This is an excerpt from “2022 Healthcare Provider IT Report — Post-Pandemic Investment Priorities”, published by Klas and Bain in October 2022.

Competitive pressures in the provider software space show no signs of abating

Eric Berger, Laila Kassis , Aaron Feinberg , Michael Brookshire , John Day , Rebecca Hammond

October 2022

Executive Summary:

Joaquim Cardoso MSc.

health systems transformation — center of excellence

October 22, 2022

Providers should expect continued vendor proliferation, and incumbent software providers should continue to expect rising competitive pressures caused by three primary forces: big tech, leading EMRs, and start-ups.

Big tech

- Big tech players (including Amazon, Microsoft, Google, and Apple) have been pushing into healthcare in recent years with targeted offerings and investments

- In general, they have focused on building upon core competencies — such as cloud services, data storage, customer relationship management (CRM), consumer devices, and wearables — to fill in the white space rather than going head to-head with entrenched incumbent enterprise software providers.

- More recently, however, big tech has been investing in healthcare capabilities further afield from core capabilities, especially via M&A activity, reflecting the growing attractiveness of the healthcare market.

- In 2022, Microsoft bought artificial intelligence and speech recognition software company Nuance (March), Oracle acquired EMR giant Cerner (June), and Amazon announced plans to purchase tech-enabled primary care provider One Medical (July, abandoning its attempt at building a scale in-house platform, Amazon Care).

- While big tech appears increasingly serious about pushing into healthcare, we believe that the threat to traditional provider software players is minimal in the immediate term, especially when looking at providers’ top 10 strategic investment priorities for the next year in which big tech’s current positioning lags market leaders (see Figure 11).

- Ultimately, while we do not see big tech capturing a significant share of the enterprise provider IT space in the immediate term, providers and incumbent software players should not underestimate cash-rich big tech players, especially in an environment of depressed valuations.

EMRs, especially Epic, are expanding offerings:

- Over the past decade, Epic has become the market leader in acute and ambulatory EMR, where it has gained formidable share from competitors

- Beyond reinforcing its strong core offering and providing exceptional customer service, Epic has aggressively pursued product adjacencies to elevate its value proposition beyond core EMR.

- Over the years, Epic has developed new products catering to a wide range of needs, spanning RCM, data analytics, patient portals, clinical communications, and clinical department modules (e.g., cardiology), and it is continuing to expand its reach across an ever-increasing set of areas.

- What’s next? While that’s impossible to predict with any certainty, many of Epic’s successful product expansions were strong across three dimensions. (1) Table stakes, (2) Ability to win, (3) Other strategic imperatives.

- While we cannot predict Epic’s future product roadmap, our research suggests that Epic and other scale EMRs will continue being spoilers to point solution software providers operating in close proximity to Epic’s ever-expanding core.

- Provider pain points around vendor proliferation could play into Epic’s hand: Again, more than 70% of providers expect to look to their EMRs for new solutions before taking meetings with point solution providers over the next one to two years.

- Additionally, as provider needs have evolved, EMRs have made investments to position themselves accordingly. This is especially true in telehealth.

Capital continues flowing into early-stage tech offerings:

- Besides competition from big tech and scale EMRs, provider software players face pressure — and see opportunities — from an increasingly robust health tech start-up ecosystem.

- In recent years, early-stage capital has poured into healthcare technology solutions, reshaping the landscape for providers and incumbent software players alike. According to Silicon Valley Bank, between 2019 and 2021, early-stage health tech activity increased from nearly $11 billion to nearly $40 billion.

- Even amid a difficult start-up funding environment, first-half 2022 funding reached nearly $18 billion, almost surpassing full-year 2020 activity

- With healthcare providers desiring fewer, more meaningful software vendor relationships, savvy incumbents can use tuck-in acquisitions to improve customer stickiness.

Infographic

ORIGINAL PUBLICATION (excerpt)

Big tech

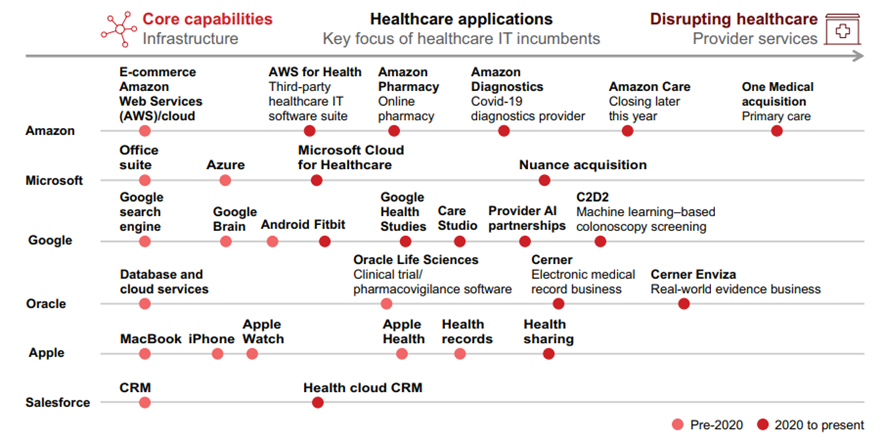

Big tech players (including Amazon, Microsoft, Google, and Apple) have been pushing into healthcare in recent years with targeted offerings and investments (see Figure 10).

Figure 10: Big tech has increasingly pushed into healthcare in recent years, making many significant investments since 2020

Sources: Company websites; financial filings; press releases

In general, they have focused on building upon core competencies — such as cloud services, data storage, customer relationship management (CRM), consumer devices, and wearables — to fill in the white space rather than going head to-head with entrenched incumbent enterprise software providers.

In general, they have focused on building upon core competencies — such as cloud services, data storage, customer relationship management (CRM), consumer devices, and wearables — to fill in the white space rather than going head to-head with entrenched incumbent enterprise software providers.

This is evident in the development of healthcare-specific cloud offerings from cloud service providers (e.g., Amazon’s AWS for Health, Microsoft’s Azure for Healthcare) or in the development of an increasing number of healthcare mobile apps that make it easier for patients to share health data with providers (e.g., Apple Health).

More recently, however, big tech has been investing in healthcare capabilities further afield from core capabilities, especially via M&A activity, reflecting the growing attractiveness of the healthcare market.

More recently, however, big tech has been investing in healthcare capabilities further afield from core capabilities, especially via M&A activity, reflecting the growing attractiveness of the healthcare market.

In 2022, Microsoft bought artificial intelligence and speech recognition software company Nuance (March), Oracle acquired EMR giant Cerner (June), and Amazon announced plans to purchase tech-enabled primary care provider One Medical (July, abandoning its attempt at building a scale in-house platform, Amazon Care).

In 2022, Microsoft bought artificial intelligence and speech recognition software company Nuance (March), Oracle acquired EMR giant Cerner (June), and Amazon announced plans to purchase tech-enabled primary care provider One Medical

According to Microsoft, its acquisition of Nuance will double the tech giant’s addressable market in healthcare to almost $500 billion given the use of Nuance products in more than 75% of US hospitals.

Similarly, Oracle’s purchase of Cerner will expand its provider customer base to include additional hospitals in which the EMR giant is entrenched.

Microsoft acquisition of Nuance will double the addressable market in healthcare to almost $500 billion given the use of Nuance products in more than 75% of US hospitals.

Similarly, Oracle’s purchase of Cerner will expand its provider customer base to include additional hospitals in which the EMR giant is entrenched.

The deal could also position Oracle for more ambitious moves in the healthcare software space given Cerner’s investments around new growth horizons, including real-world evidence (Cerner Enviza).

Amazon’s announced $3.9 billion deal to acquire primary care player One Medical, which has its own EMR platform, signals that the e-commerce and cloud giant is serious about becoming a key player in the provider space.

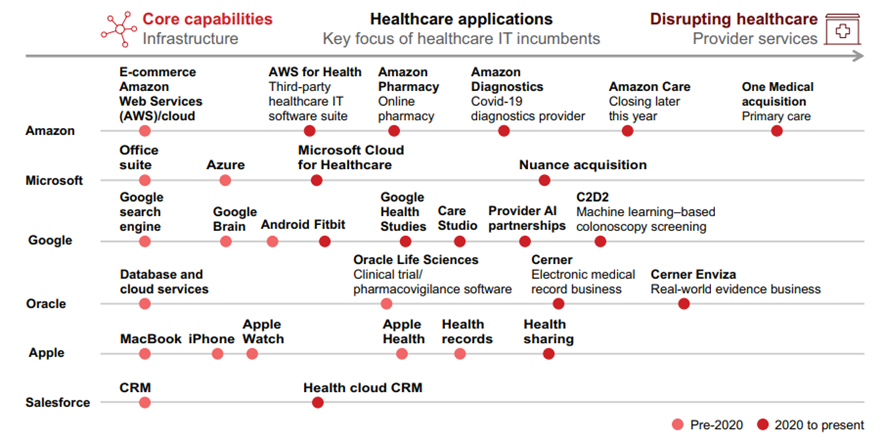

While big tech appears increasingly serious about pushing into healthcare, we believe that the threat to traditional provider software players is minimal in the immediate term, especially when looking at providers’ top 10 strategic investment priorities for the next year in which big tech’s current positioning lags market leaders (see Figure 11).

It remains to be seen how software providers will respond to big tech encroaching on their territory and how patients would feel about big tech companies having access to some of their most sensitive data.

There are exceptions, however, where providers’ top software investment priorities align with the core capabilities of big tech players.

For example, Microsoft was quick to position Microsoft Teams as a critical telehealth platform during Covid-19, and it appears well positioned in the space as we emerge from the pandemic.

CRM solutions leader Salesforce could have a strong claim on winning in patient engagement.

(CRM is a category some healthcare providers have long neglected but are growing increasingly interested in as a means of enhancing patient experience.)

With its acquisition of Cerner, Oracle is primed to grow its share of the health system enterprise resource planning space.

It remains to be seen how software providers will respond to big tech encroaching on their territory and how patients would feel about big tech companies having access to some of their most sensitive data.

CRM solutions leader Salesforce could have a strong claim on winning in patient engagement.

Figure 11: Big tech’s current positioning lags market leaders in many of providers’ top strategic priorities for this next year

Sources: Provider interviews; Bain-KLAS 2022 Provider Executive Survey (N=289); company websites; financial filings; press releases

Ultimately, while we do not see big tech capturing a significant share of the enterprise provider IT space in the immediate term, providers and incumbent software players should not underestimate cash-rich big tech players, especially in an environment of depressed valuations.

Ultimately, while we do not see big tech capturing a significant share of the enterprise provider IT space in the immediate term, providers and incumbent software players should not underestimate cash-rich big tech players, especially in an environment of depressed valuations.

EMRs, especially Epic, are expanding offerings:

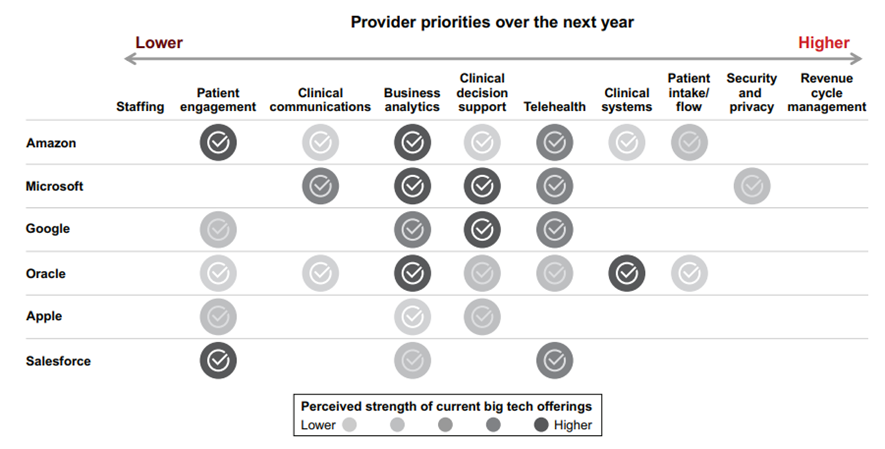

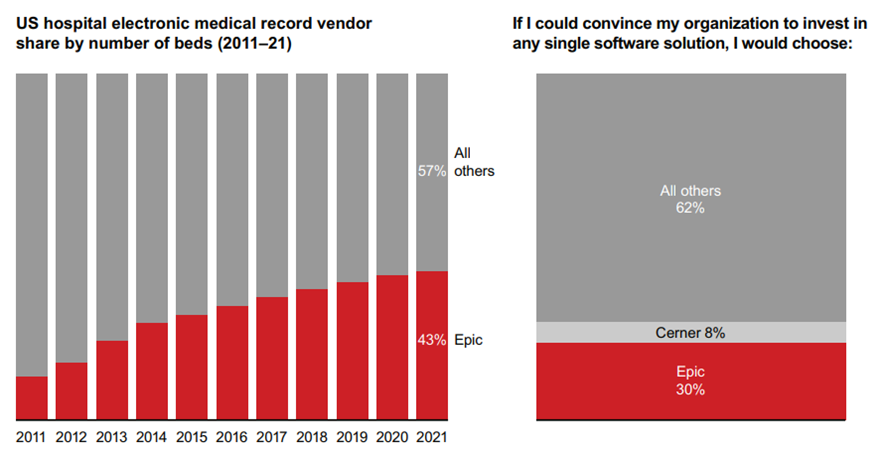

Over the past decade, Epic has become the market leader in acute and ambulatory EMR, where it has gained formidable share from competitors (see Figure 12).

Figure 12: Epic has gained share rapidly in recent years, with most provider executives preferring it to other top solutions

Sources: Bain experience; Bain-KLAS 2022 Provider Executive Survey (N=289)

Beyond reinforcing its strong core offering and providing exceptional customer service, Epic has aggressively pursued product adjacencies to elevate its value proposition beyond core EMR.

Over the years, Epic has developed new products catering to a wide range of needs, spanning RCM, data analytics, patient portals, clinical communications, and clinical department modules (e.g., cardiology), and it is continuing to expand its reach across an ever-increasing set of areas.

Over the years, Epic has developed new products catering to a wide range of needs, spanning RCM, data analytics, patient portals, clinical communications, and clinical department modules (e.g., cardiology), and it is continuing to expand its reach across an ever-increasing set of areas.

What’s next? While that’s impossible to predict with any certainty, many of Epic’s successful product expansions were strong across three dimensions.

- Table stakes: Does the potential expansion area under consideration meet basic prerequisites for engagement (i.e., product synergy with Epic’s core EMR platform, leverages existing sales channels and customer relationships, and enhances or defends the core product)?

- Ability to win: Does Epic have a high likelihood of success in this expansion (e.g., low context dependency, low switching costs, manageable complexity, proven capabilities)?

- Other strategic imperatives: Does the expansion area present other attractive characteristics (e.g., large addressable market, low regulatory exposure, limited security risks)?

While we cannot predict Epic’s future product roadmap, our research suggests that Epic and other scale EMRs will continue being spoilers to point solution software providers operating in close proximity to Epic’s ever-expanding core.

Provider pain points around vendor proliferation could play into Epic’s hand:

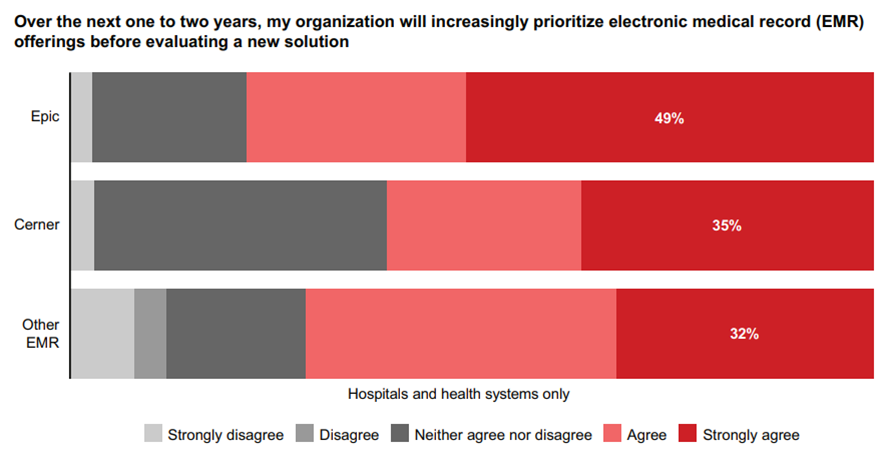

Again, as Figure 9 showed, more than 70% of providers expect to look to their EMRs for new solutions before taking meetings with point solution providers over the next one to two years.

This is truer of Epic customers than any other, including Cerner (see Figure 13).

Figure 13: Epic customers are most likely to look to their electronic medical record before evaluating new software solutions

Sources: Provider interviews; Bain-KLAS 2022 Provider Executive Survey (N=289)

Additionally, as provider needs have evolved, EMRs have made investments to position themselves accordingly.

This is especially true in telehealth, where some health systems adopted point solution offerings.

Our research indicates that some providers are revisiting EMR telehealth offerings, which could benefit Epic given recent investments in its offering.

Our research indicates that some providers are revisiting EMR telehealth offerings, which could benefit Epic given recent investments in its offering

Capital continues flowing into early-stage tech offerings:

Besides competition from big tech and scale EMRs, provider software players face pressure — and see opportunities — from an increasingly robust health tech start-up ecosystem.

In recent years, early-stage capital has poured into healthcare technology solutions, reshaping the landscape for providers and incumbent software players alike.

According to Silicon Valley Bank, between 2019 and 2021, early-stage health tech activity increased from nearly $11 billion to nearly $40 billion.

Even amid a difficult start-up funding environment, first-half 2022 funding reached nearly $18 billion, almost surpassing full-year 2020 activity (see Figure 14).

Figure 14: Early-stage funding for provider IT has erupted in recent years

Sources: Silicon Valley Bank; Bain analysis

… between 2019 and 2021, early-stage health tech activity increased from nearly $11 billion to nearly $40 billion.

Provider technology funding has been especially active, comprising more than half of deal value from 2019 to 2021 and during the first half of 2022.

Provider technology is also a key area in early-stage deals, making up more than 50% of seed/Series A rounds.

Most provider technologies receiving funding coalesce around alternative care and provider operations, …

… with later-stage venture activity skewing toward alternative care as a robust funding environment …

… brought an explosion of digital health activity and early-stage provider IT funding slanting toward provider operations solutions.

Uncertainty surrounds the second-half 2022 funding environment, we believe early-stage players will remain a formidable force in the provider IT market.

Incumbent vendors would be prudent to keep tabs on early-stage players with disruptive potential and stay active in exploring partnership or acquisition opportunities.

With healthcare providers desiring fewer, more meaningful software vendor relationships, savvy incumbents can use tuck-in acquisitions to improve customer stickiness.