institute for continuous

health transformation

Joaquim Cardoso MSc

Founder and Chief Researcher & Editor

January 30, 2023

Wellcome

25 January 2023

This report gathers the perspectives of vaccine manufacturers in Africa, highlighting the challenges to scaling up vaccine manufacturing capacity and capabilities, and the areas where manufacturers most need support.

It provides a guide for public health initiatives and investment decisions while recognising that each manufacturer has its own needs and areas of focus.

What’s inside

- The perspective of African manufacturers on the barriers to scaling up vaccine manufacturing capacity.

- The major risks which impact manufacturers’ economic viability and prerequisites to create conditions for a sustainable ecosystem.

- A methodology to identify strategic priorities for vaccine manufacturing and vaccine research and development (R&D) in Africa.

- Priority areas for donors, African governments, continental organisations and global health organisations to support African manufacturers.

- Case studies on vaccine manufacturing, including the Coalition for Epidemic Preparedness Innovations (CEPI) R&D programme for a Lassa fever vaccine and South Africa’s government initiative to develop local biotechnology talent.

Who this is for

- Public, private and philanthropic funders

- Continental health organisations and the global health community

- African governments and policy makers

- African and global vaccine manufacturers

Key findings

In 2021, the African Union and Africa Centres for Disease Control and Prevention (CDC) established Partnerships for African Vaccine Manufacturing (PAVM).

In March 2022, PAVM shared a bold goal in its continental strategy:

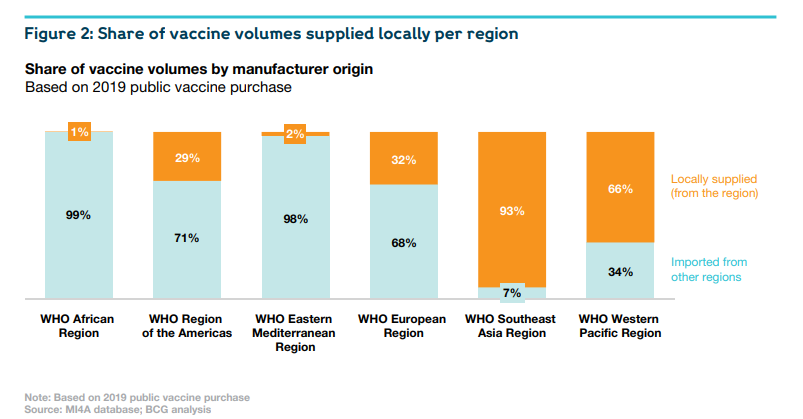

by 2040, the African vaccine manufacturing industry would develop, produce and supply over 60% of the continent’s total vaccine doses — from a base of less than 1% today.

by 2040, the African vaccine manufacturing industry would develop, produce and supply over 60% of the continent’s total vaccine doses — from a base of less than 1% today.

The past 18 months have produced many promising announcements and initiatives to develop vaccine manufacturing capacity in Africa.

But African manufacturers say that economic viability is crucial and still needs to be demonstrated, with significant risks to overcome for the strategy to be successful in the long term.

African manufacturers identify three major risks to the desired economic viability:

1.Sustainability risk: The historic dynamic, described by Gavi, the Vaccine Alliance, as the “high-price and low-volume trap”, persists, and measures are required to change it. Manufacturing initiatives also remain uncoordinated, creating a risk of overcapacity.

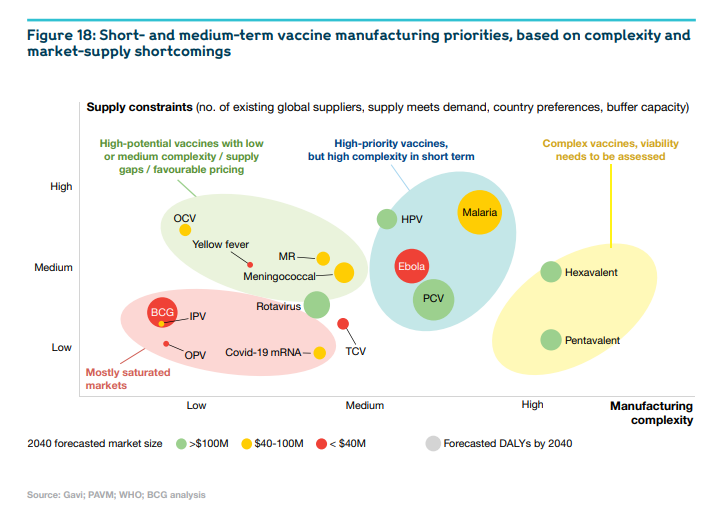

2.Strategic risk: African manufacturers need to identify which vaccines and technology platforms to prioritise in the short- and mid-term. They would have to consider the manufacturing complexity of a product, and the current and future global supply and demand.

3.Support risk: As the Covid-19 pandemic recedes, the attention and efforts being offered by national, continental and global stakeholders could also decrease.

African vaccine manufacturers have made a clear call to action to overcome existing concerns and accelerate change:

- African governments are expected to prioritise continental supply (even if more expensive) and put a supportive economic and regulatory environment in place.

- Global health organisations must introduce supportive procurement and financial mechanisms to create conditions for a sustainable vaccine manufacturing ecosystem.

- Donors need to offer sustained support to manufacturers, to help them overcome the obstacles to strengthening capabilities and scaling up capacity.

- Continental organisations must coordinate information sharing, provide market intelligence, and revisit strategic ambitions and priorities.

- African manufacturers should focus on strategic and realistic priorities, such as supply-constrained products with less complex end-to-end manufacturing processes.

“Once the system gets going and funding is there with designated and orchestrated governance, everyone will see the advantage of working together.” African health organisation

Executive Summary

The Covid-19 pandemic served as a wake-up call for many global health organisations and policymakers.

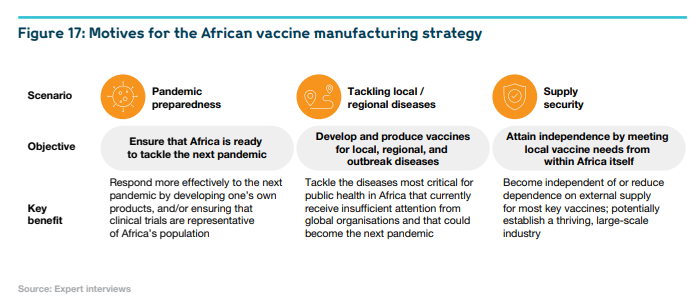

It alerted them to the compelling need for expanding vaccine-manufacturing capacity and capabilities across the African continent, in order to strengthen pandemic preparedness, to improve vaccine-supply security, and to better tackle endemic diseases. To meet these challenges, the vast majority of stakeholders — at national, continental, and global level — appreciate the value of the ambitious target defined by the Partnerships for African Vaccine Manufacturing Framework For Action (PAVM FFA): 60% of Africa’s vaccine demand to be supplied by Africa’s own vaccine-manufacturing industry by 2040.

The African vaccine-manufacturing industry today is still in its very early stages. It supplies less than 1% of the continental market.

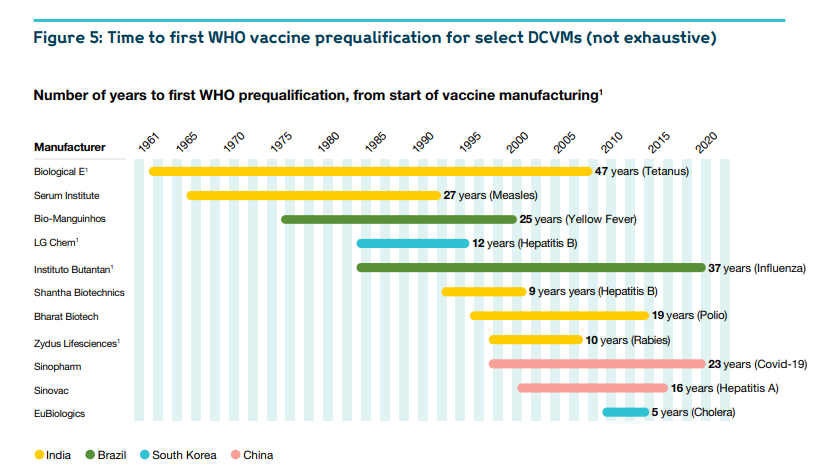

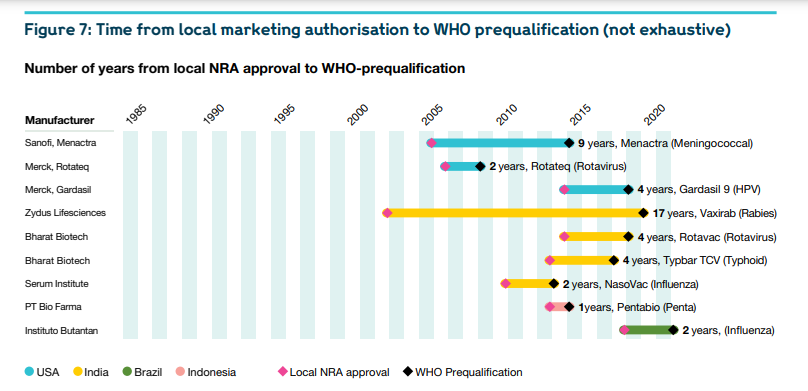

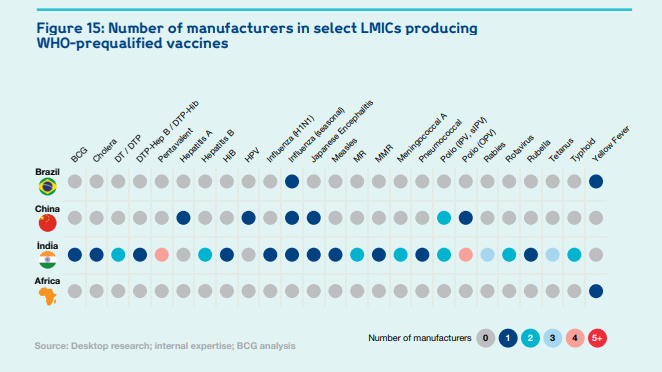

But it does have some capabilities and experience, which are ready to leverage. There are thirteen operational vaccine companies and organisations across Africa. Ten have developed Fill & Finish (F&F) capacity, five have demonstrated Drug Substance (DS) capabilities, and three conduct Research & Development (R&D).

The PAVM FFA has put forward one vision of the African vaccine-manufacturing ecosystem …

… — by 2040 in their assessment, the continent could feature 23 manufacturing facilities, including 12 end-to-end facilities and 11 F&F-only facilities, supplying 22 priority products. How this ecosystem will actually evolve remains to be seen, though the initial steps on this journey have already begun.

The past 18 months have produced many promising announcements and initiatives.

The PAVM FFA is praised for defining a continental strategy. Gavi, the Vaccine Alliance, is reviewing its market-shaping approach to further diversify its supplier base, particularly in Africa. Many manufacturing projects have been announced (30 projects in 14 countries),1 and promising partnerships have been signed between African manufacturers and Multinational Corporations (MNCs) or Developing Country Vaccine Manufacturers (DCVMs). Finally, more than $4 billion has been committed by private and public organisations.

Manufacturers stress that economic viability still needs to be demonstrated, and is crucial to the success of this strategy.

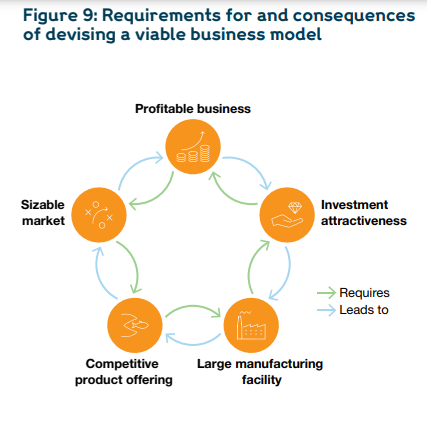

The business case for vaccine manufacturing in Africa is certainly not straightforward, as African companies will struggle to be competitive. On top of large investment costs, the manufacturers will also incur higher cost of goods sold (COGS) and higher operating costs (labour, repairs, utilities) than established DCVMs. As the manufacturers scale up, continuous innovations in the vaccinemanufacturing space should improve economics, but that will happen in the long term at best.

To improve economic viability, a few success factors should be considered.

First, large-scale facilities (about 50 million vials capacity per year) need to be prioritised, as smaller-scale F&F facilities are unviable without substantial subsidies.

Second, manufacturers will need to export their products beyond their borders, as national or regional markets are undersized.

Third, locally manufactured vaccines will have to compete with the low-price vaccines from DCVMs, so a mechanism will be needed to subsidise a portion of the extra costs.

African manufacturers identify three major risks to the desired economic viability:

- Sustainability risk: The historical dynamic, described by Gavi as the “high-price and lowvolume trap”, persists, and concrete measures are required to change it. Meanwhile, manufacturing initiatives remain uncoordinated, creating a risk of overcapacity (current and announced F&F capacity is more than 60% above 2040 PAVM targets).

- Strategic risk: Current strategy and set of possible initiatives are fairly broad, and manufacturers need further prioritisation (products, technology platforms) to guide their efforts and investments in the short- and mid-term.

- Support risk: As the Covid-19 pandemic recedes, the attention and efforts currently being offered by national, continental, and global stakeholders could recede as well.

There are several prerequisites to creating conditions for a sustainable ecosystem for African vaccine manufacturers:

1.Governments need to support manufacturers. One key enabler for manufacturers to access funding and secure technology transfers would be Advance Purchase Agreements. African countries procuring through Gavi are also expected to prioritise African supply.

2.A review of the procurement mechanisms is needed — one that would facilitate market access and offer predictable demand. Manufacturers’ suggestions include: the introduction by Gavi of a minimum share of African supply and/ or the introduction of a continental pooling arrangement.

3.Clarity is needed on the financial mechanism to counterbalance the lack of pricecompetitiveness (funding of the investments and/or operations, agreements to pay a price premium per dose, etc.) and on the source of such funding (governments and/or donors).

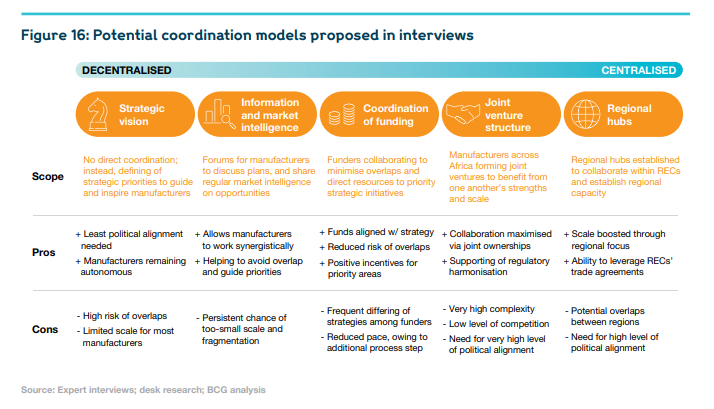

4.A coordination mechanism should be defined and launched — potentially through PAVM or other continental organisations — to improve information-sharing between stakeholders, and thereby help manufacturers to make business decisions, and help donors to identify where to direct their support.

African manufacturers should focus on strategic and realistic priorities to initiate change.

They need to prioritise supply-constrained products with less complex end-to-end manufacturing processes (six short- to mid-term priority products have been identified), and to start building F&F capabilities for more complex products. R&D efforts should concentrate in the short term on improving existing products, and thereby build capabilities across platforms. Manufacturers could also consider producing biological products aside from human vaccines; that could utilise part of the capacity of their facilities to improve the economic viability.

Donors must provide manufacturers with sufficient and sustained support, specifically for meeting the three main challenges beyond the market-access prerequisites:

- Access to finance: Offer tailored and low-cost funding with longer payback periods.

- Talent: Support African manufacturers to gain practical experience by funding secondments with experienced manufacturers, and by bringing global experts to work on manufacturing sites.

- Technology transfers: Collaborate with African manufacturers and partners on technology transfer to support capacity building, before the manufacturers attract potential private partnerships.

African vaccine manufacturers want and deserve support to overcome their existing challenges.

There is an imperative for global health stakeholders, in particular donors, to recognize the economic and operational reality of the African manufacturers, who have such a crucial role in attaining the publichealth objectives. Immediate changes are essential — changes to the current procurement, financial, and coordination mechanisms. As other changes will take time, the mechanisms will also need regular revisiting and adaptation, taking into consideration the global demand-supply dynamics.

The mood among stakeholders is one of optimism — that the current and forthcoming efforts will succeed in scaling up Africa’s vaccine-manufacturing capacity.

Infographic

Originally published at https://wellcome.org on July 13, 2022.

Acknowledgements

This report was commissioned by The Wellcome Trust, in partnership with Biovac, and authored by Boston Consulting Group. Input and oversight from The Wellcome Trust were led by Deborah King, and the wider Wellcome team consisted of Charlie Weller and Gordon Dougan. Input and oversight from Biovac were led by Patrick Tippoo, with contributions and engagement from the broader Executive Committee.

Analysis from BCG was led by Andrew Rodriguez, Mathieu Lamiaux, Emily Serazin, Tolu Oyekan, John Gooch, Jan Gildemeister, and Arthur Salaün, with contributions from Karol Yearwood, Lexi Shongwe, and Shivesh Narismulu. We would like to thank all the experts and organisations that took part in the interviews, manufacturer survey and focus groups, and whose input and expertise we drew on.

About Wellcome

Wellcome is a politically and financially independent global charitable foundation, funded by a £38.2 billion investment portfolio. Wellcome supports science to solve the urgent health challenges facing everyone. We support discovery research into life, health and wellbeing, and we’re taking on three worldwide health challenges: mental health, infectious disease, and climate

Names mentioned

- The Wellcome Trust,

- Biovac,

- Boston Consulting Group.

- Deborah King,

- Charlie Weller

- Gordon Dougan

- Patrick Tippoo