This is an excerpt of the report “Global Use of Medicines 2023”, published by IQVIA, with the title above, focusing on the topic in question.

institute for health transformation (IHT)

research, strategy and advisory consulting

Joaquim Cardoso MSc

January 18, 2023

SOURCE:

The Global Use of Medicines 2023

IQVIA

REPORT SUMMARY:

Reaching a post-pandemic era is an alluring prospect for almost everyone around the world after the disruptions of the past three years.

The outlook for global spending on medicines has become clearer as the traumas recede and uncertainties give way to more predictable challenges.

Policymakers across developed and emerging economies are shifting from crisis to rebuilding modes with a focus on longer-term issues of sustainability.

Complex trade-offs remain, and improved efficiency and quality of healthcare informed by evidence-based decision-making will inform the critical decisions in the coming decade.

The largest driver of medicine spending through the next five years is still expected to be global COVID-19 vaccinations, But leaving aside the pandemic, …

… global spending on medicines continues to be driven by innovation and offset by losses of exclusivity and the lower costs of generics and biosimilars.

In this report, we quantify the impact of these dynamics and examine the spending and usage of medicines in 2022 and the outlook to 2027, globally and for specific therapy areas and countries.

We intend for this report to provide a foundation for meaningful discussion about the value, cost, and role of medicines over the next five years in the context of overall healthcare spending.

Key findings:

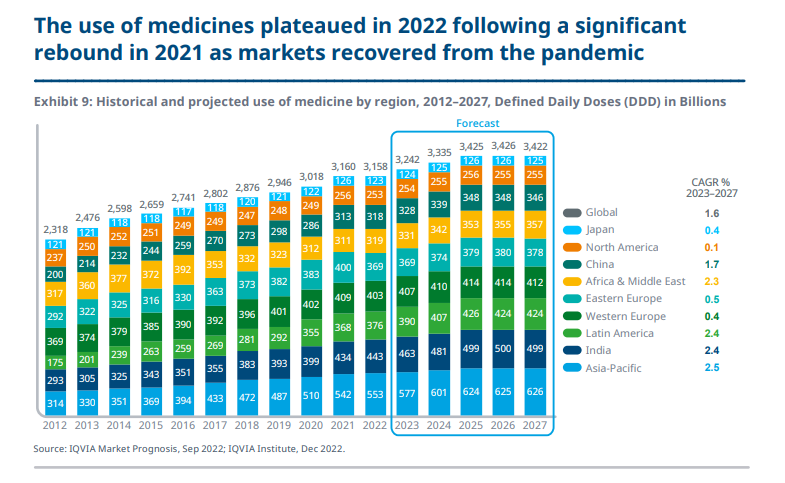

- The global use of medicines — based on modeling medicine volumes shipped according to defined daily dose assumptions — has been growing for the past decade; however, this growth is expected to slow across all markets over the next five years.

- As a lagged effect of the pandemic, the use of medicines grew sharply in 2021 and then slowed in 2022 as some of the usage was related to temporary shifts in demand, referred to as ‘stockpiling.’

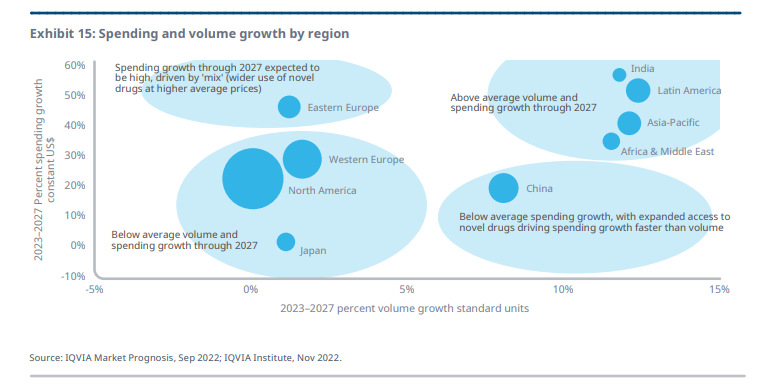

- The highest volume growth over the next five years is expected in Asia-Pacific, Latin America, India and Africa/Middle East, largely driven by population growth.

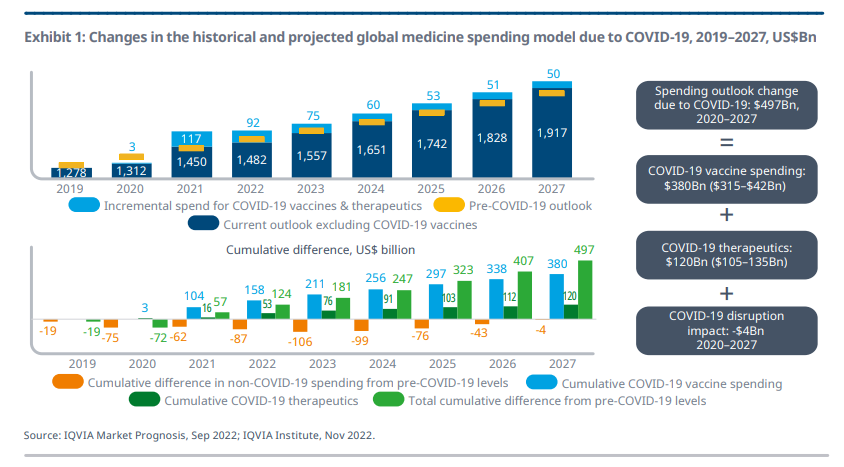

- The COVID-19 pandemic continues to impact pharmaceutical markets globally, and is estimated to expand the net cumulative pharmaceutical market by $500 billion from 2020 through 2027

- Highest volume growth is expected in Latin America, Asia and Africa, driven by a mix of population growth and expanded access.

- North America and Europe will see very low growth

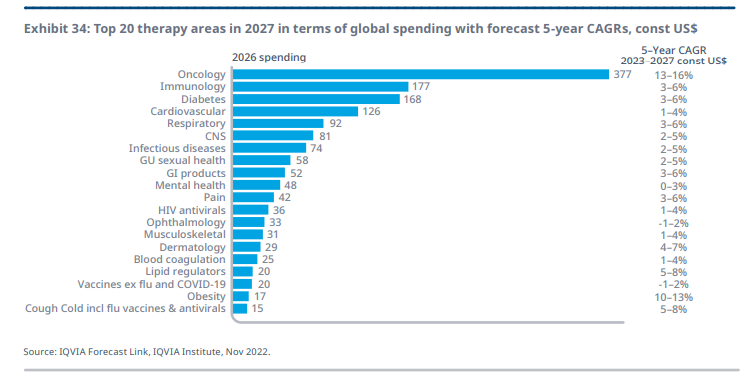

- Demand for innovative drugs will drive oncology spending to approximately $370 billion by 2027, almost double the current level

- Biotech will represent 35% of spending globally in 2027 and will include both breakthrough cell and gene therapies, as well as a maturing biosimilar segment

- The outlook for global medicine spending has shifted considerably during the COVID-19 pandemic but is expected to be largely similar to the pre-COVID outlook, excluding the spending for COVID-19 vaccines and therapeutics.

- For non-COVID spending, lower trends in the near-term are expected to be largely offset and by 2027, the cumulative reduction from the pre-pandemic outlooks is expected to be only $4Bn.

- The most important drivers of lower spending will be those, often asymptomatic, conditions that have disrupted patient engagement and fail to make up the backlog of previously expected usage and spending.

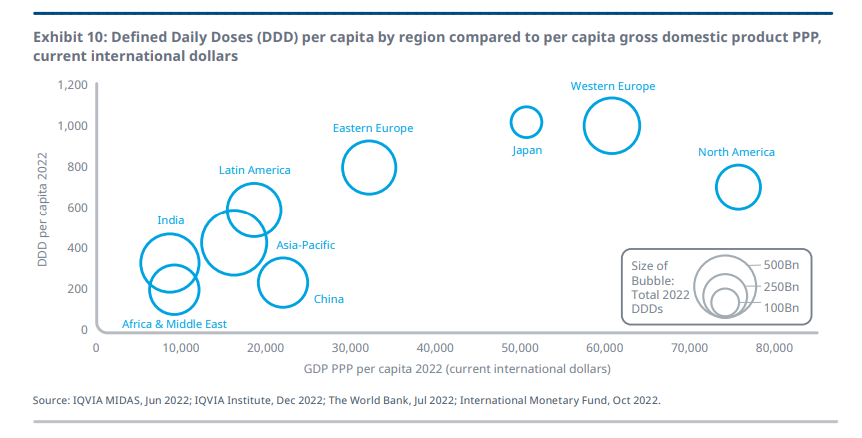

- Broadly there is a correlation to gross domestic product per capita, with higher medicine use in higher income countries.

- As countries vary in the cost burden patients directly bear, there is some correlation in the way patients use medicine.

- The U.S. has the lowest per capita DDD volumes of developed markets, which may be the result of high patient out-of-pocket cost exposure.

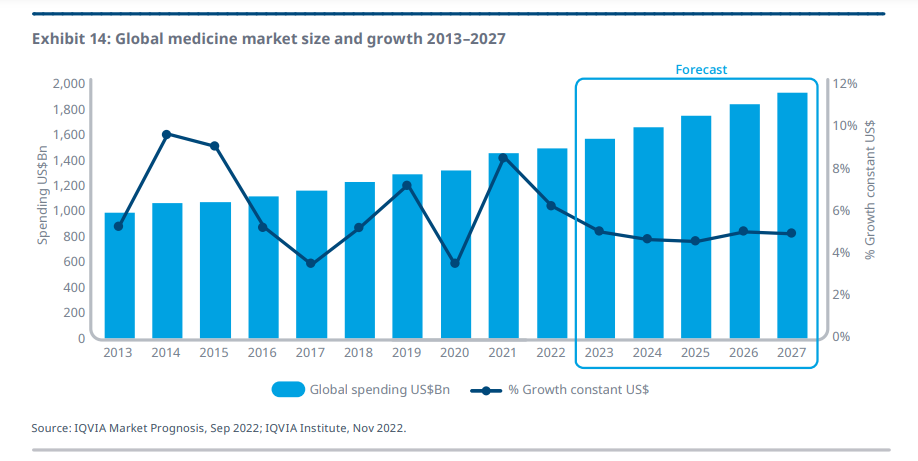

- Global medicine spending — the amount spent purchasing medicines from manufacturers before off-invoice discounts and rebates — is expected to reach $1.9Tn by 2027, increasing at a rate of 3–6% per year.

- This outlook is excluding the separate impact of spending on COVID-19 vaccines and therapeutics modeled separately (see Exhibits 1–4).

- Overall growth trends are expected to moderate after the disruptions from the pandemic in 2020 through 2022.

- Regions around the world are growing following diverging trends, with some more volume driven while others have a greater contribution from adoption of innovation.

- Countries in Latin America, Asia-Pacific, and Africa and the Middle East are expected to grow more than 10% by volume over the five years to 2027, while spending growth will increase by over 30%, …

- …indicating both population-driven volume growth and a shift in the mix of products to more expensive products.

- China as the world’s second largest country by pharmaceutical spending, will increase volume by 8% in aggregate over five years, while spending will increase 19%, a more modest rate than in the prior years and still embedding a focus on expanding access to novel drugs via the National Reimbursement Drug List (NRDL).

- The therapy areas with the highest forecast spending in 2027 are oncology, immunology, and anti-diabetics, followed by cardiovascular.

- Oncology is expected to grow 13–16% CAGR through to 2027 as novel treatments continue to be launched for the treatment of cancer.

- Immunology is expected to grow slowly in the range of 3–6% due to the launch of biosimilars; …

- … while several biosimilars are already launched in Europe, leading to slow growth of the immunology segment, the launch of adalimumab biosimilar in 2023 in the U.S. is further expected to impact growth.

Introduction

Reaching a post-pandemic era is an alluring prospect for almost everyone around the world after the disruptions of the past three years.

The outlook for global spending on medicines has become clearer as the traumas recede and uncertainties give way to more predictable challenges.

Policymakers across developed and emerging economies are shifting from crisis to rebuilding modes with a focus on longer-term issues of sustainability.

Complex trade-offs remain, and improved efficiency and quality of healthcare informed by evidence-based decision-making will inform the critical decisions in the coming decade.

Complex trade-offs remain, and improved efficiency and quality of healthcare informed by evidence-based decision-making will inform the critical decisions in the coming decade.

The largest driver of medicine spending through the next five years is still expected to be global COVID-19 vaccinations, but leaving aside the pandemic, global spending on medicines continues to be driven by innovation and offset by losses of exclusivity and the lower costs of generics and biosimilars.

The largest driver of medicine spending through the next five years is still expected to be global COVID-19 vaccinations, but leaving aside the pandemic, …

… global spending on medicines continues to be driven by innovation and offset by losses of exclusivity and the lower costs of generics and biosimilars.

In this report, we quantify the impact of these dynamics and examine the spending and usage of medicines in 2022 and the outlook to 2027, globally and for specific therapy areas and countries.

We intend for this report to provide a foundation for meaningful discussion about the value, cost, and role of medicines over the next five years in the context of overall healthcare spending.

OVERVIEW

As the COVID-19 pandemic enters its fourth year, it has been the most impactful global public health crisis in decades, …

… and yet it has illustrated the resilience of global health systems as they have readily adapted to peaks in demand and developed novel vaccines and therapeutics with significant efficacy, safety, and unusual speed.

The global vaccination program that countries and industry have implemented is unprecedented in its speed and reach to lower-income countries previously thought to be inaccessible.

While challenges remain in managing the pandemic into an endemic phase, other health concerns are also coming back into focus.

Overall, global use and spending on medicines is expected to return to pre-pandemic growth rates by 2024, …

… though the next two years are not without important uncertainties related to viral variants, vaccination rollout for COVID-19, and under-usage of booster shots, as well as economic uncertainties related to global inflation, geopolitical conflicts, and climate change.

IMPACT OF COVID-19 ON THE USE OF MEDICINES

Global spending on medicines from 2020 to 2027 is expected to exceed the pre-pandemic outlook by $497Bn in aggregate, …

… largely due to new spending on COVID-19 vaccines and novel therapeutics, as well as the impact on other therapeutic areas.

Global market growth will return to pre-pandemic projected rates by 2024 despite year-to-year fluctuations and geographical variations.

All regions around the world have exceeded previously projected first wave COVID-19 vaccination rates, resulting in 530 million more vaccinated people by the end of 2023 than initially modeled.

The largest areas of over-achievement in this area have been in upper-middle and lower-middle-income countries as defined by the World Bank, with 4.4 billion people vaccinated, 490 million more than earlier estimates.

The largest areas of over-achievement in this area have been in upper-middle and lower-middle-income countries as defined by the World Bank, with 4.4 billion people vaccinated, 490 million more than earlier estimates.

Immunity achieved from COVID-19 infection or vaccines appears to wane after a year, …

… and annual boosters are being recommended, including new versions for emerging viral variants; adoption, however, generally includes less than half of the population who had received the first-wave shots and is lagging in lower-income countries.

Immunity achieved from COVID-19 infection or vaccines appears to wane after a year, and annual boosters are being recommended, including new versions for emerging viral variants; …

… adoption, however, generally includes less than half of the population who had received the first-wave shots and is lagging in lower-income countries.

Ongoing impactful surges with new variants, and these patterns characterize the expected nature of the endemic phase.

COVID-19 therapeutics will continue to be widely used and will result in a cumulative spend over eight years of $120Bn through 2027.

COVID-19 therapeutics will continue to be widely used and will result in a cumulative spend over eight years of $120Bn through 2027.

Other medicine use was disrupted during the pandemic across a range of therapy areas, some related to the symptom profile of the pandemic, others related to disrupted management of chronic diseases.

Other medicine use was disrupted during the pandemic across a range of therapy areas, some related to the symptom profile of the pandemic, others related to disrupted management of chronic diseases.

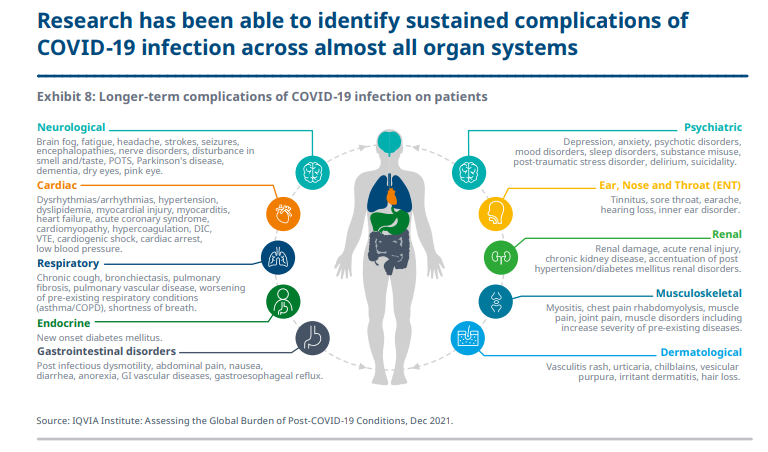

Sustained complications of COVID-19 infection across almost all organ systems, known as ‘long-COVID’, is now better understood, with 10–20% of infected patients suffering with persistent symptoms requiring ongoing demand for treatments, often with older generic drugs.

Sustained complications of COVID-19 infection across almost all organ systems, known as ‘long-COVID’, is now better understood, …

… with 10–20% of infected patients suffering with persistent symptoms requiring ongoing demand for treatments, often with older generic drugs.

OUTLOOK FOR THE USE OF MEDICINES AND HISTORIC DRIVERS

The use of medicines globally plateaued in 2022 following a significant rebound in 2021 as markets recovered from the pandemic.

Overall volume is projected to grow 1.6% CAGR in days of therapy through 2027, driven by Asia-Pacific, India, Latin America, Africa and the Middle East, and China, all of which are expected to exceed global volume growth.

Higher income countries in Western Europe and North America as well as Japan and Eastern Europe are expected to grow more slowly at 0.1 to 0.4% through 2027, partly due to their already higher per capita use.

Eastern Europe volume growth is also hampered by disruptions from the ongoing Ukraine conflict.

Overall volume is projected to grow 1.6% CAGR in days of therapy through 2027, driven by Asia-Pacific, India, Latin America, Africa and the Middle East, and China, all of which are expected to exceed global volume growth

Per capita use of medicines varies by GDP, with use in higher-income countries typically higher than in lower income countries.

Countries such as Japan and those in Western Europe have more than double the use of most other regions measured in WHO defined daily doses.

Countries vary considerably in the therapy areas which drive most of their volume use of medicines, linked to the burden of disease they experience as well as factors which influence the structure and functioning of health systems.

While overall volume has increased by 2% CAGR over the past decade, oncology has increased at 15% per year, driven by the significant advances in novel treatments and improved access to cancer care around the world.

While overall volume has increased by 2% CAGR over the past decade, oncology has increased at 15% per year, driven by the significant advances in novel treatments and improved access to cancer care around the world.

SPENDING AND GROWTH BY REGIONS AND KEY COUNTRIES

The global medicine market — using invoice price levels — is expected to grow at 3–6% CAGR through 2027, reaching about $1.9Tn in total market size.

Spending and volume growth will follow diverging trends by region with larger established markets growing more slowly, and growth markets in Eastern Europe, Asia and Latin America growing in both volume and spending.

The global medicine market — using invoice price levels — is expected to grow at 3–6% CAGR through 2027, reaching about $1.9Tn in total market size.

The U.S. market, on a net price basis, is forecast to grow -1 to 2% CAGR over the next five years, down from 4% CAGR for the past five years.

Prior editions estimated 0–3% CAGR on a net basis.

The new forecast, including projected effects of the Inflation Reduction Act, reflects an outlook that has a 1% lower range.

Provisions of the new legislation are expected to drive incremental volume by reducing cost exposure for patients and by driving lower prices through inflation penalties and price negotiations.

Other aspects of the law will impact the interactions of stakeholders and the responsibility for cost shifts between government, payers, and pharmaceutical manufacturers, especially in the Medicare program.

Provisions of the new legislation are expected to drive incremental volume by reducing cost exposure for patients and by driving lower prices through inflation penalties and price negotiations.

Other aspects of the law will impact the interactions of stakeholders and the responsibility for cost shifts between government, payers, and pharmaceutical manufacturers, especially in the Medicare program.

Spending in Europe is expected to increase by $59Bn through 2027, with a focus on generics and biosimilars, and escalating pressures on the value and negotiated prices of novel medicines.

The pandemic’s impact on Asia-Pacific countries varies considerably, but a return to steady growth is projected after 2021.

Japan medicine spending growth is projected at -1 to 2% through 2027 as robust brand growth is offset by a shift in annual price cuts and ongoing moves to generics.

Spending growth in China is expected to slow, with positives driven by greater uptake and use of new original medicines and offset by pressures on off patent and generic pricing.

Growth in developed economies continues at relatively steady rates, with new products offset by patent expiries.

Latin America, Eastern Europe and parts of Asia are expected to grow strongly from volume and adoption of novel medicines.

Latin America, Eastern Europe and parts of Asia are expected to grow strongly from volume and adoption of novel medicines.

KEY THERAPY AREAS

The key growth area for medicines in the next five years is biotech, which will represent 35% of global spending and will include many of the areas of greatest activity for novel medicines.

In addition, global savings from biosimilars will exceed $290Bn in cumulative spending through 2027, which is below estimates without new biosimilars, representing a significant mechanism to generate wider usage of these medicines as well as ease payer budget pressures on overall spending. Specialty medicines will represent 43% of global spending in 2027 and more than 55% of total spending in developed markets, continuing the shift from more traditional medicines underway for over a decade.

The key growth area for medicines in the next five years is biotech, which will represent 35% of global spending and will include many of the areas of greatest activity for novel medicines.

The two leading global therapy areas — oncology and immunology — are forecast to grow 13–16% and 3–6% CAGR, respectively, through 2027, …

… reflecting diverging trends with one still driven by novel medicines and the other facing biosimilar competition.

Oncology is projected to add 100 new treatments over five years, contributing to an increase in spending of $184Bn to a total of more than $370Bn in 2027 and facing limiting new losses of exclusivity. Treatments for auto-immune disorders are forecast to reach $177Bn globally by 2027, driven by steadily increasing numbers of treated patients and new products, and offset after 2023 due to biosimilars.

Diabetes spending growth is slowing to low single digits in most developed markets and declining in some, especially net of rebates.

New therapies contribute to growth of neurology markets, including greater use of novel migraine therapies, potential treatments for rare diseases, and the potential for therapies for Alzheimer’s and Parkinson’s.

Diabetes spending growth is slowing to low single digits in most developed markets and declining in some, especially net of rebates.

The outlook for next generation biotherapeutics includes significantly uncertain clinical and commercial prospects for cell, gene, and RNA therapies, which will grow from current $8Bn spending in 2022 to $27Bn by 2027.

The outlook for next generation biotherapeutics includes significantly uncertain clinical and commercial prospects for cell, gene, and RNA therapies, which will grow from current $8Bn spending in 2022 to $27Bn by 2027.

Originally published at https://www.iqvia.com on January 18, 2023.

REFERENCE PUBLICATION

About the author(s) & affiliation(s)

MURRAY AITKEN

Executive Director IQVIA Institute for Human Data Science

The study was produced independently by the IQVIA Institute for Human Data Science as a public service, without industry or government funding.

The contributions to this report by Mohit Agarwal, Aurelio Arias, Urvashi Porwal, Jamie Pritchett, Sarah Rickwood, Priya Srivastava, Durgesh Soni, Alan Thomas, and dozens of others at IQVIA are gratefully acknowledged.