transform

institute for continuous health transformation

Joaquim Cardoso MSc

Chief Researcher, Editor and

Senior Advisor

January 12, 2023

EXECUTIVE SUMMARY

This executive summary highlights the impact of Moore’s Law on the healthcare industry and how companies are leveraging technology to establish a lead in digital healthcare.

- The industry is estimated to be worth $12 trillion in 2022, and investments in digital health start-ups have risen dramatically in recent years, putting pressure on traditional healthcare providers.

- The shift towards digital healthcare is taking various forms, including specialist solutions and miniaturization of medical devices.

- The impact of this shift can be seen in three main areas:

(1) telemedicine,

(2) mobile apps/therapeutics, and

(3) the rise of patient engagement and hybrid health providers, all of which have been accelerated by the Covid-19 pandemic.

INFOGRAPHIC

DEEP DIVE

Three global trends are shaping digital healthcare

Huawey Media Center

Klaus Boehncke, Arnaud Bauer

Access on January 12, 2023

Everyone knows what Moore Law has done for information technology. In 1985, a Cray-2 supercomputer weighed 2,500 kilograms, consumed 195 kilowatts of electricity, and cost $30 million in 2010 dollars.

Today, a Huawei smartwatch costs around $130, weighs 30 grams, and runs all day on battery power.

Its processor is faster than the Cray’s, while its Internet-connected sensors can run an electrocardiogram. Also, it makes phone calls.

Moore’s law is now transforming healthcare, an industry estimated at US$12 trillion in 2022.

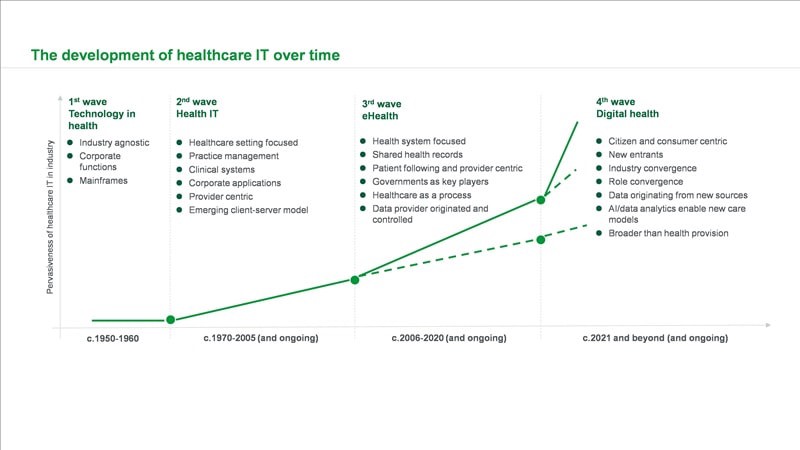

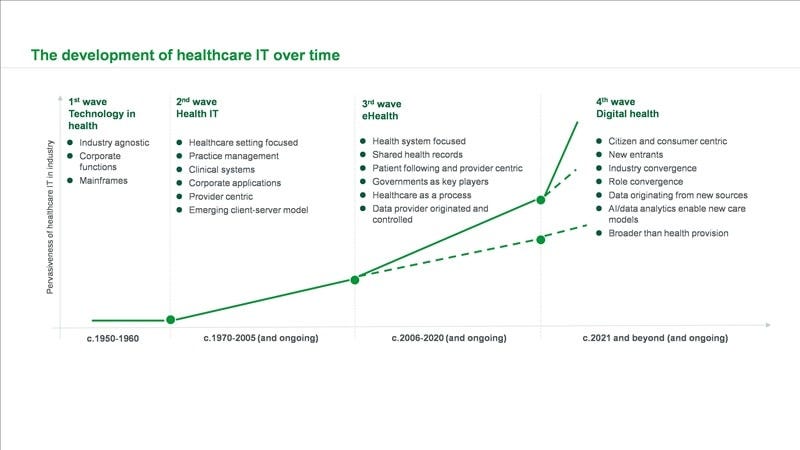

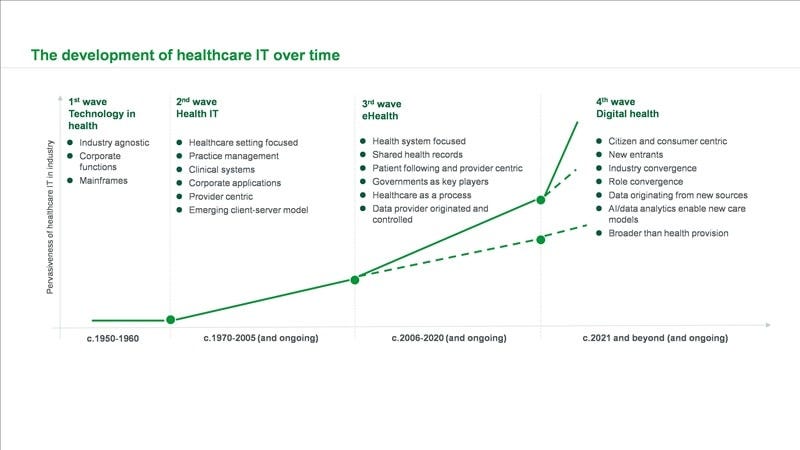

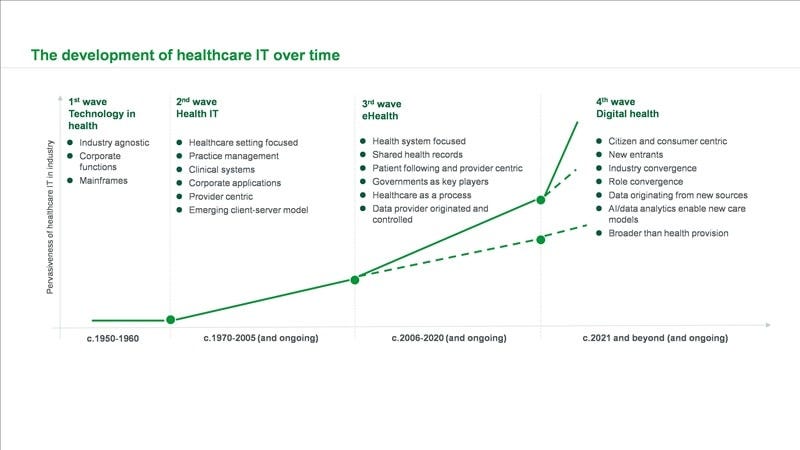

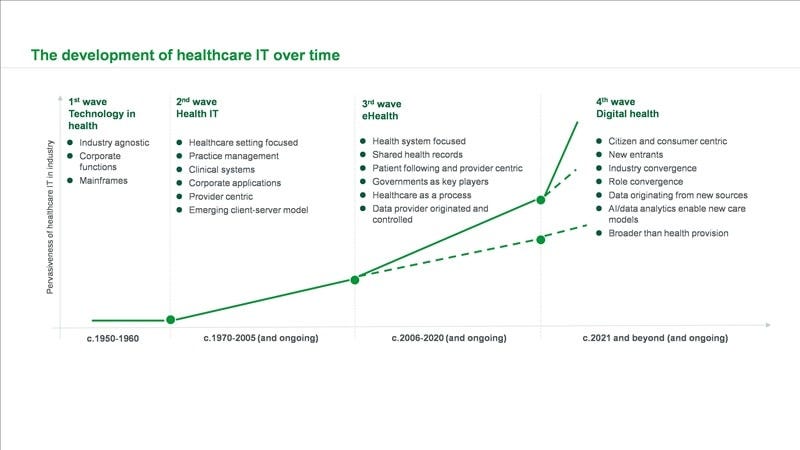

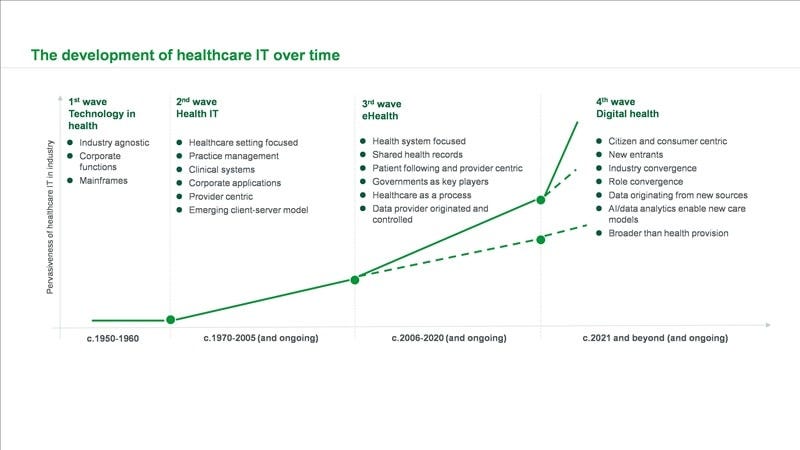

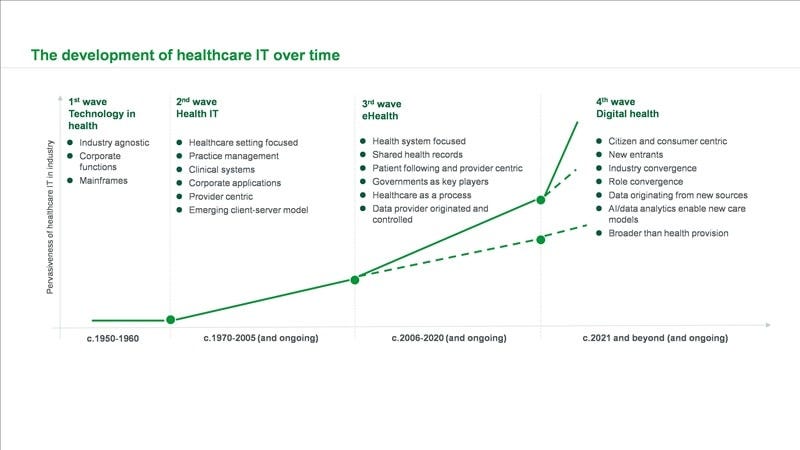

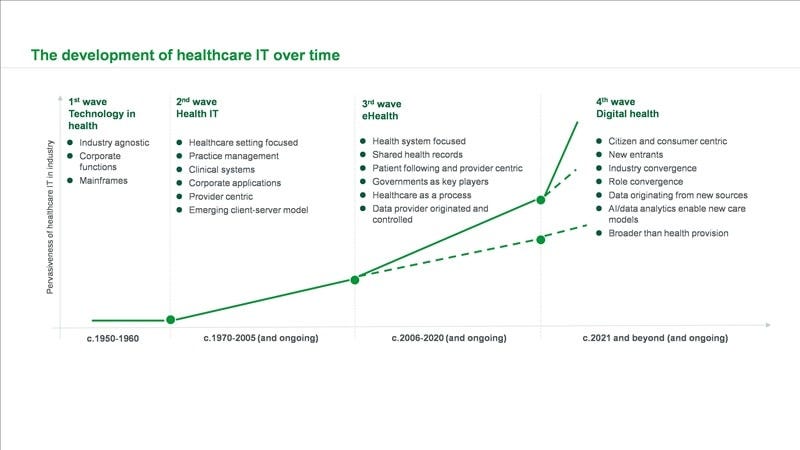

Private companies and the public sector are investing heavily in digital health, a fourth wave” of the technology revolution (see Figure 1) driven by consumer devices such as smartphones and wearables.

Companies are vying to leverage apps, cloud computing, blockchain, quantum computing and artificial intelligence (AI) to establish a lead.

Figure 1: Four waves of IT evolution in the healthcare sector

Source: L.E.K. research and analysis, David Rowlands

In nearly all industries, increasingly sophisticated technology gradually starts to push products and services into lower-cost settings.

In healthcare, that means “shifting care downstream” — from hospitals to clinics and primary care physicians, and, ultimately, into patients’ homes and pockets.

In nearly all industries, increasingly sophisticated technology gradually starts to push products and services into lower-cost settings.

In healthcare, that means “shifting care downstream” — from hospitals to clinics and primary care physicians, and, ultimately, into patients’ homes and pockets.

This shift is taking various forms.

- Specialist solutions, such as RapidAI for stroke care, enable doctors at less-specialized hospitals to benefit from AI-powered decision support.

- Technologies like Ada, a symptom checker using a powerful AI, move care very close to the patient by allowing consumers to download and use the app free of charge, enabling accurate health assessments anyplace, anytime for almost 13m users globally.

- In Asia, start-ups like FinlTop are miniaturizing large medical devices that were once available only in hospitals and clinics, including echocardiography machines, urine analyzers, and glucose meters. Shrinking these devices makes them more affordable and lets patients use them at home.

- China’s Lanchuang Technology provides a set-top box paired with a webcam and “Xiaoyi,” a Siri-like voice assistant, allowing customers to access telemedicine and an SOS system that can ring up a medical center for help.

Over the past decade, investments in digital health start-ups have risen dramatically.

Between 2018 and 2021, global venture funding more than doubled from $19.5 billion in 2018 to $52.8 billion in 2021.

Mounting competition from start-ups is putting pressure on traditional healthcare specialists, including pharmaceutical and medtech companies, insurers, and healthcare service providers.

One of the bigger mergers in recent years, an $18 billion deal, took place between two relative newcomers, Teladoc (founded 2002) and Livongo (founded 2008).

Doctolib, a booking service and telemedicine platform, was founded in 2013 and had a roughly US$1 billion unicorn valuation six years later.

Meanwhile, tech giants including Amazon, Google and Apple see healthcare as an attractive opportunity for expansion.

“If you zoom out into the future, and you look back, and you ask the question, ‘What was Apple’s greatest contribution to mankind?’ it will be about health,” said Apple CEO Tim Cook.

“If you zoom out into the future, and you look back, and you ask the question, ‘What was Apple’s greatest contribution to mankind?’ it will be about health,” said Apple CEO Tim Cook.

The impact of this downstream shift can be seen in three main areas, all of them accelerated by the Covid-19 pandemic:

1.telemedicine,

2.mobile apps/therapeutics, and

3.the rise of patient engagement and hybrid health providers.

Trend #1: Telemedicine

With some exceptions, the use of telemedicine before Covid was limited to very light-touch cases such as triage, usually staffed with nurses, or to very complex settings such as hospital telemedicine Intensive Care Units, which are command centers staffed with intensive care clinicians who remotely support frontline clinicians in other hospital settings.

Covid-19 significantly advanced the use of telemedicine globally, with lockdowns and fear of infection causing patients to avoid hospitals and doctors’ offices. Many countries changed regulations — first by allowing teleconsultations, and then sometimes as a second step offering reimbursement under a national insurance scheme.

These regulatory changes have led to rapid adoption of new digital technologies in medicine. In Australia, for example, within a few months of the start of the pandemic, more than 10 million teleconsultations were delivered by roughly 60,000 providers. Globally, the pandemic saw an estimated 80% of patients, and more than 50% of providers, use telemedicine for the very first time.

But the adoption of telemedicine varies by region and culture. For example, during the peak of the pandemic, remote primary care consultations reached close to 50% in the UK, compared with between 7% and 10% in Germany, and percentages in the low single digits in Japan. These numbers have fallen significantly since lockdowns were lifted in most parts of the world.

Overall, L.E.K. Consulting estimates that the global telehealth market will continue to expand to about US$165 billion over the next five-plus years.

New kids on the block

Many new companies used Covid to expand their consumer brands in Europe and Asia.

- HealthHero in the UK and Sweden’s Kry, for example, have established themselves in several European countries (often via acquisitions), together covering more than 100 million patient visits.

- In France, Doctolib has focused on bookings and expanded to video consultations during the pandemic, with about 40 million monthly visits to its site.

- In China, Ping An Good Doctor, a software company, has benefited from growing trust in Internet healthcare services. In 2021, its overall customer base grew by roughly 70%, while in Southeast Asia the company saw its video consultations quadruple. It has now expanded to six markets in Southeast Asia, growing to more than 1.5 million users and about 2,500 physicians.

Trend #2: Mobile apps and digital therapeutics

The second phenomenon accelerating through the pandemic was the rise of mobile health applications and digital therapeutics, the latter being defined as “evidence-based treatments delivered online.”

Leading mobile health aps include Ada, an AI-powered symptom checker used by more than 12 million patients globally for over 20 million sessions; and Happify, a mental health application that has been used by more than 5 million individuals.

Globally, there are at least 350,000 mobile health applications that support health and well-being by tracking exercise and diet.

The market for true digital therapeutics is much smaller because they are often more tightly regulated as “software as a medical device” (SaMD).

Globally, there are at least 350,000 mobile health applications that support health and well-being by tracking exercise and diet.

The market for true digital therapeutics is much smaller because they are often more tightly regulated as “software as a medical device” (SaMD).

Regulatory reforms have driven adoption of digital technologies in China. SaMDs are regulated under the medical device regime and enjoy strong copyright and patent protection.

Additionally, provisions exist for exempting certain classes of SaMDs from clinical trials. That has helped foster innovation in SaMDs and mobile health in China.

A key element widening the adoption of digital health solutions is public and private health insurance funding, which reduces patients’ out-of-pocket costs.

Germany, a pioneer in this regard, introduced legislation in 2020 allowing official review and approval of digital health apps, enabling approved apps to be covered by insurance.

Following its launch in 2020, Germany’s catalogue of approved applications more than tripled, from 10 to 32. But several apps were also de-listed after being judged not clinically impactful enough during their one-year preliminary listing period.

Widespread adoption of medical apps also requires that they be prescribed by physicians.

This is generally not a problem for big pharma companies with large sales forces, but it is a major issue for start-up app developers.

To address that challenge, several developers in Germany rethought their go-to-market approach and began either partnering with pharma companies or banding together and creating their own joint marketing and education companies.

Hello Better and Teva Pharmaceuticals joined forces to market their app for chronic pain management. Other partnerships included Deprexis and Servier for depression, and Kalmeda and Pohl-Boskamp for tinnitus.

In the future, L.E.K. expects to see more partnerships between app developers and established pharma and medtech providers, as well as other innovative approaches designed to engage healthcare professionals.

Trend #3: The rise of patient engagement and the hybrid health provider

Many digital health companies used the pandemic as a chance to establish themselves or significantly expand their brand value.

This has not gone unnoticed by brick-and-mortar healthcare providers, who have seen patients switch over to these new digital service companies in significant numbers.

Patient switching rates vary by country, region, health system, and provider but are often in excess of 15% per year.

Digital companies know they cannot meet the full range of patient needs, especially for different types of testing.

Hence, we are witnessing the rise of hybrid health providers that combine physical facilities with strong digital and telemedicine offerings.

In Europe, this trend is being spearheaded in the Nordic countries, with companies that include Mehiläinen, Kry and Doktor.se. Mehiläinen, based in Finland, owns about 700 clinics and has more than 1.5 million registered users on its digital platform.

In Europe, this trend is being spearheaded in the Nordic countries, with companies that include Mehiläinen, Kry and Doktor.se. Mehiläinen, based in Finland, owns about 700 clinics and has more than 1.5 million registered users on its digital platform.

In Asia, China’s Ping An Good Doctor has long integrated partner hospitals and clinics into its offering and has launched a “One-Minute Clinic” kiosk with access to AI and/or telemedicine physicians who can prescribe medication.

In Asia, China’s Ping An Good Doctor has long integrated partner hospitals and clinics into its offering and has launched a “One-Minute Clinic” kiosk with access to AI and/or telemedicine physicians who can prescribe medication.

In October 2022, Singapore’s Doctor Anywhere offered to acquire Asian Healthcare Specialists, a multidisciplinary medical services group with 12 clinics across Singapore.

The acquisition was aimed at enhancing Doctor Anywhere’s offline specialist offering and aligning with its goal to become a regional omni-channel healthcare provider.

In October 2022, Singapore’s Doctor Anywhere offered to acquire Asian Healthcare Specialists, a multidisciplinary medical services group with 12 clinics across Singapore.

The acquisition was aimed at enhancing Doctor Anywhere’s offline specialist offering and aligning with its goal to become a regional omni-channel healthcare provider.

Kry healthcare centre (top), Ping An Good Doctor’s “1-Minute Clinic” (bottom)

Source: Company websites

The success of these hybrid offerings has spurred many software developers to jump on the bandwagon, enabling brick-and-mortar providers with full digital patient engagement capabilities.

Mehiläinen has successfully marketed and sold its patient platform BeeHealthy into Europe, the Middle East and Africa.

Such platforms typically feature population health management; appointment booking and multi-channel communications; telemedicine and virtual care; and patient pathway management. The company supports healthcare providers in delivering an integrated patient experience 24/7, even when physical facilities are closed.

Such platforms typically feature population health management; appointment booking and multi-channel communications; telemedicine and virtual care; and patient pathway management.

The company supports healthcare providers in delivering an integrated patient experience 24/7, even when physical facilities are closed.

Digital health is here to stay

Patients have gotten used to digital engagement in all areas of life, including retail, banking and travel. Now, they are demanding the same of their healthcare systems.

Having tested these services during the pandemic, they know that most services can be delivered safely and conveniently online.

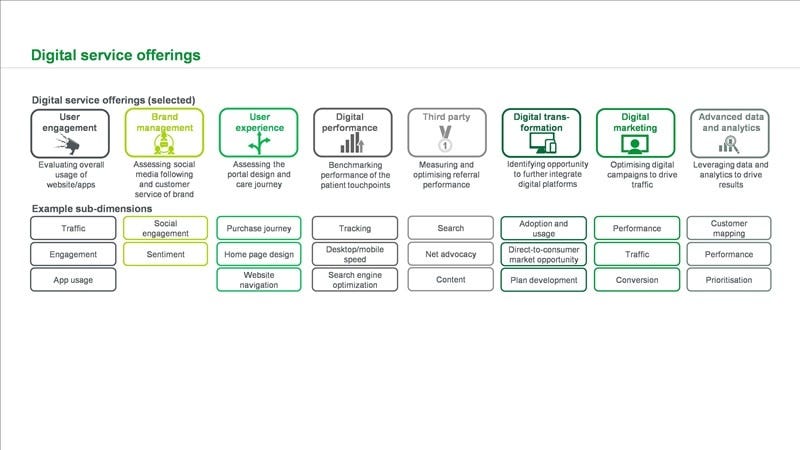

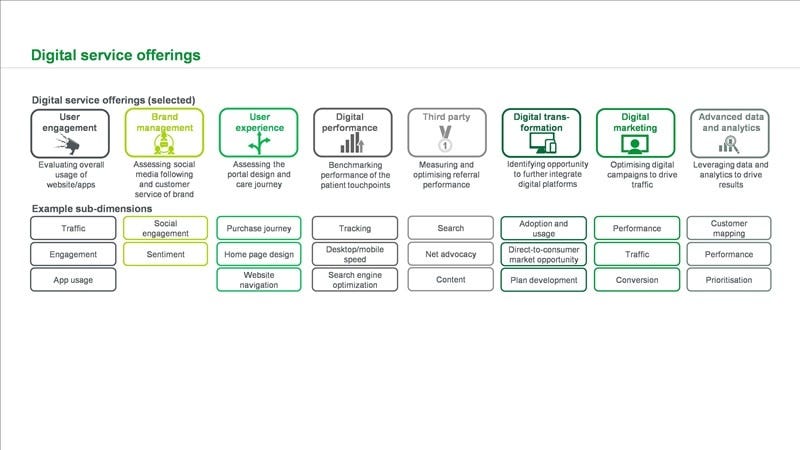

This shift will require traditional healthcare services companies to transform and meet the requirements of their digital native patients in many different areas (Figure 2).

There is no time to waste, as competing brands, bolstered by the pandemic, have already established themselves. The time for incumbents to fully embrace digital is now.

Figure 2: Digital service offerings

Originally published at https://www.huawei.com.