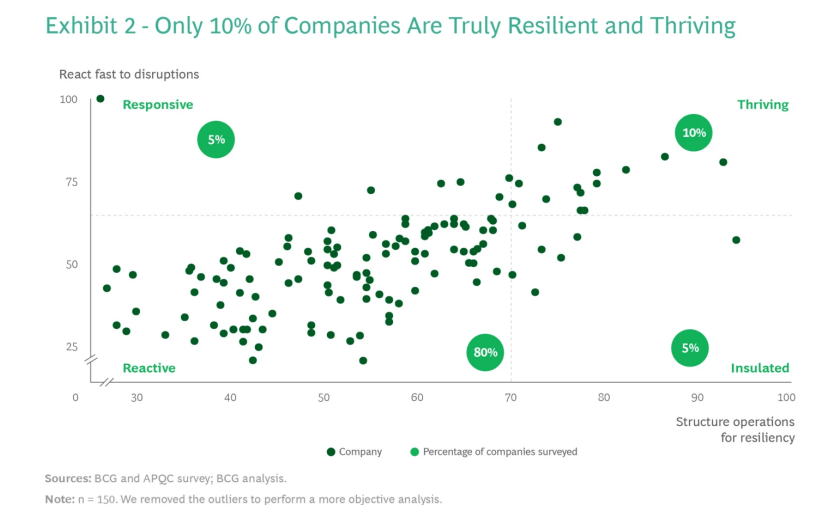

- Most companies are not prepared. BCG and APQC conducted a survey of 150 companies during the summer of 2022, and only 10% had developed the full range of resilience capabilities needed to thrive.

- Only these elite companies are able to adequately anticipate and recover from a crisis in the short term and be resilient over the middle and long terms.

- By contrast, most of the remaining 90% are simply reacting to crises as they occur.

What thriving companies do?

- Thriving. Only 10% of the companies that participated in our survey are what we call thrivers: they excel in all dimensions of the framework.

- The average thriver has more mature visibility and risk-assessment capabilities than do other companies.

- But there is significant variation among thrivers: only 50% of these companies are very strong in visibility and assessment.

What are the recommendations?

- To join the elite 10% and thrive, responsive, reactive, and insulated companies must build all the capabilities needed to implement the operations resilience framework — developing just a few capabilities is not sufficient.

- This undertaking will require investing time and money.

- Clearly, nearly all companies must increase their investments in capabilities that enhance their resilience. Organizations that invest significantly can create a potent source of competitive advantage.

What are the benefits?

- However, when companies are reasonably proficient, they will be prepared for the next crisis — and the one after that and the one after that.

- And, hopefully, fire drills will be a thing of the past.

Infographic

ORIGINAL PUBLICATION (full version)

If Disruption Is the New Normal, Operational Resilience Is the New Necessity

NOVEMBER 21, 2022

By Ben Aylor, Jeremy Kay, Neeru Pandey, and Rainer Schuster

A Framework for Resilience

While risk mitigation has become increasingly important in recent years, many companies do not plan for the full landscape of potential risks, including disruptions in their own plants, interruptions in supply from vendors, and external risks (such as geopolitical events and natural disasters).

As a result, when crises occur, these organizations lack resilience — the ability to quickly identify and assess the risks, react fast, and absorb the impacts of the disruptions across the supply chain.

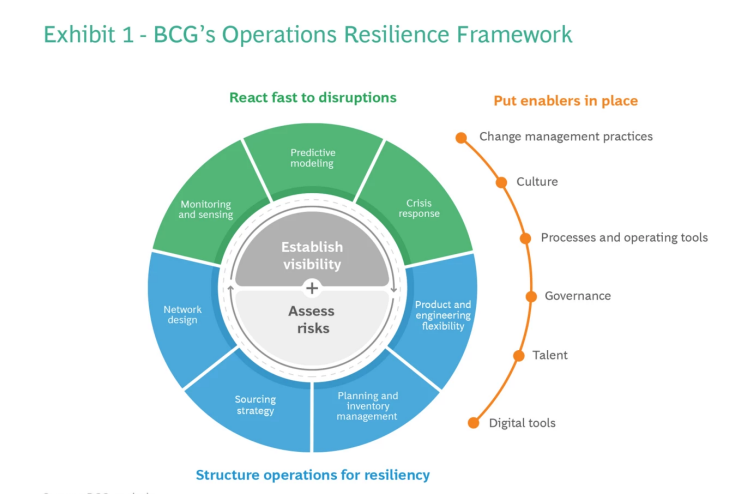

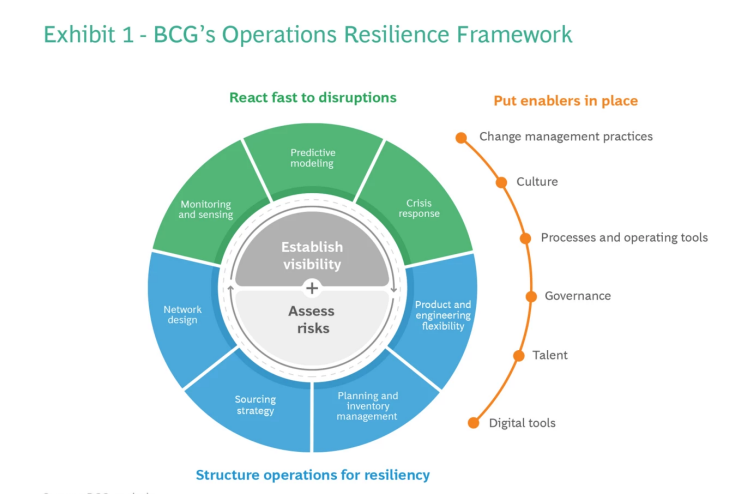

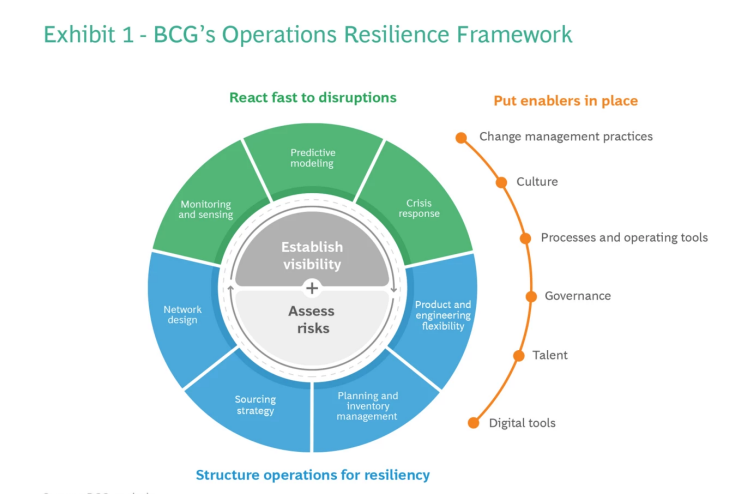

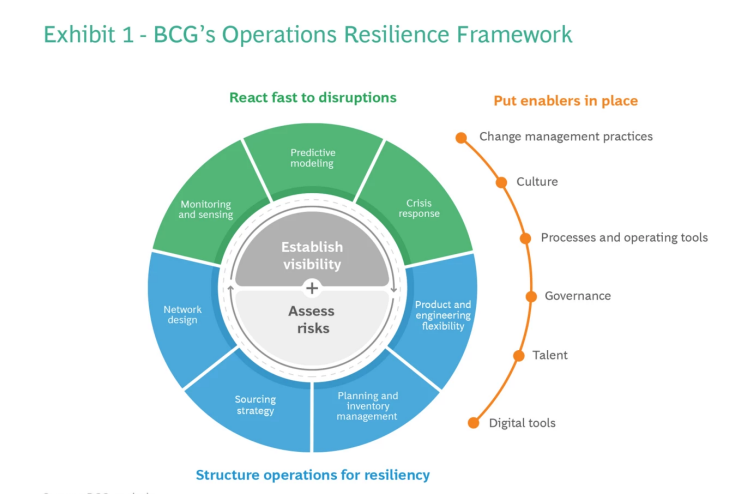

Companies can develop resilience by implementing BCG’s operations resilience framework. (See Exhibit 1.)

Establish visibility and assess risks. Companies that want to build resilience first need to establish full visibility across the supply chain. They need to have a clear view of inventory across suppliers, manufacturing plants, warehouses, logistics providers, and customers. Such visibility enables robust end-to-end (E2E) planning and inventory management and makes it easier to rapidly assess the impacts of potential disruptions.

To establish full E2E visibility, organizations should gain insight into the operations of suppliers-all the way back to the raw material sources-by using an always-on network map to display flows across the various tiers. Control towers are also useful.

To assess the risks in their supply chain, companies need to analyze the data from these different sources. KPIs and other operational metrics will help identify potential points of failure at the part, supplier, location, and product levels. These metrics will also help quantify how likely a potential exposure is and how long mitigation will take.

Organizations should also run scenarios to gauge the impacts of different kinds of disruptions. This practice is critical even for risks that seem very unlikely. Some of the largest disruptions in recent years-such as COVID-19 and the Suez Canal blockage in 2021-were low-probability events.

React fast to disruptions. If-or rather when-an unpredicted disruption occurs, a resilient supply chain can respond quickly to ensure that operations recover and return to business as usual. The faster companies can react in a crisis, the more likely they are to secure a first-mover advantage in acquiring scarce materials or capacity. A speedy response involves the following:

- Monitoring and Sensing. Organizations need to monitor external events that may impact operations across the supply chain and proactively send alerts of potential deviations and disruptions.

- Predictive Modeling. Scenario planning helps an organization grasp the impact of potential disruptions on the supply chain under various market and supply chain conditions. And digital twins make it possible to see the impact of different actions and choose the best ones to address declining revenue and increasing costs.

- Crisis Response. Processes, a playbook, and planning tools are key for optimizing decision making should a crisis occur. And real-time data is critical for responding to crises occurring in real time.

Structure operations for resiliency. To reduce exposure to risks and ward off potential disruptions to their operations long term, companies need to address four key aspects:

- Network Design. Organizations should design their supply chain network to reduce single points of failure, increase supply redundancy, and shorten the supply chain. A good network design balances these goals against cost considerations.

- Sourcing Strategy. Recent crises have shown that sourcing requires a more integrated strategy than in the past. Organizations need to have a good understanding of their suppliers’ lead times and disruption risks. Companies also need to make sourcing decisions in conjunction with strategy decisions for buffering (having backup inventory) and redundancy (having multiple suppliers). Critical materials should always be available from two or more sources to ensure that capacity is always available.

- Planning and Inventory Management. Resilient companies plan with volatility in mind. They strategically deploy inventory, allocating their most critical materials and products to multiple locations to meet customer service levels while minimizing inventory and storage levels. By integrating resilience considerations into short-term sales and operations execution as well as long-term sales and operations planning, organizations are better equipped to balance cost, risk, and working capital.

- Product and Engineering Flexibility. Organizations should develop resilient products by building flexibility into the design specifications and by using standardized or off-the-shelf components wherever possible. This approach enables easier substitutions and access to a larger pool of capable suppliers or manufacturing locations. Companies should also develop a robust design-change process so that substitutions and deviations from the original design can be evaluated and adapted on an as-needed basis.

Put enablers in place. Even operations that are strong on the three previous dimensions won’t be effective unless companies fundamentally change the way they make decisions and emphasize risk identification and mitigation.

Making this shift requires a strong foundation of enablers-change management practices, a culture that supports a mindset of resilience, processes and operating tools, governance, and talent. Together, these enablers break down silos, fostering the cross-functional collaboration and fast decision making that are essential to resilience.

Advanced digital tools are especially important enablers: when combined with business processes, they can augment human capabilities and unlock new sources of value.

For example, an AI-powered platform can make real-time supply chain decisions autonomously, helping organizations cope with market volatility more effectively.

Advanced digital tools are especially important enablers: when combined with business processes, they can augment human capabilities and unlock new sources of value.

The Resilience Capabilities Benchmark

In July 2022, BCG and APQC fielded a global survey of 150 companies to assess their capabilities for resilience across five key sectors-automotive, consumer packaged goods, health care, industrial goods, and retail. Each company was graded across nine resilience subdimensions.

The Resiliency Matrix

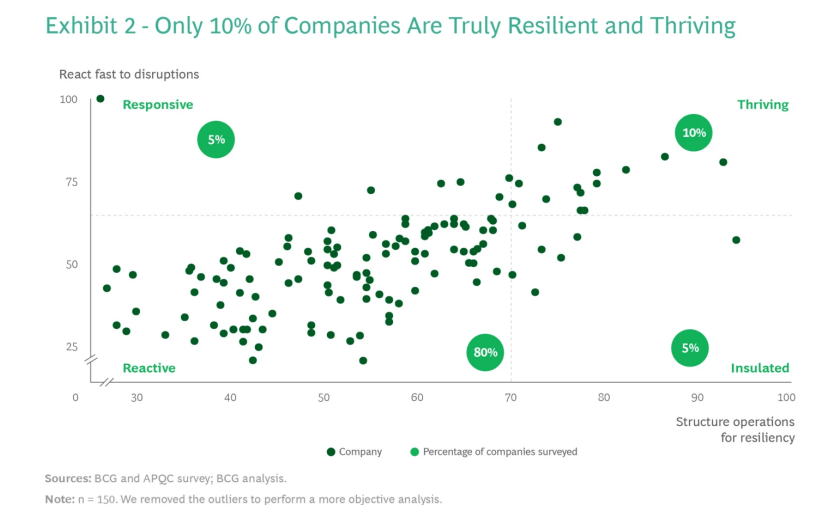

The companies that participated in our survey fall into four quadrants: thriving, responsive, reactive, and insulated.

Thriving. Only 10% of the companies that participated in our survey are what we call thrivers: they excel in all dimensions of the framework.

The average thriver has more mature visibility and risk-assessment capabilities than do other companies. But there is significant variation among thrivers: only 50% of these companies are very strong in visibility and assessment.

When it comes to reacting fast to disruptions, thrivers stand apart because of their monitoring, prediction, and crisis response capabilities. (See Exhibit 2.) And they are able to structure operations for long-term resilience because of their robust network design, sourcing strategy, and product and engineering flexibility. However, thrivers’ planning and inventory capabilities are less mature. We may surmise that thrivers’ strengths have allowed them to sidestep the need to develop inventory management expertise.

Responsive. Five percent of the companies surveyed are responsive: they have built the capabilities needed to manage short-term disruptions well, but they have not structured their operations to absorb unexpected volatility over the medium and long terms. As a result, these organizations are forced to rely on their ability to make operational adjustments quickly in times of disruption.

Reactive. Eighty percent of companies are reactive: they are unprepared to quickly address disruptions that may occur, and their operations aren’t structured for long-term resilience. Consequently, these companies are prey to cycles of firefighting. They are also unable to make the investment required to become responsive or to thrive.

Insulated. Five percent of companies are insulated: they’ve structured their operations to avert disruptions over the medium and long terms by managing inventory, sourcing from multiple suppliers, and carefully designing their supply chain network. Yet they are relatively immature in their ability to sense unexpected crises and react quickly.

STRATEGIC PRIORITIES

Given the increasing number of disruptions over the past several years, one may expect that all organizations would be investing to improve their resilience.

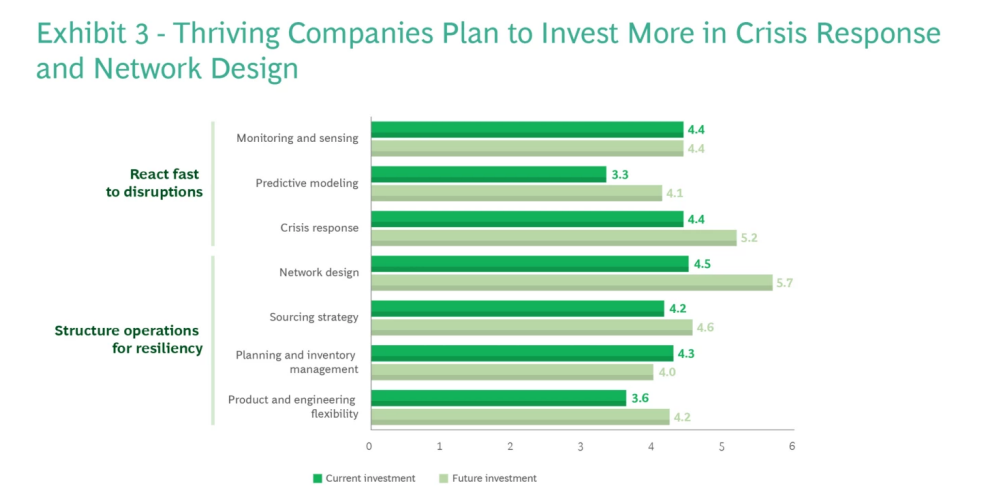

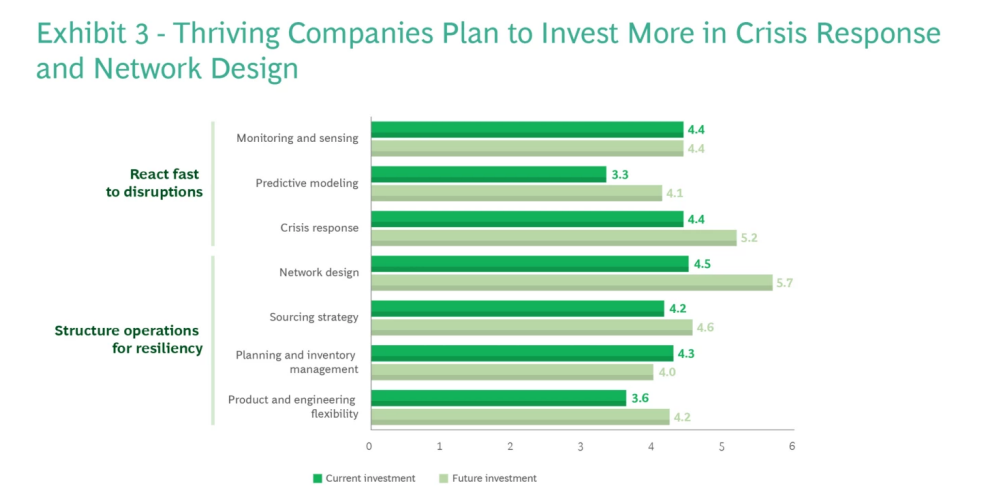

Yet only thrivers are planning to increase their investments. While they are currently investing across the board, they are planning to focus more on network design and crisis response in the future. (See Exhibit 3.)

This finding has major implications for all companies.

Clearly, thriving companies are not sitting on their laurels. They are upping their investments to ensure that their operations are resilient five years from now. Thrivers understand that increasing their investments is key to ensuring resilience and the competitive edge it bestows.

Greater investments in resilience are key for responsive, reactive, and insulated companies as well, though for obviously different reasons. Those that fail to make resilience a top priority will become increasingly vulnerable to disruption — and the gap between thrivers and the rest will widen further.

To join the elite 10% and thrive, responsive, reactive, and insulated companies must build all the capabilities needed to implement the operations resilience framework — developing just a few capabilities is not sufficient.

This undertaking will require investing time and money.

However, when companies are reasonably proficient, they will be prepared for the next crisis — and the one after that and the one after that.

And, hopefully, fire drills will be a thing of the past.

The authors wish to thank Dustin Klimczak, Jonathan Malankar, and Ashish Pathak for their contributions to this article.

Originally published at https://www.bcg.com on November 16, 2022.