the health strategist

institute for strategic health transformation

& digital technology

Joaquim Cardoso MSc.

Chief Research and Strategy Officer (CRSO),

Chief Editor and Senior Advisor

September 29, 2023

One page summary

What is the message?

In 2023, the tech industry faces a shift from the era of “growth at all costs” to one where financial markets demand profitability alongside growth.

This article discusses the challenge of balancing profitability and growth for tech companies.

It provides a strategic roadmap for transforming the operating model to create value for investors, employees, and stakeholders while maintaining or accelerating growth.

Key Takeaways:

1. Shifting to Profitability Without Sacrificing Growth

- The tech industry is transitioning from an emphasis on growth to achieving profitability without compromising growth.

- Abrupt cost-cutting can negatively impact the company’s value proposition and create long-term issues.

- A surgical approach to transforming the operating model is essential for maintaining growth and profitability.

2. The Importance of a Thoughtful Transformation

- A thoughtful transformation involves rewiring the company’s cross-functional operating model to focus intensely on creating value for end customers.

- Eliminating extraneous activities and simplifying offerings are critical components of this transformation.

- Such efforts demand deep experience with tech operating models and commitment from both management and investors.

3. Five Critical Actions for Successful Transformation

- Define the company’s “North Star” quickly to guide decisions and alignment.

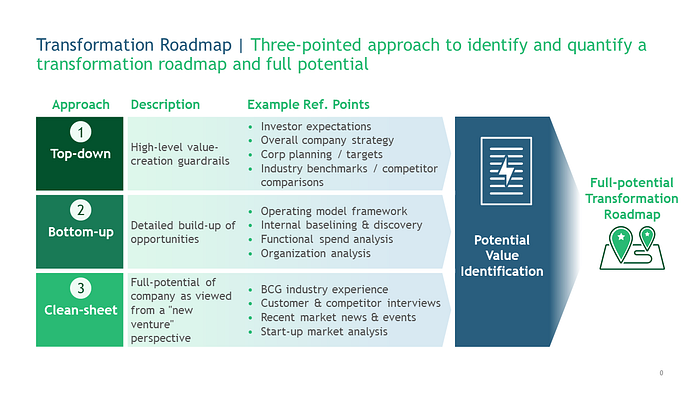

- Use a top-down, bottom-up, and clean-sheet approach to identify transformation potential.

- Gain early momentum through quick wins linked to a clear transformation message.

- Redesign the operating model with cross-functional value streams focused on end customers.

- Shift to an end-user, outcomes-based development approach that is product-led.

4. Results of the Transformation

- The transformation, typically completed in 6–18 months, leads to increased profitability.

- Long-term value creation results include the ability to explore new market-growth opportunities, employee empowerment, improved product launch velocity and quality, and strategic focus for executives.

This article emphasizes that the next phase of tech industry growth is about realizing value from assets and enhancing clarity and alignment across the entire organization, rather than simply pursuing growth or cost-cutting.

In conclusion:

Tech companies must navigate the transition from growth-focused strategies to profitability while maintaining growth.

By following a thoughtful transformation approach and focusing on value creation, companies can thrive in this evolving tech landscape.

Infographic

DEEP DIVE

As we enter 2023, the most recent era of “growth at all costs” for tech companies is likely over. Financial markets are now demanding that tech companies improve profitability while maintaining topline growth to obtain the highest valuation multiples. The key challenge for managers of tech companies that “grew up” in this growth environment over the last decade is shifting to profitability objectives while not sacrificing growth. Although this challenge can be daunting, if done the right way, it can help recapture value for investors, employees and other key stakeholders.

The natural, first temptation for most business leaders is to slash costs quickly and bluntly to improve profitability. However, this approach is also a proven way to impact value proposition of the company’s end customers and, ultimately, growth. Additionally, this approach exacerbates fundamental issues such as underinvestment in tech debt, platform architecture upgrades and process complexities / inefficiencies. After an initial burst of short-term success, costs ultimately creep back leaving management teams and investors asking, “why can’t we see the value in the P&L?”

The right long-term solution to balance profitability and growth is to adopt a thoughtful and surgical approach to assess and transform the operating model of the company. The goal is to maintain or accelerate growth of the company and re-center on its core value proposition. This transformation means rewiring the company’s cross-functional operating model from lead through delivery to hyper-focus on end-customer value creation, eliminating extraneous activities and simplifying its offerings. These efforts require deep experience with tech operating models and a “roll up your sleeves” attitude and commitment from both management teams and investors.

Moving with pace and certainty is critical to the long-term success of a transformation. We recommend that management first complete a value-creation diagnostic to evaluate the company holistically. The outcome should be a tactical transformation roadmap with near-term wins, medium-term actions and longer-term investments that enhance its growth and margin trajectory. Tech companies should look for common indicators to determine if there is a need for a transformation and the degree of change and value creation that is possible. Several common indicators are listed in Table 1.1:

Table 1.1: Common indicators that might suggest a need for a transformation

Taking action to realize profitable growth

There are five critical actions that make for successful transformations of tech companies looking to make a shift to value creation and profitability. Each action needs to be the top priority for the management teams, who will need to have a bias toward action that includes visibility and accountability:

1. Quickly and clearly define the company’s “North Star”

A solid North Star generally includes the company’s strategy, mission/vision and core operating principles that should be completed in less than a week (in most cases). This North Star is critical because it enables quick and conclusive downstream decisions (i.e. start, stop, scope change, etc.) and greases the skids on internal alignment for critical topics such as product investments, end-market prioritization, org changes, process improvements and systems/tools upgrades, to name a few.

2. Use a top-down, bottom-up and clean sheet approach to triangulate on the full-potential of the transformation

Financial benchmarks are useful to evaluate and set high-level guardrails to evaluate companies for potential transformation, but they don’t provide complete answers. Instead, we advise our clients to use a three-pointed approach of top-down, bottom-up and clean-sheet to identify the full potential of the company and triangulate on the optimal solution.”

3. Gain early momentum through quick wins that link to a clear transformation message

The value-creation diagnostic phase will identify “no regrets” actions that can be taken immediately with minimal or no risk to the underlying business. These actions can include discontinuing products, exiting certain markets, refocusing entire teams and renegotiating near-term supplier agreements. These actions coupled with a clear transformation message can help management teams gain broader buy-in with a clear signal that “we are serious, and it will be different this time.

4. Redesign the op model through value streams focused on the end-customers

Contrary to how many tech companies are currently being run, companies do not deliver value to end-customers via disjointed and overlapping functional organizations or efficient internal processes. Rather, they should define cross-functional “capabilities” and align across end-customer-focused value streams (e.g., Plan, Build, Sell, Deliver, Support) to deliver value. These cross-functional definitions include org structure, processes, interlocks and systems/tools. This realignment may mean eliminating functional, geographical, or business unit “fiefdoms” that have created redundant teams, processes and systems/tools across the company. In addition, clearly defining P&Ls and assigning ownership can help minimize unnecessary cost allocations and simplify decision making.

5. Shift to an end-user, outcomes-based development approach that is product-led

Companies can “die from a thousand cuts” by constantly responding to software features from their most influential clients and reprioritizing their development efforts. Companies need to retake the reins and own their future. To be product-led (vs. customer-led) means having a clear product roadmap that outlines feature releases and timing. This approach is much more scalable and integrates a more comprehensive view of customers’ requirements that should enable the company to compete more aggressively. Shifting to a market-led mentality requires a few structural enablers and strategic decisions. For instance, a company’s enterprise-level Product Development Lifecycle (PDLC) process should be at the center of how spend and decisions are prioritized. Product Management should be empowered and engaged with Engineering teams who are following basic agile principles and roadmaps. These product roadmaps should also incorporate tech debt that will enable the company to accelerate its future releases and improve quality.

Results of the transformation

As the company emerges from the transformation, which can be completed in 6–18 months in most cases, it should be more profitable, yes, but that is just the tip of the iceberg. More important, longer-term value-creation results include:

- Ability to attack new market-growth opportunities that may not have been addressable under the previous operating model

- Reigniting and empowering the employee base and rallying them around a clear purpose of why they show up to work every day and the impact on clients

- Improving velocity of product launches at a higher-level of quality with higher customer success scores

- Executives spending more time driving the company strategically and less time “fixing customer issues”

- The list goes on…

This next era of growth in the tech sector will not be about growth at all costs nor cost-hacking or slashing. It will be about realizing value from the company’s underlying assets and bringing more clarity and alignment to the entire company.

Originally published at https://medium.com/bcgontech