When large companies overinvest in digital capabilities, they dramatically widen the value gap with their more cautious peers, generating an average of 30% more EBIT over three years.

What are these outperformers doing right?

OCTOBER 10, 2022

By Vladimir Lukic, Karalee Close, Michael Grebe, Romain de Laubier, Marc Roman Franke, Michael Leyh, Tauseef Charanya, and Clemens Nopp

This is a republication of the paper “Show Me the Digital Value”, with the title above.

Site Editor:

Joaquim Cardoso MSc

October 12, 2022

Of all the companies that have embarked on digital transformations, relatively few have generated the value they sought to build.

Our recent research confirms that only the most digitally advanced companies produce substantial returns. The companies that trail face a widening value gap going forward.

Many companies’ digital transformation efforts are now sufficiently mature that we can separate the value builders from the rest of the pack.

When we compare performance over the last three years, a clear digital value gap becomes apparent.

This gap is expected to expand as some companies build on their success, while those that have failed to transform find themselves trapped in a vicious cycle of underinvestment and lower value generation that causes them to fall further behind.

The Digital Value Gap

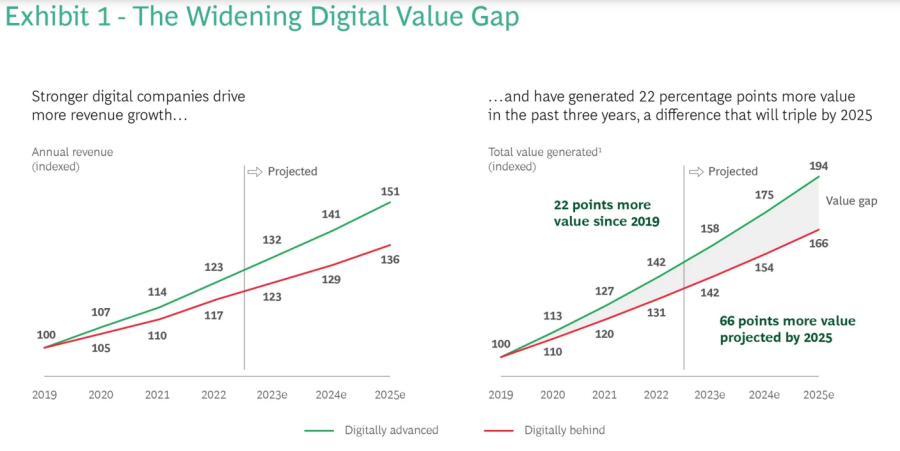

Our latest analysis of corporate investment in digital capabilities and the resulting performance shows that digitally advanced companies (the top 25% in our sample) continually outperform those that have transformed less successfully (the bottom 25%) on key financial metrics such as revenue growth and profitability. (See Exhibit 1 and the sidebar, “About Our Research.”)

BOX: ABOUT OUR RESEARCH

This year, we asked more than 2,700 business leaders to estimate their companies’ digital maturity on a scale of 1 to 4 in 42 categories.

Respondents came from 21 countries in Asia, Europe, and North America and covered nine industries: consumer goods, energy, financial services, health care, industrial goods, insurance, the public sector, technology, and telecommunications.

We then aggregated the raw scores, weighted them, and ranked each company on a scale from 0 to 100 to determine its overall performance on our Digital Acceleration Index.

The top 25% of companies are referred to here as digitally advanced companies.

At the other end of the spectrum, the bottom 25% are those that are digitally behind and have not yet succeeded in digital transformation.

The top companies achieve higher revenue growth from digital initiatives and higher EBIT.

Since 2019, the compounding effect of the spread between top and bottom performers has resulted in a value advantage of 22 percentage points for digitally advanced companies. (Value is defined as revenue growth factored with average annual EBIT.)

Since 2019, the compounding effect of the spread between top and bottom performers has resulted in a value advantage of 22 percentage points for digitally advanced companies

The future looks bleak for those that trail: if current trends continue, the cumulative value gap will triple to a 66-point margin for digitally advanced companies by 2025.

The future looks bleak for those that trail: if current trends continue, the cumulative value gap will triple to a 66-point margin for digitally advanced companies by 2025.

The latest findings are consistent with our earlier research into digital transformation, which revealed that a new class of incumbent companies is making significant value gains:

traditional businesses that have successfully executed a digital transformation and are showing progress in systematically building digital capabilities.

… traditional businesses that have successfully executed a digital transformation and are showing progress in systematically building digital capabilities.

These companies operate more like digital natives than their less digitally advanced peers, and they generate more value as a result.

- Their strength does not come only from tech and data — they have also rewired their operating models.

- They work in new ways, leveraging different incentives, overhauling their risk and security policies, and establishing new partnerships and alliances.

- They use agile cross-functional (business and tech) teams and organize their processes and teams to achieve defined outcomes, such as faster innovation, quicker speed to market, and lower costs through automation.

These companies operate more like digital natives than their less digitally advanced peers, and they generate more value as a result.

Because digitally advanced companies grow revenues more quickly, they have more funds available for investment each year.

The higher-value-creating companies in our latest study continually increased the share of revenue invested in digital transformation, from an average of 9% in 2020 to 14% in 2021.

Trailing companies invested as well but at lower levels, from 7% (2020) to 11% (2021). For a company with annual revenues of $40 billion, the difference in investment is $1.2 billion a year.

The higher-value-creating companies in our latest study continually increased the share of revenue invested in digital transformation, from an average of 9% in 2020 to 14% in 2021.

Digitally advanced companies also invest a bigger percentage of revenues in their digital programs.

Since 2019, digital value creators have put 15 percentage points more funding to work in digital programs, creating an investment gap that will increase going forward.

They have also set a flywheel spinning, as greater investment fuels the expanding value gap described above.

Digitally advanced companies also invest a bigger percentage of revenues in their digital programs.

Since 2019, digital value creators have put 15 percentage points more funding to work in digital programs, creating an investment gap that will increase going forward.

Digitally advanced companies continually outperform those that have transformed less successfully on key financial metrics such as revenue growth and profitability.

Bridging the Gap

How can companies reduce the digital value and investment gaps?

We previously described how putting the right success factors in place flips the odds of mounting a successful digital transformation from 30% to 80%, while accelerating financial performance and innovation.

We previously described how putting the right success factors in place flips the odds of mounting a successful digital transformation from 30% to 80%, while accelerating financial performance and innovation.

Our latest research puts the spotlight on three factors that characterize the companies now creating digital value:

- 1.alignment of the C-suite around purpose, strategy, and a single transformation roadmap,

- 2.a digitally enabled organization, and

- 3.modern approaches to technology through digital and data platforms.

1.ALIGNMENT OF THE C-SUITE

Leading companies integrate technical and human capabilities to work in new ways.

The active involvement of both global and local business leaders, tech leaders, and human resources is pivotal.

The full team must define and execute a shared digital vision and agenda.

More than 90% of the digitally advanced companies in our latest study get high scores for C-suite alignment and collaboration, meaning that C-suite members, globally and locally, collaborate consistently on defining and executing the digital agenda.

Only about a quarter of companies at the lower end demonstrate this kind of alignment and collaboration.

There are three key questions to ask about your C-suite:

- Do you hold C-suite members accountable for the digital transformation’s success, or is only one leader responsible — or is it not even clear clear who is responsible — globally and locally for business outcomes from digital and portfolio prioritization?

- Do your C-suite members work in a collaborative manner on digital? Are decisions made jointly with mutual buy-in, or do C-suite members operate mainly in siloes, driving the digital agenda individually?

- Does the organization pursue a common agenda, or do different business units and tech leaders follow their own priorities?

A large global pharmaceutical company was wrestling with a scattered portfolio of digital initiatives across business units and countries, which had led to complex systems that were often siloed by function.

The company had failed to scale digital initiatives and generate value in large part because of the lack of a shared vision.

Once the C-suite made digitization its priority and appointed and empowered a chief digital and technology officer, the company was able to successfully focus program and data and analytics leaders around a shared data and tech vision.

As a result, management could pursue companywide digital initiatives, create a comprehensive view on data domains, and establish common data policies and procedures that furthered value generation.

2.A DIGITALLY ENABLED ORGANIZATION

In digital companies, key processes are no longer owned by functional silos.

Instead, they are built and managed by cross-functional, product-oriented teams that have clear service levels and business missions.

The most digitally mature organizations have the technology to enable end-to-end platform processes, supported by mainly autonomous front-end teams.

These teams deliver easily scalable and tech-driven features, products, or experiences to their customers on a continuing basis, driven by the flywheel or learning loop that powers everyday innovation.

Nearly all digitally advanced companies take advantage of this type of organization.

Only 15% of digitally trailing companies do so, and most of these still operate in a traditional structure of business units, corporate support functions, and separate tech teams that are not organized in business-unit- and function-unit-adjacent structures.

These companies are only starting to identify end-to-end processes to support frontline business objectives.

Three key questions to ask about your organization are:

- Have you established cross-functional, product-oriented teams consisting of business and tech people who deploy products autonomously in an agile fashion?

- Are your teams measured on business outcomes, with defined service levels and customer-focused targets, such as OKRs (objectives and key results) for each domain?

- Have you established ways to enable dedicated experts (such as data analysts, data scientists, UI/UX designers, and software engineers) to help build capabilities across the organization, deploy digital talent and solutions at scale, and accelerate digital transformation?

A large Asia-Pacific bank achieved a step change in the customer experience — reducing the time needed to open an account from six days to ten minutes, for example — and facilitated its digital transformation by introducing new ways of working, which included multidisciplinary, co-located teams and one-on-one agile coaching to build capabilities.

The bank also achieved a 20% cost reduction in two years and 10% revenue uplift in three years.

3.DIGITAL AND DATA PLATFORMS

Digitally capable companies have a coherent set of applications, data, and technologies that are both ready to use and available across the organization.

These tools answer business needs and enable the delivery of business use cases rapidly and at scale.

Efficient tech architecture generates significant business value from data and new digital solutions.

More than 90% of digitally advanced companies operate in this manner, which is fundamentally different from “traditional IT.”

If current trends continue, the cumulative value gap will triple to a 66-point margin for digitally advanced companies by 2025.

At the other end of the spectrum, more than a third of companies often operate with a diverse set of legacy systems, which makes any change (such as updating cycles or adding new capabilities) a time-consuming undertaking.

Data remains locked in vertical, siloed channels, and reporting is available only in batches.

To make the transition, companies move from fit-for-purpose systems that use a mix of traditional technologies and an efficient, small data platform (such as a data lake) to a platform strategy and technology architecture that is decoupled from legacy system modernization (which takes more time) and allows quicker digital project delivery.

Three key questions are:

- Do you have a modular architecture strategy in place to support rapid delivery of high-value business change?

- Are components in your tech and data platforms modular, reusable, and scalable to empower effective implementation of new digital use cases?

- Have you established business (as opposed to IT) ownership of data, including definitions, governance, and data products?

Implementing a data-driven platform approach enabled a global pharmaceutical company to achieve cost savings of about €80 million in the first year and subsequent savings of more than €10 million a year by reducing complexity in analysis and processes.

In addition to efficiency gains, greater flexibility and the enablement of additional use cases in commercial and research activities generated more than €100 million of value in five years.

What Good Looks Like

One industry in which many companies have managed to close the digital value gap is consumer goods.

Consumer companies have doubled down on key levers to boost maturity and value, including the three factors described above.

onsumer companies’ C-suites work in a collaborative manner on digital transformation. Only telcos score higher on this dimension.

They use defined outcomes to focus the digitization of their organizations. These include digitized end-to-end customer journeys, dynamic and personalized pricing, and Industry 4.0 capabilities.

In addition, consumer companies have significantly boosted their enterprise agility and leveraged cross-functional teams to build digital transformation accelerators, including the creation and commercialization of new digital businesses.

As a result, consumer companies moved from one of the least digitally mature industries in 2019 to close to the top of the rankings in 2022. (See Exhibit 2.) They collectively raised their scores on BCG’s Digital Acceleration Index by 13 points — more than any other sector.

More important, digitally advanced consumer companies produced 40% more EBIT than those that lag.

Given the digital value gap, companies in other industries will want to take note.

Exhibit 2 — Consumer Companies Lead in Acceleration of Digital Capabilities

The digital value gap is clear and growing wider.

Leaders are no longer only digital natives, they now include incumbents that have fundamentally transformed by aligning accountability across the C-suite, redefining the organization, and taking a fundamentally different approach to technology and data.

As AI and other new technologies enter the mainstream, creating more opportunities for business, leaders are setting the bar higher.

Will your company be among them or be left behind?

Leaders are no longer only digital natives, they now include incumbents that have fundamentally transformed …

As AI and other new technologies enter the mainstream, creating more opportunities for business, leaders are setting the bar higher.

Will your company be among them or be left behind?

Originally published at https://www.bcg.com on October 5, 2022.