The Health Strategist

institute for continuous health transformation

in person and digital health

Joaquim Cardoso MSc

Chief Research and Strategy Officer (CRSO)

May 6, 2023

ONE PAGE SUMMARY

Executive Summary:

This executive summary provides an overview of a study conducted to characterize the involvement of private equity (PE) firms in the acquisition of oncology clinics in the United States from 2003 to 2022.

- The study aimed to examine the extent of PE-backed acquisitions, the number of affiliated oncologists, and the geographic distribution of these clinics.

- The findings shed light on the impact of PE involvement on the accessibility and affordability of oncology care.

The study identified a total of 724 oncology clinics that became affiliated with a PE-backed platform company during the study period, representing 10% of the estimated 6,919 oncology clinic locations in the US.

- These clinics included medical oncology, radiation oncology, and multi-oncologic services.

- Approximately 2060 oncologists were affiliated with these clinics, accounting for 10% of practicing medical oncologists and 15% of radiation oncologists.

The PE-backed transactions were found to span across 45 states, with notable concentrations in Florida and California.

- PE-affiliated clinics accounted for more than 20% of all oncology clinics in seven states, including Tennessee, Florida, and Nevada.

- The study identified 23 PE-backed platform companies, with several companies being acquired by other PE-backed entities or public companies.

The findings suggest a significant increase in PE acquisition and consolidation of oncology practices over the past two decades.

- However, the study acknowledges that its results likely underestimate the true extent of PE-backed involvement in oncology clinics since it focused solely on clinics involved in PE-backed transactions.

The implications of PE involvement in oncology clinics on patient outcomes and healthcare costs should continue to be evaluated.

- The consolidation of independent oncology practices due to PE involvement may lead to additional barriers in terms of accessibility and affordability of care for patients.

- Continued monitoring and assessment of the impact of PE acquisitions on oncology care are essential for policymakers, healthcare providers, and patients to ensure quality and equitable care delivery.

Selected image(s)

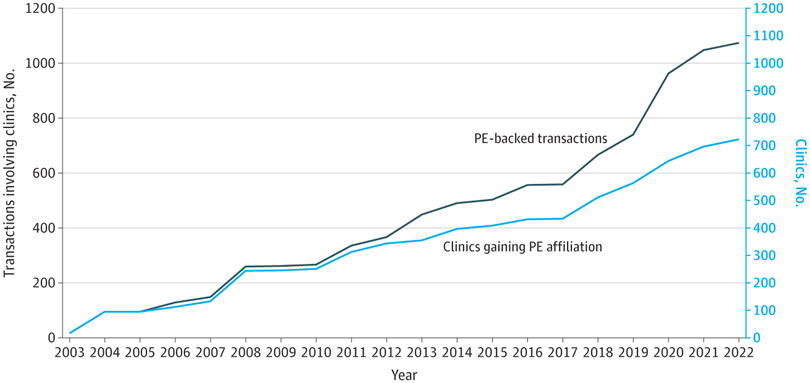

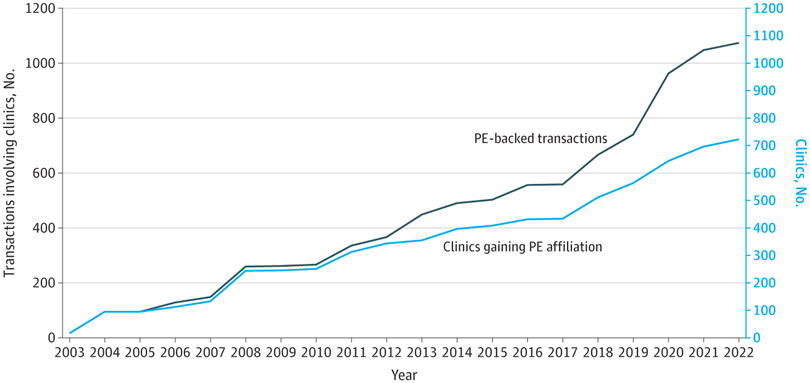

Figure 1. Cumulative Private Equity (PE)-backed Transactions and Clinics Gaining First-time PE Affiliation

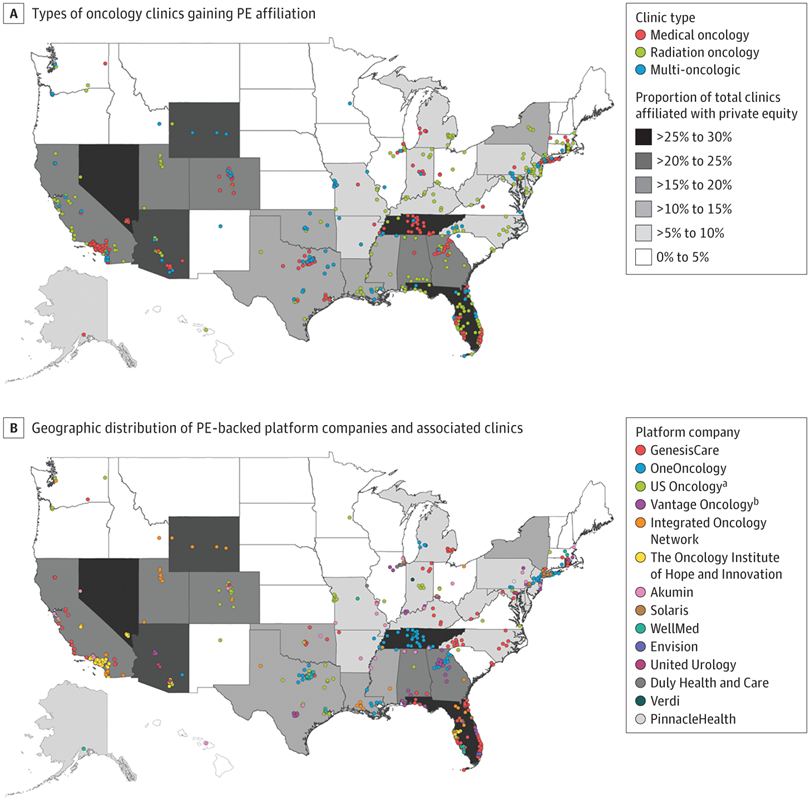

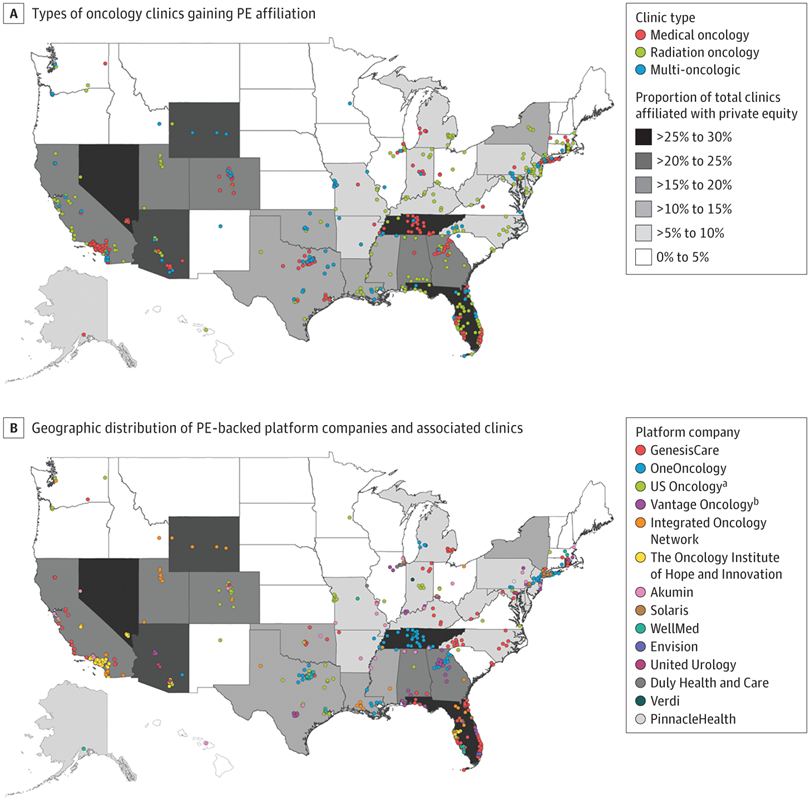

Figure 2. Geographic Distribution of Oncology Clinics and Platform Companies Involved in PE-backed Transactions

DEEP DIVE

Private Equity Acquisition of Oncology Clinics in the US From 2003 to 2022

JAMA Intern Med.

Kevin Tyan, BA1,2; Miranda B. Lam, MD, MBA3; Michael Milligan, MD, MBA1,3

Published online May 1, 2023.

Over the past 2 decades, private equity (PE) firms have become increasingly involved in the acquisition of health care practices across the US, particularly in oncology.1,2

These PE firms use capital from institutional funds and investors to create or invest in so-called platform companies, then seek financial returns by acquiring practices, opening new clinics, reducing costs, and increasing revenues.3 Although this approach may enable operational efficiencies, critics point to potential conflicts of interest and the implications for the accessibility and affordability of care.4

To date, PE-backed investments around oncology clinics have not been well characterized. We used a systematic and reproducible method to characterize PE-backed acquisitions of medical and radiation oncology clinics in the US.

Methods

In this cross-sectional study, using financial databases and publicly available data (including press releases, news sources, clinic websites, and financial 10-K reports), we screened for PE-backed transactions involving medical and radiation oncology clinics from 2003 to 2022.

The PE-backed transactions were defined as any financial investment, including partnership, recapitalization, and direct acquisition of clinics. Detailed search methods are provided in eMethods in Supplement 1. We used the Medicare Care Compare Database to approximate the total number and location of oncology clinics as well as practicing medical and radiation oncologists during the study period.5,6 This study followed the STROBE reporting guideline. Institutional review board approval was not sought per the Common Rule (45 CFR §46) because of the use of publicly available data.

Our final database included PE-backed platform companies and each oncology clinic acquired, as well as acquisition date, practice location, type of oncology service, and number of affiliated oncologists.

ArcGIS (Esri) was used to map clinic locations and the proportion of PE-affiliated oncology clinics per state. GraphPad Prism version 8.0 (Dotmatics) was used to generate charts.

Results

During 2003 to 2022, 724 oncology clinics (53% radiation, 32% medical, 15% multi-oncologic) became affiliated with a PE-backed platform company (Figure 1), constituting

- 10% of an estimated 6919 oncology clinic locations in the US. At least 2060 oncologists (64% medical, 36% radiation) were affiliated with clinics at the time of initial PE acquisition,

- constituting an estimated 10% (1318 of 13 531) of practicing medical oncologists and

- 15% (742 of 4886) of radiation oncologists.5,6

Thirty-three percent of clinics underwent multiple changes in PE ownership, with a total of 1074 PE-backed transactions occurring during the study period.

Figure 1. Cumulative Private Equity (PE)-backed Transactions and Clinics Gaining First-time PE Affiliation

We located 715 of 724 (99%) PE-affiliated clinics (Figure 2).

The PE-backed transactions spanned 45 states, with many in Florida (19%) and California (16%).

The PE-affiliated clinics accounted for more than 20% of all oncology clinics in 7 states, including Tennessee (28%), Florida (27%), and Nevada (26%).

Figure 2. Geographic Distribution of Oncology Clinics and Platform Companies Involved in PE-backed Transactions

We identified 23 PE-backed platform companies, of which 10 were acquired by another PE-backed entity or public company.

Many platform companies had a regional focus and expanded their geographic footprint through acquisitions in areas with little competition.

Discussion

There has been a marked increase in PE acquisition and consolidation of oncology practices over the past 2 decades.

Similarly, PE-backed platform companies have undergone substantial consolidation through mergers and acquisitions. The number of medical and radiation oncologists identified at PE-affiliated practices was estimated to constitute 10% to 15% of practicing oncologists in the US. Given that we focused only on clinics involved in PE-backed transactions and excluded clinics that were newly opened, our results likely underestimate the true total footprint of PE-backed involvement in oncology clinics.

Involvement of PE in oncology should continue to be evaluated to determine implications on patient outcomes and health care costs.

As increasing consolidation continues to affect the landscape of independent oncology practices, patients may face additional barriers to both accessibility and affordability of care.