Health

Transformation

Institute (HTI)

institute for continuous health transformation

Joaquim Cardoso MSc*

Founder, Chief Researcher & Editor

December 9, 2022

MSc* from London Business School

MIT Sloan Master Program (European Version)

This is a republication of the article “AstraZeneca’s covid-19 (mis)adventure and the future of vaccine equity”, published by The BMJ, with the title above.

AstraZeneca’s covid-19 (mis)adventure and the future of vaccine equity

The BMJ

Robert Fortner, freelance journalist

December 07, 2022

The pandemic brought vaccine equity to the forefront of public health consciousness like never before-yet the world seems no closer to it. Robert Fortner asks what, if anything, has been learnt

The pandemic, for a moment, wobbled the foundations of the drug industry, with calls to elevate lives above profit.

“I personally don’t believe that in a time of pandemic there should be exclusive licenses,” the researcher Adrian Hill declared to the New York Times in the spring of 2021.

Hill and others at Oxford University, UK, had produced what was then the world’s leading covid-19 vaccine candidate and planned to offer it to manufacturers royalty free.

But the insurgency was put down before it ever got off the ground.

Oxford swiftly and exclusively licensed its technology to the UK based pharmaceutical giant AstraZeneca.

The agreement did include a “non-profit” agreement: initially priced at cost, the vaccine saved more lives from covid-19 than any other in its first year of circulation. 1

Yet the no-profit pledge also unleashed a withering crossfire-equity advocates alleging grotesque hypocrisy on one side, market forces on the other.

Hill and others at Oxford University, UK, had produced what was then the world’s leading covid-19 vaccine candidate and planned to offer it to manufacturers royalty free.

The agreement did include a “non-profit” agreement: initially priced at cost, the vaccine saved more lives from covid-19 than any other in its first year of circulation. 1

Financial media in the US “clearly didn’t like the idea of a low cost vaccine, undercutting the market,” Hill told the Financial Times.

AstraZeneca’s vaccine won regulatory approval the world over, but not in the US.

Fast forward a year to 2022, and AstraZeneca seems to be exiting the stage before the pandemic ends ( box 1), its good deed having earned the company a reputational thrashing. 3

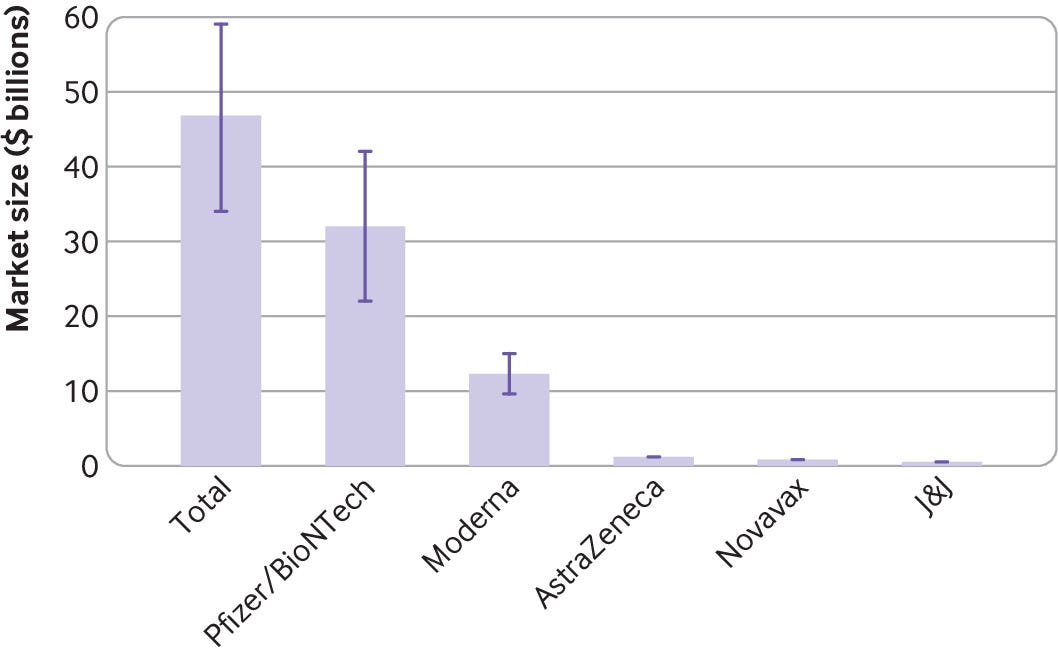

Few speak of the AstraZeneca vaccine, while its rivals Moderna and Pfizer-BioNTech look set to profit from ongoing booster shots tailored to new covid-19 variants.

These two companies have hauled in billions of dollars during the pandemic and paved the way for a new line of therapeutics based on their mRNA vaccine technology.

Box 1

Is AstraZeneca exiting the covid-19 market?

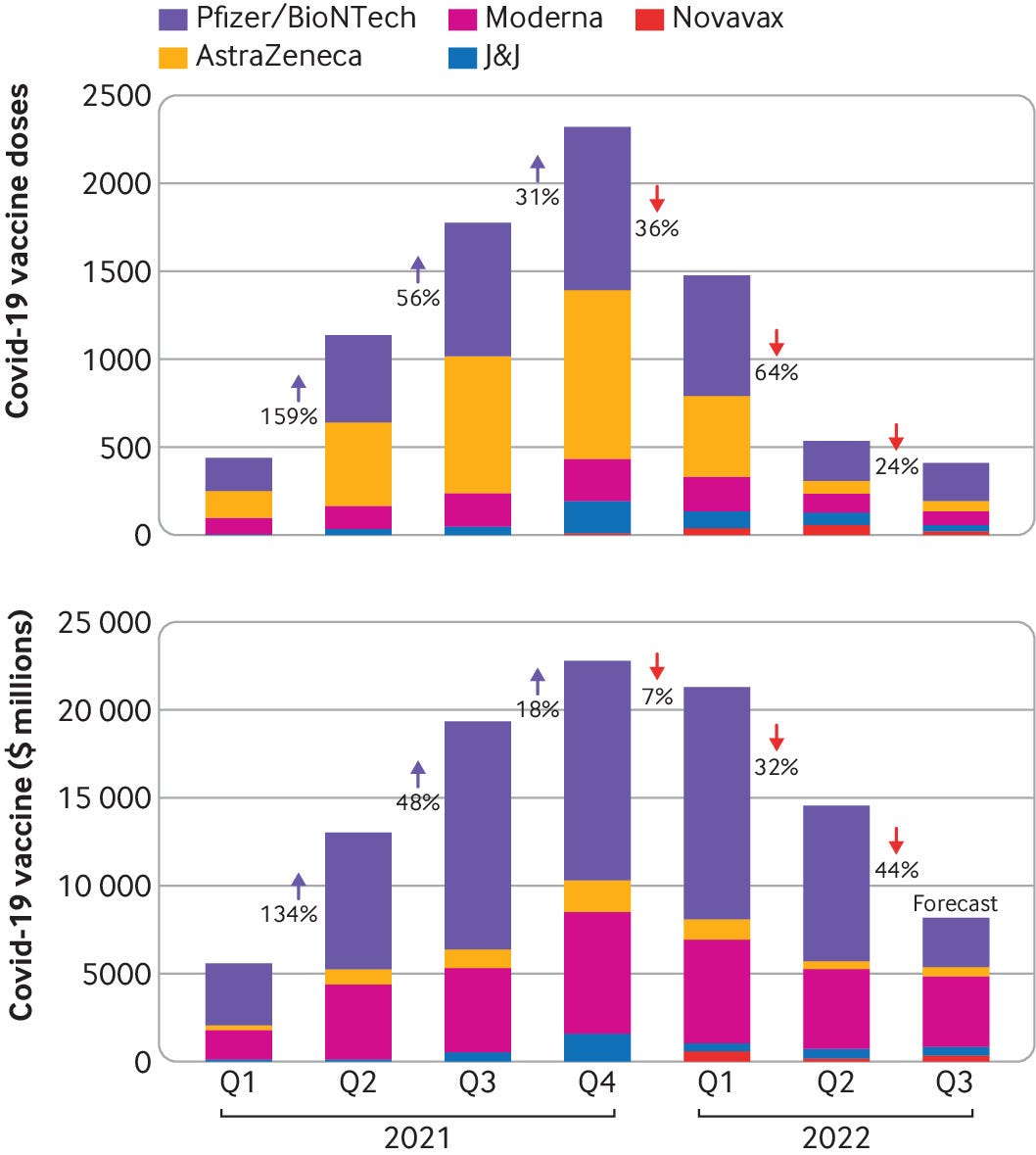

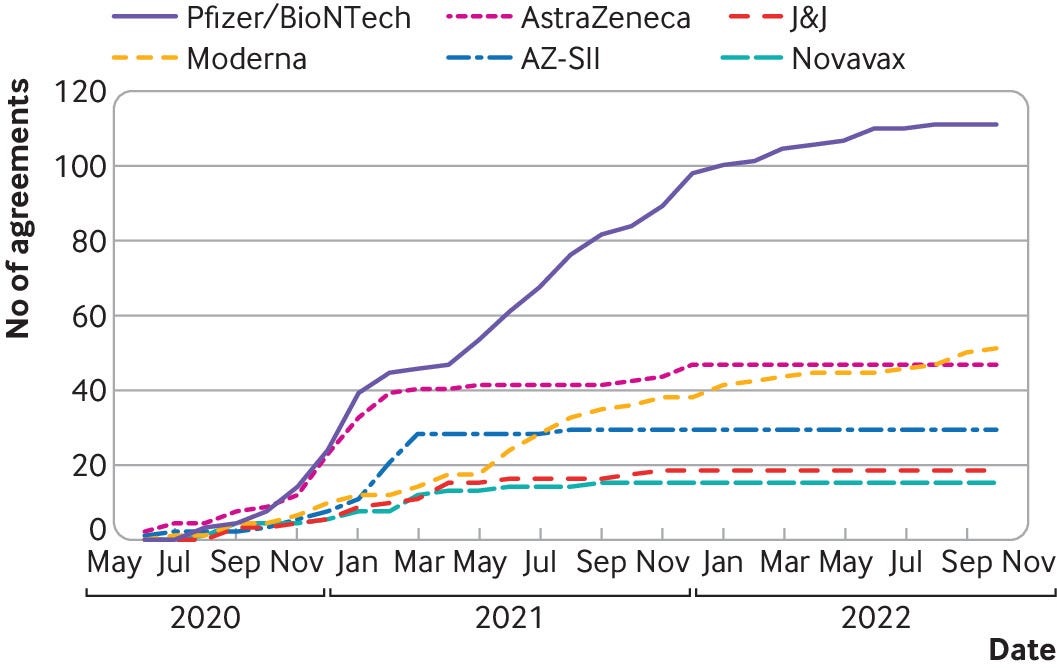

Figures provided to The BMJ by the data analysis company Airfinity indicate that demand for AstraZeneca’s covid vaccine decelerated abruptly near the end of 2020, resulting in cuts and halts to production 45 — while Pfizer and Moderna have continued to sign new agreements (figs 1–3).

The Serum Institute of India, an AstraZeneca manufacturing partner, recently announced that it was destroying 100 million unused, expired doses, and it stopped making the vaccine in December 2021 owing to low demand.6

Airfinity’s analysis also shows that production and deliveries of the AstraZeneca vaccine have been falling since the beginning of 2022, while it has also taken it nearly two years to fulfil orders originally agreed in 2020.

In a statement to The BMJ AstraZeneca said that its vaccine was “currently being manufactured, though supply numbers have decreased.”

Airfinity’s analysis also shows that production and deliveries of the AstraZeneca vaccine have been falling since the beginning of 2022, while it has also taken it nearly two years to fulfil orders originally agreed in 2020.

Fig 1 — Covid-19 vaccine deliveries dropped by two thirds in Q2 2022 from Q1 2022 (number of doses and revenue shown)

Credit: Airfinity

Fig 2

The rising number of signed covid-19 vaccine contracts stabilised over time

Credit: Airfinity

Meanwhile, Evusheld-AstraZeneca’s cocktail of monoclonal antibodies and its sole covid-19 therapy-has its own issues. The drug won approval in the US in a pre-exposure setting for immune compromised people, but it has struggled to find buyers. In the UK the Medicines and Healthcare Products Regulatory Agency approved the drug, but the government reneged on an agreement to buy it, citing “insufficient data” on the level of protection it offered against the new omicron subvariants that have come to dominate. 7

Regarding its covid-19 division, AstraZeneca told The BMJ, “We are excited about the future of this new unit.” But its pipeline for new covid vaccines and therapeutics is empty.

There are no plans for variant tweaked booster jabs, leaving Pfizer and Moderna to dominate the covid vaccine market ahead of a handful of smaller, newer players such as Novavax and Valneva.

AstraZeneca, says Bill Enright, chief executive of the Oxford spin-out company Vaccitech, “should have been able to garner a tremendous amount of goodwill in that regard for what they were doing.”

He adds, “I think that will impact future initiatives.”

No company seems likely to reprise AstraZeneca’s corporate martyr role in future crises.

And there are questions on whether Oxford’s decision to partner, rather than pursue its original non-exclusive licensing plan, was a bad decision from the start.

What now for the market foundations Hill sought to shake-which seem, if anything, reinforced, firmly ensconcing profit in the pandemic response?

And there are questions on whether Oxford’s decision to partner, rather than pursue its original non-exclusive licensing plan, was a bad decision from the start.

The big pharma middleman

Oxford’s ChAd (chimpanzee adenovirus) vector technology, which saved millions of lives from covid-19, originated from years of research on malaria vaccines and had its first clinical trial in 2007.

The intellectual property resided in Vaccitech, a company cofounded by Hill and a fellow Oxford researcher, Sarah Gilbert, and now led by Enright.

Years ago Hill recognised that people who need malaria vaccines may lack the means to produce or pay for them, so “we need a different mechanism.”

Enright says that “Vaccitech was definitely going our own way” on covid.

“We actually got approval from the National Institutes of Health to get a trial started in the US,” including funding, he tells The BMJ. Support from a European bank underwrote Vaccitech’s efforts on the continent, and resources had been assigned to the UK.

A Vaccitech press release from 27 March 2020 announced a clinical trial and, in parallel, an immediate vaccine manufacturing scale-up coordinated solely by Vaccitech. 8

But senior leaders at Oxford University had already shifted in favour of partnering with a large pharmaceutical entity, as reported by the Wall Street Journal. 9

The Bill and Melinda Gates Foundation-one of the largest and most influential funders in covid vaccine development, having spent hundreds of millions of dollars-appreciated Oxford’s work but not its plan for distributed manufacturing and open-source-style licensing.

The Bill and Melinda Gates Foundation-one of the largest and most influential funders in covid vaccine development, having spent hundreds of millions of dollars-appreciated Oxford’s work but not its plan for distributed manufacturing and open-source-style licensing.

“We told them a list of people to go and talk to,” said Bill Gates. 10

Other funders, Gavi and the Coalition for Epidemic Preparedness Innovations (CEPI), also encouraged a match with a pharmaceutical partner experienced in running large clinical trials and navigating regulatory approval processes. 11 (The Gates Foundation founded both Gavi and CEPI and continues to fund them.

AstraZeneca subsequently reached a $750m (£652m; €758m) deal with CEPI and Gavi for its vaccine. 12

Melinda Gates later told the Washington Post that the foundation supported tiered pricing rather than open-source-style approaches. 13

“High income countries pay a bit more than middle income, then low income,” she said. “That seems to be the right way to price a vaccine.” (In economics, tiered pricing is a form of price discriminating monopoly in which the seller can decide a price based on what buyers are able and willing to pay.)

Ameet Sarpatwari, an epidemiologist and attorney at Harvard Medical School’s Center for Bioethics, believes that this framework “generally makes sense from a distributive justice standpoint.”

But he notes that, “with the billions in profits these companies are making,” pricing of the tiers “is not well calibrated.”

… this framework “generally makes sense from a distributive justice standpoint.” … but, “with the billions in profits these companies are making,” pricing of the tiers “is not well calibrated.”

With the AstraZeneca partnership, Vaccitech abandoned-or at least compromised-Hill’s original vision of a non-exclusive licensing plan.

Enright now says that this was less a reflection of external pressure and more because the vaccine turned out to be much better than expected.

“It was [the animal study] data on the efficaciousness of the vaccine and the need to get it out to as many people as quickly as possible,” he tells The BMJ, …

… the implication being that a non-exclusive licence would have been too complicated, too nascent, and perhaps not sufficiently organised to move quickly enough to save lives at that time.

Still, Enright says that Hill’s original vision “was another possibility, and we were in active discussions along those lines.”

Amanda Glassman, executive vice president of the Center for Global Development, says that if Vaccitech had stuck to an open non-exclusive licence …

… it might have been able to start ramping up capacity and sign bilateral deals with middle income countries that had their own freedom-but this is far from certain.

“The Serum Institute [with which AstraZeneca signed an exclusive agreement to reproduce the vaccine for India and other countries] would not have been happy about another Indian manufacturer coming online,” Glassman says, which might have led to an exclusive arrangement in India.

She adds that in early 2021 AstraZeneca was already experiencing manufacturing problems in supplying its first clients in Europe.

This might have taken priority over supplying the non-European world. All bets were with the Serum Institute, says Glassman.

The Developing Countries Vaccine Manufacturers Network (DCVMN) is an alliance that might have jumped at non-exclusive licensing and begun producing vaccines, but Glassman isn’t so sure.

“The problem [by that point in 2021] was that the Oxford-AstraZeneca vaccine was not the most efficacious or sought-after vaccine,” she says, while supply issues “might also have limited how much DCVMN could have made.”

Even if Hill and colleagues had stuck to their guns over non-exclusivity, Glassman doesn’t think that things would have turned out differently ( box 2).

“The same manufacturers that got a licence from AstraZeneca would have been interested or able to produce the vaccine under a non-exclusive deal,” she says, adding that “it would probably have taken longer, since they in theory would not have received the same support or data from AstraZeneca.”

BOX2: AstraZeneca-right approach, wrong partner for Oxford?

Was AstraZeneca the right partner for the Oxford Vaccine Group and its noble ideals? “The answer to that might be ‘NO,’” says Amanda Glassman of the Center for Global Development.

The choice was an Anglo-Swedish drug manufacturer versus picking the best partner with a background in the vaccine manufacturing and vaccine marketing business-for example, Merck.

Vaccitech, the spin-out company handling Oxford’s nascent vaccine technology, had been in discussions with the US based Merck in late March 2020. 9

Vaccitech later rued the vaccine nationalism that grew out of its tie-up with AstraZeneca the following month.

Bill Enright, Vaccitech’s chief executive, when asked about what might have gone better, says, “The reality of the situation is that AstraZeneca wasn’t a major vaccine player.

They had FluMist [a nasal spray influenza vaccine], but other than that they don’t have a lot of vaccine expertise.” As a result, AstraZeneca was “stepping into an area where they didn’t have ultimate familiarity.”

Glassman assumes that the choice of AstraZeneca was partly out of national security considerations-”another form of nationalism that might have resulted in less than optimal outcomes.”

“The reality of the situation is that AstraZeneca wasn’t a major vaccine player

The choice was an Anglo-Swedish drug manufacturer versus picking the best partner with a background in the vaccine manufacturing and vaccine marketing business-for example, Merck.

Sarpatwari believes that AstraZeneca did the right thing but wonders if the profit oriented company disincentivised itself and delivered a suboptimal performance.

He asks, “Was the planning and logistics the same thing that would have gone into a blockbuster product that they would have unveiled? I don’t know that.”

Different approaches to equity

Much as the Oxford covid-19 vaccine has roots in malaria, so do many philanthropic endeavours in vaccines-and these parallels hold lessons.

The Coalition for Epidemic Preparedness Innovations (CEPI), as per its name, is a coalition of philanthropic partners funded through grants from Gates, the Wellcome Trust, and various governments.

Nearly 20 years earlier a similar constellation was formed, anchored by the Rockefeller Foundation and geared towards one disease-the Medicines for Malaria Venture (MMV).

CEPI and MMV both steer public funding to private sector drug research in areas that for-profit companies might otherwise skip over.

MMV came at a time when funders increasingly bypassed the World Health Organization, embracing public-private partnerships with the idea of getting better results for the money.

Over time the private component in these partnerships has increased.

MMV came at a time when funders increasingly bypassed the World Health Organization, embracing public-private partnerships with the idea of getting better results for the money.

MMV, like venture capitalist investors, gets a stake in the technology developments it pays for.

Companies can make and sell any malaria drug developed with MMV’s support but must also license the intellectual property to MMV-patents and process knowledge.

MMV is then free to pursue a scheme of manufacture and distribution tied to a goal of accessibility rather than profit.

MMV, like venture capitalist investors, gets a stake in the technology developments it pays for.

Where MMV had Rockefeller, CEPI has Gates, which is more industry oriented — something it’s been criticised for.

Sarpatwari explains, “I think there’s just been a huge anger at the Gates Foundation’s strong market approach to dealing with these public health issues.”

If the technology difficulties had been surmountable, he says, “I really do think you would have seen some radical countries move forward”-making covid vaccines despite legal prohibitions-”but I think the risk trade-off was a little too high in this situation.”

“I think there’s just been a huge anger at the Gates Foundation’s strong market approach to dealing with these public health issues.”

On covid vaccines, Gates clearly sided with the drug industry in an intellectual property row 14:

Bill Gates initially dismissed calls to waive patents during the pandemic (“The thing that’s holding things back in this case is not intellectual property,” he said in an interview with Sky News 15), before backtracking to concede a narrow waiver.

It’s arguable that if CEPI-which launched a $2bn call to support covid vaccine candidates through clinical trials at the start of the pandemic 16 and remains one of the most influential funders in the space-had a more MMV-type approach, such rows might have been obviated.

CEPI, for its part, says that the models are based on “two completely different products (small-molecule drugs v vaccines) and disease situations (malaria v emerging infectious diseases),” a spokesperson wrote in an email.

It’s arguable that if CEPI-which launched a $2bn call to support covid vaccine candidates through clinical trials at the start of the pandemic 16 and remains one of the most influential funders in the space-had a more MMV-type approach, such rows might have been obviated.

Both, however, are public-private partnerships, unlike a new player on the field:

the Pandemic Antiviral Discovery (PAD), which was announced in March 17 to develop antiviral drugs for future pandemics, is funded by the Novo Nordisk Foundation, Open Philanthropy, and Gates.

(The Novo Nordisk Foundation is the largest charitable foundation in the world, with a controlling interest in the $230bn Danish pharmaceutical titan Novo Nordisk. Open Philanthropy originates from the fortune of the billionaire Facebook cofounder Dustin Moskovitz.)

Both, however, are public-private partnerships, unlike a new player on the field:

the Pandemic Antiviral Discovery (PAD), which was announced in March 17 to develop antiviral drugs for future pandemics, is funded by the Novo Nordisk Foundation, Open Philanthropy, and Gates.

PAD’s “core” commitment to equitable access promises a “strict focus on drugs that are suitable for use in low and middle income countries.” 18

Proposals for PAD funding can be directly submitted through the Novo Nordisk Foundation’s existing system, integrating pandemic preparedness into established private sector workstreams.

And unlike CEPI or MMV it has no government investments and no nation states, multilaterals, or UN agencies contributing to its purse.

It’s arguably freer from national interests than either of those two.

Like MMV, PAD is dealing with drugs rather than vaccines, but the challenges to developing new antivirals has parallels with the struggles in vaccine development. 19

The PAD approach reduces nationalism, while retaining the ties with industry that are still an unavoidable necessary step in global pandemic preparedness and action.

What’s the future of vaccine equity?

As is well documented, many people have died of covid for want of vaccines of any kind.

The various promises and procedures around vaccine equity haven’t been enough to prevent most of those deaths skewing hard towards lower income countries.

Sarpatwari believes that Hill and Oxford’s initial open-source-style approach offered a way out, “a model where you had an academic, public institution take a vaccine across the finish line . . .

There could have been full control over logistics that was not within a pharmaceutical company, with manufacturers across the world.”

That wasn’t to be. Poor nations had to depend on wealthy ones, with serious consequences.

What’s needed after this missed opportunity, says Sarpatwari, is to build up the infrastructure in countries around the world so that they can meet their own needs.

To this end, WHO announced its mRNA vaccine technology transfer hub in June 2021. 20

This has shone a spotlight on technology transfer-or rather the lack of it. Neither Moderna nor BioNTech has contributed intellectual property, although WHO’s Martin Friede, who leads the Who Hub initiative, credits Moderna for at least taking a non-enforcement stance.

“They haven’t said, ‘We aren’t giving you patents,’ but they did indicate to us that . . . they would not use their patents to interfere with the Hub,” he says. As such, the WHO Hub has been actively working to try to reverse engineer the Moderna technology and is now close to animal trials. 21

Separately, Moderna has announced a factory in Kenya.

The facility will enable drug substance manufacturing, but it won’t have “fill and finish” capabilities to bottle and prepare vaccines for distribution.

(Moderna tells The BMJ that it “could also be expanded” to enable complete, single site vaccine production.)

While this is more than the WHO Hub currently has, it’s short of vaccine independence.

BioNTech, meanwhile, despite early discussions with WHO, is “pursuing its own agenda, especially in Africa,” says Friede. It has announced plans to build manufacturing facilities in Senegal, Rwanda, and potentially South Africa.

Moderna and BioNTech, says Sarpatwari, “can delay the process [of technology transfer], and they definitely have.”

The BMJ previously reported allegations that BioNTech supported efforts to discredit WHO’s technology hub. 22

To compete, what the WHO Hub needs is money.

Yet major players such as the Gates Foundation and CEPI are not supporting it financially. The Gates Foundation has “a slightly different model,” as does CEPI, says Friede.

To compete, what the WHO Hub needs is money.

Yet major players such as the Gates Foundation and CEPI are not supporting it financially. The Gates Foundation has “a slightly different model,” as does CEPI, says Friede.

In April 2021-when the first covid vaccines were being widely rolled out in many countries-CEPI inked a memorandum of understanding 23 with the African Union to foster mRNA vaccine capacity on the African continent (note that this has no direct crossover with the WHO Hub).

In March 2021 CEPI also announced a $3.5bn plan to deliver pandemic vaccines within 100 days of an outbreak. 24

Contrast this with the WHO Hub, which at the time of writing has just $68m. “[CEPI] will be doing things we can’t because CEPI’s got very deep pockets,” says Friede.

In March 2021 CEPI also announced a $3.5bn plan to deliver pandemic vaccines within 100 days of an outbreak

Contrast this with the WHO Hub, which at the time of writing has just $68m. “[CEPI] will be doing things we can’t because CEPI’s got very deep pockets,” says Friede.

Senegal is among those in talks with all these initiatives.

It’s one of the leaders of nascent vaccine manufacturing and development in Africa: Senegal already makes a WHO prequalified vaccine for yellow fever, putting it far ahead of other countries involved in the hub such as Nigeria, which Friede describes as “beginning from ground zero.”

He endorses a “polyamory” approach to multiple development partners-but open relationships can disguise competition, he says.

“It will be up to Senegal to decide whether they want to pursue development with BioNTech or with us [the WHO Hub], or with somebody else.”

He endorses a “polyamory” approach to multiple development partners-but open relationships can disguise competition, he says.

There is every reason to expect that in some future pandemic CEPI will deliver on its vaccine equity promises, perhaps including manufacture in low or middle income countries.

With most donor nations funding CEPI rather than WHO for vaccine development, however, the entity nominally in charge of global public health looks outdone in its efforts to develop an independent vaccine manufacturing capacity on the African continent. The newly launched Pandemic Antiviral Discovery seems to advance the trend of a diminished role for public entities: it involves none.

Back at Oxford, Hill and colleagues are bringing forth a malaria vaccine that may improve on the pathbreaking jab offered by GlaxoSmithKline. 25

For manufacturing, they are partnering directly with the Serum Institute of India and expect to deliver the vaccine, called R21, for as little as three or four dollars a dose.

Back at Oxford, Hill and colleagues are bringing forth a malaria vaccine that may improve on the pathbreaking jab offered by GlaxoSmithKline.

For manufacturing, they are partnering directly with the Serum Institute of India and expect to deliver the vaccine, called R21, for as little as three or four dollars a dose.

Asia now makes most of the world’s vaccines, Hill tells The BMJ, creating the opportunity for academic groups “to skip out going to a biotech company which would then try and sell itself or its product to a pharmaceutical company . . . and just go directly from the university to the manufacturer.”

Asia now makes most of the world’s vaccines, Hill tells The BMJ, creating the opportunity for academic groups “to skip out going to a biotech company which would then try and sell itself or its product to a pharmaceutical company . . . and just go directly from the university to the manufacturer.”

As an example he points to the covid-19 vaccine Corbevax, from Baylor University in Texas: Baylor struck a deal with Biological E, headquartered in Hyderabad, India.

“We and others have now got good links to Indian manufacturers,” he says, “and I think you’re going to see a lot more of that. There is a big change happening here, and covid has facilitated it.”

References and additional information

see the original publication

This article is made freely available for personal use in accordance with BMJ’s website terms and conditions for the duration of the covid-19 pandemic or until otherwise determined by BMJ. You may download and print the article for any lawful, non-commercial purpose (including text and data mining) provided that all copyright notices and trade marks are retained.

Originally published at https://www.bmj.com on November 11, 2022.

Robert Fortner, freelance journalist

Portland, Oregon, USA

NAMES MENTIONED

researcher Adrian Hill

Oxford researcher, Sarah Gilbert

Bill Enright, chief executive of the Oxford spin-out company Vaccitech

Amanda Glassman, executive vice president of the Center for Global Development