Second Opinion

Christina Farr

This is a co-written piece with HTN’s

Ryan Russell and Kevin O’Leary

July 5, 2022

Site version edited by

Joaquim Cardoso MSc.

Health Transformation —Institute for Continuous Transformation

Venture Capital Unit (Startups, Healthtechs)

July 5, 2022

TL;DR: With the overall market going bananas and a potential recession looming, there is a lot of speculation on the impact to the private health tech market.

So we, HTN and OMERS Ventures, have teamed up to survey ~150 health care startup operators and investors for perspectives on changing conditions.

Some of these observations may seem obvious to many of you, but we saw a need for a more quantitative (admittedly unscientific) analysis.

And we made the survey anonymous, so recipients could speak their minds.

Here were some takeaways that we’ll dive deeper into below:

- Growth stage companies appear to be changing course quickly — most are pivoting away from revenue growth to profitability and are, at the very least, slowing down hiring seemingly driven by a concern that it could be a while until they see an exit or another round of capital that isn’t overly dilutive)

- Early stage companies appear to be business as usual for the most part — many are still focusing on revenue growth

- Sub-sectors within health tech are reacting differently (care and services focused companies are experiencing the most pressure to focus)

- Investors generally seem a bit more concerned about broader market turmoil, wanting companies to prepare for the worst in the event funding markets dry up

- Yet, at the same time, a number of investors (particularly at the earlier stages) appear to view this as an opportunity to invest more, which suggests we’re seeing a new normal emerge

We don’t think this survey needs much context — it shouldn’t come as a surprise to anyone at this point that general upheaval in the financial markets has made its way to health-tech.

Look no further than the many public companies that have lost the majority of their market caps and the private growth stage companies that have been conducting massive layoffs over the last few weeks.

For a while in the first quarter of this year, it seemed to some of us in the venture world that changing sentiment in the public market valuations wasn’t trickling down to the private markets.

The world has changed, quickly.

Investors have been quick to caution startup founders, with leading backers like YCombinator cautioning founders to “ plan for the worst”.

This article prompted a good dialogue in the HTN Community Slack around what the impact of this economic downturn will be on health tech companies, specifically. The general sense within the community seemed to be that healthcare companies would see some effects from the downturn, but it’s unclear as to what specifically might happen.

So we decided to team up to ask our respective communities for their perspectives on what is happening in the market.

We conducted this (admittedly unscientific) survey to learn about how both operators and investors are perceiving changing market conditions.

We had 112 health tech operators and 37 investors fill out the survey — you can check out the bottom of the article for a bit more detail on who responded without naming names.

Below, we’ll share some of the more interesting results from the survey.

First we’ll take a look at how operators are viewing the market, before turning to investors’ views, and then wrapping with some thoughts on what this means moving forward.

Takeaways from the operators:

Revenue vs profitability: Growth stage startups are shifting to profitability but it’s not yet trickling down to early stages

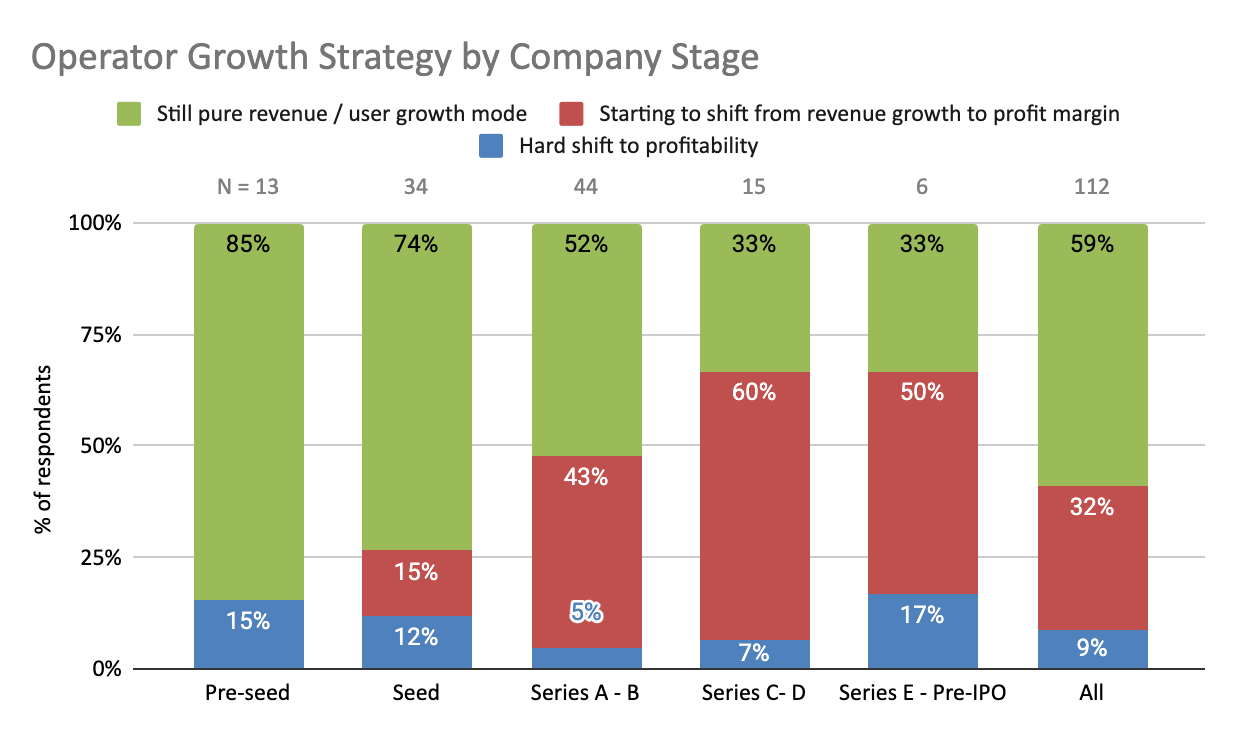

We’ve seen over the past several months virtually every public health tech company articulate a timeline to achieve profitability, even if in some cases that isn’t until 2025+. While most startups respondents are still in the camp of pursuing pure revenue growth, we’re not surprised to see that later stage companies seem to be shifting their focus more than earlier stage. It makes sense that we’d see this reaction trickling down from the public markets to growth stage companies.

Interestingly, while none of the pre-seed respondents said they were starting to shift from revenue to profitability and 85% still are focused on revenue / user growth, that group also had the second highest percentage of respondents who said they were shifting hard to profitability at 15%. It seems that there are two camps within the pre-seed responses — the majority of whom are conducting business as usual, and the minority who appear to be rethinking their approach entirely. It will be interesting to watch moving forward if more pre-seed founders choose to focus on profitability and presumably build businesses that are more resilient in terms of their ability to survive without raising outside capital.

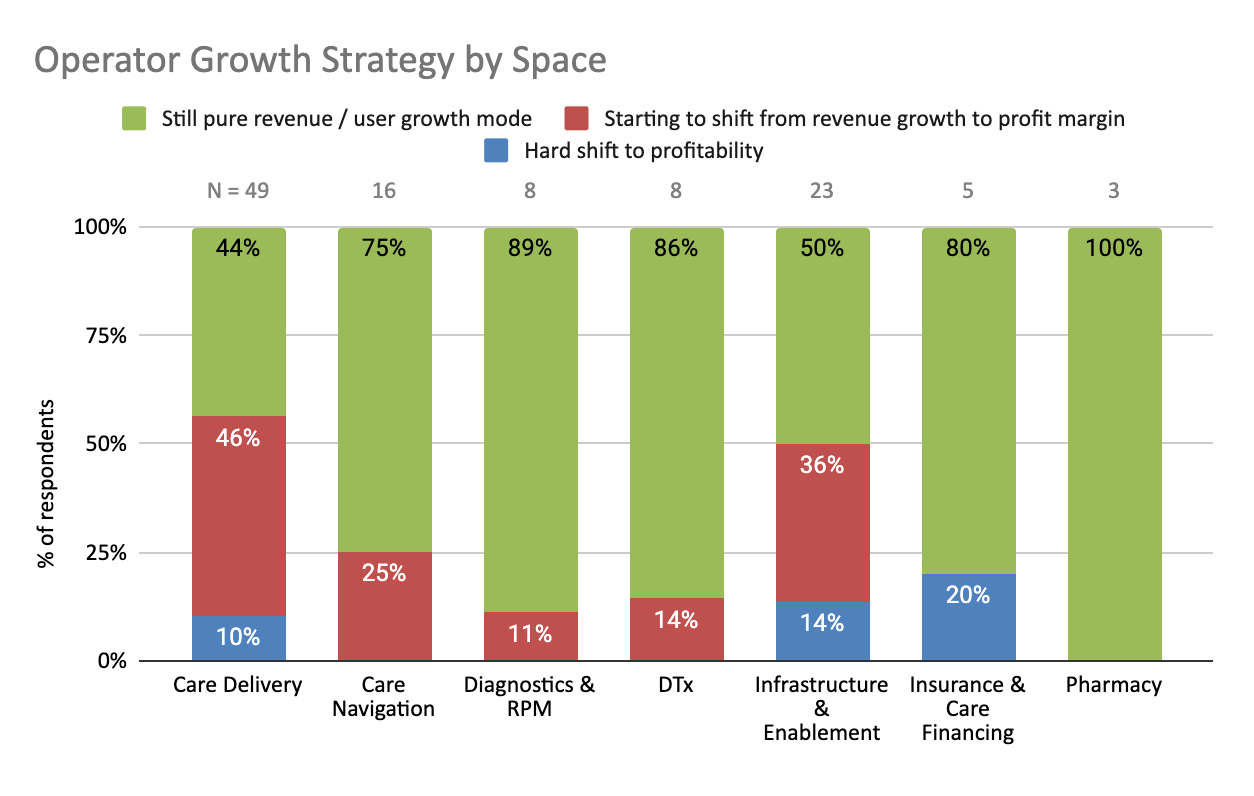

We see evidence of this when looking at the growth strategy by sub-sector rather than by funding stage in the chart below. Care Delivery and Infrastructure & Enablement over-index on shifting to profitability more so than the other spaces (this is independent of stage of these companies — i.e. 40% of the seed stage care delivery companies responded that they are either starting to shift or in a hard shift toward profitability). Over the last couple years, we’ve seen many care delivery companies crop up focused on acquiring patients at all costs — incredibly high customer acquisition costs without clear business models for unit profitability and that appears to be changing. Infrastructure & Enablement also sticks out here, but the process to get there differs, which we touch on more in the next several sections.

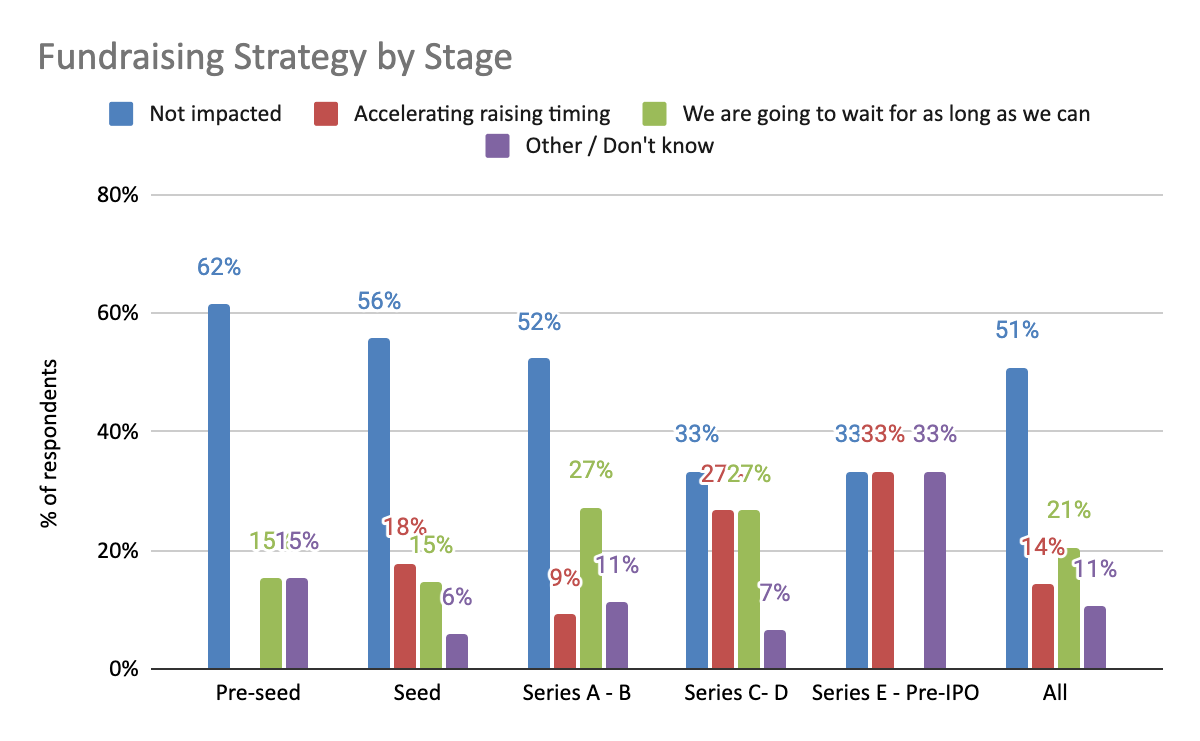

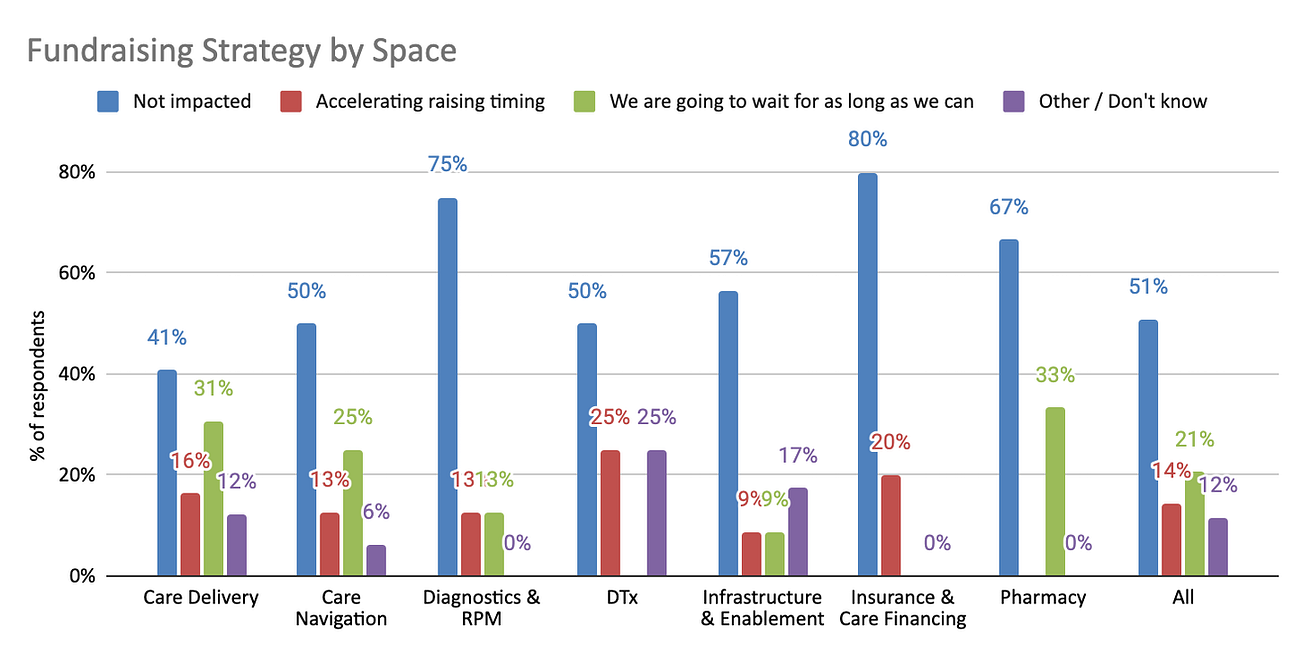

Funding: Most startups see fundraising as business as usual, with a few adjusting course

While the majority of startups, in aggregate, indicate their funding strategies have not been impacted, there is a clear trend of Growth stage companies (particularly Series C — Pre-IPO) making an adjustment. Accelerating funding makes sense for those later stage companies needing to focus on profitability but reliant on more capital do so. If you need capital to achieve those newfound profitability goals (or mandates) and are concerned about capital drying up and/or valuations continuing to lower, you would be desperate for capital now. On the other hand, if you have line of sight into profitability with the capital on hand, and you don’t want to risk worse terms (see the Investor section), the potential valuation (and dilution) benefits may outweigh the risks of going back to the well.

Related to growth strategy differences we saw between sub-sectors (particularly Care Delivery, Infrastructure/Enablement and Care Navigation), it shouldn’t come as a surprise that their funding needs have been disportionately impacted as well. It is interesting to see that the patient-focused spaces (Care Delivery and Care Navigation) are the most impacted with a higher proportion of folks geared toward waiting as long as possible, presumably because those have 1) less clear line of sight to profitability thus leading to harder conversations on terms and 2) the ability to reduce burn by focusing on core, niche markets to figure out their unit economics — the only question will be for how long.

We also have a hunch that this, in part, represents a dichotomy between startups that have investors who are encouraging them to do so, and those who don’t. It is interesting to see some of the commentary from startup operators on what they’re hearing from investors, and how different the sentiments are, even from C-level operators within Seed stage companies:

“VCs are all calling to advise belt tightening — wayyy behind the curve and not a helpful convo at this stage.” — Digital Therapeutics operator “ There still seems to be abundant $ at the Seed / A level.” — Care Navigation operator “A lot of fear being shared by big VCs who have taken a hit with big valuations last year.” — Care Delivery operator

The current market conditions are testing how aligned the incentives are between startups and their investors. This podcast from Odd Lots, while focused on tech, does a nice job of explaining some of the incentive misalignment. At their core, investors are incentivized to do what is best for their portfolio as a whole, rather than any one specific company. More aggressive terms, bigger swings (whether misses or hits), and faster failures might improve the return profile for an investor, even at the detriment of an individual company founder.

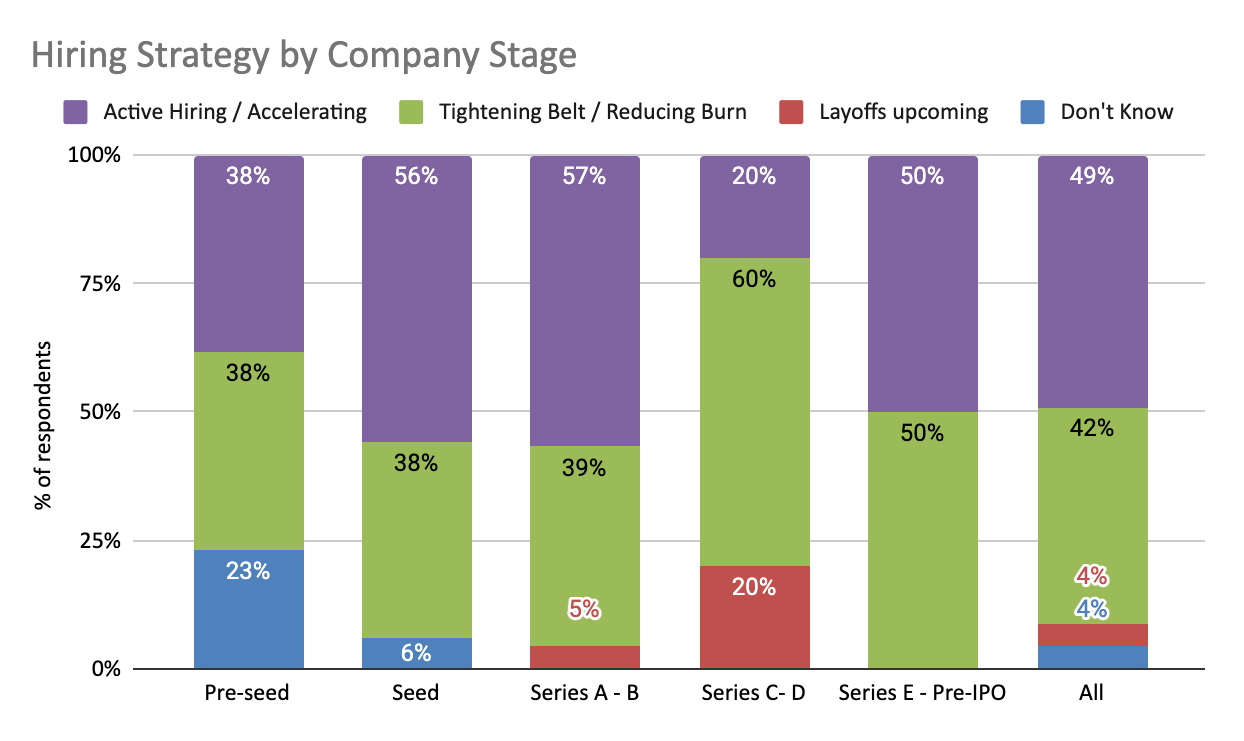

Hiring: Growth stage companies again feeling the crunch

Given the news cycle over the past few weeks, we don’t imagine it comes as much of a surprise to folks that Series C — D companies are reporting a rather dire picture from a hiring perspective. Only 20% of companies at that stage are reporting that they are either still actively hiring or accelerating hiring, while that number is around 50% across board. While 20% of Series C — D operators are expecting layoffs in their organizations, the low percentages across the other growth stages seem like they would be under-reported by operators who are, or want to be, naturally optimistic about their company’s outlook.

At the earliest stages, there seems to be a bit more uncertainty with more pre-seed and seed stage operators reporting that they don’t yet know the impact on hiring. This comment from a Seed stage operator in Care Delivery rings true when translating funding to hiring:

“Investors wanting to see a model where we can survive through at least the end of 2023 w/o additional funding.”

Given the environment we are in, this all might feel obvious — “of course, these companies should all refocus and tighten the belt.” However, imagine a year or two ago telling companies that just raised an angel or seed round that they should be slowing down hiring. With the heavy percentage of companies across the board that are tightening the belt to manage cash, it seems that this is a very real sentiment across early-stage founders. It’s also hard to imagine we won’t see more outcomes like this response from a pre-seed founder in the infrastructure space: “We’re shutting things down”.

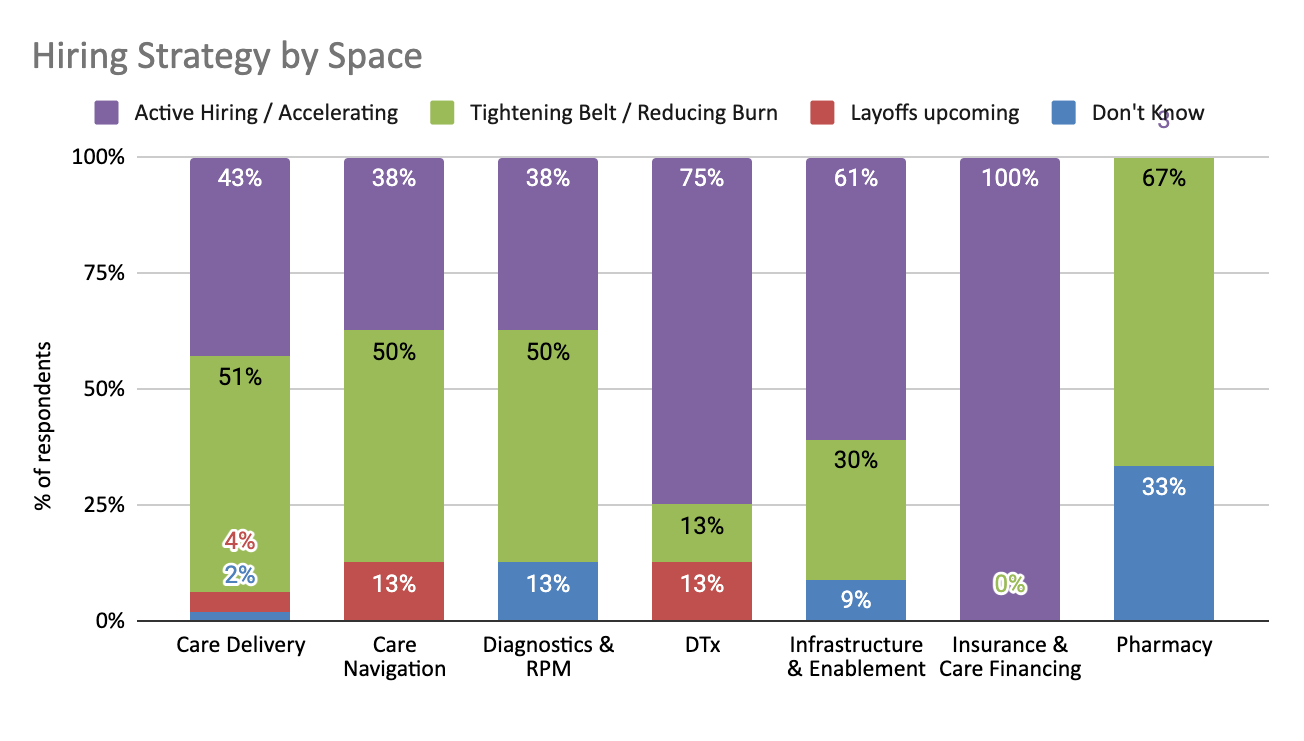

Cutting the data by sub-sectors reveals similar patterns as the growth and funding strategies in Care Delivery and Navigation with more aggressive staffing and burn management. However, you can start to see why Infrastructure & Enablement companies fit a different profile. While they skew towards shifting to profitability from a growth strategy perspective, they are able to do so with less cost cutting measures. This is a reminder that while these companies operate / sell in healthcare, they behave much more like traditional tech and services businesses.

While the sample size is lower across the other spaces, it’s interesting to see the active / accelerating hiring in Digital Therapeutics (DTx) and Insurance. Particularly in Insurance, it seems strange to see 100% still actively / accelerating hiring when 1) the recent public company performance in the space has been horrendous and 2) 20% of the group indicated a hard shift to profitability. Though, as much as we talk about “tech enabled” health plans, acquiring and supporting insurance members is still a service oriented business that requires people to scale.

Takeaways from the investors

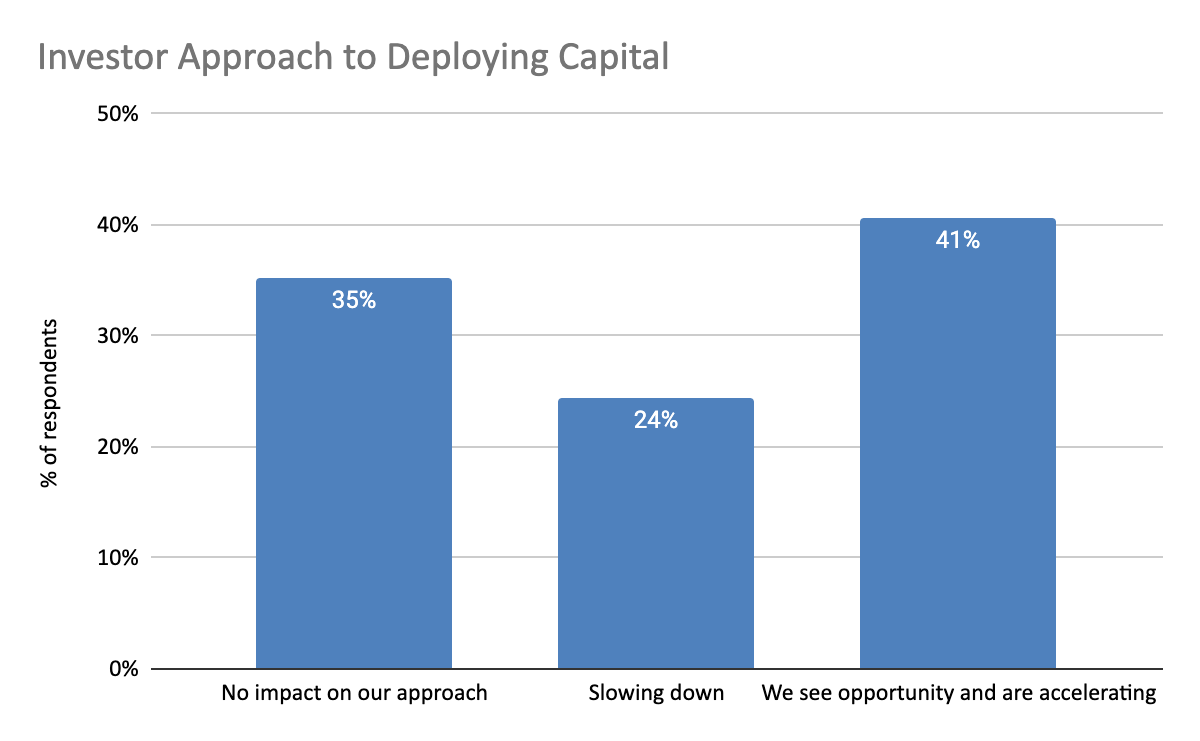

Deal Activity: Many investors appear to actually be increasing activity

This is the data that was the most surprising to us within the survey — over 40% of investors who responded to the survey see an opportunity in the current market landscape and are accelerating the pace of their investments. If this holds true, it seems far from the doom and gloom scenario we’ve been hearing VCs warning about publicly over the past few months now. Many investors still have dollars to deploy in their current funds and see an opportunity to get into a company at a more reasonable valuation. We’ve anecdotally heard that funds are looking back at deals they missed last year, at the height of the boom cycle, and proactively offering to participate in or lead a flat/down round.

A recent CNBC interview with Mel Lagomasimo, the CEO and managing partner of WE Family offices, highlighted this point saying she sees major opportunities in the private markets vs. public market in the face of worsening overall market conditions. The sentiments of investors taking this survey seem to indicate that to be the case in health tech as well with only ~24% of investors reported that they’re going to be slowing down activity. Those opportunities come with caveats for founders though. While capital doesn’t appear to be drying up entirely, it’ll be coming with more onerous terms and at reduced valuations as we’ll see next.

Investor Behaviors: Quickly recognizing a new normal and acting accordingly

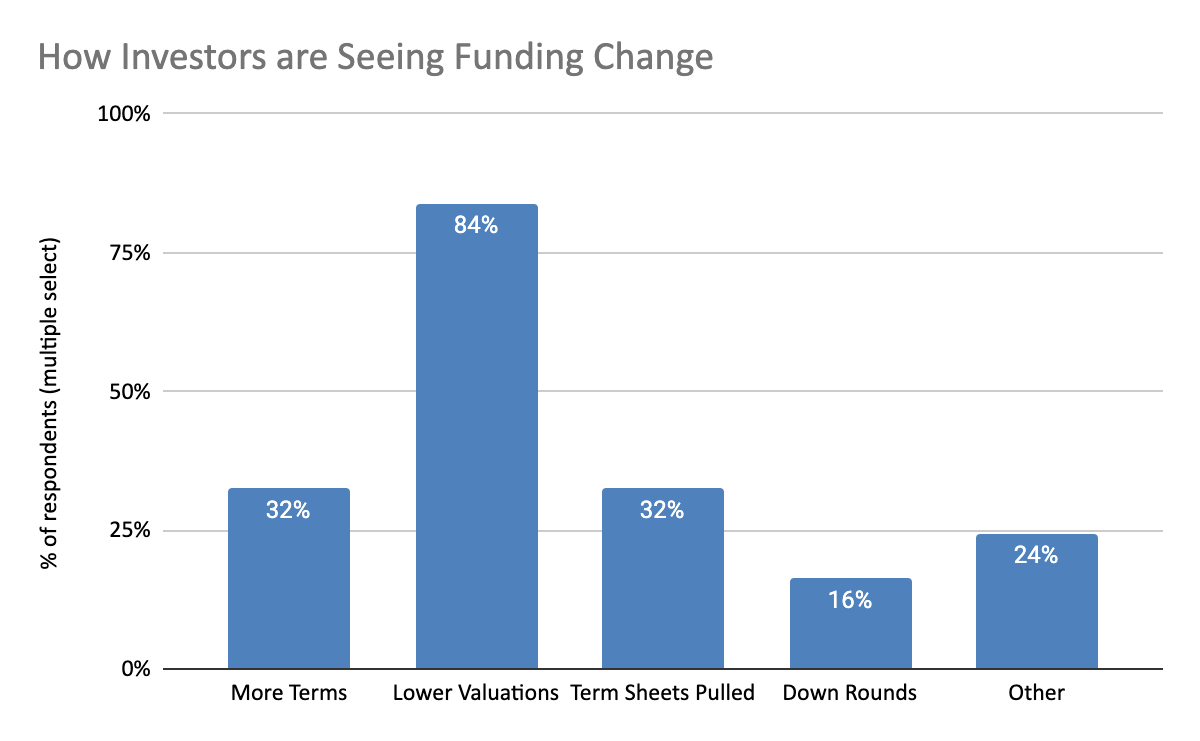

When we asked investors what behavior they’re seeing from other investors, 84% (31 of 37 investors) responded that they are seeing lower valuations in the current market. This response seems to sum up the investor sentiment here well:

Investors are expecting founders to recognize the new-normal and so lower the initial ask valuation to reflect the changing environment

Beyond lower valuations, investors also reported seeing other behaviors generally considered “unfriendly” to founders, with 32% reporting term sheets being pulled and 32% with additional terms being added. Additionally, there was a common theme in “other” that they’re seeing longer timelines, particularly compared to last year. Longer diligence periods can be a good thing, though, for both founders and investors. It gives both sides a better opportunity to get to know each other as these relationships can often continue for a decade or longer.

In general, these responses make it seem like investors know that market conditions are turning in their favor, giving them more ability to place favorable terms for an investor on the round and they are behaving accordingly.

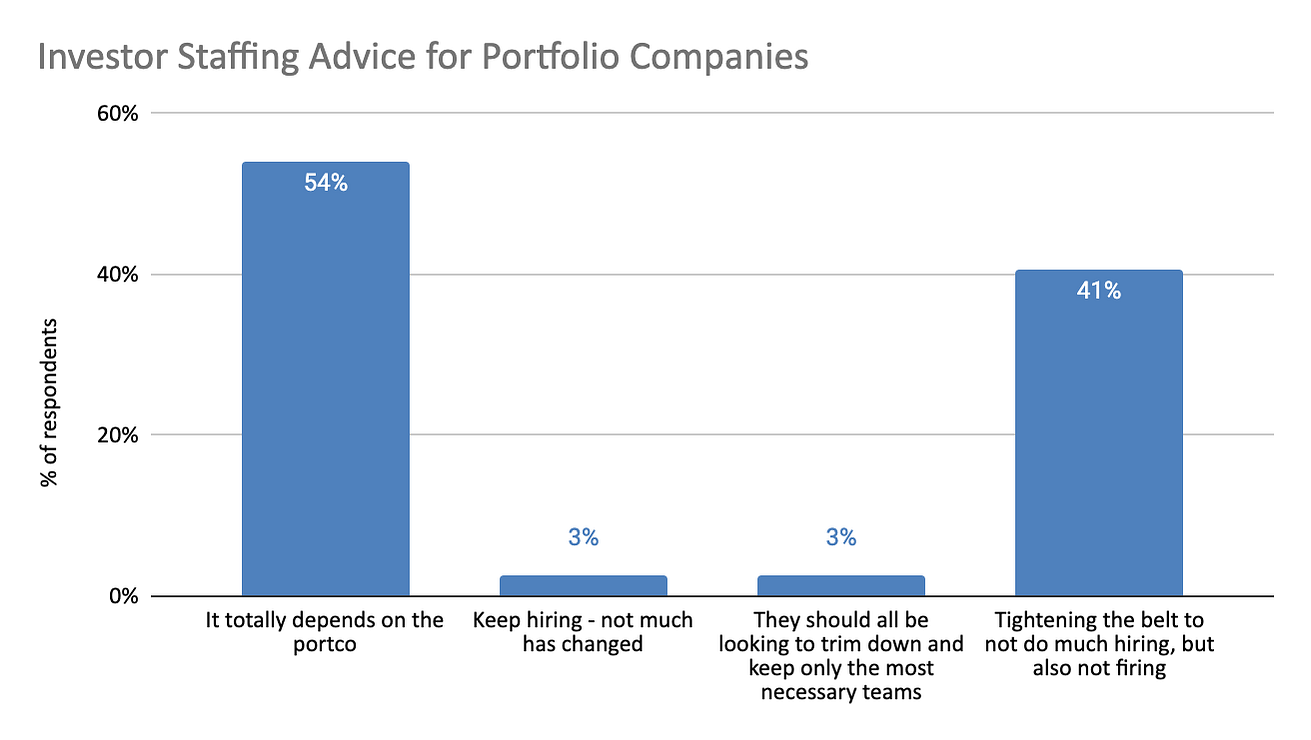

Hiring: Investors cautious on the hiring front, with virtually none suggesting their portfolios should be hiring in business as usual mode

As highlighted in the operator section, investors are generally more cautious on spending with ~40% indicating that they are advising their portfolio companies to tighten their belts. But investors are generally going to lean on “it depends” based on the situation of a specific company, as 54% of respondents do here.

It’s not hard to imagine how the “it depends” category breaks down, particularly for early stage startups — companies that are viewed as potential winners in a portfolio (i.e. seeing revenue growth, a viable unit economic model, etc), are going to be encouraged to continue hiring in order to drive that grow. If companies are viewed as laggards, and investors are questioning whether they want to invest more money into the business, we’d imagine that investors will be encouraging them to cut staff. Investors might also want their earlier-stage businesses to move faster so they can reach milestones to help them raise that crucial next round.

The Dichotomy Between Investor and Founders Views & Takeaways for Moving Forward

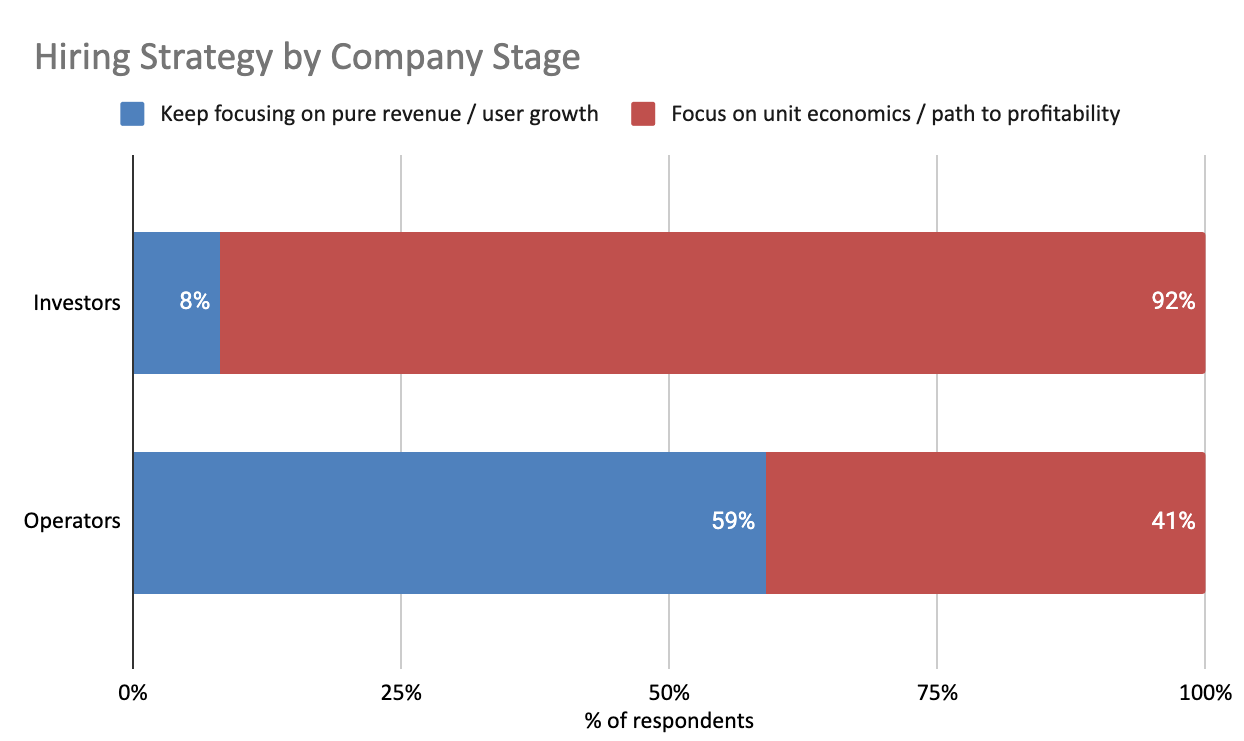

It is certainly interesting throughout to see the dichotomy between how investors and startup founders responded to the survey.

When you summarize the growth strategy approach that operators are taking vs. how investors say they are advising their portfolio companies, there is a pretty stark contrast:

It seems that investors see that there is a new normal in terms of the funding environment, and that the experience companies have had over the past few years isn’t going to be the norm moving forward.

This new normal seems to pretty clearly favor investors, and you can see that in responses to the survey like the following:

An investor on how they’re guiding startups:

Guiding them that process will take longer and valuations won’t be as lucrative as last 2 years

A growth stage startup founder on funding environment:

Personal belief is that investors are taking advantage of the reset

The common thread between those two responses is that there has been a reset in the market, which has come with a shift in the power dynamic between founders and investors. The last few years have been an extremely frothy market that has favored founders, complete with stories of firms like Tiger Global using Cameo videos of NBA players to entice founders to reverse pitch buzzy startups. Those days now seem like they are long gone and the power dynamic has reversed. We are entering an investing market that favors the investor, and VCs are going to have more ability to dictate terms of financing.

Here are a few thoughts on what we think this shift might mean for markets moving forward:

- 1.Seed / Pre-Seed companies not adjusting their approaches will be in for a rude awakening if they need to raise future capital

- 2.A flight of talent from growth stage companies

- 3.A flight of investment to sure bets

- 4.Getting back to business model basics

1.Seed / Pre-Seed companies not adjusting their approaches will be in for a rude awakening if they need to raise future capital

It is interesting to see the dichotomy between how early stage startups and investors are viewing the world currently. For early stage founders who expect their experience to be like that of companies that have grown over the last few years, at least in terms of funding and valuation, it is worth remembering that we live in a very different world now. Investors seem to have recognized that they hold the cards in this market environment, and founders would be well served to have a story for how they intend to grow their business profitably.

Of course, the way to avoid this issue entirely is to focus on building a profitable company from the get-go that isn’t reliant on outside funding, which is something that it seems more pre-seed founders are considering. It’s also worth noting that as companies take this approach, there will be a natural question of whether they are “venture scaleable”. We think this will be particularly true for care delivery startups as they grapple with how to scale a clinical workforce profitably (in our view, despite all the AI/ML buzzwords thrown around today, this remains the key question for most care delivery startups).

2.A flight of talent from growth stage companies

We think that layoffs will just be the first stage of a broader talent exodus from growth stage companies. One of the lasting impacts of the massive recent funding cycle for digital health over the past few years is that it has attracted so much new talent to the space, bringing new perspectives on how we can drive meaningful change in healthcare. Part of the attraction to healthcare presumably was the ability to do well financially while also doing good in the world. As many growth stage employees start to realize their equity is worthless and that doing good at scale isn’t as easy as they might have expected with the embedded incentives in the healthcare system, we expect it will be open season on stealing good talent from those companies.

We think this could be a huge opportunity for thoughtful incumbent organizations, in particular, who will be able to pitch people the opportunity to drive change at scale while also getting paid a nice cash salary, where your future earnings aren’t reliant on hitting crazy growth targets.

We also would expect this crop to be thinking about starting their own companies coming out of these experiences, and that this next generation of entrepreneurs in the space will have the opportunity to think about what reasonable growth expectations are within healthcare. Perhaps not all of the companies that have received venture backing over the last few years should actually be venture backed. We think that this next group of entrepreneurs will be willing to rethink how to define success of these organizations — both from a financial and impact perspective.

3.A flight of investment to sure bets

As one of the operators mentioned in their survey feedback: “There will be a flight to quality. First time founders with unproven business models will struggle to fundraise vs. serial founders and veteran management teams who have a scalable and sound business model.”

We think this is well said, and likely doesn’t need much additional context. In an environment where investors can be more picky, they’re going to favor safe bets. This means investing in people who have done it before, business models that are proven, and health tech spaces that are more conducive to venture style returns (e.g. infrastructure & enablement that are much more similar to tech than they are traditional healthcare)

4.Getting back to business model basics

Over the past few years we’ve seen a lot of funding go towards companies with grand visions of trying to fundamentally alter the healthcare landscape. Of course, the challenge with those visions is proving that they have a basis in reality. We expect that over the coming years, healthcare investors will get back to the basics, focusing on companies that have both demonstrated they can acquire customers successfully with a profitable unit economic model.

We think this ultimately will be both a good and a bad thing for the space — good in that it creates more durable companies, bad in that much of the more meaningful change that has been promised by new approaches without proven business models will fall to the wayside. We’d expect this will be particularly true with virtual first care delivery companies. No more are the days of 100x revenue valuations with underwater financial models funded on the promise of Value Based Care contract growth. Instead we’d expect to see companies recognize the need to grow in the Fee for Service environment, with Value Based Care as a potential future cherry on top. The challenge here is inevitably that much of what we view as care model innovation is actually business model innovation, and as soon as we revert back to today’s business models, the financial reality of operating a profitable business sets in.

This ultimately has always been a core challenge in healthcare innovation — i.e. many of the ideas that we all see about improving how patients can, and should be, treated generally struggle because they don’t have a financial model to support them. This is the underlying reason why healthcare innovation has been such a laggard compared to other consumer-centric industries. Unfortunately, it seems destined to remain as a core challenge with startups seeking out the same profitable business models that incumbent healthcare organizations have been benefiting from for decades at the expense of meaningful change in the space.

In general, it appears that we’re moving through this period of uncertainty pretty quickly, and we’re starting to see what the next few years of digital health investing will look like. We hope this was a helpful exercise for folks in seeing how various operators and investors are viewing the world.

Originally published at https://ovsecondopinion.substack.com on July 5, 2022.