The rapid expansion of telemedicine presents opportunities for dramatic improvement in high-value virtual care delivery beyond the Covid-19 pandemic.

NEJM Catalyst

Simin Gharib Lee, MD, MBA, Alexander Blood, MD, William Gordon, MD & Benjamin Scirica, MD, MPH

December 28, 2021

uarizona

Summary

The Covid-19 pandemic catalyzed a telemedicine revolution. Both providers and patients understand that telemedicine has become a fixture in the health care delivery landscape.

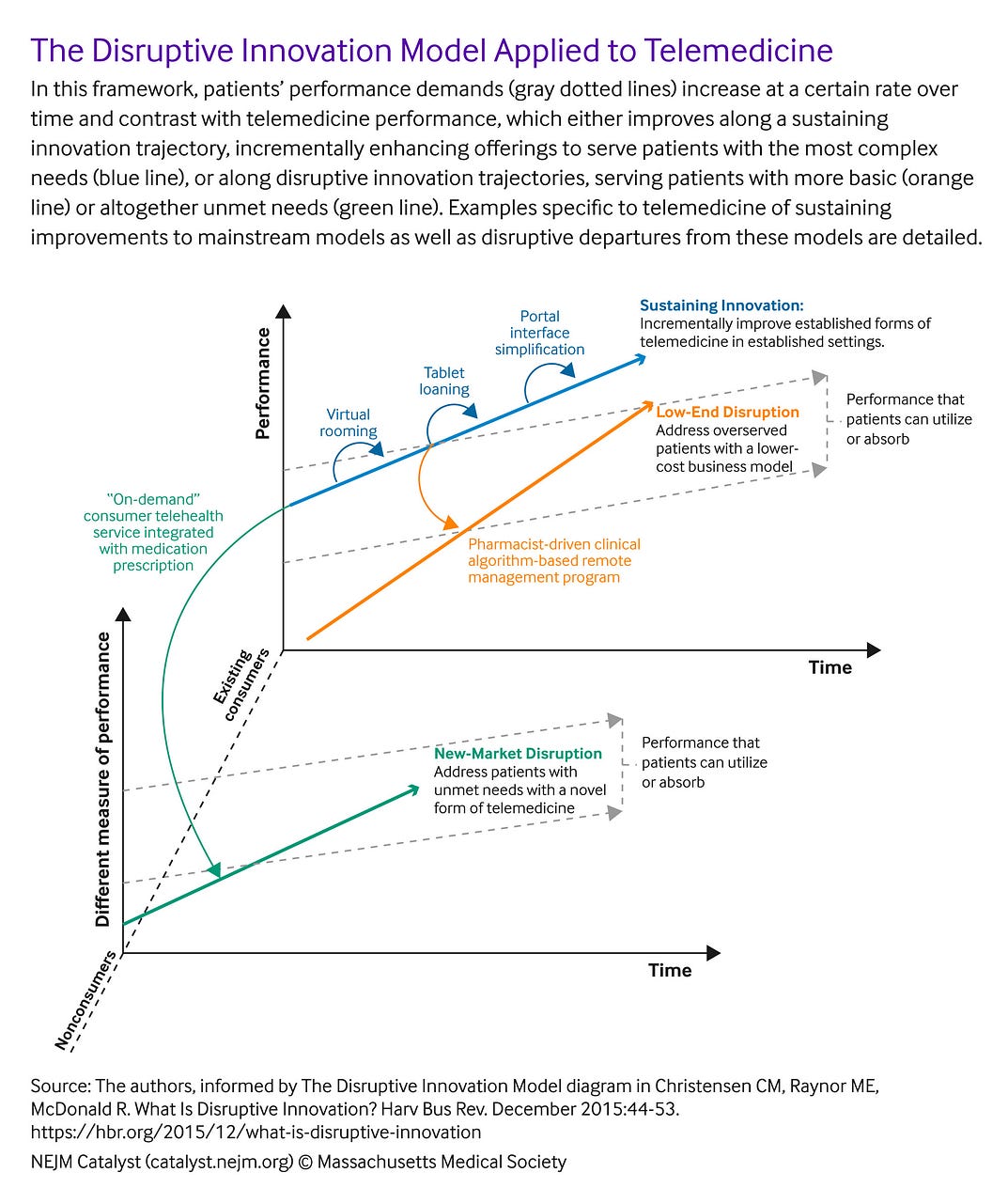

Here, the authors draw on principles of the theory of disruptive innovation to outline a strategic roadmap for maximizing telemedicine’s value to patients.

They argue that telemedicine can improve through both sustaining innovation (incremental improvement upon what we are already doing for patients) and through disruptive innovation (simpler solutions for patients with simpler needs and/or patients we are not currently serving).

Health care leaders can achieve organizational growth and deliver better care to patients during and beyond the pandemic by understanding disruption theory, building a culture of effective leadership and teamwork, embracing novel approaches to customer segmentation, and supporting evolving payment models.

Although the concept of care from a distance dates to at least 1906 — when Wilhelm Einthoven, who developed what is considered the modern electrocardiograph (ECG), conducted a 1-mile telephonic transmission of the ECG from a physiology laboratory to a clinic,- it was not until the Covid-19 pandemic that telemedicine adoption exploded. Reported telemedicine utilization rates were as high as 65% in some health systems, despite only 8% of patients in the United States reporting having ever utilized video-based telehealth prior to the pandemic. Although most clinics are now well into reinstituting in-person visits after the initial surges of cases,-many health care leaders acknowledge that, for a variety of reasons — convenience to patients, improved technology, newfound patient acceptance, and persistent concerns about new virus variants and transmission — broad utilization of telemedicine is here to stay. Disruption theory, which distinguishes between disruptive innovation and sustaining innovation, offers an important perspective on the role of telemedicine and a strategic roadmap for how it can be leveraged to deliver greater value to patients in the post-pandemic future.

The Theory of Disruptive Innovation

Disruption theory was developed in the early 1990s by the late Harvard Business School professor Clayton Christensen and describes a process of innovation-driven growth. According to Christensen’s framework, companies achieve growth by meeting customers’ evolving capacity for product performance through sustaining or disruptive innovation. In sustaining innovation, established incumbents pursue the highest profits by targeting higher-end customers with the introduction of progressively higher-quality products. This strategy inherently overserves low-end and many mainstream customers, creating an opportunity for new entrants to establish a foothold in the market by satisfying customers who require more basic or affordable products ( low-end disruption) or products that satisfy different performance needs ( new-market disruption). As companies on this disruptive innovation trajectory move through the improvement cycle and pursue higher profits from higher-end customers, they eventually overtake incumbents.

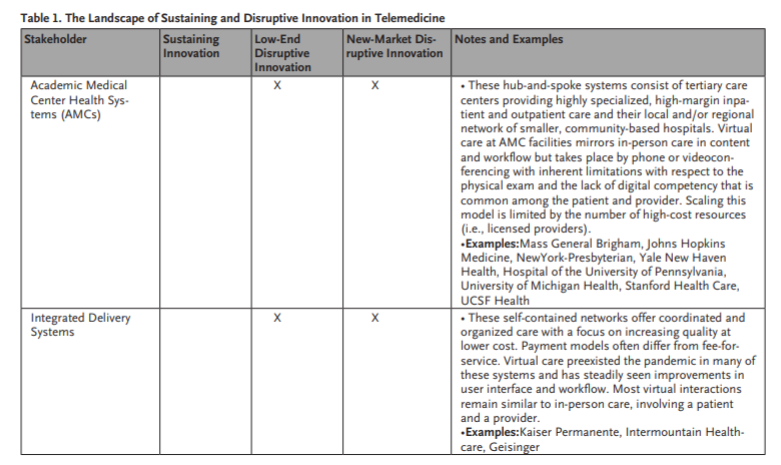

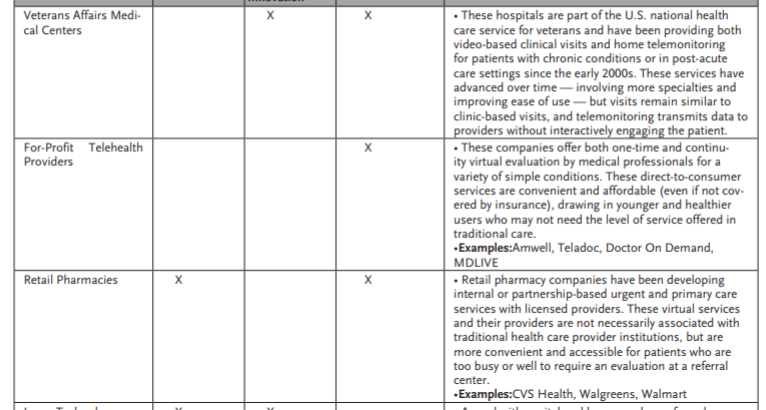

Table 1 illustrates examples of both sustaining and disruptive innovators in the current health care landscape. illustrates some of these examples within this disruption theory framework.

Stakeholder Sustaining Innovation Low-End Disruptive Innovation New-Market Disruptive Innovation Notes and Examples

Telemedicine as a Sustaining Innovation

Most telemedicine in its current form is a sustaining innovation. There has been incremental improvement in telecommunication technologies from the traditional phone to current videoconferencing software integrated with electronic medical records, development of secure platforms for short messaging service (SMS) between patients and providers, and introduction of connected devices that can monitor and transmit patients’ health data to their providers.

Despite this technological progress, most virtual visits today involve the same content and workflow as a traditional in-person visit but are simply conducted through a different medium, such as the telephone or platforms such as Zoom.

Such visits satisfy most patients; in a 2020 national survey of more than 1 million patients conducted by health care consulting firm Press Ganey, 76% of patients would recommend a video visit and 89% would recommend their physician following a telemedicine visit. However, many other customers — often medically complex patients with multidimensional needs from their care teams — are underserved and could absorb more performance than what telemedicine in its current state provides.

Many customers are currently overserved by traditional care delivery in the form of regular visits (in-person or virtual) with a physician, which are structured to provide more than what they need and less of what they want.

Current players sense this gap between the technology’s performance and its customers’ needs, and they are competing to close the gap, especially in the current environment of payer relaxation of coverage and reimbursement restrictions for telemedicine services.

Many organizations (summarized in Table 1) are focusing on accessibility of virtual care, investing in tablet loaning programs, interface improvements to minimize the number of clicks required to start a visit for both patients and providers, synchronous language interpretation capabilities for video visits, and health care ambassador programs to assist patients with low digital literacy in setting up and engaging in virtual visits.

Other sustaining innovation efforts to improve current telemedicine offerings include improvements in patient triage and scheduling, the virtual rooming process with the addition of virtual medical assistants, and designation of virtual days to avoid a complex mix of in-person and virtual visits in a given clinic session.,

As health policy experts increasingly advise against payment parity (equal reimbursement for telemedicine and traditional services) in favor of alternate payment models to encourage higher value use of telemedicine, efforts to improve telemedicine performance will inevitably march on.

This sustaining innovation will push telemedicine providers toward increasingly high-margin business, leaving low-end and mainstream customers searching for a type of health care that is more accessible, convenient, and affordable.

Disruptive Telemedicine

Beyond improving the way care is already delivered, telemedicine may also serve as a vehicle for disruption in overlooked health care markets, particularly low-end or new-market segments. Many customers are currently overserved by traditional care delivery in the form of regular visits (in-person or virtual) with a physician, which are structured to provide more than what they need and less of what they want.

Such patients have chronic conditions like hypertension, hyperlipidemia, depression, or anxiety that most primary care physicians know how to treat but all too often do not have the time to manage. Or these patients are looking for focused condition-specific health care solutions for problems such as contraception, hair-loss, obesity, erectile dysfunction, or isolated urgent care needs. Some of these patients may not even participate in the current market and have not seen a physician for years, if ever. As a result, despite the availability of established, generic, and cost-effective treatments, approximately 30%-50% of patients with hypertension and hyperlipidemia do not receive appropriate treatment and face avoidable risk of developing downstream adverse cardiovascular events such as heart attacks and/or strokes.,These patients do not demand longer or more frequent appointments in the office with doctors. They might be satisfied with something simpler or just different.

Low-End Disruption in Telemedicine

Low-end disruptions in telemedicine refer to solutions that are less complex, more accessible, and more convenient than the traditional office visit forced into a videoconference. In the world of chronic disease, patients often seek convenient care provided over the phone or by text messages and electronic messaging by teams of trained nonphysician professionals, such as pharmacists, navigators, or coaches — rather than waiting for months for a compressed follow-up appointment with a physician. Such low-end disruptions already exist. For example, the Mass General Brigham (MGB) Remote Health/Digital Care Transformation (DCT) is a remote, algorithmically driven, disease management system using navigators and pharmacists; under this model, mean systolic blood pressure (SBP) and diastolic blood pressure (DPB) were reduced by 14 and 6 mm Hg, respectively, for 1,437 patients with hypertension, and low-density lipoprotein cholesterol (LDL-C) was reduced by 18% for 3,939 patients with hyperlipidemia. Other examples of low-end disruption for hypertension have demonstrated similar success.-

Remote patient monitoring has emerged as a powerful example of low-end disruption. Companies in this space frequently offer connected health monitoring devices as well as tech platforms that analyze patient-collected data and provide personalized coaching (without medication titration) for chronic disease management.

There are many other important examples of low-end disruption outside of academic medical settings. Cadence Care is a remote care and health technology start-up founded earlier in 2021 with $41 million in initial venture capital funding. Cadence offers its users a suite of connected health devices (e.g., blood pressure cuffs and scales), a remote care management platform that collects and analyzes data from these devices, and ultimately titration of medications by clinicians to help advance the care of patients with chronic conditions. The company has partnered with LifePoint Health, a network of rural hospitals, to serve more than 100,000 patients and has established heart failure (HF) — one of the most prevalent chronic diseases associated with high rates of morbidity and mortality — as its initial focus. Although Cadence Care does not offer the extremely specialized services available in advanced heart failure and heart transplant centers at many academic medical centers across the United States (such as left ventricular assist device implantation or heart transplantation evaluation), their service of implementing guideline-directed medical therapy meets the less complex needs of their patients who otherwise do not have easy access to care for heart failure.

Remote patient monitoring has emerged as a powerful example of low-end disruption. Companies in this space frequently offer connected health monitoring devices as well as tech platforms that analyze patient-collected data and provide personalized coaching (without medication titration) for chronic disease management. One of the most notable names in this growing field is Omada. Founded in 2011 with an initial focus on type 2 diabetes prevention, Omada offered health coaching paired with wireless scales and hemoglobin A1c (HbA1c) test kits to help patients improve their glycemic control and other risk factors. Its clinical results of sustained weight loss (at least 4% of baseline body weight) and HbA1c reduction (at least 0.4% of baseline HbA1c) at 2 years have given way to impressive growth, with recent valuation estimates approximately $600 million, and expansion to other chronic conditions, such as hypertension, obesity, and behavioral health.

Livongo, another successful remote patient monitoring company, similarly offered chronic disease assistance through data analytics, connected devices, and health coaching for a similar spectrum of conditions. In August 2020, Teladoc, a global telehealth company, announced a merger with Livongo in a deal valuing Livongo at $18.5 billion. Although Livongo and Omada’s offerings are many steps away from traditional clinical care, this transaction — the largest ever in digital health at that time — demonstrates how valuable even low-end disruption solutions can be in a shifting health care landscape. Other examples of low-end disruption in telemedicine are detailed in Table 1.

New-Market Disruption

There are other consumers who are simply not participating in the current health care landscape but who would engage with a different type of virtual care. They may have winter cold symptoms, conjunctivitis, or urinary tract infections, among other common, discrete medical problems, and may not have primary care physicians but simply want a brief evaluation and direct access to a straightforward remedy. New-market disruption addresses the unmet needs of these consumers.

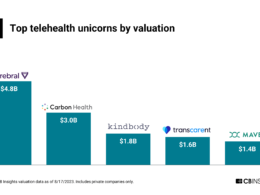

The emerging segment of consumer telehealth companies typifies new-market disruption. One prominent example is Hims & Hers, a digital health start-up founded in 2017. Hims initially offered convenient access to prescription medications for sensitive men’s health conditions, such as erectile dysfunction and male-pattern hair loss. Users would fill out personal and health information on the website, select a medication, and receive the medication in the mail after review and approval by a staff medical provider. Less than 5 years after its founding, Hims & Hers became a publicly traded company at a valuation of $1.6 billion, and with expansion into women’s health, dermatology, and basic primary care. Ro is another such consumer telehealth company, also founded in 2017 with men’s health offerings, that has grown to a valuation of approximately $5 billion and has expanded in similar directions as Hims. The young professional consumers these companies specifically target have already been shown to be withdrawing from traditional primary care (the proportion of Americans in their 30s with a primary care physician decreased from 71% in 2002 to 64% in 2015). These patients are more interested in — and willing to pay out-of-pocket for — the convenience and accessibility of these new-market, on-demand consumer telehealth products.

There are other consumers who are simply not participating in the current health care landscape but who would engage with a different type of virtual care. They may have winter cold symptoms, conjunctivitis, or urinary tract infections, among other common, discrete medical problems, and may not have primary care physicians but simply want a brief evaluation and direct access to a straightforward remedy.

Virtual clinic platforms are another popular form of new-market disruption born from the insight that millions of people who never see a doctor in the doctor’s office might be willing to see a health care provider from the comfort of their own homes. These companies strategically differentiate themselves from the à la carte consumer telemedicine models described above by providing continuity of care. One example is Firefly Health, a primary care start-up founded in 2017 that offers personalized, team-based virtual first primary care. The concierge-style model assigns patients to teams comprising a physician, nurse practitioner, health guide/coach, and behavioral health specialist for continuous virtual primary care, but also provides an in-person visit option for select cases and virtual specialty care (for problems such as cancer and diabetes) through unique partnerships. The company claims initial results of a 52% reduction in emergency department visits and a 30% reduction in employee health care costs; in April 2021, it received a $40 million series B investment from venture capital firms including Andreessen Horowitz to launch a new health plan benefit for employers.

New-market telemedicine disruption has offered convenient care to patients not only in their homes, but also in neighborhood locations embedded into their routines, such as pharmacies. Long before the Covid-19 pandemic, CVS Health seized on this market trend and partnered with Teladoc to expand the scope of its MinuteClinic primary and urgent care services to include virtual visits. More recently, in August 2021 — fueled by vertical integration with Aetna, a large payer acquired in 2018 for $69 billion — CVS Health has reduced out-of-pocket costs from a $59 fee per visit to a $0 copay for virtual primary care visits and has added features such as virtual nurse care teams (which can text and call patients beyond individual virtual visits) for additional accessibility. Other retail pharmacies have acted competitively by leveraging their community-based locations to deliver virtual care. Rite Aid and Walgreens have both invested in telemedicine kiosks, where patients can obtain virtual health assessments, speak to affiliated clinicians through secure video conferencing, and obtain on-site point-of-care testing.

Outside of retail pharmacy, other large players are emerging as new-market disruptors in telemedicine. Although the virtual care products offered by these entities mirror those of virtual care platforms, they are business- rather than consumer-facing. For example, in September 2019, Amazon launched Amazon Care, an integrated virtual health service benefit for its employees that offers virtual visits, texting with clinicians, and home prescription delivery. After a brief pilot phase limited to Seattle, Amazon expanded the program to 21 more states.

Teladoc, initially focused on urgent care and focused virtual visits for common medical problems, has recently announced its Primary360 service, a virtual primary care program that will not only be offered through CVS Health, but also more broadly through commercial health plans and large employers. The impact of these disruptions extends beyond the patient experience: Humana, which partners with telehealth vendor Doctor On Demand to provide virtual primary care to its members, has reported a 35% reduction in the cost of care for members who had at least one visit with the virtual care team.

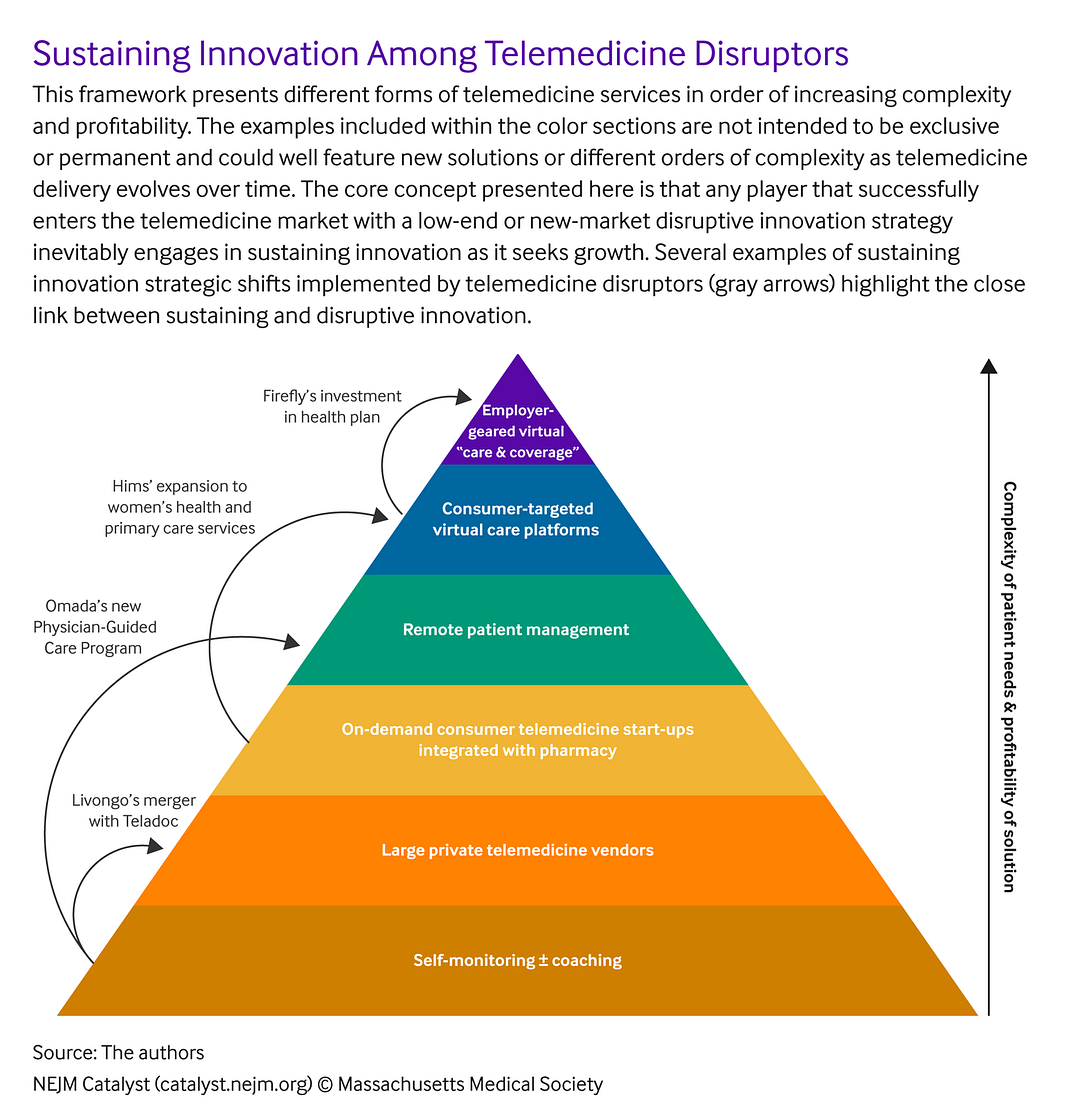

The Natural History of Disruption: The Improvement Cycle

Disruption in any form is exciting but short-lived. Before long, low-end and new-market disruptors inevitably enter the improvement cycle, investing in product enhancement as they seek growth and profitability. As they do so, they lure mainstream and higher-end customers who do not need the most high-end type of virtual care involving direct interaction with a physician at an academic medical institution.

To draw on examples already discussed above, Omada announced in 2021 that it would integrate its remote patient monitoring services with medication management in its new Physician-Guided Care program, a multidisciplinary virtual cardiometabolic clinic involving virtual visits with physicians for patients with diabetes, hypertension, and hyperlipidemia. Livongo’s merger with Teladoc similarly allowed the combined companies to marry remote patient monitoring and medication management. Consumer telehealth companies such as Hims and Ro have incrementally improved their offerings to include women’s health and primary care services. CVS Health has edged along the sustaining innovation pathway by adding comprehensive primary care services to its telemedicine portfolio at new brick-and-mortar Health HUBs. Firefly Health is incrementally improving its virtual primary care platform by using newly raised funds to start a health plan designed to better support its patients.

The core challenge facing any organization at any stage is answering the question of whether to invest in incremental growth by catering to customers’ current needs (sustaining innovation) or to invest in long-term future growth by turning to customers’ future needs or entirely new customers’ current needs (disruptive innovation).

Depending on market dynamics, some of these improvements will beget more financial success and lead to more improvements targeted at even more high-end customers, who can provide even greater margins and growth ().

Some improvements will be met with market silence and leave companies vulnerable to even fresher sources of disruption from the bottom of the market. Other examples of new-market disruption in telemedicine are detailed in Table 1.

Disrupt or Be Disrupted? Key Challenges and Solutions

The core challenge facing any organization at any stage is answering the question of whether to invest in incremental growth by catering to customers’ current needs (sustaining innovation) or to invest in long-term future growth by turning to customers’ future needs or entirely new customers’ current needs (disruptive innovation). Pursuing a sustaining innovation pathway offers the relative certainty of doing what is already working well, but a little bit better. It also avoids the risk of cannibalization of an organization’s core business through a disruptive innovation strategy — a key concern of any established business. But the failure to invest in new or lower-end products that offer broad growth prospects makes these organizations vulnerable to market takeover by disruptors. This central tension is what Christensen referred to as the innovator’s dilemma.

Many health care leaders prefer not to think of telemedicine as a Darwinian universe composed of incumbents facing inevitable demise and disruptors on a path toward certain victory. Indeed, Christensen and his colleagues frequently emphasized that one type of innovation is not inherently better than the other — that one does not have to disrupt or be disrupted. Some incumbents successfully pursue both sustaining and disruptive innovation-based growth by nurturing organizational units charged with exploring new market strategies or by creating strategic partnerships with new entrants. And, some would-be disruptors never seriously challenge, let alone successfully overtake, established competitors. The key to success along any pathway — especially in a space like health care, where current approaches underserve patients with the most complex needs, overserve patients with much simpler needs, and neglect patients with different needs altogether — is solving for the right workforce, patient need, and payment.

One of the most important challenges facing health care organizations aiming to grow and maximize value for patients is choosing the right people — leaders or team members — for the right kind of change. For larger provider organizations, individuals familiar with the core business should lead all sustaining innovation. For example, even before the pandemic, Yale’s telehealth team designated clinical champions to help lead telemedicine pilot programs. When the pandemic hit, these champions catalyzed rapid scaling of existing telehealth programs through their familiarity with the institution and the people in it.

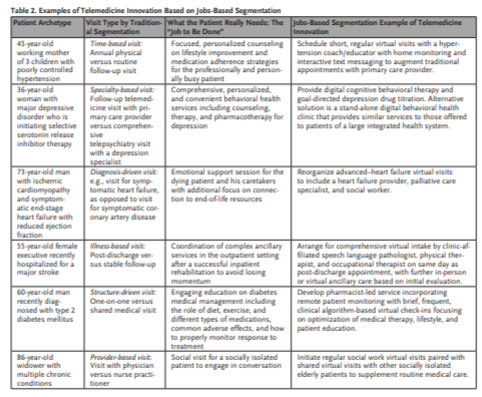

Although health care providers typically view patients’ interaction with the health care system as a function of their demographic and clinical characteristics, the jobs-based segmentation approach would instead examine how patients with specific needs in specific circumstances “hire” different models of health care delivery to do the job of fulfilling their needs.

In contrast, for disruptive change, the individuals best suited to lead the charge are those who have started and grown new programs before. Such leaders not only require experience with disruptive innovation, but also sufficient autonomy in their roles to help get an organization — whether a large, cumbersome corporation or a nimble, new start-up — on the path to growth. Teams are as crucial to innovative growth as their leaders. The more diverse these teams are in terms of experience and training, as in the case of MGB Remote Health/Digital Care Transformation and a similar pharmacist-led hypertension remote management program from Ochsner Health in New Orleans, the more likely it will be that they recognize opportunities for the right type of innovation at the right time for their organizations.

Understanding of an organization’s product and target customer (or, in health care, patient) is another critically important challenge in both sustaining disruption and identifying new targets of disruption. Most health care organizations segment visits by type (new patient versus follow-up), modality (phone or video versus in-person), frequency, and duration, and they segment patients by their demographic and clinical characteristics.

Patient Archetype Visit Type by Traditional Segmentation What the Patient Really Needs: The “Job to Be Done” Jobs-Based Segmentation Example of Telemedicine Innovation

Christensen’s disruption theory offers an alternative approach called jobs-based segmentation, in which products and services are reframed as performing certain jobs for customers. Although health care providers typically view patients’ interaction with the health care system as a function of their demographic and clinical characteristics, the jobs-based segmentation approach would instead examine how patients with specific needs in specific circumstances “hire” different models of health care delivery to do the job of fulfilling their needs. For innovation in telemedicine, visits could be reframed as checking a box off a list of annual to-dos for the busy young professional, providing reassurance for the worried parent, nurturing a relationship for the isolated senior, or creating space to process and learn information for the new diabetic ( Table 2). Innovators in health care will recognize these functions of visits and leverage telemedicine to create new types of visits and systems that get the right job done for the right patient.

Finally, payers often present challenges to growth and innovation in telemedicine. In the current environment of payment parity, virtual and traditional care are reimbursed at equal rates. Some health policy experts worry that such payment parity could hinder improvements in value-based delivery of virtual care. Furthermore, payment parity does not address the issue of a predominantly fee-for-service reimbursement structure, in which high-frequency, low-touch care and other low-end telemedicine delivery models fail to meet current standards for reimbursement. In fact, current telemedicine billing codes often incentivize against staff working at the top of their license. Collaborating effectively with payers to achieve growth synergies while nurturing innovation in telemedicine is a major challenge facing health care leaders in this moment of transition for the larger health care system.

Looking Ahead

Health care is a complex world, and the pandemic-era telemedicine revolution has introduced even more complexity.

But with that complexity comes the opportunity to do more for more patients.

Whether through sustaining innovation that improves what we are already doing for the patients we are already serving or whether through disruptive innovation that reaches different and simpler patients with different and simpler services, health care organizations must craft strategies for both types of growth if they want to lead — and not be left behind — in the health care of the future.

About the authors

Simin Gharib Lee, MD, MBA

- Clinical Fellow, Division of Cardiovascular Medicine, Brigham and Women’s Hospital, Boston, Massachusetts, USA

Alexander Blood, MD

- Fellow in Cardiovascular Medicine and Critical Care, Division of Cardiovascular Medicine, Brigham and Women’s Hospital, Boston, Massachusetts, USA

William Gordon, MD

- Director, Solution and Experience, Digital Care Transformation, Mass General Brigham, Boston, Massachusetts, USA; Assistant Professor of Medicine, Division of General Internal Medicine, Department of Medicine, Brigham and Women’s Hospital, Boston, Massachusetts, USA

Benjamin Scirica, MD, MPH

- Director of Quality Initiatives, Brigham and Women’s Hospital, Division of Cardiovascular Medicine, Boston, Massachusetts, USA; Associate Professor, Harvard Medical School, Boston, Massachusetts, USA

Disclosures

Simin Lee and Alexander Blood have nothing to disclose. William Gordon reports consulting income from the Office of the National Coordinator for Health IT and Novocardia, Inc., both outside the scope of this work. Benjamin Scirica reports institutional research grants to Brigham and Women’s Hospital from AstraZeneca, Eisai, Merck, Novartis, NovoNordisk, and Pfizer. Consulting fees from Allergan, Boehringer Ingelheim, Elsevier Practice Update Cardiology, Esperion, Hamni, Lexicon, Medtronic, NovoNordisk, and equity in Health [at] Scale and Doximity.

Originally published at https://catalyst.nejm.org on December 28, 2021.