MedTechDive

Nick Paul Taylor

April 14, 2022

Dive Brief:

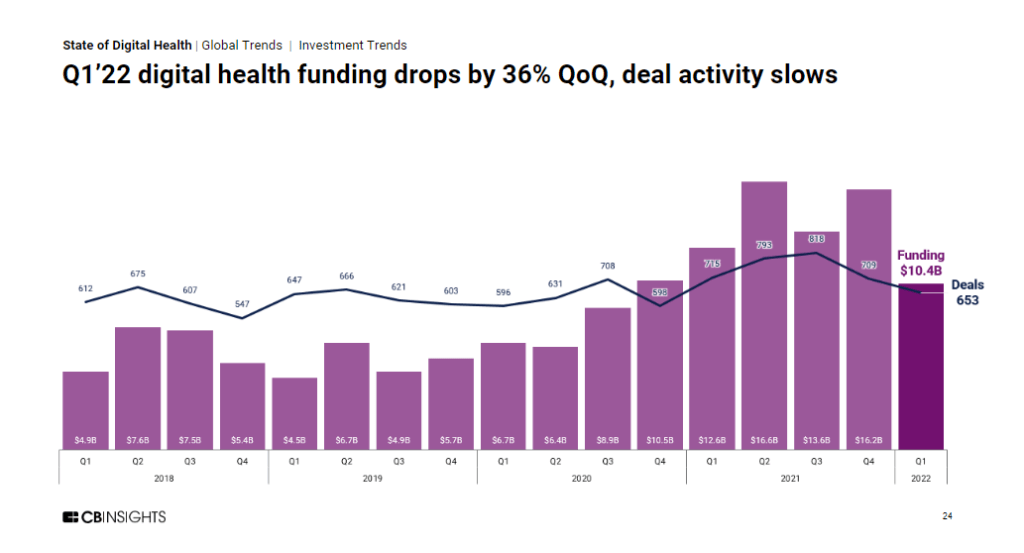

- Global digital health funding slumped in the first quarter, falling 36% sequentially to its lowest level since 2020, according to a report by CB Insights.

- The decline was driven by a halving of the funding committed in $100 million-plus mega-rounds.

- Public markets felt the squeeze, too, with the number of IPOs falling 96%.

- Only one digital health company tracked by CB Insights completed an IPO in the first quarter, and no businesses went public via mergers with special purpose acquisition companies (SPACs).

- The data is directionally in line with the findings of an earlier report from Rock Health, which described how the drying up of deals in February and March may be an early sign of a correction in digital health venture capital funding.

the drying up of deals in February and March may be an early sign of a correction in digital health venture capital funding.

Dive Insight:

The first quarter of 2022 was an unusually turbulent time, with the Russian invasion of Ukraine, supply and energy disruptions, and other factors combining to drive the Nasdaq stock market that is home to many publicly traded digital health companies down 9%.

However, venture capitalist groups still have money to deploy from funds raised before the upheaval, potentially holding up private valuations, Evercore ISI analysts wrote in an April 7 research note.

CB Insights calculated that globally, digital health companies raised $10.4 billion across 653 deals in the first quarter.

The funding figure is well down on the $16.2 billion raised in the fourth quarter of 2021, and the lowest haul by the sector since the third quarter of 2020.

… digital health companies raised $10.4 billion across 653 deals in the first quarter.

The funding figure is well down on the $16.2 billion raised in the fourth quarter of 2021,

and the lowest haul by the sector since the third quarter of 2020.

In an April 4 report, Rock Health also noted a similar trend. It put U.S. digital health funding in the first quarter at $6 billion, compared to $7.3 billion in the fourth quarter of 2021.

According to Rock Health, the first quarter is typically fairly slow, with the $6.7 billion raised over the first three months of 2021 coming in below the quarterly average of $7.1 billion for the year, but the 2022 figure still stands out as being particularly low by recent standards.

Rock Health attributed the sluggishness to the lack of deals in February and March. Across those two months, half of the total quarter haul was raised.

“This could be related to seasonality — February is a shorter month, and late-stage deals can skew monthly patterns — but this quarter’s monthly funding numbers may be early indicators of a digital health venture funding correction,” Rock Health wrote.

“This could be related to seasonality …but this quarter’s monthly funding numbers may be early indicators of a digital health venture funding correction,” Rock Health wrote.

CB Insights dug into the subsectors of the industry to explain the decline.

The amount raised in $100 million-plus deals fell 52%, bringing down the proportion of global funding generated by mega-rounds.

Mental health tech had a slow quarter, too, with funding falling 60% from the record set in the last quarter of 2021.

CB Insights dug into the subsectors of the industry to explain the decline.

The amount raised in $100 million-plus deals fell 52%, bringing down the proportion of global funding generated by mega-rounds.

Mental health tech had a slow quarter, too, with funding falling 60% from the record set in the last quarter of 2021.

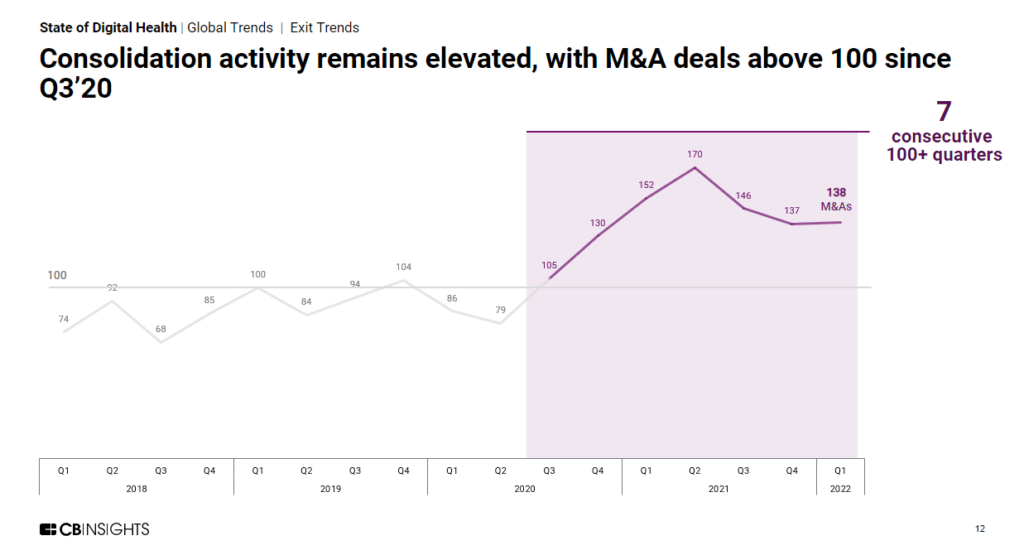

The exit routes available to investors who back digital health startups shifted in the quarter.

Consolidation continued, with the 138 M&A deals tracked by CB Insights being in line with the prior period.

The industry has now had seven consecutive quarters with more than 100 M&A deals.

CB Insights expects the trend to continue as “dominant players emerge in this fragmented market.”

A lack of alternative exit routes could drive more M&A.

In the fourth quarter, CB Insights saw 29 digital health companies go public, mostly via IPOs but in some cases via SPAC mergers.

CB Insights reported just one IPO and no SPAC mergers in the first quarter.

CB Insights expects the trend to continue as “dominant players emerge in this fragmented market.”

A lack of alternative exit routes could drive more M&A.

The decline follows drops in the share prices of public firms.

From July 1, 2021, to March 31, Rock Health’s index of digital health stocks fell 38%, versus a 5% dip in the S&P 500.

Traditional healthcare stocks beat the S&P 500 over the same period.

From July 1, 2021, to March 31, Rock Health’s index of digital health stocks fell 38%, versus a 5% dip in the S&P 500.

Original published at https://www.medtechdive.com

CB Insights

Rock Health

EXCERPT FROM THE REFERRED ROCK HEALTH ARTICLE

Shakeups in funding allocation

Notably, Q1 2022’s $6.0B of digital health funding is flowing to different cohorts of startups than we’ve seen in the past several quarters.

Funding for digital health startups catalyzing R&D in biopharma and medtech ($1.0B) dropped slightly to second place this quarter, while funding for startups augmenting clinical workflow ($888M) rose eight spots to third place.

This category includes several players that reduce or offload clinician tasks—think medical transcription (DeepScribe, $30M), complex care workflow (Memora Health, $40M), or clinical surveillance (Decisio, $18.5M)—a stark need during healthcare’s Great Resignation.

In terms of clinical focus area, startups offering mental healthcare kept the top spot with $1.0B, bolstered by employer-focused Lyra Health’s Series F ($235M) and Omada Health’s Series E ($192M), announced as Omada integrates behavioral health into all of its virtual care programs.

Notably, funding for startups supporting reproductive and maternal health ($424M) reentered the top six for the first time since 2019.

Q1’s reproductive & maternal funding went to heavyweights like Ro (which owns Modern Fertility and recently acquired male fertility startup Dadi), as well as new entrants like specialty maternal care marketplace Zaya Care ($7.6M) and virtual fertility clinic Turtle Health ($2.7M).

While Q1 2022’s investment distribution deviates from some of 2021’s patterns, funding numbers in each category are still too small to signal yearly trend shifts.

And as we mentioned, mega deals like those from digital health’s late-stage players can throw off rankings in the first few months too. With that in mind, we’ll be watching whether Q2 funding reverts to old favorites or continues to chart in new directions.

Originally published at https://rockhealth.com/insights/q1-2022-digital-health-funding-staying-the-course-in-choppy-waters/

https://rockhealth.com/insights/q1-2022-digital-health-funding-staying-the-course-in-choppy-waters/