the health strategist

institute for research & strategy

Joaquim Cardoso MSc.

Chief Research and Strategy Officer (CRSO),

Chief Editor and Senior Advisor

August 18, 2023

What is the message?

The article explores the present and future role of AI in insurance, highlighting its current applications such as automating tasks, generating insights, and enhancing risk assessment.

It emphasizes the collaborative integration of AI with human expertise, discusses key technologies like Machine Learning and Computer Vision, and underscores the need for responsible AI usage to manage potential risks and ensure societal benefits.

Key takeaways:

Current Applications of Narrow AI in Insurance:

- Narrow AI is being utilized in the insurance industry for automating repetitive tasks, generating insights from complex data sets, and enhancing parametric products and risk solutions.

- Its functions include automating tasks like classifying submissions and claims, aiding decision-making through data analysis, and improving risk assessment.

Value of Human Interaction and AI Combination:

- The effectiveness of AI in insurance depends on the smart integration of AI models with human processes; AI alone doesn’t replace human involvement but complements it.

- The collaboration between AI and human expertise results in enhanced efficiency and new solution offerings.

AI Technologies Leveraged in Insurance:

- The insurance industry mainly leverages Machine Learning, Natural Language Processing, and Computer Vision for various AI applications.

- These technologies assist in tasks like risk assessment, underwriting, claims processing, and fraud detection.

Underwriting Benefits and Customer Tailoring:

- AI-driven predictive models support smarter triaging and routing in underwriting processes.

- AI’s ability to convert data into insights enhances risk assessment, allowing insurers to offer more personalized coverage and pricing to customers.

Claims Processing and New Coverage Solutions:

- AI capabilities improve back-end claims processes, leading to efficiency gains and insights.

- AI also enables the development of new products, such as Swiss Re’s parametric Flight Delay Compensation, which uses AI models to predict flight delays and offer instant payouts.

Computer Vision for Claims and Fraud Detection:

- Computer vision, combined with edge computing and AI, aids in detecting car accident fraud and identifying driving styles.

- An Italian startup’s patented system records and analyzes video data to determine accident dynamics and driving behaviors while ensuring data privacy compliance.

Potential for Wider AI Integration:

- AI’s impact spans across the entire insurance value chain, benefiting processes from underwriting to claims handling.

- However, responsible AI usage and data literacy are crucial to maintain human control over decision-making and manage associated risks.

Risks and Challenges of AI at Scale:

- As AI tools become more accessible, insurers, policymakers, and tech companies need to address potential new risks associated with AI adoption.

- Ensuring responsible AI usage is vital to derive societal value while mitigating potential downsides.

Balancing AI’s Benefits with Human Enjoyment:

- The article concludes by highlighting the dream of AI freeing up time from tedious tasks, allowing individuals to engage in more enjoyable activities.

- In summary, the article emphasizes the current and potential benefits of AI in the insurance industry. While current applications of Narrow AI enhance efficiency and decision-making, the collaborative integration of AI with human processes is essential.

- The use of advanced AI technologies like Machine Learning, Natural Language Processing, and Computer Vision is transforming various insurance processes, from underwriting to claims processing.

- It also discusses the importance of responsible AI usage, data literacy, and addressing potential risks associated with widespread AI adoption.

Infographic:

DEEP DIVE

Benefits and use cases of AI in insurance – Part 2: Decrypting AI for insurance

SwissRe

Pravina Ladva & Antonio Grasso

April 17, 2023

Predictions of how Artificial Intelligence can change industries – and even lifestyles – rarely fail to inspire. And we have to admit: the idea that AI could take care of some of life’s tedious paperwork, allowing us to spend more time doing things we love, is a nice dream.

When it comes to the re/insurance industry, a recurring vision for the future is that AI will potentially enable more precise coverage and pricing adjustments. While this is an attractive long-term goal, let’s discuss where AI is delivering benefits today and the opportunities for the insurance value chain in the near future.

Current insurance AI applications are based on a narrow type of Artificial Intelligence.

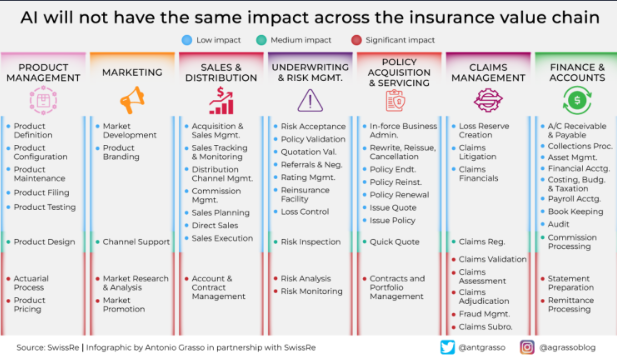

AI will not have the same impact across the insurance value chain

What is Narrow AI for?

Narrow-AI is already being used in many industries. In insurance, it has three main functions:

- First, it can automate repetitive knowledge tasks (e.g., classify submissions and claims)

- Second, it can generate insights from large complex data sets to augment decision making (e.g., portfolio steering, risk assessment)

- Third, it can enhance parametric products and risk solutions

Although AI enables re/insurers to become more efficient and offer new solutions, it’s important to keep in mind that, so far, an entire system is required for its use, including human interaction. The added value of AI therefore only comes from the smart combination of AI models and human processes, not just a standalone AI model.

The AI technologies most leveraged in insurance today are Machine Learning, Natural Language Processing, and Computer Vision. As illustrated in Part 1 of our Series on “Decrypting AI in insurance”, there are many governance, organisational and cultural conditions that AI applications must fulfil to benefit the insurance industry and society at large.

Advanced analytics, and some forms of AI, have been increasingly enriching the insurance value chain for several years and will have a different impact on each stage of the value chain in the future.

General vs Narrow AI: understanding the difference

We use the following definitions: AI refers to mathematical models that learn patterns from data and enable faster or even automated decisions. Depending on its scope, AI can be referred to as either “narrow-AI” (models designed to fulfil a specific purpose in a defined context) or “general-AI” (a universal model with human-like intelligence). No true general-AI exists yet, but recent advances partly begin to exceed capabilities associated with narrow-AI (e.g., Open AI’s ChatGPT and GPT-4 or Google’s Bard).

AI use cases in insurance

Let’s look at examples in three areas:

1. Underwriting – improved risk assessment and customer understanding

Re/insurers get access to more and more data at the time of underwriting thanks to the digitalisation of existing touch points or access to new data assets with digital partners – just consider telematics, remote sensors, satellite images or digital wellness records. The ability of re/insurers to convert this data into actionable insights for underwriting, is a key competitive differentiator, as it allows them to offer customers more tailored coverage and pricing.

AI techniques such as supervised learning can complement and streamline certain UW processes – for example, when it comes to smarter triaging and routing. AI-driven predictive models at Swiss Re support triaging Life & Health underwriting and simplify the consumer journey.

These AI models have been integrated into Magnum Pure©, Swiss Re’s Life & Health automated underwriting solution platform, to orchestrate and utilise both human and machine intelligence at scale. With Magnum Pure©, this expert-backed and machine-learning-based risk assessment solution can be easily deployed across multiple distribution channels and in point-of-sales tools.

2. Claims – improved back-end processes, new products, and coverage for more risks

AI capabilities can not only improve efficiency and insights but can also enable the development of new solutions and coverage for previously uninsurable risks. Swiss Re’s parametric Flight Delay Compensation is built on an AI model that can predict flight delays. In the event of a delay, customers who purchased the insurance when buying their ticket will receive an instant pay out – with no need to file a claim. The solution uses more than 200 million historical data points and the machine learning capability of the pricing engine allows for rate adjustments, based on data from over 90,000 flights per day.

3. Claims – Computer vision can reduce car accident fraud and detect driving style

Taking advantage of the confluence of edge computing and AI, an Italian startup has been granted a patent to record the front visual panorama of a moving vehicle, identify the driver’s driving style, and certify the accident by recording its dynamics.

When the engine starts, the device begins recording the video and simultaneously transmits it to the cloud using proprietary technology that allows secure transmission of encrypted video snippets. Once in the cloud, the video snippets are reassembled and processed using computer vision algorithms that anonymise the personal data collected during the recordings (such as people’s faces and car license plates) to comply with data privacy regulation (e.g., GDPR).

The anonymised video can then be used as evidence of accident dynamics and to extract key data to identify driving styles and the ability to classify driver risk.

The system has received funding from the Italian government to develop part of the project.

These are a few examples of data-driven AI models that have been successfully deployed. However, at Swiss Re and across the industry, many AI projects are also internally driven and address core processes – for example, using natural language understanding to help ingest and classify unstructured data into decision-making processes or to better understand the exposure in contracts and the overall portfolio.

Through the various entry points, AI has the potential to impact and add value to the entire insurance value chain and bring significant benefits to customers. However, with wider access to these powerful tools, it is also crucial to be on top of their risks and challenges. Data and responsible AI literacy are key for companies to ensure that humans remain in control of the decision-making process.

There are many new risks associated with the use of AI at scale that policymakers, big tech companies and insurance companies need to consider working on now so that AI adds value to society and that we can still effectively protect against the new risks associated with it. And, of course, as many of us ponder the potential for AI to enhance our own lifestyles, we’d love it if AI could free up more time for some of life’s enjoyable activities!

About the Authors

Pravina Ladva, Chief Digital & Technology Officer

Antonio Grasso, Entrepreneur, Technologist, Founder & CEO

Originally published at https://www.swissre.com