This is an excerpt of the report “The Future of Supply Chain Management 2021–2025: Balancing Sustainability, Resilience and Cost”, focusing on the topic above. For the Executive Summary of the report, please, refer to the second part of this post.

CAPS Research, BCG

Bryan Fuller, Geoff Zwemke, Daniel Weise, Alex Dolya, Chitt Jha

May 2022

2021 vs. 2016: Different Change Drivers, Different Strategies

Survey dimensions have evolved since last edition of this survey in

2016, in line with the changing dynamics of the supply chain world.

We have added new categories for sustainability and resilience, reflecting manufacturers’ growing concerns about these issues.

Over the past few years, managers focused on removing redundancies in the supply chain to lower costs, but the pandemic made them realize they had taken these measures too far, and they needed to balance their business model by improving supply chain security and resilience.

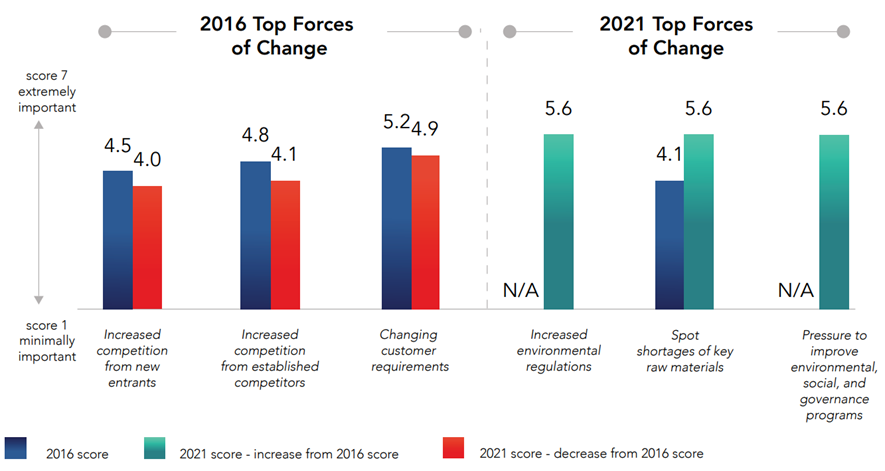

Because companies are more focused on these new areas, they are less concerned about other factors, such as searching for ways to beat the offerings of new and existing competitors (Figure 5).

Figure 5: Worries about competition have diminished as other concerns have become top of mind

Ensuring business continuity has gained importance, aligning with the new focus on resilience.

In addition, companies say accelerating the adoption of digital process and analytics — another new category — will be extremely important in the years ahead.

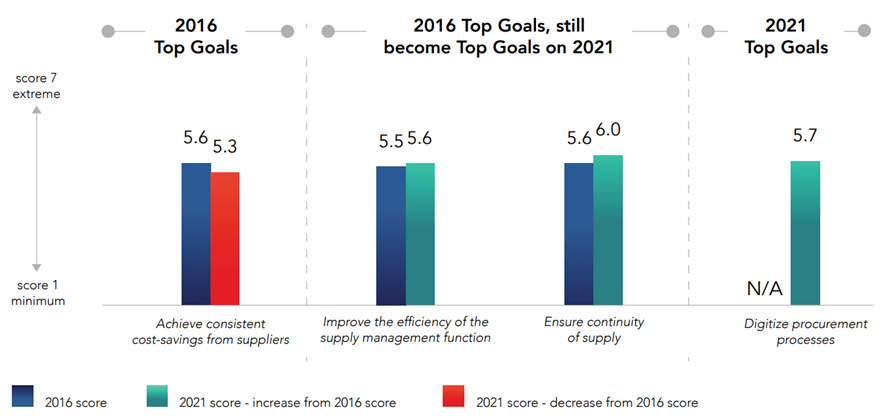

Aligning with the shift in business strategies, cost savings is not the top supply chain goal for 2021–2025. However, respondents still see the importance of improving efficiency.

As mentioned above, concerns about costs, though still important, have receded in the face of new initiatives. Boosting resilience, in particular, requires a tradeoff on costs. This is reflected by a shift in companies’ top goals (Figure 6).

Figure 6: Top supply goals and performance expectations, 2016 vs. 2021

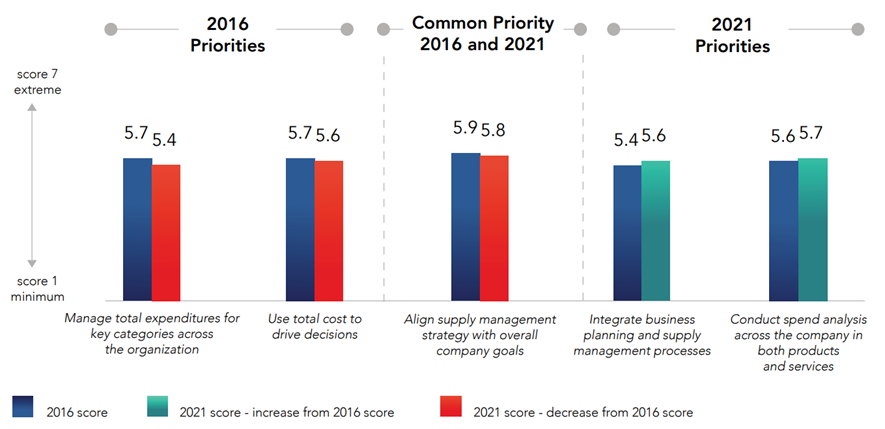

Respondents in both surveys were asked how they intended to achieve their goals, listing specific strategies and processes they planned to adopt to facilitate progress.

Here again, we see a trend of less reliance on cost reduction measures and more emphasis on better integrating plans.

There is also a slightly higher emphasis in 2021 on analyzing spending for products and services.

This may reflect the new focus on analytics as much as it does the continuing need to monitor expenses (Figure 7).

Figure 7: Top priority supply strategies, processes, and goal enablers, 2016 vs. 2021

EXECUTIVE SUMMARY

The Future of Supply Chain Management 2021–2025: Balancing Sustainability, Resilience and Cost [Executive Summary]

CAPS Research, BCG

Bryan Fuller, Geoff Zwemke, Daniel Weise, Alex Dolya, Chitt Jha

May 2022

The Future of Supply Chain Management

Every five years, the Center for Advanced Procurement Strategy (CAPS), a joint initiative of the Institute for Supply Management (ISM) and Arizona State University, conducts a global survey of practicing supply chain executives and knowledge experts, asking about the challenges they expect to face and their strategies and performance goals in the coming years.

For the 2021 survey, CAPS worked with BCG to query 157 supply management leaders across industry segments, including discrete manufacturing, process manufacturing, and service industries.

We gained their insights on a host of important topics, including:

- Supply chain market dynamics

- Cost savings and efficiency

- Risk and resilience

- Environmental, social, and governance (ESG) regulations and initiatives

- Supplier management

- Supply chain operations

- Human resources

- Technology

Key Insights from Procurement and Supply Chain Leaders

Two trends in the new survey stand out.

First, fulfilling environmental, social, and corporate governance (ESG) goals has assumed paramount importance.

The second notable trend is a greater emphasis on achieving resilience in the face of unpredictable raw materials shortages and logistical challenges, which were greatly exacerbated by the pandemic.

Two trends in the new survey stand out: (1) fulfilling environmental, social, and corporate governance (ESG) goals ; (2) … a greater emphasis on achieving resilience

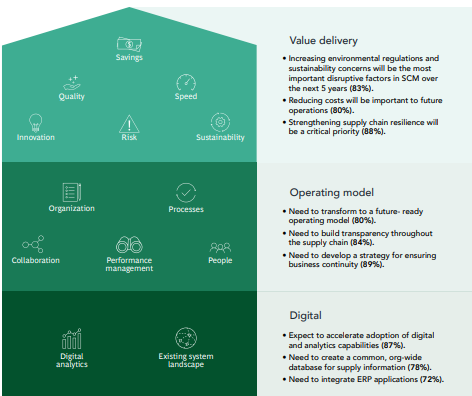

The schematic below summarizes some of the survey’s most important findings.

Summary Figure: Highlights from the 2021–2025 CAPS and BCG global survey of procurement leaders

ZOOM VIEW

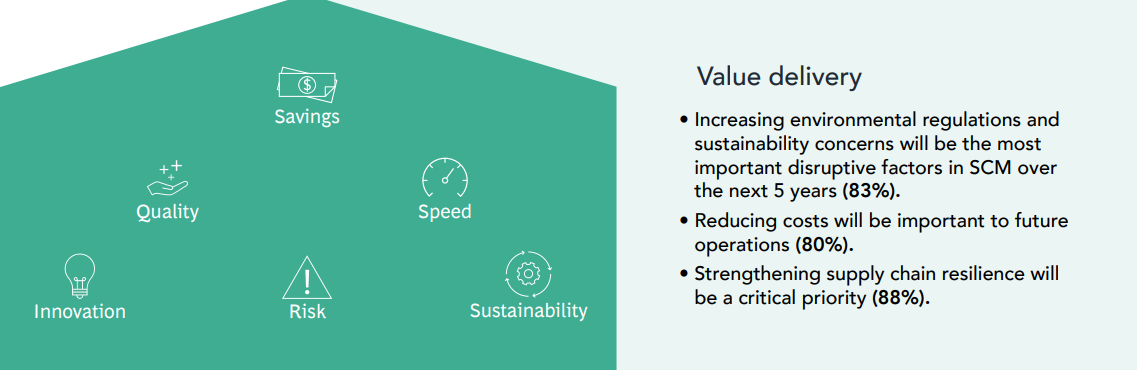

Value delivery

- Increasing environmental regulations and sustainability concerns will be the most important disruptive factors in SCM over the next 5 years (83%).

- Reducing costs will be important to future operations (80%).

- Strengthening supply chain resilience will be a critical priority (88%).

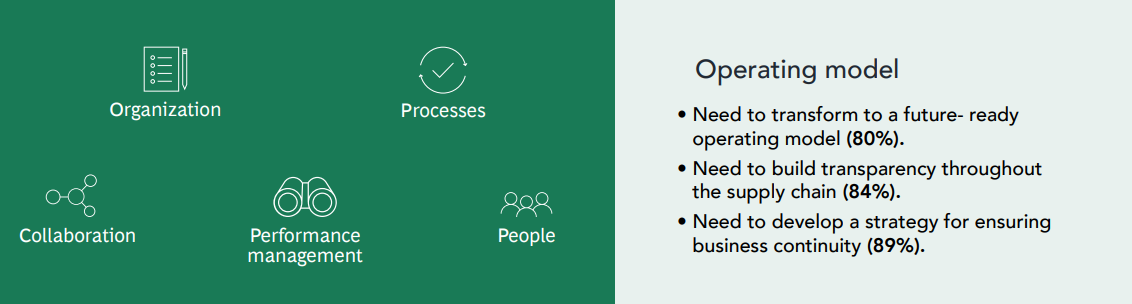

Operating model

- Need to transform to a future- ready operating model (80%).

- Need to build transparency throughout the supply chain (84%).

- Need to develop a strategy for ensuring business continuity (89%).

Digital

- Expect to accelerate adoption of digital and analytics capabilities (87%).

- Need to create a common, org-wide database for supply information (78%).

- Need to integrate ERP applications (72%).

“Going forward, CPOs will need to constantly balance tradeoffs between sustainability, resilience and cost.

CPO KPIs and capabilities will need to evolve respectively to reflect all these priorities. This will be the most challenging task for the next five years,” — Alex Dolya

CPOs need also to rethink through their approach to suppliers, given their need to balance priorities.

If in the past, cost savings were primary objective of supplier engagement, today CPOs need to ensure that suppliers can deliver in the face of decarbonization, supply resilience and cost competitiveness.

Getting the equation right could prove tricky.

CPOs need also to rethink through their approach to suppliers, given their need to balance priorities. Getting the equation right could prove tricky.

Structure of the report

· The Future of Supply Chain Management

· Key Insights from Procurement and Supply Chain Leaders

· The Rising Importance of Sustainability

· The Need to Improve Supply Chain Resilience

· Sustainability and Resilience Top Cost Concerns

· 2021 vs. 2016: Different Change Drivers, Different Strategies

· Upgrading Supply Chain Technology

· Looking Forward

Report Authors

Bryan Fuller

Senior Director, Procurement, Solidigm, Former Executive Director, CAPS Research

Geoff Zwemke

Director of Product, CAPS Research

Daniel Weise

Managing Director and Partner, BCG, Global Leader for BCG Procurement Practice, CEO of Inverto

Alex Dolya

Managing Director and Partner, BCG, Asia Pacific Leader for BCG Procurement Practice, Global Leader for Procurement and SCM in Energy and Mining, BCG

Chitt Jha

Partner and Associate Director, BCG, BCG Global Expert on Procurement Resilience, Sustainability, and Digital

Originally published at CAPS Research.