The Health Strategist

institute for continuous health transformation

and digital health

Joaquim Cardoso MSc

Chief Research and Strategy Officer (CRSO)

May 11, 2023

ONE PAGE SUMMARY

There are many challenges faced by health systems in managing rising expenses and explores the strategies they are adopting to streamline their operations.

As hospitals and health systems grapple with staffing shortages, lower patient volumes, and increasing expenses, they are actively seeking ways to reduce costs in non-clinical areas.

- A study in the Journal of General Internal Medicine highlights that administrative expenses grew at a faster rate than clinical costs during the pandemic, indicating a need for efficient cost management.

- Health systems are considering job cuts among non-clinical staff, including executives, as a means to cut costs and optimize their operations.

While hospitals are experiencing a recovery in patient volumes in 2023, the revenue generated often falls short in covering the mounting expenses.

- Hospital margins are near zero, leading to the depletion of reserves to meet financial obligations.

To address these challenges, health systems are investing in digital capabilities, such as data analytics-driven programs and artificial intelligence, to automate mundane tasks and allow employees to focus on higher-level skills.

- This automation aims to enhance core operations and improve overall efficiency.

Healthcare executives also face market-share pressure from retail disruptors like Walmart, Walgreens, and CVS Health.

- These retail giants are expanding their healthcare services, posing a potential threat to traditional health systems.

- As a result, healthcare executives must make strategic decisions to adapt and compete effectively in the changing landscape of healthcare.

Several health systems have already taken steps to streamline their operations.

Monument Health in South Dakota recently

- laid off 80 employees, primarily in corporate service roles,

- citing rising costs in medical supplies, staffing, and low reimbursement rates as contributing factors.

Providence in Washington state

- restructured its operations by consolidating divisions, eliminating some executive leadership positions, and

- revising its shared services model.

This restructuring aimed to reduce overhead costs and allocate more resources to frontline workers.

Jefferson Health in Philadelphia also

- plans to restructure its organization by consolidating divisions to streamline processes and optimize their health system.

In conclusion,

- health systems are facing significant financial challenges due to rising expenses, staffing shortages, and increased competition from retail disruptors.

- To mitigate these issues, organizations are implementing cost-cutting measures, including job cuts at various levels, while investing in digital capabilities to enhance efficiency.

- Strategic restructuring and optimization of operations are becoming essential for health systems to remain financially stable and provide quality care.

DEEP DIVE

Health systems turn to restructures, job cuts amid rising expenses

Advisory

May, 2023

Hospitals look for ways to reduce expenses

As many health systems struggle with rising expenses and other financial difficulties, some organizations are considering cutting jobs among non-clinical staff, including at the executive level, to cut costs and streamline their operations going forward, Carole Hudson reports for Modern Healthcare.

As hospitals and health systems continue to struggle with staffing shortages, lower patient volumes, and increasing expenses, many are searching for ways to cut costs in non-clinical areas.

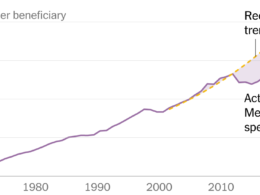

According to a recent study in the Journal of General Internal Medicine, hospitals’ administrative expenses grew at a faster rate than clinical costs during the pandemic. Between 2019 and 2020, median administrative expenses increased by 6.2%, while clinical expenses saw only a 0.6% increase. This rise in administrative costs may have been due to operational efforts during the pandemic or inefficient cost management.

Ge Bai, an accounting and health policy professor at Johns Hopkins University and one of the study’s authors, said, “[Health systems] got some cushion from federal relief, but now that that’s gone, they have to rely on their operations to earn money.”

Although hospitals are seeing their patient volumes recover in 2023, this revenue is often not enough to compete with growing expenses.

“Hospital margins are near zero,” said Lori Kalic, a healthcare senior analyst at professional services firm RSM US. “They’re dipping into their reserves to pay their bills. … I think many hospitals needed to do some quick layoffs in the administrative levels — because there’s still clearly clinical need — in order to keep their doors open.”

Currently, health systems are investing in digital capabilities to automate mundane tasks and help employees focus on core operations. Some of these new technologies include data analytics-driven programs and artificial intelligence, which allow staff to devote more time to higher-level skills.

According to Kalic, as healthcare executives work to enhance their core operations, they must also prepare for the market-share pressure from retail disruptors like Walmart, Walgreens, and CVS Health.

“The more and more success [retailers] have, I think it’s going to resonate, and I think folks are going to respond,” Kalic said. “I do think that the way that we have been traditionally served will change.”

“If the right decisions are made, the right strategic decisions, I think that the strong hospitals will make it through,” she added.

How health systems are streamlining their operations

Last week, Monument Health, which is based in Rapid City, South Dakota, laid off 80 employees, or around 1.5% of its workforce. Most of these employees were in corporate service roles such as billing, marketing, and human resources. According to the health system, rising costs in medical supplies and staffing, as well as low reimbursement rates from payers were some of the drivers of the recent decision.

“Our goal is to always be good stewards of resources,” said a Monument spokesperson. “This is why we continue to take thoughtful actions to ensure we are providing quality care, achieving our budget goals and positioning ourselves for future growth and success.”

In Washington state, Providence restructured its operations by consolidating its seven regional divisions to three last year. It also eliminated some executive leadership positions and revised its shared services model to better support the consolidated operations.

As a part of the consolidation, Providence reduced duplicate operations and eliminated of some day-to-day tasks for its employees. Overall, the restructure aimed to reduce overhead costs and allocate more resources to frontline workers.

“It’s essential that we look at every opportunity to create streamlined systems, so that we can have speed to execution,” said Providence COO Erik Wexler. “And, in our case, some of these decisions resulted in not only efficiencies, but allowed us to keep caregivers at the bedside.”

“Just believing we can continue to do everything that we were doing before and do it effectively with less people is not realistic,” he added.

Jefferson Health, a Philadelphia-based nonprofit system, is also planning to restructure its organization. Earlier this year, the health system announced it plans to consolidate its five divisions into three, with a president overseeing each one.

In a statement, a Jefferson spokesperson said the change would “streamline processes and optimize our health system,” but declined to comment on any potential layoffs due to the decision. (Hudson, Modern Healthcare, 5/10)

Originally published at https://www.advisory.com.