Site editor:

Joaquim Cardoso MSc

The Health Institute — for continuous health transformation

October 4, 2022

MIT Technology Review

Produced in partnership with Databricks

2022

Executive summary

It’s been several years since organizations began adopting artificial intelligence (AI) to improve their business; few have come close to mastering its existing capabilities.

A small number of organizations in our research aim to become AI-driven — a status we define as AI and machine learning underpinning almost everything the enterprise does — by 2025.

However, this elite group — who we term “AI leaders” 1 — as well as the many others looking simply to embed AI more firmly in the enterprise foundations face formidable challenges to achieving their objectives.

A small number of organizations in our research aim to become AI-driven — a status we define as AI and machine learning underpinning almost everything the enterprise does — by 2025.

Addressing shortcomings in companies’ data management and infrastructure, as well as internal structural and process rigidities and talent deficits, loom large among those challenges.

- Seventy-two percent of the technology executives we surveyed for this study say that, should their companies fail to achieve their AI goals, data issues are more likely than not to be the reason.

- Improving processing speeds, governance, and quality of data, as well as its sufficiency for models, are the main data imperatives to ensure AI can be scaled, say the survey respondents.

Improving processing speeds, governance, and quality of data, as well as its sufficiency for models, are the main data imperatives to ensure AI can be scaled, …

… if companies fail to achieve their AI goals, data issues are more likely than not to be the reason.

This report sheds light on these and other data constraints that organizations must address to unleash the potential AI holds for their businesses.2

It also identifies the investments and other measures companies plan to take to align their data capabilities more closely with their AI ambitions.

The study’s findings are based on a global survey of 600 chief information officers, chief technology officers, and other senior technology leaders. We also drew insights from in-depth discussions with 10 such executives.

Infographic:

Following are the study’s key findings:

- 1.Companies view wider AI adoption as mission-critical for their future

- 2.Scaling AI successfully is priority one for the data strategy.

- 3.Major spending growth is planned to bolster AI’s data foundations

- 4.Investment growth intentions are strongest in the financial services industry

- 5.Multi-cloud and open standards are integral to AI progress.

1.Companies view wider AI adoption as mission-critical for their future.

From mostly limited AI use across the enterprise today, the surveyed executives plan a major expansion of use cases in all core functions in the next three years.

Well over half expect AI use to be widespread or critical in their IT, finance, product development, marketing, sales, and other functions by 2025.

While most will pursue a wide variety of use cases, many also aim to boost AI’s impact on the top line, increasing the returns from revenue-generating uses.

While most will pursue a wide variety of use cases, many also aim to boost AI’s impact on the top line, increasing the returns from revenue-generating uses.

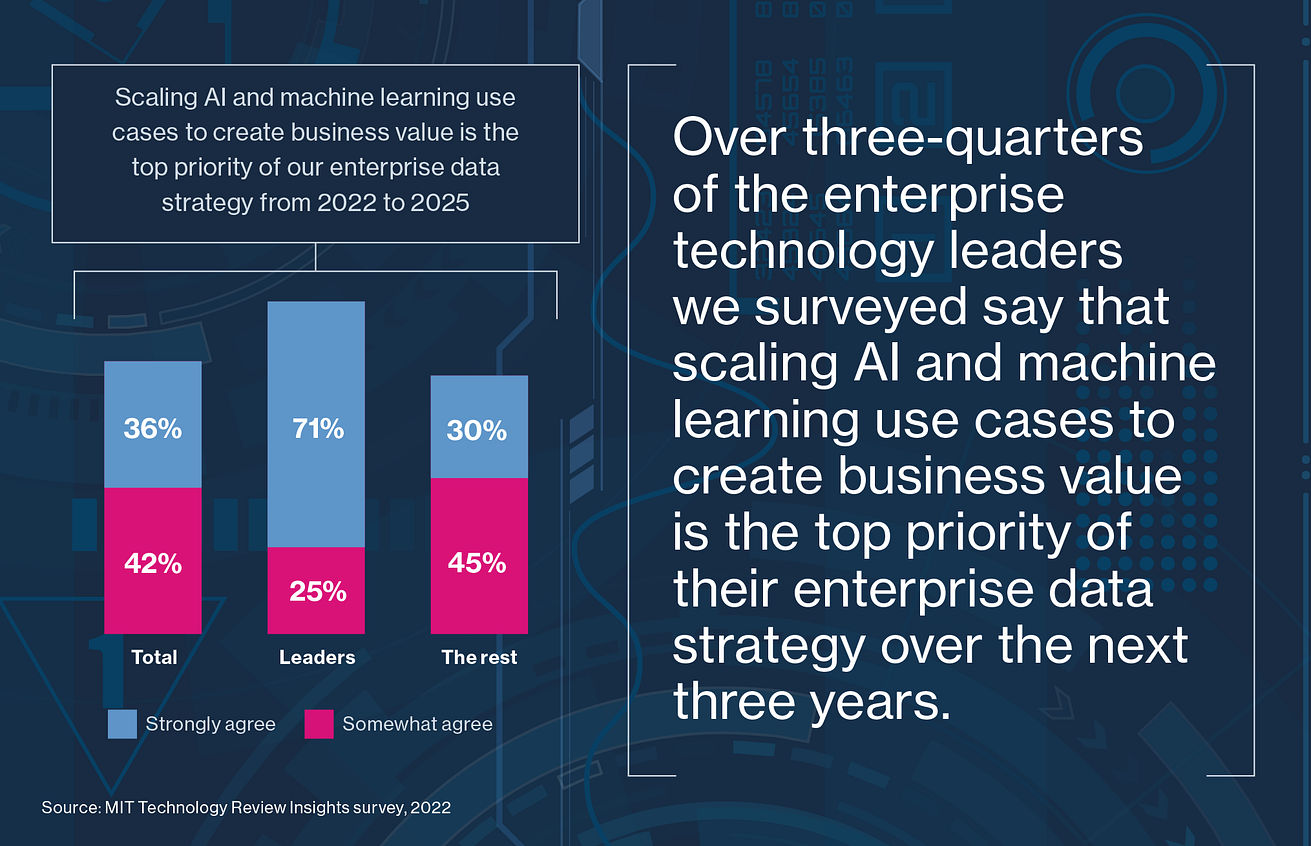

2.Scaling AI successfully is priority one for the data strategy.

The surveyed companies’ data and AI strategies are closely interlinked.

- Over three-quarters (78%) of the executives we surveyed — and

- almost all (96%) of the leader group — say that scaling AI and machine learning use cases to create business value is their top priority for enterprise data strategy over the next three years.

… scaling AI and machine learning use cases to create business value is their top priority for enterprise data strategy over the next three years.

3.Major spending growth is planned to bolster AI’s data foundations.

The surveyed CIOs — especially those in the leader group — plan sizeable increases in investment between now and 2025 to strengthen different parts of their data and AI foundations.

Leader spending on

- data security over the next three years will rise by 101%,

- on data governance by 85%,

- on new data and AI platforms by 69%, and

- on existing platforms by 63%.

(The analogous figures among the sample as a whole are 59%, 52%, 40%, and 42%, respectively.)

Leader spending on: (1) data security over the next three years will rise by 101%, (2) on data governance by 85%, (3) on new data and AI platforms by 69%, and (4) on existing platforms by 63%.

4.Investment growth intentions are strongest in the financial services industry.

Among the 14 industries in the survey, AI leaders are most numerous among retail/ consumer goods and automotive/manufacturing companies.

Expected investment growth in these sectors in the above areas of data management and infrastructure is higher than in others with one exception: planned increases by financial service providers will substantially exceed those in all other sectors.

5.Multi-cloud and open standards are integral to AI progress.

Most of the survey respondents (72%) — and almost all leaders (92%) — appreciate the flexibility that a multi-cloud approach provides for AI development.

CIOs interviewed for the study also emphasize the role of open architecture standards in supporting multi-cloud, and the importance of both in progressing their AI development.

Most … appreciate the flexibility that a multi-cloud approach provides for AI development.

Conclusion

As much as organizations have done to develop AI capabilities and embed them in the business, their journey to becoming AI-driven has only just begun.

CIOs recognize that their organizations have thus far only scratched the surface of the efficiency, speed, innovation, and other gains that the use of AI and machine learning can generate across different functions.

They also recognize that the data, talent, and other foundations they are putting in place to support AI development cannot remain static.

The foundations must evolve not just to enable the critical scale of use cases to be reached, but also to keep pace with future advances in the science of AI and the demands they may pose for additional power, expertise, and process change.

CIOs cannot expect the technology foundations they are putting in place today for AI to be future-proof.

However, this research points to a handful of attributes that technology leaders can instill in their data and other technology foundations in order to facilitate a smoother evolution.

- Democratization

- Openness

- Multi-cloud.

Democratization. The greater the number of employees in an organization who can configure and improve AI algorithms, the more AI-based innovations are likely to materialize.

Many CIOs are looking to “citizen data scientists” — data-literate employees without specialist data science training — to rise to this challenge.

Democratization is all the more important while qualified AI specialists and data scientists remain in limited supply.

The infrastructure modernization that CIOs pursue should aim to widen employee access to data needed for algorithm development.

Many CIOs are looking to “citizen data scientists” — data-literate employees without specialist data science training — to rise to this challenge.

Openness. Few fields of technology have benefitted as much from open, multi-partner collaboration as AI.

CIOs know that their companies’ future success in innovating with AI will rely at least in part on the data, insights, and tools they are able to source externally.

Data technology that favors open standards and open data formats is well placed to facilitate such collaboration.

Data technology that favors open standards and open data formats is well placed to facilitate such collaboration.

Multi-cloud. The multi-cloud approach that technology leaders favor to help scale AI in their business can be challenging to manage, due to the complexities involved in monitoring and optimizing AI projects across several vendor environments.

However, platforms with centralized capabilities (MLOps, for example) are increasingly an option to manage the complexities.

And it’s hard to argue with the access multi-cloud affords to data processing power on-demand and new, cloud-based AI solutions.

However, platforms with centralized capabilities (MLOps, for example) are increasingly an option to manage the complexities.

CIOs recognize that the foundations they are putting in place to support AI development must evolve to keep pace with future advances in the science of AI and the demands they may pose for additional power, expertise, and process change.

Preface

“CIO vision 2025: Bridging the gap between business intelligence (BI) and AI” is an MIT Technology Review Insights report sponsored by Databricks.

To produce this report, in May and June 2022, MIT Technology Review Insights conducted a global survey of 600 chief information officers, chief technology officers, chief data and analytics officers, and other senior data and technology executives.

We also interviewed 10 C-level executives from Fortune 500 companies and successful start-ups.

The survey respondents are evenly distributed among North America, Europe, and Asia-Pacific.

There are 14 sectors represented in the sample, and all respondents work in organizations earning $500 million or more in annual revenue.

The research also included a series of interviews with executives who are directly involved in their organizations’ AI and machine learning initiatives.

Contents [long version]

- Executive summary

- About the survey

- Room to grow with AI

- Lofty ambitions

- Tokio Marine: Striving to become AI-driven

- Databricks perspective

- A shift to financial value realization

- AI use case development to 2025:

- Selected company examples

- Meeting the challenges of scale

- Procter & Gamble (P&G): Automating to scale

- The data priorities

- Priorities in focus

- Multi-cloud and open

- CNH Industrial: AI, open data, and the sustainable tractor

- An industry lens on data and AI

- Conclusion

About the survey

The survey that forms the basis of this report was conducted by MIT Technology Review Insights in May and June 2022. Following are the key demographic details of the 600 executives who took part in it.

The respondents hold senior technology roles in their organizations. The majority (84%) are C-level executives: chief information officers, chief technology officers, chief data/analytics officers, and chief AI officers (CIOs are 72% of the total sample). The balance consists of senior vice-presidents or vice-presidents of AI, of data platforms, or of engineering, and heads of AI and machine learning.

These executives work in predominantly large organizations. While 10% of the latter earn annual revenue of between $500 million and $1 billion, 45% earn between $1 billion and $5 billion and the other 45% — $5 billion or over. Just over three-quarters (76%) employ over 5,000 people

In terms of geography, North America accounts for 35% of the respondents, with the rest divided equally between the other two regions.

About the authors

Denis McCauley was the author of the report,

Francesca Fanshawe was the editor, and

Nicola Crepaldi and Natasha Conteh were the producers.

The research is editorially independent, and the views expressed are those of MIT Technology Review Insights.

Acknowledgements

We would like to thank the following executives for providing their time and insights:

Sherry Aholm, Chief Digital Officer, Cummins

Vittorio Cretella, Chief Information Officer, Procter & Gamble

David Hogarth, Chief Information Officer, Virgin Australia

Marc Kermisch, Chief Information Officer, CNH Industrial

Swamy Kocherlakota, Chief Information Officer, S&P Global

Mike Maresca, Global Chief Technology Officer, Walgreens Boots Alliance

Masashi Namatame, Group Chief Digital Officer, Managing Executive Officer, Tokio Marine

Jeremy Pee, Chief Digital and Data Officer, Marks & Spencer

Prasad Ramakrishnan, Chief Information Officer, Freshworks

Rowena Yeo, Chief Technology Officer & Global Vice President, Technology Services, Johnson & Johnson

Originally published at: https://www.technologyreview.com