Kaufman Hall

APRIL 7, 2022

Key messages

Summarized by Joaquim Cardoso MSc.

The Health Strategy Blog

April 8, 2022

Overview of Q1 Activity

- … M&A activity in the first quarter of 2022 continued a trend we have seen since the pandemic began: a smaller number of transactions.

- The size of the transactions was smaller than usual and represented a departure from what we have seen during most of the pandemic.

For-Profit Portfolio Realignment Continues

- In recent years, we have commented several times on portfolio realignments by for-profit health systems. That trend continued in Q1 2022, …

- Hospitals that did not have a strong market presence or financial position going into the pandemic have been under significant strain as infection surges have continued to disrupt operations.

- This is likely motivating some for-profit operators to exit markets where efforts to turn around financial performance or seek growth have been unsuccessful, to date.

- This also aligns with a trend to double down on core markets and businesses and shed underperforming assets, which we have been following throughout the pandemic.

Verticalization of National Health Plans

- National health plans have been pursuing vertical integration strategies, with a focus on expanding into care delivery to support value-based payment structures and gain stronger control of members’ medical spend

- The latest frontier in this verticalization strategy is home-based health services.

- Last year, Humana acquired Kindred at Home, which has approximately 775 locations in 40 states.

- In Q1 2022, UnitedHealth Group’s Optum division announced its plan to acquire home-based health operator LHC Group, which has a presence in 37 states and the District of Columbia.

- … we believe that health systems also are moving into a new phase of vertical partnerships that focus on offering consumers access to new services or enhancing the delivery of services that require specialized skillsets.

Looking Forward

- The pandemic has affirmed the imperatives of scale and we expect that this quarter’s results will prove to be an anomaly …

Infographic

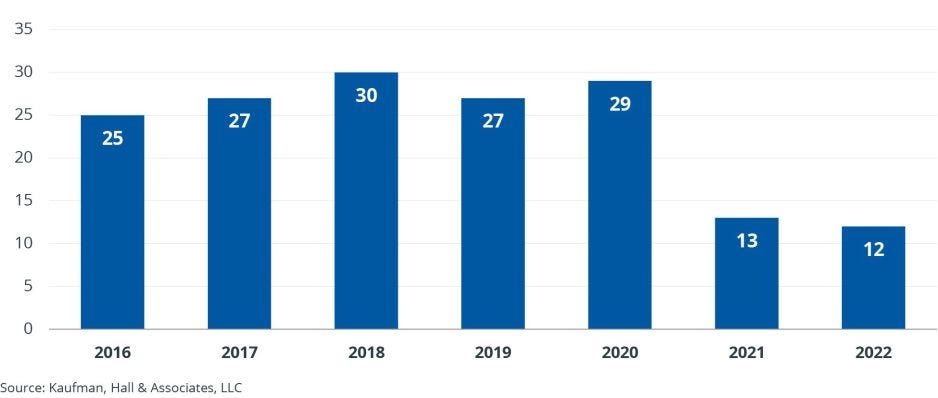

Number of Q1 Announced Transactions by Year, 2016–2022

In Q1 2022, UnitedHealth Group’s Optum division announced its plan to acquire home-based health operator LHC Group, which has a presence in 37 states and the District of Columbia.

… the transaction “will greatly enhance the reach of Optum’s value-based capabilities along the full continuum of care, including primary care, home and community care, virtual care, behavioral health and ambulatory surgery”[2]

which includes almost everything except acute inpatient care

[Decker @ Optum)

ORIGINAL PUBLICATION (full version)

M&A Quarterly Activity Report: Q1 2022

Kaufman Hall

APRIL 7, 2022

As the surging Omicron variant continued COVID-19’s disruption of healthcare operations, M&A activity in the first quarter of 2022 continued a trend we have seen since the pandemic began: a smaller number of transactions.

… M&A activity in the first quarter of 2022 continued a trend we have seen since the pandemic began: a smaller number of transactions.

In recent quarters, this trend had been offset by a high percentage of “mega” transactions, in which the seller or smaller party has revenues in excess of $1 billion.

That was not the case in Q1 2022. There were no mega transactions this quarter, and in four of the 12 announced transactions, the smaller party’s average revenues were below $100 million.

Also notable in Q1 2022 was the high percentage of transactions in which for-profit health systems were the seller.

Seven of the 12 transactions, involving 14 hospitals in total, had for-profit sellers. In contrast, only one of the 12 transactions had a for-profit acquirer.

Overview of Q1 Activity

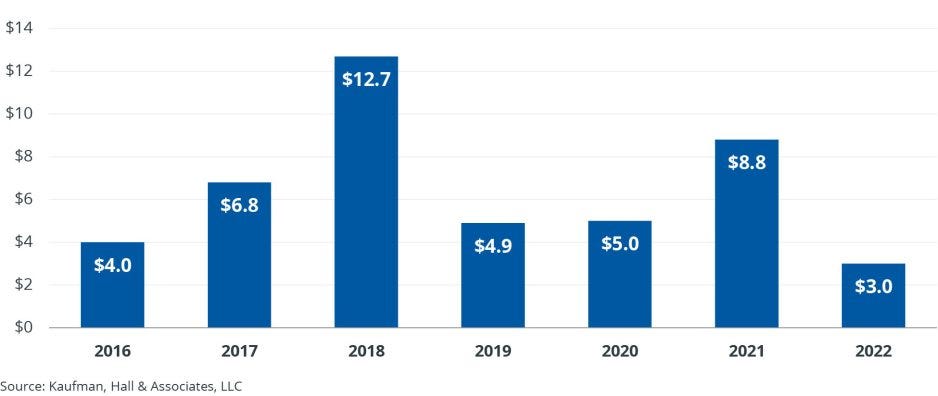

As noted above, the 12 announced transactions in Q1 2022 were consistent with what we have seen since the pandemic began, with the number of transactions running below historical, pre-pandemic levels (Figure 1).

Figure 1: Number of Q1 Announced Transactions by Year, 2016–2022

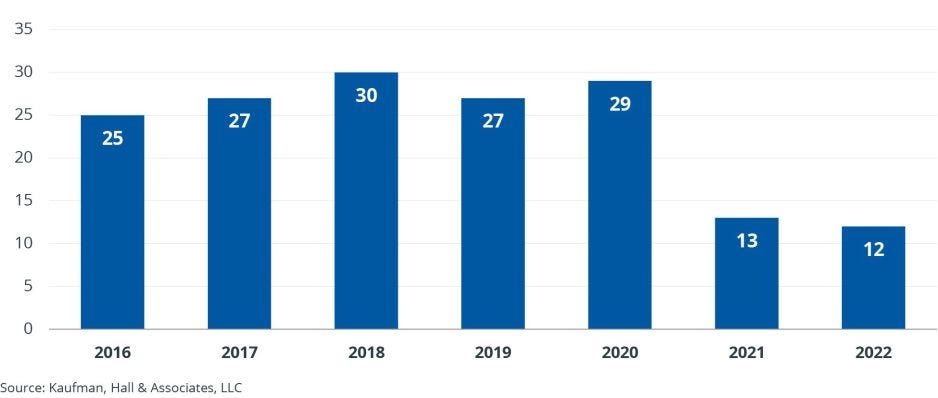

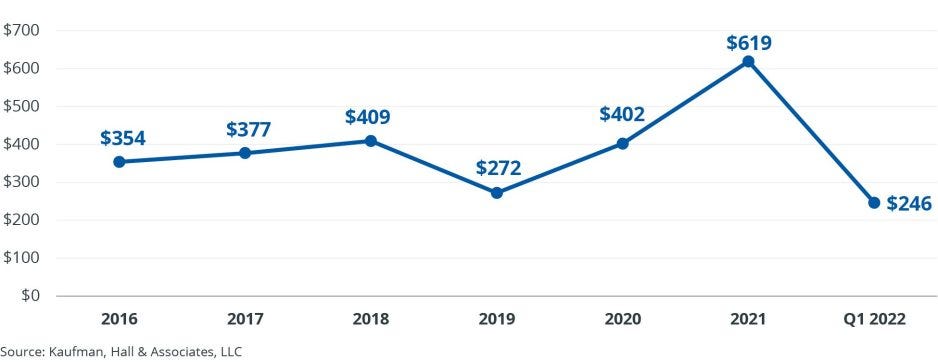

The size of the transactions was smaller than usual and represented a departure from what we have seen during most of the pandemic.

For all of 2021, the average size of the seller or smaller party to the transaction reached a historic high of $619 million, driven by the highest percentage of mega transactions seen in the past six years.

For Q1 2022, average size of the smaller party was $246 million (Figure 2). In addition to the four transactions with smaller party revenues below $100 million, another six had revenues between $100 million and $500 million, and two had revenues between $500 million and $1 billion.

The size of the transactions was smaller than usual and represented a departure from what we have seen during most of the pandemic.

Figure 2: Average Seller Size ($s in millions), Q1 2022 Compared with Year-End Averages, 2016–2021

With both a smaller number of transactions and a smaller average seller size, total transacted revenue for the quarter was also below historical averages at $2.95 billion (Figure 3).

This was substantially below the $8.8 billion seen in Q1 2021, which was the second highest first quarter figure we have recorded.

With both a smaller number of transactions and a smaller average seller size, total transacted revenue for the quarter was also below historical averages at $2.95 billion

Figure 3: Total Q1 Transacted Revenue ($s in Billions) by Year

In eleven of the 12 announced Q1 transactions, the acquirer was a not-for-profit health system.

Of these 11, two were academic/university-affiliated and three were religiously affiliated organizations.

For-Profit Portfolio Realignment Continues

In recent years, we have commented several times on portfolio realignments by for-profit health systems.

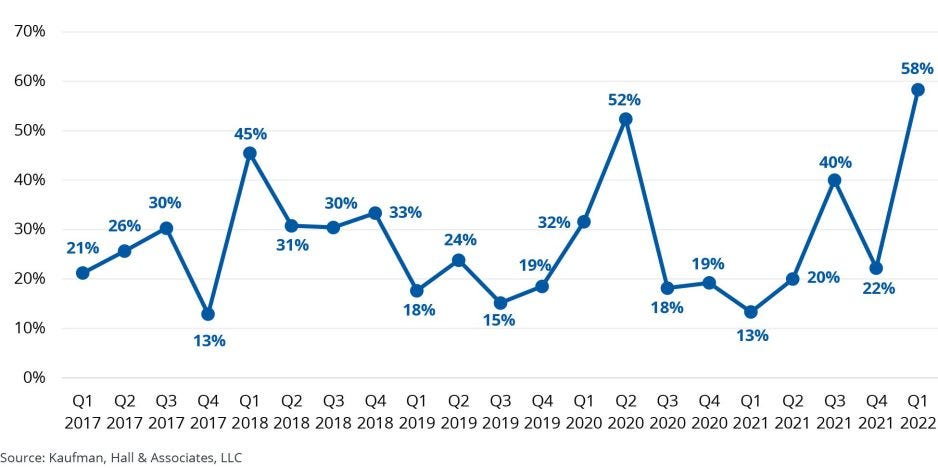

That trend continued in Q1 2022, with the percentage of transactions involving a for-profit seller reaching an all-time high of 58% of transactions (Figure 4).

In recent years, we have commented several times on portfolio realignments by for-profit health systems.

That trend continued in Q1 2022, …

Figure 4: Percentage of Transactions by Quarter with a For-Profit Seller, 2017–2022

Fourteen hospitals are included in these seven announced transactions, with half (seven) being transferred to a new owner in two transactions involving California-based Prospect Medical Holdings.

Prospect will be exiting two of three states where it has hospitals in the Northeast with the sale of Pennsylvania-based Crozer Health (four hospitals) to Christiana Care and the sale of Connecticut-based Waterbury Health (one hospital) and Eastern Connecticut Health Network (two hospitals) to Yale New Haven Health.

All seven of the hospitals involved in these two transactions will return to not-for-profit status after the transactions close.

Other for-profit health systems selling hospitals this quarter included LifePoint Health, Community Health System, and Pipeline Health, which will be exiting the state of Illinois with the announced sale of two hospitals to Michigan-based Resilience Healthcare, a new company formed for the transaction.[1]

As shown in Figure 4, the portfolio realignment trend began in 2017, with the percentage of transactions involving a for-profit seller climbing to 30% in Q3 2017 and then 45% in Q1 2018.

Three of the five most significant spikes, however, have occurred during the pandemic, in Q2 2020 (52% of transactions), Q3 2021 (40%), and Q1 2022 (58%).

Hospitals that did not have a strong market presence or financial position going into the pandemic have been under significant strain as infection surges have continued to disrupt operations.

Hospitals that did not have a strong market presence or financial position going into the pandemic have been under significant strain as infection surges have continued to disrupt operations.

This is likely motivating some for-profit operators to exit markets where efforts to turn around financial performance or seek growth have been unsuccessful, to date.

This also aligns with a trend to double down on core markets and businesses and shed underperforming assets, which we have been following throughout the pandemic.

This is likely motivating some for-profit operators to exit markets where efforts to turn around financial performance or seek growth have been unsuccessful, to date.

This also aligns with a trend to double down on core markets and businesses and shed underperforming assets, which we have been following throughout the pandemic.

Verticalization of National Health Plans

National health plans have been pursuing vertical integration strategies, with a focus on expanding into care delivery to support value-based payment structures and gain stronger control of members’ medical spend.

The latest frontier in this verticalization strategy is home-based health services.

National health plans have been pursuing vertical integration strategies, with a focus on expanding into care delivery to support value-based payment structures and gain stronger control of members’ medical spend.

The latest frontier in this verticalization strategy is home-based health services.

- Last year, Humana acquired Kindred at Home, which has approximately 775 locations in 40 states.

- In Q1 2022, UnitedHealth Group’s Optum division announced its plan to acquire home-based health operator LHC Group, which has a presence in 37 states and the District of Columbia.

The extent to which Optum has moved into delivery of healthcare services was evident in the statement by Optum Health CEO Wyatt Decker announcing the planned acquisition.

Decker said that the transaction “will greatly enhance the reach of Optum’s value-based capabilities along the full continuum of care, including primary care, home and community care, virtual care, behavioral health and ambulatory surgery”[2] -which includes almost everything except acute inpatient care.

… the transaction “will greatly enhance the reach of Optum’s value-based capabilities along the full continuum of care, including primary care, home and community care, virtual care, behavioral health and ambulatory surgery”[2] -which includes almost everything except acute inpatient care — [Decker @ Optum)

As noted in our 2021 year-end report, we believe that health systems also are moving into a new phase of vertical partnerships that focus on offering consumers access to new services or enhancing the delivery of services that require specialized skillsets.

These partnerships will become increasingly important as a variety of organizations compete for control of healthcare’s front door and consumers’ medical spend at the local, regional, and national levels.

… we believe that health systems also are moving into a new phase of vertical partnerships that focus on offering consumers access to new services or enhancing the delivery of services that require specialized skillsets.

Looking Forward

Since the pandemic began, we have consistently seen fewer transactions per quarter.

The small size of transactions in Q1 2022 is, however, a departure from the high percentage of mega transactions we have seen during the pandemic.

The pandemic has affirmed the imperatives of scale and we expect that this quarter’s results will prove to be an anomaly as we (hopefully) move beyond the COVID-related distractions that health systems have faced over the past two years.

The pandemic has affirmed the imperatives of scale and we expect that this quarter’s results will prove to be an anomaly …

Originally published at https://www.kaufmanhall.com on April 7, 2022.

Co-contributors

Anu Singh, Managing Director and Leader of the Partnerships, Mergers & Acquisitions Practice

Kris Blohm, Managing Director

Nora Kelly, Managing Director,

Courtney Midanek, Managing Director

Chris Peltola, Assistant Vice President

Blake Dorris, Assistant Vice President

Matthew Santulli, Senior Associate

References

See the original publication

TAGS; M&As, Vertical Integration; Home Based Health Services