the

health transformation

foundation

downturn management institute

Joaquim Cardoso MSc

January 30, 2024

Key Takeaways

- Critical Focus on Controlling Labor Costs: For not-for-profit (NFP) hospitals, improving margins hinges on managing expenses, particularly labor costs, according to Fitch Ratings. Despite recovering volumes, expenses, especially salaries and wages, remain high.

- Margin Decline: Median operating and operating EBITDA margins notably declined in FY22 compared to FY21, indicating ongoing challenges in maintaining financial health.

- Persisting Weak Margins: Fitch anticipates weak margins to continue through 2023 and into 2024 due to factors like an inelastic revenue model and heightened labor costs amid tight labor conditions.

- Staffing Shortages Impact: Success in attracting and retaining permanent staff is crucial for mitigating margin pressure. Providers may face challenges with staffing shortages, leading to reliance on expensive external contract labor (ECL), further impacting margins.

- Operational Challenges: While outpatient visits improved gradually, some providers experienced payor mix degradation and a shift to medical from surgical volumes, negatively impacting margins.

- Long-term Staffing Challenges: Staffing shortages, termed as a “labordemic,” are expected to persist through 2024 and beyond, with high-growth markets better positioned to address these challenges.

- Positive Trends: Hospitals are reducing reliance on expensive travel nursing staff and increasing permanent staffing levels by offering higher salaries and bonuses. Efforts in recruitment and retention are reducing job openings and resetting wages to a higher level.

- Expense Control Strategies: Management teams are exploring various strategies to control expenses, including payor contract negotiations, supply chain efficiencies, and service line optimization.

These takeaways underscore the significance of addressing labor costs and implementing effective expense management strategies for NFP hospitals to improve margins and financial sustainability.

Infographic

Key recommendations:

Prioritize Labor Cost Management:

Given the significant impact of labor costs on margins, NFP hospitals should prioritize strategies to effectively manage and control these expenses. This may involve optimizing staffing levels, negotiating favorable labor contracts, and implementing efficiency measures to mitigate the financial strain.

Focus on Recruitment and Retention:

To address staffing shortages and reduce reliance on expensive external contract labor, hospitals should invest in robust recruitment and retention initiatives. Offering competitive salaries, bonuses, and benefits can help attract and retain permanent staff, thereby reducing the need for costly temporary staffing solutions.

Diversify Revenue Streams:

NFP hospitals should explore opportunities to diversify their revenue streams beyond traditional sources. This may include expanding services, developing strategic partnerships, or exploring alternative payment models to supplement existing revenue sources and enhance financial stability.

Optimize Operational Efficiency:

Streamlining operations and improving efficiency can help NFP hospitals reduce costs and enhance margins. This may involve optimizing supply chain management, standardizing processes, and leveraging technology to automate tasks and improve productivity.

Evaluate Service Lines:

Assessing the profitability and viability of different service lines can help hospitals identify areas for optimization or consolidation. Hospitals may consider exiting less profitable service lines or expanding high-demand services to maximize revenue generation and improve overall financial performance.

Negotiate Favorable Payor Contracts:

Proactively negotiating favorable contracts with payors can help hospitals secure better reimbursement rates and improve revenue realization. Hospitals should leverage their bargaining power to negotiate terms that align with their financial goals and support sustainable margin improvement.

Monitor and Adjust Strategies:

Continuously monitoring financial performance and market dynamics is essential for identifying emerging challenges and opportunities. NFP hospitals should regularly evaluate the effectiveness of their strategies and adjust course as needed to adapt to evolving market conditions and achieve long-term financial sustainability.

DEEP DIVE

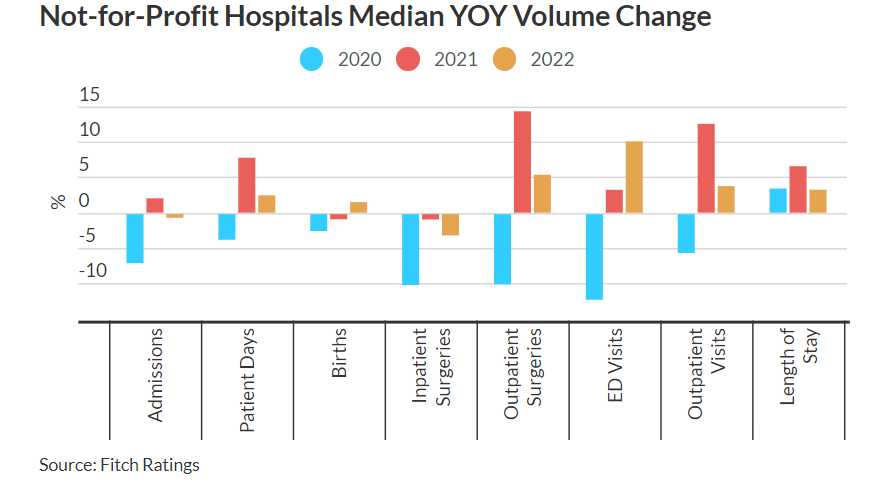

Controlling expenses, especially labor costs, will be critical for not-for-profit hospitals to return to stronger margins and alleviate credit pressure, Fitch Ratings says. Hospital volumes have largely recovered from the initial hit during the pandemic and are generally at, or even above, pre-pandemic levels for many in our rated portfolio. However, expenses, particularly salaries and wages, remain stubbornly hig

Median operating and operating EBITDA margins declined notably to 0.2% and 5.8%, respectively, in FY22 compared to 3.0% and 8.9% in FY21, according to Fitch’s latest median report. We expect weak margins to persist through 2023 and into 2024 due to an inelastic revenue model and higher labor costs due to still very tight labor conditions, even as operations broadly continue to gradually rebound.

Given current and projected staffing shortages and the associated upward reset of labor rates, Fitch believes that providers’ success in attracting and retaining permanent staff is key to mitigating stress on margins. The sector will trifurcate, with highly successful labor recruiters generally gravitating to higher investment grade ratings. Another set of providers will continue to struggle with recruiting and will need to rely on expensive external contract labor (ECL), pressuring margins and shifting ratings further down the rating scale. This is reflected in our 3:1 downgrade to upgrade ratio year-to-date. The largest set of our rated portfolio falls somewhere in the middle, with ratings likely to remain unchanged in the near to medium term, as this group will have some success in recruiting, albeit at higher wage rates, but also some reliance on ECL. This will contribute to overall weaker margins in 2023 and 2024 for the sector.

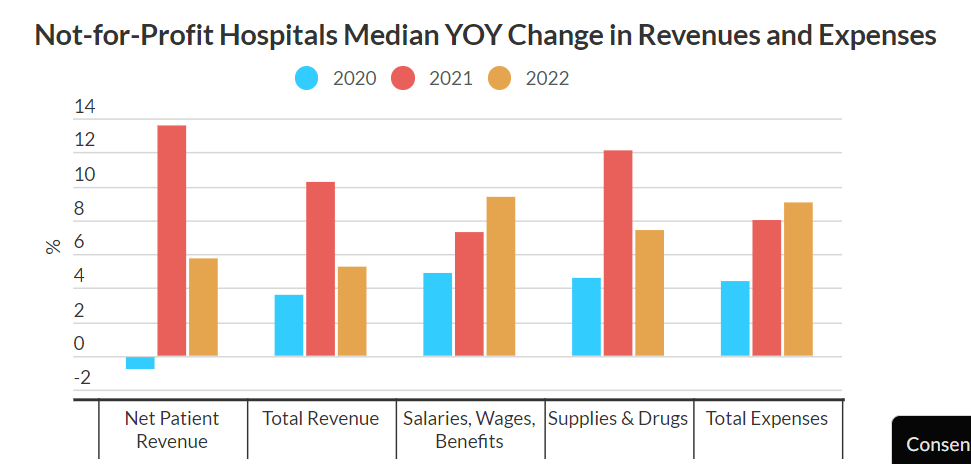

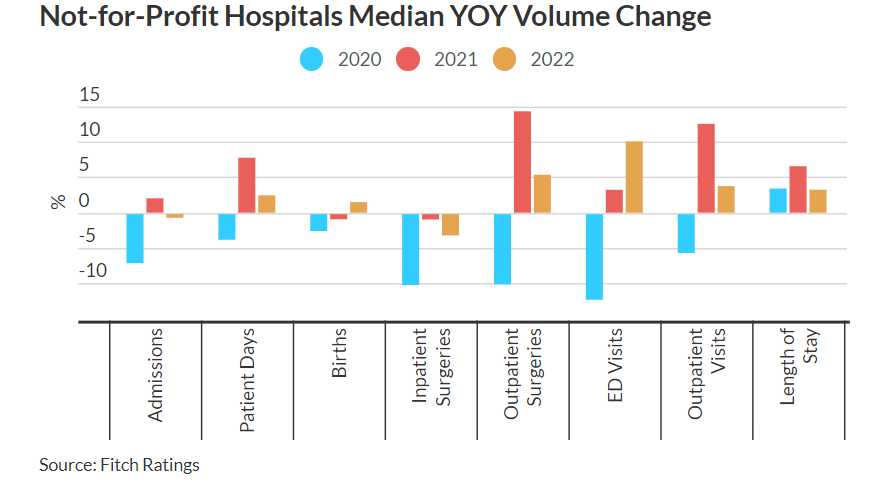

As the charts below demonstrate, expenses grew in 2020 even with a huge drop in year-over-year volumes and revenues. Outpatient visits improved gradually, with inpatient admissions increased from pandemic lows in 2021, helping drive revenue growth, with a considerable amount of provider costs offset by federal stimulus funds. With these funds tapering off, 2022 median revenue growth slowed while median expenses growth increased, the result of a heavy reliance on ECL and/or increased salary and wage costs for full time employees. Medicaid rolls grew during this time due to the public health emergency remaining in place.

The improvement in volumes, particularly outpatients, are not a constraint to operational success, although many providers are experiencing both some payor mix degradation and a still notable shift to medical from surgical volumes, both of which negatively impact operating margins.

The “labordemic” of staffing shortages, both clinical and non-clinical, will likely continue through 2024, and probably longer in many markets, with high-growth markets generally, but not always, better able to address staffing challenges.

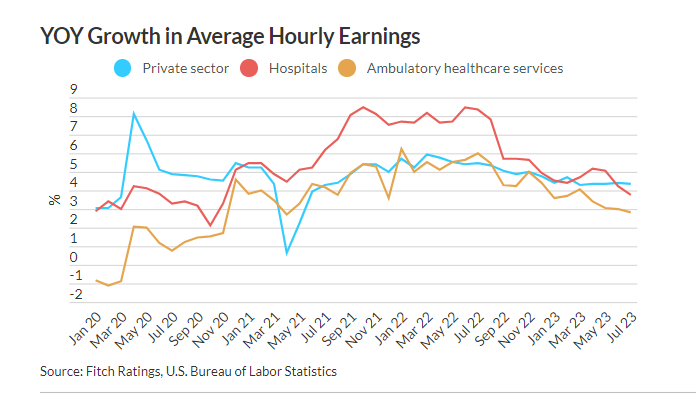

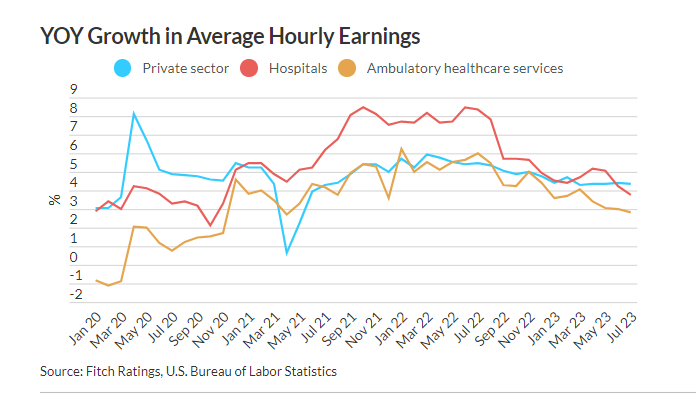

Positively, hospitals have begun to wean themselves off of more expensive travel nursing staff and build their permanent staffing levels by offering higher salaries and bonuses in some cases. ECL utilization has declined in 2023, with hospital payrolls rising for 19 consecutive months as of August 2023, as recruitment and retention efforts are reducing job openings. This has increased baseline staffing rates, with payrolls 2.1% higher than in Feb. 2020, and reset wages to a higher level.

Hospital employees’ average hourly earnings growth slowed to 3.75%, down from a high of 8.4% since the start of the pandemic, but remains well above the 2.3% growth of hospital employees from 2010 to 2019.

Management teams are also likely to use other levers to control expenses, such as payor contract negotiations, supply chain efficiencies, eliminating/consolidating less profitable service lines, reducing average length of stay, or even exiting financially challenging markets.

Originally published at https://www.fitchratings.com.