Linkedin

Ari Gottlieb, A2Strategy Corp

October 18, 2022

Site Editor:

Joaquim Cardoso MSc.

Health Transformation Center — in search of excellence

October 25, 2022

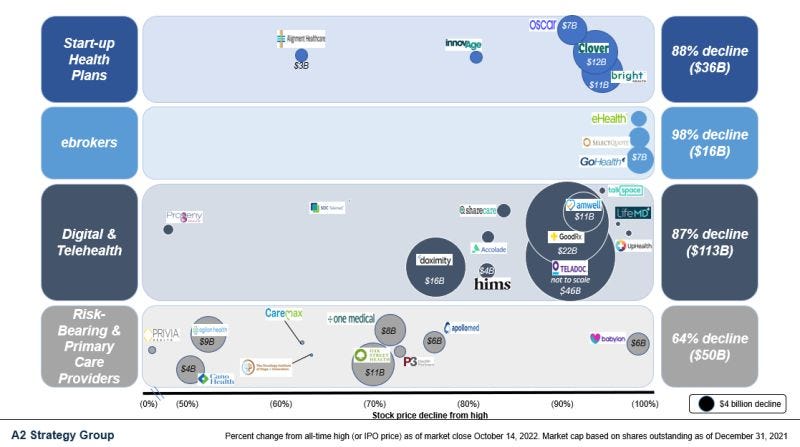

In January, public companies across the health tech landscape had lost $190 billion in market value from the highs (73%).

Today, even more value has been eroded — over $215 billion or 81%.

Within the additional $25 billion market cap loss are some cross-currents tethered to real market realities, as investors begin to differentiate between long-term viable business models and hype.

The best performing sector, risk-bearing and primary care providers, has gained $3 billion in value over the last nine months — down only $50 billion (64%).

- Amazon’s proposed acquisition of One Medical

- and the previously reported (now off) interest in Cano Health has helped to propel valuations higher,

- particularly for Privia Health (now the best performer in the space).

- This is sensible risk continues to shift to providers, with the multi-line players like Privia best positioned.

- The worst performer, Babylon, is now down 98% with liquidity issues (they raised today) and a consistent and coherent strategy appearing elusive,

- while ApolloMed despite having a profitable and growing business has been caught-up with the Bright Health debacle (guessing in year they’ll buy back the MA assets they sold to Bright).

The biggest declines are in the digital and telehealth companies, now down $113 billion (87%).

- Teladoc Health has lost a staggering $46 billion of value — now worth $4 billion, after acquiring Livongo for $19 billion, with its stock at levels not seen since 2017.

- UpHealth, Inc. may be considering a name change to DownHealth and hopefully Talkspace is considering offering investors a discount given the performance lately.

- The only digital/telehealth company up over the past nine months is hims & hers showing that selling ED pills to college kids appears to perform well and keeps growing, even leading into a recession.

Teladoc Health has lost a staggering $46 billion of value — now worth $4 billion, after acquiring Livongo for $19 billion, with its stock at levels not seen since 2017.

Overall, the eBrokers are down 98% suffering from liquidity issues and accounting rules.

- With a collective market cap of $250 million and clear value for MA plans, we can expect to see more moves like Elevance Health’s recent investment in GoHealth.

Finally, the start-up health plans, now down 88% or $36 billion from the highs.

- Alignment Health has performed well over the last nine months,

- while my favorites, Oscar Health, Clover Health, and Bright have not — down 91–95%, proving some level of rationality and discrimination exists between those with viable business models and those without (more on Bright’s failure later this week).

Overall, it appears long-term viability and near-term liquidity are driving valuations and moves in the sector, which for those of us interested in sustainable value creation is likely a good thing.

It is likely those competing interests will be even stronger going forward as the businesses that can demonstrate real value will be rewarded and those with less sound business models or cases will fail or be acquired for a fraction of prior valuations

Originally published at: https://www.linkedin.com