Consumer willingness to share data is a given — the burden is now on the insurance industry to deliver value to the customer.

Evangelos Avramakis, Head Digital Ecosystems R&D

Swiss Re Institute

September 2019

Digital Ecosystems Series

Digital Version Edited by

Joaquim Cardoso MSc.

Digital and Health Transformation . Institute

for Better Health and Better Care are Lower Cost, for All

June 17, 2022

Executive summary

In the field of healthcare, ecosystems present opportunities that can improve health outcomes, prevent premature mortality and enhance quality of life for many.

The rising prevalence of lifestyle diseases and behavioural risks are leading to higher costs and poorer health outcomes, especially if care provision is inefficient.

Wellness platforms and devices are already becoming important conduits for data exchange between consumers and service providers.

In future, healthcare will involve using so-called digital ecosystems to promote, maintain and restore patient health by providing superior care anywhere and-anytime.[1]

- Insurers can transform engagement data into indicators for risk selection and health management.

- Yet there are signs of change as new ways of information sharing turn passive consumers into active health managers.

- Key questions regarding regulation, privacy and customer behaviour need to be navigated.

- Collectively, the industry must be a few steps ahead to remain relevant.

Insurers can transform engagement data into indicators for risk selection and health management.

Insurers need to leverage these ecosystems to help consumers manage risk and prevent premature mortality or adverse health incidents.

The growth of data and tools to analyse data within ecosystems can help obtain useful consumer insights and provide individuals with what feels like a bespoke experience.

Better consumer outcomes could result if underwriting processes and products embrace the modifiable nature of L&H risks.

This is something that will be possible with well-integrated, explicitly connected ecosystems.

However, we seem to be still quite far from this Utopian ideal.

Yet there are signs of change as new ways of information sharing turn passive consumers into active health managers.

Yet the landscape is showing signs of change; consumers are evolving from passive purchasers to active health managers, seeking more engaging and personalised experiences connected and relevant to their lifestyle.

They are also living longer lives.

But longevity in poor health is no gift.

Digital ecosystems are helping consumers manage their lifestyles better.

The insurance industry has been a pioneer in health data investigation and evaluation, and insurers will soon have the ability to connect with digital ecosystems through real-time services enabled by application programming interfaces or APIs.

Key questions regarding regulation, privacy and customer behaviour need to be navigated.

For insurers, there are a number of crucial questions.

- How should they support consumers in maintaining or improving their health?

- How should they assess key modifiable risks, dynamically over time?

- How can they develop more engaging and inclusive products for all consumers, and what should they do to attract and reward those willing to proactively manage their health?

- How best should insurers engage with governments and regulators on topics such as competition and privacy?

Collectively, the industry must be a few steps ahead to remain relevant.

It is not enough to simply understand trends.

Collectively, the insurance industry must be a few steps ahead to keep our offerings relevant.

The sector is uniquely positioned to lead that change by harnessing new advances that change the mode and type of engagement with customers, for a start.

Insurers are agents of change, with a duty to help everyone live their best lives.

Structure of “Trends reshaping the digital health landscape”

- 1.Data proliferation — through sensors and high-end healthcare technology

- 2.Decentralisation of care delivery

- 3.Advent of digital therapeutics and treatment

- 4.Consumers demand superior experiences (consumer experience)

- 5.Demographic shifts and lifestyle risks

- 6.Growing relevance of machine intelligence (artificial intelligence)

Trends reshaping the digital health landscape

Key trends

The health landscape is undergoing multiple changes.

Digital health is the use of data and technology to treat patients, conduct research, educate healthcare professionals, track diseases, monitor health, and facilitate healthy lifestyles through prevention.

Different macroeconomic and technology trends are impacting the landscape. Use of digital health tools, big data and analytics, consumer focused regulation and modifiable risk factors are all trending, many with overlapping qualities. These developments in health present an opportunity for insurers to reinforce their relevance.

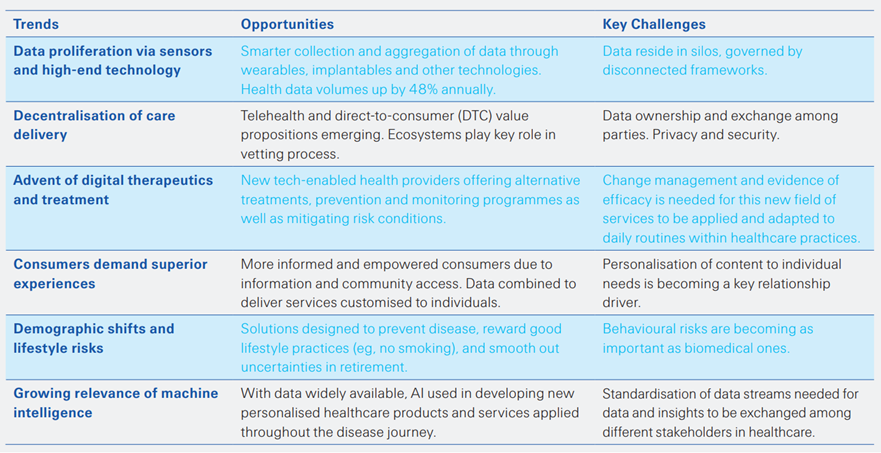

Table 1 — Overview of key trends leading to and impacting digital ecosystems

Source: Swiss Re Institute

Summary of key trends leading to and impacting digital ecosystems

- 1.Data proliferation — through sensors and high-end healthcare technology

- 2.Decentralisation of care delivery

- 3.Advent of digital therapeutics and treatment

- 4.Consumers demand superior experiences (consumer experience)

- 5.Demographic shifts and lifestyle risks

- 6.Growing relevance of machine intelligence (artificial intelligence)

1.Data proliferation through sensors and high-end healthcare technology

The last decade has seen a boom in the collection and aggregation of healthcare data.

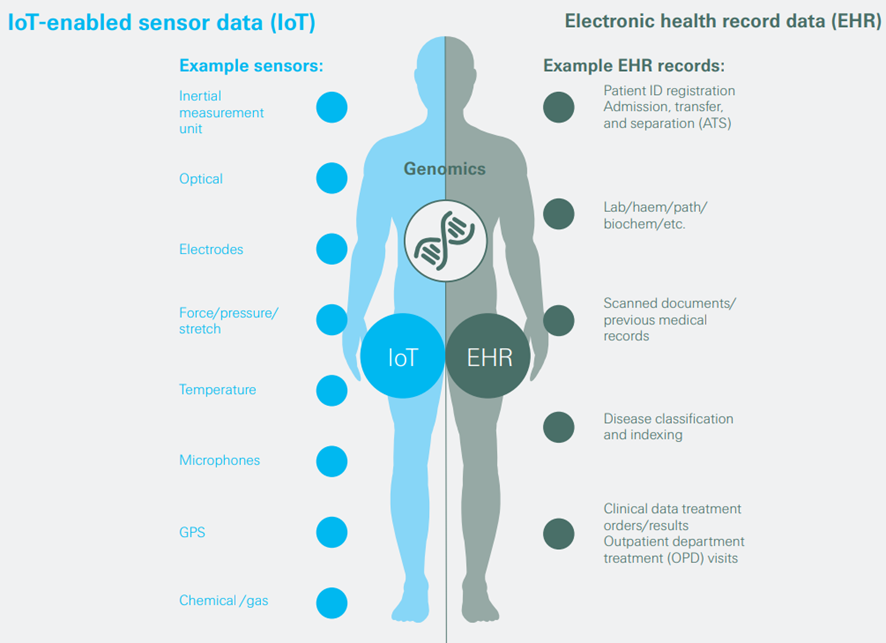

This decade has seen a boom in the collection and aggregation of health data. International Data Corporation (IDC) estimates that health data volumes are growing at 48% annually, at which rate the volume of global healthcare data will balloon to 2314 exabytes (EB) by 2020, from 153 EB in 2013.[2] However, much of these data currently reside in silos and are governed by disconnected frameworks and standards. Curating and integrating the data is a tall order. Data are available in multiple structured sources, such as claims, clinician data, electronic health records (eHR), pharmacy and laboratory data, as well as non-traditional, non-clinical forms of data, like social media; or local, geographic data, such as transportation, environment, food, crime, and safety. (See Figure 1 for examples of health data collated by ecosystems via IoT enabled sensors as well as electronic health records.)

Better data will lead to solutions targeting specific health challenges.

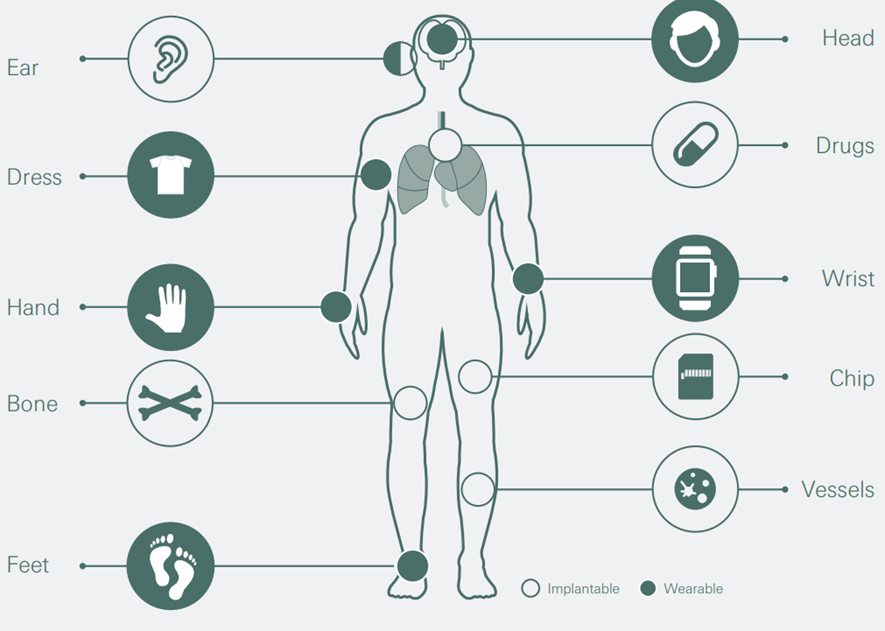

Standards must be developed, and data harmonised into common models to be fully utilised. Data must be pulled in through an interface to enable replication of a real person into a digital person (also called digital twin — see Figure 2). As more and more people create digital twins, much more modelling becomes possible. Figure 1 shows how digital twin data (steps etc) can be combined with medical evidence data available from eHR. Combining data will provide augmented intelligence to consumers and should work well in a digital ecosystem.

Figure 1 — Health data sets that can be collected in ecosystems

Figure 2 — Wearable and implantable technologies

Platforms are taking the first steps to combine data for downstream consumption by applications and analytics.

Harnessing these data could deliver significant improvements in healthcare outcomes while reducing cost and waste. Data exchange and care coordination platforms will leverage complex governance and policy enforcement to harmonise the data and make them available to downstream consumption platforms, applications and analytics. For example, by maximizing value not only for the platform itself but also for service providers eg, by passing on insights from consumers. These platforms are expected to automate data ingestion from all recognised and authorised sources; provide tracking and auditability; and govern identity, compliance and security.[3]

2.Decentralisation of care delivery

Ecosystems seek to stitch together many products and integrate them into a coherent care delivery programme.

This wide range of digital health effort creates a fragmented service landscape. Relatively low barriers to market entry have spurred a proliferation of tools from innovative small and medium-sized companies often new to the health market. Global venture capital investment in healthcare in the first half of 2019, at USD 5.1 billion, is the highest amount ever raised in the first six months of any year to date.[4] These tools need rigorous testing and validation, especially when used in diagnosis and treatment. Industry stakeholders have called for peer reviews of the algorithms underpinning the technologies and asked that the data be made available in the public domain. Ecosystems can play a key role in participating in this vetting process.

3.Advent of Digital therapeutics and treatment

Ecosystems enhance advantages of digital therapeutics and can spur changes in behaviours.

Digital therapeutics are tech-based programmes that use evidence-based therapeutic interventions to prevent, diagnose and treat medical conditions. They can be broadly defined as treatments or therapies that use digital and webbased tools to cause changes in patient behaviours. The effectiveness of digital therapeutics is based on large amounts of clinical data, research and trials which also need to be tested for efficacy of results. (See box on measuring the effectiveness of digital health technologies.)

Evidence suggests that consumers are beginning to see value in digital health management programmes.

Further developing and deploying digital therapeutics in an ecosystem environment has the potential to significantly enhance customer benefits. A recent study in the BMJ (formerly, the British Medical Journal) on the benefits of digital management programmes noted that patients are increasingly open to digital interventions. According to the study, patients value the flexibility as to location and time, the absence of waiting lists, and the option of daily interaction with a therapist.[5] Understanding these behavioural patterns will be critical for insurers in leveraging ecosystems to retain existing customers and attract profitable new business.

Measuring the effectiveness of digital health technologies

There is no agreement on evidence frameworks to distinguish effective digital products from ones that fall short.

There is no clear evidence framework for clinicians and policymakers to rely on to distinguish effective digital products from products that fall short. Randomised controlled trials (RCTs), the highest level of evidence, are seldom used in digital medicine, in part because such trials are expensive to run and do not lend themselves to the iterative nature of digital product design.[6] Other areas of medicine have faced the same conundrum. For example, RCTs are very difficult to run in surgery, in part because each surgeon has a uniquely different style and skill. As a result, the IDEAL[7] recommendations for surgeons emerged from conferences between surgeons and methodologists and are now used to evaluate surgical innovation and research.

However, a number of regulators are currently developing guidance and standards for innovators.

The American Psychiatric Association (APA) has created a model to evaluate the efficacy and security of digital health apps and recently announced an expert panel to review apps and guide patients and clinicians.[8] Likewise, a working group led by the Digital Health&AI Clinical Lead at the UK’s National Health Service (NHS), involving the UK National Institute for Health and Care Excellence (NICE), has developed guidance so that innovators can benchmark themselves against evidence based standards for effectiveness and economic impact of digital tools.[9]

4.Consumers demand digital health experiences on a par with other industries

Improved customer experience is the top area in which healthcare can learn from other industries.

Consumers expect high-quality digital health experiences on par with standards set in other industries. In general, health systems need to make significant progress in improving customer service and customising experiences to individual needs. Clinicians and healthcare executives in a recent survey reported by the New England Journal of Medicine (NEJM) said an improved customer experience is the top area in which healthcare can learn from other industries (selected by 57%), followed by customisation to individual needs and preferences (35%).[10]

Evidence suggests that consumers are beginning to see value in digital health management programs.

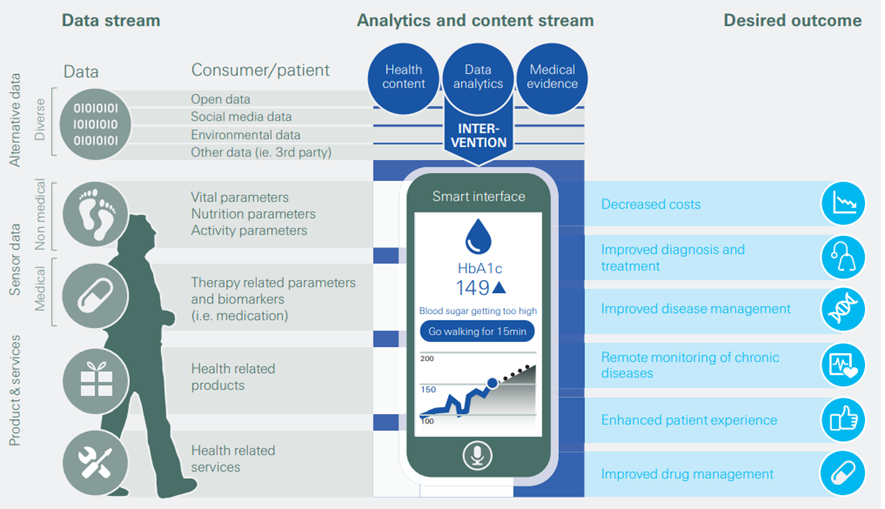

Consumers also desire greater transparency and demand engaging experiences, flexibility and value. Sensor data can be combined with traditional data to deliver services customised to individual needs. Patient empowerment is crucial but requires engaging content combined with consumer-focused interfaces and communication channels. For example, Livongo, a US digital health service, allows diabetics to test blood sugar levels, have results analysed remotely and be told via an app what they need to do immediately.[11]

Figure 3 shows a data-powered, digitally enabled customer intervention and the desired outcomes it aims for, such as recommending a walk for improved disease management when a patient’s blood sugar levels are elevated. Tech giants like Google have started moving in the similar direction.[12]

Figure 3 — Sensors can enable a range of health-related consumer services (eg. for diabetes)

Source: Medtech and the Internet of Medical things, Deloitte 2018, Swiss Re Institute

Consumers driving better, tailored healthcare experiences has led to the identification of healthcare inequities

Tailored healthcare experiences may help identify healthcare inequities.

Women have been underrepresented in healthcare data sets, which has led to adverse healthcare outcomes. Women’s heart attacks present differently and yet this is not widely known. Furthermore, some conditions specific to women have a long latency, such as endometriosis, which is excruciatingly painful and can severely impact quality of life — and takes an average of seven years to diagnose. Researchers have found sex differences in every tissue and organ system in the body, but little evidence of different approaches to male and female patients. For example, there are sex differences in lung capacity, even when normalised to height, and among men and women who smoke the same number of cigarettes, women are 20–70% more likely to develop lung cancer.[13]

5. Demographic shifts and lifestyle risks

For insurers, ageing still bears substantial uncertainties connected to underwriting the right risks.

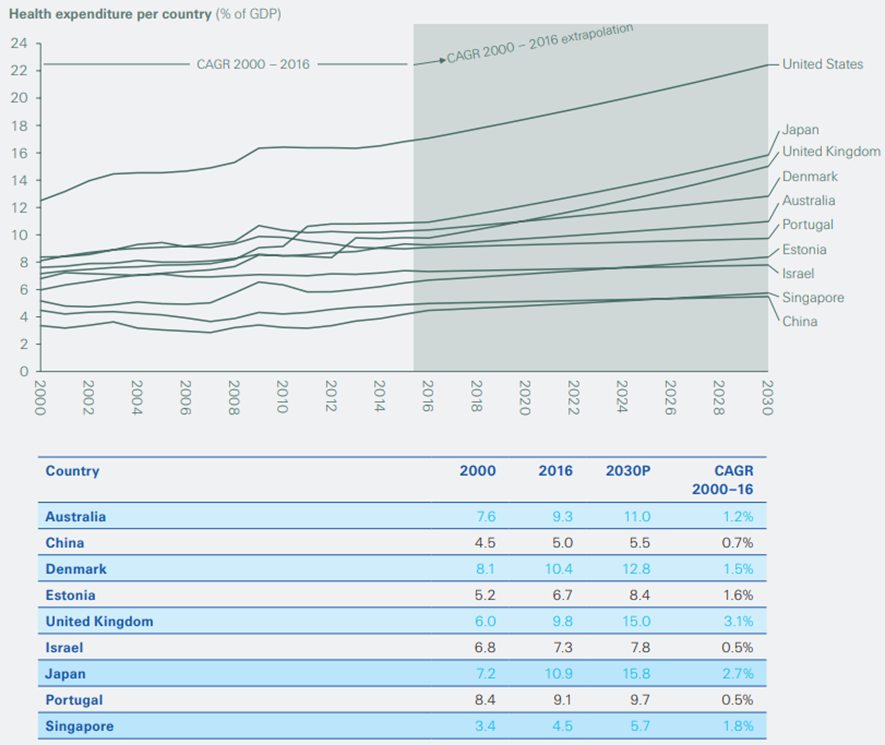

Demographic changes such as ageing populations and changes in societal behaviours are contributing to a steady increase in costly long-term health issues. As a result, healthcare costs are expected to grow across countries, in most cases exponentially (see Figure 4). Global increases in life expectancy paired with falling fertility rates mean that the over-65 population will be growing rapidly in coming decades, in both advanced and emerging economies. Currently, the financial services industry has products to help address risk in the accumulation phase of life, but fewer solutions to deal with needs during retirement.

Figure 4 — Healthcare expenditure for selected countries as % of GDP (2000 to 2030)

Source: World Bank, Swiss Re Institute

Demographics are also being influenced by changes in migratory patterns.

As well as ageing populations, we see demographics shifting with migration. Relocation of large population groups has an impact on healthcare trends. Conditions surrounding the migration process can increase vulnerability to ill health. However, several health controls can be put in place. In 2011 the prevalence of tuberculosis (TB) in London was 15.6 per 100000 people; by 2017 it had fallen to 9.3 per 100000. The decline was due to a number of factors, including screening of migrants from high-burden countries, and roll-out of the Find and Treat service specifically targeting underserved sections of the population, among them vulnerable migrants, homeless people, and the formerly incarcerated.[14]

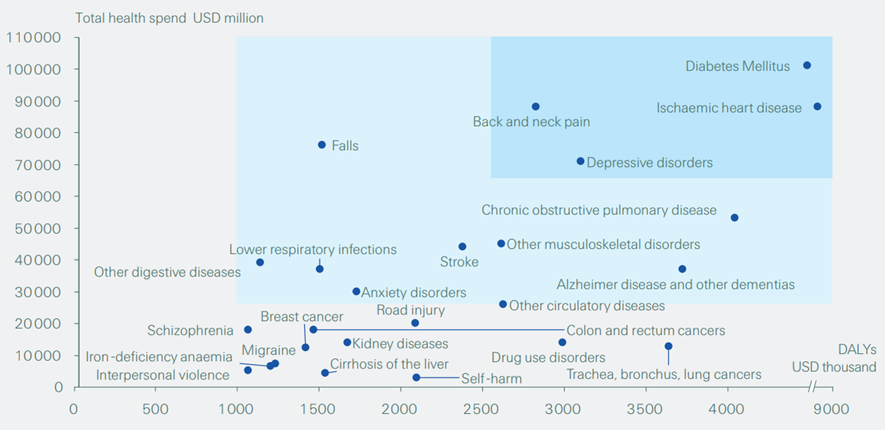

Non-communicable diseases cause 71% of all deaths globally

Non-communicable diseases (NCDs) account for 71% of all deaths globally.[15] Between 1990 and 2017, the overall disease burden — expressed as DALY rates or the number of years lost due to ill-health, disability or early death — increased by 40% for NCDs, but decreased by 41% for communicable diseases.[16] The majority of premature NCD deaths are linked to four causes: cardiovascular diseases, cancers, respiratory ailments and type 2 diabetes (T2D).[17] In the US, T2D and ischaemic heart disease have the highest impact on DALYs and total health spend (see Figure 5). Behavioural risks are becoming as important as biomedical ones. In the UK, for instance, 80% of heart attacks and strokes are believed to be preventable if people were to adopt healthier lifestyles.[18]

Figure 5 — Relationship between disability-adjusted life years (DALYs) and total health spend(ing) for key diseases (US)

Source: Tracking personal health care spending in the US, Institute for Health Metrics and Evaluation (IHME) and University of Washington, 2015.

However, insurers have yet to fully harness the power of ecosystems for dynamic approaches that reward good behaviours.

Healthcare spending and DALY impact society in many ways, such as where people cannot afford healthcare due to high premiums and coverage exclusions, as a result of which more costs need to be funded by out of pocket, and/or by employer and individual health insurance. Insurers are aware that healthy lifestyle choices like eating well, exercising, managing stress and proper sleep can help mitigate the risks associated with lifestyle diseases. However, insurers lack integrated tools to show clients how these different health factors are linked. They will need to harness the power of ecosystems to develop a dynamic, personalised pricing approach that rewards good behaviours (see box on genetic testing going mainstream).

Genetic testing going mainstream

Consumers who learn that they are at higher risk for disease are more likely to buy additional insurance.

The number of people taking genetic tests is increasing dramatically. A Swiss Re survey in the US found that more than 20% of those surveyed said they had taken a genetic test, either to diagnose or predict disease (14%) or as a direct-to-consumer (DTC) test (6%). Those who took a medical genetic test and whose results showed an increased health risk were four times more likely to buy life insurance. Guided by country-specific regulation, insurers may or may not be allowed to take genetic results into account when underwriting. In the aforementioned US survey, about 80% of respondents declared their willingness to share genetic information with their insurer in return for a premium reduction or a health management benefit.[19]

Products such as genetic testing services may encourage healthy behaviours.

Genetic tests motivate people to make lifestyle changes or take healthy actions. Inspired by these findings, insurers are exploring ways to offer customers genetic testing services as a way to improve long-term health outcomes. Several companies are developing consumer tests that could potentially drive the development of products and services that are linked with test outcomes, such as personalised medicine. However, the health benefits offered through predictive genetic testing should be balanced against the risk of potential anti-selection, adverse claims experience and increased exposure to legal and reputational challenges.

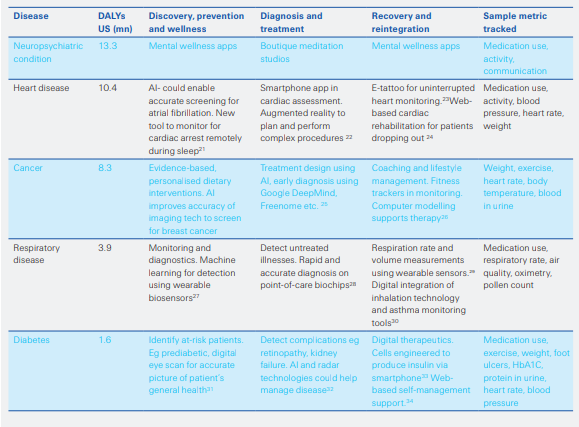

6.The rise of machine intelligence

Applying machine intelligence can produce new insights on population health and healthcare.

Machine intelligence is increasingly being used to develop new products and services for the healthcare market (see Table 1). Insurers can process and clean large amounts of heterogeneous data to build strong foundations for modelling, and leverage text mining and natural language processing algorithms to extract insights from unstructured data sources. Research from John Brownstein’s team at Boston Children’s Hospital demonstrates that analysis of social media data can be as effective as traditional methods of analysing population health data.[20]

Table 2 — Examples of digitally enabled interventions in key diseases

Trackers can use intelligent algorithms to help patients diagnose and triage themselves.

There are many algorithms that physicians follow and automating many of these algorithms into tools could be promising. Early stage startups are leveraging artificial intelligence techniques to check someone’s symptoms based on their responses to questions and help users appropriately triage and answer their own medical-related question. Artificial intelligence techniques are used to analyze large datasets in order to pinpoint risk and improve diagnostics and treatment. However, standardization of data streams, data and insights exchange among different stakeholders in healthcare remains a challenge.

References

See original publication

Names mentioned

Evangelos Avramakis,

Head Digital Ecosystems R&D

Structure of the publication

- Executive summary

- Trends reshaping the digital health landscape

- The rise of digital health ecosystems

- Contrasting perspectives on value within health ecosystems

- Building blocks for digital health ecosystems

- Implications for re/insurers

- Conclusion