Oncologists report caseloads are 20–29% below pre-COVID-19 levels, and while cancer screenings in the U.S. have returned to pre-pandemic levels, …

… more than 30 million screenings in four common tumors were disrupted since the start of the pandemic, risking delayed or missed diagnoses for more than 58,000 patients

IQVIA

May 2022

Web Summary

Oncology is the leading therapy area for innovation — in terms of the level of clinical trial activity, number of companies investing in therapeutics, size of the pipeline of therapies in clinical development, novel active substances being launched, and the level of expenditure on these drugs.

In 2021, during a global pandemic, cancer care continued to be delivered although a backlog in treatment and screenings raised worrying questions.

In a record-setting year, more novel cancer medicines became available for the first time than in any year in history, and many of them employ immunology or precision biomarkers to transform the way patients are treated.

Adoption of breakthrough medicines and diagnostics is improving outcomes for millions around the world, though broad and equitable access remains a significant challenge to healthcare stakeholders — including patients.

This year’s annual report on Global Oncology Trends examines those novel medicines and the clusters of research, which promise a continuing sequence of breakthroughs in the decade to come.

The report explores the impact of COVID-19 disruptions and the longer-term trends in the use of cancer medicines as well as the drivers of spending globally, in key geographies, by tumor type, and for specific types of oncology drugs.

Key Findings

- Oncology trial starts reached historically high levels in 2021, up 56% from 2016 and mostly focused on rare cancer indications

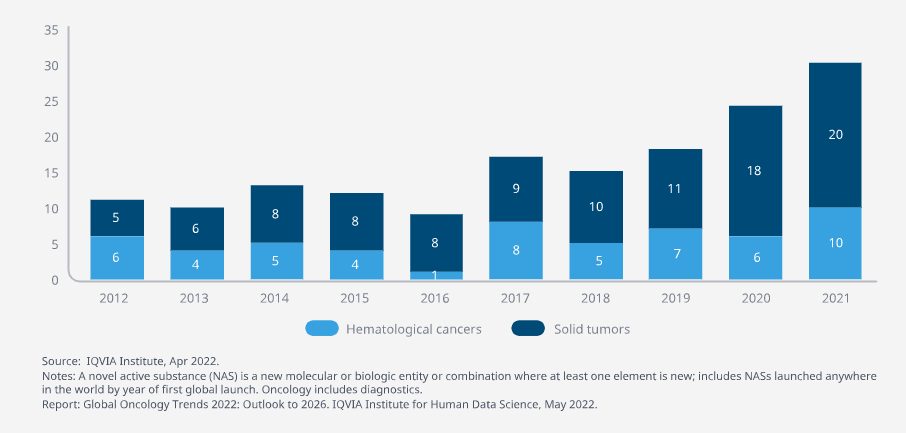

- A record 30 oncology novel active substances (NASs) were initially launched globally in 2021, and a total of 159 have been launched since 2012

- Oncologists report caseloads are 20–29% below pre-COVID-19 levels, and while cancer screenings in the U.S. have returned to pre-pandemic levels, more than 30 million screenings in four common tumors were disrupted since the start of the pandemic, risking delayed or missed diagnoses for more than 58,000 patients

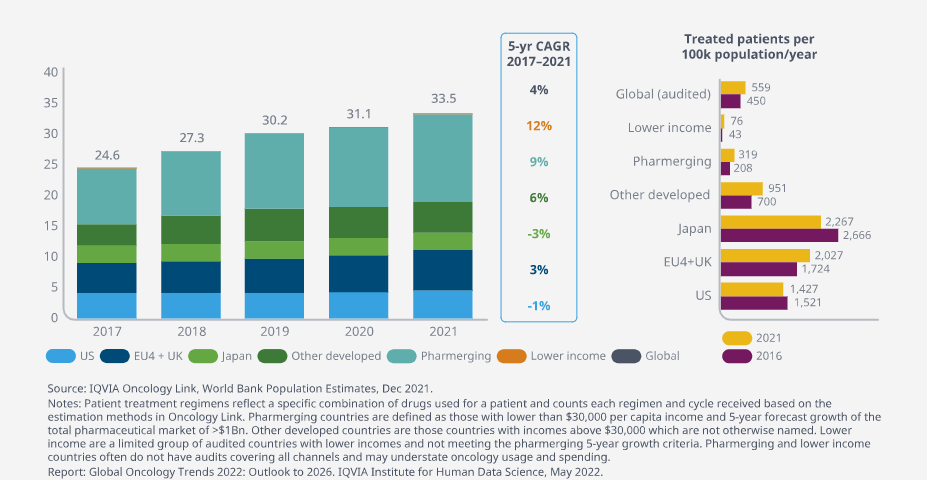

- Global numbers of treated patients have increased at an average of 4% over the past five years

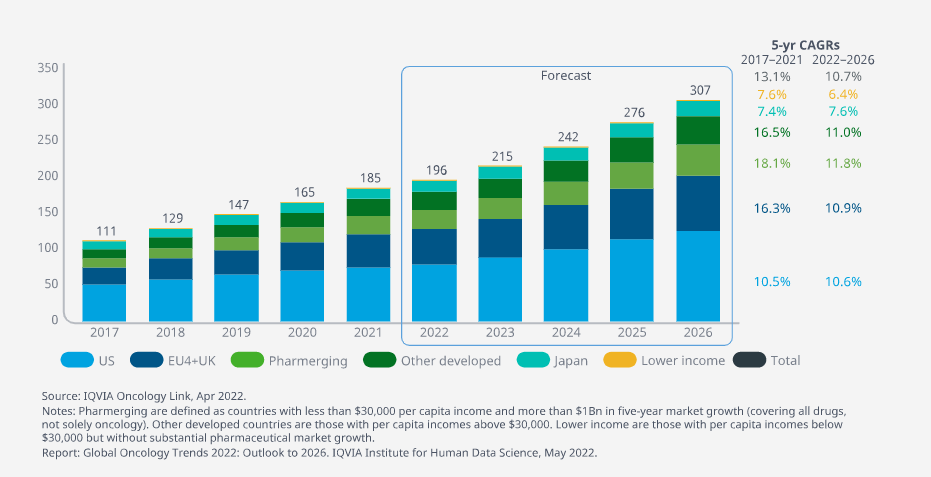

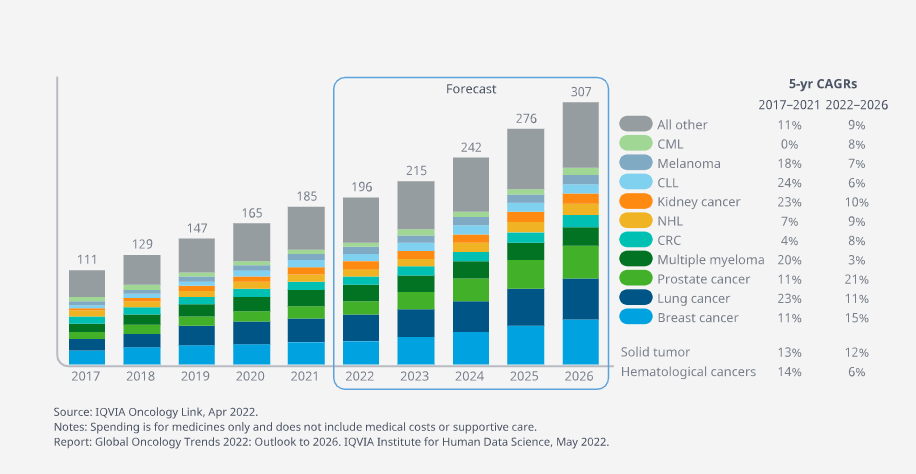

- Global oncology spending is expected to exceed $300 billion by 2026

Oncologists report caseloads are 20–29% below pre-COVID-19 levels, and while cancer screenings in the U.S. have returned to pre-pandemic levels, …

… more than 30 million screenings in four common tumors were disrupted since the start of the pandemic, risking delayed or missed diagnoses for more than 58,000 patients

Other Findings

A record 30 oncology novel active substances (NASs)

- While the number of NASs launched for oncology globally averaged 11 each year from 2012–2016 — and averaged just 5 the five years prior — this has grown to an average of 21 new oncology launches each year from 2017–2021 and is steadily trending upward.

- Two-thirds of oncology NAS launches have been for solid tumors in recent years, with 68 launches for solid tumors in the last five years, up from 35 in the five years prior.

Global numbers of treated patients have increased at an average 4% over the past 5 years, to accelerate in next 5 year

- Aging populations and robust access to care are driving steady levels of cancer treatment in developed markets.

- Widening access to care in lower income markets along with longer treatment durations are resulting in higher numbers of patients receiving treatment each year.

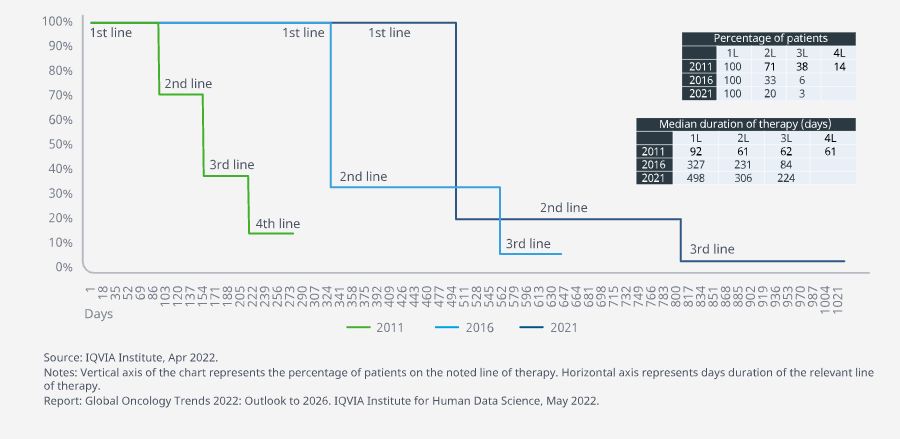

Significant advances, primarily in immunotherapy, have extended median duration of first-line therapy with more responding

- Significant improvements in therapies for non-small cell lung cancer have increased the effectiveness of first-line therapy in patients over the last decade.

- The median duration of first-line therapy has quadrupled since 2011 and now first-line therapy duration is at nearly a year-and-a-half compared to just three months a decade ago.

Cancer medicine spending rose to $185Bn globally in 2021 and is expected to reach more than $300Bn by 2026

- Cancer medicine spending rose to $185Bn globally in 2021, with 74% focused in the major developed markets (the United States, EU4+UK and Japan) down from 77% in 2017.

- Spending growth in these major developed markets is expected to be similar in the next five years to the last five, with the exception of EU4+UK, which is expected to slow.

7 of the top 10 tumors have double-digit spending growth, all areas of significant numbers of breakthrough new medicines

- Collectively, the top five tumor types (breast cancer, lung cancer, multiple myeloma, prostate cancer and colorectal cancer), account for 53% of all oncology sales.

- The continued launch of innovative medicines is one of the key drivers fueling the growth in oncology.

Executive summary

Global oncology is witnessing a remarkable surge in R&D and innovation, potentially leading to new therapies for unresolved cancers and including some of the most advanced breakthrough science in the life sciences.

These therapies represent the largest area of collective research and the largest overall area by drug spending in the world.

By contrast, the global oncology community and patients continue to struggle with the impact from delays in screenings, diagnoses and cancer care from COVID-19, as well as gaps in access and care which predated the pandemic.

The outlook for the next five years includes important continuation of some of these trends and shifts in others.

NOVEL ACTIVE SUBSTANCES IN ONCOLOGY

A record 30 oncology novel active substances (NASs) were initially launched globally in 2021, 104 in the past five years and a total of 159 since 2012.

While not all of these drugs have become available in every country, most have access to some key breakthroughs in immuno-oncology and the use of precision biomarkers have become the standard of care in dozens of tumors.

In the U.S. there were 83 unique new cancer medicines launched in the past five years, with many approved for more than one indication.

There have been important concentrations of new therapies in solid tumors of the lung, breast, prostate, and skin, as well as hematological malignancies such as non-Hodgkin’s lymphoma and multiple myeloma.

Many of these drugs are receiving accelerated approvals, orphan or breakthrough designations, and a small but increasing number are proceeding from patent filing to product launch in less than five years.

As with most years in the past decade, new medicines launched in 2021 included significant clinical advances across a range of tumors and mechanisms.

The global oncology community and patients continue to struggle with the impact from delays in screenings, diagnoses and cancer care from COVID-19, as well as gaps in access and care which predated the pandemic.

ONCOLOGY RESEARCH AND DEVELOPMENT ACTIVITIES

Oncology trial starts reached historically high levels in 2021, up 56% from 2016 and mostly focused on rare cancer indications, which have higher success rates despite greater complexity.

Most cancer research focuses on metastatic or advanced cancers, but early cancer and vaccines have more than doubled in 10 years and represent a steady 11% of trials.

Compared to other therapy areas, oncology trials have significantly higher complexity measured in numbers of eligibility criteria, endpoints, trial sites, countries, and clinical subjects.

Oncology also shows among the lowest “white space” — the difference between the duration of clinical trials and the duration of time between trial phases when administrative activities often take place — ultimately accelerating successful drugs time to the market.

Composite success rates in oncology have been trending down since 2015, reaching 5.2% in 2021, while rare tumors averaged 15.6%.

Combining probability of success with complexity and duration, overall productivity of oncology research is among the lowest in the industry, though rare cancer productivity is high and is rising steadily.

In terms of the sponsors of research, emerging biopharma companies were responsible for 68% of the oncology pipeline in 2021, up from 45% a decade ago, and increasingly involved without larger pharma company partners until later in the development of an asset, or even after it has launched.

Notably, some emerging companies headquartered in China have succeeded in getting approval for novel drugs in the U.S.

There has been a steady rise in the number of companies from China sponsoring research and many of them will likely partner with multinationals to reach developed markets.

Even with such arrangements, recent setbacks with FDA suggest that these emerging companies may not have designed trials to meet the expectations of developed market regulators.

IMPACT OF COVID-19 ON CANCER CARE

Oncologists are reporting caseloads are 20–29% below pre-COVID-19 levels and more new patients presented to community oncologists with metastatic disease in several tumors during 2020 and 2021.

After two decades of innovation driving improved outcomes across solid and hematological tumors, these setbacks in engagement, screening and prevention are worrying providers and policymakers.

Even as disruption to cancer care eases with the pandemic shifting into a new phase, delays in surgeries, chemotherapy and fewer diagnoses being conducted continue to be a concern for oncologists.

Screenings for common cancers were down 1–16% in the U.S. through the end of 2021.

More than 30 million screenings for four common tumors have been disrupted since the onset of the pandemic, risking delayed or missed diagnoses for more than 58,000 patients.

CANCER PATIENT ACCESS AND USE OF SCIENTIFIC ADVANCES

The number of treated cancer patients globally grew at an average of 4% over the past five years and is expected to accelerate in the next five years as COVID-19 disruptions ease.

Despite this growth, the pace of bringing novel cancer therapies to patients is uneven across countries, with differences in biomarker testing rates, adoption of novel therapies, and the presence of infrastructure capacity to deliver some of the most advanced therapies.

While some biomarkers are tested similarly across countries, others have wide differences, which influence the medicines that are used.

Use of checkpoint inhibitors is two to three times higher in some major developed countries than others and is much higher than in lower income countries.

Non-small cell lung cancer treatment has shifted to include checkpoint inhibitors as the standard of care in the past three years, contributing to the extension of the median duration of first-line therapy by almost half a year, and yet lower income countries with the least access often have the highest persistent rates of smoking in the world.

Melanoma is treated with immuno-oncology checkpoint inhibitors 80% of the time with rising use of combo regimens, bringing significant life extension for metastatic patients.

Next-generation biotherapeutics, including cell and gene therapies, are an area of intense research, and while the number of CAR T centers is growing, locations are generally not convenient to all patients and not all centers have all approved products available, potentially resulting in lack of access to patients without the resources to travel longer distances.

SPENDING ON ONCOLOGY MEDICINES

Cancer medicine spending rose to $185Bn globally in 2021 and is expected to reach more than $300Bn by 2026, driven by continued innovation.

Growth in major markets is driven by new products and brand volume and offset by losses of exclusivity, including biosimilar impact.

The U.S. remains the largest market globally followed by major countries in Europe.

China oncology spending now exceeds the rest of pharmerging countries, driven by expanded access to new therapies and offset by lower prices.

Globally, seven of the top ten tumors will see double digit spending growth from expected novel therapies.

Together, PD-1/L1 inhibitors are used across most solid tumors and represent 45% of spending for lung cancer in 2021.

The robust pipeline of next-generation biotherapeutics in oncology includes significant potential as well as a wide range of uncertainty both clinically and commercially, with a potential to lift the current $3Bn global spending to $15Bn by 2026 or as high as $40Bn in optimistic scenarios.

Originally published at https://www.iqvia.com