Industrial companies may not be the face of digital disruption, but their evolutionary approaches to successful digital initiatives hold lessons for other sectors.

MIT Sloan Management Review

Ivanka Visnjic, Julian Birkinshaw, and Carsten Linz

March 03, 2022

Executive Summary

by Joaquim Cardoso MSc.

Chief Editor of “The Health Strategy Blog – Digital Driven”

March 3, 2022

What is the context?

- Business leaders are often counseled by expert advisers to set up a dedicated digital unit that “disrupts,” driving change from the top that is executed on a grand scale.

- The author´s research into digital transformation in industrial companies shows that the best approach in many cases is not revolutionary but evolutionary.

- They suggest that, depending on circumstances, that may be the better approach for organizations in other sectors as well.

How the research was conducted?

- See the long version of the original publication.

What is a good example of an Incremental Transformation?

- Take the case of Italian electric utility Enel, which serves about 70 million customers worldwide.

- Enel is now one of the most digitally advanced utilities in the world, but there was no big-bang revolution.

- Rather, the transformation was managed in an integrated and incremental way, through initiatives put in place by executives working across all the different parts of the organization.

What is an example of failure of Radical Transformation?

- For example, General Electric launched an ambitious software platform (Predix) in 2013 and placed it in a separate business unit, GE Digital, in 2014.

- But without real buy-in from other parts of the company, and without any game-changing ideas, it was scaled back and deprioritized in 2018 when John Flannery took over as group CEO.

What is the point? What are the success factors?

- The contrast points to an important insight from our examination of 12 companies’ approaches to digital transformation — namely, that such successful initiatives in industrial companies are usually stories of evolution, not revolution.

- Executives in the organizations we studied mostly took a long-term view, exploring use cases for new technologies in small pilot studies and scaling them up cautiously.

- They also took a largely decentralized approach, with a view to building digital capability in the heart of the business rather than in a specialized or separate unit.

This article describes this evolutionary approach to digital transformation in greater detail, focusing on three key aspects:

- the choices companies make in their initial responses to new technologies;

- how digital initiatives are scaled up effectively; and

- the pros and cons of appointing a chief digital officer (CDO) to oversee all these activities.

Finally, the authors offer a set of questions that can help companies in any sector determine whether they would be best advised to follow the revolutionary model set by consumer-facing companies or an evolutionary one exemplified by industrial companies.

In short, the authors argue that the right choice depends on certain characteristics of an organization’s products, customer and partner relationships, and user needs.

Applying These Insights to Your Company

- While our research focused specifically on industrial companies, we believe there are lessons that apply in a variety of other contexts as businesses embark on digital transformation projects.

A foundational question that many executives grapple with — and that shapes the approach as either revolutionary or evolutionary — is whether the company should create a new digital technology unit or embed a digital project within an existing line of business.

We suggest the following diagnostic exercise, which involves considering five questions, to assist in making that decision:

- What is the form in which the digital technology will be delivered?

- What is its implication for current company assets and capabilities?

- To what degree does using the technology depend on the company’s relationship with the buyer?

- Does the digital technology meet an entirely new need, or better satisfy an existing one?

- What is the level of integration between the digital technology and related company activities?

Conclusion of the authors

- Our research revealed that successful industrial companies addressed the challenge of digital transformation in an evolutionary way.

- While many consumer-facing companies took a highly strategic approach, using a quickly assembled and semiautonomous unit reporting in at the board level, …

- We saw a very different model in industrial companies, with front-line teams taking small steps, working directly with users, piloting projects with embedded teams, and then gradually getting more freedom and more visibility as they scaled up.

- Aiding and abetting them in this process was the CDO.

- Most industrial companies were somewhat late to the party in digitalization. This may have been a blessing in disguise, allowing them to learn from the successes and failures of their consumer-oriented counterparts.

- Showing how a steady progression of evolutionary steps can allow a company to find new ways to create, deliver, and capture value through digital technologies is a lesson that successful industrials can share with the world.

ORIGINAL PUBLICATION (long version)

When Gradual Change Beats Radical Transformation

Industrial companies may not be the face of digital disruption, but their evolutionary approaches to successful digital initiatives hold lessons for other sectors.

MIT Sloan Management Review

Ivanka Visnjic, Julian Birkinshaw, and Carsten Linz

March 03, 2022

Transforming the organization to reap the benefits promised by advanced digital technologies is no longer a question of “if” or “when”; it’s a question of “how.”

Business leaders are often counseled by expert advisers to set up a dedicated digital unit that “disrupts,” driving change from the top that is executed on a grand scale.

That approach isn’t right for all companies, but there’s another way to successfully tackle this major change.

Our research into digital transformation in industrial companies shows that the best approach in many cases is not revolutionary but evolutionary.

We suggest that, depending on circumstances, that may be the better approach for organizations in other sectors as well.

Our research into digital transformation in industrial companies shows that the best approach in many cases is not revolutionary but evolutionary.

The Research

- The authors conducted an inductive study, examining in-depth longitudinal cases of incumbents in complex manufacturing industries.

- Data was collected through cross-sectional interviews, direct observation of the day-to-day operations during extended site visits, and archival data from internal and external documents.

- The researchers also conducted extensive interviews in two companies (Atlas Copco and Enel) and a smaller number of interviews in 10 others (BAE Systems, Bayer, Gree, Lanxess, Mölnlycke, Rio Tinto, Sandvik, Schneider, Siemens, and Stellantis).

Take the case of Italian electric utility Enel, which serves about 70 million customers worldwide.

It was the first utility to bring smart meters into people’s homes in 2001, and it pioneered many digital enhancements to the user experience through the 2000s.

In 2017, it started a digital plant project, harnessing the latest sensor and automation technologies to improve the efficiency of electricity generation and distribution.

It created a digital twin of the electricity network and brought in virtual reality and augmented reality to train field service technicians.

Alongside these changes, the company moved its IT infrastructure to the cloud and pushed responsibility for IT operations out to 13 digital hubs.

It trained employees across the company in digital technology, put in place a crowdsourcing innovation platform, and introduced so-called agile working practices.

Enel is now one of the most digitally advanced utilities in the world, but there was no big-bang revolution. Rather, the transformation was managed in an integrated and incremental way, through initiatives put in place by executives working across all the different parts of the organization.

Enel is now one of the most digitally advanced utilities in the world, but there was no big-bang revolution.

Enel’s evolutionary approach contrasts markedly with the large-scale transformations attempted in some industrial companies.

For example, General Electric launched an ambitious software platform (Predix) in 2013 and placed it in a separate business unit, GE Digital, in 2014.

But without real buy-in from other parts of the company, and without any game-changing ideas, it was scaled back and deprioritized in 2018 when John Flannery took over as group CEO.

The contrast points to an important insight from our examination of 12 companies’ approaches to digital transformation — namely, that such successful initiatives in industrial companies are usually stories of evolution, not revolution.

Executives in the organizations we studied mostly took a long-term view, exploring use cases for new technologies in small pilot studies and scaling them up cautiously. They also took a largely decentralized approach, with a view to building digital capability in the heart of the business rather than in a specialized or separate unit.

This article describes this evolutionary approach to digital transformation in greater detail, focusing on three key aspects:

- the choices companies make in their initial responses to new technologies;

- how digital initiatives are scaled up effectively; and

- the pros and cons of appointing a chief digital officer (CDO) to oversee all these activities.

Finally, we offer a set of questions that can help companies in any sector determine whether they would be best advised to follow the revolutionary model set by consumer-facing companies or an evolutionary one exemplified by industrial companies.

In short, we argue that the right choice depends on certain characteristics of an organization’s products, customer and partner relationships, and user needs.

Drive digital exploration through the lines of business.

It is tempting to give the job of exploring new digital technologies to a strategy or business development team close to the CEO. This is certainly a commonplace approach in many sectors, such as consumer products and financial services. But in the successful industrial companies we studied, new technologies were typically assessed by people in the lines of business — often midlevel managers in technical roles who were looking for ways to improve the efficiency of their existing operations.1 For example, Swedish industrial company Atlas Copco began looking at remote monitoring technology for its compressors in the mid-2000s following a discussion between the development teams at headquarters and line managers in a foreign subsidiary who were looking for a better approach to proactive maintenance. Another example is the German conglomerate Siemens. Its Mobility division’s most successful software application, called Railigent, started from the work of a local customer service team.

Piloting new technologies can also be done in a decentralized way by a small mixed team of business, digital, and IT people embedded within a business unit.

Consider the case of Sandvik, the Swedish mining equipment company. Its mining and rock technology business began working with digital technology in the mid-2000s. A couple of early experiments in mine equipment telemetry led the team to conclude that the quality of the sensor technology was not sufficiently developed and the cost was too high. They tried again in 2010, with a focus on remote monitoring to improve efficiency and safety. In 2011, they implemented several pilot projects, such as monitoring the equipment for malfunctions and scheduling maintenance more efficiently. These pilots were conducted with specially chosen clients that faced particular challenges, such as a client with mines in remote African locations that was experiencing a shortage of skilled operators. The success of these pilots enabled Sandvik to build out its MySandvik digital platform for a range of clients over the following years, as we discuss further below.

This low-risk and embedded approach had a couple of important benefits.

First, by focusing on genuine use cases, these projects had real focus — they forced managers to figure out how technology created value, whether it was done by enabling the business to cut costs or to grow.

Success, in other words, came from applying digital technologies to real-world problems rather than implementing the technologies for their own sake (that is, rolling out “solutions looking for problems”).

Second, these pilots enabled internal capability-building.

The organizations we studied exposed their midlevel managers and engineers to digital projects to ensure that they understood the initiatives’ potential value as well as their limitations. There was a lot of trial and error in these projects, including in the selection of the technology and development of user interfaces. For example, Sandvik’s remote monitoring technology was producing too many alerts that were not necessary and confused the clients, so it went through many iterations of the user interface. The project team included people with deep digital skills, but they were overseen by midlevel managers with extensive domain knowledge in mining operations and business development.

In sum, this integrated approach with a mixed team kept everyone focused on practical use cases aimed at generating measurable business impact, ensured better integration with other activities of the business, and helped build digital skills across the organization.

When does it make sense to instead pull digital technologies out into a separate unit?

We saw a few examples in the industrial sector, including Enel’s creation of Enel X for smart home, energy storage, and connectivity solutions for cities, among other things; and Lanxess’s CheMondis marketplace, a cross-manufacturer and cross-dealer B2B platform for selling chemicals on the open market. These were cases involving direct sales to end customers, very early-stage and highly uncertain market needs, and new business models.2 The lack of interdependencies with established operations, along with concerns about cannibalization, made it sensible to pull them out as separate operations and helped prevent them from becoming costly distractions.

Give digital initiatives the freedom to scale.

In consumer-facing businesses, scaling up often involves bringing a promising product out of an incubator or venture unit and placing it in a mainstream business unit so that it can leverage an established distribution network (often referred to as a “separate then integrate” model).3 In the industrial companies we studied, the pattern was different: The new digital technologies were already embedded within a division, and the process of scaling them up often involved giving the project team greater autonomy to facilitate growth.

Consider the MySandvik digital platform discussed earlier. Most of Sandvik’s customers used equipment from multiple suppliers, so for this platform to gain widespread use, it needed to be opened up to these other equipment suppliers. Sandvik built the necessary APIs to enable this connectivity. It created a new analytics team, as well as a dedicated sales team. It also partnered with and subsequently bought a company specializing in wireless internet-of-things technology, called Newtrax.

Another example of scaling with outside help is Siemens Mobility and its Railigent software system for monitoring trains, tracks, and signals. Although the rail software system was first conceived and developed internally, it is growing via partnerships. Railigent Application Suite already has more than 100 applications contributed by more than 10 partners in its cloud-based platform developed with Amazon Web Services.4

We also observed cases of spinoffs.

For example, Bosch’s agricultural equipment division partnered with a corporate venture builder, FoundersLane, to create a digital service called Deepfield Connect to help farmers increase yields. Bosch was deeply involved in setting it up but stepped back to enable Deepfield Connect to scale up quickly as a more entrepreneurial, stand-alone operation.

These vignettes illustrate a couple of important points.

First, if a company is trying to scale digital projects, it is often useful to give teams a significant degree of freedom so that they can take whatever steps are necessary to succeed, including collaborating with competitors.

Second, external partners have an important role to play in facilitating growth, whether those partners are technology service providers such as IBM, Google, or Amazon; startups; or venture builders.

In contrast to the “separate then integrate” model we see in consumer-facing industries, the model for industrial companies can be characterized as “embed then scale out.”

As discussed, this requires careful attention to structure and, notably, an openness to letting go and allowing the digital activity to operate on a semi-independent basis. But both models depend on robust sponsorship from the top. The successful cases we observed had senior leaders who were sensitive to the power bases within the organization, and who were able to use their political skills to overcome potential sources of resistance.

Use the chief digital officer to embed digital capabilities into the company.

Many of the companies we studied appointed a CDO during the period of our research.

In the first wave, CDO appointments were made to signal the importance of the digital agenda and to provide a focal point for important initiatives. Most of the CDO-led initiatives in this first wave were run centrally. For example, at GE, Bill Ruh initially created a software center of excellence “as a mechanism to bring in data scientists and people who understood open source, cloud, and Agile DevOps.”5 In this period, CDOs typically put in place large numbers of “lighthouse” projects that captured attention and helped evaluate strategic options, but with limited business impact.

In the second wave of CDO appointments, the emphasis shifted toward enabling and embedding digital capabilities across the company. In such cases, business lines typically took the lead in piloting and scaling digital activities. The CDO then became the facilitating partner to evaluate their opportunities, provide a reality check in assessing emerging technologies, set up the implementation projects, and foster collaborations across the business lines. CDOs also played an important role in building the technical backbone on which many of these digital initiatives were built.

The CDOs we interviewed were mostly appointed over the past five years, and they recognized the evolving nature of their role, in particular the shift toward achieving business impact. “Digital is not an end in itself. My job is to help businesses evaluate their needs, which starts with the customer, not the technology,” said one respondent. Another observed, “The more digitally mature we become, the more the focus shifts toward measurable impact.”

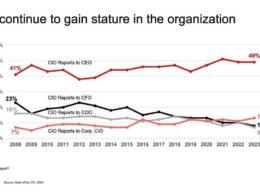

What’s next for the CDO?

Taking a big-picture perspective, we can see the role of “digital-business enabler” as transitory. It was important to help companies get up to speed on digitalization, but it becomes less necessary as these digital capabilities become embedded and the importance of domain-specific knowledge increases.

However, there is still important work to be done in assessing use cases for emerging technologies, building P&Ls for digitally enabled businesses or digital-native revenue streams, and brokering relationships with ecosystem partners.

For example, many industrial companies are attempting to create an IoT platform along the lines of GE Digital’s Predix or Siemens MindSphere, but through a bottom-up, user-driven process rather than in a top-down fashion.

But it is an open question whether such activities require a CDO per se.

One interesting new trend is the role of CDIO (chief digital and information officer) at the board level or one level below that — an explicit recognition, perhaps, that orchestrating digital and information technology activities for business impact is an increasingly important priority.

Applying These Insights to Your Company

While our research focused specifically on industrial companies, we believe there are lessons that apply in a variety of other contexts as businesses embark on digital transformation projects.

A foundational question that many executives grapple with — and that shapes the approach as either revolutionary or evolutionary — is whether the company should create a new digital technology unit or embed a digital project within an existing line of business.

We suggest the following diagnostic exercise, which involves considering five questions, to assist in making that decision:

1. What is the form in which the digital technology will be delivered?

If it is integrated into a physical product, and the value proposition has both digital and physical elements, an embedded approach may be superior. If it replaces a physical product, and the value proposition exists in purely digital form, setting up a separate unit may yield better results.

2. What is its implication for current company assets and capabilities?

An embedded approach may serve you best if your existing assets and capabilities still have value alongside the digital technology, but if the technology will render those assets and capabilities obsolete or threatens to cannibalize them, it’s advisable to manage it in a separate unit.

3. To what degree does using the technology depend on the company’s relationship with the buyer?

For example, many consulting companies provide data analytics services that need to be tailored to the needs of clients and delivered alongside other services. In such cases, integrating those digital technologies within an existing line of business can be helpful.

4. Does the digital technology meet an entirely new need, or better satisfy an existing one?

If the technology is essentially creating a new market by delivering on a previously unrecognized need, then it may be best managed through a separate unit. However, if it is meeting an existing user need but doing so more efficiently or effectively, it may be more appropriate to launch it from within an existing business unit.

5. What is the level of integration between the digital technology and related company activities?

This kind of integration can be complex, requiring mutual adjustment. For example, IoT technology collects data to identify or predict equipment failure, offering the opportunity to sell services (such as maintenance) and/or to design better next-generation equipment. Working via an existing business line is the best way to make use of these synergies and address potential conflicts of interest. However, working through a separate unit is a viable option when clearly defined interfaces make a modular approach possible (think offering the capability to 3D-print spare parts across several lines of business, or creating a digital marketplace that sells not only your own products but also those of other companies).

Your answers to the questions above won’t necessarily be consistent, in which case you will still have to exercise some judgment on their relative weightings — but the exercise is useful as a first-stage diagnostic tool.

Our research revealed that successful industrial companies addressed the challenge of digital transformation in an evolutionary way.

While many consumer-facing companies took a highly strategic approach, using a quickly assembled and semiautonomous unit reporting in at the board level, we saw a very different model in industrial companies, with front-line teams taking small steps, working directly with users, piloting projects with embedded teams, and then gradually getting more freedom and more visibility as they scaled up.

Aiding and abetting them in this process was the CDO. While there was always a signaling and agenda-setting element to this role, the effective CDOs we spoke with preferred to work directly with front-line teams, facilitating them in their digital initiatives, connecting the dots, and building the organization’s capability in this important area.

Most industrial companies were somewhat late to the party in digitalization. This may have been a blessing in disguise, allowing them to learn from the successes and failures of their consumer-oriented counterparts. Showing how a steady progression of evolutionary steps can allow a company to find new ways to create, deliver, and capture value through digital technologies is a lesson that successful industrials can share with the world.

About the Authors

Ivanka Visnjic (@ivankavisnjic) is an associate professor at ESADE Business School.

Julian Birkinshaw (@jbirkinshaw) is a professor at London Business School.

Carsten Linz (@carstenlinz) is an investor, board director, and a member of the World Economic Forum’s Expert Network.

References

See the original publication

Originally published at https://sloanreview.mit.edu