This is a republication of the paper “Charting Economic Opportunities in the New Digital Paradigm”, published by “By Faisal Hamady, Thibault Werlé, and Katharina Skalnik” with the title above.

transforming health & care

research institute and advisory consulting

for continuous health transformation

Joaquim Cardoso MSc

Founder and Chief Researcher & Advisor

December 26, 2022

Executive Summary

- The recent decline in tech-heavy global stock market indices is being accompanied by news outlets sounding alarm bells for the industry.

- Analysts everywhere, from broadcasts to podcasts, are chiding venture capital (VC) firms for losing the house by betting on the promise of radical technology, claiming that innovations are either early to the market or offer solutions to problems that do not exist.

- The reality however is more nuanced.

- Since the internet began gaining mainstream adoption in the early 90s, the growth of the digital economy has experienced an unprecedented bull market.

-

(1) Digital streaming services are attracting more audiences than cable TV in some countries,1

(2) branchless banking is becoming the norm all over the world,

(3) millions are traded in digital art daily,2 and

(4) e-commerce businesses are rapidly onboarding talent and systems to cater to consumer demand for transacting via new digital payment mediums.

- We are experiencing a new economic paradigm that exists parallel to the standing ‘physical’ one.

- It includes (but is not limited to) content creators who work, communicate, and transact entirely online, systems and platform developers connected across geographies, networks around which the entire ecosystem is built, and intelligent analytics engines that use high-speed processing power to crunch data and simulate strategies for best performance.

- Additionally, as existing value pools draw en masse into the digital economy, new value pools with an increasingly diverse array of actors continue to emerge.

- The gaming sector, for instance provides compelling evidence of this, having birthed an e-sports industry and now luring entrants from the NFT phenomenon.

- With burgeoning growth showing no signs of peaking, the digital economy will profoundly affect markets and policy makers who are watching existing industries disrupt as new ones emerge.

- The digital sector’s multi-trillion-dollar expansion leaves leaders and decision-makers with only two options:

(1) adapt to its accelerating pace, or

(2) be left behind.

Infographic

ORIGINAL PUBLICATION

Charting Economic Opportunities in the New Digital Paradigm

DECEMBER 20, 2022

By Faisal Hamady, Thibault Werlé, and Katharina Skalnik

Unprecedented Economic Disruption and Opportunity

Today, every business, from financial services and healthcare to education and mobility, is embracing digital technology to attract target audiences, automate and optimize processes, cut costs, and grow revenue.

Macroeconomic uncertainties might abound in the short-term, but advances expected from the use of automation, robotics, and a historic explosion of data and intelligence in the coming years, present significant opportunity for unprecedented disruption and wealth creation.

To derive the maximum possible benefit from a surging digital economy, vital government decision-makers must act to ensure that it is allowed to continue its proliferation, while also balancing important considerations in the exchange of digital goods and services, property rights, network access, data usage, equipment and protocol standards, and even human rights.

Given that adaptability and flexibility are naturally associated with a higher propensity for survival and successful outcomes, governments need to drive a mental shift to understand the potential of the digital world and its economy.

Thus, by considering how systems can change at the same pace as technology, governments can recalibrate the regulatory framework for a digital-first world.

This perspective can help guide thought around the right investments to make in infrastructure, specifically in merging value pools, to spur innovation and economic opportunity.

Defining the Digital Economy

Given its broad nature and impacts on society that are beyond economic measure, defining the digital economy has proven complicated.

As a result, definitions in use with organizations around the world are often not congruent with each other.

To find middle ground, the OECD has attempted a three-tiered definition emphasizing sectors that exist due to digital technology (as opposed to those that employ it to enhance productivity).

While “not a panacea”, the definition is more holistic and provides decision-makers with more clarity to make policy decisions.

According to the OECD,8 the digital economy: “…incorporates all economic activity reliant on, or significantly enhanced, using digital inputs, including digital technologies, digital infrastructure, digital services, and data.

It refers to all producers and consumers, including governments that are utilizing these digital inputs in their economic activities.

This definition is adequate and important because given that the digital economy extends beyond what is measured in economic statistics, an appropriate definition should encompass all its aspects, be conceptually flexible, and allow for the possibility of accurate measurement.”

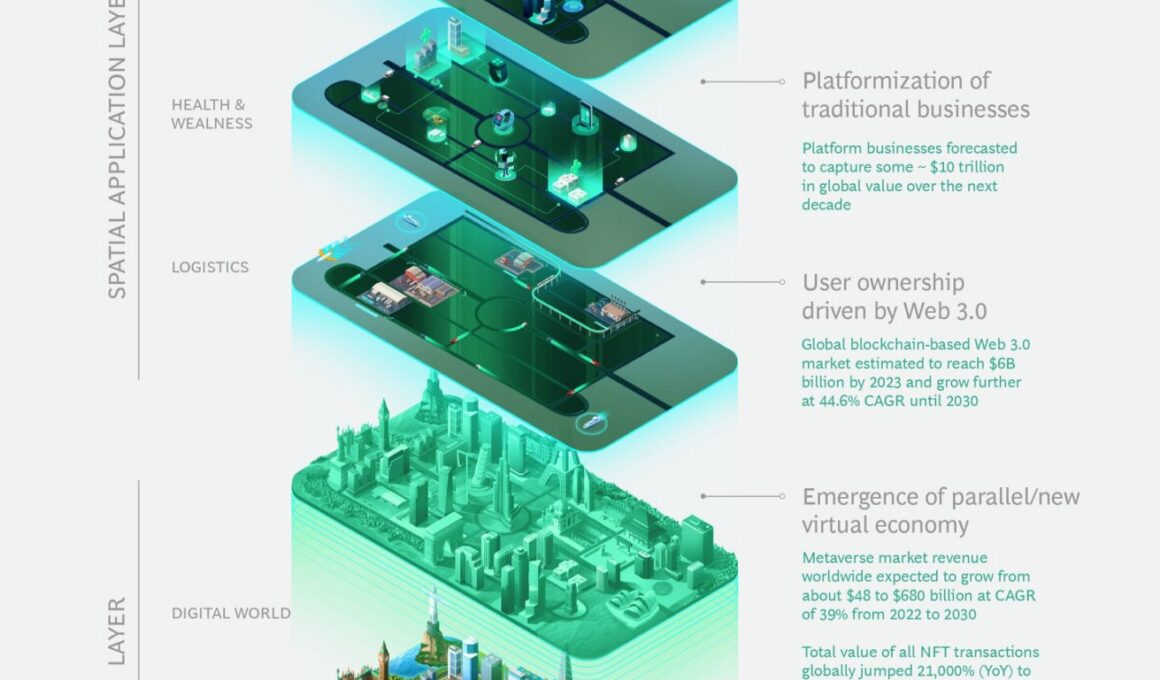

Visualizing the digital world can help better illustrate how its future will unfold in the coming years.

As per the definition shared above, the digital world comprises economic activity created by producers and providers across three tiers:

- Core: economic activity from producers of digital content, ICT goods and services (including IT and communications businesses that cover hardware, software, and services)

- Narrow: adds economic activity derived from firms that are reliant on digital inputs (such as digital services and platforms businesses) — those are generally defined as ‘digital only’ businesses

- Broad: economic activity from firms significantly enhanced by the use of digital inputs (including significantly digitalized businesses in e-commerce, industry 4.0, etc.)

In its report for the G20 Digital Economy Task Force, the OECD also includes a Digital Society tier but mentions that this layer extends beyond the definition outlined earlier and encompasses digitalized activities excluded from GDP production (such as zero-priced digital services).

Visualizing a Digitally Enabled Future

Crypto, metaverse and AI are some of the most hyped new technologies entering the fore, but their rapid growth is evidence of how distributed technology and spatial computing innovations will impact the way that the world functions.

There is no crystal ball capable of discerning how multi-billion-dollar opportunities in individual technologies will present themselves, but from the ongoing reimagining of how technology stacks can work, we can extrapolate how the dynamics of digital technology’s evolution are outlining a future vision for the digital economy.

The proliferation of consumer and business devices, including IoT sensors, will generate an exponential increase in the volume of data produced.

Estimates from leading vendors suggest that approximately 40 billion connected devices will be online in the next half decade.11

With big data and analytics technology revenue, including from hardware, software, storage and services in the mining of unstructured data expected to reach $260 billion this year …

… and spending forecasted to grow at a compound annual growth rate of 13 percent over the next three years,12 AI’s game-changing applications in education, retail, pharma, agriculture and more should compound further data generation and usage around the world.

With big data and analytics technology revenue, including from hardware, software, storage and services in the mining of unstructured data expected to reach $260 billion this year …

It is crucial to recognize as well that the rapid growth of the market and accelerated convergence of informational and operational technology will create a much larger surface for the cybersecurity industry to defend against attacks or unforeseen events.

The vulnerability of economic and national digital structures will heighten risk and demand for security will lead to increased spending (double-digit growth expected) on security products and services, as well as on measures to protect from or mitigate new risks (e.g., crypto crime, climate change, etc.).

This platformization is causing ripple effects and we are beginning to witness a new wave of Web 3.0 businesses emerge.

Distributed autonomous organizations (DAOs), for instance, rely on decentralized trust-based communities and smart contracts, eliminating the need for intermediaries, to come together and create a coin or a contract without relying on a centralized authority to define what either is.

For instance, by allowing members to vote on pieces written by aspiring members, Mirror DAO allows writers to crowdfund novels.

These organizations present a massive shift in how organizations can work, and value is created.

The emergence of decentralized and community-driven creation models powered by Web 3.0 is driving user ownership in a new parallel virtual economy and allowing businesses to manifest in other ways as well.

NFT marketplaces OpenSea or Rarible allow artists to create and collectors to speculate on the value of digital art, profile pictures and music, and transact via blockchain-based currencies.

Entities such as Decentraland and Sandbox develop digital real estate on their individual metaverses for users to monetize — the latter recorded 65,000 transactions in virtual land totaling $350 million in 2021.

As metaverse-led investments diversify outside of augmented and virtual reality entertainment into identity, security, and productivity-centered workplace collaboration engines, the metaverse market revenue worldwide is expected to surge.

Platformization and Web 3.0 will likely lead to more complexities in the labour markets.

The former’s effect on the gig economy has been widely documented, while the latter is leading to a growing pool of artists, developers, marketers and other talent working without being bound by geography.

This has implications on how organizations process health insurance, commercial real estate and care for employees connected entirely online.

Traditional businesses could also likely reinvent themselves to offer a range of services through digital marketplaces.

By aggregating services and driving social dynamics, they could force the transformation of sectors, as has been seen in how the ‘uberization’ of transport opened the doors to other revenue streams and allowed the company to become a full-scale logistics firm.

Similarly, Facebook transformed itself from being a pure-play social media company into a diversified communications business.

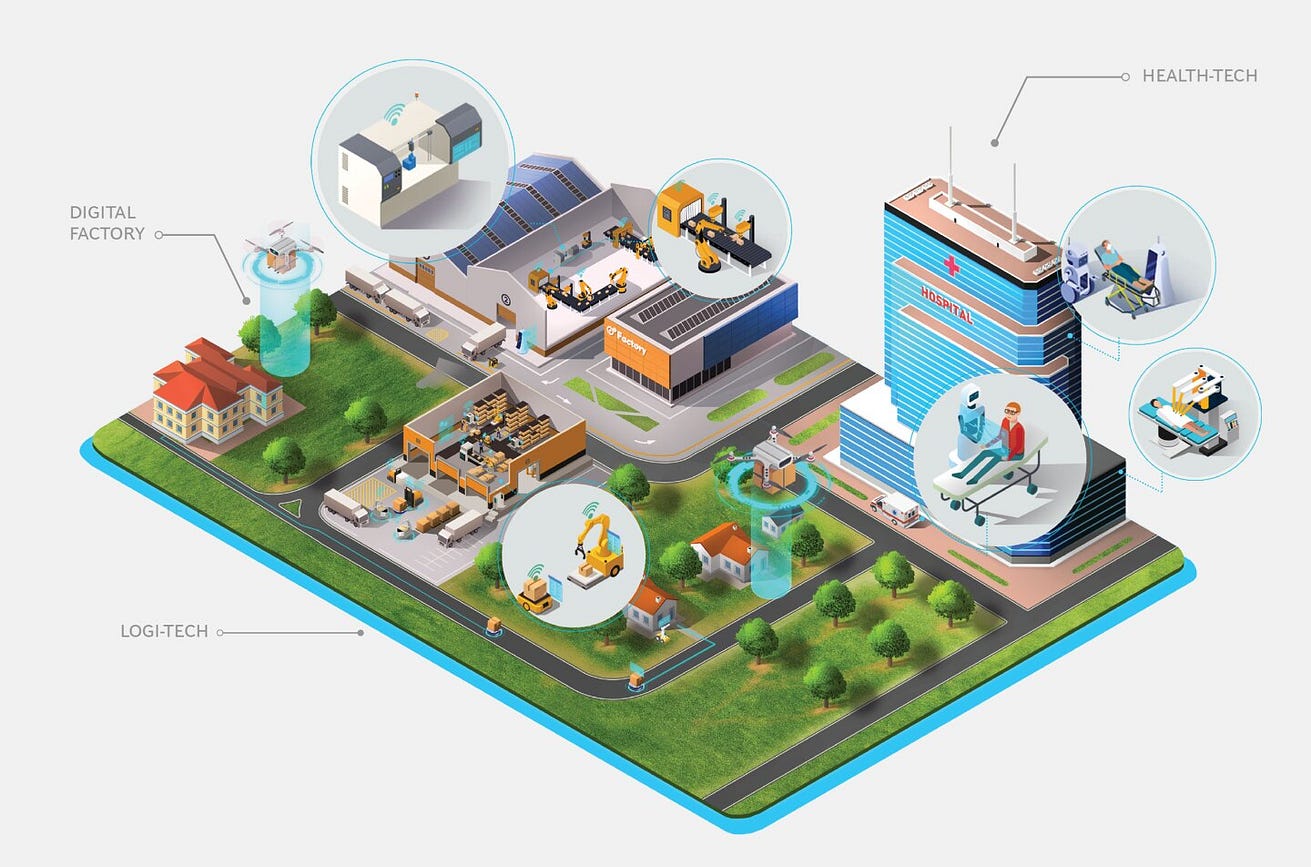

In the broad tier of the digital economy, various sectors could face a ‘bionic future’ where a new logic of competition and economic-digital advantage portends success.

By bionic, we mean a future where organizations marry the power of humans and machines to achieve superior performance throughout the organization and operating model.

In this scenario, businesses would compete on ‘pace of learning’ instead of economies of scale.

Iterative improvements to AI models and algorithms, and augmented cognitive machine capabilities blended with flexibility, adaptability, and comprehensive human experience could lead to ‘superhuman enterprises’ that produce competitive advantage.

As a result, traditional businesses, not just digital natives, could be redesigned in a way where every worker has access to technology and resources that allow the use of behavioral data to deliver personalized experiences.

Widespread digitization of brick-and-mortar businesses will increase in-store conversion, while internally, businesses will want to see layers of approval replaced by small, autonomous and digitally trained teams that are empowered to make decisions quickly.

In the race to seize digital and virtual opportunities beyond national borders, conventional value chains could break along with new economies of creation (e.g., limited add-on cost of software), triggering a pursuit for economic-digital-advantage.

Response Options for Governments

For governments, the digital economy is not an elective.

It marks a profound departure from the way that economies have historically been organized and regulated.

Tackling this brave new world head-on will prove essential to remaining competitive and relevant on the global scene.

In a rapidly transforming world, new governance structures are required to address issues such as competition, taxes, data privacy, employee rights and the new view on labor market economics that extend from the growth of all things digital across each of the tiers discussed earlier.

Governments also need to prioritize considerations around how digital utility ecosystems can help value chains grow.

For instance, standardized digital registration and verification processes for IDs and payments can help boost security and speed when sharing sensitive information and resources in marketplaces.

For instance, standardized digital registration and verification processes for IDs and payments can help boost security and speed when sharing sensitive information and resources in marketplaces.

Given the fragmented nature of current developments, regulators also need to approach collaboration mechanisms with private sector tech players to develop mandatory standards, and to support interactions and experiences across multiple environments.

Legacy laws will need to be adapted to new frameworks in establishing sandboxes and privacy standards to allow agility in reacting to fast-moving spaces, such as in digital asset ownership for instance.

The digital economy will also require the blending of social concepts into the digital fabric of society (think ethics, values and inclusion).

By collaborating with other public entities to align strategic priorities, governments can help address wide-ranging issues that are gaining prominence such as digital inclusion, social prosperity, and questions around digital ethics including how to eliminate social bias in AI (both from a structural data perspective, and from algorithm definition and training).

Similarly, a bionic future for business will mean inducing opportunities to conduct digital trade and commerce.

Digital economy agreements, such as DEPA signed electronically between Chile, New Zealand and Singapore in 2020 and the UK-Singapore Digital Agreement of 2022, present an innovative approach toward addressing challenges of interoperability between digital economy activities in various countries.

Through regulators, governments can set clear guidance on reforms needed to build trust across businesses, investors and end users, and promote economic opportunities in the trading of digital goods.

Lastly, macro trends that most enhance total factor productivity, i.e., where future addressable markets can allow the digital economy to contribute meaningfully to overall GDP, must be emphasized.

This can be done through policies that encourage investments in digital infrastructure and R&D into frontier technologies, such as AI and robotics, and create an environment for innovation that trains or attracts highly skilled and specialized talent.

However, it is important that this focus does not pull support for traditional sectors but instead facilitate providing digital on-ramps to businesses to make them more competitive and productive.

Narrowing Window of Opportunity

The good news for the digital economy is that its pace of growth is quickening.

Two-thirds of the world’s unicorns emerged in the last two years;18 cross-border data flows, which have been surging since 2015, are estimated to account for two-thirds of global GDP;19 and more than two-thirds of venture capital funding is now concentrated in technology.20

Two-thirds of the world’s unicorns emerged in the last two years;18 cross-border data flows, which have been surging since 2015, are estimated to account for two-thirds of global GDP;19 and more than two-thirds of venture capital funding is now concentrated in technology.20

The leaders in this area are reaping significant benefits that are allowing them to reinvest in the future while remaining competitive during downturns.

In the corporate arena, this ‘winner-takes-most’ dynamic is manifested in the form of the roughly five tech giants that have captured 50% of the market value of their sectors in key markets globally.21

In the corporate arena, this ‘winner-takes-most’ dynamic is manifested in the form of the roughly five tech giants that have captured 50% of the market value of their sectors in key markets globally.21

On the global stage, only five nations hold more than 80% of the patents in key technologies such as AI, blockchain, etc,22 giving them a significant head start in terms of much influence they will command in the future of the digital economy.

On the global stage, only five nations hold more than 80% of the patents in key technologies such as AI, blockchain, etc,22 …

… giving them a significant head start in terms of much influence they will command in the future of the digital economy.

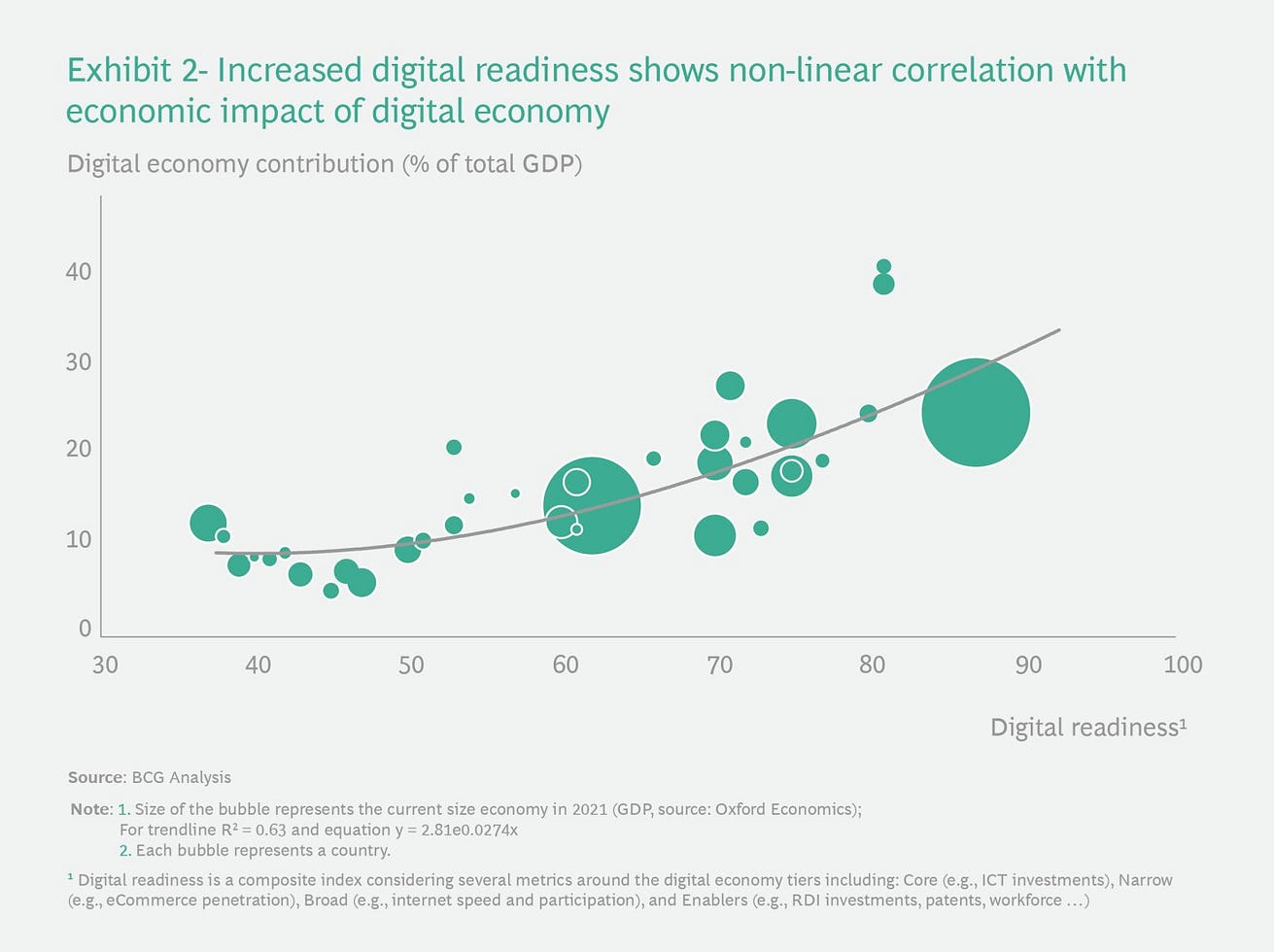

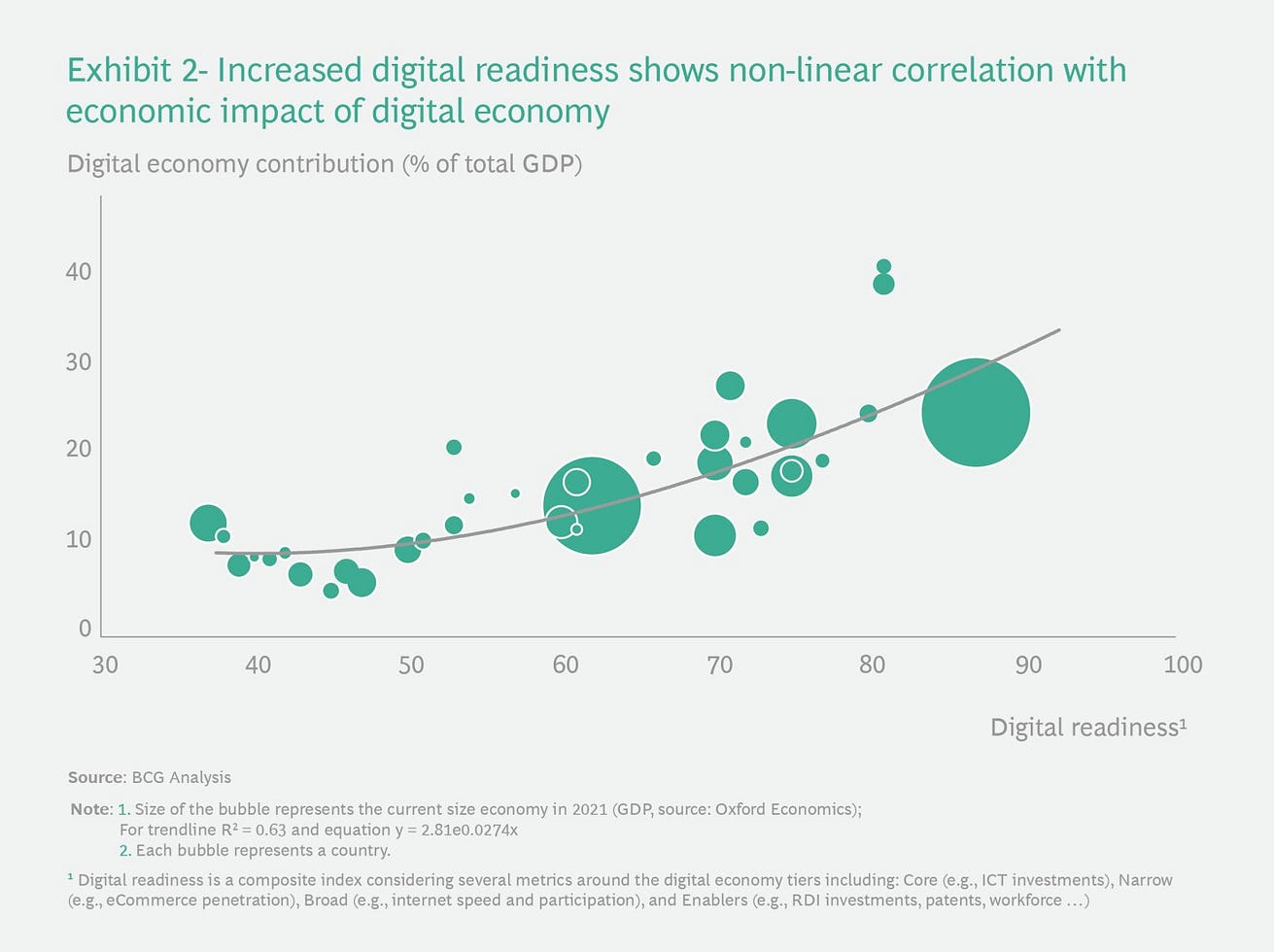

Fortunately for economies just beginning to accelerate their digital economy ambitions, research 23 shows that the maturity of digital drivers in the core, narrow, and broad tiers have a non-linear relationship to value created in the form of contribution to GDP.

This means that investments toward accelerating digital maturity in an economy can likely deliver increasingly higher economic contribution levels. An exponential increase in benefits should incentivize economies looking to advance from lower digital maturity levels as it would make it easier for an economy to become a digital leader rather than remain a digital laggard.

However, the data also suggests that market actors have a narrowing window of opportunity to react.

To put it into perspective, the average lifespan of a company has shrunk by a factor of three over the past five decades (to 18 years from 61 years),24 the technology adoption curve is today ~7x what it used to be 2 decades ago,25 Notes: 25 Hannah Ritchie and Max Roser (2017) — “Technology Adoption”. Published online at OurWorldInData.org. Retrieved from: https://ourworldindata.org/technology-adoption + https://marketrealist.com/2015/12/adoption-rates-dizzying-heights/ and industry disruption is the leading cause of Fortune 500 companies going bankrupt, being acquired, or ceasing operations since 2000.26 There is a need to act, and to act fast.

It is no news that there is no crystal ball that exists to discern what the future holds.

Nevertheless, while it is unclear who will emerge as tomorrow’s winners, past decades provide ample evidence of a winner-takes-most consolidation on the horizon.

What market actors now require is to ask important questions about how to approach the digital economy and accelerate the development of each of its tiers, before constructing holistic digital economy acceleration initiatives, backed up by strategies that can help mitigate labor disruption, overcome productivity lags, stay competitive and build resilience to external shocks.

As stated earlier, adaptation is survival and is the need of the hour to win the digital economy race and remain competitive in the future.

What market actors now require is to ask important questions about how to approach the digital economy and accelerate the development of each of its tiers, before constructing holistic digital economy acceleration initiatives, …

… backed up by strategies that can help mitigate labor disruption, overcome productivity lags, stay competitive and build resilience to external shocks.

As stated earlier, adaptation is survival and is the need of the hour to win the digital economy race and remain competitive in the future.

Originally published at https://www.bcg.com on November 18, 2022.