Site Editor:

Joaquim Cardoso MSc.

Health Transformation Journal

Vision of the Future of Health Care Institute

September 6, 2022

Executive Summary

Almost every US and international healthcare system intends to be in some stage of digital transformation by 2026–2027.

Those that take too long to launch or advance, however, may find younger patients have moved on — to rivals and retailers already embracing more modern care models.

That was among the key findings from the 2022 Future of Healthcare study conducted by HIMSS and its Trust Partners — Accenture, The Chartis Group and ZS Associates.

Patients, providers, payers and health system leaders in five countries were asked about the shifts, advancements and priorities shaping care delivery.

Their responses make clear that a transition toward digitally enabled and personalized care is well underway, even as adoption rates vary.

Their responses make clear that a transition toward digitally enabled and personalized care is well underway, even as adoption rates vary.

The research was conducted in November and December of 2021, and included respondents in the United States, United Kingdom, Germany, Australia and New Zealand.

Among the participants were: 359 clinicians; 1,600 patients; 273 health system leaders and 145 representatives of payer organizations.

Each cohort outlined plans for digital transformations and levels of personalized care they expected to offer within the next five years.

Most providers, payers and clinicians understood that traditional healthcare will give way to a different patient experience …

… — one in which patients rely on digital health tools like fitness and sleep trackers, as well as telehealth and mental health apps to manage their own health from home.

When a doctor visit is warranted, they will more likely seek medical centers with digital front doors, retail-based urgent care and big tech companies moving into the healthcare arena.

“Health systems see new market entrants offering unprecedented access points and feel competitive pressures to meet consumer demands for where the bar has been effectively raised,” said The Chartis Group Chief Innovation Officer Tom Kiesau.

“Success is not merely measured by adoption of technologies, but rather the impact those technologies have on increasing access, outcomes and patient satisfaction with their experiences.”

Fewer than 15% of clinicians across different countries believed they would be working in a fully digital work environment five years from now.

This reflects growing understanding that digital transformation is ongoing, and that technology’s role is to augment and not fully replace human interaction, according to Kiesau and Darryl Gibbings-Isaac, MD, Senior Manager, Health Strategy Practice, at Accenture.

Clinicians globally are encouraged by potential workflow improvements that free up time to spend on complex cases.

Meantime, payers are excited by digital transformations’ potential cost savings …

… and intend to improve incentives to push both plan holders and healthcare partners toward adopting digital tools that keep patients healthy and out of hospitals.

“Improving healthcare affordability and driving personalized care are the top strategic objectives from a digital transformation perspective,” said Shreesh Tiwari, Principal and Data and Technology Leader with ZS Associates.

Healthcare providers will need to carefully introduce these technologies to patients dependent on traditional care models out of need or necessity.

“It’s up to us to solve those social inequities because ultimately every patient everywhere deserves the same level of care no matter the setting or demographic background,” noted Lauren Goodman, Senior Insight Director for HIMSS Market Insights.

Every group in the study was encouraged by the potential for digitally transforming health systems to greatly improve current health access disparities, rather than to further isolate patients located in digital deserts.

“The opportunities are immense to increase efficiency, improve healthcare experiences and deliver care more equitably,” said Gibbings-Isaac.

“Indeed, we are just getting started. The road ahead is very exciting and ripe with potential for both patients and providers.”

Other key takeaways [source: site]

- Almost every U.S. and international healthcare system intends to be in some stage of digital transformation by 2026–2027.

- Those that take too long to launch or advance, however, may find younger patients have moved on to rivals and retailers that embraced modern care models more quickly.

- Personalized care will continue to become increasingly important.

- Digital health app patient usage will grow by at least 33% in the next three to five years;

- data in the final report showcases a breakdown of trends across major product categories.

- Interestingly, 44% of providers expect to partner with competitors to deliver personalized care to keep up with the growth and demand.

- Every group in the study was encouraged by the possibility of reducing the further isolation of patients in digital deserts by digitally transforming health systems to greatly improve current health access disparities.

- Working together, the opportunities to increase efficiency, improve healthcare experiences and deliver care more equitably are immense.

Outline of the publication

- 1.Health Systems

- 2.Clinicians

- 3.Payers

- 4.Patients

ORIGINAL PUBLICATION (full report)

1.Health Systems

The survey shows that almost every healthcare organization within and outside of the United States expects to undergo some degree of digital transformation over the next five years.

“Health systems realize that digital transformation is a long-term, enterprisewide journey,” said Tom Kiesau, Chief Innovation Officer for The Chartis Group.

“They see that several years on the horizon, they’ll still be enveloped in their digital transformation initiatives, but hopefully in a much better relative position than most find themselves today.”

Roughly 9 out of 10 health systems overall are positioning themselves to offer digital-first primary care within the next five years, according to the Future of Healthcare study.

During that same span, a similar number intend to gear up for remote patient monitoring.

Roughly 9 out of 10 health systems overall are positioning themselves to offer digital-first primary care within the next five years, …

During that same span, a similar number intend to gear up for remote patient monitoring.

Digitally enabled service centers and digital front doors — which provide technology at every touchpoint during a patient visit — are among the top priorities for those trying to recapture demand in the wake of the pandemic.

Patients in search of new providers will establish relationships with those offering convenient, often mobile, care options.

As a result, almost half of US health systems in the study expect to offer digital specialty care, up from the nearly 20% recorded in the 2022 State of Healthcare study.

A similar number expect to be implementing digitally enabled contact/service centers in the same timeframe — a sharp increase from 25% in the prior study, 2022 State of Healthcare.

“It is no longer sufficient to just have digital access points,” explained Kiesau, who is also The Chartis Group’s Digital Leader. “They must serve as connected pathways for patients to easily receive care.”

“It is no longer sufficient to just have digital access points,” …“They must serve as connected pathways for patients to easily receive care.”

… almost half of US health systems in the study expect to offer digital specialty care, up from the nearly 20% recorded in the 2022 State of Healthcare study.

A similar number expect to be implementing digitally enabled contact/service centers in the same timeframe — a sharp increase from 25% in the prior study, 2022 State of Healthcare.

Similarly, healthcare leaders recognize the need to develop the infrastructure to create Hospitals at Home, which leverage digital health tools to provide acute-level care in the home to reduce hospitalizations.

This care delivery model is not new, but it gained momentum during the pandemic when patient bed demand outstripped supply during COVID surges.

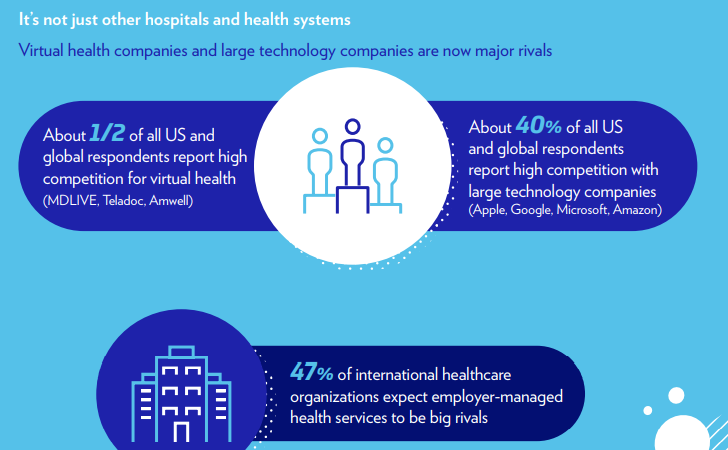

Given the increased reliance on technology companies, health systems should anticipate big tech companies becoming rivals for patients.

Kiesau noted that these enterprises have an advantage.

“These new market entrants are hyper-focused on meeting consumers’ needs, which has effectively raised the level of expectations for how easy and satisfying care should be to access and receive,” he said.

It’s that personalized care that US and international health systems should focus on going forward — and many are.

The study showed 44% of US providers anticipate partnering with tech firms to provide personalized care, while 45% of international health systems expect to compete with big tech.

“Now that digital channels like telehealth have become the norm, patients are starting to expect more from their digital encounters, and personalizing care is the next frontier of those expectations,” Kiesau concluded.

Roughly 9 out of 10 health systems overall are positioning themselves to offer digital-first primary care within the next five years

“Now that digital channels like telehealth have become the norm, patients are starting to expect more from their digital encounters, and personalizing care is the next frontier of those expectations,” …

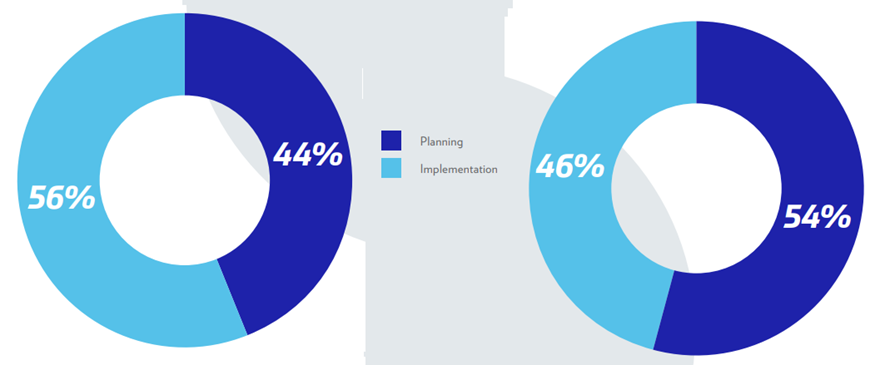

Many US organizations expect to be in implementation stages for digital transformation in 5 years.

As it relates to the digital transformation journey, which best describes where your organization will be 5 years from today?

*Numbers may not equal 100% due to rounding

2.Clinicians

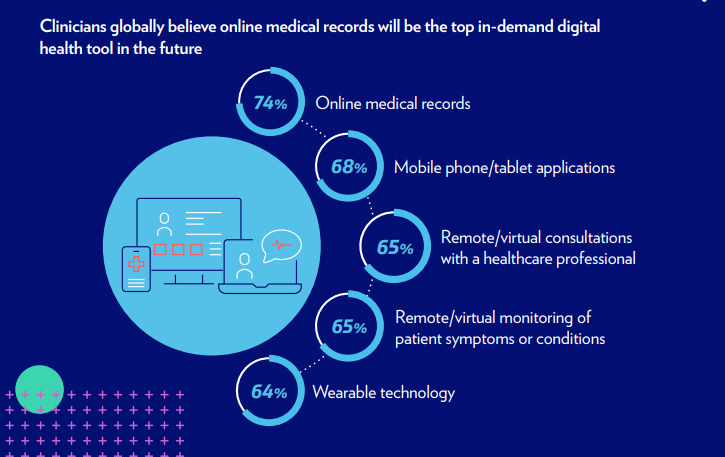

Clinicians appear to understand the role modern medical and IT devices will play in healthcare delivery.

In the Future of Healthcare survey, nearly nine out of 10 practitioners intend to use digital health tools to a greater extent within the next five years.

…nearly nine out of 10 practitioners intend to use digital health tools to a greater extent within the next five years.

These clinicians are motivated by technology’s ability to free up time and help with clinical decision support, as well as provide a new means to interact with patients.

“If technology is doing what we want it to do — reduce burden, minimize stress and increase efficiency — then clinicians would have more time to focus on patients and complex cases,” said Darryl Gibbings-Isaac, MD, Senior Manager, Health Strategy Practice, at Accenture.

The key, he added, is being intentional about design so tools fit within clinical workflows without creating more friction.

These clinicians are motivated by technology’s ability to free up time and help with clinical decision support, as well as provide a new means to interact with patients.

According to the study, 70% of clinicians surveyed believed digitally enabled, patient-centered tools would be valuable for ongoing disease management.

Sixty-four percent saw the benefit of better coordination of care, while 60% homed in on preventative care and screenings.

Globally, 79% of clinicians supported storing patient data in the cloud to some degree, but a minority expected to be less supportive in the future.

Gibbings-Isaac believes the data shows clinicians’ awareness of the transformative capabilities of moving protected data to the cloud, including better care delivery and operational efficiencies through data analytics.

It also provides business continuity and disaster recovery with almost no downtime.

The right data and technology can also allow clinicians to determine the best way to deliver care based on a person’s preferences or lifestyle choices.

“When more data is brought into decision-making, it can help make medicine more precise,” he noted.

The study also found that 72% of clinicians globally believed patients with cardiovascular diseases will benefit most from personalized models of care in 2026–2027.

That was followed by

- mental and behavioral health (63%) and

- respiratory (61%).

Gibbings-Isaac is especially encouraged by the second therapeutic area’s potential, given, he says, that one in five people currently suffer from mental health issues and may be reluctant to seek treatment.

Delivering basic therapies such as cognitive behavioral therapy virtually offers more opportunities for people to seek help, particularly given care is not location specific.

“Digitally delivered psychological interventions can dissolve some important barriers to care-seeking — such as stigma, cost, time and travel,” he said. “And in doing so, it can pave the way to greater health outcomes at scale.”

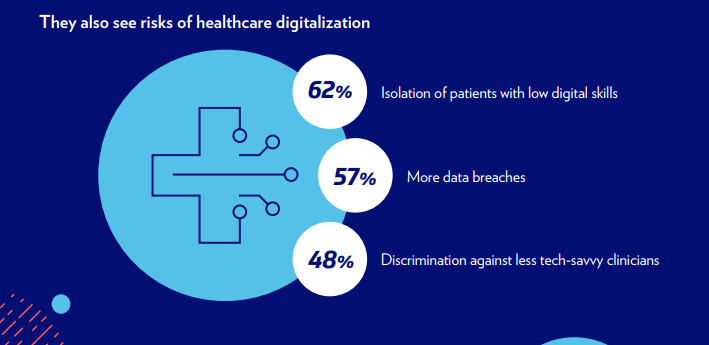

One risk that should concern clinicians is health equity.

“Technology can be used to improve care access, quality and patient experience,” Gibbings-Isaac said. “But we must help those who aren’t digitally competent.”

That includes clinicians in need of training and patients in digital deserts who will need the bandwidth, device and training assistance.

“If we do this right, we can create a health equity advantage, rather than widening the gap,” he pointed out.

“Technology can be used to improve care access, quality and patient experience,” …“But we must help those who aren’t digitally competent.”

70% of clinicians surveyed believed digitally enabled, patient-centered tools would be valuable for ongoing disease management

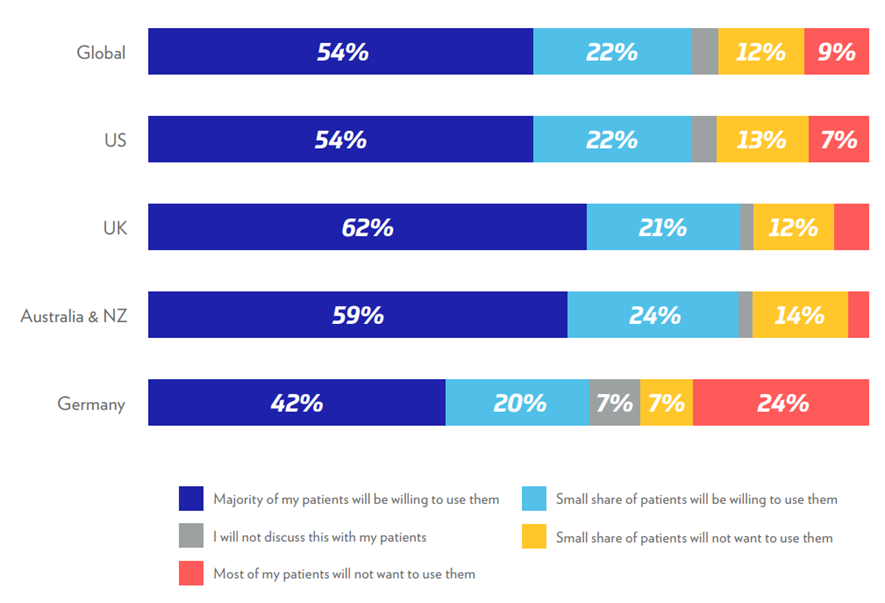

Clinicians believe that patients’ willingness to use digital health tools will increase

Overall, 76% believe that patients will be willing to use DHTs

Q21 (b). What are your patients’ attitudes towards digital health tools in 2026/27?

3.Payers

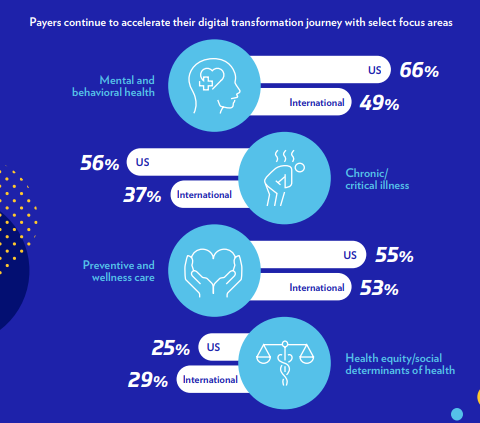

Healthcare payers report increased organizational readiness to accelerate their digital transformation journeys, …

…with an eye on improving health equity and addressing mental/behavioral health as two means of holding down healthcare costs.

“The pandemic has exasperated inequities and disparities, and thus payers are increasingly focused on areas where digital disparities could be addressed in the near term,” said Shreesh Tiwari, Principal and Data and Technology Leader at ZS Associates.

Internationally, digitally progressive health plans believe focusing on personalized care and wellness is key to engaging patients to managing their healthcare needs.

They also appear to be slightly more digitally ready than US payers, but Tiwari believes that has to do with payers outside of the United States starting financially and technically better positioned.

While financial, technical, regulatory and organizational challenges remain, particularly regarding digital health reimbursements, payers are optimistic that at least financial and technical barriers will ease during the next five years.

While financial, technical, regulatory and organizational challenges remain, particularly regarding digital health reimbursements, …

… payers are optimistic that at least financial and technical barriers will ease during the next five years.

One source for that optimism are advances coming from innovative technology companies that stand to introduce or improve remote patient monitoring, home health and health-related apps —

… including within care areas and communities that have clung to more traditional, more costly care plans.

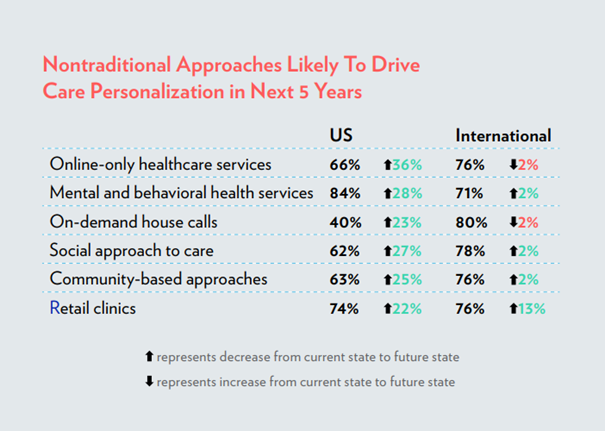

Some 74% of payers in the US and 76% internationally also see retail clinics playing a significant role

Nearly three-quarters of US payers believe big tech innovation will be a major driver of digital transformations, compared to 51% of international payers.

A lower number of US payers (64%) were convinced these technology companies will stir innovation in personalized care, versus 44% of international payers.

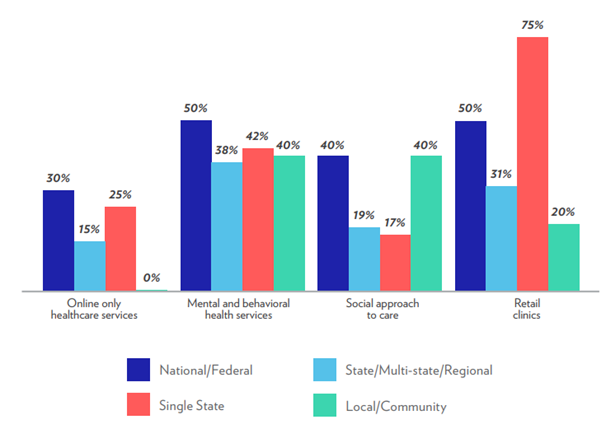

The most anticipated nontraditional approaches tied to care personalization by 2026–2027 will involve mental and behavioral health services, …

… according to 84% of US payers and 71% of payers outside the US Some 74% in the US and 76% internationally also see retail clinics playing a significant role.

The same number of international payers support online-only healthcare services (66% for US), representing the biggest jump (36%) in support from health plans, according to the survey.

Tiwari noted that the data shows payers are most excited about leveraging remote and homebased care services for select members and services.

“We have seen that the site of care is shifting away from hospitals to ambulatory to remote/home care,” he said. “Personalized care models are a win-win proposition for payers and members.”

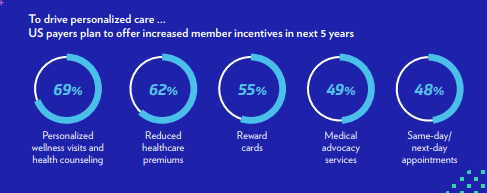

Payers also intend to increase incentives to drive broader investments in personalized care during the coming half-decade.

In the United States, this is most apt to be through wellness visits and health counseling or health plan premium reductions.

International payers expect to offer cost sharing and greater choice of specialists.

The vast majority of US and international payers anticipate that health equity issues will be addressed in coming years as digital transformations continue, paving the way for fewer hospitalizations and better patient outcomes.

“There seems to be a high degree of recognition that the whole person needs to be addressed differently,” Tiwari said.

“There are specific approaches we can take to integrate clinical data, social data and mental and behavioral health data to address gaps in care and issues around health inequity

“There seems to be a high degree of recognition that the whole person needs to be addressed differently,

Payers to expand leveraging nontraditional care sites for enhanced personalization

Per our survey, large national plans are expected to lead the way in supporting nontraditional approaches for care delivery

4.Patients

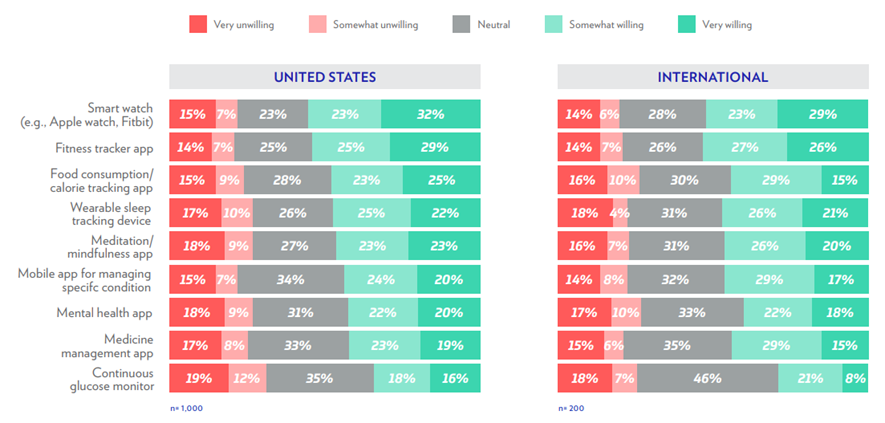

HIMSS estimates health app usage to manage specific conditions to grow by 33% or more in the next three to five years

Younger patients, particularly those considered digital natives, are pushing healthcare organizations to digitally transform at a rapid rate to meet their nontraditional approach to patient care.

This brand of healthcare emphasizes convenience, virtual care and self-management through health trackers and other smart devices.

The Future of Healthcare study found …

… significant opportunity for consumer health-related digital tools that help patients manage specific conditions or medications.

Based on survey results, HIMSS estimates health app usage to manage specific conditions to grow by 33% or more in the next three to five years.

Also encouraging is the finding that … patients are willing to share data …

Also encouraging is the finding that half of British and German patients and nearly two thirds of US, Australian and New Zealand patients are willing to share data they collect on apps and devices with their providers to receive more personalized care.

In turn, they expect these healthcare practitioners and systems to match the digital capabilities they experience in other industries.

Also encouraging is the finding that … patients are willing to share data …In turn, they expect these healthcare practitioners and systems to match the digital capabilities they experience in other industries.

“Traditional healthcare models need to adapt and change, or patients may no longer be willing to use them,” said Lauren Goodman, Senior Insight Director for HIMSS Media Insights.

“Patients are now more engaged in their healthcare.

They like being able to track their own health and fitness levels because they think if they monitor small things, they won’t become a big thing. So, they are fully engaged.”

“Patients are now more engaged in their healthcare.

“Traditional healthcare models need to adapt and change, or patients may no longer be willing to use them

This shift will continue to impact overall care delivery as more patients take charge of their own healthcare using wearables and simple medical devices to monitor things like heart health, blood glucose and blood oxygen levels from the comfort of home.

Among patients in the study, Germans had the highest use of smart watches in the past 12 months and tied with the UK for fitness tracker usage.

This shift will continue to impact overall care delivery as more patients take charge of their own healthcare using wearables and simple medical devices to monitor things like heart health, blood glucose and blood oxygen levels from the comfort of home.

Goodman described the strong preference for health and fitness trackers and mental health apps as “consumerism on fire.”

Referring to patients, she noted: “They don’t care that some providers are no longer gatekeepers with their health, so either healthcare providers change their traditional model and adapt, or patients are not going to engage with them.”

This may already be happening with Gen Z and Millennial consumers globally, whom the study found more apt to use urgent care as needed.

US and UK participants favored retail clinics, while those in Germany, Australia and New Zealand preferred on-demand house calls.

US and UK participants favored retail clinics, while those in Germany, Australia and New Zealand preferred on-demand house calls.

This patient cohort is driving the need for healthcare digital transformations and personalized care, given that their ranks will swell as Baby Boomers’ numbers decrease.

“And then that patient base supporting the traditional model is not going to exist anymore,” Goodman said. “So, providers have this really great opportunity to transform.”

Traditional healthcare providers need to rapidly adapt and change, to lean into digital transformation, Goodman concluded, and added, “Or patients may no longer be willing to use them as they no longer fit the care model the patient is seeking.”

American and British consumers are most willing to use smart watches and fitness tracker apps in the future to track their health

Regardless of which health-related digital technologies (e.g., mobile apps, wearables like an Apple watch or Fitbit, etc.) you may currently use to track your health, how willing are you to use/continue to use each of the following in the next 3–5 years?

Originally published at: https://www.himss.org/

NAMES MENTIONED

Tom Kiesau, Chief Innovation Officer for The Chartis Group.

Kiesau and Darryl Gibbings-Isaac, MD, Senior Manager, Health Strategy Practice, at Accenture.

Shreesh Tiwari, Principal and Data and Technology Leader with ZS Associates.

Lauren Goodman, Senior Insight Director for HIMSS Market Insights.

Darryl Gibbings-Isaac, MD, Senior Manager, Health Strategy Practice, at Accenture.