This is a republication of the paper “Covid-19 as a Stress Test for the American Health Care System” with the title above, in order to apply the principles that are transferable, to other countries as well.

Third Orizon Strategies

May 2022

Hfma, THE COUNCIL, and ata

Executive Summary by:

Joaquim Cardoso MSc.

Health Transformation Review

September 7, 2022

What is the background?

- The breathtaking pace at which the Covid-19 pandemic upended American society and commerce with lingering effects has scores of lessons that will teach future generations how society should grapple with a debilitating public health crisis while preserving economic vitality, political function, and social cohesion.

- Aside from the profound implications on education, retail, travel, entertainment, and other vital industries, the American health care system stands apart for no other reason than its position in the very eye of the storm.

Why the health system failed with Covid-19?

- Our nation’s health delivery infrastructure had the size, scope, and expertise to deftly manage the burgeoning volumes and uncertainty wrought by Covid-19.

- However, this infrastructure also represents a byzantine and fractured system steeped in largesse, inefficiency, and waste.

What was the impact of the pandemic?

- The pandemic did not necessarily exacerbate these defects, but it did critically wound the whole of American health as the entire system buckled under stressors it was not built for.

- In truth, our system is still standing strong, with barely visible outward signs of wear and tear from a macrolevel view.

- However, we believe that the most critical damage was wrought at the system’s core, causing it to come perilously close to collapse in certain regions, threatening to significantly worsen the effects of the pandemic and loss of life.

- The line separating these two realities is thin and far from trivial.

Why this review is important?

- We believe that such an examination is urgent for two reasons:

- First, the same realities before Covid-19 remain stubbornly attached to our health system as we exit the pandemic.

- Second, while Covid-19 was a catalyst for a significant loss of human life and years of foregone productivity, — the pathogen (and its subsequent variants) pales in comparison to the devastation that could be wrought to cities, regions, or the country at large through other nefarious or naturally emergent infections.

- We live in a time of remarkable geopolitical tension undergirded by globalization, deforestation, and other artificial forces that will shift the face of our planet over the next 20 years.

- Our ability to weather future events will be inextricably linked to our health system’s resilience.

What went wright?

- Despite our country’s political dysfunction, social fatigue and unrest, and ineptness of certain areas of our health system, the United States was also responsible for providing leading (although at times, woefully inaccurate) public health guidance, developing the first series of highly reliable vaccines, and promulgating evidence based therapies responsible for saving countless lives.

- To be sure, American ingenuity, innovation, and capitalism were critical features of an unprecedented R&D cycle that accelerated the timeframe for lessening the risk of the pandemic.

- These victories are instructive of how the very best of the American economy can coalesce during a time of need to meet unexpected and existential challenges.

What are the main stress tests:

As hospitals throughout the country navigated unprecedented pressure on financial structures, our nation’s clinical workforce reached a level of fatigue and burn-out not seen in the modern era, communities wrought with longstanding inequities were devastated, and one million Americans perished — a number that seemed unfathomable in March 2020.

- STRESS TEST ELEMENT #1 — NATIONAL HEALTH CARE WORKFORCE

- STRESS TEST ELEMENT #2 — HOSPITAL FINANCIAL PRESSURE

- STRESS TEST ELEMENT #3 — HEALTH INSURANCE

- STRESS TEST ELEMENT #4 — PUBLIC HEALTH

Where Do We Go from Here?

- Significant work is required to make necessary structural changes to the nation’s health system.

- While we could add pages to this analysis with such recommended reforms, we believe a stress test of the nation’s delivery capacity during Covid-19 points to three critical priorities if we are to endure future pandemics or endemics:

- 1.Focus on institutional resilience, investing more deeply in workforce attachment and well-being.

- 2.Accelerate the pace at which we pay providers for the value of their services instead of keeping them attached to financial rewards linked to volume.

- 3.Embed digital health solutions so deeply within employer and provider institutions that they are indistinguishable from in-person care.

What are the challenges?

- Accomplishing these priorities will not be easy.

- Our system is stubborn and rigid, rewarding the status quo.

- However, the toll borne by our colleagues, neighbors, and fellow citizens provides ample reason to be better prepared for unexpected events in an uncertain future.

ORIGINAL PUBLICATION (full version)

INTRODUCTION

The breathtaking pace at which the Covid-19 pandemic upended American society and commerce with lingering effects has scores of lessons that will teach future generations how society should grapple with a debilitating public health crisis while preserving economic vitality, political function, and social cohesion.

Aside from the profound implications on education, retail, travel, entertainment, and other vital industries, the American health care system stands apart for no other reason than its position in the very eye of the storm.

Our nation’s health delivery infrastructure had the size, scope, and expertise to deftly manage the burgeoning volumes and uncertainty wrought by Covid-19.

However, this infrastructure also represents a byzantine and fractured system steeped in largesse, inefficiency, and waste.

The pandemic did not necessarily exacerbate these defects, but it did critically wound the whole of American health as the entire system buckled under stressors it was not built for.

… the health delivery infrastructure had the size, scope, and expertise to deftly manage the burgeoning volumes and uncertainty wrought by Covid-19.

However, this infrastructure also represents a byzantine and fractured system steeped in largesse, inefficiency, and waste.

The pandemic did not necessarily exacerbate these defects, but it did critically wound the whole of American health as the entire system buckled under stressors it was not built for.

This paper examines the American health care system’s key features to understand better the effects of such stressors and how the country’s institutions withstood their weight.

We believe that such an examination is urgent for two reasons:

First, the same realities before Covid-19 remain stubbornly attached to our health system as we exit the pandemic.

Medical cost inflation is forecast to grow at a rate of 4.6 to 5.3 percent annually from 2022 through 2030.[1]

These cost increases will outpace consumer price inflation (CPI), continuing a multi-year trend of health resources consuming more of our national income.

If the past is prologue, this increased spending will do little to raise our country’s poor comparative health outcomes as measured against other OECD nations.

Despite our scientific prowess, clinical sophistication, and excellent workforce, the system continues to metastasize without core improvements to evidence-based activities that yield a healthier population.

Second, while Covid-19 was a catalyst for a significant loss of human life and years of foregone productivity, …

… the pathogen (and its subsequent variants) pales in comparison to the devastation that could be wrought to cities, regions, or the country at large through other nefarious or naturally emergent infections.

We live in a time of remarkable geopolitical tension undergirded by globalization, deforestation, and other artificial forces that will shift the face of our planet over the next 20 years.

Our ability to weather future events will be inextricably linked to our health system’s resilience.

We live in a time of remarkable geopolitical tension undergirded by globalization, deforestation, and other artificial forces that will shift the face of our planet over the next 20 years.

Our ability to weather future events will be inextricably linked to our health system’s resilience.

In truth, our system is still standing strong, with barely visible outward signs of wear and tear from a macrolevel view.

However, we believe that the most critical damage was wrought at the system’s core, causing it to come perilously close to collapse in certain regions, threatening to significantly worsen the effects of the pandemic and loss of life.

The line separating these two realities is thin and far from trivial.

… we believe that the most critical damage was wrought at the system’s core, causing it to come perilously close to collapse in certain regions, threatening to significantly worsen the effects of the pandemic and loss of life.

A GOOGLE EARTH VIEW OF COVID-19’S STRESS ON AMERICAN HEALTH CARE

Despite our country’s political dysfunction, social fatigue and unrest, and ineptness of certain areas of our health system, the United States was also responsible for providing leading (although at times, woefully inaccurate) public health guidance, developing the first series of highly reliable vaccines, and promulgating evidence based therapies responsible for saving countless lives.

To be sure, American ingenuity, innovation, and capitalism were critical features of an unprecedented R&D cycle that accelerated the timeframe for lessening the risk of the pandemic.

Despite…. the problems … the United States was also responsible for providing leading (although at times, woefully inaccurate) public health guidance, developing the first series of highly reliable vaccines, and promulgating evidence based therapies responsible for saving countless lives.

These victories are instructive of how the very best of the American economy can coalesce during a time of need to meet unexpected and existential challenges.

However, these accomplishments paper over the inner workings of our country’s health system for the majority of the pandemic period.

As hospitals throughout the country navigated unprecedented pressure on financial structures, our nation’s clinical workforce reached a level of fatigue and burn-out not seen in the modern era, communities wrought with longstanding inequities were devastated, and one million Americans perished — a number that seemed unfathomable in March 2020.

As hospitals throughout the country navigated unprecedented pressure on financial structures, our nation’s clinical workforce reached a level of fatigue and burn-out not seen in the modern era, communities wrought with longstanding inequities were devastated, and one million Americans perished — a number that seemed unfathomable in March 2020.

- STRESS TEST ELEMENT #1 — NATIONAL HEALTH CARE WORKFORCE

- STRESS TEST ELEMENT #2 — HOSPITAL FINANCIAL PRESSURE

- STRESS TEST ELEMENT #3 — HEALTH INSURANCE

- STRESS TEST ELEMENT #4 — PUBLIC HEALTH

STRESS TEST ELEMENT #1 — NATIONAL HEALTH CARE WORKFORCE

Over the first few months of the pandemic, most Americans were sequestered in their homes while so-called “essential workers” were expected to continue driving the fundamental gears of the economy.

All such essential workers were placed in harm’s way; the threat of contracting Covid-19 ever-present.

However, no other part of these essential workers can compare to the toil and burden placed on clinically trained professionals who, sometimes adorned in garb as extensive as hazmat suits, regularly interacted with the riskiest members of the public.

There was a sense of national unity for those initial weeks where we collectively and dutifully played our part while celebrating nurses’ and physicians’ selflessness.

Billboards of gratitude adorned highways, commercials paid tribute, and a sense of general reverence graced cable television.

Our nation’s front-line workers represented infantrymen in what would be a protracted war, and they were deserving of our gratitude and support.

However, by the summer of 2020, these sentiments began to fade. As disinformation began to proliferate, our nation’s culture wars found a footing in the pandemic.

Frontline workers were increasingly seen as the harbingers of hyperbole and misinformation, setting up a scene where nurses dressed in scrubs were harassed at grocery stores, dying patients litigated Covid-19 conspiracy theories, and scientifically-based clinical advice went unheeded.

With unprecedented hospital volumes, practitioners worked significant hours under heightened trauma and stress conditions, watching unprecedented numbers entering their facilities with flu-like symptoms and facilitating telephonic or FaceTime-enabled goodbyes with loved ones.

The convergence of these factors has resulted in a seriously wounded workforce that will take years to recover.

This, however, was a self-inflicted wound. One that we can learn from.

The limited information about the virus in March 2020 cast an air of debilitating uncertainty over American society, causing families, individuals, and institutions to exercise conservatism in financial planning for the weeks and months to follow.

Hospitals suspended (profitable) elective procedures to ensure public safety and optimize capacity for the infected.

Families retrieved loved ones from skilled nursing facilities or checked in on loved ones through windows and iPads.

Clinics became cautious about interacting with patients.

Patients, for their part, de-prioritized physical and mental health needs in favor of remaining secluded from hazardous environments.

Over March and April 2020, 129,000 midlevel practitioners were either displaced or otherwise separated[2] as institutions sought to dramatically reduce costs to align with a new reality of depressed revenues.

These two months represent the industry’s most significant and most rapid workforce shift in the modern era.

To put a finer point on this, there were 136,700 such displacements between March 2018 through February 2020 (Exhibit 1).

To put a finer point on this, there were 136,700 such displacements between March 2018 through February 2020

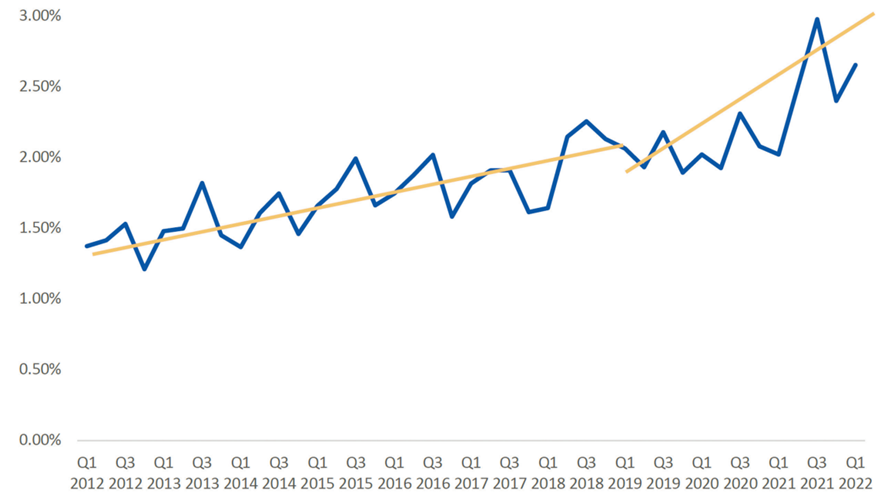

The period of economic growth preceding the pandemic was already a catalyst for a higher turnover of mid-level practitioners in the industry, with the three-month moving average of resignations sitting around 1.38 percent of the total workforce.

By the pandemic’s beginning, the resignation rate increased to 1.9 percent.

At the height of the pandemic years, it reached 2.98 percent (Q3 2021) before settling at 2.66 percent as of the first quarter of 2022.

Clinician turnover rates soared to three times their 2012 levels and almost double the rates in the period immediately preceding the pandemic.

The most evident culprit and widely cited scapegoat for such turnover is an assertion that midlevel practitioners were simply “burned out,” causing many to leave the industry.

While it is true that some clinicians left health care (temporarily or permanently) to find employment in lower-stress and higher-pay service industries, most others simply capitalized on the disproportionate demand for nurses.

Hospitals, which had materially decreased their staffs in the early days, clamored to attract a trained workforce capable of meeting newly projected demands, which led to two unique phenomena.

First, labor market competition grew fierce, driving up wages and the promise of overtime pay and accelerating the profession’s turnover rate.

The second came from staffing agencies that aggressively hired nurses under the auspices of greater flexibility and higher income, charging unprecedented rates to facilities that had no other choice but to pay.

The most evident culprit and widely cited scapegoat for such turnover is an assertion that midlevel practitioners were simply “burned out,” causing many to leave the industry.

Exhibit 1: Percentage of Clinical Workforce that Left a Job (2012–2022)

After March and April 2020, revenue among travel nurse providers surged 10 percent, with 60 percent of travel nurse firms reporting higher negotiated rates for their services.[3]

These numbers have generally persisted through the pandemic, changing the face and transience of the health care workforce.

A health care executive for a major hospital system reported that the monthly outlay for traveling nurses is now equivalent to the historical annual outlays made in 2019 and before.

This has become an additional financial burden to hospitals, already operating at substantially lower revenues.

Structurally re-instating a workforce is expensive, with an estimated average cost of turnover for a bedside Registered Nurse of $40,000.[4]

Structurally re-instating a workforce is expensive, with an estimated average cost of turnover for a bedside Registered Nurse of $40,000

Labor economies subscribe to the same supply and demand principles as any other industry.

A person sells their time and expertise for a rate set by the market.

The sudden collapse and gradual resurgence of demand eventually outweighed the supply.

The equilibrium price point has driven up the cost for these professionals and will likely persist far into the future.

As of the first quarter of 2022, there were approximately 2 million monthly openings for midlevel practitioners with 579,000 to 800,000 actual hires.[5]

This gap will prove stubborn to close in the coming years and will likely shift the structural compensation expectations of the nursing workforce, particularly given the maltreatment the industry experienced on all fronts during the pandemic.

As of the first quarter of 2022, there were approximately 2 million monthly openings for midlevel practitioners with 579,000 to 800,000 actual hires

This gap will prove stubborn to close in the coming years and will likely shift the structural compensation expectations of the nursing workforce, particularly given the maltreatment the industry experienced on all fronts during the pandemic.

Bottom Line: The rapid dismissal of nursing professionals combined with non-competitive wages, demanding work climates, and social antipathy have structurally shifted the profession leading to a lagged recovery time and higher wage costs per capita than at any other point before the pandemic period.

The rapid dismissal of nursing professionals combined with non-competitive wages, demanding work climates, and social antipathy …

… have structurally shifted the profession leading to a lagged recovery time and higher wage costs per capita than at any other point before the pandemic period.

STRESS TEST ELEMENT #2 — HOSPITAL FINANCIAL PRESSURE

Going into the pandemic period, America’s ~5,000 hospitals boasted strong balance sheets with over $600 billion in current assets and over $1 trillion under the general fund category (the equivalent of shareholder’s equity).

As with all other American health care, these assets were distributed unevenly, with large, specialty focused academic medical centers boasting strong reserves while many safety-net and rural hospitals were operating with less than six months of cash on hand.

The pandemic catalyzed tremendous financial uncertainty for institutions that consistently play a tricky balancing act between bond repayments necessary for growth, significant fixed assets, and income dependence on volumes curtailed by legislative or cultural abandonment of average care utilization.

The pandemic catalyzed tremendous financial uncertainty for institutions that consistently play a tricky balancing act between bond repayments necessary for growth, significant fixed assets, and income dependence on volumes curtailed by legislative or cultural abandonment of average care utilization.

Ironically, the long-standing industry consensus on the shortcomings of volume-centric reimbursement was deftly validated.

America’s hospitals and the underlying industrial complex were not built to withstand significant exogenous shocks.

The industry’s tardiness to seriously transform payment flows and incentivize different population management and support approaches inflicted a considerable cost.

Ironically, the long-standing industry consensus on the shortcomings of volume-centric reimbursement was deftly validated.

However, the federal government’s timely action and health systems’ quick operational recalibration averted what could have been a catastrophic outcome.

Hospital Systems Are Financially Wounded, Despite Some Emerging with Greater Financial Strength

We cannot yet put together a complete financial picture of the impact the pandemic has had on the operational and structural economics of health systems.

However, using the available data for 2020 — arguably the worst of the two preceding pandemic years — we see a picture of a more substantial post-pandemic asset base.

Using aggregated financial data from Modern Healthcare,[6] we tracked key ratios from 2013 through 2020.

Each year, the number of health systems counted under this dataset shifts given industry M&A activity or divestiture.

For 2020, the dataset reflected 313 for-profit and nonprofit health systems across the country.

From 2013 through 2019, net patient revenue (NPR) grew at annual rates between 0.65 and 8.08 percent. In 2020, NPR contracted by 20.87 percent.

This deficit was countered with unprecedented subsidies from the federal government designed to offset losses to health systems related to varying timelines for suspended elective activities and changed utilization patterns.

Nonoperating revenue for the health systems in this dataset grew by 712.55 percent, over 10x the next highest annual growth rate from the preceding years (2013 through 2019).

A separate analysis conducted by Kauffman Hall shows that the median hospital operating margin in 2020 was -0.9 percent, climbing to 2.5 percent in 2021. Adding CARES funding to this number increases the median hospital margin to 4.0 percent.[7]

the median hospital operating margin in 2020 was -0.9 percent, climbing to 2.5 percent in 2021. Adding CARES funding to this number increases the median hospital margin to 4.0 percent

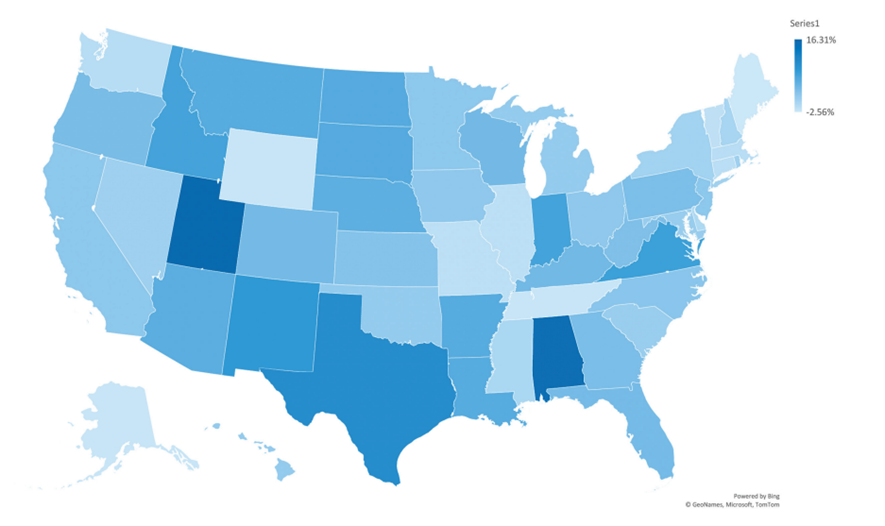

State variation in operating income as a percentage of NPR tells an important story, with clear lines of demarcation between states that imposed more stringent limitations on residents and hospital facilities.

For example, Utah, Mississippi, Texas, New Mexico, Indiana, Idaho, and Virginia had disproportionately high-income figures (not calculating for federal subsidies).

In contrast, the northeast corridor, California, Illinois, Missouri, and other states showed negative or nearly flat margins (Exhibit 2).

Government’s Role in Curbing Financial Losses to Health Systems

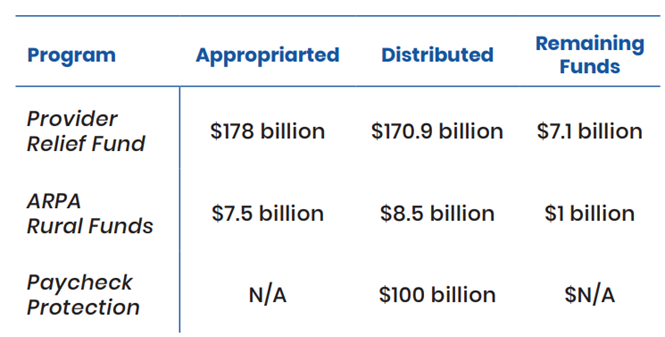

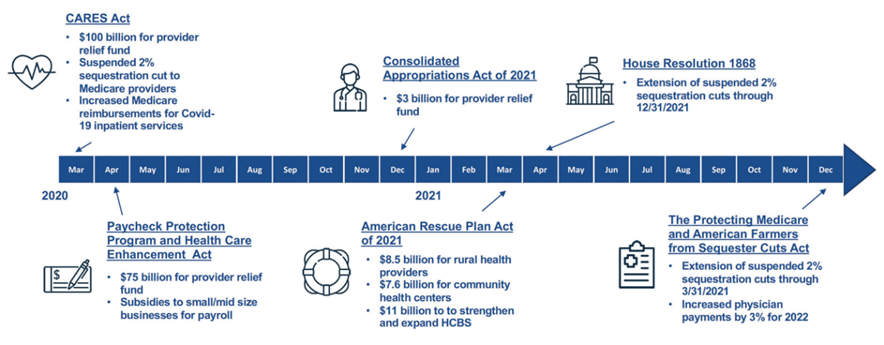

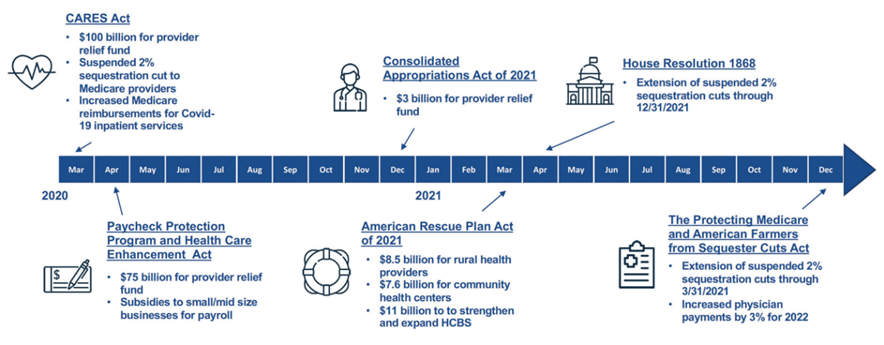

The federal government took six material actions from March 2020 through the end of 2021 that provided relief to providers.

The most critical of these interventions was establishing a provider relief fund. Additional funding streams to support community health centers and rural health facilities were also appropriated, providing a veritable lifeline.

Further, the Paycheck Protection Program offered additional funding to smaller health care entities, incentivizing them to mitigate reduction in force plans (Exhibit 3).

Exhibit 2: State Variation of Operating Income to Net Patient Revenue (2020)

Exhibit 3: Federal Direct Funding Programs

In addition to this direct funding, federal budget sequestration legislation eliminated Medicare reimbursement cuts scheduled for March 2022.

Physicians also saw a modest increase in Medicare reimbursement rates while payment parity for telehealth was instituted through the Public Health Emergency (Exhibit 4).

These measures stabilized what would have been an otherwise untenable financial situation for the nation’s health systems.

According to MedPAC, these programs were directly responsible for some hospitals to remain profitable through the first three quarters of 2020.[8]

However, other preliminary data from MedPAC tell a decidedly better story showing that “among the six largest health systems, operating profits exceeded prepandemic levels.[9]”

This view comports with our preliminary analysis — government action allowed America’s hospitals’ structural economic vitality to remain in place.

However, a new and unexpected challenge looms for hospitals as the country exits the pandemic.

The unexpected rise in inflation and widespread staffing challenges are increasing operating costs.

At this time, the federal government is not taking action to curb the losses to hospital systems.

Combined with the regional ebbs and flows of Covid-19 subvariants, these factors are sustaining the financial pressure on hospital systems.

For example, in Q1 2022, Ascension (based in St. Louis) had increased revenues but reported an operating loss of $671.14 million (compared to a reported loss of $16.71 million in the preceding year).[10]

HCA, a national publicly traded portfolio of hospitals, forecasted both a decline of $500 million in revenue and “high water mark” labor costs that are likely to drain earnings.[11]

However, a new and unexpected challenge looms for hospitals as the country exits the pandemic. The unexpected rise in inflation and widespread staffing challenges are increasing operating costs.

Exhibit 4: Schedule of Federal Programs and Legislation Related to the Covid-19 Pandemic

Telehealth as a Mitigant to Rapidly Declining Encounters

Early in the pandemic, the Centers for Medicare & Medicaid Services (CMS) and state regulators established unprecedented exemptions for the use of telehealth services by requiring reimbursement at parity, eliminating site origination exclusions, and even permitting reimbursement for audio-only encounters.[12]

This regulatory flexibility and the financial duress on providers combined with countless investor-backed digital solutions to create unique pathways to making up for lost in-person encounters.

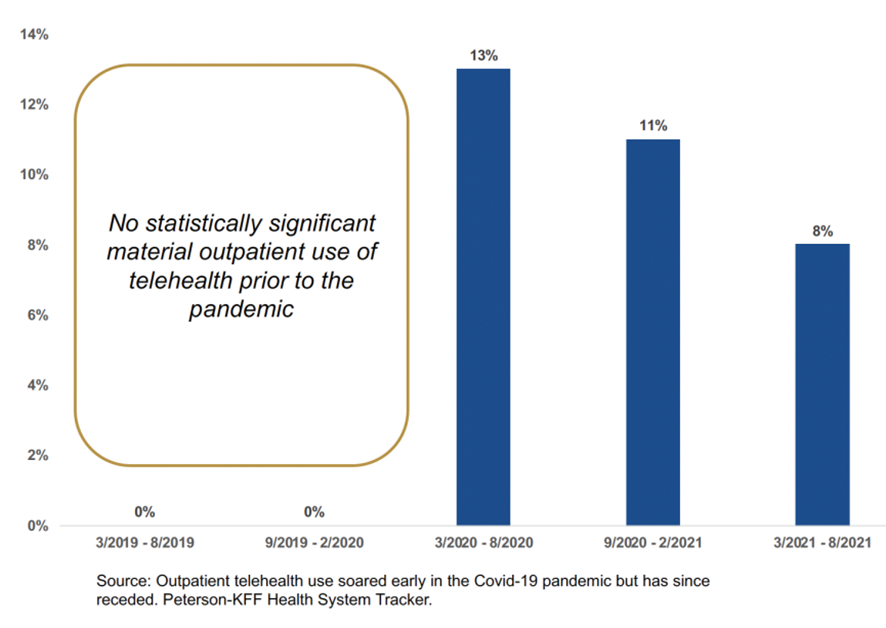

Health systems and payers were able to transition to digital solutions capable of supporting remote patient interactions in mere days or weeks. The volumes for digital encounters exploded, as shown in Exhibit 5.

Exhibit 5: Telehealth and In-Patient Utilization Rates (2020–2021)

Health systems and payers were able to transition to digital solutions capable of supporting remote patient interactions in mere days or weeks. The volumes for digital encounters exploded,

The number of telehealth encounters increased by approximately 1,200 percent in less than 90 days.

Though the number has fallen since the peak, the volume of virtual encounters remains 38 times higher than before the pandemic, ranging from 13 to 17 percent of visits across specialties.[13]

The number of telehealth encounters increased by approximately 1,200 percent in less than 90 days.

Another view of this shows that before the Covid-19 pandemic, there was virtually no material use of telehealth for outpatient services (Exhibit 6).

Exhibit 6: Outpatient Telehealth Use Prior to and During the Pandemic (by Percentage of Encounters)

The dynamic illustrated in Exhibit 6 demonstrates that the country’s digital health infrastructure is robust and capable of being mobilized to create alternative access points to care at scale.

The dynamic illustrated in Exhibit 6 demonstrates that the country’s digital health infrastructure is robust and capable of being mobilized to create alternative access points to care at scale. However, the transition and its longevity are not without dilemmas.

However, the transition and its longevity are not without dilemmas.

A series of roundtables recently conducted with members of the American Telemedicine Association (ATA) highlighted the work required for seamless continuity between clinical workflows, administrative systems, and revenue cycle management functions was disjointed.

A series of roundtables recently conducted with members of the American Telemedicine Association (ATA) highlighted the work required for seamless continuity between clinical workflows, administrative systems, and revenue cycle management functions was disjointed.

The comparative experience between in-person and virtual encounters for a patient or practitioner within the same practice was highly varied, creating confusion and inefficiencies.

In short, the delivery system did not have the planning or strategies in place to make a transition of this size and magnitude within the pandemic’s truncated timeframe.

… the country’s digital health infrastructure is robust and capable of being mobilized to create alternative access points to care at scale. However, the transition and its longevity are not without dilemmas.

These duct tape solutions raise the specter of an era where telehealth access could grow in postpandemic years.

Alternatively, the frustration experienced by practitioners and patients alike could curb demand or substantiate a preexisting aversion to telehealth, despite the larger economy’s acceleration to digitizing functions across industries.

Another threat to maintaining this newly developed infrastructure is the the health system continues to favor revenues associated with in-person encounters.

This becomes truer if specific telehealth provisions or exemptions under the public health emergency are not materially extended or otherwise codified into law.

Another threat to maintaining this newly developed infrastructure is the the health system continues to favor revenues associated with in-person encounters.

Further, the country still struggles with a digital divide.

Though most Americans own a smartphone, the variability between upload and download speeds, mobile data availability, and the affordability of good data plans continue to drive a digital access divide between Americans.

These disparities exacerbate health inequities across the country and dilute the long-term effects or promise of digital health solutions to address an unconventional operating environment where patient access to facilities is limited.

Bottom Line: Digital health solutions were prepared to meet the sudden challenge of the pandemic. Regulatory flexibilities and institutional exigence caused a structural shift to the nation’s digital health adoption curve, and lost revenues became partially offset as encounters became increasingly virtual. However, the long-term adoption implications remain unknown.

Digital health solutions were prepared to meet the sudden challenge of the pandemic.

Regulatory flexibilities and institutional exigence caused a structural shift to the nation’s digital health adoption curve, and lost revenues became partially offset as encounters became increasingly virtual.

However, the long-term adoption implications remain unknown.

STRESS TEST ELEMENT #3 — HEALTH INSURANCE

At their core, insurance companies are risk management institutions.

They are experts at assimilating data instructive to risk factors, analyzing these data, and conducting make-or-break analyses on product portfolios and premiums.

However, this competency does not always translate well to situations of heightened uncertainty wrought by global exogenous shocks, certainly not ones bereft of historical data.

At their core, insurance companies are risk management institutions. However, this competency does not always translate well to situations of heightened uncertainty wrought by global exogenous shocks, certainly not ones bereft of historical data.

At the onset of the Covid-19 pandemic, insurance companies quickly re-calibrated operations to support staff shifting work to home.

Markets had a brief moment of panic as an uncertain future was laid bare.

However, investors promptly realized the upside of an environment where elective procedures would be delayed, and utilization of health services would be disproportionately lower than forecasted trends.

One significant uncertainty resided in how other industry labor markets would fare as the economy essentially shut down for a protracted period.

Some economists predicted an unemployment rate of 30 percent,[14] causing insurers and providers to brace for the potential impact of a significant decline in commercial coverage. However, the resilience of the American economy combined with some of the additional stimulative measures taken by the federal government mitigated the level of coverage turnover throughout the market.

Financial Performance of the Insurance Industry Was Unparalleled

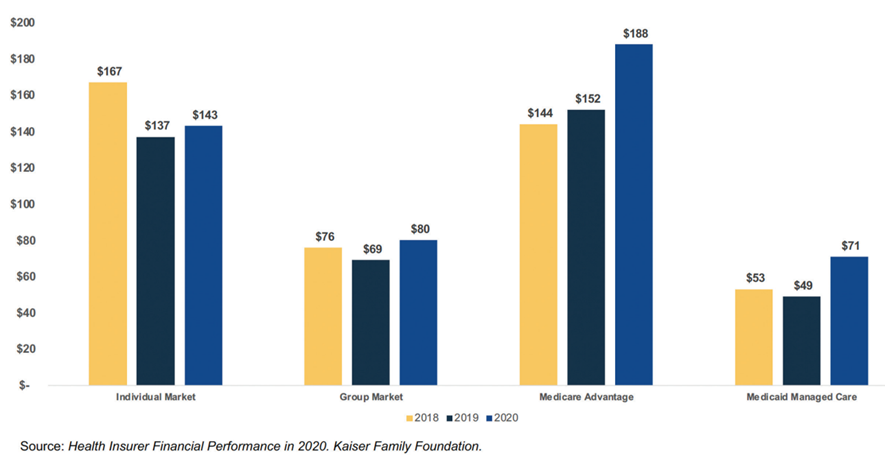

Depressed levels of utilization over the entire pandemic period created a veritable windfall for insurance companies, with the industry showing increased per member per month (PMPM) profitability over 2019 across all lines of business (LOB).[15]

Depressed levels of utilization over the entire pandemic period created a veritable windfall for insurance companies, with the industry showing increased per member per month (PMPM) profitability over 2019 across all lines of business (LOB).

From 2019 to 2020, profits for the group (employer-sponsored) market increased by 15.9 percent, Medicare Advantage market profitability increased by 23.6 percent, and Medicaid managed care’s profitability increased by 44.9 percent.

The only LOB laggard was the individual market which saw a year-over-year profitability increase of 4.4 percent (Exhibit 7).

This is due to the market’s difficulty with setting premiums since the introduction of the Affordable Care Act (ACA) and the significant changes that govern networks, distribution, enrollment, and administration.

Exhibit 7: Health Insurance PMPM Gross Margins by LOB (2018–2020)

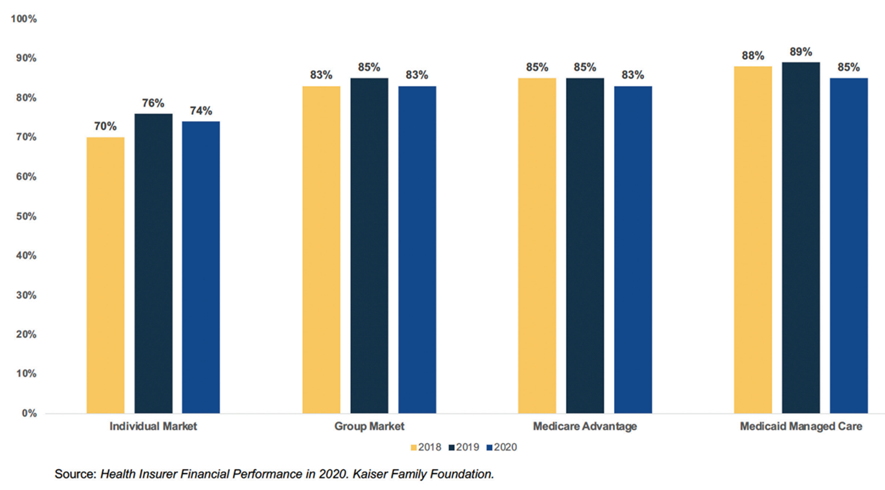

Insurance companies are not permitted to stash excess profits under an ACA-era rule called the Medical Loss Ratio (MLR), which requires insurance companies to remit a refund to enrollees if the cost for medical claims reimbursed to providers falls under either 80 or 85 percent (depending on the LOB).

However, MLRs across the four primary LOBs only had marginal decreases, indicating that insurance carriers incurred other allowable costs.

Two areas where this occurred were:

- Most insurance companies’ coverage of Covid-19 testing drove up claims volumes and insurance-related expenditures.

- Investments in care management infrastructure and resources capable of improving operational efficiency in outlying years.

Nevertheless, every LOB in the insurance industry saw money flow back to members, given the lower claims cost (Exhibit 8).

Exhibit 8: Health Insurance MLR by LOB (2018–2020)

We should be careful to avoid the conclusion that depressed MLR and higher PMPM by LOB equated to real profits for insurance companies.

Like every other organization in the country, insurance companies had to rapidly shift workforce and resource investments to support seamlessness in operations.

However, it is highly likely that most insurance companies in the United States generated higher earnings than predicted or have been customary in preceding years.

Like every other organization in the country, insurance companies had to rapidly shift workforce and resource investments to support seamlessness in operations.

However, it is highly likely that most insurance companies in the United States generated higher earnings than predicted or have been customary in preceding years.

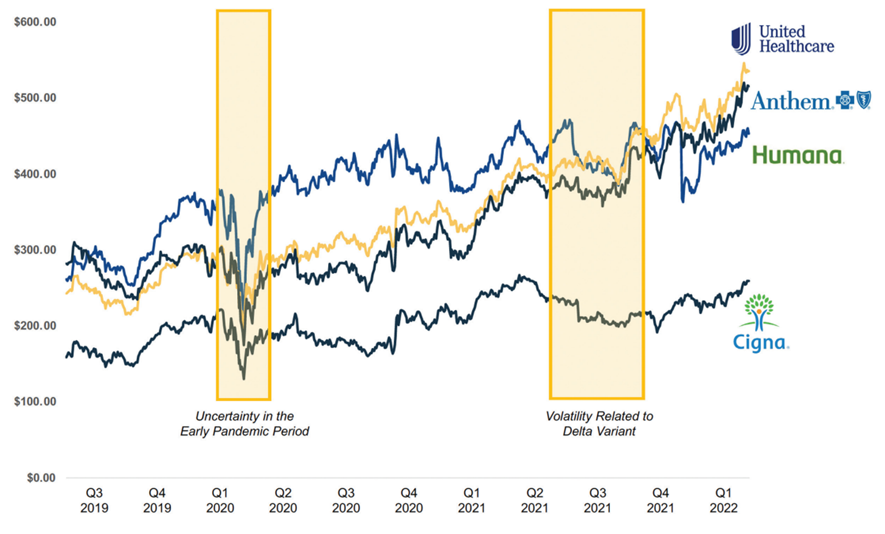

A separate indicator that highlights the performance of insurance companies can be found in stock market performance before and during the pandemic.

National insurance companies with a more diverse portfolio across LOBs saw increases from July 2019 through April 2022 (Humana, Anthem, United Healthcare, and Cigna).

Three of these insurance carriers saw significant growth in share price, whereas one only grew marginally (and more consistently with broader market trends) (Exhibit 9).

All four of these stocks saw a precipitous decline in the days surrounding Covid-19 lockdowns and the country’s initial surge of cases.

However, all share prices rebounded quickly, with two companies rising above the pre-drop price level.

Some growth stagnation and volatility hit these four stocks as the country grappled with the Delta variant in the second half of 2021, but again, they quickly rebounded and have all seen an upward trajectory (Exhibit 10).

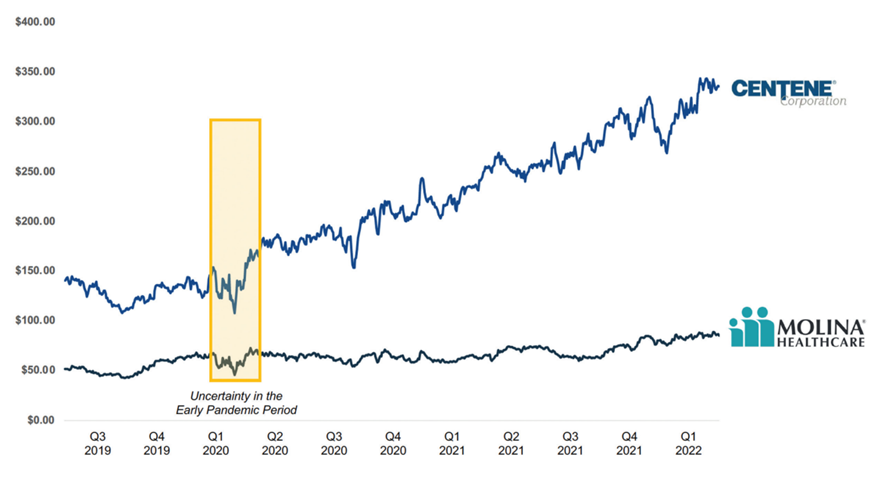

The country’s two leading national Medicaid managed care organizations (MCO) saw a less protracted decline in stock performance during the onset of the pandemic.

Centene has continued to outperform the broader market with steady and sustained growth from around $120 a share to about $325. Molina Healthcare has remained flat.

Exhibit 9: Stock Performance for Diverse LOB National Insurers (Q3 2019 — Q1 2022)

Exhibit 10: Stock Performance for National Managed Medicaid Organizations (Q3 2019 — Q1 2022)

Changes in Coverage

Shifts in how Americans accessed health insurance were far more muted than initially anticipated.

According to the National Health Expenditure data released in 2022, the Medicaid program grew 13.6 percent (from 72.3 to 82.2 million members) from 2019 through 2022.

Private health insurance only declined by 200,000 members during the same period.

Medicare followed its typical year-over-year growth trajectory, rising from 60.2 million members in 2019 to 62.5 million members in 2021.[16]

Shifts in how Americans accessed health insurance were far more muted than initially anticipated.

…the Medicaid program grew 13.6 percent (from 72.3 to 82.2 million members) from 2019 through 2022.

If the economy had failed to rebound in Q3 2020, Medicaid could likely have seen an additional 20 million or more enrollees with a much sharper decline in employer-sponsored insurance.

This would have created significant financial headwinds for insurance companies less adept at managing Medicaid enrollees and providers who would have had the additional economic duress of a more extensive payer mix tilting in favor of the lower-reimbursable Medicaid program.

This says nothing of the significant budget pressures states would have faced.

Pent Up Demand and Prospective Utilization

One of the most considerable remaining uncertainties for insurance companies is how demand for services was pent up during the pandemic years.

One of the most considerable remaining uncertainties for insurance companies is how demand for services was pent up during the pandemic years.

According to an analysis conducted by Peterson-KFF, utilization levels had not even normalized by April 2021, let alone seen a surge of services presumably foregone in 2020.

This could mean one or all of two things:

1.Most of this pent-up demand was distributed across 2020 and is “baked-in” to a new baseline for utilization trends.

2.There is a pent-up demand for services that will manifest in larger volumes over the next two to three years.

However, most projections do not forecast a looming and unexpected surge of utilization and claims.

Insurance companies pricing for 2022 show a “business as usual” mindset, with standard increases in premiums and lower anticipated costs related to the Covid-19 virus itself.[17]

Further, National Health Expenditure forecasts indicate a normalization of prepandemic LOB compositional levels and health care cost growth continuing with its prepandemic levels.

Bottom Line: Insurance carriers were generally insulated from the most significant financial pressures of Covid-19. The coming two to three years will determine lingering demand-side effects on the insurance industry. However, any surge in demand for services will be coupled with increasing premiums, allowing insurance companies refuge.

Insurance carriers were generally insulated from the most significant financial pressures of Covid-19.

The coming two to three years will determine lingering demand-side effects on the insurance industry.

However, any surge in demand for services will be coupled with increasing premiums, allowing insurance companies refuge.

STRESS TEST ELEMENT #4 — PUBLIC HEALTH

A critical element of how a nation grapples with a public health crisis is its residents’ degree of trust and confidence in vital institutions.

A national poll commissioned by the Robert Wood Johnson Foundation in May 2021 found the following:[18]

- Seventy-one percent of Americans support “substantially increasing” public health funding, and 72 percent see the role of public health institutions as “extremely or very important” to the health of the nation.

- The favorability of the United State’s public health institutions declined from 43 to 34 percent from 2009 through 2021, while positive sentiments toward the health care system increased from 36 to 51 percent during the same period.

These data indicate that Americans place more trust and confidence in their direct practitioners (doctors and nurses) than in public health institutions.

Further, the levels of disinformation, Covid-19 fatigue, and decision-making sometimes viewed as political or erratic have likely eroded confidence in certain institutions from the May 2021 observations.

Bottom Line: Political institutions and scientists will need to work double-time to restore confidence in the public health field.

Political institutions and scientists will need to work double-time to restore confidence in the public health field.

It Could Have Been Worse

As part of this analysis, we created a financial model that projected various scenarios based on what could have happened to health systems across the country had federal funding been more limited or had the recession and adjoining rate of unemployment been deeper.

In our estimation, there are two primary areas of disruption related to a public health crisis similar to Covid-19.

The first derives from shifts in utilization resulting from prolonged elective services suspensions and lower patient volumes and revenues.

The second is centered on changes in coverage, wrought by higher unemployment and expanded enrollment in state Medicaid programs that reimburse at much lower rates than their commercial counterparts.

Shifts in Utilization

Several notable research entities and economists have attempted to measure and describe the overall impact of varying utilization patterns on the financial viability of the county’s hospitals. These analyses have focused on specific regions or states, while others have operated at a higher, more abstract level.

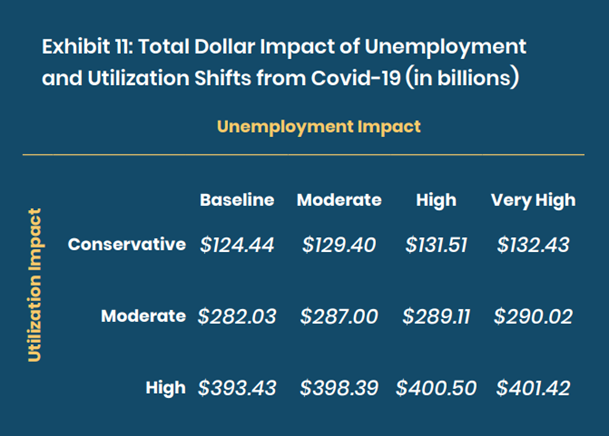

For our assumptions, we set the hospital industry’s baseline projected loss leveraging an analysis conducted by Kauffman Hall in July 2020[19] and March 2021.[20] These analyses projected that Covid-19-related declines in inpatient and outpatient services would create financial losses of $320 billion in 2020 and $53 to $122 billion in 2021.

We established three scenarios from these projections, applying the offset of Provider Relief Fund from the CARES Act, funding against these baseline losses, and independent conservative (lower than the baseline) and high (higher than the baseline) scenarios. The veracity of the moderate (or baseline) utilization impact assumption is contingent on the accuracy of the Kauffman Hall analysis and an expectation that ongoing challenges in managing the effects of Covid-19 will continue to place strain on volumes.

Shifts in Coverage

Calculating shifts in coverage required certain assumptions about the change in unemployment during the height of the Covid-19 period in 2020 and extrapolating expectations through 2021.

We first partitioned labor markets according to three classes based on the North American Industry Classification System (NAICS) code descriptions: trades, services, and professionals. We assessed the general differences in the period where unemployment spiked in April 2020 and modeled the recovery rate for each of the three industry classes from July through October 2020 using the Bureau of Labor Statistics (BLS) unemployment data. We then determined the state level of unemployment during three different periods: Q1 of 2020, Q2 2020, and the second half of 2020 (in aggregate).

Similar to the shifts in utilization, we applied different scenarios to unemployment numbers, building on the baseline and establishing higher methods of ‘moderate’ (10 percent), ‘high’ (11.5 percent), and ‘very high’ (13 percent) rates for 2021.

To calculate the dollar impact of the shift in coverage, we used 2018 hospital financial data. We created a regression model, assessing the correlation across every county with acute operating care, critical access, or long-term hospitals. The dependent variable was the facility level margin, and the independent variables consisted of the county-level line of business composition[21] and controlling for volumes using total annual discharges.

The elements of the model were statistically significant.[22] The total spread in coefficients between the accretion for commercial business and the reduction when measuring Medicaid business show a $1,278 loss for every individual whose coverage changed. We applied this number ubiquitously across all states and the corresponding unemployment scenarios.

Outcomes

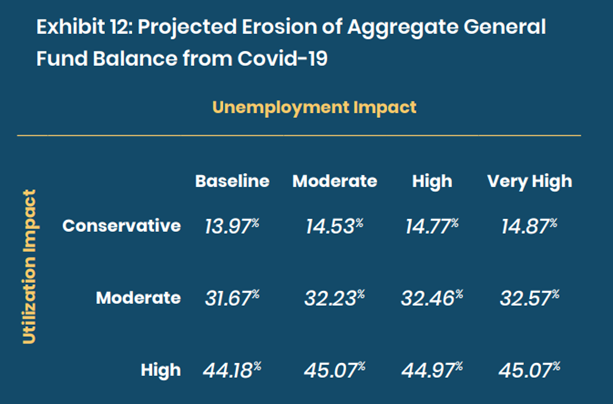

The hospitals included in our data set had a total 2018 general fund balance (the difference between assets and liabilities) of $891 billion, with $468 billion in current assets.

These numbers represent the solvency and liquidity anchors that we use to gauge overall “stress[23]” on the country’s hospitals.

Based on our four unemployment and three Covid-19 impact scenarios, there were 12 different combinations of outcomes.

Exhibit 11 illustrates that the projected dollar loss for each scenario ranges from $124.44 to $401.42 billion.

Applying these projected losses against the total aggregate dollars for the general funds shows a net impact ranging from 13.97 percent to 45.07 percent, as shown in Exhibit 12.

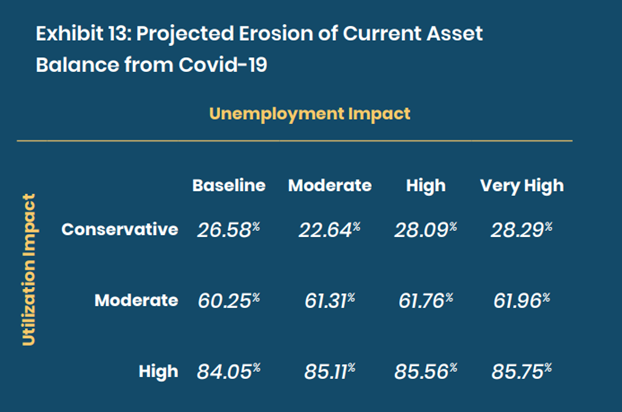

Examining liquidity, the erosion range when total loss numbers are applied against the current assets is 26.58 percent to 85.75 percent (Exhibit 13).

This analysis shows how perilously disastrous the Covid-19 pandemic could have been for the nation’s critical health resources.

Federal funding, the speed of vaccine development and approval, and a faster economic recovery combined to preserve the health system’s financial integrity.

This analysis shows how perilously disastrous the Covid-19 pandemic could have been for the nation’s critical health resources.

Federal funding, the speed of vaccine development and approval, and a faster economic recovery combined to preserve the health system’s financial integrity.

However, given the current state of political dysfunction, replete misinformation, and geopolitical uncertainty, the United States cannot afford to roll the dice on the same fortuitous circumstances emerging during a future crisis.

… given the current state of political dysfunction, replete misinformation, and geopolitical uncertainty, the United States cannot afford to roll the dice on the same fortuitous circumstances emerging during a future crisis.

Where Do We Go from Here?

Significant work is required to make necessary structural changes to the nation’s health system.

While we could add pages to this analysis with such recommended reforms, we believe a stress test of the nation’s delivery capacity during Covid-19 points to three critical priorities if we are to endure future pandemics or endemics:

1.Focus on institutional resilience, investing more deeply in — workforce attachment and well-being.

2.Accelerate the pace at which we pay providers for the value — of their services instead of keeping them attached to financial rewards linked to volume.

3.Embed digital health solutions — so deeply within employer and provider institutions that they are indistinguishable from in-person care.

… we believe a stress test of the nation’s delivery capacity during Covid-19 points to three critical priorities if we are to endure future pandemics or endemics: (1) Focus on institutional resilience, investing more deeply in workforce attachment and well-being.

(2) Accelerate the pace at which we pay providers for the value of their services instead of keeping them attached to financial rewards linked to volume;

(3) Embed digital health solutions so deeply within employer and provider institutions that they are indistinguishable from in-person care.

Accomplishing these priorities will not be easy.

Our system is stubborn and rigid, rewarding the status quo.

However, the toll borne by our colleagues, neighbors, and fellow citizens provides ample reason to be better prepared for unexpected events in an uncertain future.

References

See the original publication.

Originally published at https://www.leadersedge.com

Note from the editor of this site:

The authors of the report did not highlight all the topics, such as “Supply Shortage”, for example, among others.

TAGS

- STRESS TEST ELEMENT #1 — NATIONAL HEALTH CARE WORKFORCE

- STRESS TEST ELEMENT #2 — HOSPITAL FINANCIAL PRESSURE

- STRESS TEST ELEMENT #3 — HEALTH INSURANCE

- STRESS TEST ELEMENT #4 — PUBLIC HEALTH

Telehealth