The health strategist

institute, portal & consulting

for workforce health & economic prosperity

Joaquim Cardoso MSc.

Servant Leader, Chief Research & Strategy Officer (CRSO),

Editor in Chief and Senior Advisor

January 12, 2024

This executive summary is based on the article “UnitedHealth reports highest medical costs since COVID-19 pandemic’s start”, published by Health Care Dive and written by Rebecca Pifer, on January 12, 2024.

What is the message?

UnitedHealth reported its highest medical costs since the start of the COVID-19 pandemic in the fourth quarter of 2023.

Despite the surge in medical expenses, the health insurance giant exceeded Wall Street’s financial expectations, showcasing its resilience in navigating challenges.

ONE PAGE SUMMARY

What are the key points?

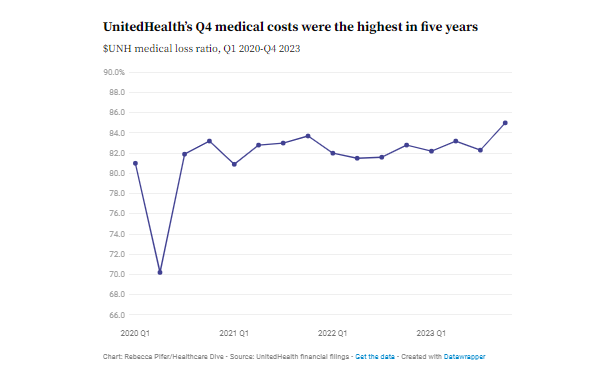

Medical Loss Ratio (MLR): UnitedHealth posted an MLR of 85% in Q4 2023, marking the highest since the onset of the pandemic. The MLR is a crucial metric reflecting the percentage of revenue spent on covering members’ medical expenses.

Factors Driving Higher Costs

Increased Senior Utilization: The primary contributor to elevated costs was a rise in seniors seeking outpatient services. This trend emerged in the second quarter of 2023 and continued into the fourth quarter.

Orthopedic and Cardiac Procedures: UnitedHealth noted particularly high costs associated with orthopedic and cardiac procedures.

Seasonal Activity: A surge in seasonal activity, driven by seniors seeking vaccinations for respiratory virus RSV, contributed to increased medical costs.

COVID-19 Activity: Higher COVID-19 admissions and associated expenses, fueled by the more infectious JN.1 variant, added to the financial pressures.

Financial Performance

Earnings and Revenue: UnitedHealth surpassed Wall Street expectations in both earnings and revenue for the fourth quarter, reporting a topline of $94.4 billion.

Full-Year 2023 Performance: The company achieved $371.6 billion in revenue for the full year, a 15% increase from 2022, with a profit of $23.1 billion, up by 12%.

Segment-wise Performance

UnitedHealthcare: The health insurance arm’s revenue grew by 13% year over year to $281.4 billion. Despite Medicaid losses due to redeterminations, UnitedHealthcare added over 1 million members in 2023, ending the year with 52.8 million members.

Optum: The health services division’s revenue grew by 24% to almost $227 billion, with Optum Health’s revenue rising by 34% through increased participation in value-based care arrangements.

What are the key statistics?

Q4 Medical Loss Ratio: 85%

Total Revenue (Q4): $94.4 billion

Full-Year 2023 Revenue: $371.6 billion

Full-Year 2023 Profit: $23.1 billion

Optum Health Value-Based Arrangements Growth (2023): Almost 900,000 people, totaling over 4.1 million patients.

What are the key examples?

UnitedHealth’s proactive adjustment of benefit designs for 2024 to accommodate heightened outpatient care levels.

Financial resilience demonstrated by beating Wall Street expectations despite soaring medical costs.

Conclusion

UnitedHealth’s robust financial performance amid escalating medical costs reflects its ability to adapt and navigate challenges effectively.

While the fourth quarter presented significant cost pressures, the company’s strategic adjustments and financial results showcase its resilience in a dynamic healthcare landscape.